Bluestone Resources Inc. (TSXV: BSR): Advancing 100% Owned Cerro Blanco Gold Project, in Guatemala, One of the Highest Grade Gold Projects in the World, Interview with Darren Klinck, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/26/2018

Bluestone Resources Inc. (TSXV: BSR) is a mineral exploration and development company, focused on advancing its 100% owned Cerro Blanco Gold project, located in Guatemala. Cerro Blanco is one of the highest grade undeveloped, fully permitted gold projects in the world, and it had more than 230 million dollars invested in it by Goldcorp, in terms of infrastructure and exploration work. As we learned from Darren Klinck, President and CEO of Bluestone Resources, Bluestone was fortunate to acquire Cerro Blanco from Goldcorp for 18 million dollars. We learned from Mr. Klinck that over the last 12 months of exploration work the Company was able to confirm the existing resource, upgrade some of the indicated into the measured category, and also add about 300,000 ounces to the inferred category. Near term plans include completing the feasibility study by the end of the year, while simultaneously running the task of financing the project. With a very strong management team, strong shareholder support, and one of the best undeveloped gold projects on the globe today, Bluestone Resources is well positioned for growth.

Cerro Blanco Gold Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Darren Klinck, who is President and CEO of Bluestone Resources Inc. Could you give our readers/investors an overview of your company, Darren?

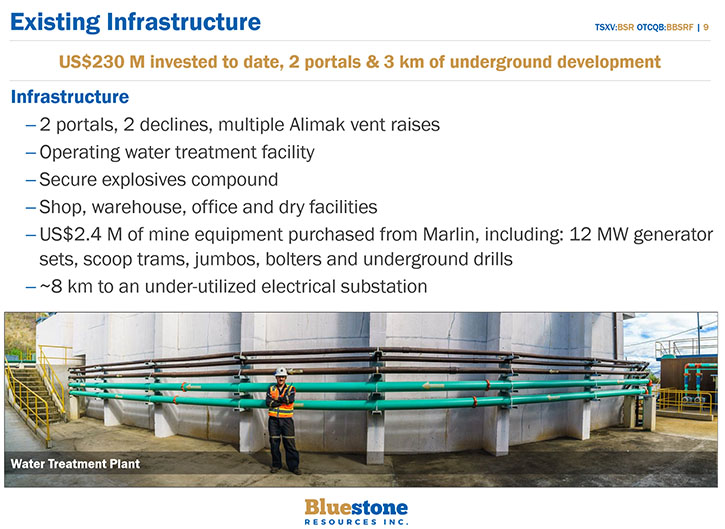

Darren Klinck: Very good, Al. Thanks very much for this opportunity. Bluestone is a relatively new company in its current form. Less than 18 months ago, Bluestone closed the transaction to acquire the Cerro Blanco Gold and Mita-Geothermal projects in the southeastern part of Guatemala, through an acquisition from GoldCorp. Goldcorp had been active in Guatemala and Central America, for many years, going back to their $8.6 billion acquisition of Glamis Gold Ltd. when Glamis had a very strong footprint in Central America. Goldcorp, over the last dozen years, produced about a quarter of a million ounces of gold per annum from the Marlin mine, in the western part of Guatemala. They also had the Cerro Blanco gold project, a development project, for just over a decade, they had invested more than 230 million dollars.

Bluestone was fortunate to be able to acquire that from Goldcorp. We paid 18 million dollars U.S. cash, plus another two million dollar deposit towards equipment, which we purchased from the Marlin mine, since it moved into closure, and enhanced Goldcorp's decision to exit Guatemala. Goldcorp also retained a 4.9 percent equity interest and a one percent NSR on the project. That deal closed the first of June. Our capital raising closed just before that, where the company raised 80 million dollars Canadian. We're supported by some of the most well-known investors in the industry. The Lundin family is a 36 percent holder of Bluestone. CD Capital out of London, has another 17 percent, Goldcorp has just under five percent and management has nine.

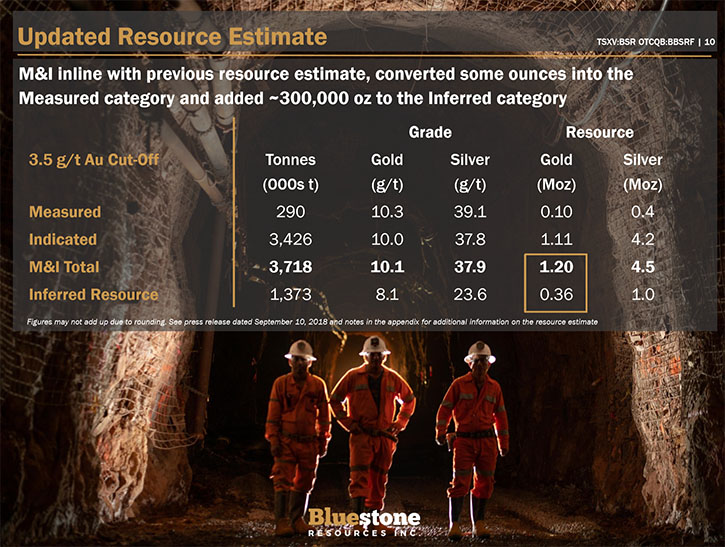

This is a company, which has been actively pursuing and moving the feasibility study forward, over the last 12 months. We expect to complete it by the end of the year. In fact recently, we put out an important piece of news, the updated resource that was a key driver for the feasibility study. After a lot of structural work that we did late last year and early this year, along with an infill drill program. Successfully, we not only maintained the resource, our drilling indicated and upgraded some of it into measured and we were successful in adding about 300,000 ounces to the inferred category. This is a high grade, roughly ten gram per ton, gold deposit. We're really excited about the fact that, while we had intended just to focus on the infill drilling and firm up the confidence and continuity in the deposit at Cerro Blanco, we've come away with adding another 20-25 percent to the high-grade resource inventory.

Dr. Allen Alper: That sounds excellent, an excellent deposit, very high grade gold. It's very important that you increase the resources. Could you give us any more information on the resource?

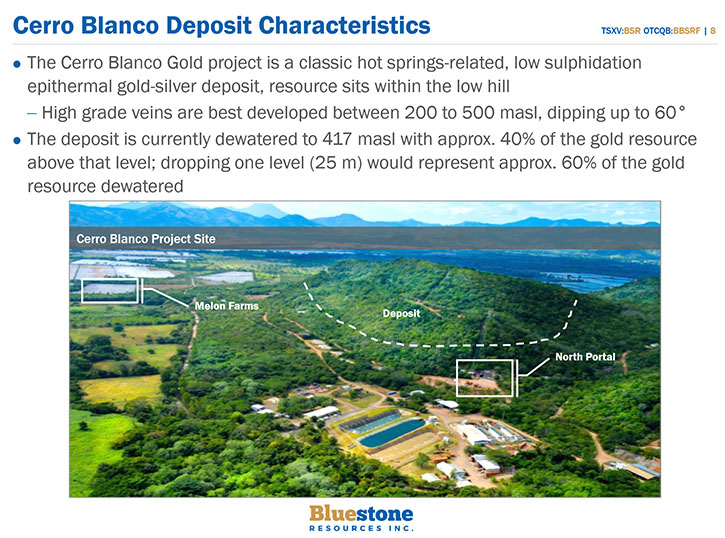

Darren Klinck: Yeah, for sure. The deposit itself is a classic low-sulfidation epithermal system. This is a project that has had more than 130,000 meters of drilling into it. It was actually discovered by a junior company called Mar-West, which was acquired by Glamis and then subsequently, Goldcorp took over Glamis in 2007. Through that period of time, the deposit had drilling, many studies, and even almost 3.5 kilometers in underground development, which is the key aspect for us as we firmed up our confidence in the geologic model. Being able to drill both from surface and into underground and to undertake a significant battery of sampling and mapping in the underground as well.

This high grade deposit is really within a much broader bulk tonnage resource. We updated that recently as well. The initial resource that Bluestone had put out early last year, as part of the financing and subsequently acquisition of Cerro Blanco, was much smaller than it actually is. The size of that bulk tonnage resource is much larger, using 0.5 gram per ton cutoff, it runs about 60 million tons and measures indicated, almost three million ounces. Then in the inferred category, another almost 580,000 ounces. It has very strong endowment here. It's indicative, of course, of the work that's gone on for well over a decade.

The deposit itself is high quality. When you're looking at the high grade component, which is really what the exploitation license, the mining license, that we currently hold, is based around a 1,250 ton per day operation. This deposit is a real gem! We're very excited! It's the sort of project that you could really build a company around.

Dr. Allen Alper: That sounds excellent. Could you give us a few more details on your plans for this coming year?

Darren Klinck: Sure. It’s been a busy year. The key focus has been the feasibility study, but of course there're a lot of moving parts that go into that. There was that PEA that was completed in February of last year, largely based on the work that had been done and completed by Goldcorp previously. It was necessary as part of the capital raising that Bluestone undertook to acquire the asset. Late last year, we kicked off this feasibility study work, everything from firming up our view on the geological model, doing additional geo-tech work, and getting a lot of additional metallurgy and process plant configuration and design.

A big one is the hydrology and making sure that we have a strategy on how to manage the water. It's not a wet mine, but the same thing that drives the geothermal potential to the east of the project, is also creating water that is hot. As we go deeper into the ore body, we will be extracting hotter water from the perimeter and we need to have correct strategy for our water model.

We're still working towards completing that feasibility study by the end of this year. At the same time, we've had a number of discussions over the last six months with various project finance groups. The financing of the project will run simultaneously, over the next six months, as we finish up the feasibility study and look to put the financing in place.

Dr. Allen Alper: Excellent! Darren, could you refresh the memories of our readers/investors on your background, your Management team and your Board?

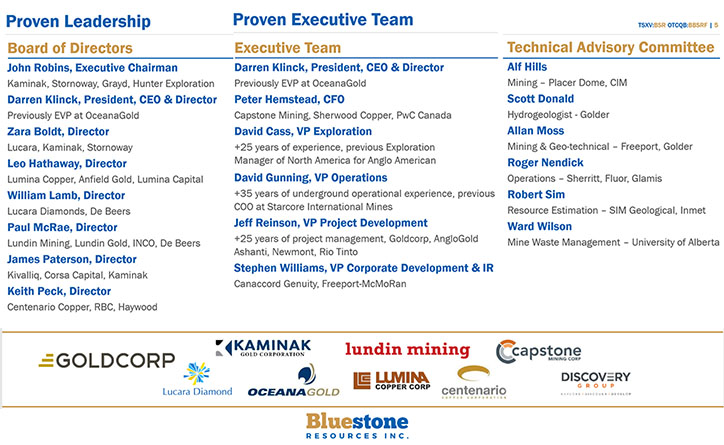

Darren Klinck: Yes, for sure. I joined Bluestone last year in August. Previously for just over ten years, I worked with a company called OceanaGold, based both in Australia and Canada. Oceana is arguably one of the fastest growing, mid-tier gold producers, with assets throughout Australasia and the Americas. I went through quite a significant growth phase, on the back of quite a high-quality asset in the Philippines.

This opportunity in Guatemala reminded me of when I first went to the Philippines in 2007 and visited the Didipio project, which was the foundation, enabling Oceana to grow to the size it is today. I've known John Robins, our Chairman, for well over a dozen years. John was a very successful explorationist and leader in the mining industry here in Canada. He was a founder of Kaminak Gold Corp., which was acquired by Goldcorp a few years ago. It was actually through that relationship that John was approached for the opportunity here at Cerro Blanco.

Peter Hemstead, our CFO is former Capstone, with a lot of experience in the Americas as well, with that copper miner. Jeff Reinson, our VP Project Development, joined from Goldcorp the first of January. He's worked all over Latin America and Canada and he's really leading the feasibility study and the planning around the project development. David Cass, our VP Exploration, spent a lot of time in Latin America, has lived in Peru, formerly with Anglo. Dave Gunning, who's spent a career working and managing high-grade underground mines, mainly in Canada, but also in Mexico. And Stephen Williams, our VP Corporate Development and Investor Relations is a metallurgist by training. He worked for Freeport in the United States, and more recently was in the investment banking business. Quite a wide range on our management team.

The Board is made up of a solid group, deep on experience, and quite varied as well. I mentioned John earlier, myself on the Board. William Lamb, our lead director is the former Chief Executive Officer of Lucara and one of the Lundin family appointees, Paul McRea, is VP Construction and Development for Lundin mining, a career of building projects around the world. Zara Bolt is the CFO of Lucara and former CFO of Kaminak as well. Keith Peck, former investment banker and involved with a number of mining companies over the years. Jim Paterson as well, CEO of a junior company called ValOre Metals, and also has been involved, with Kaminak and more recently, Northern Empire, which was acquired by Coeur. So quite a wide range of experience and talent on the board. I would be remiss to not also mention of course, Leo Hathaway, who is Chief Geoscientist for the Lumina Group and has worked all through Latin America and has been a key part of our board and in fact, the chair of the technical board committee as well.

Over and above that Al, it's probably worthwhile mentioning a technical advisory committee that we pulled together last year. This is something that was quite important to me when I joined in August. Obviously Bluestone is a junior company, doesn't have the access to dozens or hundreds of technical experts within an organization like the big mining companies have, of course. As we rolled through and looked to kick off this feasibility study, I felt it was important that we had the ability to peer review and to have a sounding board of experts in their fields that had, if you will, stepped through the bear traps previously, that we often see with mining projects.

We've pulled together very much a world-class technical group. This group is a peer review over the top of the feasibility study. We have an engineering group, JDS, that's leading the feasibility study and of course working with management, but that group lead by Alf Hills, as the chair, former Placer Dome for over 25 years. Allen Moss, on the underground mining, Allen's a consultant but works closely with Freeport and underground mines like Grasberg, of course, very well known. Roger Nendick who's the peer review over the processing and infrastructure. Roger's built and operated mines all over the globe. In addition to that Rob Sim, who's done the resource review, he's a resource geologist and resource estimation. Scott Donald, on the hydrology as well, an expert out of Ontario. Finally, Ward Wilson, who is a Professor at the University of Alberta and a leader when it comes to waste and tailings management, within the mine industry.

We're very fortunate to have that broad group of technical experts, acting as a sounding board for us and I think it's been an important part as we've rolled through this feasibility study and no doubt will be important to ensure we have a feasibility study that we can move into a construction and development phase in due course. Without stepping in the same bear traps that have perhaps been stepped in for many years in many cases.

Dr. Allen Alper: That sounds like you have an excellent team pulled together of Board and Management team and advisors. It looks like you're in great shape to carry out your feasibility study and move forward into development and production. That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Darren Klinck: Sure, Al. I think it's very rare that one has such an opportunity and it's one of the reasons that I'm here. In fact, we've been able to pull together that team to get involved in what is a project and opportunity that has had, in this case, more than a 200 million dollar head start. It's one of the highest grade undeveloped gold projects on the globe today and it's permitted with an exploitation license. Our whole management team has come from larger companies, companies that have in most cases multiple operations. We all, over the last year have identified the opportunity here. It is quite special.

On top of that, having the support and backing of some of the most well-known resource investors in the world, very successful resource investors. For a company our size, we've actually been able to obtain, bank, and broker research coverage from six different groups, well known banks and brokers in Canada. Which, at this particular point in the cycle, I think is another testament to the quality of the asset.

We're really excited about the opportunity that Cerro Blanco and Guatemala itself actually holds. It's a country that for decades has had a very strong, business-oriented government, right of center. Of course, there're very strong links with the United States, and the mineral endowment here is something that's quite exciting. We've had nothing but support from our government partners and our local communities. We, of course, need to continue to work and nurture that for decades to come, but we think it's a great opportunity, at ground level, to get involved with a high grade project, with modest capital and with what looks to be tremendous returns.

Ultimately we'll develop a strong platform, from which we can continue to grow as we go forward and advance. Both the global project and also the opportunity that exists with the renewable energy, geothermal project, the Mita-geothermal project just to the east of the project in the southeastern part of Guatemala.

Dr. Allen Alper: Those sound like excellent reasons why high-net-worth readers/investors should consider investing in Bluestone. Is there anything else you'd like to add Darren?

Darren Klinck: No doubt, we'll continue to have a fair bit of news flow over the next few months. The resource that went out yesterday was a big positive, it's been very well received, and I think a surprise for most that the infill program has actually demonstrated the ability to grow ounces. It's indicative of the prospective nature of these sorts of deposits.

Ultimately, as we move forward over the next six to nine months, it doesn't really matter what the gold price is, this project will work. It will be economic, by all measures that we've seen so far through the PEA. That's something that's pretty special. At the end of the day, this is a business, just like any other, and you want to align yourself with businesses that have strong margins and strong management teams, and the ability to weather the storms. I think this is a great opportunity. I look forward to connecting and catching up with you again soon.

Dr. Allen Alper: Well that sounds excellent. Metals News will post your news releases because I know our readers/investors will be eager to watch your successes.

http://www.bluestoneresources.ca/

Bluestone Resources Inc.

Phone: +1-604-646-4534

info@bluestoneresources.ca

|

|