Calidus Resources (ASX: CAI) : Controls the High-Grade, Near-Surface, 712,000-ounce Warrawoona Gold Project, in East Pilbara District of Western Australia, Interview with David Reeves, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/16/2018

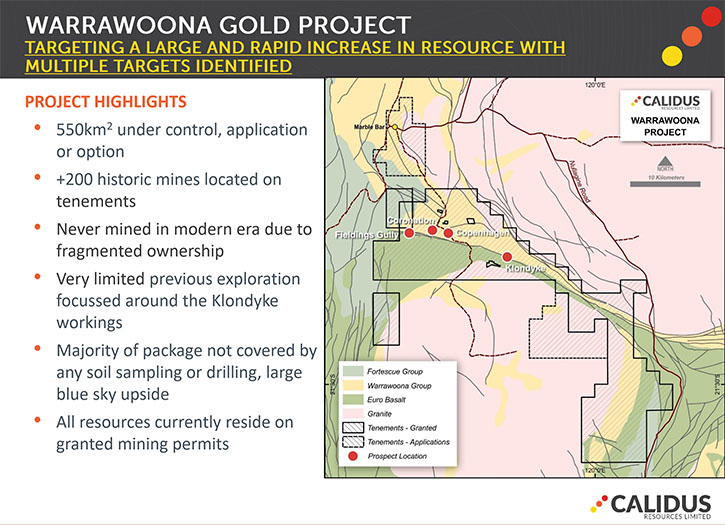

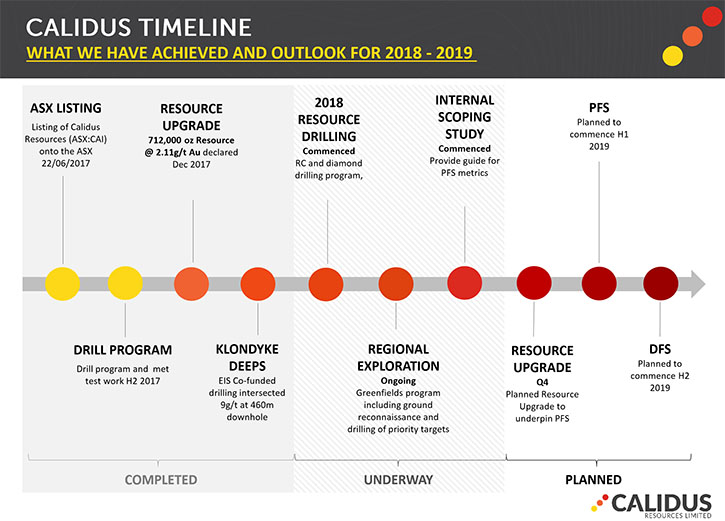

Calidus Resources (ASX: CAI) is a gold exploration company, which controls the high-grade, near-surface, 712,000-ounce Warrawoona Gold Project, in the East Pilbara district of the Pilbara Goldfield, in Western Australia. We learned from David Reeves, Managing Director of Calidus Resources, that they currently have three rigs turning on their Warrawoona Gold Project, with the aim of extending known deposits of Klondyke and Copenhagen, as well as looking for resources in the new deposits, called Coronation and the St. Georges Shear. The aim of all of this drilling is to get through the million-ounce mark, on the next resource upgrade, due in January-February of 2019. Plans for the next year include the pre-feasibility study due to be completed around June-July, which will lead to the feasibility study and on to development.

Calidus Resources Warrawoona Gold Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing David Reeves, who is Managing Director of Calidus Resources Limited. Could you give our readers/investors an overview of your Company, your focus and current activities at Calidus?

David Reeves: At Calidus, we currently have three rigs turning on our Warrawoona Gold Project, which is in the north of Western Australia. The project has 712 thousand ounces at two grams a ton out-cropping at surface currently. The drilling we're doing at the moment is extending known deposits of Klondyke and Copenhagen, also putting an initial resource onto a new deposit called Coronation. We’re also drilling out a shear that sits immediately north of our Klondyke deposits. It's about 150 meters to the north called the St. Georges Shear. We're doing an initial resource drill-out program there.

The aim of all of this drilling is to break through the million ounce mark on our next resource upgrade.

Dr. Allen Alper: Sounds great. Could you update us a bit more on the resource and the data you have collected on your properties so far?

David Reeves: Previously there's been about 40,000 meters of drilling put into the property. The resource at Klondyke is our largest deposit, at 654,000 ounces. We're currently drilling farther out to the east on it, near surface, down to about 100 meters depth. We're also putting in some diamond drilling beneath the resource to look at potential underground extensions. We do have a hole down about 350 meters below surface that intersected nine grams per ton so we are optimistic about what we will find.

Dr. Allen Alper: That sounds very good. Could you give our readers/investors more information on your plans for the coming year 2019?

David Reeves: Yes. January or February of next year, we'll be putting out a resource upgrade. We're doing an internal scoping study at the moment and that will lead to a pre-feasibility study the first half of next year. That will be complete next summer around June, July, which will lead into the feasibility study and then on to development.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors about your background, the Directors, and the Management at Calidus?

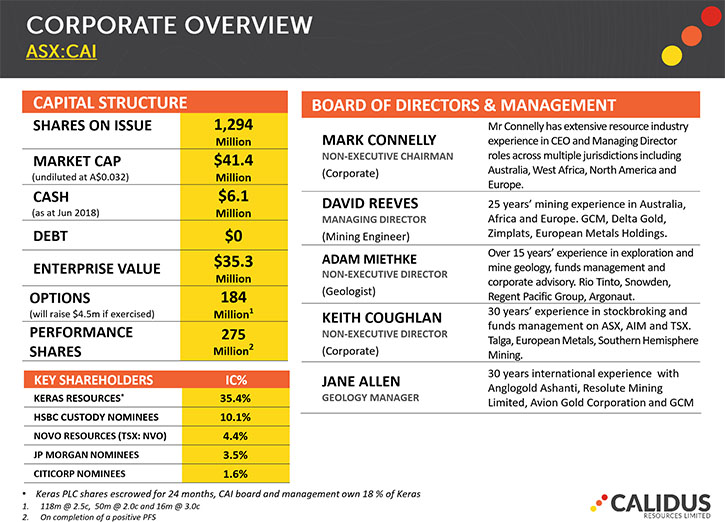

David Reeves: I am a mining engineer. I worked up to Mine Manager, operationally, in the gold fields of Western Australia. I have been involved in building about four mines, from feasibility through development, mainly platinum mines over in Africa, that's my core skill set. Our chairman Mark Connelly is very well known in the gold circles. He was involved with Papillion Resources, and building a couple of mines in West Africa. Jane Allen is our Chief Geologist. She most recently headed up brownfield exploration, for Anglogold Ashanti, for all of continental Africa. We have other board members: Adam Miethke, a geologist, who was in funds management and corporate advisory; Keith Coughlan, who’s been in stock brokering, is on the board as well to help with development funding when we get to that point.

Dr. Allen Alper: Sounds like you have a great background and your directors and management team are very strong. Great group there! Can you update our readers/investors?

David Reeves: We reversed the project into a two cent shell. Because of that we have about 1.25 billion shares on issue at the moment, a share price around three cents. That gives us a market cap of around 40 million Australian dollars. At the end of last quarter, we had 6 million dollars in the bank so an enterprise value of around 34 million. There are some performance shares and options outstanding which will take the fully diluted share capital to 1.75 billion shares.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Calidus LDS Resources?

David Reeves: A lot of news flow is happening at the moment, with three rigs drilling and a resource upgrade due next year. We believe once we're over the million ounce mark we'll see a re-rating of the stock. We are doing an internal scoping study. It's showing really good results. By the time we get the prefeasibility study out to market, I think people will realize what a good deposit this is. That's such a very good reason to invest now.

Dr. Allen Alper: Sounds like very strong reasons to invest. Is there anything else you'd like to add, David?

David Reeves: I want to thank you for interviewing us for Metals News

Dr. Allen Alper: I know our readers/investors will find it very interesting. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

https://www.calidus.com.au/

Dave Reeves

Managing Director

dave@calidus.com.au

|

|