Minotaur Exploration Ltd (ASX: MEP): Successful Prospect Generator, Focused on Copper Gold and Base Metals Exploration in Australia, Interview with Andrew Woskett, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/23/2018

Minotaur Exploration Ltd (ASX: MEP) has extensive minerals exploration tenements in South Australia, Queensland and Western Australia. We learned from Andrew Woskett, Managing Director of Minotaur Exploration, that they are a grassroots copper/copper-gold exploration company that relies upon joint ventures to provide working capital. We learned from Mr. Woskett that the company was founded and established about 25 years ago in Adelaide and had very early-stage success, with a significant discovery called Prominent Hill, which is now a big copper mine, owned and operated by OZ Minerals (ASX: OZL). The company's focus is currently on Cloncurry/Mount Isa region in northwest Queensland. According to Mr. Woskett, Minotaur's team is very good at what they do in terms of prospect generation, turning prospects into targets, drilling targets, invariably hitting the target exactly where it's meant to be.

Minotaur Exploration Ltd. Cloncurry

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Andrew Woskett, who is managing director of Minotaur Exploration. Could you give our readers/investors an overview of your Company, explain your business model and your current activities?

Andrew Woskett: Thanks, Al. We have a very simple and straightforward, but very effective business model. Minotaur is and has always been an exploration company. It has a long pedigree of successful base metals, and particularly copper, exploration history in Australia. Over the last two decades that business activity has always been underpinned by the benefit of enduring joint venture relationships.

We rely upon joint venture participation in our projects to provide the working capital that exploration requires. Being a grassroots exploration company, a greenfields explorer, you and your readers will know that it's problematic and the success ratio is quite low. As an exploration company, with no revenue stream, the challenge always is to maintain our cash reserves, maintain a cash balance that will permit us to maintain a reasonable level of activity. And that's the crux of it.

We rely very heavily on joint venture participation; we gratefully receive investment from our joint venture partners and we go spend that on their behalf on our projects. That allows us to maintain an activity level which is far greater than what a small company like us would typically be able to do, or at least sustain over a long period of time. So in summary, the business model is very much about having as many joint ventures as we can and accepting that ultimately we will dilute our equity interest in a project as the partner earns in. But that also obviates the need for us to go back to shareholders every three months, six months, looking for more money just to keep the working capital level up. We try to avoid shareholder dilution as much as we possibly can by maximizing joint venture participation.

Dr. Allen Alper: Well, that sounds excellent, an excellent business model.

Andrew Woskett: We sometimes get criticized for, gee, you're diluting, you're giving away half the project, you are giving away 70% of the project. That may well be the case but, of course, not all projects continue. You might spend two or three, five million dollars on an exploration project via a joint venture party, and then you might get to the point where you say, "Okay, well, that was a good exercise to do. It was worthwhile, we learned a lot. But let's face it, it's not going anywhere. Let's close that one down and let's move on to something else where we see new opportunity." It's very easy to cancel a project, but it's very difficult, impossible in fact, to cancel equity if you've issued it. So we think we are better off, taking the hit at the project level and trying to preserve our equity intact.

Dr. Allen Alper: That sounds excellent. So could you give our readers/investors an overview of your company and talk about some of your major projects?

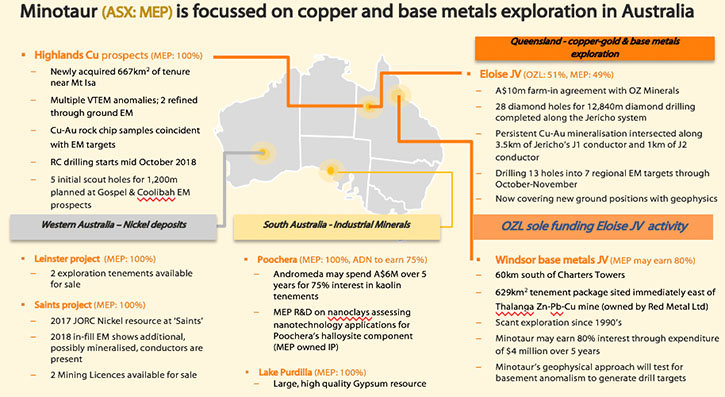

Andrew Woskett: Yeah, certainly. Minotaur is wholly and solely focused on exploration inside of Australia on the mainland. And presently only in three states, South Australia where we're based in Adelaide, the wine capital of Australia, and also in Western Australia and Queensland. The company was founded and established 25 odd years ago in Adelaide and had very early stage success with a significant discovery called Prominent Hill, which is a big copper mine now owned and operated by OZ Minerals.

We have been continuing to apply very much the same techniques that led us to discover Prominent Hill, now around Australia while refining those techniques. It is proving to be quite successful for us. We tend to restrict our interest to base metals generally, with a predilection towards copper, copper-gold systems. And at the same time through happenchance, we've generated a number of other assets in industrial minerals and iron ore which are sort of by the by because we found those when we were looking for base metals. We have an interesting portfolio of commodities but we're primarily, in fact very much, focused on copper and other base metals like zinc and lead.

Dr. Allen Alper: Well, that sounds excellent. Could you say a bit more about several of your major projects, what stage they're at, what makes them look interesting?

Andrew Woskett: I’d be happy to. Our main focus right now is in northwest Queensland. We're in an area called Cloncurry, which is the Cloncurry/Mount Isa mineral district in northwest Queensland. That's known to be the copper belt of Queensland and it's a prolific area. There are very many mines in the area, such as Mount Isa, Ernest Henry, and Cannington. It's a well-known mineral resource district.

We have, over the last six years or slightly more, been acquiring ground in the area. We've built a fairly significant tenement position, spread around the Cloncurry - Mount Isa region, where we see opportunity for new discoveries that perhaps have not been well recognized or haven't been pursued by other explorers. The reason I say that is because Minotaur cut its teeth in South Australia where the basement rocks that host mineralization are buried below a thick cover sequence. In South Australia the cover sequence can be anywhere from 300 meters to 900 meters or 1000 meters thick.

As an explorer, you have to be able to see through that cover, using geophysics to pinpoint where you're targeting mineralization, in the basement. Now, we're able to do that quite well, and successfully I might add, but it's very expensive drilling for a small company. If you have to drill a thousand meter hole to get to the start of the target, that's quite expensive. Those holes have to be diamond holes. We saw opportunity around the Cloncurry - Mount Isa copper belt because the cover sequence up there is much thinner. It can be as little as 15 meters to perhaps 100, maybe even 130 meters thick.

Drilling through the cover up there is much less problematic, much less expensive. But there's always a ‘but’, and the but is the cover sequence is very, very conductive. We didn't fully appreciate that when we went grazing up there originally. We found that using geophysics was not as successful as we expected, because the conductivity of the cover sequence interferes with the geophysical response. It made our modeling very fuzzy and hazy and not so well defined. We spent a few years actually working out how to overcome that.

And I'm pleased to say that, as a result of a lot of learning and practice, we now have the ability to see through the highly conductive and to see down and to model down, using geophysics, to at least 700 meters below surface. We're now able to pinpoint anomalies, geophysical responses, down at least 700, perhaps 750 meters, using off-the-shelf geophysical electromagnetic tools and modeling the data our way so that we can see through this interference. The fact that there is this interference which limits the utility of geophysics through cover, obscuring the basement rocks, has really dissuaded most explorers from having a crack at much of this ground.

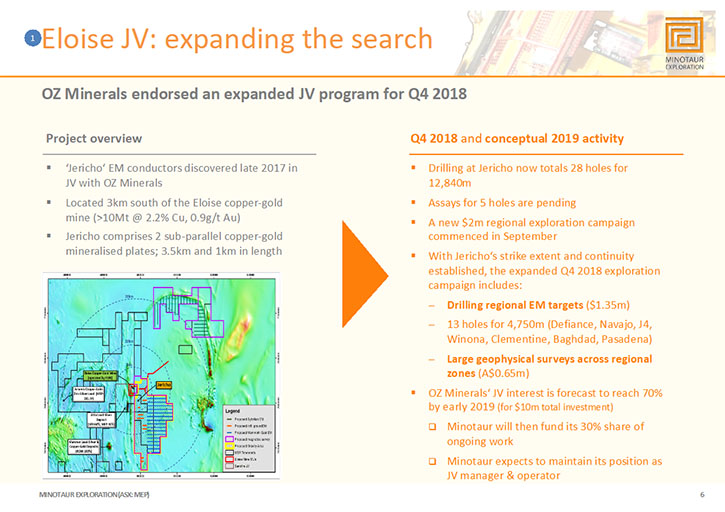

Some discoveries have been made, for sure, through cover. A notable one is the Eloise Copper Mine discovered by BHP using electromagnetic systems just like we are. But the cover was relatively thin at that point. The model was well established by BHP back in the day, and others have gone on to do similar things. But when you get into thicker cover it becomes more and more difficult. Thus our current focus is around the Cloncurry area of northwest Queensland, where there haven't been any significant discoveries in the last decade. The reason for that, as you may well appreciate, is that the conductive nature of the cover has limited the ability of explorers to see into the basement rocks and target drill positions.

However we see that as an opportunity because we think that we can potentially see things that others have not bothered to see or could not see. That proposition has been borne out over the last year or two, especially around the Eloise Copper Mine that I mentioned, because we have been able to pinpoint a vast number of EM anomalies within three, five, 20, 30 kilometers of that particular operation that nobody else had identified or had even looked for. We're not afraid to go where others think it's too difficult because we have the benefit of being able to apply our in-house methodology for filtering the noise out of the geophysics and targeting drill positions.

A measure of how good that is - there always has to be a test - is when you drill a hole to intersect a conductive plate, an EM anomaly, does the drill hole intersect the plate where you predicted it to be by the model? What is the type of mineralization that you're going to intersect that generates that particular EM response? I can say that virtually for every hole we put in, we hit the model position within a meter or two, or maybe a few meters, of where it was predicted to be by the model. That means that our modeling is accurate.

Of course, the model itself does not tell you why the anomaly is there, what's the source of the anomalism? Only a drill hole will do that; you need to get the core out of the drill hole to ascertain what the source of the anomaly is. Of course, we're always looking for sulfides, copper sulfides in particular. In this particular area, chalcopyrite is the dominant form of copper sulfide but we don't always find it. Some of these holes are termed ‘technical successes’ in that the anomaly is where it was predicted to be but the source of the anomalism is not copper. It can be barren pyrrhotite, it could be pyrite, or even graphite. There is the risk that the target may not give you the mineralization style you're looking for; that's what exploration is all about. There's only one way to check it and that's to drill holes.

We see lots of opportunity in the Cloncurry area. We're improving our ground position all the time and the way we do our work and the results we have generated over the last five years have been recognized and appreciated by larger companies that are active in the copper space, such as OZ Minerals in Australia and Sandfire Resources. We have joint ventures with both those organizations in and around the Eloise mine where we are applying our techniques to find new discoveries.

The work that we've done over the years is bearing fruit. It's giving us the opportunity to expand our footprint and to attract the interest of well-funded larger organizations who need to build a pipeline of projects for their own purposes and are very happy to effectively outsource their exploration to Minotaur because they've come to realize that we can do that work very cost effectively and technically with great competence. This comes back to the joint venture model. We're able to exploit our track record and the prospectivity of the ground that we have acquired and we're building on that to bring in these sorts of partners to fund our work. Their support is growing stronger all the time.

Dr. Allen Alper: All right, that sounds excellent. By the way, we have an interview scheduled with Karl from Sandfire next week.

Andrew Woskett: Sandfire Resources has a very large tenement position around and next to us doing their own exploration for copper. We talk to them as they are also a shareholder in Minotaur and they keep a fairly close eye on what we're doing. We have a joint venture with them over a lead, silver, zinc deposit called Altia, which is also very close to the Eloise mine. They're a good partner to have. They understand the challenges of exploring in that region and they persevere. I'm confident that as time evolves we'll work more closely with them.

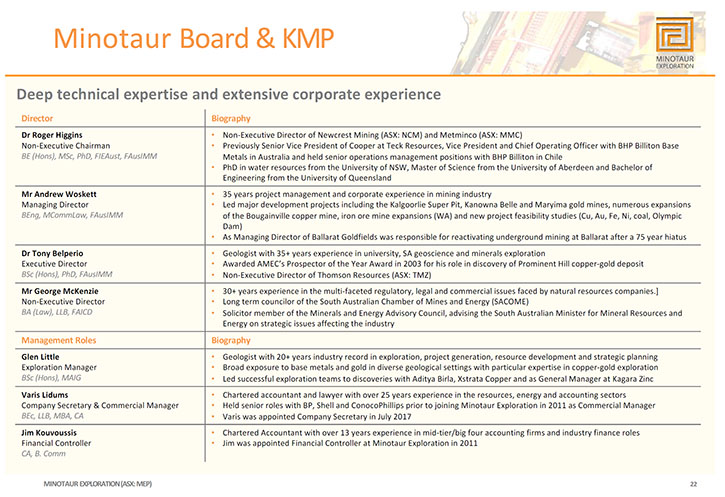

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a bit about your background and your board and your team?

Andrew Woskett: Certainly can. We have a very, very good board, I've got to say. We're a junior company with two Non-executive Directors and two Executive Directors. My fellow Executive Director is Doctor Tony Belperio. Tony was essentially responsible for the Prominent Hill discovery and is still with the company in an executive role. He is a doyen of the base metals exploration industry in Australia. Very well known, highly respected, terrific, fantastic geologist. He also has a very good understanding of the corporate side of things as well. Tony and I work hand in glove. It's a great partnership and I'm very grateful that he continues as an Executive in the company.

Our Non-executive Chairman is Doctor Roger Higgins. Roger has 40 odd years of operational experience with Teck and BHP in their copper divisions, including at Olympic Dam in South Australia. A very well credentialed engineer, working in the copper mining and production industry, for a very long time right around the world. He is currently a Non-executive Director of Newcrest Mining, which is a gold, copper mining company in Australia. Our other Director, Mister George McKenzie, is one of Australia's noted lawyers specializing in native title law and commercial law, also based in Adelaide. He has a very high profile in the legal industry, particularly in this state because of the intricacies of native title and his knowledge and ability to work his way through those. Minotaur has an excellent Board and we all work very well together. I’m very fortunate to have that.

Strangely, Al, within an organization populated by geo-scientists, being geologists and geophysicists, I'm the only engineer. My background is originally civil engineering. I've worked in the mining industry since 1981 starting out with what is now Rio Tinto, but in those days was CRA, in their engineering group. I've been working around the industry ever since with some experience in exploration and a background mainly in project development, project implementation and execution, feasibility studies. I was asked to join Minotaur to bring a bit of engineering discipline and that line of thinking to the company. I've been here now for eight and a half years and it's been a great relationship, I think, very constructive, very productive.

The team that we have in Minotaur is incredibly stable. The same people that were here when I started are still here. They're continuing to refine their skills and they take great pride in what they do. The company and the shareholders, frankly, are very fortunate to have the quality of the geo-scientists and managers that we have in this business. They are looked up to throughout the industry in Australia. People in our industry take specific notice of what Minotaur is doing because it is actually so innovate in its geoscientific pursuits.

Dr. Allen Alper: Well, that sounds excellent. It sounds like you have a great team, a great background and a diverse mix.

Andrew Woskett: It makes my life very easy. I can say that quite honestly.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a bit about your share structure?

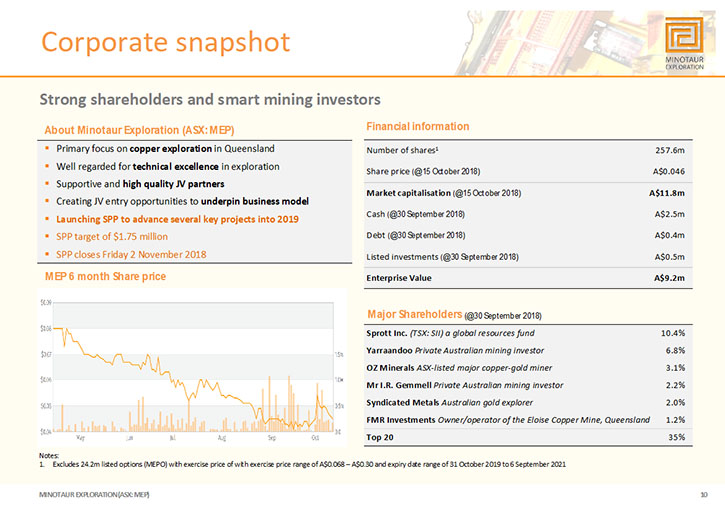

Andrew Woskett: We have ordinary shares listed on the Australian stock exchange. The ticker code on the ASX is MEP. We have on issue 258 million shares currently trading at around five cents, which gives us a market capitalization, and I'm going to talk Australian dollar terms here, Al, if you don't mind.

Dr. Allen Alper: No problem.

Andrew Woskett: Market capitalization of, say, 14 million Australian dollars. When you strip out the cash of two and a half million dollars that we held at the end of September a few days ago, and you strip out the half million dollars’ worth of listed investments, then our enterprise value is around about $11 million Australian. And I will convert that to US. That's about $8 million US. Now, our share price has been hammered over the last six months in particular. We've lost 30% of our share value in the last six months.

We're not on our lonesome there, of course. Many other companies are in the same position. But that sort of downward trend that's been in place now for the last six months or so has perplexed me somewhat because we have been able to provide continuous market updates over that period of time - news flow all positive, and despite that there hasn't been a lot of interest in the market. That's what it is, and we accept that. We're seeing signs of a little bit of a turnaround in our share price now but the enterprise value of 8 million US is really quite incongruous. When you look at the projects that we are working on and are currently active in, particularly around the Cloncurry region where we have three current projects underway, and take into account the amount of money that our joint venture partners are pumping into those projects, at the enterprise value there's a complete disconnect there between that and the value of the work being done and the amount of money being spent.

I'm one of those MDs, like most, that says we're undervalued. No one is going to say any different, of course, but I'm just trying to point out here that the enterprise value does not reflect the quality of the projects, the amount of money being spent or the results that we are pumping out on a regular basis, and will continue to pump out through to the end of the year. The turnaround we're starting to see in the share price, I think, is probably recognition that there's better value here and that investors are starting to come back on board again.

Dr. Allen Alper: Well, it sounds like there's a lot of potential for share wealth and value. What are the primary reasons our high-net-worth readers/investors should consider investing in Minotaur Exploration?

Andrew Woskett: The answers are very simple, Allen. Its focus. We don't get distracted by the fad commodities like cobalt or lithium or vanadium. We stick to our knitting. Point number one, we're focused.

Point number two is we are very good, and I don't want to sound conceited here, but we are very good at what we do in terms of prospect generation, turning prospects into targets, drilling targets, invariably hitting the target exactly where it's meant to be. And sometimes even finding that there's the right sort of mineralization that we were seeking at that particular target. So our techniques and our exploration management is first class. That's point number two.

Point number three, and a very important point, is the benefit that we derive from our joint venture partnerships, whereby in most cases those joint venture partnerships are based on the other party providing us the money to work on our projects in return for which they earn a beneficial interest in that particular project. We have a number of these. They're all active and they mean that Minotaur can work at a pace, at a level and a breadth and scope that far exceeds its ability were it to self-fund its projects. That's point number three.

Point number four, we are undervalued. I'll say it again. Clearly if people look at the projects, read our announcements and appreciate or try to understand what it is we are actually doing, they'll see a very consistent approach and methodology which pays off. Exploration is a numbers game. While you're drilling holes, you have a chance of success. If you're an explorer and you're not drilling, well, you've gone to sleep. We're able to say that we are very active.

By the middle of this month, for example, I'll have three diamond rigs working up around Cloncurry. We have two at the moment. Activity is important. You have to provide the opportunity for success. Success, of course, brings share price improvement and shareholder benefit realization. That's the fourth point. The activity level leads to the potential for success and Minotaur has a track record of success. There is no reason why we can't keep replicating that success.

Dr. Allen Alper: Well, they sound like very strong reasons for our high-net-worth readers/investors to consider investing in Minotaur Exploration. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.minotaurexploration.com.au/

Andrew Woskett

Managing Director

Minotaur Exploration Ltd

T +61 8 8132 3400

|

|