Aethon Minerals Corp. (TSX-V: AET): A Canadian-Based, Copper-Focused Exploration Company, Positioned for Growth in a Top-Tier Mining Jurisdiction, Interview with Robert Davies, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/14/2018

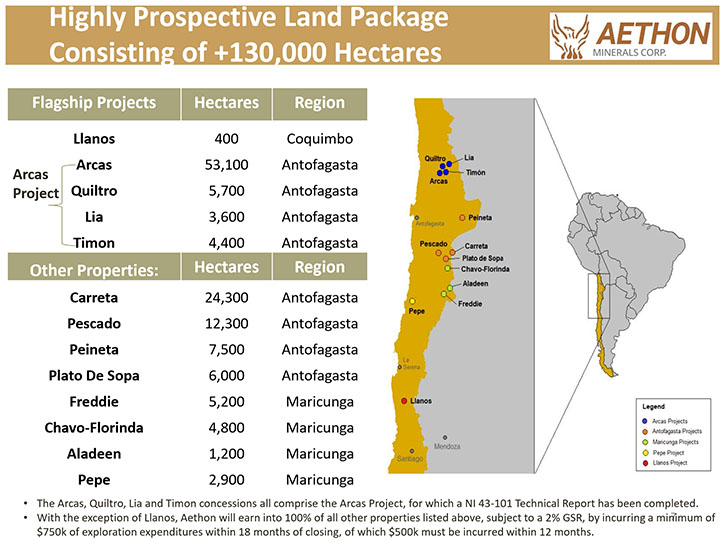

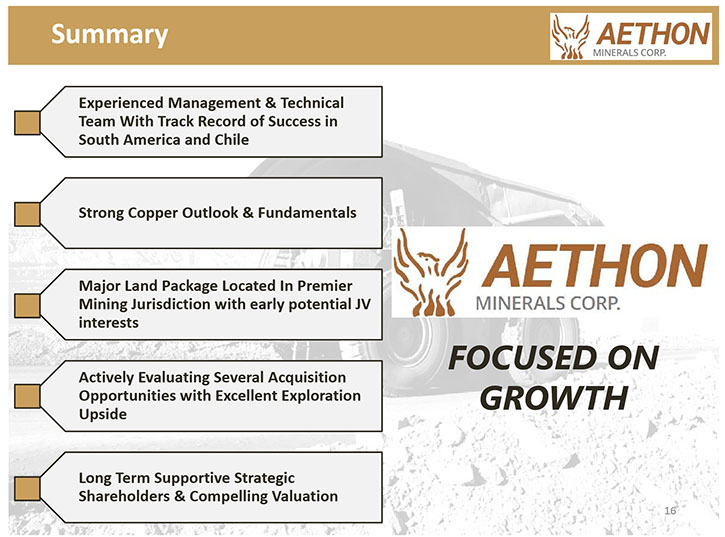

Aethon Minerals Corp. (TSX-V: AET) is a Canadian-based, copper-focused exploration company, uniquely positioned for growth. The company has consolidated a very large prospective land position in northern Chile, consisting of over 130,000 hectares, along prolific mining belts, located in Chile’s Maricunga and Antofagasta regions. We learned from Robert Davies, who is President and CEO of Aethon Minerals, that their Llanos property, located in Chile's Region IV, with excellent access and existing infrastructure, has potential for a substantial copper-gold-molybdenum porphyry body. We also learned from Mr. Davies that their other flagship property, Arcas, located in the Antofagasta region, is surrounded by a number of major producers, and had an NI 43-101 technical report completed on it earlier this year. Future plans for 2018 include the drilling program at Llanos, with the simultaneous advancement of exploration activities on the existing 130,000 hectare package, particularly the Arcas project, followed by additional exploration on the Maricunga properties. According to Mr. Davies, Aethon has no debt and is very fortunate to have strong strategic relationships with Altius Minerals, as well as Rick Rule and the Sprott Organization.

Robert Davies, President and CEO of Aethon Minerals, at Sprott Natural Recourse Symposium

Aethon Minerals Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Robert Davies, President and CEO of Aethon Minerals Corp. Robert, could you give our readers/investors an overview of your company?

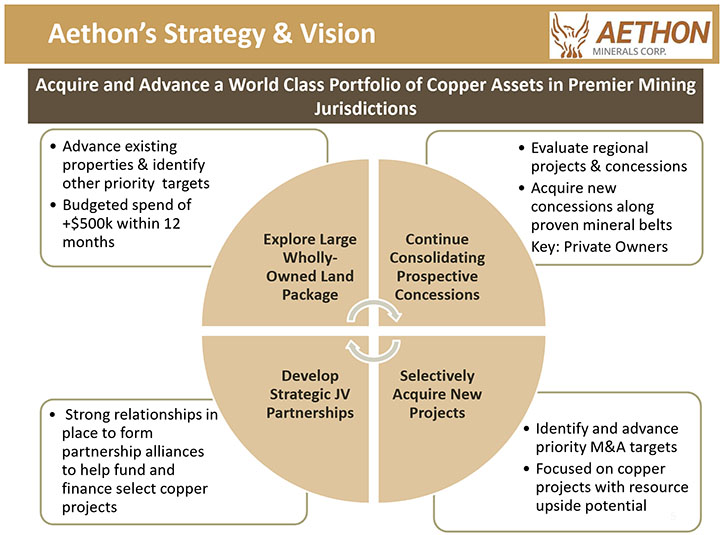

Robert Davies: Absolutely. We are a copper-focused exploration company currently focused in Chile. We are a spin out of Altius Minerals, who acquired a large 130,000 hectare land-package back in the downturn of the copper market, with the idea of spinning out a new copper company when the market heated up. Altius remains our largest shareholder.

They brought me in, September 2017, to build the management team, get the company listed, and put a strategy forward to maximize the value out of this very prospective land package. Our current management team, which has over 50 years of experience combined in Chile and South America, is focused on adding value to the company, by strategically advancing and growing our portfolio of high quality exploration projects.

Dr. Allen Alper: Could you tell our readers/investors your plans for this year?

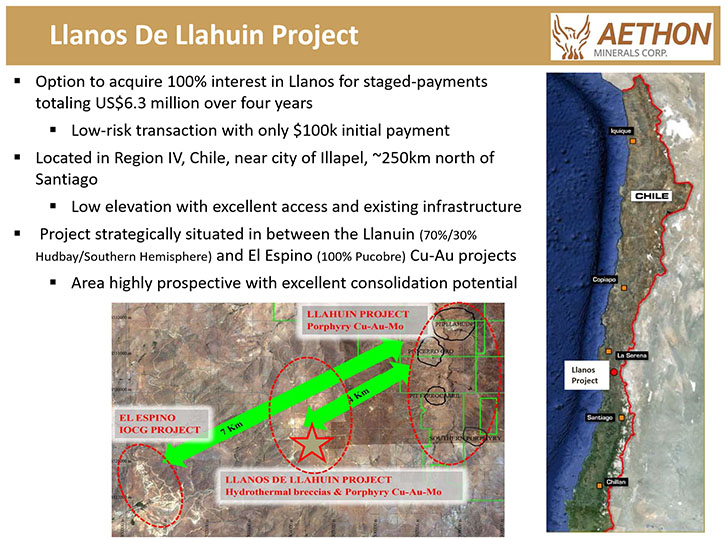

Robert Davies: For sure. We hit the ground running. We started trading May 3rd, 2018. About two weeks later in May, we acquired an option to purchase 100% of the Llanos property, which is in a very prospective area. The project is strategically located between the El Espino project, which was discovered by our own geologist David O’Connor, and currently has about 230 million tonnes grading about 0.45% copper to the south-west, and the Llahuín project to the north-east, which is a copper-gold porphyry, currently optioned by Hudbay Minerals, containing about 150 million tonnes. So we believe we are in a very prospective region, which also benefits from being at low elevation, near the coast, and having excellent infrastructure in place. We just commenced drilling activities at Llanos in mid-July.

Dr. Allen Alper: It's a good time.

Robert Davies: Yes. Perfect timing with the conference and whatnot. And in parallel we have a commitment to spend about $500,000 in the next 12 months on exploration on our existing 130,000 hectare package. So we have commenced early exploration activities, ground samples, channel sampling on our other flagship project, Arcas where we completed a 43-101 technical report earlier this year.

Dr. Allen Alper: Could you give us the highlights of the projects?

Robert Davies: For sure. On the one hand we have the Llanos project, which we are currently drilling and we feel is highly prospective. We entered into an option agreement on the project earlier in the year, from a private Chilean family, for staged payment totaling $6.3 million over 4 years, with the bulk of the payments being back-end weighted. So that gives us the opportunity to invest some money in the ground early on through exploration and verify that our intuition is correct.

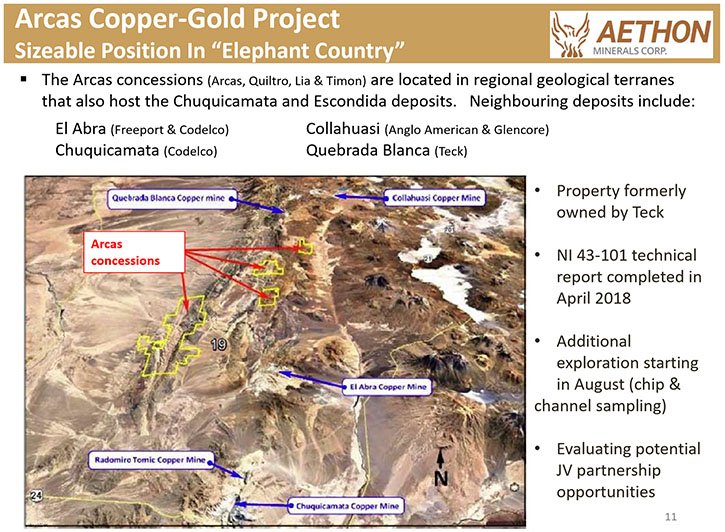

With regards to the Arcas property. It's a great property in the Antofagasta region. We are surrounded by a number of major copper producers, neighboring the border of our Arcas property and in the immediate vicinity. The land package was hand-picked, based on prospectiveness and is based in one of the top mining jurisdictions globally.

Dr. Allen Alper: Thanks. That's very good. Could you tell our readers/investors a bit about your background?

Robert Davies: I'm an engineer by trade. I started working in large infrastructure projects in oil and gas, nuclear power, and then in the last 15 years I've been working in the mining industry. I worked for some of the bigger mining companies in the world, Barrick, Kinross, Inmet Mining, and General Electric on the mining side.

I've been in charge of some of the largest projects. I was one of the project directors for the Pueblo Viejo project, in the Dominican Republic, which was a $3.5 billion project, gold, copper, silver and zinc. It was completed on time and on budget, and it's producing right now, 600,000 ounces of gold. I was in charge of development of the Cobre Panama project, when I was at Inmet, which was a $6.5 billion project in Panama that was acquired through a hostile takeover bid by First Quantum Minerals.

So I've been around, particularly focusing on South America. I'm fluent in Spanish as is most of my team. We all have experience in the South America region and in particular in Chile. I think we are strategically positioned to bring a lot of value from this land package and from existing land packages that particularly private owners have, on which they've been paying annual fees for years if not decades. Now we can knock on their doors and they'll probably be willing to open the door to us.

Dr. Allen Alper: Very good. Could you tell us a bit about your Board?

Robert Davies: Absolutely. Our Board is a very supportive board. We have Jens Mayer, our Chairman. He has an incredible background, particularly on the institutional side. He's also a geologist by trade. We have Flora Wood, who just joined our board as the Altius representative. She was the VP of investor relations for Inmet Mining, as well as many others. We have Sam Leung, who's the VP of corporate development for Adventus Zinc, which is another Altius spin out, focusing on zinc, and has been absolutely successful partnering with key partners, geologists in Ecuador and they've been getting absolutely amazing results on their projects in Ecuador. We also have Michael Atkinson, who sits on different boards and is very supportive of everything that we are doing.

Dr. Allen Alper: That sounds like an excellent board. Could you tell us a bit about your management team?

Robert Davies: Absolutely. Our management team are all experienced in the region. My Chief Geologist is David O'Connor. He lived in Chile for about 20 years, and before that he lived in Bolivia for eight years. He's started five different companies in his tenure as CEO. He discovered the El Espino deposit, just south of our Llanos property. He's very knowledgeable about the area. He's been helping us focus particularly on three districts that we really like, and we are focusing on consolidating various projects.

We have our VP of Corporate Development, John Miniotis, who started his career at Barrick when I was there. He worked at Lundin Mining, in their Corporate Development team and was also in charge of Investor Relations, and lately he was the VP of Corporate Development for AuRico Metals, until they were acquired by Centerra Gold.

I have Carlos Pinglo, a Peruvian national. He's been the CFO and VP of Finance for at least six different junior mining companies. He has cemented his experience, not only as CFO and VP of Finance, getting IPOs and RTOs completed, as well as managing junior companies, from the finance and compliance point of view.

Dr. Allen Alper: It sounds like great people you have there.

Robert Davies: Yes, absolutely. I think we have been very lucky to get all of them. We are very well supported by our Board. They've been very involved in our hiring process, vetting our management team. Most of them have come through contacts from our Board and our parent and sister companies, Altius and Adventus. So we believe we have a very highly qualified management team, with the technical and the managerial experience to be successful in Chile.

Dr. Allen Alper: Excellent. Very good. Could you tell our readers/investors a bit about your capital structure?

Robert Davies: Yes, absolutely. We were very fortunate to be backed by Altius Minerals and also have strong support from Rick Rule and the Sprott Organization. We were able to raise $8 million from the seed financing, which was well over-subscribed. We have no debt. We have about 27.6 million shares outstanding, with a market cap of about $13 million, as of yesterday.

Dr. Allen Alper: Wow, that's excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Robert Davies: I think we have the strategic advantage of our management team and their experience, particularly in the region in Chile. We have tremendous long-term shareholder support, compared to other juniors, with Sprott, Altius, and others backing us up.

We have no debt. We are very lean. We are keeping our cost down, both in Toronto and in Santiago. We aim to operate, for the next three to five years on a very lean, no debt budget. We also believe we have access to more financing if we need it down the road for the right opportunities.

Dr. Allen Alper: That sounds excellent. Anything else you’d like to add, Robert?

Robert Davies: No. I encourage anyone interested in Aethon and our story to contact us, either John Miniotis, our VP of Corporate Development or myself. You'll find our email and contact details on our website. We are glad to answer any questions you have. We expect to give you great and continuing news and press releases in the near future.

Dr. Allen Alper: Sounds excellent!

http://www.aethonminerals.com/

220 Bay Street, Suite 550

Toronto, ON

M5J 2W4 Canada

Tel: 1-647-339-0434

Email: robert@aethonminerals.com

|

|