Interview with Bob Felder, President and CEO, Renaissance Gold: A Nevada-Based, Gold/Silver-Focused, Prospect Generator, Utilizing a Joint Venture Business Model

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/28/2018

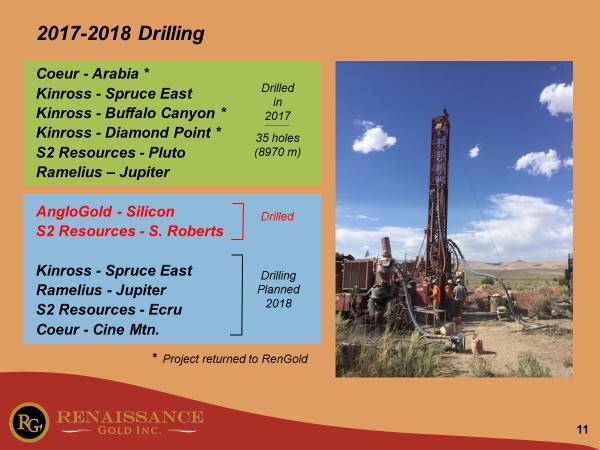

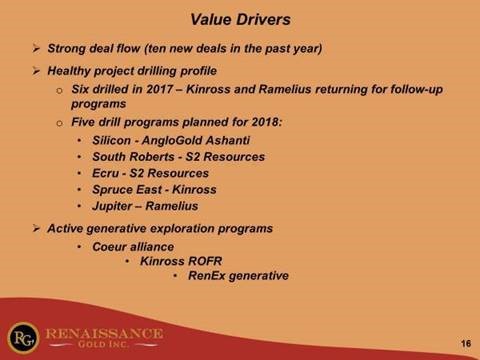

Renaissance Gold Inc. (TSX.V: REN) is a Nevada-based, gold/silver-focused, prospect generator, utilizing a joint venture business model. RenGold maintains a large portfolio of gold and silver exploration properties and has entered into over 65 exploration agreements, with the objective of testing as many drill targets as possible and providing maximum exposure to success through discovery. We learned from Bob Felder, President and CEO of Renaissance Gold, that they acquire properties mostly through staking, then do initial work of mapping, sampling, geochemistry, geophysics, developing targets and marketing to companies, who will come in and spend a certain amount of money to earn an equity interest in the project. RenGold's most significant projects to drill this year are: the Silicon project in Nevada under option agreement with Anglo Gold Ashanti, the South Roberts gold project, located on Battle Mountain/Eureka Trend, which is under an earn-in agreement with S2 Resources, the Spruce East, Carlin-type sediment-hosted gold deposit, located in the Spruce Mountain mining district, in Elko County, Nevada, under an earn-in agreement, with Kinross Gold, and the Ecru Project in Cortez area of the Battle Mountain/Eureka Trend under an agreement with S2 Resources. Another joint venture is the Cine Mountain gold project, with Coeur Exploration, to be drilled this fall.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Bob Felder, President and CEO of Renaissance Gold Incorporated. Bob, could you give our readers/investors an overview of your company and your business model?

Bob Felder: Sure. Thanks Allen. We are a prospect generator. We operate under a joint venture business model. As many investors know, this is a business model that allows us to leverage our risk and minimize our burn rate by spending partner's money on advancing projects. We acquire properties mostly through staking. Then we do some initial (pre-drilling) work such as mapping, sampling, geochemistry and geophysics. We develop targets and then we go out and market to companies, who will come in and spend a certain amount of money to earn an equity interest in the project.

And so by doing that we can maintain a portfolio of properties and have it largely funded by partners’ money. It gives us wider exposure to success, because our ultimate goal is to become involved in another successful discovery project. Right now we have about 20 projects in the portfolio and about half of those are in deals with partners. So right now we're doing very well with that model.

Dr. Allen Alper: Sounds excellent! Could you discuss and highlight some of the key projects?

Bob Felder: Sure. I'll start with what's on tap for drilling this year? Our Silicon project is in the Bare Mountain District in southern Nevada, which is the same area where Corvus Gold and Northern Empire have been drilling and reporting good results. (Note: Coeur announced on August 2 that they have entered into a definitive agreement to acquire Northern Empire). We were able to go in there and stake open ground in 2015 during a market downturn.

We staked a very large alteration system that was fairly gold poor, but we developed a model that indicated that we were up high in the system. We attracted AngloGold Ashanti into that deal and they completed a drilling program this winter and spring. We're not able to talk about the results yet except in general terms. What I can tell you, is they drilled six core holes. They also did some geophysics, mapping and some geochemical work. Those six core holes provided enough encouragement for them to continue the option on the project and the continuation of that option included them paying us $200,000 US in June. So we can say that they had sufficient encouragement to continue forward, in a very, very busy district, with a lot going on. So we're quite encouraged by their results and hopefully there'll be more news to disclose on that in the coming months.

We also drilled in May, our South Roberts project that's under an earn-in agreement with S2 resources, which is an Australian company. This is a project where we're drilling under gravel cover, so it's a blind target, but it's right in the heart of the Battle Mountain-Eureka trend. It is south of the Cortez camp. We've had two drilling programs out there, and in each case we've intersected low grade gold mineralization. Really just an anomaly, but good indications of a Carlin type system in terms of alteration and host rock. Our partners are coming to the US to meet with us in August to discuss the next steps on that project. As many people know, exploring undercover takes a little bit more diligence because you can't see the rocks and you can't take samples directly. So it's more drilling intensive, but we're at a great address, on one of the major trends and we've seen some encouragement, so we're hoping to continue forward with more drilling on that one as well.

In July we began drilling our Spruce East project, a Carlin-type target that's in an earn-in agreement with Kinross Gold. Kinross drilled it last year, had sufficient encouragement and are coming back for another round this year. We're drilling structural and stratigraphic targets and last year we had intercepts as high as one gram per ton gold. We're looking forward to more results and hopefully improving and developing this project.

Another project in a deal with S2 resources is the Ecru project, right in the heart of the Cortez camp. We've developed a pretty interesting target. We were able to stake claims on open ground in 2014 that had been held for 20 years, we were paying attention and were able to pick those up. Most of that area is controlled by Barrick and others. We control claims covering a gravity high, which is interpreted to be an upthrown block of favorable lower plate carbonate rocks. We’re exploring for a large, Carlin-type system like those occurring in this district. Our partner plans to drill this project later in 2018.

Dr. Allen Alper: I heard you're also working with Coeur.

Bob Felder: We have an exploration alliance with Coeur. This is the second year of that alliance and what that entails is they've funded us at $250,000 a year in a selected area of interest to go out and develop targets for them. Last year we showed them several ideas and they picked up one of our targets, named Cine Mountain. And surprisingly, following their announced acquisition of Northern Empire and the Sterling Property, they terminated their agreement on Cine Mountain, prior to drilling it, so we just got that project back.

As a company, as a project generator, we're getting a lot of projects drilled. As you know, exploration, is a numbers game and we choose not to have all our eggs in one basket. We're trying to test as many targets as possible because exploration is a very difficult and risky business, but the more projects we can test, we figure we can significantly raise the odds of success for our shareholders.

Dr. Allen Alper: Well that sounds excellent. Sounds like you're in the right place and you have the right partners working with you. Very strong partners! That's excellent. They must have a lot of confidence in what you and your team are doing.

Bob Felder: Well our team is pretty well-steeped in Nevada and we've been involved in discoveries in the past. So people tend to invest in people and their track records and we have that going for us and we're working very hard to make it happen again.

Dr. Allen Alper: Oh, that's excellent. Could you tell our readers/investors a little bit about your background, your board, your management team and your advisors?

Bob Felder: Sure. I'm classically trained as a geologist. I came into the industry several decades ago and worked my way up through technical positions, geologist, senior geologist, and moved into more managerial and leadership roles in the late nineties.

One of the founders of the company is Ron Parratt, who along with Richard Bedell started our predecessor company, AuEx Ventures, Inc., which after the success at Long Canyon, spun out Renaissance Gold. Ron has a long history in the business, and has been involved in a lot of discoveries in Nevada. When I came in, he handed over the role of CEO to me and he's now Executive Chairman on the board, and still very involved. We're still benefiting from his experience and his expertise as a company.

We have a seven person board made up of four geologists, a mining engineer, and two financial and corporate development guys, who have worked both in the capital markets and in corporate development roles, within large mining companies. We have a pretty good spread of expertise on the board.

Dr. Allen Alper: Do you want to say anything more about your management team, your senior management?

Bob Felder: Ron is the Executive Chairman now. Richard Bedell is now a board member and a Technical Advisor. He and Ron both bring very important technical and institutional knowledge to the company. They have both stepped aside, after we did a combination of companies last year. I was the founder of Kinetic Gold and we merged our companies a little over a year ago. Part of that was to merge our portfolios, which were quite complimentary. The other key player on our management team is our Exploration Manager Dan Pace. He is highly energetic and very bright, and a key component of the exploration team. As a junior prospect generator, we run pretty lean and mean. We have about nine people on staff as a total. So we're not a large company, mostly it is technical people doing the nuts and bolts fieldwork.

Dr. Allen Alper: Sounds like you have a fantastic background and a very strong team. And boy, so experienced! I could see why people are funding you. They have confidence in you. Excellent!

Bob Felder: Yes.

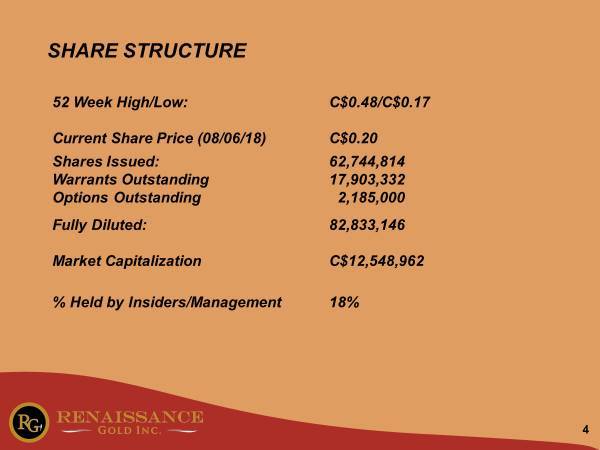

Dr. Allen Alper: Could you tell our readers/investors a little bit about your share structure?

Bob Felder: Sure. In round numbers, we have about 62 million shares outstanding, with about 18 percent held by management and insiders. Another 20 percent are held by individuals and companies that we know well, in other words, associates and long-term shareholders. So it's about half closely held stock.

We have about 18 million warrants out, most of those went out with the last financing we did with Sprott. We have about 2 million options out. We've tried really hard, over the years to keep the share structure tight. With the acquisition of Kinetic Gold, and a couple of recent private placements, and the financing that we just did with Sprott this year, our share capital is up to 62.7M shares outstanding, 18.1M warrants and 2.1M options., which is still pretty good for a company that's going on 10 years old.

Dr. Allen Alper: Oh, that's great. It shows that you, your team and the board have confidence in your company and you have skin in the game. That's very important. I have interviewed Rob McEwen many times and that's one thing he stresses, the importance of investing in a company, where management and the board put money into the company. That shows confidence in the Company.

Bob Felder: Absolutely.

Dr. Allen Alper: They believe in it.

Bob Felder: Yes. Ron, Richard and myself, we all own significant chunks and our board owns shares, and we have a few key shareholders that own more than five percent of the stock each and they're definitely long term supporters. So it's nice to know that a lot of our stock is in trusting long-term hands and they're waiting for us to have another success, where we sell an asset or sell the company again. That's the best way to create value, through discovery.

Dr. Allen Alper: You have people, who will be willing to stick with you and continue to invest and have the patience to see it through. That's good that you have a core group like that backing you up.

Bob Felder: Absolutely. We're happy to have Rick Rule on board now too, because he's bullish on prospect generators and he has quite a following. I think Rick's involvement is quite beneficial to us as well.

Dr. Allen Alper: That's excellent. Bob, could you tell our readers/investors the primary reasons they should consider investing in Renaissance Gold?

Bob Felder: Sure. A very strong technical team with a very, very successful track record. We all have the right experience and perspective to make another discovery. We keep our share structure tight, so investors can participate at a higher level in a future success. With as many joint venture partners and as many drilling programs as we have, our opportunities for success and to make a real material change in our share prices is as high as it can be. We're always generating new ideas and new targets and we're trying to keep this level of momentum of partner-funded drilling up so that we maximize our chances and our probabilities of success.

Dr. Allen Alper: It sounds like a very good Company for our high-net-worth readers/investors to consider.

Bob Felder: I appreciate your interest and the opportunity to tell your readers/investors

about Renaissance Gold.

http://www.rengold.com

For further information, contact:

Robert Felder 775-337-1545 or bfelder@rengold.com

Ronald Parratt 775-337-1545 or rparratt@rengold.com

|

|