Interview with Anthony Milewski, Chairman and CEO, Cobalt 27 Capital Corp. (TSXV: $KBLT, FRA: $27O): An Opportunity for Investors to be Involved in the Voisey’s Bay Cobalt Stream and the producing Ramu Nickel-Cobalt Stream

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/8/2018

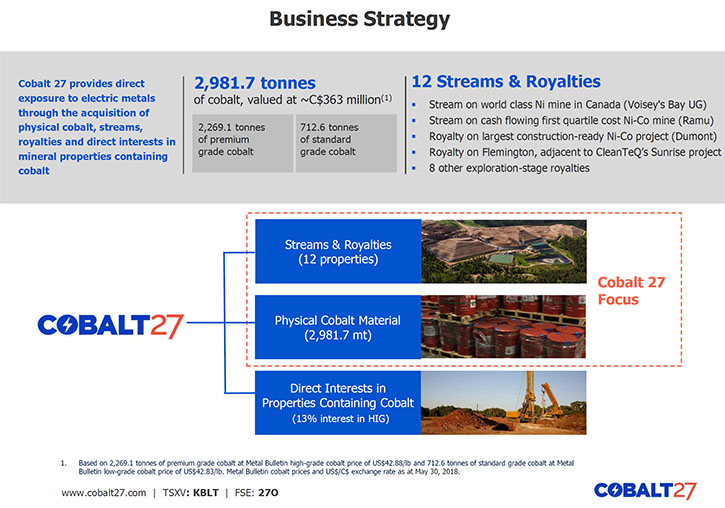

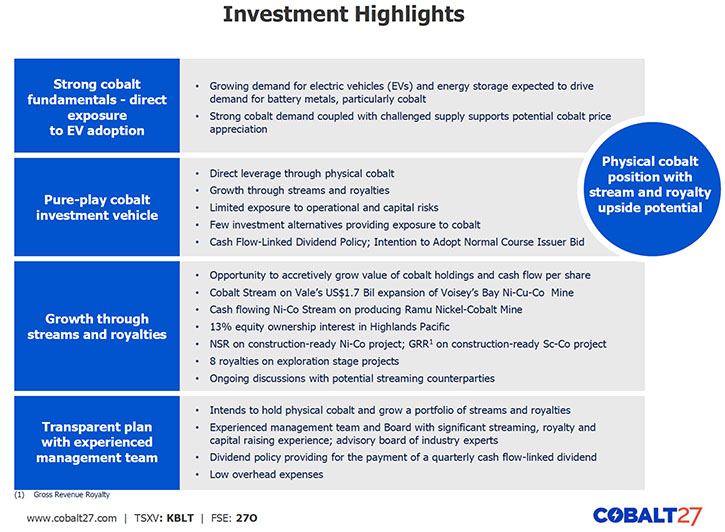

Cobalt 27 Capital Corp. (TSXV: $KBLT, FRA: $27O). We learned from Anthony Milewski, Chairman and CEO of Cobalt 27, that the company has recently completed two large acquisitions that have transformed Cobalt 27 into the leading electric metals streaming and royalty company. First, they acquired the world’s first producing nickel-cobalt stream on the low-cost, long-life Ramu Nickel-Cobalt Mine for US$113 million, which will bring immediate free cash flow into the company, over the estimated 30 year life of mine. The second transaction is the US$300 million acquisition of a 32.6% cobalt stream on Vale's world-class, Voisey's Bay mine, located in a conflict-free, first-world jurisdiction of Newfoundland and Labrador, Canada. The Voisey’s Bay Cobalt Stream is expected to deliver approximately 1.9 million pounds of cobalt per year to the company beginning in 2021, to be settled in physical delivery for the life of the mine. We also learned from Mr. Milewski, that Cobalt 27 owns approximately 3,000 tonnes of cobalt, making them the second largest holder of physical cobalt in the world, after the Chinese government’s strategic stockpile. According to Mr. Milewski, the heart of the power of the electric vehicle is the nickel-manganese-cobalt chemistry that drives rechargeability, speed, and range in EVs.

Anthony Milewski, Chairman and CEO of Cobalt 27 Capital, at the company’s cobalt warehouse in Rotterdam, the Netherlands. Photo courtesy Cobalt 27 Capital Corp

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Anthony Milewski, Chairman and CEO of Cobalt 27 Capital Corp. Could you give our readers/investors an overview of your company and your strategy?

Anthony Milewski: Cobalt 27 is an electric metals streaming and royalty company, with a large, strategic physical cobalt position of approximately 3,000 tonnes. While we are focused on cobalt, by virtue of the fact that cobalt is a by-product of nickel production, we have exposure to nickel as well. We went public in June 2017 with a large physical cobalt position. In recent months, we've now transitioned fully into having a physical position, plus two large streams and 8 royalties, and so we see Cobalt 27 as a proxy for the adoption of the electric vehicle through basic materials.

Dr. Allen Alper: Could you tell us a bit about Cobalt 27’s assets, streams and royalties, your physical cobalt material, and your mineral properties?

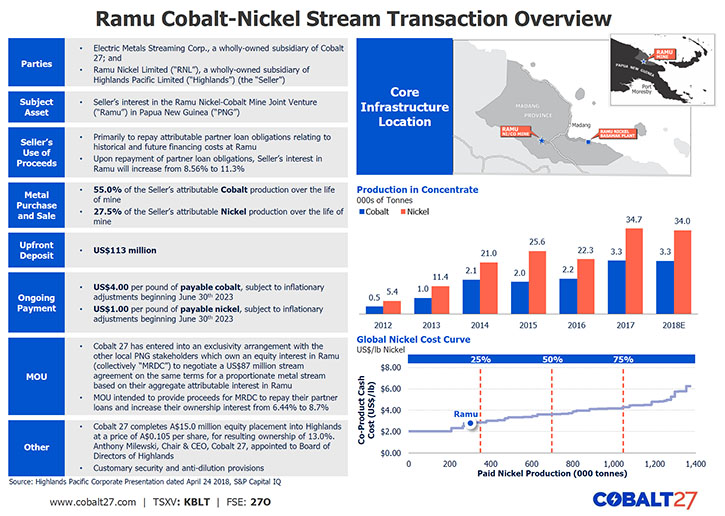

Anthony Milewski: Since we last talked, we have executed on two game changing transactions. First, in May 2018, Cobalt 27 announced the acquisition of the Ramu I Nickel-Cobalt Stream over 55.0% and 27.5% of Pacific Highlands’ attributable share of cobalt and nickel production, from the world-class Ramu Nickel-Cobalt Mine in PNG, in exchange for a US$113 million upfront payment. The Ramu mine was financed, constructed and commissioned in 2012, by majority owner and operator Metallurgical Corporation of China Ltd. (MCC) for US$2.1 billion which, at the time, was China’s largest overseas mining investment. MCC is listed on the Hong Kong and Shanghai stock exchanges and has a market cap of approximately US$12 billion.

The Ramu stream is transformative for Cobalt 27; it’s a producing cobalt-nickel stream over a long-life, world-class asset that provides immediate cash flow to the Company. The estimated attributable stream production is approximately 450,000 lbs. of cobalt and 2.25 million lbs. of nickel, in concentrate, per year. Ramu has everything we look forward to in a streaming transaction, a world-class operator, low-cost production and an estimated mine life in excess of 30 years.

Also, Ramu expands and diversifies Cobalt 27’s portfolio to include cobalt and nickel, important battery metals that we feel are positioned to benefit from global adoption of EVs and large-scale grid energy storage systems. Also, in that transaction we completed an equity investment in Highlands Pacific and now own 13% of Highlands’ common shares.

Finally, Cobalt 27 is also in discussions to acquire a second nickel-cobalt stream on the Ramu mine for an additional upfront payment of US$87 million on the same terms as our Ramu I Nickel-Cobalt Stream. Combined, Ramu I and Ramu II would create a US$200 million Nickel-Cobalt Stream which would deliver immediate free cash flow to the company.

Dr. Allen Alper: Yes, the Ramu Nickel Mine is certainly world-class and considered one of the top operating nickel mines globally. Could you tell us about Cobalt 27’s second acquisition?

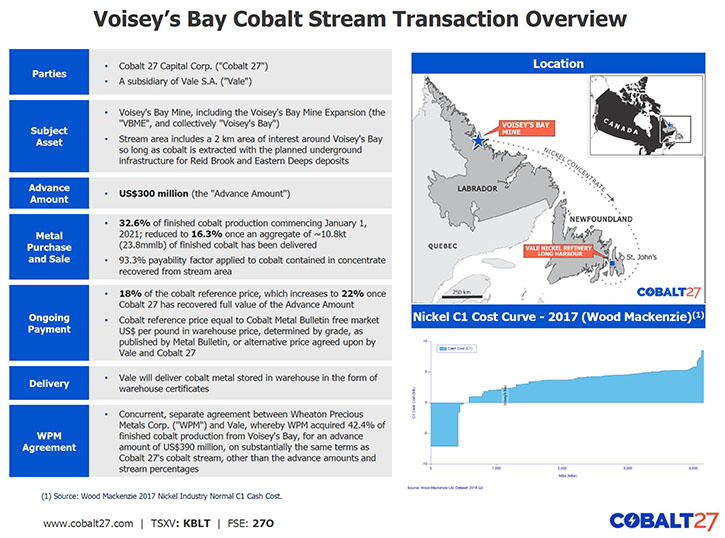

Anthony Milewski: Cobalt 27’s second transaction, which we announced and closed in June 2018, is the 32.6% Voisey’s Bay Cobalt Stream, which the company acquired for US$300 million. In fact, there were 3 major announcements related to Voisey’s Bay all released on June 11, 2018. Firstly, Vale announced their highly anticipated plans to proceed with construction and commissioning of the Voisey’s Bay Mine expansion for US$1.7 billion. Secondly, Cobalt 27 announced that it was to provide US$300 million of stream financing to Vale; and, thirdly, in a separate transaction, Wheaton Precious announced that it was to provide US$390 million of stream financing to Vale. So, combined, US$690 million of the US$1.7 million CapEx required for Vale to complete the Voisey’s Bay mine expansion, is from cobalt streaming, with Cobalt 27 acquiring 32.6% and Wheaton Precious acquiring 42.4%, for a total of 75% of life of mine cobalt production from Voisey’s Bay Mine expansion.

Needless to say, June 11, 2018, was a big day for the expansion of Canadian nickel and cobalt production required to meet future demand for EVs and energy storage systems. It certainly was a milestone achievement for Cobalt 27 and an exciting way to mark the close of our first full-year since completing our IPO in June 2017.

Dr. Allen Alper: That is a major milestone in Canadian mining history and a cornerstone asset for Cobalt 27 in your first year public. Could you tell our readers/investors a bit more about the actual delivery and pricing mechanics of the Voisey’s Bay Cobalt Stream?

Anthony Milewski: Yes, it’s actually fairly straight forward. Our 32.6% Voisey’s Bay Cobalt Stream is expected to deliver approximately 1.9 million pounds of cobalt per year to Cobalt 27, which is to be settled in physical delivery for the life of the mine. Essentially, the stream will be settled by Vale delivering to Cobalt 27 cobalt metal stored in warehouse in the form of warehouse certificates.

In addition to our US$300 million upfront payment to Vale, Cobalt 27 will also make ongoing payments equal to 18% of the Cobalt Reference Price, most likely Metal Bulletin’s or a similar agreed to reference price, for each pound of cobalt delivered under the 32.6% Cobalt Stream, until Cobalt 27 has recovered the full value of the upfront payment through Vale's deliveries of finished cobalt. After this time, the Ongoing Payments will increase to 22% of the Cobalt Reference Price for the live of the mine. So, as you can see, at current cobalt spot prices, the Voisey’s Bay Cobalt Stream is expected to add significant cash flow to Cobalt 27, for an initial 14 year mine life, which is expected to be extended through ongoing exploration.

In total, the Voisey’s Bay and Ramu streams represent approximately $500 million dollars in transactions, in the past two months, of which we've been a part.

Dr. Allen Alper: That sounds very exciting. Could you give our readers/investors, an overview of why cobalt and nickel, are so important in the electric vehicle application?

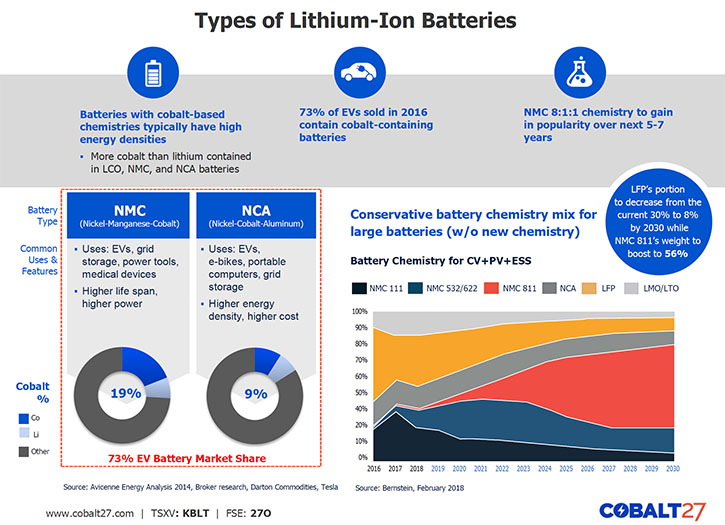

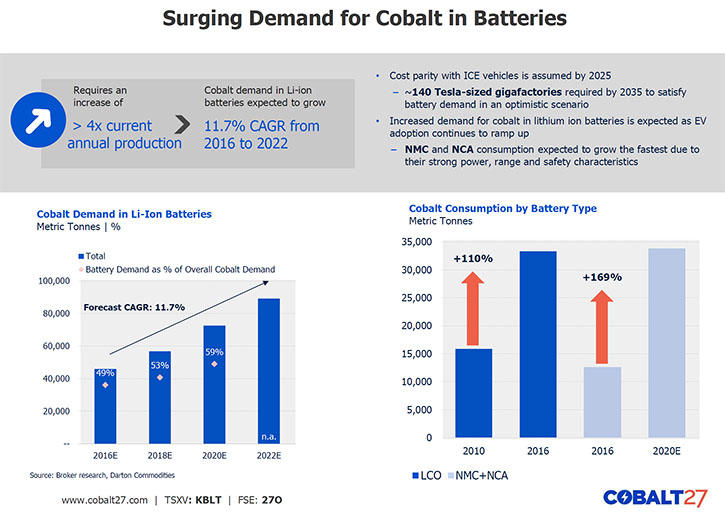

Anthony Milewski: If you look at the world today, what you're seeing is really an industrial revolution of sorts unfolding. And you're seeing the adoption of the electric vehicle, from almost the starting point of zero, accelerate now and become mainstream and those vehicles are powered by lithium ion batteries. Globally today, there are really two chemistries, you have on the one hand, the chemistry that Tesla uses, the nickel, cobalt, aluminum chemistry otherwise known as the NCA Chemistry. And then you have, the NMC Chemistry, the nickel, manganese, cobalt chemistry, used by almost every single auto maker in the world, except Tesla. At the core of both of those chemistries, and in particular, the NMC Chemistry, which is the most ubiquitous, is nickel and cobalt.

The nickel and cobalt, which give the battery the energy density and rechargeability for these vehicles to have the speed and the range that consumers desire in a car that is practical and weighs an amount that is sensible for the road. As we hear about electric vehicles, the heart of their power is the nickel, manganese, cobalt chemistry that drives rechargeability, range, and all these different factors. And so it's an absolutely critical aspect of the electric vehicle story.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a bit about the supply and demand situation of cobalt?

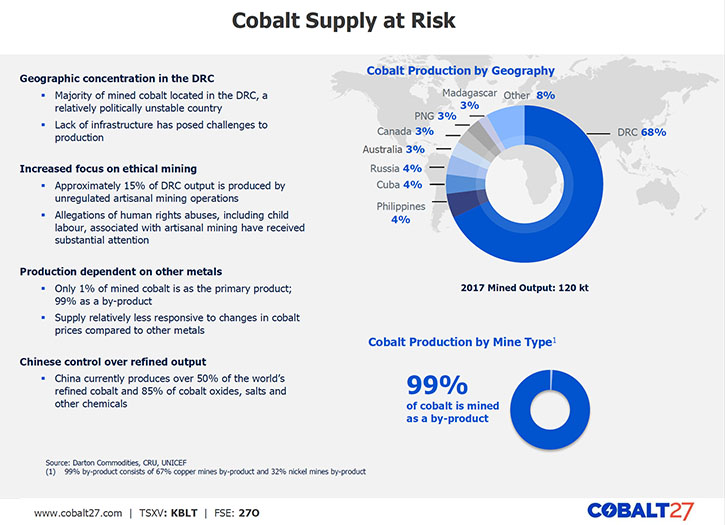

Anthony Milewski: The market today, is approximately a hundred thousand metric tons globally. It might be a bit bigger when you include artisanal mining out of the Congo. Now, the majority of that production, at least 65% comes out of the DRC. The balance comes out of Canada, Australia, Cuba and Russia, with a sprinkling globally. Cobalt is a by-product. There's only one primary product line in the world, and that's in Morocco. In the balance of cases in the Congo, cobalt comes with copper. In the rest of world it comes with nickel.

What is the supply and demand dynamic? If the market is 100,000 metric tonnes today, in 2025, if you're at fifteen, sixteen percent penetration globally, that number, in terms of demand, could be well over 300,000 metric tonnes of cobalt. You're talking about probably a multiple of today's entire market in a few short years, if people continue to buy in and the adoption accelerates.

On the supply side you have an interesting dynamic. Since cobalt is mainly a by-product, it's very hard to bring on additional production. When we think about where production is coming from, there are two projects in the Congo, Katanga and RTR, where there are copper projects or tailings projects that will come online, starting next year, and ramping up in the coming years. There are some nickel mines, one in Australia, Clean TeQ and Dumont and other mines may be built in Canada. It's not like a lot of commodities where you can just go build another name-your-commodity copper mine. In the case of cobalt you're actually held hostage to a primary commodity having a high enough price and enough investor interest to build a mine around that primary commodity, where cobalt is a by-product.

Dr. Allen Alper: That sounds like a great opportunity for Cobalt 27. Could you tell us a little bit about your background, your team, your board, and your advisory board?

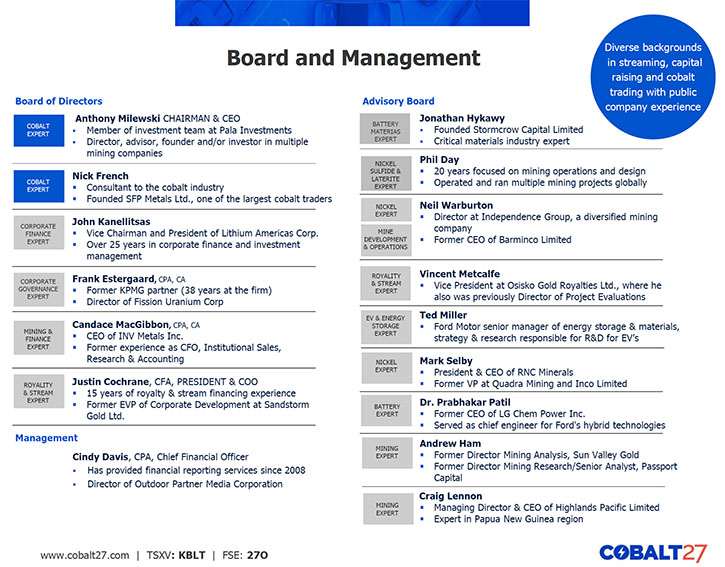

Anthony Milewski: I have spent my career at a fund, focused on metals and mining and commodities more broadly, and thinking about supply and demand and looking at trends and how new technologies will impact future demand for specific commodities. My key partner, Justin Cochrane was at Sandstorm a streaming and royalty company, prior to Cobalt 27, where he ran business development. Prior to that he was at NBF, where he worked on streaming and royalty transactions, for twelve years. We have a team that understands the commodities side, the physical side combined with the streaming and structured finance side of the business. Our Board includes individuals, who are physical traders in cobalt and financial experts, on the advisory board, battery experts and mining experts and you really have a team that has a lot of experience in the sector, across a wide spectrum of aspects of the sector.

Dr. Allen Alper: That's great. Could you tell us anything more about your board, or your advisory board?

Anthony Milewski: Yes, we have a range, like the former CEO of LG Chem, one of the big battery makers, is on our advisory board. We have the head of Ford Batteries on our advisory board. Also, Phil Day, who is a nickel expert is active on our advisory board. So, it's a group of individuals, with deep expertise in their respective fields. On the board itself, Nick French has been trading cobalt since the 70s, and Frank Estergaard, who has spent almost 38 years at KPMG, so a very good member of the audit team. It's a very experienced group of individuals.

Dr. Allen Alper: That's fantastic. You have really positioned Cobalt 27 so strongly in the cobalt market. That's great. Could you tell our readers/investors a bit more about your physical gold cobalt material?

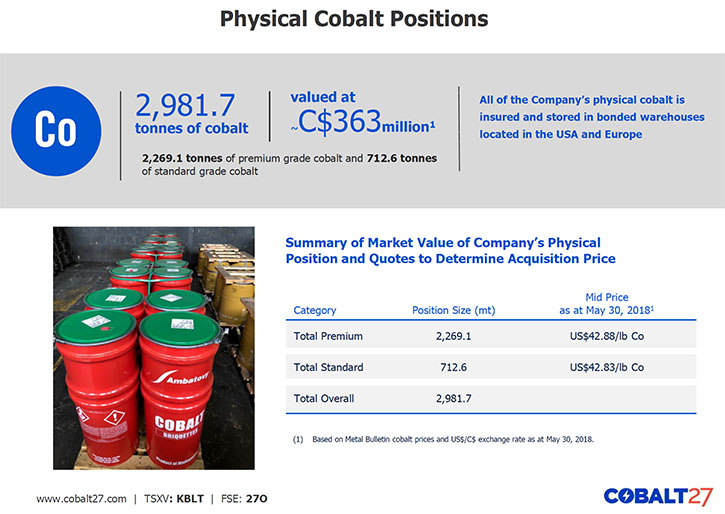

Anthony Milewski: We have three thousand metric tons of cobalt, making us probably the second largest holder of physical cobalt in the world after the Chinese government stockpile. And that really underpins the NAV, it gives us access to relatively inexpensive inventory financing and it adds uniquely to the value proposition of Cobalt 27, which is having that physical cobalt outside of the Congo, conflict-free cobalt, and driving forward NAV creation for shareholders.

Today the business is focused on streaming and royalties and then on the JV, or mineral properties side, represented by our thirteen percent interest in Highlands Pacific. Right now we're more focused on that streaming part of the business.

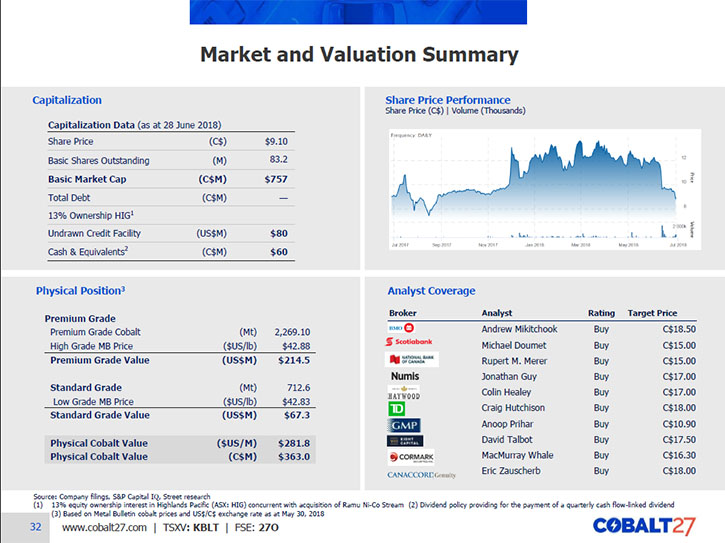

Dr. Allen Alper: Could you tell us a little bit about your capital structure, your investors, et cetera?

Anthony Milewski: Sure, we have a pretty clean capital structure today. We only have common equity. We have secured a US$80 million revolving credit facility that remains undrawn. We strive to keep the capital structure as clean as possible, so that it's an easier story for investors. In terms of our share register, we have a lot of really large, long-only institutions, who have participated in our financings over the last year. They underpin our ability to go into the market, like we've just done, and raise capital to execute on critical acquisitions and support the stock.

Dr. Allen Alper: That sounds excellent! Excellent to be in such a great position, to have such strong backing and be able to raise capital like that and do long term deals, so that's fantastic. What are the primary reasons our high-net-worth readers/investors should consider investing in Cobalt 27 Capital Corp?

Anthony Milewski: Yes, investing in Cobalt 27 is really expressing a view on the adoption of the electric vehicle and the battery storage thematics. There're a lot of ways to play, you can buy Tesla, or you can buy a stock like Invidia, but ultimately it's hard to know who's going to win in that race. But, if you do believe there's going to be a winner, then the basic materials in those batteries are going to be winners.

Dr. Allen Alper: That sounds excellent. Sounds like an excellent opportunity for our high-net-worth readers/investors to have a chance to be in the growing electric vehicle market and to have a presence. Is there anything else you'd like to add Anthony?

Anthony Milewski: Just to thank you, I really appreciate your interest.

Dr. Allen Alper: I enjoyed talking with you, very interesting.

http://www.cobalt27.com/

Betty Joy LeBlanc, BA, MBA

Director, Corporate Communications

+1-604-828-0999

info@co27.com

|

|