Nemaska Lithium Inc. (TSX: NMX, OTCQX:NMKEF, FRANKFURT:N0T): is Positioned to Become a Fully-Integrated Lithium Producer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/18/2018

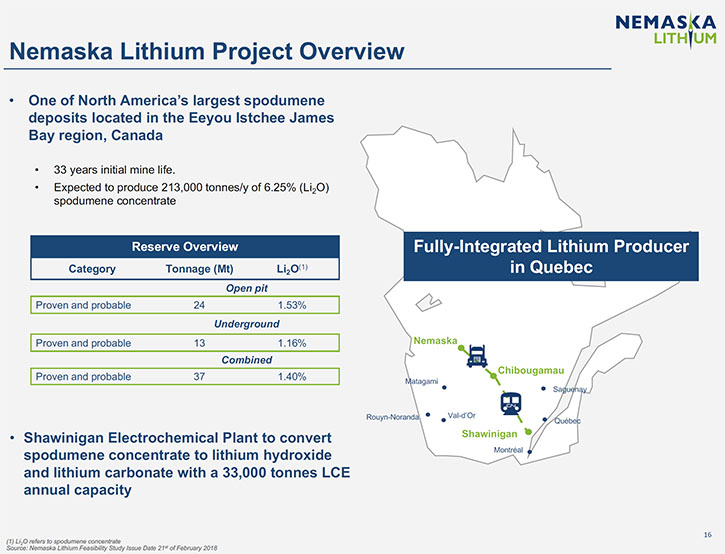

Nemaska Lithium Inc. (TSX:NMX, OTCQX:NMKEF, FRANKFURT:N0T) is a pure play lithium investment, solely focused on developing its Whabouchi lithium project, in Quebec, into a viable lithium mine and electrochemical plant and becoming a leading supplier of lithium hydroxide and lithium carbonate to the emerging lithium battery market, as well as other applications. Nemaska Lithium plans to be one of the world's largest producers of lithium hydroxide, vertically integrated, from spodumene mining to the commercialization of high-purity lithium hydroxide and lithium carbonate. The Whabouchi mine is one of the richest lithium spodumene deposits in the world, both in volume and grade. We learned from Wanda Cutler, Investor Relations Manager for Nemaska Lithium, that close to 70% of the Company’s future production is spoken for, via off-take or right of first offer, with several large end-users. Nemaska just closed the $1.1 billion Canadian financing and is now fully financed to build both the mine as well as the electrochemical plant in Shawinigan that will utilize the company's patented process to transform spodumene concentrate directly into high purity lithium hydroxide. This technology gives Nemaska a considerable cost advantage over its competition, coming in as the lowest cost producer of lithium hydroxide in a high growth market.

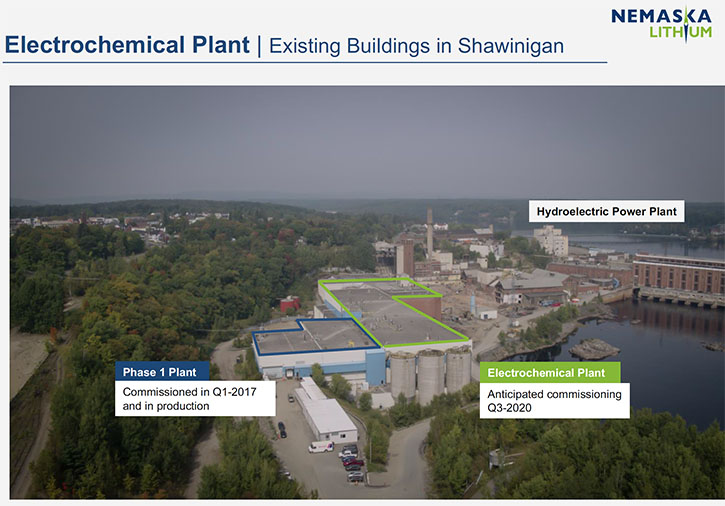

Future Electrochemical Facility in Shawinigan

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Wanda Cutler, who is Investor Relations for Nemaska Lithium.

Wanda, could you give our readers/investors an overview of your company, what's happening and what differentiates your company from other lithium companies?

Wanda Cutler: Nemaska Lithium is a hard rock project located in Quebec, Canada so we're in a very safe jurisdiction. And we are vertically integrated, we'll be going from the mine all the way through to process battery-grade lithium chemicals. We have the capacity to do both hydroxide and carbonate, and both of battery-grade quality. We have offtake agreements in place with several large end-users. Those offtakes and right of first offer agreements would account for close to 70% of our production. We're strategically located in Quebec, Canada, and we should be one of the largest producers of lithium hydroxide in the world, and certainly a major production center for North America.

Dr. Allen Alper: That's fantastic. Could you tell our readers/investors about the financing that you are in the process of doing?

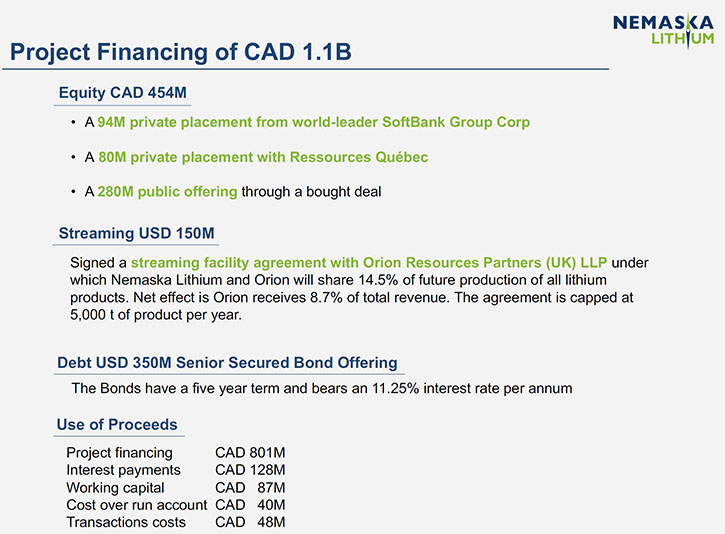

Wanda Cutler: Yes, we just closed the financing. We raised approximately $1.1 billion Canadian. We did that through several financial tools or instruments: European bond, a senior secured bond listed on the Norwegian exchange for $350 million US. Then we signed a streaming agreement with Orion Mine Finance, the first lithium streaming deal Orion has done, and raised another $150 million US. We did a private placement with Softbank, the fourth largest company in Japan, whereby they would own 9.9% of Nemaska Lithium post-financing. They invested roughly $93.8 million Canadian, or $72 million US. We did a second private placement, with the government of Quebec, through Investment Quebec, for $80 million Canadian. Finally, through a prospective offering, we raised $280 million Canadian from the general market. All of these different sources of financing, were contingent upon one another for closing and we were just able to close all the transactions. We are fully financed now to build both the mine as well as the electrochemical plant in Shawinigan.

Dr. Allen Alper: Fantastic! You are all to be congratulated on an excellent job.

Wanda Cutler: Thank you.

Dr. Allen Alper: You have the right property, the right location, and you got the money to do the job. You all came through! Remarkable!

Wanda Cutler: Yeah, it was a big effort.

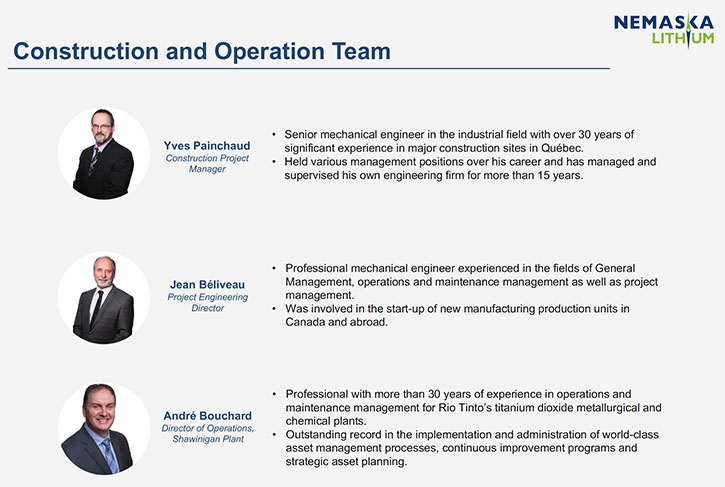

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a bit about your management team and Board of Directors?

Wanda Cutler: The Company is led by Guy Bourassa, our President and CEO. Guy is actually a founder of the company. He has over 33 years of mining experience. He founded the company in 2008 and put the lithium property into the company. He spearheaded the development of the technology, our method to go directly to hydroxide versus carbonate. That's given us some considerable technical advantages, improved product quality and cost advantages over our competition. Guy was joined by Steve Nadeau in 2008 as well. Steve's our CFO, a very solid finance and accounting guy. He has 20 plus years in accounting and finance in the mining and manufacturing arena.

Chantal Francoeur is our VP of human resources. She has been in mining and the mining industry for 25 years. She's been responsible for human resources, building out at least two mines. I think this is her third mine that she will have built from the start, from the human resources perspective. A great management team.

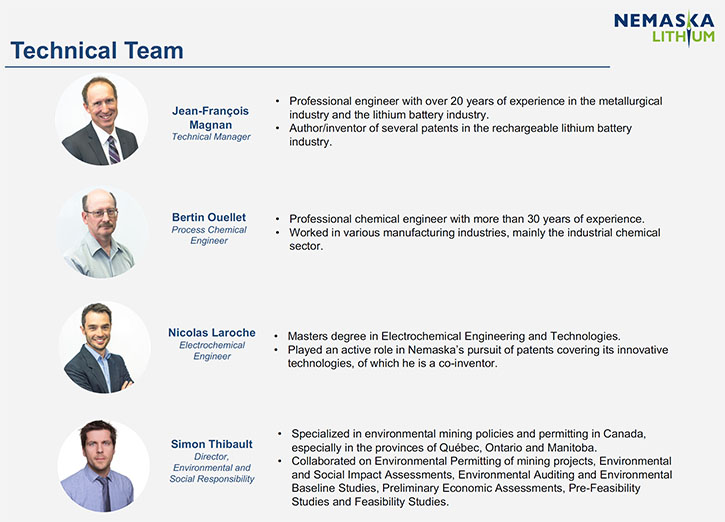

Marc Dagenais is our VP Corporate Secretary and Legal. He has 25 years’ experience in the mining industry, in the mining space and on the chemical side. At the end of the day, we're going to be a chemical plant or a chemical producer that's backed by a mine. Jean-Francois Magnan has been with us since about 2013. He is the author/inventor of several patents in the lithium rechargeable batteries field. Obviously, he's extremely familiar with the battery space. He's been instrumental in helping us on the chemical processing side, and he has built a strong team of electrochemical and chemical engineers. So that whole team has really been instrumental in developing our patented process to go directly from concentrate to lithium hydroxide.

We have Andre Bouchard, who has more than 30 years of operation and maintenance. He'll be the head of operations at our Shawinigan facility. So we have a lot of the key players in place already, to build out such a big project. We're very pleased with the staff that we've brought onboard.

In terms of our Board of Directors, Michel Baril is our Chairman, he's worked very closely with us since the beginning. Michel is actually an ex-Bombardier, a mechanical engineer, and he's a senior executive. We have Francois Biron, a mining guy with more than 40 years of mining experience, very well respected in Quebec. Paul-Henri Couture brings a lot of financial expertise to the board. He's previously held senior positions at the Caisse de depot, and at Sentient Asset Management. So that rounds out the board and the management team. Also we recently added two new Board Members, the Quebec Government appointed Mr. Patrick Godin, COO of Stornoway. He recently led the construction and commissioning of their diamond mine in Quebec on time and on budget. Finally Softbank appointed Shigaki (Sean) Miwa who is a key executive at Softbank Group. We are delighted to add his business acumen and Softbank’s perspective to our Board. Both gentlemen are excellent and welcomed additions to our Board of Directors.

Dr. Allen Alper: It sounds like you have a great board and management team. Very, very accomplished and very knowledgeable.

Wanda Cutler: With the addition of a significant investor, I believe they will appoint a board member as well.

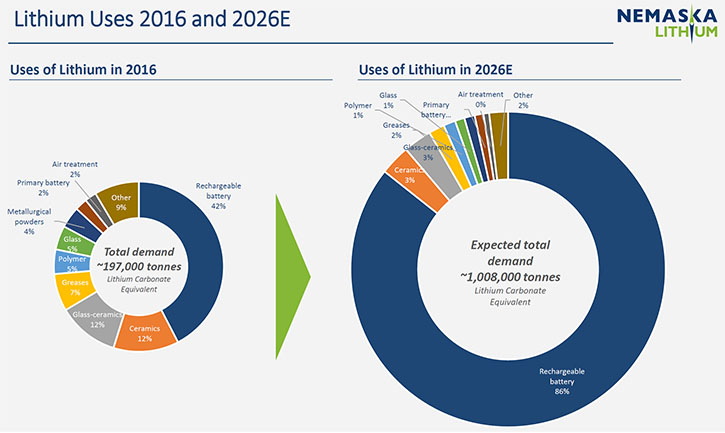

Dr. Allen Alper: Great. Would you like to tell our readers/investors why lithium is so important? Most know about it, but you might say a couple of words.

Wanda Cutler: Sure. Lithium is the key component in a lithium-ion battery. There's been a number of R&D initiatives and product improvements in the lithium-ion battery; and each time that happens there is a new iteration of a cathode or an anode, but one thing remains constant in the battery and that is the use of lithium. So you always need lithium in a lithium-ion battery. It is the critical component. Even though it is the critical component, a fairly small percentage of the cost of the battery is actually the cost of the lithium. We've seen the prices of lithium go from $6,000 to $7,000 a ton to $14,000, $15,000 a ton, and that has not impacted the demand for the product. When you look at the overall cost of the battery, lithium, while essential, doesn't represent a major cost component.

Lithium-ion batteries are basically replacing batteries in every application of our lives, from your cell phone to your laptop computer to any portable power equipment that you have, portable tools, cordless lawnmowers, golf carts, all the way to the vehicles that we're seeing on the road today. Every major automotive company in the world has a lithium electric vehicle platform, and most are looking to increase the sales of their EVs. And then of course, you have energy storage. As we start to see more and more sources of renewable energy, like wind, like solar; a lot of those times those types of projects require energy storage. So batteries, and those batteries are oftentimes lithium-ion or at least moving toward lithium-ion technology.

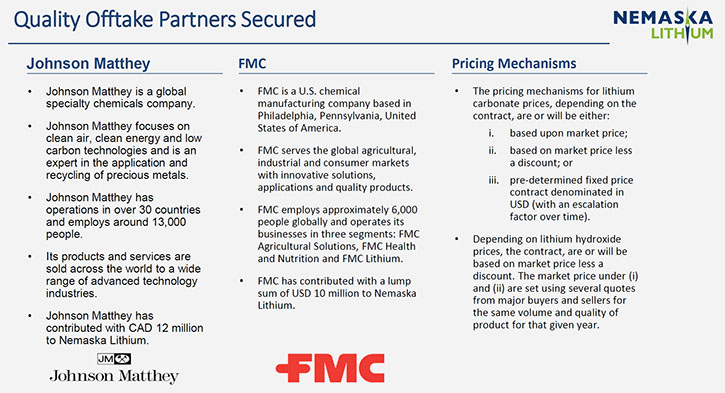

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a bit about your offtake partners?

Wanda Cutler: We have offtake agreements signed with Johnson Matthey, a very large, multi-national organization based in the UK. They do a lot of metals refining, but they also do cathodes. They also make what's called LFP cathodes. Their cathodes production facility is located in Candiac, Quebec, just a couple of hours away from our Shawinigan chemical plant. We have a multi-year agreement with them.

We also have an agreement with FMC, one of the large producers of lithium battery chemicals. FMC has contracted with Nemaska a multi-year agreement for lithium chemicals. And they'll be basically selling that to their customers.

We have Northvolt, a Swedish Gigafactory. It would be like Sweden's version of Tesla's Gigafactory. It's a very large installation under construction in Sweden. We signed a letter of intent with Northvolt, and that would be for between 3,500 to 5,000 tons of lithium hydroxide. We expect that agreement to turn into a binding agreement, very shortly.

Finally, with the signing of Softbank as a 10% investor, they have a right of first offer, on up to 20% of our refined end product. That won't be a binding take or pay agreement like the others, but it is a right of first offer on 20% of production.

Dr. Allen Alper: That sounds excellent. You have some great offtake partners.

Wanda Cutler: If they all take their maximum, we're around 70% sold at this point.

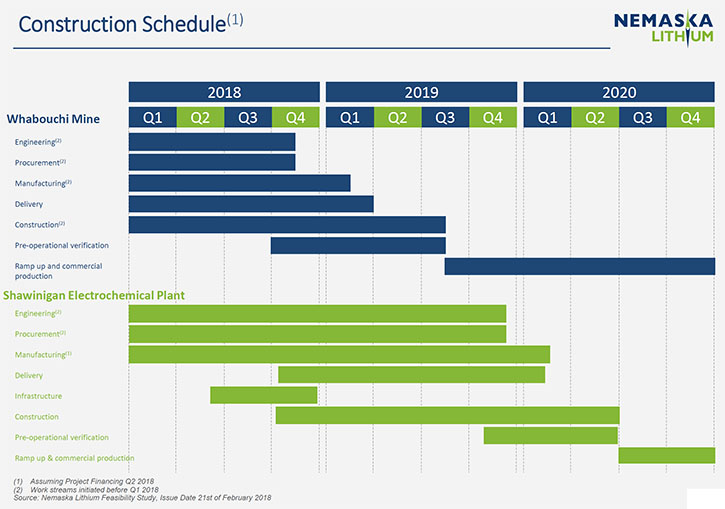

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a bit about the schedule for the mining and the chemical plant?

Wanda Cutler: Absolutely. The mine is actually fairly advanced. We've already built the administrative offices up there. The access roads are in, the shell of the commercial concentrator building has already been constructed. So really, the mine is fairly well advanced. The electrical line has been installed and hook up is expected in August and the mine will be fully electrified. At this point we're looking at finishing up the installation of the equipment for the concentrator, and then building some additional facilities, maintenance facilities, garages, etc. So the mine schedule is about 12 to 15 months construction and commissioning time. The electrochemical plant has a 24 month construction and commissioning time. Let's say that this all starts as of June 2018, the mine will be up and running for about a year or so before the chemical plant is ready to actually start receiving concentrate.

In the interim, we have signed an offtake agreement for our concentrate. So that would be for about a year and a half worth of production, which would be somewhere around 250 to 300 thousand tons of concentrate. We'll be selling that concentrate to a Chinese group, because that's where most of the concentrate is processed right now, within China.

We put the announcement out on May 29; it's brand new, so effectively we'll be selling to General Lithium Corp. They'll take our concentrate and transform it into battery-grade chemicals. That will only happen for a year, because ultimately we're going to be vertically integrated ourselves, going all the way to chemical. But in this interim year, where we have an opportunity to generate revenue, we're going to go ahead and take advantage of that. We'll be generating revenue hopefully by the last quarter of 2019.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a little bit about your share structure?

Wanda Cutler: Our share structure is changing, as we just closed the financing. On a non-diluted basis, we are 846 million shares outstanding, fully diluted about 911 million shares out.

Dr. Allen Alper: And could you tell our readers /investors where your shares are listed?

Wanda Cutler: We are listed on the Toronto Stock Exchange, under the symbol NMX, so we're on the TSX big board. We also have a listing in the States on the OTCQX, under NMKEF.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Nemaska Lithium?

Wanda Cutler: Once we're fully up and in production, Nemaska will be one of the largest, if not the largest, lithium hydroxide producers in the world. We do have a considerable cost advantage over our competition, we are projecting to be the lowest cost producer of lithium hydroxide. When you look at lithium battery chemicals, most people look at carbonate and hydroxide as the two main chemicals that are being used in the lithium-ion battery. Talking to customers and end-users, more and more prefer lithium hydroxide. Lithium hydroxide is the chemical that we produce more of, our production line is set up to actually produce hydroxide first, which gives us a cost advantage over our competition. Also the way we produce our product ensures that we produce very high quality lithium products.

We have a great cost advantage over the competition. At the same time we’re coming into an enormous growth market in the lithium-ion battery, as more and more vehicles and battery applications are moving to lithium-ion technology. If you look at the NPV on our project, our net present value. Our after tax NPV is CAD 2.4 billion at an 8% discount. We have an IRR of 30% on our project, with a 2.9 repay back of our capital. The economics in this project are extremely robust. We are a low cost producer in a great jurisdiction, coming into a huge growth market.

Dr. Allen Alper: That sounds fantastic. Sounds like very compelling reasons our high-net-worth readers/investors would consider investing in Nemaska Lithium. Is there anything else you'd like to add?

Wanda Cutler: Once in production Nemaska Lithium is going to be the largest producer of lithium battery chemicals in North America. As soon as we finish constructing our current projects and get up and running, we're going to be looking at expansion. We'll be in a position where we can start to look at consolidating other assets and growing through organic growth as well as acquisition.

Dr. Allen Alper: That sounds excellent.

|

|