Deep Yellow Limited (ASX: DYL): Well-Funded, World Class Leadership, Proven Track Record in Uranium, Significant Resource Expansion, Interview with John Borshoff, Managing Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/11/2018

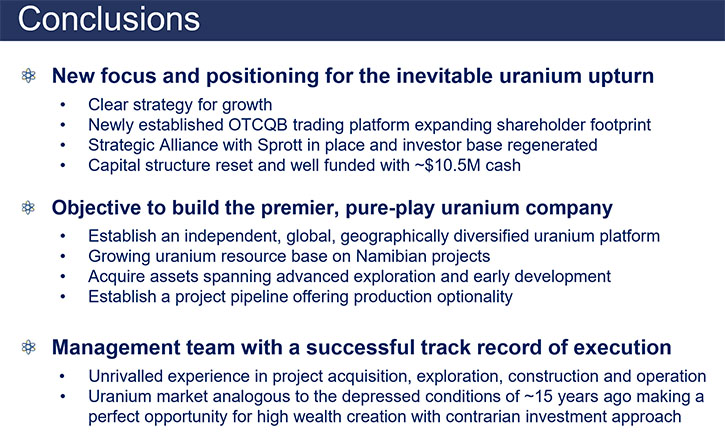

Deep Yellow Limited (ASX: DYL) is a specialist uranium company focused on growing the existing uranium resources, across its portfolio of uranium projects in Namibia, a top-ranked African mining destination. We learned from John Borshoff, Managing Director of Deep Yellow, that when he became involved in the company it had a market cap of about six and now it is about 65 million dollars. They have more than doubled the resource and are about to triple or even quadruple it by the end of this year. The long-term objective of Deep Yellow is to become a sector consolidator, by building an independent, multi-project, geographically diverse uranium platform, which will have production optionality. Mr. Borshoff believes that the uranium market is in for an incredible rise, but not as soon as some may think.

John Borshoff, Managing Director of Deep Yellow at Sprott Natural Resource Symposium

Deep Yellow Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing John Borshoff, Managing Director of Deep Yellow. Could you give our readers/investors an overview of your company, your focus and current activities?

John Borshoff: Yes, I'm the MD/CEO of Deep Yellow. I've been with the company for 18 months. Before that, I was Founder of a company called Paladin, which is probably one of the most successful stocks in the resource sector where its share price increased around eighty-nine thousand percent from its low. My background - I'm a world authority on uranium. Before Paladin, I was working with a big German uranium group, which then ultimately discovered Key Lake and Cameco was born out of that. So, I have strong credentials in uranium and in the nuclear space. I have proven performance in Paladin, where I developed the only two operating, large-capacity, conventional uranium mines in the last 30 years. No other company has done that. And I delivered what I said I would, until Fukushima came about. An incredible story really. After I retired out of Paladin in 2015 it dawned on me that the same sort of situation was occurring, as when I started at Paladin on a contrarian play.

Different dynamics, but the same issues. When I started Paladin it was a demand-driven catalyst, and of course, this is completely different now. A lot of the juniors don't understand, it's the supply and delivery aspect to question focusing on who is going to build this new supply.

So, I joined Deep Yellow, a company that was floundering and had no direction, no strategy. I chose this company because it was clean, and it had a market cap of about six million dollars. It's now about 65 million. And I raised fifteen million dollars, because Rick Rule, who made a fortune from Paladin when we started in those days, said, "I'll back the management group, and I'll back you" in this contrarian play.

So, it's a dual strategy we have. Some projects were already existing in Deep Yellow, which I knew we could upgrade and discover more. That has since proven true. We've more than doubled the resource from when we came in. And I reckon we'll triple, maybe four times the resource, by the end of this year.

Parallel to our efforts in Namibia, we regard ourselves as sector consolidators. Now, we haven't done much in that area at the moment, but there is no question that there are parties out there with interest in uranium, who believe we're the only management, available, to do some big consolidations. And that's my objective.

Dr. Allen Alper: So, what are your plans going forward?

John Borshoff: My plan going forward is to build an independent, multi-project, geographically diversified uranium platform that will have production optionality. We're the only proven builders and operators of conventional mines in the smaller market capital space. Nobody else has done that. I have a solid reputation, and utilities know I can deliver. In 2007, there were six mining operations started, four failed. Only the 2 Paladin ones worked and I’m very proud of that and the utilities understand the significance of this achievement

So, I want to build a platform, starting with a mine start-up, maybe out of Namibia, and then, as prices go up, I'll have projects available for potential development in 2025, 2028, 2030, and be able to contribute to that growth in supply at a pace, depending on the demand and uranium price.

Dr. Allen Alper: That sounds excellent.

John Borshoff: Yes.

Dr. Allen Alper: Could you tell us a bit about your capital structure?

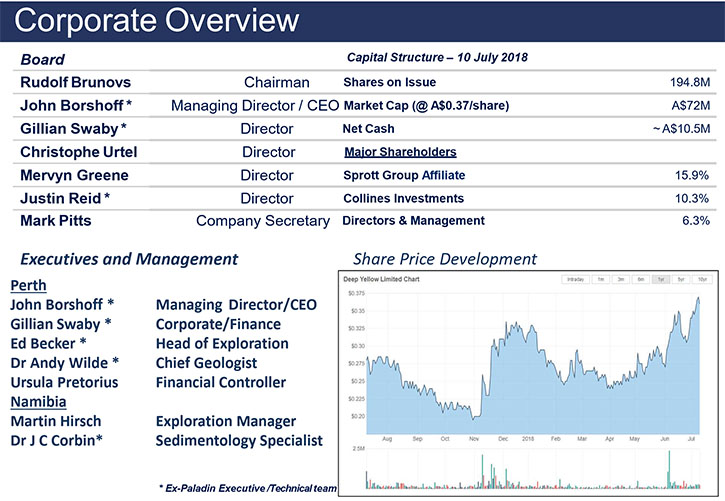

John Borshoff: When I came into the company, there were nearly two billion shares in Deep Yellow. I consolidated that to a hundred and thirty million. There were generally just moms and dads in the share register, except Paladin had 10% which I knew would sell down, because they were going through all their financial hassles. So, now we have a hundred and ninety-four million shares after raising $15M which is good for an Australian stock. Sprott group own about 16% of the stock and there is a very secure long term holder over the other 10% crossed from Paladin, and management has around a six percent position. We have ten and half million dollars in the bank, plenty of cash for what we're going to do in the next few years.

We also have a joint venture that I negotiated with the Japanese. The party is JOGMEC, which is the strategic resource development arm of the government, and they're putting in four and half million dollars to earn a 40% interest, adjacent to our 100% owned Reptile Project in Namibia. Why would Japanese invest in uranium? Well, they invested in uranium for two reasons. One, the Japanese need uranium, two, they wanted to be associated with a management of the caliber available in Deep Yellow, and a group that they could trust to deliver.

So, they will fund all expenditure up to $4.5M with zero funding required from ourselves. And that gives us an extra kick in terms of discovery opportunity in Namibia.

Dr. Allen Alper: That sounds excellent. Could you tell me a little about other members of your management and board?

John Borshoff: The board that was originally there, was small. I have added three members that were ex Paladin. Myself as MD, Justin Reid, who used to work for me, now he's a successful business man out of Toronto in the resource sector, and Gillian Swaby became an executive director.

This changeover in management was done on a very friendly basis, because the board could see that it was a difficult situation for the company as it existed. On my team, my head of exploration is Ed Becker, who's been with me for over 30 years. My chief geologist, Dr. Andy Wilde has been with me 20 years. JC Corbin, a Frenchman, is also a specialist, and he's also ex Paladin.

On the technical side, I have access to engineers, who designed and built projects with Paladin and were part of my team, and they want come with me into Deep Yellow when the time is right. The team works part time, so it's not overly expensive. As we succeed, they'll be coming in with more time.

Dr. Allen Alper: Sounds excellent. Sounds like you have a very well-rounded, seasoned team.

John Borshoff: Yes.

Dr. Allen Alper: And it's nice to work with people you know.

John Borshoff: Absolutely

Dr. Allen Alper: And could trust.

John Borshoff: Absolutely. We have made a discovery already on our Reptile Project that we believe has potential to eventually turn into a mine. We know and understand the targets we are seeking. We know how to handle environmental issues and stakeholder concerns. Uranium is a very demanding commodity and we work accordingly. We have stakeholders that we need to assure. We know what we're doing and our proven track record reassures these groups.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit more about the property?

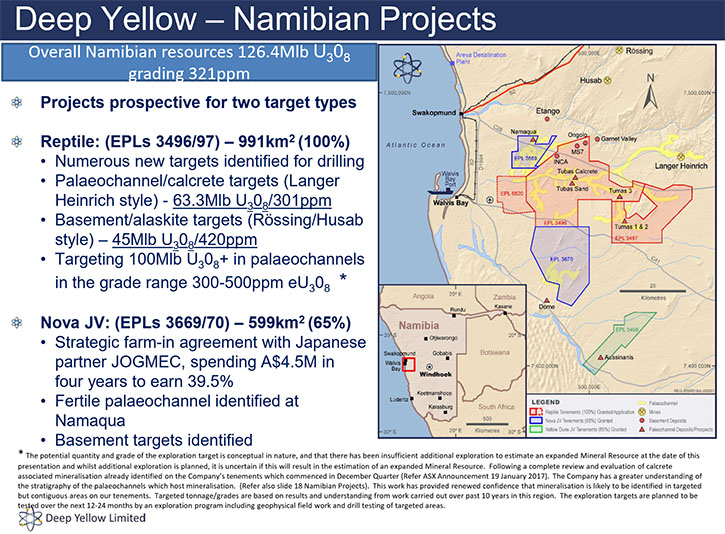

John Borshoff: The properties are in Namibia. They're about 40 to 80 kilometers away from the coast, from the town called Swakopmund. We have about fifteen hundred square kilometers of ground. One is called the Reptile Project, which we own 100%. When we became involved in it had thirty-one million pounds of uranium. Now, it has about sixty-four million pounds. We doubled the resource within one year with two 10,000m drilling campaigns. We have expectation that by the end of this year, we'll have about a hundred million pounds, and we believe this is just the start. In the adjacent property, which is the Nova Joint Venture Project, where the Japanese are funding us, we're spending about 1.4 million a year. Last year, we made an interesting discovery, which is worthy of follow up.

One of the target types we're looking for is palaeochannel associated in which uranium is deposited similar to the nearby Langer Heinrich deposit. They're shallow and we have a hundred and twenty kilometers of paleochannel defined which is highly prospective for that type of deposit where we've already grown the resource base, from the thirty million, to 65 million by making new discoveries. This is an area by the way that has been previously heavily explored. We’ve been fortunate to find these very valuable resources that were missed by others.

We're also exploring for basement related targets similar to the Rössing/Husab deposits in the region.

Dr. Allen Alper: Sounds excellent. Could you tell our readers, in a nut-shell, what your thoughts are on the uranium market, what's taken place, and what might happen?

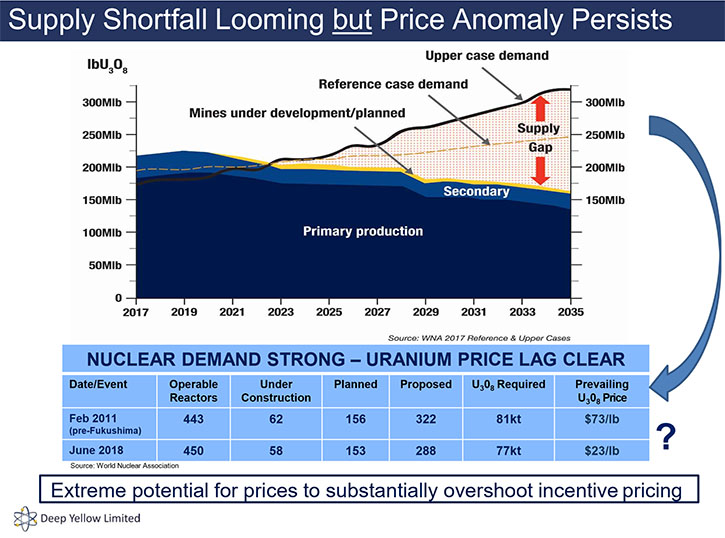

John Borshoff: Everybody's enthusiastic. We believe the uranium market is in for an incredible rise, and it will be phenomenal. This will not be in the timeframe that all the enthusiasts are looking at. This is a commodity that's tortured. You've had Chernobyl, which had its effect on nuclear growth, then Fukushima. On top of this there has been over supply.

The demand is there for sure. But, people don't fully understand supply. They think just because there are 20 deposits and 20 juniors saying, "We're going to do this, and we're going to do that," that this will actually happen, in terms of successfully building new mines. There is a risk here. There are very few companies that have managements that have performed and built uranium mines in a uranium company. Uranium is difficult. You have to know absolutely what you're doing in a fundamental sense. When you're performing on the ground, you're dealing in a serious, serious situation and mistakes are not tolerated.

I'm talking about conventional operations here. ISR projects are different and these do have managements with appropriate experience especially in the US. But I don't believe that in the US, these will be big producers. The big production is going to come out from elsewhere in the globe, needing conventional, high capacity producing mines. So, the problem is complex. Yes there will be a shortage, which will be post 2023. The question is the exacerbation of that shortage, because of the lack of expertise that exists to build the new mines, many of which are low grade. So, I expect there will have big, big start-up problems. Not enough people are analyzing this as a risk in the whole supply side dynamic.

Dr. Allen Alper: I appreciate that synopsis for our readers/investors. What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

John Borshoff: It's unique for a start. You won't find a leadership or a management team in uranium anywhere like it. We are proven, turning a vision into reality group. Over the last 18 months, I've proved that again in terms of establishing Deep Yellow. The other thing is, choosing the jurisdiction in Namibia for the possibility of starting our first operations. I can get a project going very quickly, but what really differentiates us, is I'm a sector consolidator. No other company emerging producer has that dual strategy of wanting to build a multi project platform, where I aim to have production optionality over the longer term. There might be a few that are doing this in the US, but it's on a minor scale. I'm creating what the industry will need in the post Fukushima repair.

Dr. Allen Alper: That sounds excellent. Great reasons to consider investing!

http://deepyellow.com.au/

PO Box 1770

Subiaco WA 6904

Australia

Tel: +61 8 9286 6999

Email: info@deepyellow.com.au

|

|