Perseus Mining Limited (ASX/TSX: PRU): Diversified West African Gold Producer, Growth Strategy to Transform the Company into a 500,000-Ounce per Year Gold Producer, Interview with Jeff Quartermaine, Managing Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/12/2018

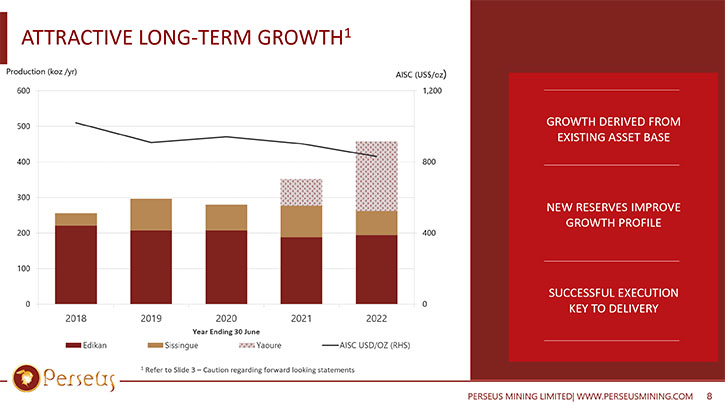

Perseus Mining Limited (ASX/TSX: PRU) is a diversified West African-focused gold production, development and exploration company, producing gold from its two mines in Ghana and Côte d’Ivoire, and developing the third gold mine in Côte d’Ivoire. Perseus' growth strategy aims to transform the Company into a 500,000-ounce per year gold producer, with three operating mines in West Africa by 2020. We learned from Mr. Jeff Quartermaine, Managing Director and CEO of Perseus Mining that the company has been continuously establishing a credible record of performance, building up their own production, while at the same time, bringing down cost, increasing cash flow and available cash. Plans for 2019 include construction of the Yaouré Project, also in Côte d'Ivoire. According to Mr. Quartermaine, Perseus Mining has come from being a single mine operation, with single country exposure, to a multi mine, multi country Company in a very strong financial position, which allows it to fund projects and future growth.

Perseus Mining

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Jeff Quartermaine, who is Managing Director and CEO of Perseus Mining. Could you give our readers/investors an overview of your Company, what's happening in West Africa and the progress you've made since we spoke before?

Mr. Jeff Quartermaine: As people may recall, we are an Australian gold mining company that has all of our operations in West Africa. We are involved at each stage of the business of gold mining: exploration, project development, and of course operations.

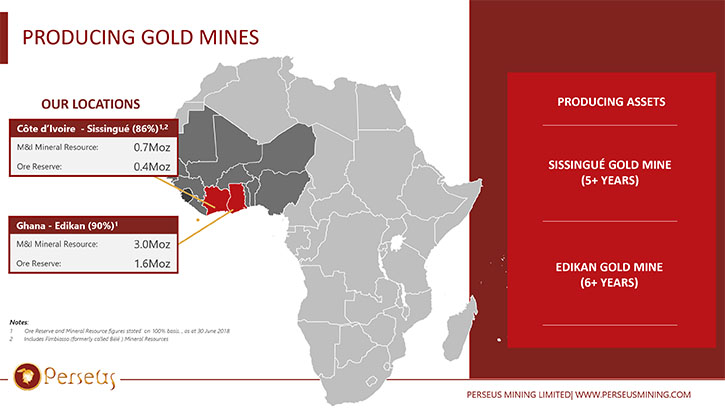

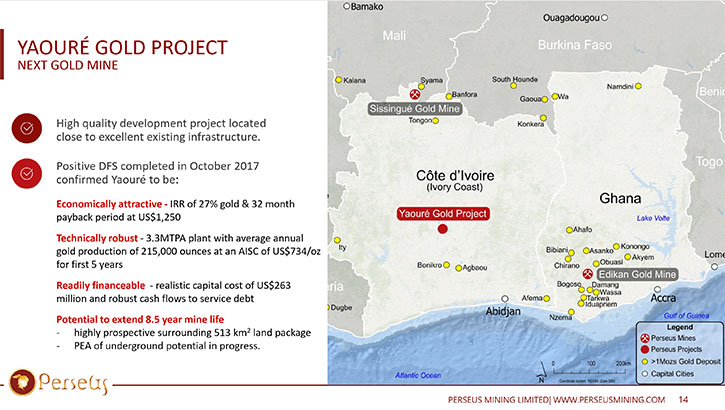

At the present time we are currently operating two mines in Africa. One is located in Ghana, and we have another mine in Cote d'Ivoire. We are also in a position to shortly start development of our third project, which is also in Cote d'Ivoire, hopefully late this year or early next year, certainly as soon as we've confirmed or locked in our financial package.

Since we last spoke, we have made a lot of progress. We have been continuing to establish a very credible performance record, building up our gold production, and at the same bringing down our cost. So that's had the impact of increasing cash flow and available cash. At the end of July, we were holding cash and bullion of about $76 million, and had debt of about $60 million, giving a net cash position of about $16 million.

So we've moved from being in a position of having net debt to a position of having net cash, and our cash build continues quite strongly, on a month to month basis. This is very important in the context of our company, because it allows us to fund the development of the next project, using a combination of debt and internal cash, which means that we don't need to revert to the equity market for the funding at this stage of the game.

So we have made a lot of progress. We came from being a single mine operation, single country exposure, to a multi mine, multi country, and we have put ourselves in a very strong financial position, which allows us to fund projects hence the future growth.

Dr. Allen Alper: Well that sounds excellent. That's really something to be proud of. You and your team have made excellent progress. What are your goals for 2019?

Mr. Jeff Quartermaine: Well in 2019, we will be seeking to achieve our earnings budgets, achieve the production and cost guidance that we have given to the market. In terms of activities, we are moving ahead getting our funding in place for the development of the Yaouré project, and we’ll probably start construction of that mine early in the new year.

Dr. Allen Alper: That's excellent. Could you elaborate a bit on what you're achieving right now from your operations?

Mr. Jeff Quartermaine: Yes, I can. We’ve published production statistics up to the end of June. In the June quarter we produced, between the two operations, about 85,000 ounces of gold at a cost of a little over $900 an ounce. In the period since then we've continued that strong performance and will announce results for the September quarter very shortly. The Edikan mine is working extremely well. We're getting a commendable increase in production, and we're bringing our cost base down.

The Sissingué mine, which we developed early this year, has also been working very, very well. We've been very pleased with the performance of that mine. We're either exceeding or achieving all of the technical parameters that were set out for us. Up until the end of August, we were running well above our budgets at both Sissingué and Edikan and that good performance has continued during September.

Unfortunately, at Sissingué, we've been hampered a little this quarter by some extremely wet weather. We've seen a little in excess of 40 inches of rain drop on the site at Sissingué. While we managed to cope with that very comfortably early in the quarter, by the latter stages of the quarter it has caught up with us hampering our ability to mine the high grade that we were intending to mine during that period, so we're processing ore, which is of slightly lower grade than planned.

We are still very close to our budgets though and are performing well.

Dr. Allen Alper: Well it sounds like you're doing quite well in adverse climates. And how is the weather forecast four months ahead?

Mr. Jeff Quartermaine: We are at the end of the wet season now, so in the next few weeks we expect that there'll be a significant decrease in the wet weather. But, we are back mining the area that we want to be mining now. The weather situation is short lived and does not represent a fundamental problem for our business. These things occur from time to time. We just need to be a position to deal with things as we go forward.

Even in future years we won't be impacted by weather in the same way as we have been in this period, because at the moment we're mining oxide ore which is very soft and liquefies very easily.

We are just about to start mining transitional ore and by the end of October we'll be into the fresh material. Now what that means is that once you're mining in fresh material, you've got base material which you can use to sheet roads and the ROM pad which means that you don't have the same sorts of problems when it rains as you do when you're working in soft clay like materials, as we are at the present time.

So it is a short term situation. What's it's really meant is that we've just achieved our budget instead of exceeding it by a very long way, which is what I was hoping to achieve.

Dr. Allen Alper: It sounds good. Could you refresh our readers/investors about your background, your team and Board?

Mr. Jeff Quartermaine: I've been in the mining industry now for a very long time, I must say. It seems like a very long time at least. I'm an engineer by profession, and I'm also an accountant by profession, and I've been involved in corporate management of public companies now for the last 25 years.

So personally I'm fairly experienced in this sort of thing. I have an extremely good team around me, in fact a very, very good team around me in both the technical and financial areas, commercial areas. Recently we beefed up our team in the area of human relations and also in the areas of business development and investor relations.

I'm very fortunate to be supported in this endeavor by an outstanding team of people both at our corporate office and at each of our sites in Africa. These are technically excellent people, all highly motivated and very keen to deliver the outcomes that we've been pursuing collectively.

Dr. Allen Alper: Sounds very good. Could you tell our readers/investors about your capital and share structure?

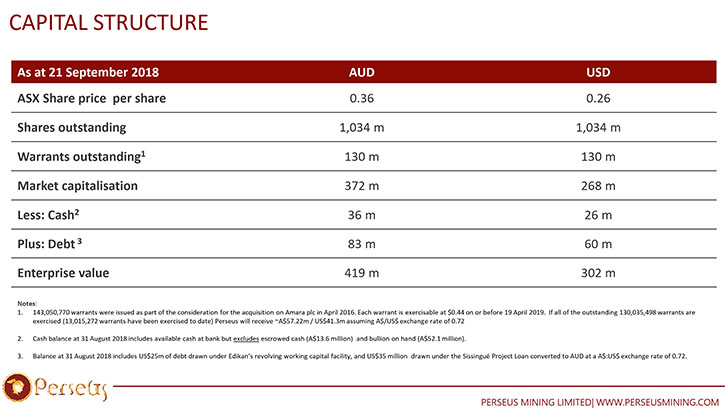

Mr. Jeff Quartermaine: Yes. On issue we have about a billion shares at the present time. These shares are trading at around AUS$0.36 per share. That equates to a market capitalization of something in the order of 360 million Australian dollars or about US $265 million at the current exchange rate.

Now, we have about $76 million US in cash and bullion, and we also have debt of about $60 million US at the present time, although that our debt will be reduced by at least another US$5 million by the end of the quarter.

For a company that is producing the amount of gold and the amount of cash that we are, our share price and our market capitalization is extremely low, relative to many of our peers. We think that with our progress over the last 18 to 24 months, we're starting to be recognized by the market and we're anticipating seeing our shares increase in value in the not too distant future.

Dr. Allen Alper: Well that sounds great. It's like you're poised for an increase in share value and market value.

Mr. Jeff Quartermaine: Well certainly we expect that to be the case. We have just finished holding 30 meetings at the Denver Gold Forum. We met with a range of investors and stockbroker analysts. The reaction to our recent achievements and to our plans was overwhelmingly positive. If that's any guide, then I think that our expectation of a share price re-rating not too far into the future is a very reasonable expectation.

Dr. Allen Alper: Well it sounds great. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Jeff Quartermaine: Well if your investors would like to invest in a company that represents a safe haven in troubled times, then Perseus represents a very good investment for them. The gold price at the moment is running at around $1200 an ounce. There are a lot of reasons out there to believe that in the future we might see a higher gold price. If that happens, then I think the broader market, professional and private investors will certainly be looking to include larger amounts of gold in their portfolios.

According to the people I've been speaking with recently, when investors look for gold stocks in which to invest, our company ranks very, very highly on almost every measure, and particularly in terms of the achievements, relative to our valuation.

Now, the importance of this is that, if there is a shift in the thinking of the market and when it does come back into the gold sector, then we are going to see a very rapid correction process, and I would think, given our attributes and given our relatively low valuation, we are likely to be a beneficiary of some of that money coming into our sector.

We do know that in recent times, for instance in the Canadian market, there's been very little interest in the precious metals area. Lots of money has been taken away from that and invested in cannabis and crypto currencies and things of that nature.

People will have different opinions on whether that is a long term shift or just currently fashionable. I tend to think that these things move in cycles, in which case money will come back into the minerals sector in due course, and when that happens, we believe our stock is likely to be a major beneficiary. I think that's why your readers/investors should consider investing in our company, because it does have the potential to have a very material rise in share price, and this is a company that I've invested in. I'm really proud of it. I think it is a well-managed company, and we've managed our downside risk very well, and our shareholders will benefit from our success.

Dr. Allen Alper: Sounds like excellent reasons to consider investing in your company. Could you tell our readers/investors how it is operating in West Africa?

Mr. Jeff Quartermaine: A lot of people who haven't worked in West Africa are a little anxious about it. It's something like “the fear of the unknown”.

I think what appears in the media, from time to time, tends to exaggerate the situation. I can say that the West African countries are absolutely no different from Australia, the United States, Canada, or any of the other countries around the world, where politicians are trying to do the best for their citizens.

The African countries welcome foreign investors, but they do expect to receive a fair recompense for having foreign investors come in and exploit their natural resources. I think that's a perfectly reasonable expectation. We are well past the days where people come in and take everything and leave nothing behind.

I think the concerns people have about African countries are very much overstated. A lot of commentators miss the fact that on the African continent, there are over 50 separate countries, depending on the definition of the country. And each of these has its own set of rules and cultures and behaviors. And so what applies in one country, doesn't necessarily apply in other countries. For instance if the government changes the tax rules in Tanzania or the DRC as has been done in recent times, it doesn't automatically follow, at all, that the governments of the countries in which we will operate, will act in a similar manner. In fact there is absolutely no basis for this whatsoever.

A lot of people make a big thing about operating in Africa. For us, we've been there for quite a lot of years now. I think we're very experienced in dealing with the ups and downs that occur. We think that the ups and downs are no different from what a mining company will experience in any other country. I guess, through our many years of working in these places, we've come to learn the issues that you need to be very worried about. We've certainly become quite adaptive, dealing with the challenges as they arise.

Dr. Allen Alper: Well it sounds very correct. Is there anything you'd like to add here?

Mr. Jeff Quartermaine: The Perseus story is probably one of the best turnaround stories in the gold sector in recent years. We did experience some real challenges when we started our company. But in the last couple of years, we've focused very hard on our physical assets, our human assets, our social license to operate and our financial assets. And by doing that we've been able to turn the business around and turn it into a very viable, multi operation, multi country business. We have the financial capacity to deliver, as well as the people.

I think that some time ago, Perseus was in a relatively weak position. But, now we are in a much stronger position. We are very excited about the future. We are very excited about starting to deliver significantly to the shareholders in coming years.

Dr. Allen Alper: Well that's excellent. That's really something. Guys, you've done a fantastic job you and your team.

Mr. Jeff Quartermaine: Thank you.

Dr. Allen Alper: We’ll publish your press releases as they come out so our readers/investors can follow your amazing progress.

http://perseusmining.com/

Jeff Quartermaine

Managing Director

+61 8 6144 1700

jeff.quartermaine@perseusmining.com

|

|