Paramount Gold Nevada Corp. (NYSE American: PZG): Advanced Stage Grassy Mountain Gold Project, Prefeasibility Study showing Robust Economics, Interview with John Seaberg, Executive Chairman

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/2/2018

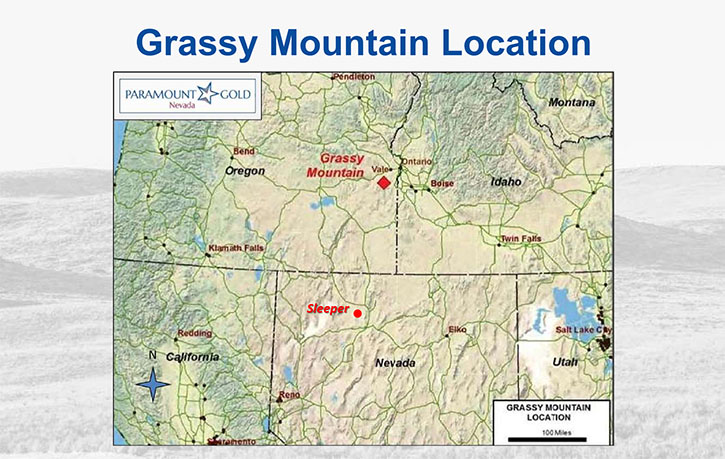

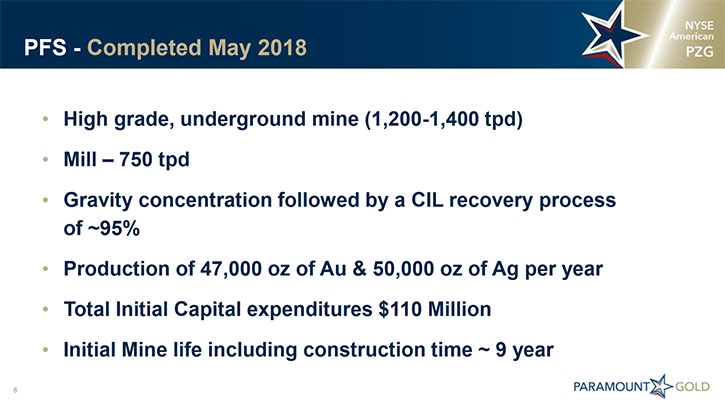

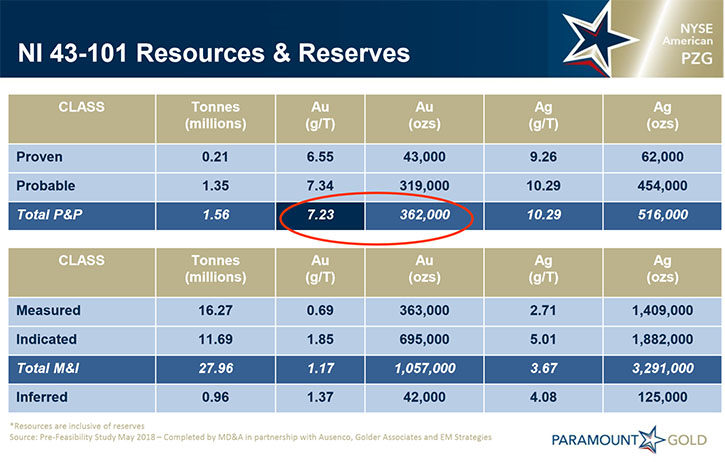

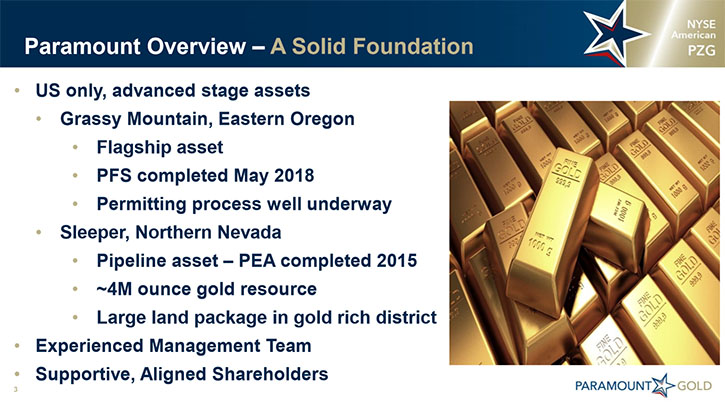

Paramount Gold Nevada Corp. (NYSE American: PZG) is a U.S. based, U.S. focused precious metals exploration and development company, with a strategy to minimize shareholder risks and expenses, while maximizing gold ownership per share. Paramount owns 100% of the Grassy Mountain Gold Project, which consists of approximately 9,300 acres, located on private and BLM land in Eastern Oregon. Additionally, Paramount owns a 100% interest in the Sleeper Gold Project, located in Northern Nevada. We learned from John Seaberg, Executive Chairman of Paramount Gold Nevada, that in the near-term the company is focusing on the Grassy Mountain Project, which is now an advanced stage project, with a prefeasibility study completed and published in May of this year, showing robust economics, even at moderate gold prices. The project is in permitting stage, with several key permitting milestones accomplished. According to Mr. Seaberg, the Grassy Mountain will be a small, very profitable operation, with a high-grade underground mine, a small footprint, a resource of 362,000 ounces of gold at 7.23 g/ton, processing 1,200 to 1,400 tons per day, producing 47,000 ounces of gold and 50,000 ounces of silver a year.

Paramount Gold Nevada Corp. Grassy Mountain Gold Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Seaberg, who's Executive Chairman of Paramount Gold Nevada. John, could give our readers/investors an overview of Paramount Gold Nevada and your vision and strategy for the company.

John W. Seaberg: First of all, Dr. Alper, thank you for this opportunity to have me on this interview. I appreciate it very much.

Dr. Allen Alper: You're welcome.

John W. Seaberg: Paramount Gold Nevada is a Spin-off of the old Paramount Gold and Silver that merged with Coeur Mining in 2015. This version of Paramount, Paramount Gold Nevada really was created in April 2015, with one asset, the Sleeper mine in Nevada. Paramount is a US focused company. We're only listed on the New York Stock Exchange American, under the symbol ‘PZG’. We have only US assets and are a US focused company. Our assets are the Grassy Mountain Project in Eastern Oregon and the Sleeper mine in Northern Nevada. We're a company that, given our advanced stage assets, their resources and robust economics, we only have a market capital of about $25 million. We only have 25 million shares outstanding as well, which we'll speak to later because I think it's an important point to highlight. But we are blessed to have a very strong and experienced board and a very experienced management team.

The vision for Paramount in the near term is focusing on the Grassy Mountain Project in Eastern Oregon. It's an advanced stage project that has a prefeasibility study that was completed and published in May of this year, with very robust economics, even at moderate gold prices. We're currently in the permitting phase, which is a journey in itself that we should speak to in a bit. One of the attractions for me to join the Paramount team, in addition to the experienced and strong management team as well as the board, was the strategy of focusing on per share metrics and maximizing the value our investors have on a per share basis, and it's a bit of a story to pioneer the permitting process in Oregon. There hasn't been a chemical mine to my knowledge ever permitted in Oregon. The permitting rules and regs that we're operating under have been around for over 25 years, but they have been relatively untested, especially in the gold sector. So we're embarking on new territory in a partnership with the regulators in Oregon and I’m excited about that opportunity.

Dr. Allen Alper: It sounds excellent. Could you elaborate a bit more on the Grassy Mountain Gold Project? What makes it so interesting?

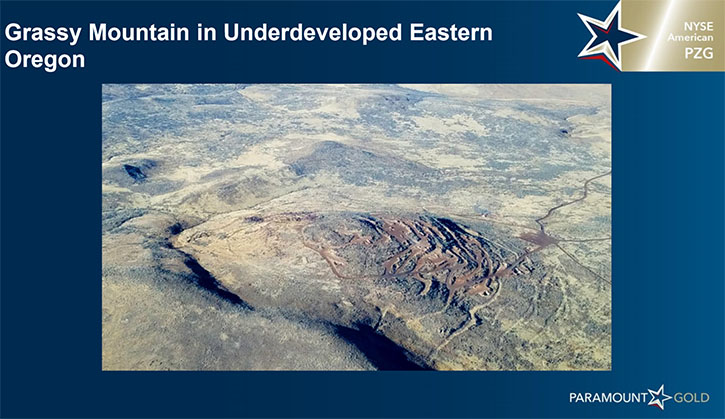

John W. Seaberg: Sure. The Grassy Mountain Project is located in Eastern Oregon, which is an important point when we're talking permitting. A lot of our investors and potential investors, when they hear Oregon, think of the Oregon to the west of the Cascades, the big trees, rivers and lots of wildlife. Eastern Oregon is very different. It's a lot like Northern Nevada. It's environmentally benign and it's going to be a really suitable place to have a nice mine. It's about 22 miles south of Vale, Oregon, which is the nearest town. It's approximately 70 miles west of Boise, Idaho. We completed a prefeasibility study recently and the economics are quite robust. We have over a million ounces of total resources at Grassy Mountain, at roughly 1.23 gm/ton, but we're only focusing on the high-grade portions. The prefeasibility study economics were based on 362,000 ounces of gold at 7.23 gm/ton. The economics are robust, but we also did it because we want to focus on a small underground mine versus an open pit. We want to have a small footprint in Oregon because that'll help on permitting.

We've completed most of the baseline studies and have submitted them to the regulators for review. They've reviewed and approved 12 of the 23, so over half, and we're actually quite pleasantly surprised about the cooperation that we're getting with the regulators, which is run in Oregon by the Department of Geology and Mineral Industries. The acronym is DOGAMI. So they're leading the effort on the state side and then of course, the BLM is involved on the federal side. At Grassy Mountain, the resources sit on 100% private land that we own, but the infrastructure, the mill and warehouse, etc., is going to be on federal land and that's why the BLM is involved. The BLM and DOGAMI are operating on a very cooperative basis, very collaboratively and they're aligned on this. They also see an opportunity to be the team that successfully permits the first gold mine in Eastern Oregon, but we're going to do it the right way. The process has been relatively smooth and we have a good relationship with both departments.

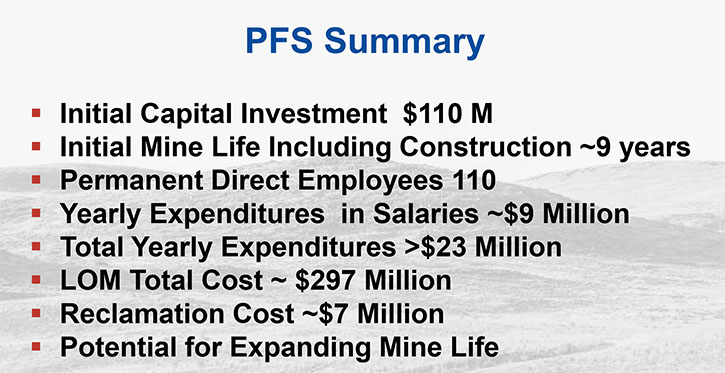

It will be an underground mine producing 1,200 to 1,400 tons per day. The mill is going to be a 750 ton per day mill, so we'll mine four days a week and then take the weekends off and then continue to process on a 24/7 basis in the mill. What I really like about Grassy Mountain, Allen, is the simplicity of the project. In today's mining world, there are so many risks that investors need to consider before investing in a company and a project; geopolitical risks, geology risks, metallurgy. Is there ample labor, power, etc., for the mine? Grassy Mountain is an ideal situation. It's a small, very profitable operation. At 750 tons per day, the CapEx is only $110 million. The process is a simple gravity concentrate followed by a CIL recovery process and it will produce 47,000 ounces of gold a year and 50,000 ounces of silver.

In front of us today, we already have about a seven year mine life, which for an underground operation is pretty good. I've been involved in underground mines and they typically have a three year mine life. It's hard to get that runway in front of you and we're forcing it to have, at a small annual production rate, a relatively long life, with a lot of exploration potential in the area that could provide further feed to the mill.

We're well underway in the permitting. We expect to submit the consolidated permit application in the first half of next year. Fortunately for us, the permitting process in Oregon is unique in that it is time based. Once we submit our consolidated permit application, the regulators have 90 days to deem it complete. And once they deem it complete, there's a 225 day review process. At the end of that 225 days or sooner, we will have draft permits issued. Then there's a public review and consultation period for 60 to 120 days and then we'll get final permits issued for the project. We expect to do detailed design in 2019, while we await the final permit. Then, we'll begin construction in 2020 and expect to have our first production in the first half of 2021.

Dr. Allen Alper: That sounds excellent. That's really a great plan in a rather short period of time. It sounds like it's very well thought out and there's a great team in place to accomplish it. Excellent!

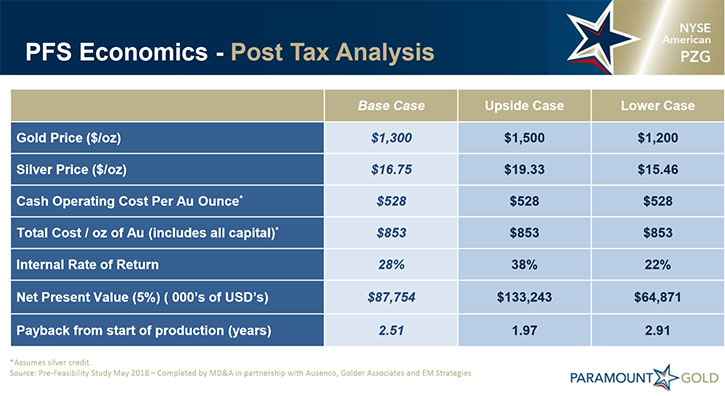

John W. Seaberg: Yes, and just a little detail on the economics. The gold price is right around $1,200 today, which in our prefeasibility study, is our low case. But even at $1,200 gold, the project has an internal rate of return of 22% and generates approximately $65 million of after tax net present value. So these are after tax numbers of 22% and $65 million NPV. At $1,300 gold, our base case, those numbers jump up to 28% and about $88 million. So even at lower gold prices, this little simple project makes good money because the grade is high, over 7 gm per ton. The recoveries are high, we are expecting 95% recoveries and low costs at roughly $528 per ounce cash cost. To summarize the opportunity, we are in the United States. It has low metallurgical risk. We know the ounces are there, with exploration upside, it will be a low cost operation and so far, the permitting is going well.

Dr. Allen Alper: That's sounds excellent. Those are excellent numbers. That's very good. I realize your focus is on the Grassy Mountain Gold Project. But would you like to say a few words on the Sleeper Gold Project?

John W. Seaberg: I will because our $25 million market cap is getting essentially zero value for Sleeper today. There's been a lot of work done on the Sleeper mine over the years. It was a high grade gold producer, operated by AMAX from 1986 to 1996 at which point it shut down operations due to gold prices. The former, Paramount Gold and Silver purchased the asset through the acquisition of X-Cal Resources in 2010. Both the former and current renditions of Paramount have done significant work to advance the asset. Today, it has over 4-1/2 million ounces of total resource. It's in the premier gold mining jurisdiction of Nevada. 4-1/2 million ounces of resources in Nevada is worth something. We're not focused on it yet. It provides tremendous option value to Paramount. It is lower grade. It's roughly 0.4 gm per ton, but it's a heap leach operation, so it'll be a low cost operation and there's a lot of exploration upside potential as well. We have a very large land package, roughly 40,000 acres, and in a very good gold mining jurisdiction. To the south of our property is Newmonts Sandman property. It has the right address. It has the right geology.

We need to do some work on it. We have a preliminary economic assessment that has robust economics. At 1,250 gold, it has an NPV of $72 million and a 20% IRR. So it's worth something and it only costs us about $400,000 a year to maintain the claims. It's a great project. It'll be our next focus once we get Grassy Mountain up and running. But there are a lot of strategic alternatives that we're considering for Sleeper with the rest of the Board and our Executive team. Perhaps a larger senior company would come in and do an earn in or a joint venture. It would be a good project for a royalty company to invest in for future royalty and some seed capital for us to do some drilling and to take the PEA and generate a prefeasibility study. There is a lot of optionality and strategic alternatives that are on the table for that asset.

Dr. Allen Alper: It sounds like a very good opportunity in the future for Paramount Gold, Nevada. Right now you’re focusing on Grassy Mountain, getting that into production. You have the backup plan to move forward with your Sleeper Gold Project. Both of those plans sound excellent. Could you tell us a bit about your background, your Board, and your Management team?

John W. Seaberg: Sure. I've been in the mining sector, in several different roles, for over 25 years. The majority of my career was spent at Newmont Mining Corporation, where I served in roles in Corporate Development as well as Investor Relations. I spent approximately three years at Klondex Mines, where I got a lot of underground experience and I was the Senior Vice President of Strategic Relations in that capacity, focusing on our investors, on our banking relationships and strategy. Our board is very experienced, as you know. You mentioned Rudi Fronk. Rudi brings a tremendous amount of experience to the table. He probably doesn’t need a lot of introduction. Dave Smith is also on our Board. I won't read all the names because they're on our website, but it's a very experienced Board that has been very supportive. Our larger investors have participated in each of our financings, so we have a really strong shareholder base, anchored by FCMI out of Toronto. They own about 19.9% and Seabridge owns approximately 9%.

You know our management team. They're the same management team that was involved with Paramount Gold and Silver before this version of Paramount was created. Glen Van Treek is a geologist and our President and CEO. Carlo Buffone is our Chief Financial Officer. We have a Director of Communications, with whom you've been speaking, Christos, who is also part of our experienced team. So, it's a small nimble team, with a lot of experience in bringing these assets, de-risking them and advancing them to a more valuable stage in their life.

Dr. Allen Alper: That sounds excellent. You have a great background and excellent Board and Team, so that sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Paramount Gold Nevada?

John W. Seaberg: We have a great Board of Directors and our Executive team has a lot of credibility. We only have 25 million shares outstanding. Most junior mining companies, exploration and development companies, have issued a lot more stock than that to fund their current development. 25 million shares is not a lot. We'll likely need to raise more capital in the future in some capacity, but I think the strategy of the board and the executive team to protect our investors' value on a per share basis is important. We have two great assets in the United States, which equates to low geopolitical risk. The assets are not complex. There's not a lot of risk and they make good money even at today's gold prices and even lower. We have a very strong shareholder base. Between our top two shareholders and management, it's roughly 30% of the ownership of the company. We're American focused and we're making significant positive progress on the permitting of the Grassy Mountain Project in Eastern Oregon.

I am quite confident that this team is going to take Grassy Mountain from an early stage development opportunity into production and the shareholders that invest today in this company will be rewarded by us successfully executing that goal and that mission and being the first gold mining company to earn a permit in Oregon.

Dr. Allen Alper: That sounds fantastic. Very strong reasons to consider investing in Paramount Gold Nevada. And it's an excellent way to leverage being connected with the gold market, don’t you think?

John W. Seaberg: Yes. I think we have a bright future in front of us. We do need to execute and we have the right team in place. A little bit stronger gold price environment would be a bonus.

Dr. Allen Alper: Right. It sounds like most gurus think that the gold price should start to improve in the next few months. Is that what you think too?

John W. Seaberg: Yes. If you track gold cyclically in the calendar and we're approaching the wedding season in India. The dollar's been unusually strong since April this year and that trend is likely to stop or at least flatten out a bit. Q3 and Q4 typically are strong quarters for gold prices. I think we've been in a bear market long enough and I do believe that we will see stronger prices in the next few months and into 2019.

Dr. Allen Alper: I think you gave an excellent presentation of where Paramount is and where they're going. I think our readers/investors will be very interested in what you've said and they'll be looking forward to following your progress as you start to get more and more results.

Drilling form 2016/17 Program — in Vale, Oregon

John W. Seaberg: Hopefully, we can do some regular updates as we progress, especially with the permitting process in Oregon. We are going to be doing some drilling at Grassy Mountain in the coming months as well and hopefully, those results will be positive and support even a longer life at Grassy Mountain. Maybe next year, after we submit the consolidated permit application in Oregon, we can focus our attention on our strategy for Sleeper. But clearly there's significant value in that operation still today and we'll find the best way to unlock that value for our investors.

Dr. Allen Alper: That sounds excellent. I enjoyed talking with you, John, and being updated on your progress. I'll be looking forward to talking with you in the future and following what's happening at Paramount Gold Nevada.

http://www.paramountnevada.com/

@ParamountNV

Glen Van Treek, President, CEO and Director

John Seaberg, Executive Chairman

Christos Theodossiou, Director of Corporate Communications

866-481-2233

info@paramountnevada.com

|

|