Osisko Metals Inc. (TSX-V: OM; FRANKFURT: OB5): Developing Canada’s Two Premier Zinc Mining Camps, Interview with Jeff Hussey, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/17/2018

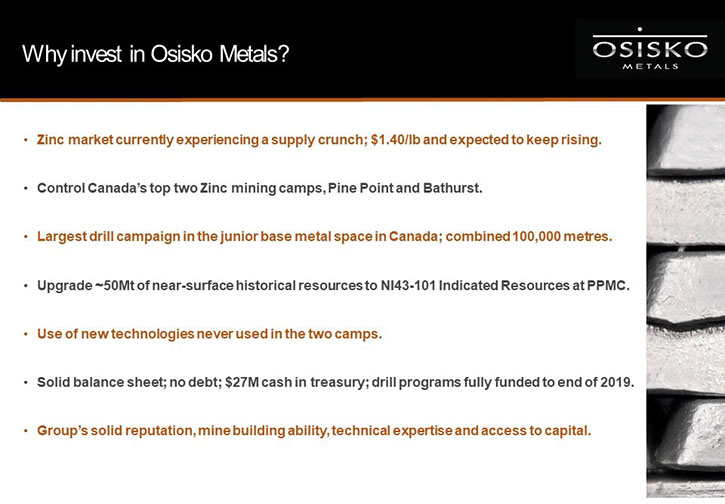

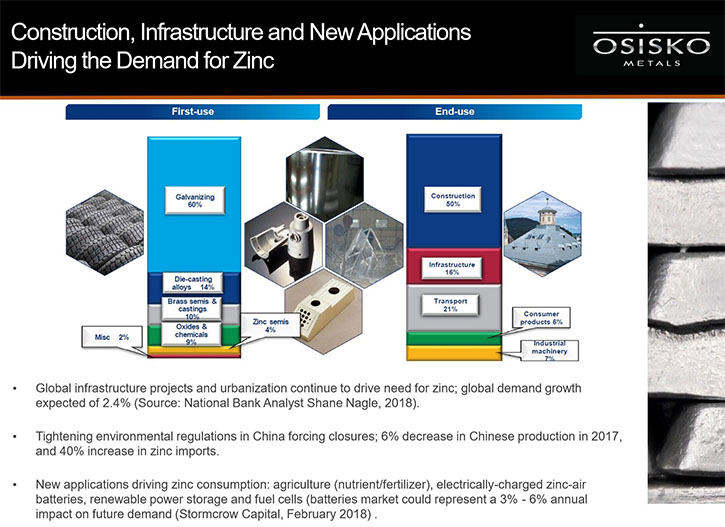

Osisko Metals Inc. (TSX-V: OM; FRANKFURT: OB5) controls Canada’s two premier zinc mining camps, the Pine Point Mining Camp (PPMC), located in the Northwest Territories and the Bathurst Mining Camp (BMC), located in northern New Brunswick. Both projects are past producers, with access to excellent infrastructure. We learned from Jeff Hussey, President and CEO of Osisko Metals, that their third project is a joint venture with Osisko Mining (TSX: OSK), where they are going to start drilling 12 high-priority drill ready base metal targets in June. Other plans for 2018 include exploration drill programs for Pine Point and Bathurst (50,000 meters each) totaling 100,000 meters of drilling, which is the largest base metal exploration program, occurring at this moment, in Canada. According to Mr. Hussey, there's been a steady decline in zinc supply during the last five years and the zinc prices are rising significantly. We also learned that the main uses of zinc are galvanization, in the infrastructure, construction and transportation industries; as nutrient in fertilizers in the agriculture industry, and in renewable power storage, within the batteries market.

Pine Point Mining Camp

Pine Point Mining Camp

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jeff Hussey, President and CEO of Osisko Metals Incorporated. Could you give us an overview of Osisko Metals?

Jeff Hussey: Osisko Metals is an advanced exploration company in the base metals space. We have an emphasis on zinc, but we are looking for copper, zinc, lead, all of the base metals. Right now we are focusing on zinc. In the last year, we've been able to acquire a controlling position in two of Canada's premier producing mining camps, the Pine Point Mining Camp, which was the most profitable zinc mine in Canada between 1964 and 1988, and in the Bathurst Mining Camp, where we own 63,000 hectares of mineral claims. We're aggressively pursuing advanced exploration in order to advance toward a development scenario.

Dr. Allen Alper: That sounds fantastic. Could you give our readers/investors an overview of some of Osisko's accomplishments in the past?

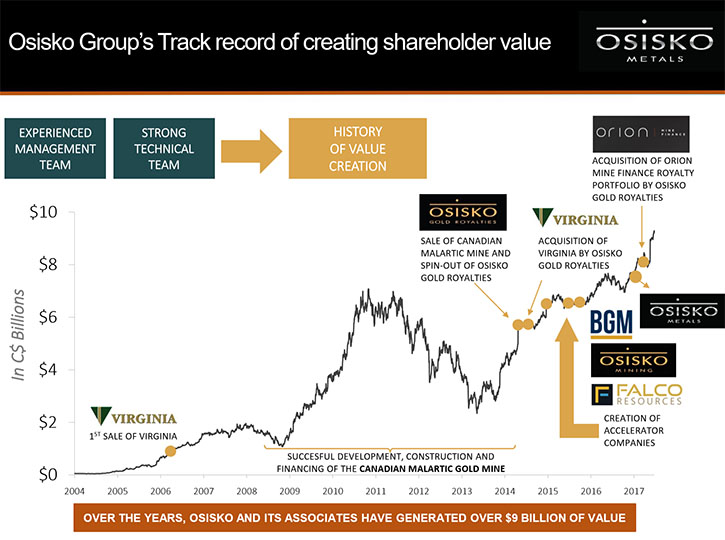

Jeff Hussey: Sure. With pleasure. The Osisko group, in the last 14 years, has created over nine billion of value for its shareholders. The first major milestone, was the development, construction and financing of the Canadian Malartic Gold Mine, which is still Canada's largest open-pit gold mine to date. Immediately after the sale of the Canadian Malartic Mine, Osisko Gold Royalties was formed. Three years later, it is one of the top four royalty companies in the space. During that process, Sean Roosen, the Chairman, and his team have established what they call the accelerator model. This has lead them to support various juniors that have a mining camp scale type of approach. Osisko Mining is the best example.

In June of last year, we were happy to get the Osisko brand. We were the first venture into the base metal space in June of last year. Following that, Osisko Gold Royalties acquired a basket of royalties from O'Ryan, and that purchase was over a billion dollars. Osisko Gold Royalties, after the sale of the Canadian Malartic Mine, went to a two to three million dollar market cap, within three to four years. At the same time, initiating and supporting the various juniors, with good management teams, mining camp scale visions, and the objective of creating value, especially at the drill bit.

Dr. Allen Alper: That's fantastic.

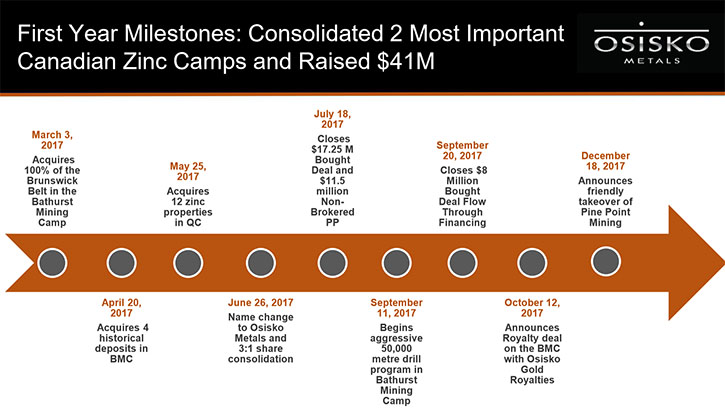

Jeff Hussey: Yeah, the Osisko metal story is relatively new, but we've managed to achieve a number of objectives, out of the gate, because of the brand name. We raised over 41 million in 2017. The Bathurst mining camp was our first step into the base metal space. We have a large portfolio, in Quebec, of grassroots projects. On February 23rd, we completed the friendly takeover of Pine Point Mining. Shortly after that, we announced a joint venture with Osisko Mining, where we're going to start drilling 12 high-priority, drill-ready, base metal targets in June. Those are the major milestones we achieved over the last year.

Dr. Allen Alper: Fantastic! Could you elaborate a bit more on the projects?

Jeff Hussey: We currently have three main projects: the Pine Point Mining Camp, the Bathurst Mining Camp, and the JV with Osisko Mining. For the PPMC & BMC, we've announced a 50,000 meter drill program at each camp for a total of 100,000 meters of drilling, The drilling, through the JV with Osisko Mining, will begin in the next few weeks and will be operated by OSK, since they already have over a dozen drills on the ground . This means we will have good news flow from all of those drill campaigns going forward.

Dr. Allen Alper: Oh, that sounds excellent. Could you tell our readers/investors a bit about the zinc market?

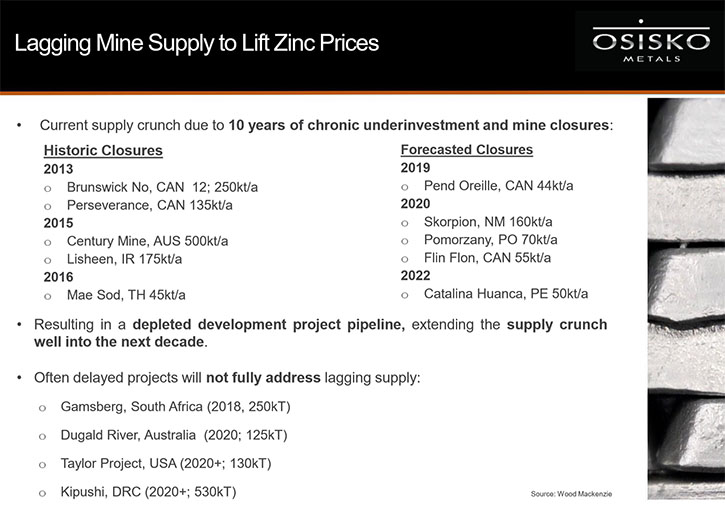

Jeff Hussey: Essentially, it hasn't changed. Within the last year, there's been a significant rise in the zinc price, due to a steady decline in supply since 2013. The LME and Shanghai supply diminished from 1.5 million tonnes down to about 300,000 tonnes, over the last five years. Since 2016, the price has risen from US$0.70/lb. to a high of US$1.60/lb. It now sits at around the 1.35-1.45 range. That price level is indicative of the low supply. The supply is at critical levels. The project pipeline is relatively depleted, due to decades of very little exploration and development. Our objective is to change that.

Dr. Allen Alper: Sounds excellent!

Jeff Hussey: The positive outcome is that treatment charges are at their lowest levels. The current price was just announced in May, benchmarked at about US$150/tonne, down 15% from just last year and down from historical highs of US$250 to US$300/tonne. The supply, price and treatment charges are the three major indicators. They all indicate a strong zinc market for the next few quarters and beyond.

Dr. Allen Alper: Sounds excellent. Could you refresh our readers/investors’ memories about zinc applications.

Jeff Hussey: Absolutely. The two main industries are galvanization and die casting. They account for 75%-80% of the market. Galvanization is used in the infrastructure, construction and automobile industries. In the global economic context, lots of infrastructure is being built, in China, India, or elsewhere. Everyone is looking to build more infrastructure recently, to stimulate economic growth and to replace depleting existing infrastructure. Today, where sustainability is a key performance indicator, extending the life of a bridge building or overpass is important, so the steel that goes into the rebar is going to be galvanized.

Galvanization in the automobile industry in both China and India is important because people want the same thing we did 20, 30 years ago, to have a car that does not rust for its lifetime. All of those will contribute to galvanization. Die casting is about 14, 15% of the market. That's still ongoing. There are new applications. Everyone wants to talk about batteries these days. New grid storage batteries, to store large volumes of electricity, use zinc. That may also help on the demand side, but mainly it is galvanization and die casting, which has always been the case for the zinc market.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors what differentiates Osisko Metals from others?

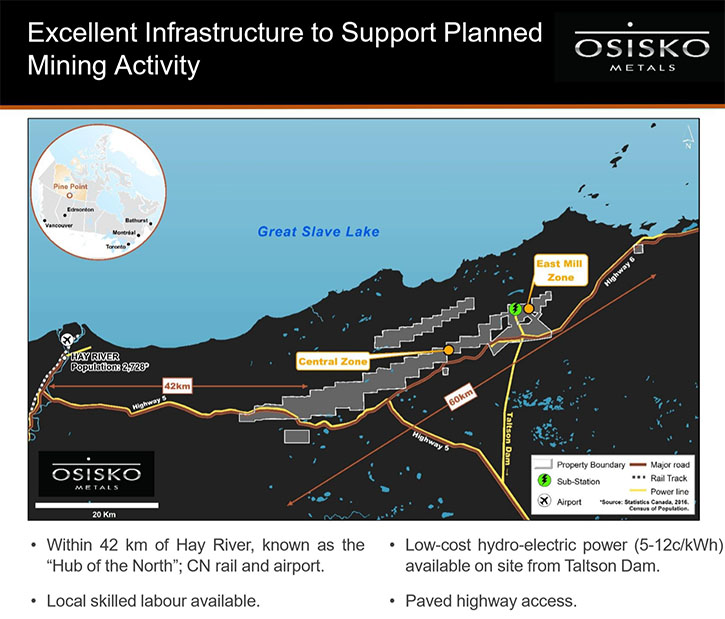

Jeff Hussey: We've taken a very rigorous approach on base metals. Our key criteria is to explore for zinc mineral resources that have the ability to be developed at reasonable capital expenditures. Both the BMC and PPMC are former producers and have all of the infrastructure that is necessary to restart development studies. In both Bathurst and Pine Point, we have full access to power located nearby. In the case of Pine Point, it is right on the property, adjacent to where we will be looking to construct, if we get a sufficient resource base. In the BMC, there are power lines and we have access to paved highways and secondary forestry roads. At Pine Point, there're over 100 kilometers of 25-meter-wide hall roads, because it was once an open pit mining operation. So it has big roads all throughout the areas where we're working. In both cases, there is rail. There is rail that goes through the Bathurst Camp right by our land package. It used to serve the Brunswick 12 and Brunswick 6 mines. So the rail is there. In the case of Pine Point, there's rail all the way to Hay River. There used to be rail that went from Hay River right into the heart of the project. That was removed in 1988. But we have railhead nearby, within 60 kilometers. Lastly, in both camps, there are people available to hire.

There could have been several projects of interest and of tonnage. But they're stranded, without infrastructure or with haulage of 500 kilometers or more. Or there are no people nearby. They need to fly in and out. There may be some fly in, fly out at Pine Point. But mainly these are operations that have existing infrastructure and local workforces. There's a larger team behind Osisko Metals. The Osisko group and their technical team are in our head office. We have support from all of the disciplines, on an as needed basis. They're very helpful and supportive. We raised 41 million in 2017 at startup of the company. That shows the capacity of the corporation and its backing to reach out to large shareholders and finance good projects that have promise of development in the base metal space.

Dr. Allen Alper: Sound’s fantastic, a great position to be in, to be able to fund your projects, and fund your drilling and your exploration. Sound’s excellent!

Jeff Hussey: We have 27 million in the bank, and so we're funded to feasibility. We have everything we need to execute the plans that we've laid out.

Dr. Allen Alper: That's excellent. Would you like to highlight a little bit about your plans for 2018?

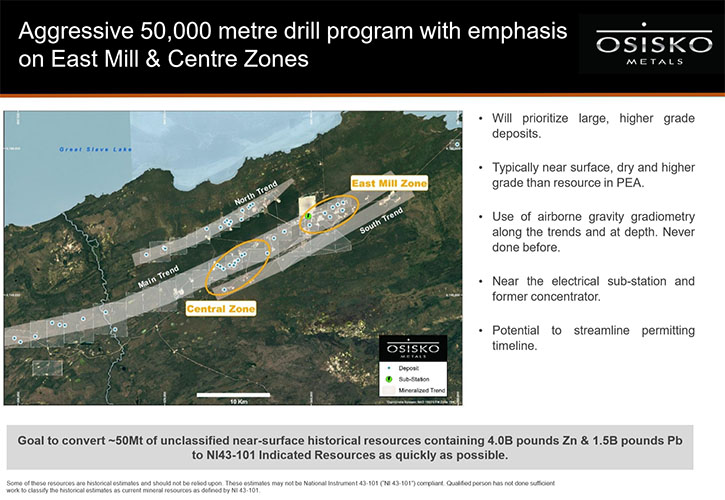

Jeff Hussey: We're currently drilling 50,000 metre drill programs in each camp, a combined 100,000 meters, making us one of the largest, most aggressive junior exploration companies in the base metal space. At Pine Point, our goal is to upgrade the approximate 50 Million tonnes of unclassified historical resources to an NI43-101 indicated category, as quickly as possible. Over the last 6 weeks or so, we have begun reporting the first 129 of 600 holes of our Phase 1 drill program here. The results we are getting are excellent, as we had expected from Pine point. Most intersections occur above 65 metre depths, at average grades varying anywhere between 5% Zn+Pb and 20% Zn+b. This is very good grade for shallow pits in a camp that for the most part would be mined in an open-pit scenario.

Dr. Allen Alper: That sounds excellent.

Jeff Hussey: We have 50 million tons of open pitable reserves in the Pine Point mining camp. At the same time, we're also aggressively pursuing the Bathurst camp. We'll have lots of news flow coming out of there. We acquired the Key Anacon property, at the end of December, which has quickly become our focal point in the Bathurst mining camp. Key Anacon was held by the Irving family (Oil and Gas) over the last 40 years. We successfully negotiated the purchase over a lengthy nine month period. Key Anacon contains a historical resource of 1.87 Million tonnes grading 9.56% Zn+Pb, 0.16 Cu and 84g/t Ag. Our first results out of Key Anacon were press released a few days ago, June 28. They were very good zinc + lead results and also high copper grades for the area. We believe we have the copper feeder zone, giving way to a potentially large zinc-lead deposit. We will also be pursuing drilling, aggressively, on over 25 gravity Electro-Magnetic (EM) targets. We're in the process of prioritizing those. Those are scattered throughout the camp. We'll put one to two drills on those this summer, as we want to test quickly and plan on advancing or dropping those targets. These are targets that were identified in 2004, when the first airborne gravity survey in the world, was flown in the Bathurst mining camp. Any one of these new targets could be a break open target. So we want to test those. We have many other projects to talk about, but those are the main ones.

Dr. Allen Alper: That's a very ambitious program. It's great that you have the funding to carry it out. Excellent!

Jeff Hussey: Yes.

Dr. Allen Alper: Could you say a few words about your share structure?

Jeff Hussey: Yeah, we were very tightly held, I'd say, before the Pine Point acquisition. 74% of our stock was in long term hands. When we financed the 41 million last year, M&G Investment, JP Morgan Asset Management and BlackRock Investment Management, all out of the UK participated in that financing. These are very sophisticated, very large institutional funds that are now part of our story, long term hands. They total approximately 15% of our current shareholding. During the acquisition of Pine Point, Renvest Mercantile Bancorp now owns 6.2% of Osisko Metals. Zebra Holdings and Investment own 3.9%. Last but not least, Osisko Gold Royalties and Osisko Mining own a combined 11.5% of our shares. At this point, we have approximately 115 million shares outstanding, 148 million shares fully diluted.

Dr. Allen Alper: That sounds very good.

Jeff Hussey: Recently, we have analyst coverage from Canaccord and Paradigm.

Dr. Allen Alper: Wow, that's excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Jeff Hussey: The first thing is to understand a bit about the zinc market. Right now, it's a perfect storm for zinc. Supply is low, the price is high. Talking to the market research people, the days of zinc being below a dollar are behind us. For years to come, it will be above a dollar or more. We could see it rise as high as a buck 50 again, to two dollars. But you know, annual averages could be somewhere between a buck 50, a buck 75. That's a very good price for zinc, and that drives everything, economic, cash flow models for the future and what we want to do. Personally, I think this is the best growth story in the base metal space. We have large drill programs in three different camps, and we're mainly converting historical and aiming to grow those resources. Backed by a world class, probably the best Canadian mining team. So you have good assets, good market, great management and board, and a perfect storm for zinc.

Dr. Allen Alper: That sounds excellent. Very compelling reasons for our high-net-worth readers/investors to consider investing in Osisko Metals.

https://www.osiskometals.com/en/

Jeff Hussey

President & CEO

Osisko Metals Incorporated

(514) 861-4441

Email: info@osiskometals.com

|

|