Interview with Carl Dumbrell, Managing Director and Company Secretary, Emperor Energy (ASX: EMP): Significant Amount of Conventional Gas at Vic/P47 in Great Demand Due to an Energy Crisis in Southeast Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/22/2018

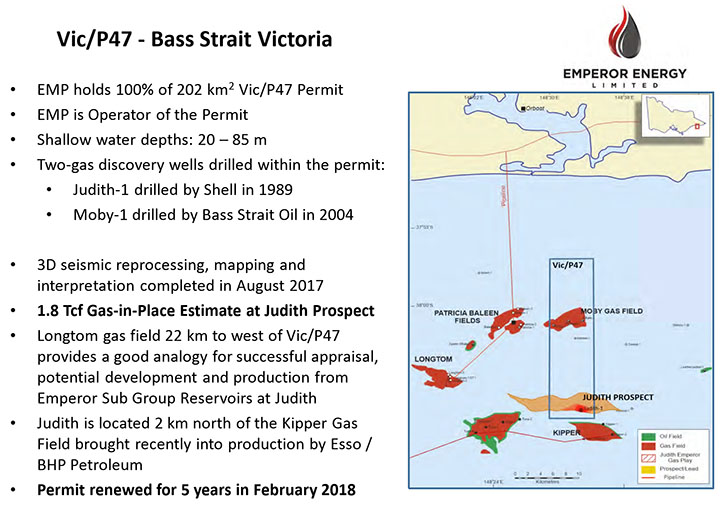

Emperor Energy (ASX: EMP) is a diversified energy company, with upstream and downstream assets in Australia. The company’s strategic asset, Vic/P47 oil and gas project, is located in the Gippsland Basin, next to the BHP/ExxonMobil Kipper field. We learned from Carl Dumbrell, Managing Director and Company Secretary of Emperor Energy, that they have a significant amount of conventional gas at Vic/P47 and it is in great demand, due to an energy crisis currently happening in Southeast Australia. The project was renewed in February for five years and the company has completed the 3D seismic work, including processing, mapping, and quantitative analysis. Emperor has plans for a drill program in 2021. Near term plans include a program of engineering work, static modeling and moving toward getting an independent resource statement, expected to be released in August. This will allow Emperor to start discussions around MOU and off-takes, which they hope to finalize by quarter four of 2018.

Emperor Energy

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Carl Dumbrell, Managing Director and Company Secretary of Emperor Energy, Ltd. Could you give our readers/investors an overview of your company?

Carl Dumbrell: Emperor is a junior resource company, listed on the Australia stock exchange. We have three projects, one strategic project that is located in the Bass Strait, known as the Gippsland Basin. It's next to the Kipper Exxon Mobile project. We are an oil and gas company, focused very much on gas. Our strategic project, as I mentioned, is next to Exxon Mobile's Kipper project, but it's a project that has a significant amount of conventional gas. It's in a basin, which is heavily demanding gas, due to a bit of an energy crisis that is going on in Southeast Australia, at the moment. Gas prices there are moving from $3.00 a kilo to $8.00 to $10.00, with high demand.

Dr. Allen Alper: Sounds very good. Could you give us more details about that project?

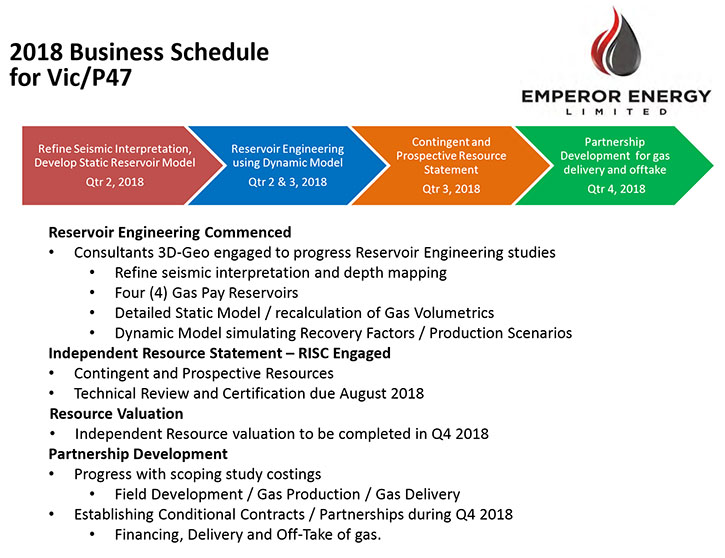

Carl Dumbrell: Yeah. Our presentation, which I'm just finalizing and sending to the printers at the moment, shows we're right on our timeline. The project was renewed in February for five years. We have plans for a drill program in 2021. At the moment, we've completed our 3D seismic work, including processing, mapping, and quantitative analysis. The conclusions reached, out of that three day seismic work, is that we have 1.8 Tcs of gas and a recoverable amount of gas at about 1.1 Tcs.

We've done some petro-physics work in the recent months to look at the water content in the gas in the play, and those results have been released publicly and they ultimately conclude very good results on the water/gas content. We are currently working on a program of engineering work, static modeling and moving toward getting an independent resource statement done by Risk, which we hope to release in late August.

That Independent Resource Statement should conclude a very good resource number on the project. Following that, the company's plan is to take that resource statement and have an evaluation done of the gas in field. We believe that evaluation will lead to a very significant number. A number that is far superior to our market capitalization. At the end of that, we have arranged contacts for discussions around MOU and off-take of our program, which we hope will complete by quarter four of 2018.

Dr. Allen Alper: Well, that sounds excellent.

Carl Dumbrell: I have a timeline, which shows what we're doing quarter by quarter in 2018. At the moment, it is the static modeling engineering works, around the drill program that will have to happen, leading into an independent resource assessment. That's quarter two, quarter three. At the end of Q3, the independent evaluation is to be done by a major finance organization of global house. On the back of that, we’ll go back to off-take parties in quarter four and get a MOU for off-take of gas status infrastructure, etc. There's a very big play on this in 2018.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors about your other projects?

Carl Dumbrell: We have two other projects. One is an offshore project far North of WA and we are looking to farm that project out, at the moment. We've just signed a contract with another party to market the farming of that project. It's a small offshore project, it's in very low-lying water, you are talking 17 meters water depth. It's very good for a jack-up rig. It is a drilled program, it's on what's called a retention lease. It has around three million barrels of oil in it. It's a small, little project, but realistically it's 60 million dollars to a party that is actually going to pull the oil out of the ground. An investment that could be quite a significant payback for a party. We're looking to farm that out in the next six months because our core focus is on this other gas project we discussed and we feel that this could land in somebody else's home and it would be a much better opportunity.

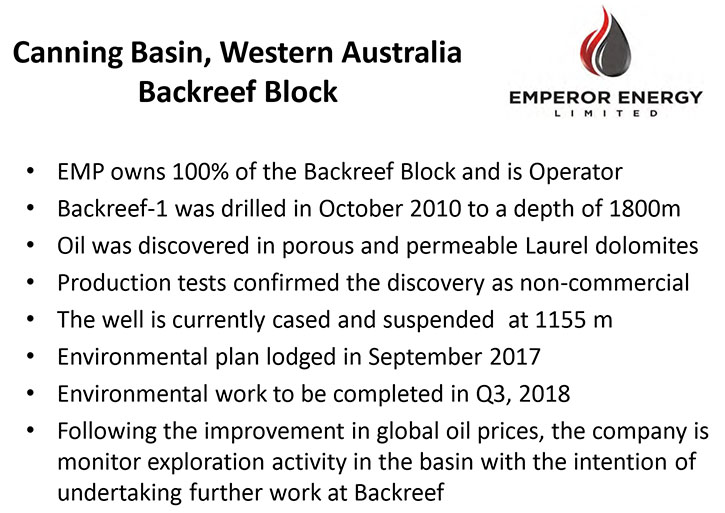

Our other project is called Backreef. Our Backreef project is North of WA onshore. It's in the Canin basin. It's an unconventional oil play. It has very significant numbers of unconventional oil, but would require a fracking drill program to go forward. We have a well that has been drilled up there and at the moment, what we are doing is undertaking some environmental works required and then we want to do some engineering work to see if we can drill into that well farther and go deeper than what was previously done because there is a very significant play we see deeper in that well.

Those are our three projects in a nutshell. We're very focused on our major project in the Gippsland basin.

Dr. Allen Alper: That sounds very good. Could you tell our readers/investors a bit about your background, your Board’s and your team’s?

Carl Dumbrell: Certainly, the board of directors is led by myself. I am a chartered accountant, I've worked in the resource industry for 20 years, both in Sydney and London. I am also a Director of another company called, Herencia Resources Plc, which is listed in London. Our other two directors, are Justyn Peters, a lawyer by training, Executive Chairman of Leigh Creek and previously, Executive Lead Manager of Link Energy. And Vaz Hovanessian, with 25 years’ experience in oil and gas. Vaz is an accountant and he serves on other boards.

We have two other members of our team. One is Phil McNamara and one is Geoff Geary. Phil McNamara, a Qualified Mining Engineer, former CEO and Managing Director of Waratah Coal, a subsidiary of Armor Energy, has thirty years in the resource industry. Geoff Geary is a geologist in the petroleum industry with 35 years of experience and has done lots of work with Shell.

It's a pretty lean company, not a lot of money spent on these guys, but ultimately we have a highly experienced, motivated group of people, who are focused on getting a result.

Dr. Allen Alper: Awesome, that sounds like you all have great experience. Would you tell us a bit about your capital structure?

Carl Dumbrell: Absolutely. We have 907 million shares at the moment and we have issued 518 million options in one issue. We pay exercise price at half a cent a unit. We are currently trading at point three, point four. Our market cap is three and a half million. We have money in the bank to undertake our 2018 program. At the end of 2018, once we are through that work program internally, independent resource statement released, evaluation done by a major finance house, MOU signed, we will be looking into a capital raise at that point in time. Hopefully, there will be a much stronger share, possibly, than what we show today.

Dr. Allen Alper: That's really interesting. Could you tell our readers/investors the reasons they should consider investing in your company?

Carl Dumbrell: At the moment, we, the company, believe that our share parcels are very much under-valued. We see a lot of upside in that. We provide investors with a very clear, concise plan of what we are trying to achieve in the short term, the next six months. We have a global gas project. I go back to P47, our Gibson gas project, we're sitting there on 1.8 trillion cubic feet (tcf) of gas. We're in a basin where there is significant demand. We're a little company with a significant gas asset, next to Exxon’s Kipper project, only three kilometers from their hardcore infrastructure. If I were Exxon, I would be doing a lot of homework on our asset and potentially looking into taking it over in the near term. We would hope Exxon might be thinking the same.

Conversations have started that have noted our progress. We think there is a lot of upside for an investor on this. 1.1 tcf of gas recoverable, that's the equivalent of 1.1 billion units of gas. The Australian market is buying gas at $8.00 retail per unit, for the final point of sale in the household. That's about 8 billion dollars’ worth of gas. Clearly, the end resource of gas in field doesn't have that kind of valuation, but it would have something between 20 to 30 cents a unit. They should have to give us a price of two to three hundred million dollars for the gas in field and looking at a market cap of three and a half million, as you can see, it's a significant difference for us.

Clearly we are a near-term project. We are not talking twenty years, we're talking things that will have been done in the next six months. It should be a big upside for buyers. Low cost, low cash burned, clear and focused management.

Dr. Allen Alper: That sounds like an excellent opportunity. Is there anything else you'd like to add? I enjoyed talking with you. I am very impressed with what you have.

Carl Dumbrell: It's actually a very good project. Our major shareholders are in New York. Our Board is part of the top handful of shareholders. When we talk to people, like Exxon Mobile and Mitsubishi Group, they are surprised, first that we have the project, second the amount of work we are doing and the clear concise plan we have of driving towards independent assessment, global valuation and MOU off-take on project. They recognize that we are really driving this hard and we are. It's going to lead to a very good return for shareholders.

Dr. Allen Alper: It sounds like it, with what you're doing.

Carl Dumbrell: We're making progress. We're driven. We're focused and we're here to get a result. Thank you for this opportunity.

https://emperorenergy.com.au/

Carl Dumbrell

Ph +61 402 277 282

carl@emperorenergy.com.au

|

|