Orocobre Limited (ASX: ORE, TSX: ORL): A Dynamic, Global, Lithium Carbonate Supplier, Established Producer of Boron, Interview with Andrew Barber, Investor Relations Manager

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/4/2018

Orocobre Limited (ASX: ORE, TSX: ORL) is a dynamic, global, lithium carbonate supplier and an established producer of boron. Orocobre’s operations include its Olaroz Lithium Facility in Northern Argentina, Borax Argentina, an established Argentine boron minerals and refined chemicals producer, with a 29% interest in Advantage Lithium. We learned from Andrew Barber, Investor Relations Manager of Orocobre, that they produce both a battery-grade, lithium-carbonate product and a technical-grade product. For the past two and a half years, their margins have continued to grow quarter upon quarter. According to Mr. Barber, the Company is very profitable, generating a lot of cash, and is in a very strong position, with 317 million dollars cash on the balance sheet. Near-term plans include adding another 25,000 tons of production capacity for lithium-carbonate in Olaroz, while simultaneously building a lithium hydroxide plant in Japan with their joint venture partner, Toyota Tsusho, to utilize some of the technical- grade product from Olaroz as feed stock. According to Mr. Barber, they have built a vertically integrated business, with significant product diversification as they move into both carbonate and hydroxide production.

Olaroz Lithium Facility in Northern Argentina

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Andrew Barber, who is Investor Relations Manager of Orocobre Limited. Could you give our readers/investors an overview of your company?

Andrew Barber: We've been producing lithium chemicals, from northwest Argentina, for the last three years or so. We've been progressively ramping up our operations and just achieved, at the end of June, the second best quarter we've ever had. We feel that's quite a milestone. It reflects the fact that we're stabilizing our operations and growing the base. The company has significant growth plans for the next 18 months to two years. And it's working towards delivering that right now.

Beyond that, we have a lot of potential in Argentina. We're starting a program to test that fully and understand how big the potential size of this resource is.

Dr. Allen Alper: That sounds great. Could you tell us a bit more about your operations?

Andrew Barber: Sure. Over the last 12 months, we've been working very hard to improve the operations and management, of our pond system, in particular. That had been identified as being an issue about 12 to 18 months ago. And we had a couple of problems around that. But I think the recent results demonstrate that we've moved well past that. We're continuing to produce both a battery-grade lithium carbonate product and a technical-grade product. They're both very high purity and they're much sought after in the lithium chemicals market. The operation of the plant and processing is going very well. The front end of our plant runs at, or well above, nameplate capacity and is a very stable operation. We're continuing to see a really significant improvement in the purification part of our plant, as well, where we produce the battery-grade material. That is ramping up really nicely.

The fact the front end of our plant is going so well gives us a lot of confidence with our expansion plans because that'll be the part of the plant that's replicated in the expansion that we're going to be building-out over the next two years.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about some of your financial results?

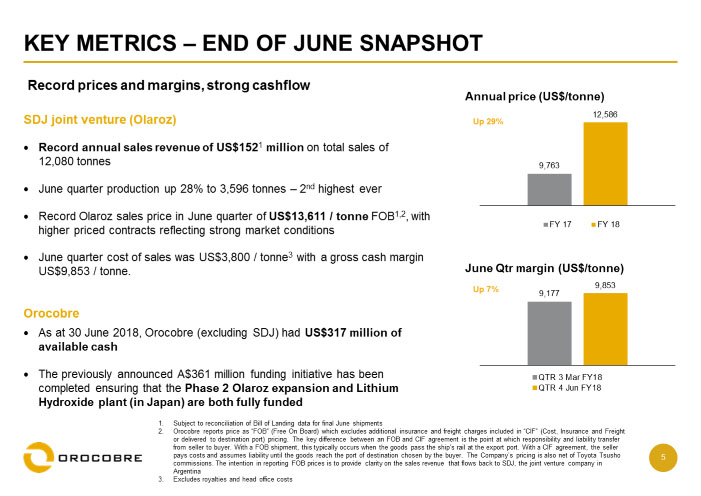

Andrew Barber: We've had continuing increases in our contract prices over the last two and a half years now. Each quarter has been up, quarter after quarter. And we're still seeing really strong conditions and markets. In terms of the prices we've been receiving for our chemicals, our margins have continued to grow. The last reported margin was our June quarter, which was over 9,800 dollars per ton of operating profit margin.

So we're in a great position, where we're generating a very large amount of cash. The business is highly profitable. And the company overall is in a very, very strong position with 319 million dollars cash on the balance sheet. All of that gives us great confidence to invest in the business and continue to grow the base.

Dr. Allen Alper: That sounds excellent. Could you elaborate a bit more on your plans for this year?

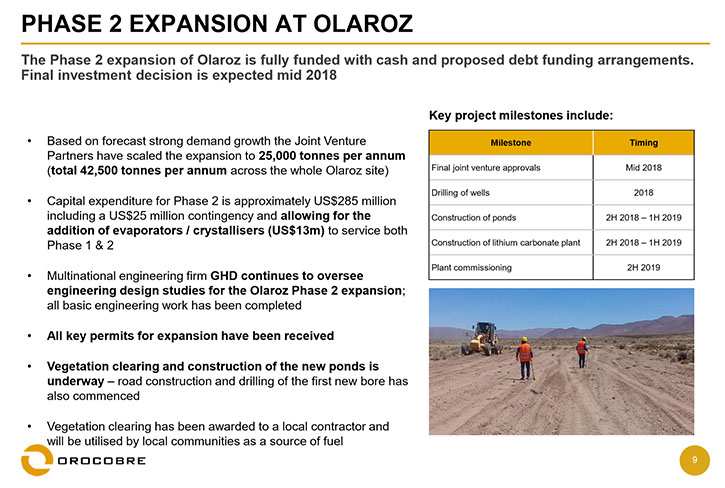

Andrew Barber: The plans stretch over 18 months through to the end of calendar year 2019. Our plans are twofold. First to expand our operations in Argentina and add another 25,000 tons of production capacity for lithium carbonate in Argentina. That work has already started, with some early works which involve new pond construction, some road works, and camp infrastructure being put in place. So we're very confident in moving forward with that.

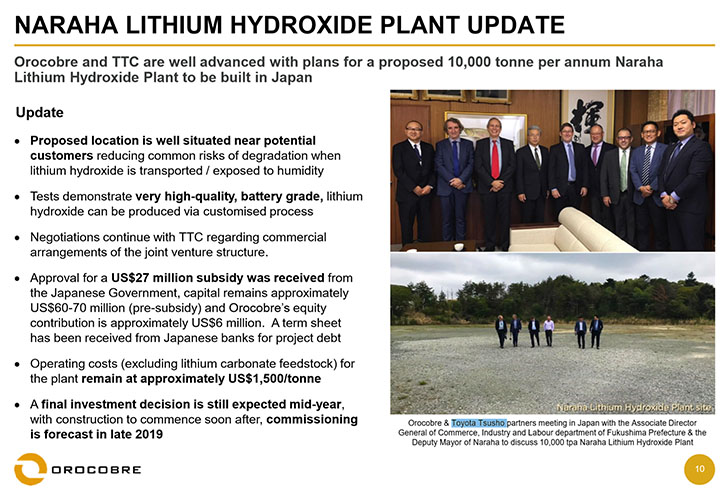

The second part of our growth strategy, for the next 18 months, is to build a lithium hydroxide plant in Japan, with our joint venture partner Toyota Tsusho, the procurement arm of the Toyota Motor Group and they're very keen to see more lithium chemical processing in Japan to supply the growing Japanese industry. We're fortunate to have such a strong partner. We're moving forward, with the plans to put in 10000 tons of lithium hydroxide production capacity. That hydroxide production will utilize some of our technical grade product from Argentina as feed stock. So we've become a very much vertically integrated business, but with some really significant product diversification, as we move into both carbonate and hydroxide production. That gives us the ability to participate in all parts of the battery and electric vehicle EV thematics. As different battery technology is changing, they're moving between carbonate and hydroxide. And it allows our business to retain exposure to all parts of the battery market as it develops and grows.

Dr. Allen Alper: That sounds excellent. Could you tell me and our readers/investors a bit about your Board and Management Team? And also your background, Andrew?

Andrew Barber: Our Board and Management Team are a very experienced team. Recently, we had a new director join us who's actually a representative of Toyota Tsusho. He came on board through the capital raising process we did, earlier this year, where Toyota Tsusho took a 15 percent position in the company and provided the funding for stage two in the hydroxide plant. So we've slightly grown the board, adding additional skills and experience. The management team has been very stable over the last couple of years. Our Managing Director, CEO, Richard Seville joined the Board of Orocobre as Managing Director in 2007, when it was a very small company, chaired by Neil Stuart. Richard took Orocobre through to listing on the ASX in December 2007, to what it is today. Now he's going to retire. We're in the process, at the moment, of looking for a new CEO, whom we expect to start at some point over the next 12 months.

I started my career in the mining industry as a geologist. And eventually moved into finance. I worked as a professional investor for a variety of pension funds in Australia for over 11 years. I've been working in a number of corporate communications roles for different companies over the last few years.

Dr. Allen Alper: That all sounds excellent. Could you tell our readers/investors a little bit about the lithium market, what's happening and how it's developing?

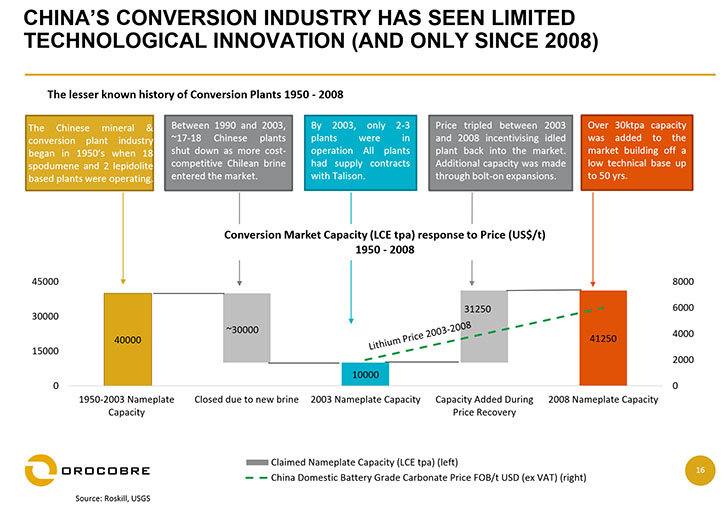

Andrew Barber: The lithium market is still really strong. There's been a bit of noise over the last five to six months, with some of the spot market pricing coming off a little bit. It's important to recognize that spot market pricing only reflects a very small part of the traded volumes of lithium carbonate. Probably only around four or five percent of total traded volumes go through the spot market. The underlying contract market, in which all the major producers, like ourselves operate, continues to see significant strength. The battery-grade lithium carbonate and lithium chemicals remain in high demand and generally in under supply. We expect that that situation will continue. There is some discussion about new supply of lithium out of hard rock mines, particularly out of Australia.

We see that that new supply will be constrained by the availability of Chinese conversion processing plants in China. We've done a significant amount of analysis of that industry, on which it is quite difficult to get information. But it's becoming clear to us that there is going to be a significant bottleneck that will constrain the delivery of lithium chemicals into the market. So that's going to mean that lithium chemical prices will remain high in the short to medium term.

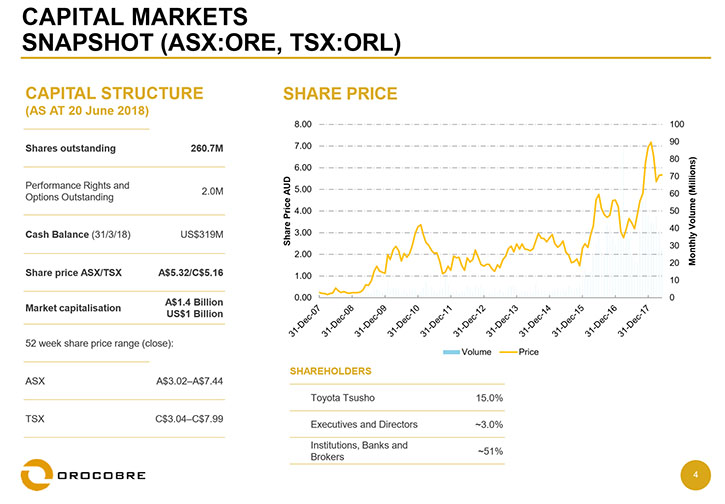

Dr. Allen Alper: Could you tell our readers/investors a bit about your capital structure?

Andrew Barber: Our Company is listed on the ASX, the TSX. We have 261 million shares on issue. Our major shareholder is now Toyota Tsusho. We have a very strong balance sheet and are well capitalized and funded for our future grade plans, with 317 million dollars on the balance sheet. We have no debt at the corporate level. There are debt facilities at the project level, being fully funded and repaid, through operating cash flow.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Orocobre Limited?

Andrew Barber: Absolutely, Orocobre Limited is very high margin business, with high operational earnings. We don't expect to have to raise any further equity to be able to deliver on our growth projects. We have really significant growth beyond our current expansion plans, with drilling that we're undertaking across our basin at the moment to understand just how big it is and determine what the optimal production rates are going to be out of the basin.

Dr. Allen Alper: That sounds excellent.

Andrew Barber: Thank you for the opportunity to speak with you. I think the market is probably undervaluing lithium equities at the moment. We see the ongoing strength in lithium demand and we expect strong pricing and demand for our products going forward.

Dr. Allen Alper: That sounds excellent!

https://www.orocobre.com/

Andrew Barber

Investor Relations Manager

T: +61 7 3871 3985

M: +61 418 783 701

E: abarber@orocobre.com

|

|