Interview with Steve Poulton, CEO Altus Strategies Plc (AIM: ALS & TSXV: ALTS): A Diversified Mineral Exploration Project Generator Focused on Africa

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/13/2018

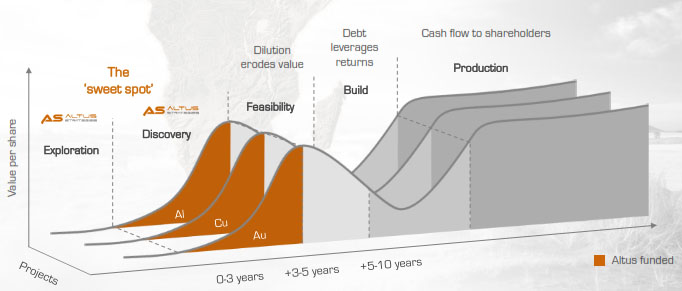

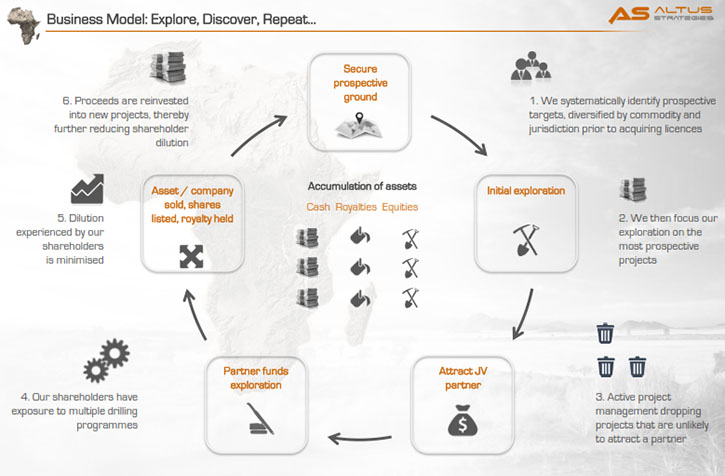

Altus Strategies Plc (AIM: ALS & TSXV: ALTS) is a diversified mineral exploration project generator focused on Africa. Through its subsidiaries, it discovers new projects and attracts third party capital to fund their growth, development and ultimately create exit optionality. This business model is designed to create a growing portfolio of well-managed and high-growth potential projects, diversified by commodity and by country.

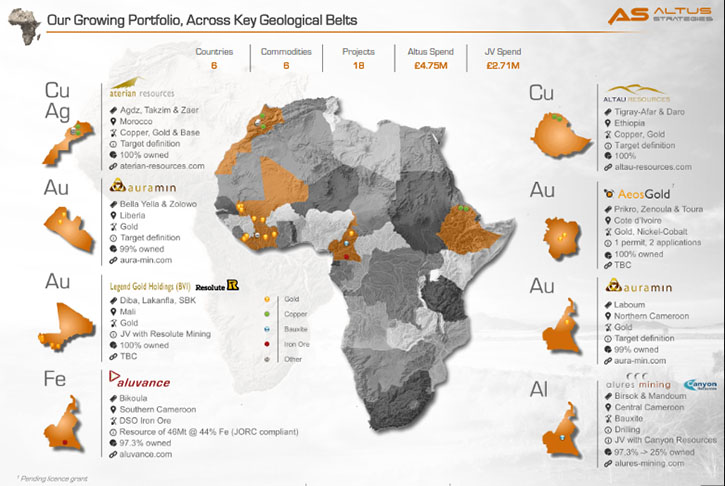

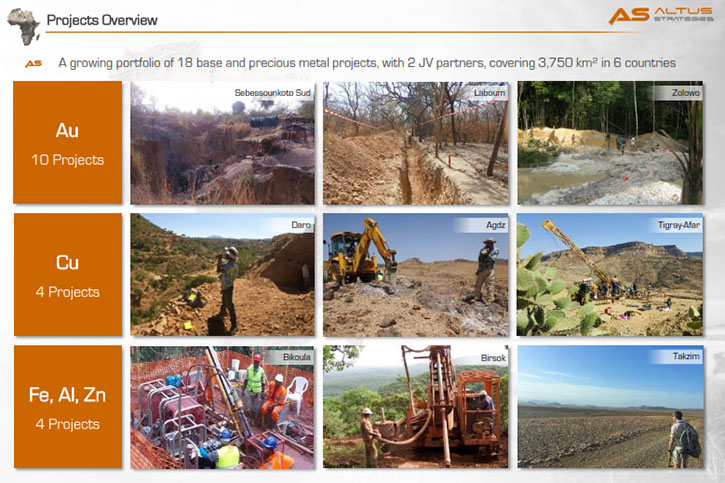

Altus currently has eighteen projects, in six commodities and across six countries. We learned from Steve Poulton, who is CEO and co-founder of Altus Strategies, that their projects are located in West Africa and East Africa primarily and specifically in Mali, Cameroon, Ethiopia, Morocco, Liberia, and Ivory Coast. Approximately half of Altus’ assets are gold focused. We also learned from Mr. Poulton that since their August 2017 AIM IPO in London, how they moved rapidly to acquire Legend Gold on the TSXV in January, undertook a C$4.1m financing in April and completed a TSXV dual listing of their shares in June 2018. The Company is currently the only Canadian listed project generator, which is focused exclusively on Africa. The Company has just announced an exciting development from their bauxite discovery in Cameroon.

Assessing drill core at Tigray-Afar, copper-gold project, Northern Ethiopia

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing, Steve Poulton, who is CEO and co-founder of Altus Strategies. Could you give our readers/investors an overview of your company and a bit about your strategy and your business model?

Steve Poulton: Absolutely, a pleasure. Altus Strategies is a project generator company. We founded our Company in 2007, meaning we’re well established, but we've only recently taken the company public. In August last year we listed on the AIM market of the London Stock Exchange. Thereafter we undertook a transaction with Legend Gold, which was at that time a TSXV listed company with a portfolio of strategically located gold projects in western and southern Mali. That deal completed in January 2018 and we subsequently raised $4.2 million in April, mostly from North American based institutional and private investors. We followed that financing with a dual listing on the TSXV in June. Our ticker in London is ALS and on the TSXV it's ALTS.

We currently have 18 projects and we're focused exclusively on Africa. Our portfolio is diversified across six countries and approximately six commodities. Our projects are located in West Africa and East Africa, with about 50% of the portfolio focused on gold and the rest being a range of base metal projects.

Dr. Allen Alper: Could you tell us about some of your key projects, your assets and your team?

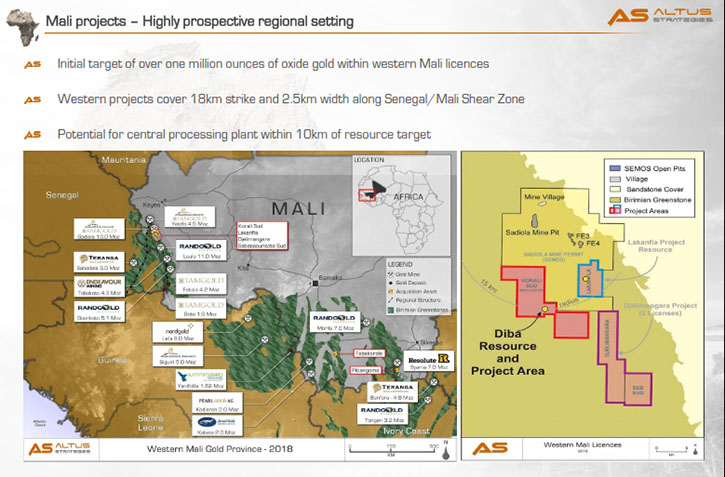

Steve Poulton: Certainly. The transaction that we undertook with Legend Gold is probably the best place to start. That is the most recent activity. Legend had assembled a very interesting portfolio in significant gold producing areas of Western and Southern Mali. Mali is Africa’s 3rd largest gold producer, with 1.6Moz produced in 2017. We saw a fantastic opportunity with Legend to combine their assets in a top mining destination with our own and at the same time gain the expertise of Michael Winn, who was the President and CEO of Legend, to become a Director of Altus. We also gained the services of a number of highly experienced geologists who joined us with the deal.

The former Legend assets are strategically located, very close to the Sadiola gold mine, which is operated by a consortium formed of Anglo Ashanti IAMGOLD and the Malian government. There are two strategic assets that we acquired from Legend that warrant a closer look. One is called DIBA, which has a 275,000 ounce oxide resource, (not presently in accordance with 43-101) located approximately 15 kilometers from the Sadiola mine. Sadiola itself, historically, has a reported resource of about 13 million ounces. It's now coming to the end of its oxide life and there're plans to build a sulfide plant there. That's quite a serious investment and will require some negotiations with the government, who have a 20% economic interest in the mine. The DIBA oxide ounces conceivably represent a very interesting feedstock for Sadiola, while they go about adding the sulfide plant to their project.

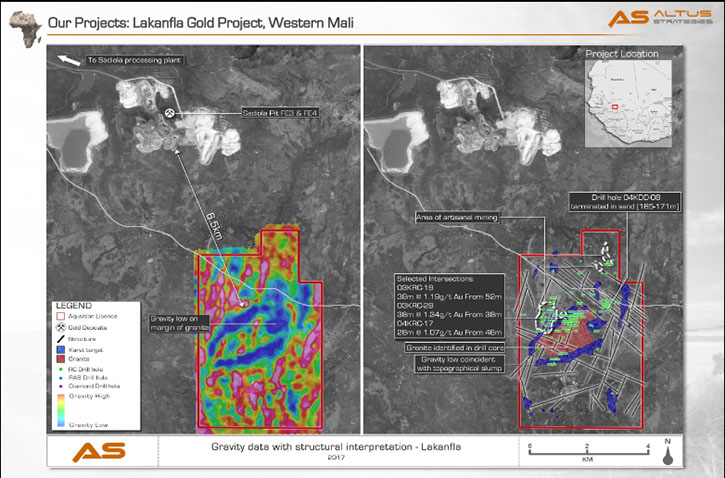

The second project, which is worth highlighting is LAKANFLA, which is also in Western Mali. LAKANFLA is interesting because of its scale and its karst-style geological characteristics. There are a couple of satellite pits at the Sadiola mine, called FE3 and FE4 and these deposits are considered to be karst-style. Also there's the historic 4.5 million ounce Yatela mine, located 45km to the northwest and which is also a karst-style orebody that was also mined by AngloGold-Ashanti and IAMGOLD. Karst-style deposits can be very large. The deposits form where you have a low grade gold mineralized system, occurring predominately within limestone, for example. With the process of weathering and erosion, the limestones dissolve and as sulfides are liberated they the ground waters are acidified which accelerates the dissolution of the limestone. This process of erosion and gold remobilization can result in a high-grade supergene ore body along the interface of the limestone and more competent lithologies.

The process of karstification results in the formation of voids. Some of those voids are filled over time, geologically, with things like eroded sand and more recent rocks which have collapsed in from above. It's quite fascinating that in the pit wall of karst style deposits such as Yatela you can see sands and erratic boulders at depth.

As for the LAKANFLA project, a great deal of drilling has been completed, but nearly all of it was shallow, focused on where the artisanal miners are chasing higher grade mineralized breccia. Only when geophysics defined several, two to three kilometers long gravity-low features, did it become evident that a karst-style ore body is the primary target. LAKANFLA is only a matter of six kilometers from FE3, FE4 and a number of the very few drill holes which did coincide with the gravity target contained karst-style characteristics, including limestones with background gold mineralization as well as unconsolidated sand and voids. All in all, we think the results to date at LAKANFLA, suggests it represents a ‘walk up’ drill target for a potential multi-million ounce discovery.

So, those are two of our interesting projects in Mali. We also have a number of others there, specifically one called PITIAGOMA EST which is a joint venture with ASX listed Resolute Mining, located approximately 45km to the south of their 8.0Moz Syama gold mine. We also have three other assets, with all of them showing hard rock artisanal gold workings and being prime ground for new discoveries to be made.

Mali is just one of the countries, in which we're active in Africa. The others are Cameroon, Ethiopia, Morocco, Liberia, and Ivory Coast. I probably described some of our key gold assets as being the Malian ones. Staying within gold, we have a very interesting project called LABOUM, located in the center of Cameroon and in what we believe to be a brand new gold province. We've staked the best part of twenty kilometers of a very large and wide gold bearing shear zone. We've been undertaking soil-sampling and ground geophysics on that and have defined five or six targets, each of which is between one and three kilometers long and up to half a kilometer wide. These targets now require trenching and drilling. The project also boasts hard rock and alluvial artisanal gold workings. In all LABOUM exhibits many of the hallmarks of a potentially substantial gold mineralized system.

In western Liberia, we're keying in on the Archaean geology, which is very similar to that found in the world famous gold provinces of Ontario, Western Australia or Tanzania. Our ZOLOWO project is located along the same geological trend as the 100,000 ounce per year New Liberty gold mine, which is operated by TSX and AIM listed Avesoro Resources. We're finding substantial artisanal alluvial as well as hard rock gold workings. The results to date which are incredibly compelling for the prospectivity of the license to host an economic gold deposit.

I'd be happy to tell you about some of our other projects, including our copper assets. Before I get into that, it might be worth mentioning that we also have a very interesting strategic bauxite project in Cameroon called BIRSOK. Bauxite is the ore mineral for aluminum. There aren't many listed exploration companies that have bauxite assets. It's a bulk commodity and typically requires significant infrastructure to accompany the deposit, such as; transportation, refining and smelting. BIRSOK, is located in the center of Cameroon where Altus have attracted a joint venture, with the company earning in called Canyon Resources which is listed on the ASX. Drilling by Canyon at BIRSOK has returned some very high bauxite grades from surface and the project is located very close to a functioning rail line, which runs down the spine of Cameroon to the Atlantic coast. As part of our deal with Canyon we have received eight million shares in Canyon to date and our Chairman David Netherway sits on Canyon’s board. What is quite exciting is that Canyon has recently announced that they have been granted an exploration license on the Minim Martap bauxite project. Minim Martap has the potential to be a very substantial, indeed potentially ‘world class’ high-grade and direct shipping ore bauxite mine. We are currently in discussions about vending BIRSOK into Canyon. Altus staked BIRSOK and cost-effectively advanced it, spending approximately US$140,000 on exploration. Our return on investment to date is a strong validation of our project generator business model

There's a lot of interest right now in battery metals, and electrification of the world, not least starting with transportation. A strong case could be made that increased use of aluminum to make vehicles lighter, because aluminum is so much less dense, is actually a way of making energy efficiencies. So we think aluminum is certainly a future metal. We're very excited about our exposure to bauxite.

Dr. Allen Alper: It sounds like you have some excellent projects. I wonder if you could tell our readers/investors a little bit about your background, the board, and the management team.

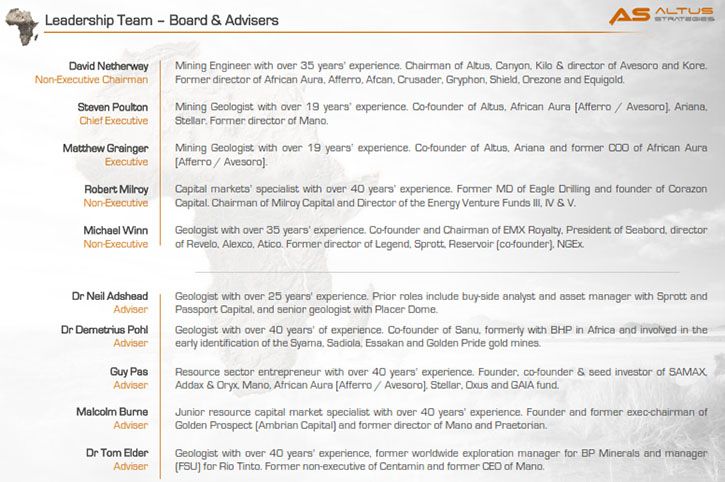

Steve Poulton: Certainly. I'm a graduate in geology and hold a Masters in mining geology from the Camborne School of Mines graduating in 1998. I then went to work, straight out of university, for a junior exploration company called Mano River that was listed on the CDNX and AIM in London, and which was operating in West Africa, specifically Liberia, Sierra Leone and Guinea. The Chairman of Mano was a very successful and dynamic resource entrepreneur called Guy Pas and the CEO was Dr Tom Elder, who was formerly a very senior manager at Rio Tinto. Over a period of years, I joined the board of Mano, and it ended in a successful amalgamation in 2011 with a firm that I had founded in 2004 called African Aura and which we listed on the TSXV in 2008. That company, African Aura, was divested into two companies, one called Afferro Mining, which was an iron ore business that was then sold for approximately $200 million to a group called IMIC in 2013. The other is a gold mining company that's now called Avesoro Resources, formerly Aureus Mining, which operates the New Liberty mine in Liberia, producing approximately 100,000 ounces of gold per year. The third spin out from African Aura was a company called Stellar Diamonds plc, where I was director. Stellar discovered a kimberlite dyke project in Sierra Leone and was then acquired by ASX listed Newfield Resources earlier this year.

Our board includes Matthew Grainger who was a co-founder of Altus. Matthew also graduated with an MSc in Mining Geology from the very same course as myself. On graduating Matthew also secured work in a junior exploration company straight out of university. It was only two years after the Bre-X disaster, so the market was very fragile in the late 90's. He went to work for a company that was active in Ireland and in latterly Spain, primarily looking for base metal deposits. After this he was a co-founder of Ariana and joined African Aura as a director and COO.

In 2002, Matthew, myself, and another economic geologist called Kerim Sener co-founded an exploration company in Turkey, called Ariana Resources, which we listed on the AIM market of the London Stock Exchange in 2005 and is now producing gold. David Netherway is our Chairman and also a co-founder of Altus, joining our board from our inception in 2007. David is a mining engineer by background, and has been involved in the successful discovery and development of at least three active and historic gold mines in West Africa, and also one in China. He's very well regarded in the industry and sits on a number of boards of listed companies. This brings a huge wealth of expertise and networking to Altus.

We also have a director called Robert ‘Woody’ Milroy. Woody is a North American who is based in Guernsey, in the UK. He's a specialist investment manager, and has as well as currently sits on the board of a number of investment management firms in the resource sector. He has a great deal of experience in natural resources, from being an owner, operator and investor.

The final director on our board is Michael Winn. Michael is a very highly accomplished geologist and resource investment professional. He previously worked with Rick Rule at Sprott and is currently the Chairman of EMX Royalties, a Toronto and New York listed royalty business, which was formerly a project generator company like Altus is today. Michael has a strong track record in the resources sector with has a number of notable successes to his name including Reservoir Minerals, which was acquired by Nevsun in 2016 for US$365m.

We have a very strong board, which has strong technical skills and a track-record of being highly commercial, in discovering and monetizing assets, through transactions and developing mines.

Dr. Allen Alper: It sounds like a very accomplished, experienced, and excellent board and team, so that's fantastic. And you have an excellent background. Could you tell us a bit about your capital structure?

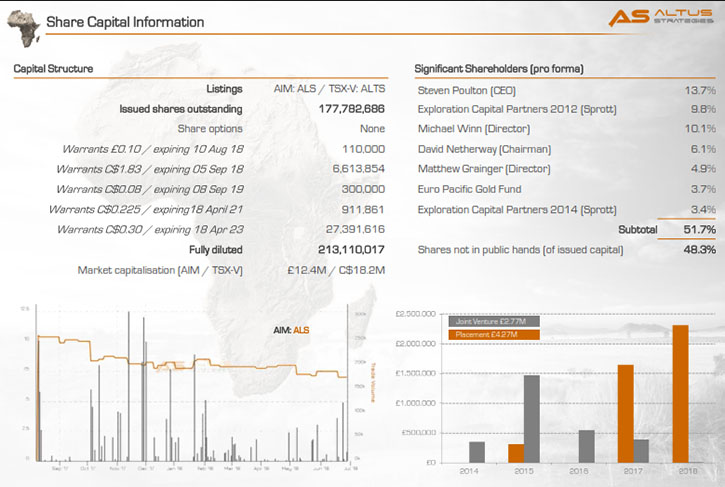

Steve Poulton: Certainly. Currently we have 177.7 million shares on issue and we’re trading at around 9 cents on the TSX venture and 5.5p on the London market. About 35% of the company’s shares are owned by our board and advisers. I think that speaks to two things. One, to the fact that we've been very conservative. We've managed to ensure over the ten years since our formation, that the company hasn't had excessive shareholder dilution. Also the management team has a material interest, because they are all investors in the company.

Unlike many exploration companies, where the promoters are working on the basis of options and payouts, our management team and board are all vested and their interests are aligned with all shareholders in the company. I think, in this day and age, that's a critical and important characteristic for any company which is active in the exploration sector.

Dr. Allen Alper: That sounds excellent! It shows that you all have skin in the game and you believe in what you're doing.

Steve Poulton: That’s exactly the case. As mentioned we recently completed a non-brokered financing working with Sprott, raising approximately 4.2 million Canadian dollars at 15 cents with a full 30 cents five year warrant. We were delighted that Sprott led the deal and they now hold approximately 13% of the company. A number of other notable new as well as existing investors participated in the placement. We are delighted to have such a strong shareholder register.

Dr. Allen Alper: That sounds excellent. Could you tell our high net-worth readers/investors the primary reasons they should consider investing in your company.

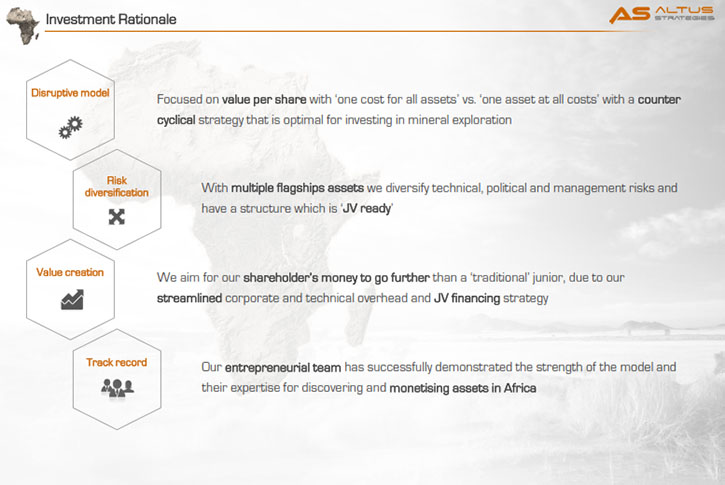

Steve Poulton: In a nutshell for our excellent projects and attractive valuation. More strategically however, it is because Altus is executing the project generator model and is focused on Africa, where projects can be found rapidly and cost efficiently at surface. The project generator model endeavors to align the interests of management and shareholders, reduce share dilution, diversify risks and maximize the upside exposure to the underlying assets.

The business of exploration is basically about discovering resources. Our team has a fantastic track record of doing this. But it's not only important to be able to find assets, it's important to actually do so on a cost-effective basis and0 to monetize them profitably. Our business is to make discoveries and attract joint venture partners to finance them. That means that we're not only diversifying the geology and geopolitical risks, we're also diversifying the capital at risk. So if one of your readers buys shares in Altus, we will aim to make their dollar go further.

When you have 18 projects, as Altus does, and a plan to increase the number under joint venture, then you can quickly understand that in buying Altus shares, an investor is buying ownership of a diversified exploration portfolio, managed by industry professionals who have a track record of making and monetizing discoveries in Africa and critically whose interests are fully aligned with shareholders. Over time our business model is designed to accumulate cash, partner equity interests and royalties as we start to monetize our projects.

Dr. Allen Alper: That sounds like very strong reasons for our high net-worth readers/investors to consider investing in your company.

http://www.altus-strategies.com/

14 Station Road

The Orchard Centre

Didcot

Oxfordshire, OX11 7LL

United Kingdom

Tel: +44 (0) 1235 511 767

E-mail: info@altus-strategies.com

|

|