Middle Island Resources Limited (ASX: MDI) : Gold Exploration and Aspiring Development Company Focused on Western Australia, Interview with Rick Yeates, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/16/2018

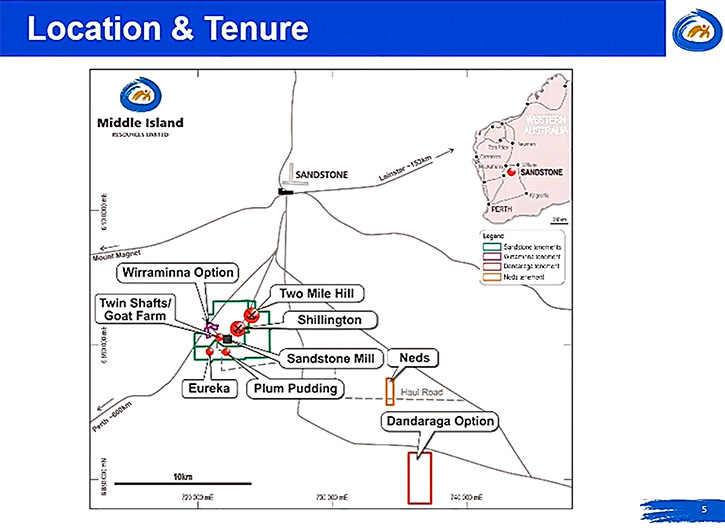

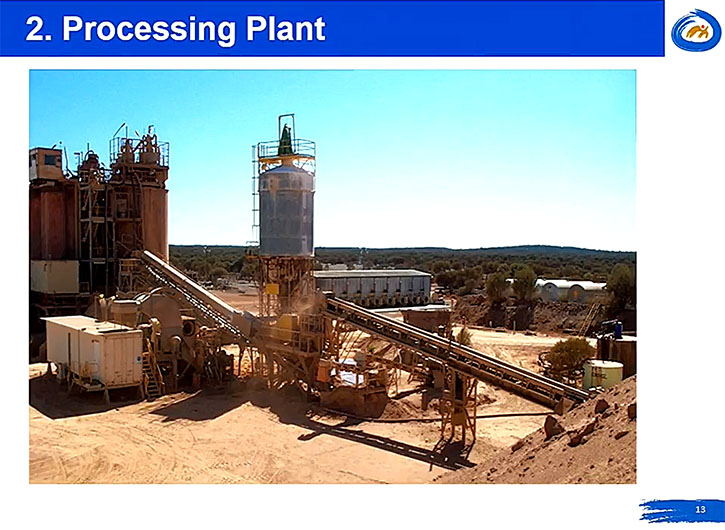

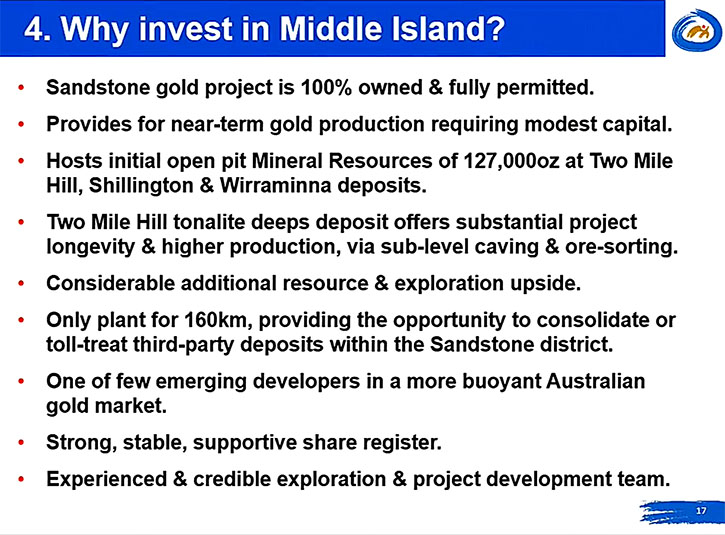

Middle Island Resources Limited (ASX: MDI) is a gold exploration and aspiring development company focused on Western Australia. We learned from Rick Yeates, managing director of Middle Island Resources, that they are focused on a single project called the Sandstone gold project located about 400 km northwest of Kalgoorlie in the heart of the Western Australian goldfields. The project is 100% owned and fully permitted. The project's resource is approximately 540 thousand ounces plus an exploration target of 900 thousand to 1.5 million ounces. The project includes a 600 thousand ton a year processing plant, which is on care and maintenance, and the company's primary strategy is to recommission that plant and get into production as soon as practically possible. According to Mr. Yeates, this is the only processing plant for 160 km, providing the opportunity to consolidate or toll-treat third party deposits within the Sandstone district.

Middle Island Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rick Yeates, managing director of Middle Island Resources Limited. Rick, could you give our readers/investors an overview of your Company, your focus and current activities?

Rick Yeates: We're an ASX listed gold explorer and aspiring developer. We're focused on a single project, which is the Sandstone Gold project in Western Australia. It's located about 400 km northwest of Kalgoorlie in the heart of the goldfields. We have resources there of approximately 540 thousand ounces plus an exploration target of 900 thousand to 1.5 million ounces. The project includes a 600 thousand ton per annum processing plant, which is on care and maintenance. Our primary strategy is to recommission that plant and get into production as soon as possible. We've had the project for about two years and the challenge for us has been building the resource inventory, first in terms of longevity,

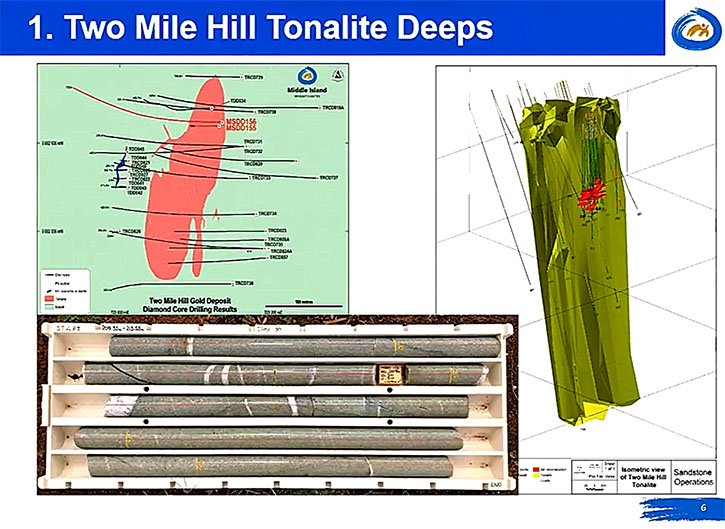

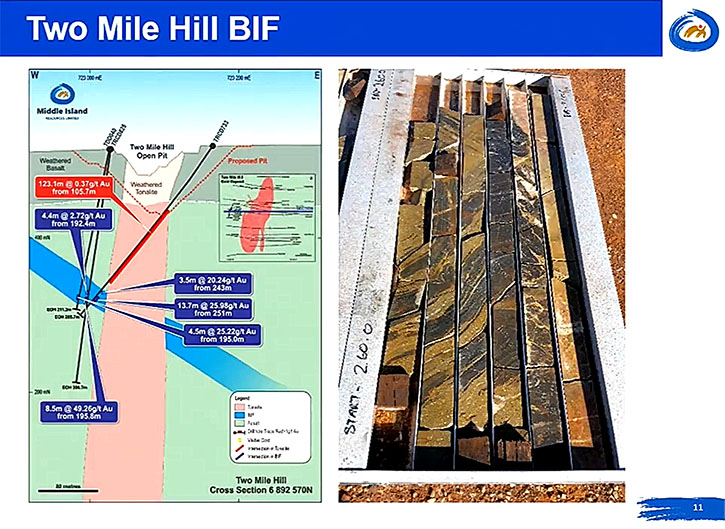

secondly in terms of enhancing the production profile at the front end of that schedule to improve the payback. The first objective we're well and truly on the way to achieving, via a potential 12 to 15 year mine life extension at the Two Mile Hill tonalite deeps deposit. This deposit presently comprises a tightly constrained Exploration Target of 900 thousand to 1.5 million ounces, between the base of the quantified open pit material at 140 meters depth to the base of our deepest drilling 700 meters depth.

That exploration target is focused on a tonalite plug, which is pervasively carbonate-sericite-pyrite altered and hosts ubiquitous, sub-horizontal, sheeted quartz veining. The deepest hole is a little over 700 meters, and the tonalite plug remains open below that level. At surface the tonalite measures about 250 meters in length, about 90 meters in width, we've chased it down to 700 meters, and it's open below that. The longest diamond drill intercept to date is 500m at 1.4g/t Au, and we have many others of similar magnitude.

The project is quite low-grade, probably 1.3 or 1.4 grams overall, so beyond the realms of the open pit. We are evaluating bulk mining scenarios, whether that be a block cave or most likely a sub-level cave type operation, and the economic key is ore sorting. Some 99.6% of the gold is hosted by quartz veins within the tonalite. We've completed a couple of ore-sorting campaigns, primarily based on color or laser sensors, followed by an XRT scavenge. This results in a significant upgrade, recovering some 93 percent of the gold in about 30 to 40 percent of the mass. Importantly, that brings the project into compatibility with the 600 thousand ton per annum processing plant. Previously we'd parked the deposit up as a separate project that was incompatible with the existing processing plant. So, the Two Mile Hill tonalite deeps deposit certainly takes care of the potential longevity of the operation, assuming we can demonstrate the economics of a sub-level cave operation, applying ore-sorting technology.

Secondly in terms of enhancing the production profile at the front end of the schedule to improve payback, that's primarily been focused on shallow, higher grade, low strip ratio open pit deposits. We've been undertaking a number of RC drilling programs and we’re in the process of updating resource estimates on two of these Likewise, exploration of our greenfields targets has identified several new potential open pit opportunities. We own the only processing plant within 150 kilometers and there are a number of stranded deposits held by other parties within the district. As such, we are in discussions about potential consolidations, be they at the corporate-level or asset-level, to effectively amalgamate the field around a central processing hub. So that, Al, is probably the company in a nutshell.

Dr. Allen Alper: That sounds very good. What is the timing on going forward to bring your project into production and expand the resource?

Rick Yeates: We completed a pre-feasibility study in late 2016 and concluded that the mine life and grade profile were inadequate to justify recommissioning at that time. So we've been very focused on the drill bit since that then. We would hope to be in a position to revisit the study in the first half of calendar 2019.

Dr. Allen Alper: That sounds very good.

Rick Yeates: The total refurbishment cost of that recommissioning, completed to a DFS level, is 10.3 million Australian dollars, including owners’ costs. On top of that, of course, we would need to consider contractor mobilization, pre-production mining and working capital, so the ultimate number will probably be nearer 20 than 10 million Australian dollars.

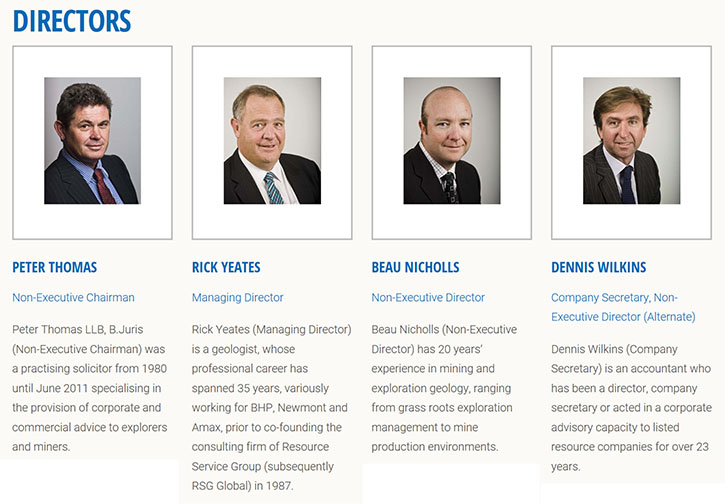

Dr. Allen Alper: Yes. Could you tell our readers/investors a bit about your background, the Board and the Management team?

Rick Yeates: I'm a geologist, primarily an exploration geologist, but I've also worked in several mining environments. 23 years of my career was as a consultant. I co-founded the consulting company, Resource Service Group, which, following a merger, became RSG Global, and in 2006 we sold that business to Coffey International, into what became Coffey Mining. I finished up with Coffey in 2009 before it was taken over by US company, Tetra Tech. I started pulling Middle Island together in 2010, which was then primarily focused on West African gold assets. But, in 2013 we fell afoul of one of our host government's mine ministers, who proceeded to interfere with our transaction to acquire a gold operation and then proceeded to expropriate our permits, which included resources surrounding that project. In an effort to mitigate shareholder exposure to sovereign issues, we came home. We are now very much focused in Western Australia.

Dr. Allen Alper: Sounds like a very strong background. A great variety of experience!

Rick Yeates: Yes, as a consultant, I had the good fortune to work in some 39 countries on all continents, and I've worked on over a thousand projects. I’ve had exposure to a number of commodities, a number of operations and exploration projects and a variety of geographies. Overall I've been in the industry for about 38 years and I've had a very varied and rewarding career.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit more about the other Board members?

Rick Yeates: Yes. The Company is chaired by a former mining lawyer, Peter Thomas, and we have one other non-executive director, Beau Nicholls. Beau is a geologist, again with a wealth of global experience. He's Australian by background and he spent many years in Africa and South America. He's currently CEO of a private consulting group called Sahara Mining Services, based in West Africa.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a bit about your share structure?

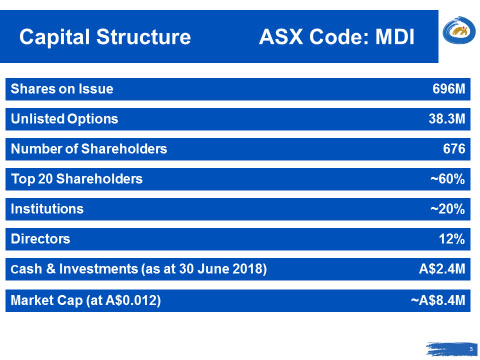

Rick Yeates: We listed in December 2010, so we've seen some good years and some not-so-good years, so the capital structure has blown out somewhat. We have about 700 million shares on issue, but these are still quite tightly held. Approximately 60 percent of the register is held by the top 20 shareholders. So it's still surprisingly tightly held. Some 20 percent of the register comprises institutional investors, while the directors are well-incentivized with about 11 percent collectively. The cash and liquid investments at of the end of June comprised about two and a half million Australian dollars and the market capitalization was about nine million Australian dollars.

Dr. Allen Alper: That sounds very good. Sounds like an excellent opportunity for investors to investigate. What are the primary reasons our high-net-worth readers/investors should consider investing in Middle Island Resources?

Rick Yeates: I would argue that there are probably not too many companies around with a fully-permitted processing plant and mining leases, with some 540 thousand ounces in resources and a further 900 to 1.5 million ounces in an Exploration Target, with a market capitalization of only nine million Australian dollars. So certainly a very compelling investment opportunity, particularly in light of the near-term gold production opportunity, the significant exploration potential and the ambition to consolidate all deposits within the region.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, Rick?

Rick Yeates: First of all I want to thank you for interviewing me for Metals News. We appreciate it. We have a very strong team. Due to previous consulting relationships, we have ready access to top flight consultants, variously in resource estimation, mining engineering, pit optimization and metallurgical assessment. I'm the only full-time employee. I have an administration assistant, who is at 70 percent, a full-time contract geologist, a part-time contract mining engineer and a part-time contract metallurgist. So we are a very small, but productive, team and certainly able to keep our overheads to an absolute minimum.

Dr. Allen Alper: That sounds excellent. We’ll publish your press releases as they come out, so our readers/investors can follow your progress. You have a very well thought-out approach and my guess is we’re going to have some good news to follow.

http://www.middleisland.com.au/

Rick Yeates

Mob: +61(0)401 694 313

rick@middleisland.com.au

|

|