Gran Colombia Gold Corp. (TSX: GCM, OTCQX: TPRFF): Largest Gold and Silver Producer in Colombia, Interview with Mike Davies, CFO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/3/2018

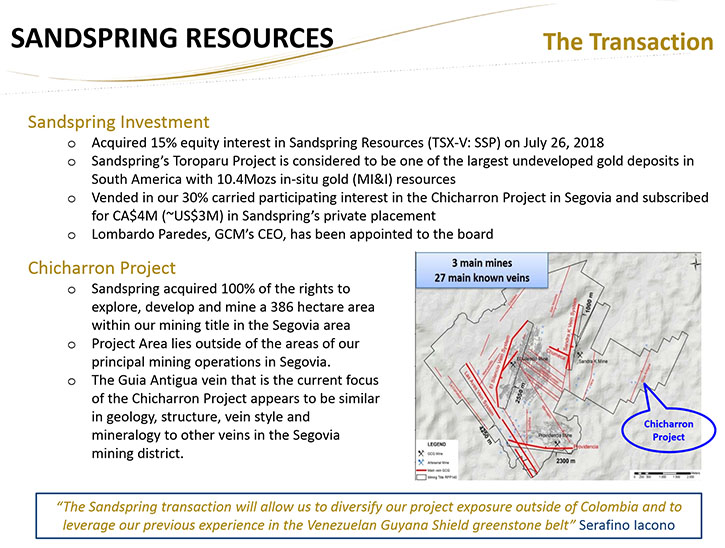

Gran Colombia Gold Corp. (TSX: GCM, OTCQX: TPRFF) is a Canadian-based gold and silver exploration, development and production company, with several underground mines in operation at its Segovia and Marmato Operations. We learned from Mike Davies, CFO of Gran Colombia Gold, that the company is currently the largest gold and silver producer in Colombia, with 90% of production coming from the Segovia project in the Antioquia belt. At its Marmato project, Gran Colombia is running a small mining operation, with plans for potential expansion. Its third project, Zancudo exploration project, is under option to IAMGOLD, who are currently executing a drilling program as part of an earn-in agreement. We learned from Mr. Davies that the company recently acquired a 15% interest in Sandspring Resources, who's Toroparu Project is considered to be one of the largest undeveloped gold deposits in South America. At the same time, Sandspring acquired 100% of the rights to explore, develop and mine the Chicharron Project, within Gran Colombia's mining title in the Segovia area. According to Mr. Davies, things are moving along well for the company. Their production more than doubled since 2014. Mr. Davies believes that Gran Colombia Gold's stock is significantly undervalued compared to its piers, they are "a mid-tier gold miner available at a junior price".

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Davies, who is CFO of Gran Colombia Gold Corporation. I wonder if you could refresh the memories of our readers/investors. Give them an overview of your Company and your strategy.

Mike Davies: Happy to. Gran Colombia is a Canadian listed company on the Toronto Stock Exchange that is currently the largest gold and silver producer in Colombia. We have our primary operations at the Segovia project in the Antioquia belts of Colombia, about 90% of our production. We also have an interest in the Marmato Project.

For our Marmato project, where we have a small mining operation, we're currently working on a project to work out the potential for expansion of our mining operations, from an underground mining perspective. Our third project is the Zancudo exploration project in Colombia, currently under option to IAMGOLD, who are doing a drilling program, right now, as part of an earn-in project. Most recently, at the end of July, we acquired a 15% interest in Sandspring Resources, a TSX-V listed company that is currently advancing their Toroparu project in Guyana toward feasibility. At the same time, Sandspring recently acquired a 100% interest in a project that we have at our Segovia title, called Chicharron, which is a potential future silver/gold producer.

Dr. Allen Alper: Sound great. Could you elaborate a little bit more on the resources of your projects and production?

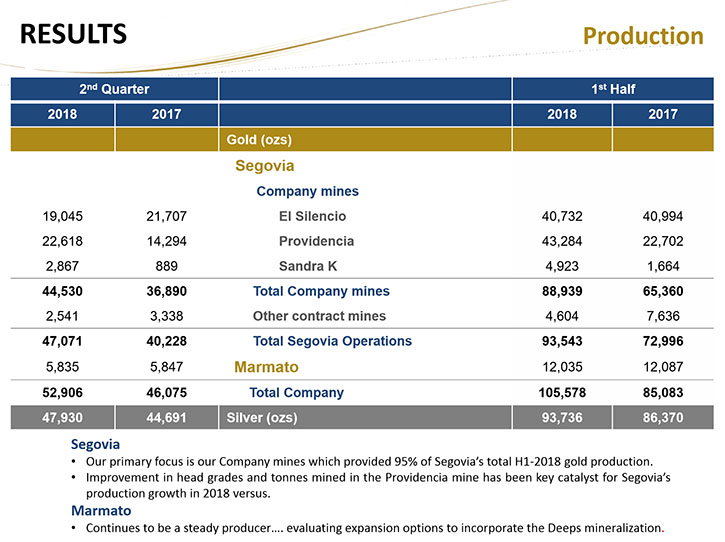

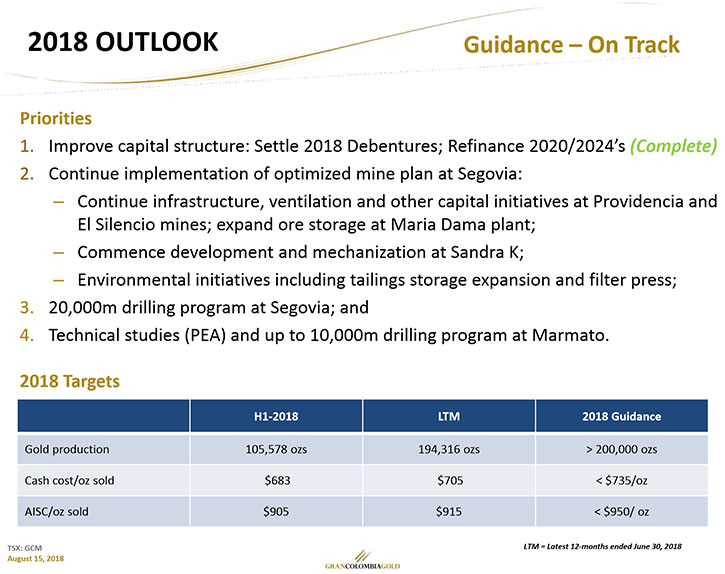

Mike Davies: Earlier this year we announced our maiden reserve on the Segovia project, which is our flagship producer. We have proven and probable of 660,000 ounces of gold, with an average grade of about 12 grams a tonne. Our resource on the project, which is capable of taking the mine life out about eight years, at the present moment, has about 2.3 million ounces, grading between ten and eleven grams per tonne. Our production since 2014, in total for the company, has more than doubled, Segovia being the key driver. Its production has also more than doubled. Its latest 12 month production at the end of August was 187,000 ounces and we're expecting more improvement on that by the end of the year, so probably a little bit north of 190,000 ounces for this year.

Marmato right now has an underground resource, measured, indicated and inferred about eight million ounces. It's producing at a run rate of about 25,000 ounces a year, at the moment. That's the project on which we're currently starting the work this year towards a potential expansion of its underground mining operations.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit about your operating results and balance sheet?

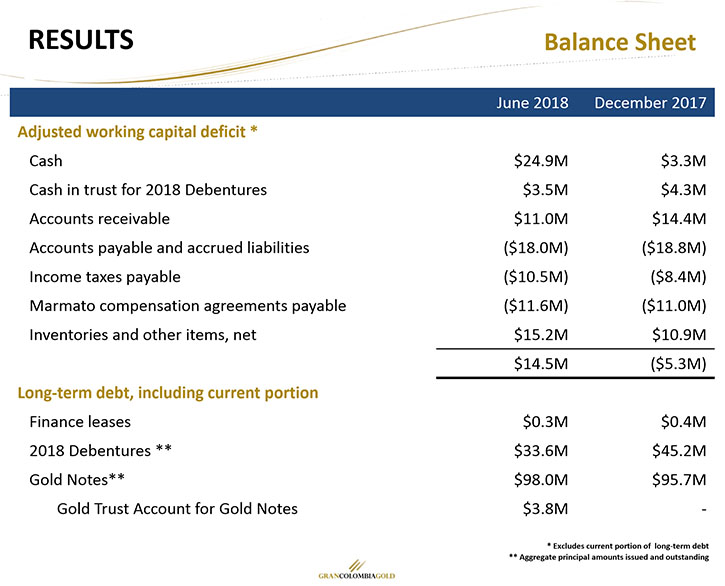

Mike Davies: Yes, happy to. When we look at Gran Colombia, since we last talked in June, things have really continued to move along well for this company. Back when we talked in June, we had just completed a financing to refinance the senior secured convertible debentures. Since then, the senior unsecured convertible debentures that were coming due as shares in August, we were able to complete that successfully. Now we're sitting with a balance sheet, which is much stronger than we've ever had and a capital structure that is quite simple and certainly not fraught with the dilution that the previous convertible debt structure had.

At the moment, we have US$25 million dollars of cash that showed up on our June 30th balance sheet as a result of the cash flow we're generating and the refinancing that brought sinking funds for the convertible debentures back onto our balance sheet. We feel that we have a very strong cash position to backstop our operations as we move ahead. We have 93 million of debt outstanding at the moment, which is the balance of our gold notes that we issued at the end of April. They're a six year loan that is repayable in cash based on the gold price at the time of the quarterly repayments, whereby the holders will get a gold kicker for the ounces we repay on those quarters, if gold is above US$1,250 an ounce. It has an 8.25% coupon. We're thrilled with the new debt package because it has a disciplined repayment structure, but more importantly it eliminates two things that I think were problematic for us with the previous convertible debt structure. One was the threat of the dilution that worried a lot of investors and potential investors. The other is we don't need to set aside all of our free cash flow into sinking funds for the debt. I can keep that on our balance sheet and use that to move forward with our business strategy faster.

We're currently sitting with 48 million shares outstanding. We have another 12 million shares issuable on warrants at CA$2.21 per share that went out with the gold notes. We have another three million stock options that are near the money. So total fully diluted share count for us at the moment is around 63 million shares.

Our strategy, now that we've completed all the clean-up of the balance sheet and the capital structure, is to take us now from the current level where we're north of 200,000 ounces. We're now a mid-tier gold producer. We have strong EBITDA. We generated US$95 million dollars of EBITDA in the twelve months ended in June 2018, of which US$25 million of that came out as excess cash flow. So a very strong position.

We're going to continue to focus on increasing our production. 300,000 is the next level we're going to target. We're going to do that by, first and foremost, keeping the priority on the exploration and development of our high grade Segovia project. We're continuing to do some study and evaluation of an expansion of Marmato. In our pipeline, we have Zancudo and the Sandspring project to round out our opportunities for production and cash flow growth.

Dr. Allen Alper: Well that sounds excellent. That sounds like your company is making excellent progress and doing extremely well getting off the ground, increasing your production, increasing your profitability. Excellent results!

Mike Davies: We have been, we are, and we’re going to continue to focus on the things we can control; our cash, our costs and our execution of our programs. Gold price is what it is. Not much anyone can do there. We're targeting cash generation, which is an important attribute. So it's not necessarily about trying to produce as many ounces as we can, but we're trying to produce as many cash accretive ounces as we can, as we move forward.

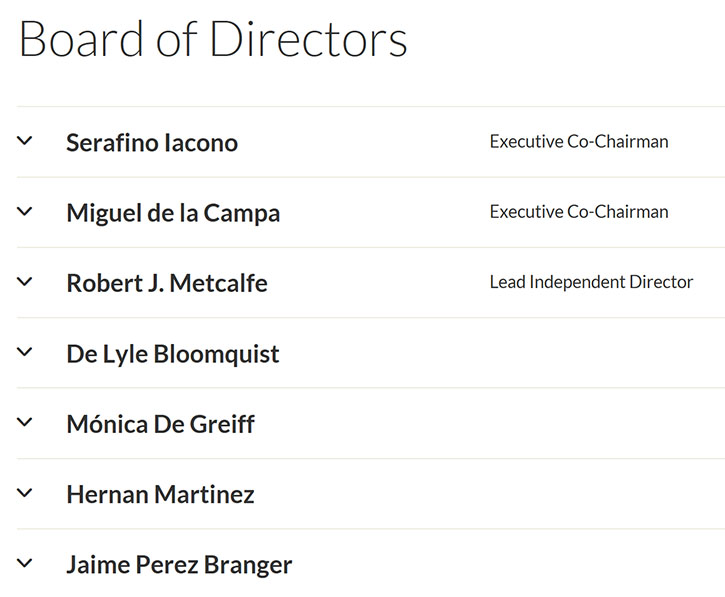

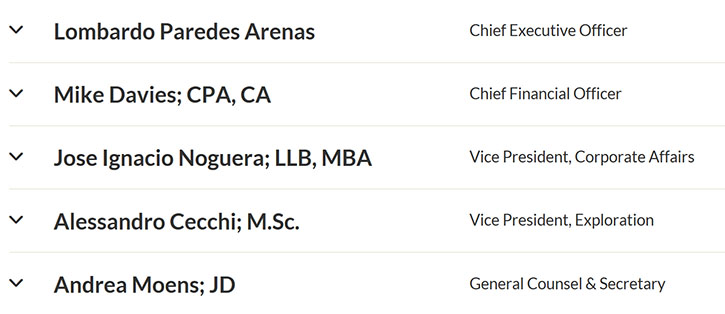

Dr. Allen Alper: That sounds excellent. Can you refresh our readers/investors’ memories on your background, the Team’s and the Board’s?

Mike Davies: I joined the company at the time it started back in 2010. I've worked with this group for the past eleven years, in numerous resource projects in Colombia. I'm a CPA in Canada, with over twenty years’ experience in public companies. Our founders and co-chairmen Serafino Iacono and Miguel de la Campa had great success in numerous resource companies, in the past, including Bolivar Gold, which started up a project in the Guyana shield belt. Sandspring's project is also in the Guyana shield belt, so there's a good segway for us into that project. Our founders have good experience in that belt to understand that project and how it can move ahead.

Our CEO is Lombardo Paredes, who had significant experience running large businesses and transforming the business. He deserves most of the credit for the operation turnaround the last couple of years.

Mr. Iacono has over thirty years of experience in capital markets and public companies and has raised more than four billion dollars for numerous natural resource projects internationally. He is currently a director and chairman of Western Atlas Resources Inc. and is a former Co-Chairman and an Executive Director of Pacific Exploration and Production Corporation and a former director of PetroMagdalena Energy Corp. Mr. Iacono was also a co-founder of Bolivar Gold Corp and Pacific Stratus Energy, among others, and is involved in numerous resource and business ventures in Latin America, Canada and United States.

Dr. Allen Alper: Sounds like a very strong team and very competent. That's excellent. Could you tell our readers/investors how it is operating in Colombia, working there?

Mike Davies: There is a lot of optimism, in Colombia, for the new government that's recently taken power. Certainly it is a business friendly environment, investor friendly. We're very positive right now about the potential for continuing and improved support for the mining industry as things move ahead. We've benefited, as a company, from the fact that most of our senior management team are based in Colombia, we have an office in Medellin. So our people on the ground, understand very well what it takes to work in Colombia and certainly the specific nuances of what it takes to work, within the areas in which our projects are located.

We have a pretty good social footprint, especially in Segovia. A foundation that's responsible for many social projects, including the local schooling system in Segovia. We focus on our responsibility to the community for the health and safety of our workers and certainly our interaction in the local mining congress and work with the local mining community that gives us a good position to operate within Colombia.

Dr. Allen Alper: Very good, Mike. What are the primary reasons our high-net-worth readers/investors should consider investing in Gran Colombia Gold?

Mike Davies: Aside from the usual things, the quality of our assets, the financial and operating metrics, I think the number one reason why someone should be looking at investing in Gran Colombia right now, is the valuation opportunity. It has been quoted out there that "we're a mid-tier gold miner available at a junior price". Through some recent benchmarking of ourselves against a dozen other piers that include people like Leagold, Guyana Goldfields, Westdome, Golden Star, and several others of our size and production level. Each of the metrics that we've looked at, I can give you three of them, price to cashflow per share: 2018 estimates we're about 1.9 times, our piers are four and a half times. If you look at enterprise to EBITDA based on 2018 estimates, we're currently trading about 1.7 times, whereas our piers are trading at about 5.4 times. If you look at our enterprise value at the moment versus 2018 production, we're sitting at a valuation of roughly a little over eight hundred dollars an ounce. Our piers are just over twenty-three hundred dollars an ounce. All of this anecdotal information shows that right now our valuation is a fraction of what we see the market giving our peers. So we believe, as the market begins to get more confidence in our story, more awareness of our story that we should see our valuation re-rated to be more like our peers.

Through 2016 and much of 2017 we traded below CA$2.00 a share, in around the CA$1.40 to CA$1.80 type range. Earlier this year, we saw momentum in our stock, as we came out of the announcements of the financing we were doing and lifting the dilution overhang of our stock. In the middle of May we hit a 52-week high of CA$3.45 a share. We've seen some fallback in our stock since then. We're currently trading in the CA$2.20 to CA$2.30 per share range. We’ve been hit, much like others, with what I call summer malaise as well as the fallback in the gold price over the last couple of months.

We're still well above where we were in 2016 and 2017 and we do feel that there's potentially positive momentum for our stock, as the gold market starts to settle out a little better in the months ahead.

Dr. Allen Alper: That sounds like an excellent opportunity for our high-net-worth readers/investors to consider investing in Gran Colombia Gold. That sounds very good. Is there anything else you'd like to add, Mike?

Mike Davies: I'm happy to give your readers/investors an update today. Thank you for that opportunity. Certainly we have moved the needle forward since our discussion in June and completed the balance sheet capital structure items and we've continued to have positive momentum in our production, which has led to positive momentum in EBITDA and more-so in our excess cash flow generation. We're very pleased with the progress we've made and are looking forward to providing future updates as we move ahead.

Dr. Allen Alper: I'm very impressed with the progress you've made since June. That's excellent and sounds like you have a lot of opportunity to keep on improving and growing your resources and your production, and so improving the bottom line. We’ll publish your press releases as they come out so our readers/investors can follow your progress.

http://www.grancolombiagold.com/

Mike Davies

Chief Financial Officer

(416) 360-4653

investorrelations@grancolombiagold.com

|

|