Eastmain Resources Inc. (TSX: ER, OTCQX: EANRF): Advancing Three High-Grade Gold Assets in the Emerging James Bay Gold Camp in Québec, Interview with Claude Lemasson, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/27/2018

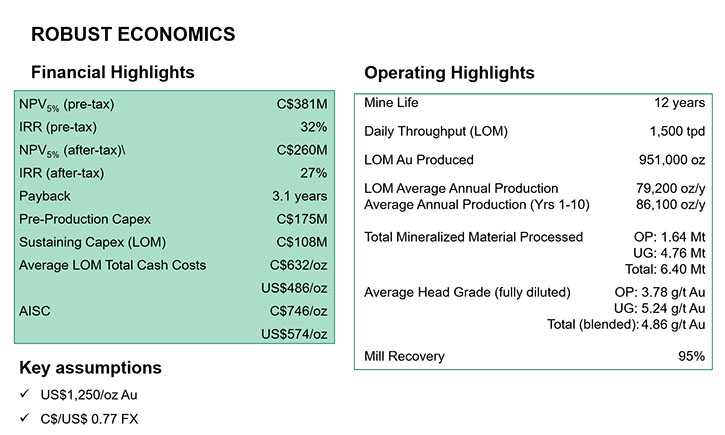

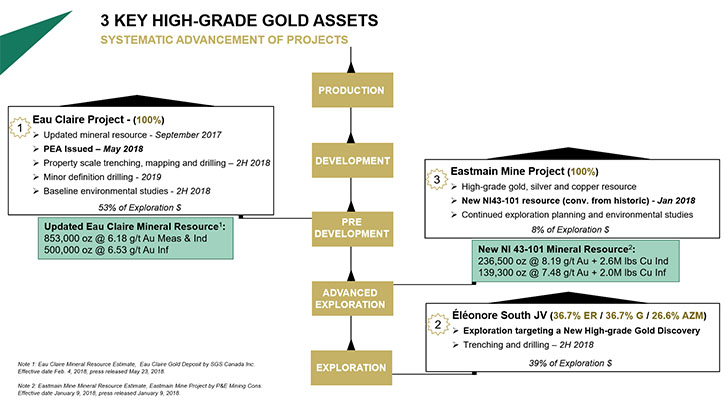

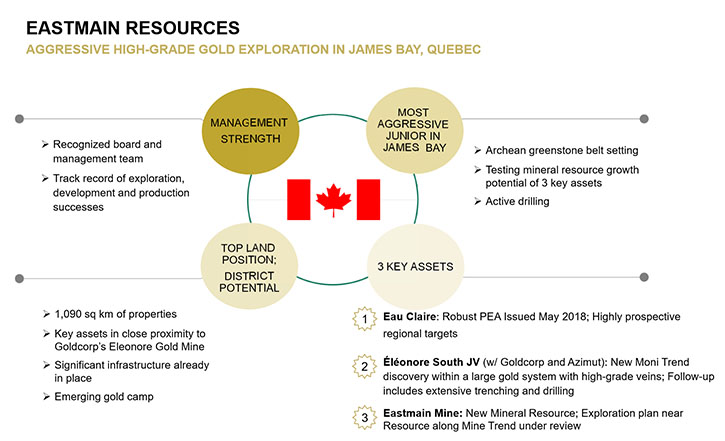

Eastmain Resources Inc. (TSX: ER, OTCQX: EANRF) is a Canadian exploration company advancing three high-grade gold assets in the emerging James Bay gold camp in Québec. The Company holds a 100% interest in the Eau Claire Project, for which it recently issued a Preliminary Economic Assessment (“PEA”), and the Eastmain Mine Project, where the Company prepared a NI 43-101 Mineral Resource Estimate in 2018. Eastmain is also the manager of the Éléonore South Joint Venture, which hosts a new high-grade gold discovery found in late 2017. It is located immediately south of Goldcorp Inc.'s Éléonore Mine. We learned from Claude Lemasson, President and CEO of Eastmain Resources, that the PEA on the Eau Claire Project is very robust and very strong, with high grade gold and an NPV of $260 million dollars Canadian at a 5% discount after tax, and a 27% IRR after tax. Plans for the coming two and a half years include exploration drilling to increase the total resources to 3 million ounces.

Eastmain Resources Eau Claire Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Claude Lemasson President and CEO of Eastmain Resources. Could you give our readers/ investors an overview of Eastmain Resources and your current activities?

Claude Lemasson: Yes, absolutely. Thank you for having us. Eastmain Resources is a junior exploration company, based in Canada. Our three main assets are in James Bay, Quebec. James Bay Quebec is a very stable and safe jurisdiction, with excellent infrastructure. There are roads, power and airstrips and airports near our projects. We are also focused on high-grade gold assets. In the last two years, after a lot of extensive work, including drilling on some of our sites, we have come up with two new 43-101 compliant resources plus one major discovery and that's on all three projects. We are currently, generally undervalued in the market, compared to the work that we've done, the ounces in the ground that are officially reported and the progress that we've made.

Dr. Allen Alper: Could you give our readers/investors a little more detail on what you found, why it's so significant and your recent gold discoveries?

Claude Lemasson: In the last two years, we did extensive drilling on our main project, which is the Eau Claire Project. We completed significant drilling, we also issued a new revised resource that was very robust and conservative. Based on that resource, we proceeded, earlier this year, to complete a preliminary economic assessment (PEA). The PEA is very strong, very robust. It is a high-grade gold deposit. The net present value (NPV) at a 5% discount after tax is $260 million dollars Canadian and the after tax IRR is 27%. Those are very strong numbers. Obviously, with the market the way it is, there has been little reaction yet as far as recognizing our increased value.

This has been a major milestone for Eastmain and we're continuing to advance that project. Additionally, we issued a new resource, earlier this year in January 2018, on another project called the Eastmain Mine Project and that's been also published. So we have two projects, with two different high-grade gold resources. Also, at our third project, the Éléonore South joint-venture, we announced a new discovery late last year. Since then, we have progressed very well, doing more work in the field on the Éléonore South joint- venture, in and around the discovery. We've advanced that and released very positive results. This fall we are proceeding with a new campaign at Éléonore South, just like we are at Eau Claire.

Dr. Allen Alper: That sounds excellent! Could you give us more information on the resources in each of your three projects?

Claude Lemasson: Sure. The main resource on our anchor project, the Eau Claire project, is a total resource of around 1.35 million ounces. For the measured and indicated category, we have about 853,000 ounces at over 6 grams per tonne, and another 500,000 ounces at over 6.5 grams per tonne for the inferred category. So that's for the Eau Claire Deposit.

The deposit at the Eastmain mine project has a total of over 375,000 ounces. The indicated category has 236,000 ounces at over 8 grams per tonne, very high grade. The inferred category has over 139,000 ounces, around 7.5 grams per tonne. That's for the Eastmain mine project. Those are the resources we've published.

Dr. Allen Alper: That sounds excellent! Could you tell our readers/investors what are your plans for the coming year?

Claude Lemasson: Absolutely. On September 10th and 11th 2018, we issued two press releases, one for each of our two main projects, the Eau Claire project, on the Clearwater property, as well as the Éléonore South joint-venture.

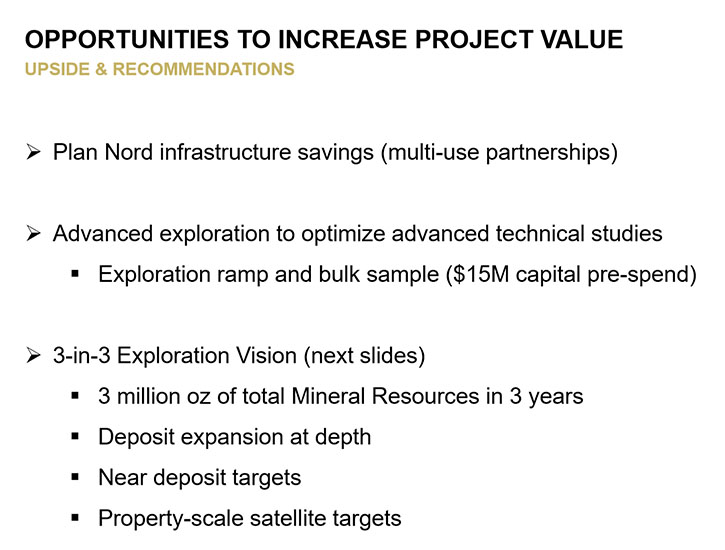

Overall at Eastmain, we have a 3-in-3 exploration vision, which was set out earlier this year. It is to reach 3 million ounces of total mineral resources in the next three years. We're about eight months into that now and we have about one and a half million ounces. With our exploration work, we expect to grow the resources towards 3 million ounces in the next two years and four months or so.

At our anchor project Eau Claire, we are proceeding with post PEA pre-development activities, including engineering studies for the underground exploration ramp, a proposed project, as well as environmental and infrastructure studies. So we're moving beyond the PEA into pre development activities.

We're also looking at the Eau Claire mineralization, doing up to 2,000 meters of drilling on the deposit itself to test the eastern plunge of the deposit. That work will be completed this fall and should show the extension of the deposit, as we move forward. Nearby, on the Clearwater property, we are doing a mapping, soil and outcrop sampling program. We're also planning a 1,600 meters trenching program and a 5,500 meters drilling program at the Cannard deformation zone, which extends for a few miles east of the Eau Claire deposit itself.

These are new exploration targets, on which we've done some work, and we're now more aggressively pursuing them. On the Éléonore South J.V in the next few months, we've already embarked on a program of doing over 2000 meters of mechanized trenching, that work is currently ongoing on site. And we are also looking at about 7,000 meters of drilling on two main trends that are part of the discovery that I referred to earlier, one called the Contact Trend, the other one called the Moni Trend. They are two parallel significant trends, within 200 to 300 meters of each other and they extend over potentially about two kilometers. So we are doing more work on that, both trenching and diamond drilling, in the next few months right up until year end.

Results from these programs, on all projects, will start coming out in October, and will continue in October, November, December and into January. By year end we will announce our plans for 2019, which will be in line with this based on success and doing further exploration and advancing our main project, the Eau Claire Project.

Dr. Allen Alper: Those are excellent programs and plans. They should yield very good results. Our readers/investors will be able to follow your news releases that we will publish on Metals News as they come out. We’re all excited about following your successes.

Claude Lemasson: Great!

Dr. Allen Alper: Could you refresh the memory of our readers/investors about your background, your Management team and your Board?

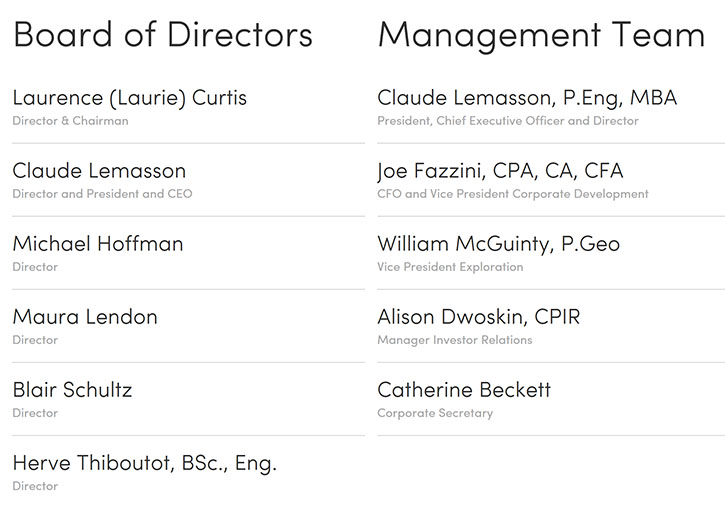

Claude Lemasson: We have a very strong board, it's not a big board. I'm on the board as the one executive and then there are five independent members, all very experienced and well-versed in mining. Most of them have been senior executives in various mining companies over the years. Our chairman is Laurie Curtis. He has a fairly important background. He ran Intrepid as a CEO and was a senior executive and analyst for Dundee Precious Metals, back in the day. He has a lot of varied experience. Very senior geologist! We have various other members that have a mix of backgrounds, mining engineering backgrounds, capital markets, raising money and also legal backgrounds. A really good balanced board! We're very close.

I communicate with them on a regular basis. We talk about strategy regularly. For myself, I've been 30 years in the mining business. I come from a background of building mines and operating them as well. I was involved with the Red Lake Mine, with Goldcorp. I was the project manager, who built the Red Lake Mine back in 1999 - 2000. I then moved it forward and became the mine’s general manager and operated the mine for the following six years. Then I was promoted, and involved in major projects with Goldcorp. I looked after the Éléonore mine in the early days up in northern Quebec, where we are now with Eastmain. I was also President and COO of Guyana Goldfields and moved the project forward, for a few years, which is now a producing gold mine.

I've also served on various boards of junior gold exploration companies. I have continued to sit on the Board of Premier Gold for the last six and a half years. Our team has been built from scratch. Over two years ago, I recruited pretty much everybody on the team. We have Joe Fazzini as a CFO, a very experienced ex mining analyst, an experienced in the business. Bill McGinty is our VP Exploration, with lots of experience on various projects in various jurisdictions including Quebec and Ontario and other places in the world. A very solid team! We work extremely closely together. We keep it small, but very focused. There are a few other key members on the team. We've all been together for over two years. We continue to work to bring value to the company.

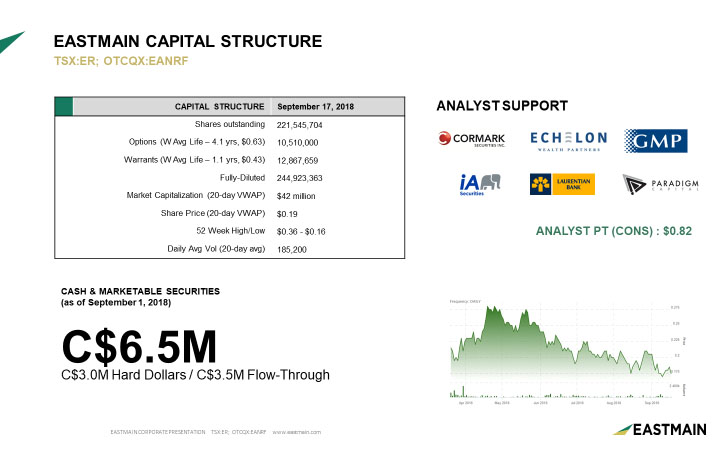

Dr. Allen Alper: That sounds excellent. You have a fantastic background and a very experienced team, so that's really great. The company's in excellent hands. Could you tell our readers/investors a little bit about your capital structure?

Claude Lemasson: We are on the main board on the TSX in Toronto, under ER. We're also in the US on the OTCQX, under EANRF. We have around 221 million shares outstanding and a market cap hovering around $40,000,000 Canadian lately. Our share price has been around 20 cents plus or minus a couple of cents. We are covered by 6 analysts from well-known, very reputable brokerage firms that follow us very closely. We are well-funded and have over $6.5 million dollars in the bank. We're well-funded into 2019 to be able to execute on our programs, to which I referred earlier.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Eastmain resources?

Claude Lemasson: We have a Company that's been well established for many years on the main board, on the TSX. Our assets are in Quebec, Canada in a great jurisdiction, very stable and safe. Quebec government is extremely supportive. It has good infrastructure in the James Bay region, where we are. All our resources are high- grade gold, from six to eight grams. We've done a lot of excellent work in the last couple of years to bring value to the company, including issuing two 43-101 compliant resources, one major discovery and we are moving forward on our key projects. In the market right now, with the gold market and the gold equities market being somewhat out of favor with many investors, we're seeing a really deeply discounted value in our company.

This creates an opportunity for an investor, who wants to come back to gold or continue investing in gold, with a very well-established company. We have ounces in the ground and a PEA behind our main project. We have strong resources and a discovery. All key elements that are excellent when eventually the market turns around for gold and gold equities. We believe that could happen in the next few months. This is a great time to buy at a very discounted value compared to standard valuations that we normally see in the market. So it’s a great opportunity for investors to get into the gold equities market right now with Eastmain Resources.

Dr. Allen Alper: Sounds like very strong and compelling reasons for our readers/investors to consider investing in Eastmain. Is there anything else you'd like to add, Claude?

Claude Lemasson: Thank you for this opportunity. We continue to deliver on what we set out to do two and a half years ago, when I took over the company. We have more than delivered along the way and investors can keep on expecting us to report to the market and deliver on key catalysts and milestones and make major achievements. That's our MO and we're happy to execute on what we say we're going to do.

Dr. Allen Alper: That sounds excellent. We will publish all of your press releases, so our readers/investors will be able to follow your excellent progress. Thank you for sharing with us.

Disclosure: The Alper family owns Eastmain Resources stock.

http://www.eastmain.com/

Claude Lemasson, President and CEO

+1 647-347-3765

lemasson@eastmain.com

Laurenn Russell, Investor Relations Consultant

+1 647-347-3735

lrussell@eastmain.com

|

|