Giga Metals Corp. (TSX.V: GIGA, FSE: BRR2): Becoming a Premier Supplier of the Key Battery Metals for Electric Vehicles: Nickel and Cobalt, Mark Jarvis, President and CEO Interviewed

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/23/2018

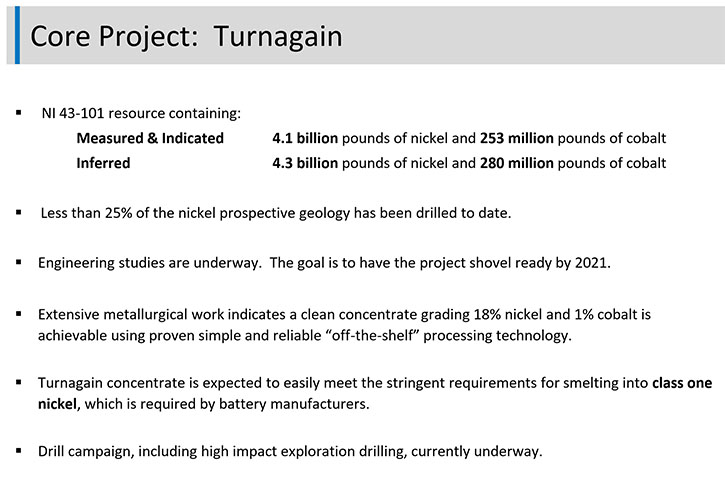

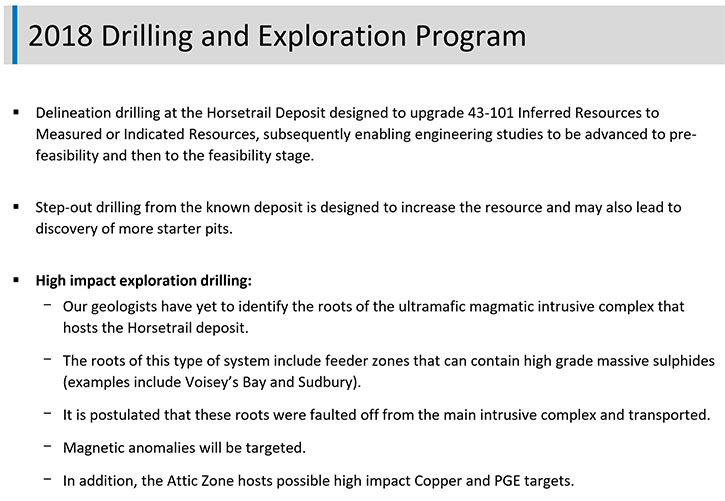

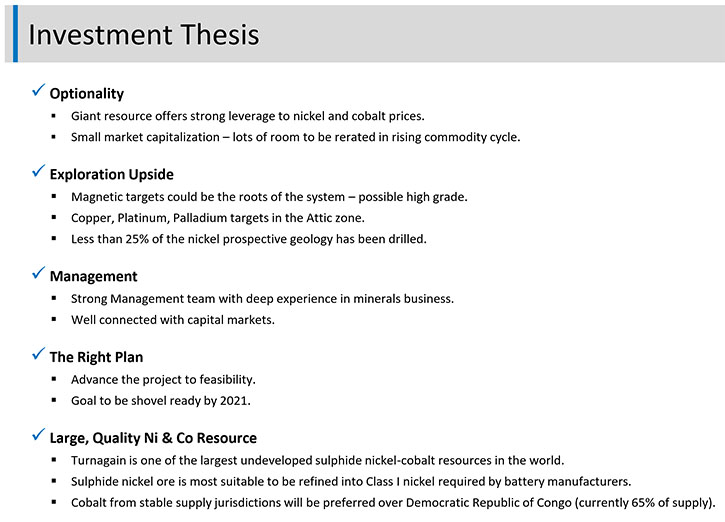

Giga Metals Corporation (TSX.V: GIGA, FSE: BRR2) aims to be a premier supplier of the key battery metals for electric vehicles: Nickel and Cobalt. The Company's Turnagain Project, located in north central British Columbia, is among the largest undeveloped nickel-cobalt sulfide deposits in the world in terms of total contained nickel. The NI 43-101 compliant resource contains 4.1 billion pounds of nickel and 252 million pounds of cobalt in the measured and indicated categories, plus a further 4.3 billion pounds of nickel and 279 million pounds of cobalt in the inferred resource category. We learned from Mark Jarvis, President and CEO of Giga Metals, that they have recently closed a NSR transaction with Cobalt 27, in which Cobalt 27 bought a 2% net smelter return in Turnagain Project for a million dollars U.S. in cash, plus 1.125 million shares of Cobalt 27. We learned from Mr. Jarvis that while currently the Turnagain is a huge low-grade open-pitable nickel and cobalt sulphide project, Giga Metals has identified high-impact exploration targets that could be the roots of the system where they hope to find the massive high-grade sulphides. The drilling of the targets is underway as part of the 2018 drill campaign. Near term plans include getting the project ready to pre-feasibility by the third quarter of next year.

Turnagain Camp

Dr. Allen Alper: This is Dr. Allen Alper, Editor in Chief of Metals News, talking with Mark Jarvis, who is President and CEO of Giga Metals. Could you remind our readers/investors with a brief overview of your Company, your focus and current activities? Update them on all of the exciting things that have been happening since the last interview.

Mr. Mark Jarvis: We have one of the largest undeveloped nickel-cobalt sulphide deposits in the world. Our target is to get this to pre-feasibility by the third quarter of next year. It's a huge, low-grade, open-pittable nickel cobalt sulphides deposit. We also have exploration targets that could be the roots of the system, the feeder zones, from which you get the high-grade massive sulphides. We're going to be drilling several high-impact exploration targets during this summer.

Dr. Allen Alper: That sounds exciting. I advise our readers/investors to pay close attention to the news and see what results you get.

Mr. Mark Jarvis: Indeed. Exploration is always long odds, but if we do hit something involving massive sulphides over significant intervals, it will be a game changer for us.

Dr. Allen Alper: I know there's been some exciting news for Cobalt 27. Could you tell our readers/investors about it?

Mr. Mark Jarvis: Cobalt 27 approached us. As you probably know, they're in several businesses. They hold a whole bunch of physical cobalt. So, they trade as kind of a proxy for Cobalt, but they've also been putting together royalty deals and streaming deals. They've put together a couple of very significant streaming deals. Most recent, they paid 300 million in cash to Vale for a cobalt stream, which will kick in when Vale goes underground at Voisey's Bay.

They like what we have enough that they paid us a million dollars U.S. in cash, plus 1.125 million shares of Cobalt 27 for a 2% net smelter return in our project, covering both the nickel and the cobalt. With our goal of getting into production early in the 2020’s, this could be an extremely good investment for them. From our point of view, the value of the investment totaled more than our market capitalization, so it's truly a transformative transaction, for our Company.

Dr. Allen Alper: That sounds excellent. It's great to be backed by such a strong player in the Cobalt marketplace.

Mr. Mark Jarvis: It really is. They are truly sophisticated investors, and beyond the immediate transaction, it's also connecting us to very deep pools of sophisticated mining capital.

Dr. Allen Alper: That sounds excellent. I've spoken with Anthony Milewski, Chairman and CEO, Cobalt 27.

Mr. Mark Jarvis: I think what they have done is sheer genius. There really was no way for investors to play Cobalt and there's no such thing as a Cobalt ETF. What they have created isn't exactly a Cobalt ETF, but it certainly is a way to play Cobalt. As an investor, if you're bullish on Cobalt, you can buy the stock, if you're bearish, you can short it. You have a way to express your opinion. They created that out of nothing. It's just brilliant financial engineering in my view. And although cobalt is trading at short term lows, the fundamentals are excellent over the next few years. It is still almost impossible for car manufacturers to secure long term supply contracts.

Dr. Allen Alper: I agree. Could you tell our readers/investors a bit more about what you have accomplished since the last interview and your plans for the coming year?

Mr. Mark Jarvis: We've started a drill program. We have two drill rigs that have been going now for about a month. The first thing they're doing is some infill drilling. We have two starter pits, where we have higher than average grade, coming right to surface. They're both drilled off to the measured-plus indicated category, but the area between them was only drilled off to the inferred resource category, so the infill drilling program is designed to elevate that area from inferred to measured-plus indicated.

You cannot use inferred resources for a pre-feasibility or a feasibility report. It's our intention to take this project to pre-feasibility next year and then, on to the full-scale feasibility report. That infill drilling is very close to being done. After that, one of the rigs will continue on in that area, drilling holes for metallurgical work. We have a very robust metallurgical and comminution program underway right now to feed into the pre-feasibility work.

The other rig will start testing targets we have that could be the roots of the system, the feeder zones to the system. Personally, I love exploration, it gets my blood going. To have the ability to test these targets is very exciting to me. If we hit on any of our targets, that would make the markets sit up and take notice.

Dr. Allen Alper: That sounds excellent. That's an exciting time, exploring and getting information about the deposits. Very exciting time! I understand how you feel.

Mr. Mark Jarvis: The way I look at it is, we already have a huge resource. Even if we were to miss on every single target, we'd still have a huge resource and we'd still move forward and take it to feasibility. We're in a rising cobalt and nickel market and this is material that is going to be needed if the electrical vehicle revolution is to continue to go the way it has been going. You really can't lose, can you?

Dr. Allen Alper: It sounds very positive! Could you update our readers/investors on why cobalt and nickel are so important in electric batteries?

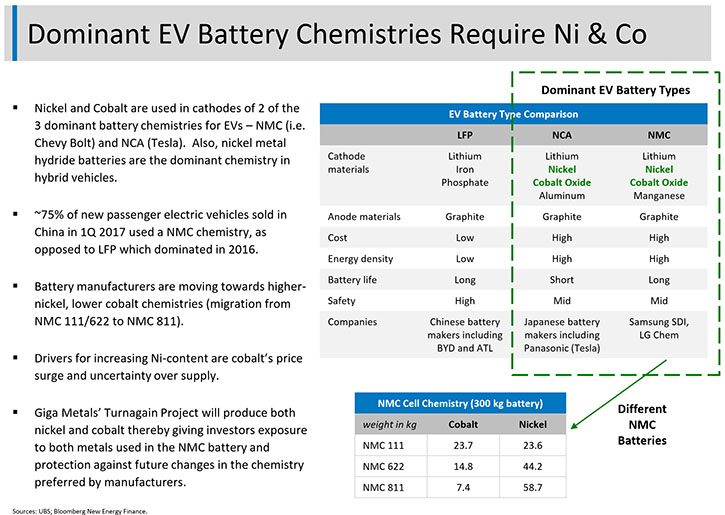

Mr. Mark Jarvis: Well, they're a critical part of lithium ion batteries. In fact, nickel itself is a critical part of every battery chemistry you can think of. Nickel cobalt aluminum (NCA) is what's used in Teslas. Everyone else uses nickel, cobalt, manganese (NCM). Then there's nickel metal hydride, used in batteries in hybrid vehicles like the Toyota Prius. Whatever battery you're looking at, nickel is part of it. And the reason nickel is part of the battery chemistry is that it has very high energy density. In other words, you can pack a lot of electrons into a given amount of nickel. The role cobalt plays is to stabilize the battery. When you're packing a lot of electrons into a small space, it can be quite volatile. The cobalt controls that volatility. I don't see any way forward for any of the battery chemistries without nickel and cobalt being involved. We have both nickel and cobalt in our deposit. It's primarily nickel, but it has a very significant cobalt byproduct credit.

Dr. Allen Alper: My memory is you have billions of pounds of nickel and millions of pounds of cobalt. Could you refresh my memory on more detail?

Mr. Mark Jarvis: In the measured-plus indicated category, we have a little over 4 billion pounds of nickel in the resource and a little over 250 million pounds of cobalt. When you add in the inferred category, you double that. This is an immense resource that we've already drilled off and that's defined by 204 drill holes. Although, by the end of this season, we'll be up to 227 drill holes defining the resource.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a bit more about where the deposit is located, access to it, etc.

Mr. Mark Jarvis: It's in north-central British Columbia. The Golden Triangle, where there are a lot of high grade mines that have been discovered, is in the Coast Range Mountains to the west of us. We're right at the same level as the Golden Triangle, but we're to the east. We're in the rolling foothills terrain, east of the Coast Range Mountains. We're also in the rain shadow of the Coast Range Mountains, so we don't get the huge snowfalls that they get. Highway 37, a paved highway, runs within 65 kilometres of our deposit and a dirt road comes right to our deposit. It's very easy road building terrain where we are, so it's quite easy to upgrade the dirt road to something that could support an operating mine. We would take our concentrate down the highway to Stewart, B.C., which is a year-round ice-free port, which already handles concentrate and has room for expansion.

Dr. Allen Alper: That sounds excellent. Could you refresh the memory of our readers/investors about your background, your team?

Mr. Mark Jarvis: My background was originally as a broker that financed exploration plays, oil, gas and mining in Vancouver. Then I went onto be one of the founding directors of a company called Ultra Petroleum, which started out with a very large, unusual tight gas deposit. We were the first to use multistage hydraulic fracturing to exploit that gas resource, and ultimately, we drilled up 3 trillion cubic feet of proved reserves in that play. It went from a big idea to a big reality and people made a lot of money in that.

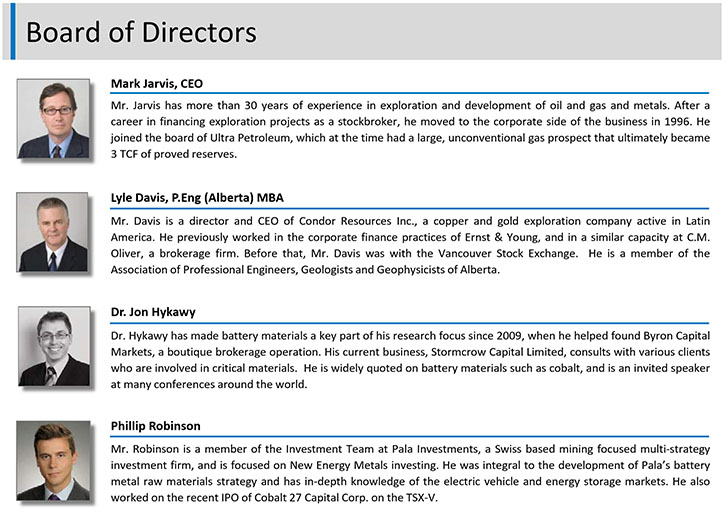

Corporate Management

Mark Jarvis

President, CEO and Director

Mr. Jarvis has more than 30 years' experience in exploration and development of mineral resources, both in oil and gas and metals. After a career in financing exploration projects as a stockbroker, Mr. Jarvis moved to the corporate side of the business in 1996. He joined the Board of Ultra Petroleum, which at the time was a small oil and gas exploration and development company with a large, unconventional gas deposit. As Director responsible for Corporate Finance, he raised the equity capital necessary to prove the concept and to establish enough production to finance further growth with debt. Ultra Petroleum has grown from an exploration play to 3 TCF of proved gas reserves.

Mr. Jarvis became CEO and President of Giga Metals Corporation's predecessor company, in January 2004. During his tenure, the company has drilled off a giant nickel/cobalt deposit, worked out a reliable metallurgical circuit, and published a Preliminary Economic Assessment.

Matt Anderson, CPA, CA

Chief Financial Officer

Mr. Anderson completed his bachelors of commerce degree at McGill University in Montreal. He earned his CPA, CA accreditation in 2008 after which he began providing accounting and CFO services to junior public companies primarily involved in the natural resource sector. He has extensive experience in financial and accounting related functions based on his experience working with companies such as Claren Energy Corp., I-Minerals Inc. and Callinex Mines Inc., among others.

Leslie Young

Corporate Secretary

Ms. Young's 25-year background in the junior capital markets started with CM Oliver & Company where she served as Executive Secretary to senior management and board members. Ms. Young joined Giga Metals' predecessor company in February 2004 as the Corporate Secretary and Office Administrator. She is responsible for corporate filings, assisting and reporting to the President, secretary to the Board Meetings, to act as liaison with corporate council and respective corporate matters, and to act as Manager to administrative employees and the general operations.

David Tupper, P.Geo.

Manager of Exploration

David has over 32 years of mineral exploration experience, which includes managing the identification, acquisition and execution of numerous high quality, early stage to large-scale drill exploration projects. He has experience exploring for uranium, gold, base metals and coal in a wide variety of geological settings in North, Central and South America, as well as Asia. He also has experience in surficial geological mapping associated with slope stability and contaminated sites environmental work. David is a Qualified Person under National Instrument 43-101.

Tony Hitchins, B.A.Sc., M.Sc.

Geologist

Mr. Hitchins completed his bachelor’s and master’s degrees in engineering geology and economic geology at the University of Toronto. Subsequently Mr. Hitchins spent the next twenty years involved in various aspects of mineral exploration from field geologist to project manager. Exploration targets included volcanogenic massive sulphides, carbonate and sandstone hosted Pb-Zn-Ag, vein gold, intrusive hosted gold, base metal skarn, and tungsten-molybdenum porphyry deposits for the Amax group of companies. 1994 through1998, he was district exploration manager for Cyprus Gold, in Western Australia. Since returning to Canada, Mr. Hitchins has worked with Vancouver based junior exploration companies.

Greg Ross, P.Geo.

Project Manager

Mr. Ross has over 12 years of experience in the mineral exploration and resource development industries. He has served in Project and Senior Geologist roles for junior mining companies operating in Western Canada, including almost 10 years in the Ni-Cu-Co-PGE space. Mr. Ross is a Professional Geoscientist with Engineers and Geoscientists British Columbia (formerly APEGBC) and is a Qualified Person under National Instrument 43-101.

James Edward Beswick, P Eng. FCIM

Environmental, Safety and Community Programs Manager

Mr. Beswick is a registered professional mining engineer with over 30 years of experience in environment, permitting and community relations. Ed was previously Director of Environment and Permitting for Hillsborough Resources Limited and has worked with numerous coal, base and precious metal companies. He is currently a Trustee for the Canadian Institute of Mining Foundation.

A critical member of our team is Tom Milner, a mining engineer, directing the metallurgists and engineers that are working toward a pre-feasibility document. Tom was responsible for the restart of the Gibraltar Mine in British Columbia, a big copper porphyry. He then worked with Ken Shannon at Corriente Resources and they put together a feasibility report on a large copper porphyry, in Ecuador and ultimately sold the company to the Chinese for $20 a share. Tom is a very talented mining engineer, with some very successful projects under his belt.

Greg Ross is our Project Manager. It's actually kind of an interesting story. His first job out of university was with us. He worked with us for about three or four years and we trained him very well. He's very good at running a project, QAQC, database management and so forth. In the down turn, we had to let him go, but we managed to hire him back. And it's a very good hire indeed.

We're using Chris Martin, at Blue Coast Metallurgy, for our metallurgical campaign. We have a team at Hatch that is running our comminution and mining engineering, as well. It's a very top notch, just a brilliant team we've put together with Tom Milner’s guidance.

Dr. Allen Alper: It sounds like you and your team have excellent experience, excellent backgrounds, and are very capable people. That sounds great. Do you want to say anything more about your Board?

Mr. Mark Jarvis: We've added a couple of new Board Members within the last year. One is a gentleman named Jon Hykawy. He is an expert in battery materials and sourcing them for large users. He speaks at battery materials conferences around the world.

And then there's Phillip Robinson, who is a part of the investment committee at Pala Investments. Pala is a large private equity group, out of Switzerland. I think they're a $3.5 billion equity group and they've become quite significant shareholders of our Company. Phillip is just a brilliant, brilliant guy. He's a very good Director.

Also, there's Lyle Davis who chairs our Board. His background is corporate finance, advisory and management of public companies. He's an expert in corporate governance and takes it very seriously. He's a very good citizen.

Dr. Allen Alper: That sounds like a very strong team and great new members and backing, so that's excellent. Could you tell our readers/investors about your capital structure?

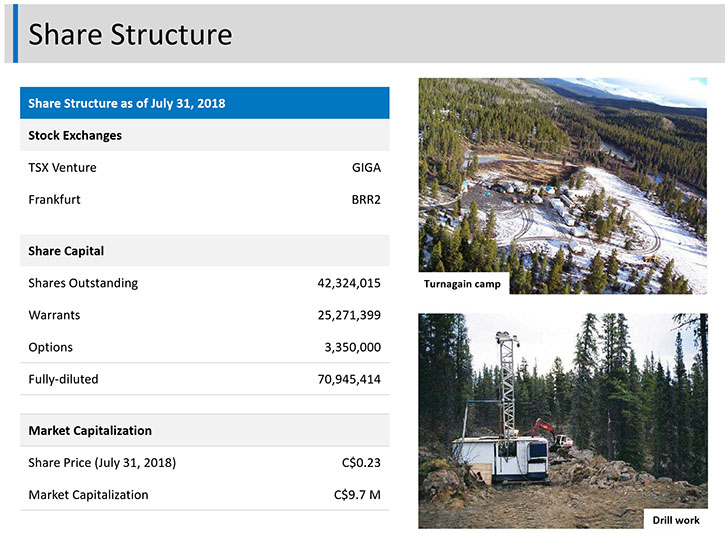

Mr. Mark Jarvis: We have 42 million shares outstanding. We have warrants and options as well, of course, that add up to 71 million shares, fully diluted. We're currently trading at 26 cents. We're trading at less than our recent transaction value with Cobalt 27. It's just a sign of the times, though. The market is pretty soft right now. I think everyone in the junior space has noticed that in the last 6 months, however that's the nature of our business. It always goes down and it always comes up again.

Dr. Allen Alper: Right. Usually the summer months are kind of a slow period when the resource market slows down.

Mr. Mark Jarvis: We are definitely in the doldrums right now, Al, but I expect in September, things will pick up again as they usually do.

Dr. Allen Alper: Right, that's usually what happens.

Mr. Mark Jarvis: So, what that means is, usually the summer months are a pretty good time to buy.

Dr. Allen Alper: I recently spoke to Rick Rule and Brian Lundin and they both stated the same thing. Summer is usually the time to consider buying.

Mr. Mark Jarvis: Yes, and especially if you can find a real bargain. I feel that trading for less than our cash and marketable securities per share is like you're getting our project for free. That's a pretty compelling story, I think.

Dr. Allen Alper: That sounds like a great opportunity for investors.

Mr. Mark Jarvis: I think so. But again, I'm not giving advice. I'm just a CEO noticing that we're, in my view, undervalued.

Dr. Allen Alper: Right. That sounds very correct. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Mr. Mark Jarvis: If, as an investor, you believe that electric vehicles are the wave of the future, you have to consider the supply chain for these electric vehicles, and in particular for the batteries that power them. If you believe as I do, that electric vehicles are really taking over the market, then nickel and cobalt are going to be significantly supply constrained from the early 2020s on. What happens when supply becomes constrained is prices have to rise to a level that will induce new supply to come to the market. In other words, there's an incentive price for large new deposits to get built.

Wood McKenzie studies these markets in depth. I've read recently that they think to bring on new supply of significant size requires $12 a pound nickel. We're currently sitting at about $6.30 or $6.40 a pound. Nickel has to move significantly higher. We think we can make a good return on capital, with our project at around $9 or $10 a pound. At those kinds of prices, our project would have very robust economics.

In terms of incentive price, we're at the low end of prices that are needed to bring known large deposits on stream.

Dr. Allen Alper: That sounds like an opportunity for Giga Metals and an opportunity for investors. Is there anything else you would like to add, Mark?

Mr. Mark Jarvis: Al, I think we've covered it pretty well. It's these really large, undeveloped deposits where you get the leverage. If you're more conservative, you can buy a producer. You can buy a Vale, you can buy a Glencore or you can buy a Norilsk. If the commodity market does well, you can make 2, 3, 4 times your money. It's riskier to invest in large, undeveloped deposits, but the leverage is much greater. If you're looking for leverage to make many multiples of your investment and you don't mind accepting some risk, well this is for you, then.

Dr. Allen Alper: That sounds like an excellent analysis for our readers/high-net-worth investors. I enjoyed talking with you again, Mark. I'll be looking forward to watching your drill results and talking with you again, probably in the fall.

Mr. Mark Jarvis: Thank you very much for the opportunity, Al.

Dr. Allen Alper: Thank you, it is great hearing about your progress!

https://www.gigametals.com/

Suite 203, 700 West Pender Street

Vancouver, British Columbia

Canada

V6C 1G8

Phone: (604) 681-2300

Email: info@gigametals.com

Corporate Communications: Juliet Heading

Email: jheading@gigametals.com

|

|