Neometals Ltd (ASX: NMT, OTC: RDRUY): Aim to Create the Most Sustainable Highest-Margin Lithium Business, Interview with Mike Tamlin, COO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/7/2018

Neometals Limited (“Neometals” - ASX:NMT) is a developer of industrial mineral and advanced materials projects. Neometals has two key divisions – a fully integrated Lithium business and a Titanium-Vanadium development business. Both are supported by proprietary technologies that assist downstream integration through revenue enhancement and cost efficiencies.

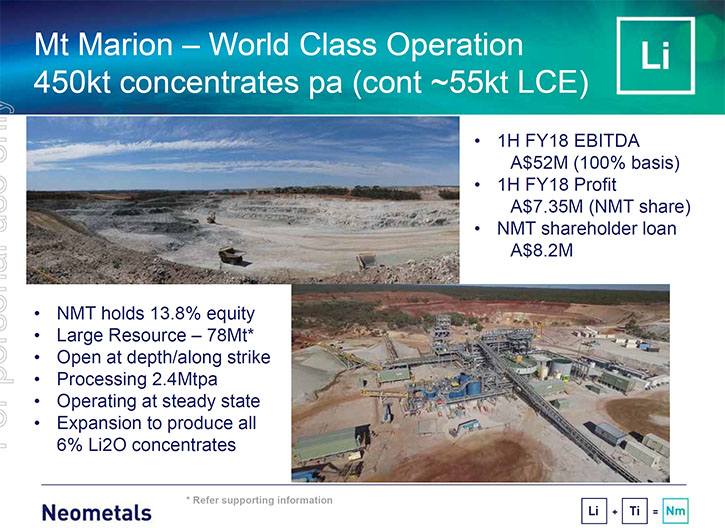

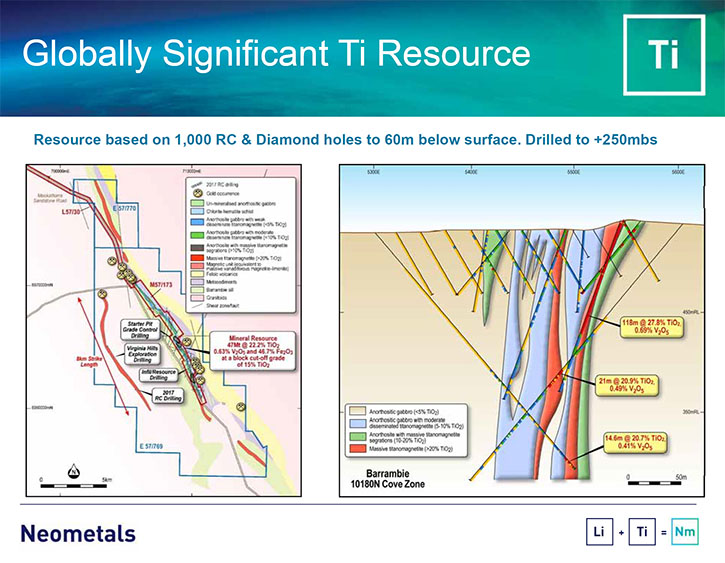

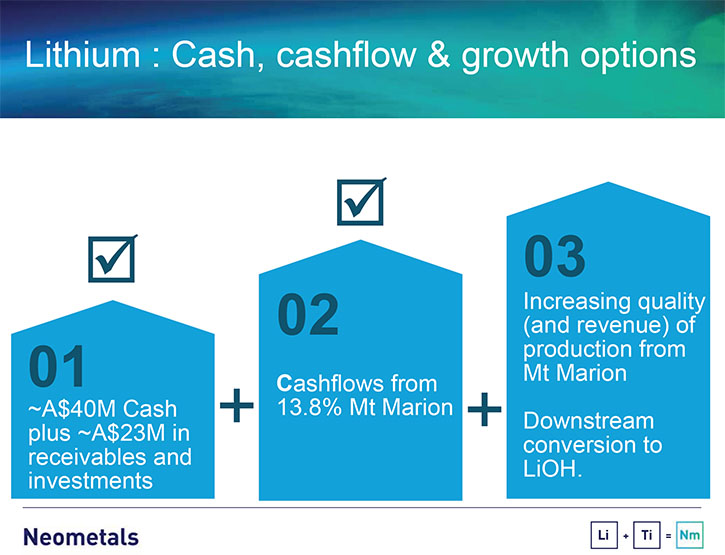

Neometals owns a 13.8% stake in the Mt Marion lithium mine near Kalgoorlie, which operates one of the world’s biggest lithium concentrators. Neometals holds an offtake option, which forms the backbone to its fully-integrated lithium business aspirations which include a Lithium Hydroxide Refinery and Lithium-ion Battery Recycling process. The 100%-owned Barrambie Titanium-Vanadium Project in WA’s Mid-West is one of the world’s highest-grade hard-rock titanium-vanadium deposits.

Neometals’ strategy focuses on de-risking and developing long life projects with strong partners and integrating down the value chain to increase margins. The company aims to leverage its cashflows to grow opportunities that provide sustainable mineral and material solutions to customers and to return value to shareholders.

We learned from Mike Tamlin, COO of Neometals, that they have two strong operating partners in the Mt Marion Mine: Mineral Resources Ltd., which is Australia's largest contract minerals processor, and Ganfeng Lithium, China's largest and most diverse lithium producer, who entered a life-of-mine off-take agreement with Mt Marion. According to Mr. Tamlin, Mt Marion mine has reached maximum production capacity, at a time when the lithium prices are at an all-time high. From the third quarter of this year, Mt Marion Mine is planning to start paying the mine JV shareholders their share of profits. Revenues are very strong and looking to go stronger when the concentrator production is upgraded, later in 2018. The Kalgoorlie Lithium Refinery, which will produce 10,000 tonnes of lithium hydroxide equivalent per annum, is in the middle of its front-end engineering and design phase. The site is well-located and well-serviced. Neometals is in the middle of the approvals process, expecting to commission the plant in mid-2020-2021.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Tamlin, who is COO of Neometals. Could you give our readers/investors an overview of Neometals, your focus and current activities?

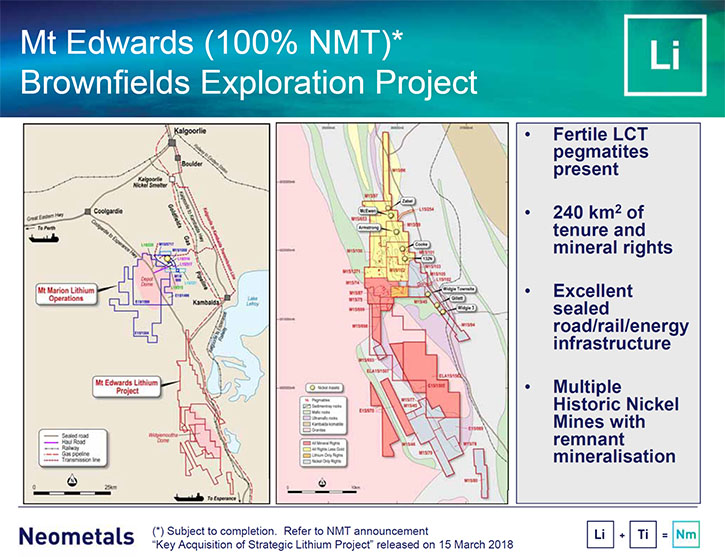

Michael Tamlin: Certainly, Al. Neometals is a company involved in resources, primarily lithium and titanium. We have two key mineral resources. One is Mt Marion for the lithium operations and one, at Barrambie, for titanium and vanadium. Mt Marion has an operating mine and concentrator, while Barrambie is a development project. Since the last time we spoke, we have added the Mt Edwards lithium project to our group of resources. It is a brown-field site, highly prospective for lithium, where we've seen outcropping spodumene and pegmatites. It also has a substantial nickel resource. We have 48,000 tonnes of contained nickel in the resource that has been announced to the stock exchange recently. Further announcements are likely on that resource. We also have the lithium hydroxide project, which we call 'The Kalgoorlie Lithium Refinery', under development and the lithium ion battery recycling project. Development of these assets is supported by a suite of proprietary technologies that are used to enhance opportunities and the associated economics. Our integrated lithium arm is involved in extraction of the resources from the ground and also with the chemical processing of concentrates from those resources into high purity, fine chemicals.

Dr. Allen Alper: That sounds excellent, could you tell our readers/investors a bit about your partners and your offtake agreements?

Michael Tamlin: Yes, indeed. Our Mt Marion mine was acquired by the company in 2009 and from 2015 development of the concentrator and the mine commenced. We have two partners in the Mt Marion operations. The first partner to come onboard was Mineral Resources Ltd, who entered a Build-Own-Operate agreement in exchange for earning 30% of the project. They've subsequently completed their obligations to build and operate the plant, and develop the mine, and so we now have a mining agreement in place that covers arrangements for mining and producing spodumene concentrates. The other partner is Ganfeng Lithium. Ganfeng Lithium is a major Chinese lithium production company. It's listed in China and it is well known for high purity chemicals, and lithium metal, very much at the advanced production end of the lithium supply chain. Ganfeng needed supply security and so they entered into a life of mine off-take agreement for 100% of the concentrate produced at Mt Marion and also took a substantial shareholding in the company that runs the mine (RIM) so that they're fully engaged as a partner and as an off-taker in that operation.

Dr. Allen Alper: That's great. Can you tell our readers/investors a bit about the financial projections of the company?

Michael Tamlin: Yes, indeed. Mt Marion has had more than a year of stable operation now and we're very pleased with the way the operation has developed. It is operating at design capacity. We have the maximum production at a time when the lithium prices are at an all-time high. It's working very well for us. The mine has nearly cleared all of the repayments for shareholder loans that were made during the development stage. From the third quarter of this year, it's planning to start paying the mine (RIM) shareholders their share of profits from the operation. It's a big step for us. The global spodumene concentrate prices are running at roughly $900-$1000 a tonne, depending on which part of the market you look at. Certainly our sales have been of the order of $900 a tonne. We expect the price will increase in the third quarter. Revenues are very strong and expected to go stronger.

In terms of overall revenue, we have no published numbers, but we have made public our anticipated share of the operating profits, coming to Neometals for the year completing in June, 2018. We're looking at about seven million Australian dollars, based on our financial year, from July '17 to June '18. Mt Marion earned an EBITDA of about 52 million dollars. The 52 million dollars is for 100% of RIM, the joint venture management company and that has been based on the initial year's operations. It's a little bit lower than we had initially anticipated, due to retained funds in the company to cope with enlargement of the supply chain stockpiles and some prudent allocation of funds for development. We would anticipate that the EBITDA for the operation for financial year '19, running from July 2018 to June 2019, will be significantly higher than that. We just have to wait until we're in a position to announce the numbers before we can put a number on it. Nonetheless, you can do the math. If we are looking at 52 million this year, it would be significantly higher next year.

Dr. Allen Alper: That sounds excellent, congratulations on the great job you are doing.

Michael Tamlin: Thank you. It's really pleasing to see a mine come into production. When we make it work financially, according to our plans and expectations, then we certainly feel a sense of real achievement.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about your Kalgoorlie Lithium Refinery, what your plans are?

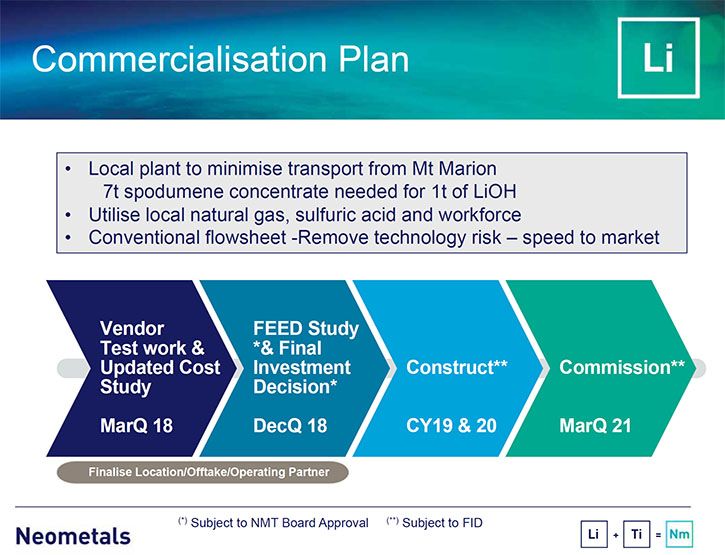

Michael Tamlin: Yes, that's a really exciting part of our lithium business arm. The Kalgoorlie Lithium Refinery is in the middle of its front end engineering and design phase. We have a study that will be completed late this year and the study results will be incorporated into a feasibility study that we'll be taking to our Board sometime in the second quarter of next year, before June, seeking an investment decision from them. We've made some notable progress this year. The early part of the year, we received the test results from all of the process testing, which included us Calcining spodumene, taking it through the full process and producing high-purity lithium hydroxide. That result was incorporated into an update of the pre-feasibility study, the pre-feasibility study was reviewed by the board who gave us the approval to spend the money on the feed study.

While that's in progress, we've acquired an operating site for the project and taken an option on that site. We've negotiated with the City of Kalgoorlie-Boulder for a site that is outside the town, but within about 5KM of the town. It gives us plenty of space, we have an option on over 40 hectares of land, more than enough to site the first 10,000 tonne module for the lithium refinery and enough for at least one expansion in the future. We've worked very closely with the City of Kalgoorlie-Boulder and one of the pleasing features is that we have access on our doorstep to the Trans-Australia Rail Line so we can freight the products from the plant, either east or west, shipping to other destinations. We're also on the highway, the main East-West Highway across Australia and only about 40 minutes’ drive for the trucks to deliver concentrates from the mine into the plant.

In addition, the council is going to assist with the provision of power and natural gas, and also reclaimed water for industrial use. The site is well located, well serviced and we are in the middle of the approvals process for development of that site. The site will then be cleared and leveled, although it's a pretty flat site, and then prepared once we have made the investor decision. Very exciting, we have a lead time of about three years, so looking at mid-2021, for commissioning a plant with 10,000 tons of lithium hydroxide capacity per annum.

Dr. Allen Alper: That's amazing, that's really fantastic. Could you explain to our readers/investors the advantage and value added by manufacturing hydroxide?

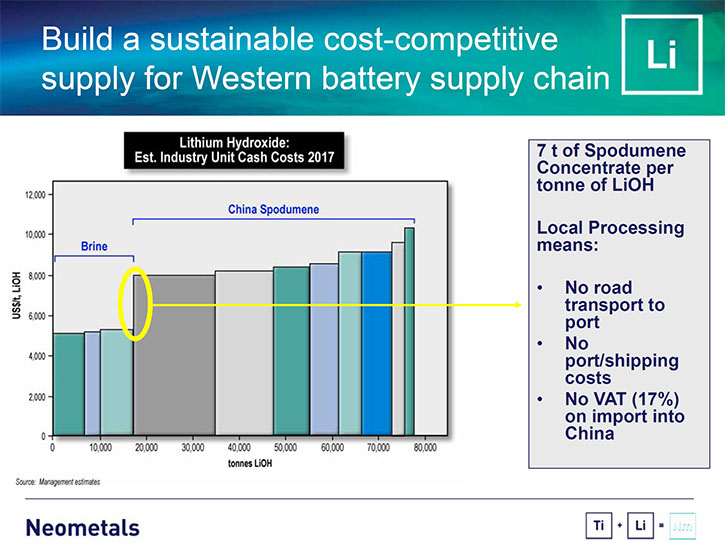

Michael Tamlin: This is the key point for our decisions to move down this path, Al. We have spodumene concentrates that are certainly priced at an all-time high. Whether or not the price continues like that, history shows us, by processing those concentrates into either lithium hydroxide or lithium carbonate, you increase the value of the lithium units contained by probably a factor of two. The conversion process is well known and we're using a version of the proven process. For us, process risk is being minimized. The convention, until now, has been with concentrates produced in Australia taken to an ocean bulk terminal and then shipped up to China, transferred either into warehouses or into barges and then transferred from barges and trucks, and trains into inland conversion plants. That's a very long and expensive supply chain and by locating in Kalgoorlie we're eliminating not only the costs and the inconvenience of that long supply chain, but also creating a substantially smaller footprint for the operation, certainly in terms of emissions as well as the physical handling characteristics.

We have a 40 minute drive on the highway for our trucks, which will deliver concentrates from Mt Marion straight onto a stockpile at the gate and we have the practical minimum costs in our situation. The only way for us to reduce the transport further would be to co-locate on the site at Mt Marion, but there are several limitations doing that, not least of which is water supply and power supply. We believe we have a very good balance. It opens the door for us, to convert our share of the production from Mt Marion and increase its value by, we expect, a factor of two, and importantly, allow us to engage directly with the battery sector, through delivery to the cathode producers.

Dr. Allen Alper: Excellent! Great plan! To be able to do that in three years is fantastic.

Michael Tamlin: Yes. It is very important for us to produce the lithium hydroxide from the spodumene. It not only increases the value contained in the lithium units, but it allows us to improve our competitive position in the overall unit cost curve in lithium. Producing concentrates and shipping them to China is done with 80% or 90% of the lithium produced from spodumene in the world (maybe 50% of global lithium production), but it's also the highest cost lithium production. We can make very significant savings by shortening the transport length, moving ourselves into what we expect to be the low second quarter on the cost curve. As a business, it puts us into a much stronger position to weather the ups and downs of the industry.

Dr. Allen Alper: That sounds excellent. What opportunity do you see with other deposits to increase the resource of lithium as you move on in the future?

Michael Tamlin: Yes. Mt Edwards is immediately to the south of the Mt Marion operations. They're only separated by about 10KM and Mt Edwards has been historically mined for nickel. It was there that the mineral field was really discovered by Western Mining Corporation (WMC) in the 1960s and '70s. They had a few attempts to evaluate lithium production, but in those days, the market was too small to be of economic interest to a company that was primarily a nickel producer. But times change. While we have our nickel resource on our tenement, our primary focus is developing the known incidence of lithium into a lithium resource and subsequently, into a lithium mine.

Conventional wisdom is lithium mines take about five years to bring into production. We're starting with a very sound database, now showing there is lithium value in the ground. Now we have to find out how much is there, so we've started drilling this week and from there, we will have a campaign over the next six to 12 months to find lithium resources. Then we'll go through the evaluation process, such as evaluating the mineralogy and constructing, and testing a flow shift to develop that. The position in our supply chain is that we would anticipate firstly the Kalgoorlie Lithium Refinery being commissioned in 2021. After a couple of stable years of production, that would take us to 2023. We'd then have a fully optimized flow sheet that we could duplicate or duplicate at bigger capacity and by that time, given five years, we would hope that Mt Edwards could be brought into production and feed the expansion.

We have two or three horizons associated with our lithium production, the first being the current concentrate operation, second being lithium hydroxide production and then in the five year timeframe, Mt Edwards production and an expanded lithium hydroxide operation.

Dr. Allen Alper: That sounds excellent. Could you say a few words about your plans on lithium battery recycling?

Michael Tamlin: That's another very important part of our business, we're in process development now. We've had a couple of delays, but we are now making good progress on the pilot operation. The process is taking shape in a pretty robust manner, firstly based on the lithium cobalt (LCO) batteries, we find in all of our consumer electronics. The second phase will be the NMC and NCA batteries that we find in cars and in energy storage devices for the grid. Our strategy in this is to provide a fully integrated and closed loop supply to our supply partners, by providing lithium hydroxide as fresh lithium hydroxide and by processing the off-spec materials from their battery and cathode production. Also, eventually by assisting their sustainability commitments and their stewardship commitments by reprocessing all of the used batteries that they'll be obliged to take back. We can provide a service that allows them to comply with sustainability and stewardship obligations, and to deliver lithium hydroxide back into their circuit. That gives them supply chain security and reduces their reliance on used supply through capturing the used materials, and renewing them.

Dr. Allen Alper: Excellent operating plans! You could have such a great relationship with your customers.

Michael Tamlin: It also allows those customers to have probably the optimum cost of supply, through recycling, not requiring any mining operations and reusing materials that have been already processed. It works for everybody and is a very sustainable solution.

Dr. Allen Alper: That's excellent. Could you say a few words about your plans for titanium, vanadium and iron?

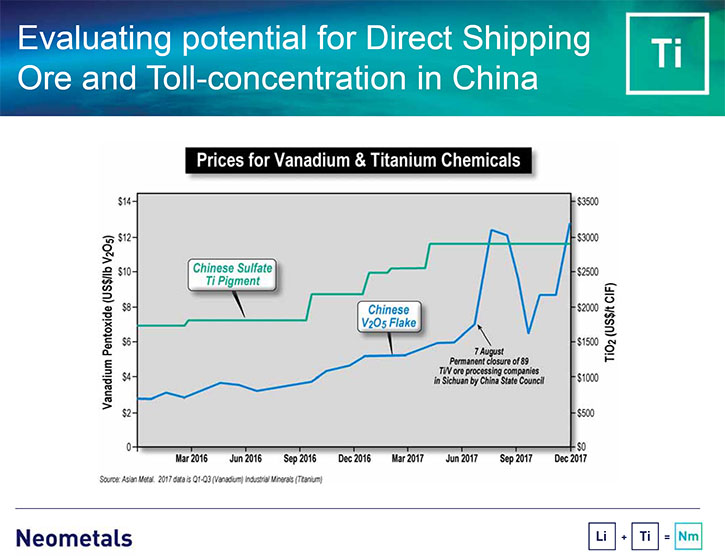

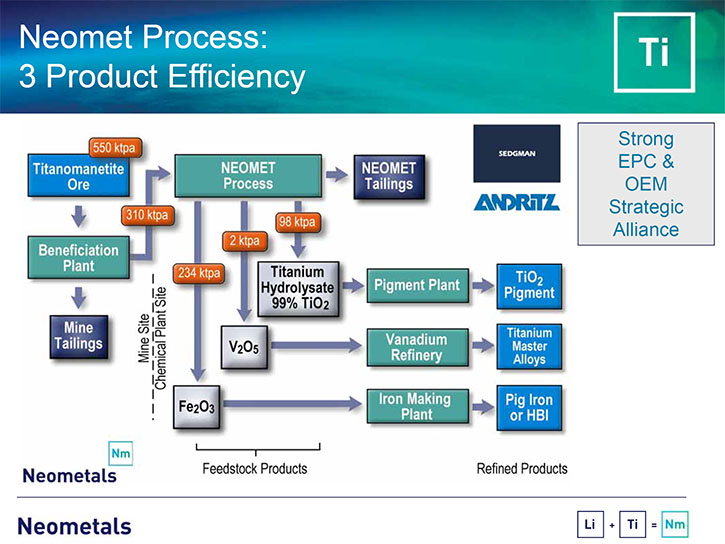

Michael Tamlin: Yes, indeed. The reason I was a bit late joining this call was I was in discussion with my colleague Darren Townsend, who is responsible now for the Barrambie project. We've increased our executive staff since we last spoke, I'm responsible for the lithium operations, Darren's responsible for the development of Barrambie. There are two phases in the development of Barrambie. The first phase is seeking to produce ore and ship directly to China, where titanium ores and concentrates are in relatively short supply. Vanadium ores and concentrates are also in fairly short supply, so current pricing appears to support an operation that direct ships ore to China for concentration in China and subsequent processing. That will develop some cashflow, while we're completing the piloting of the Barrambie treatment process. Ultimately, we want to have a mining operation that produces titanium and vanadium concentrates that are then fed into a processing operation that produces titanium dioxide and vanadium pentoxide. Iron oxide is the byproduct.

That operation's a few years off, it requires some thorough pilot testing of the process, which will be piloted in the late part of this year and early part of next year. One of the key technical advantages of our process is that it has a low temperature, acid-regeneration step and it allows acid to be captured, and reused, and significantly improve the economics of production. In addition, the titanium operating costs are reduced very, very substantially over conventional minerals and treatment processes. We feel that this is going to deliver a very strategic advantage to people in the titanium industry, through being able to operate with much larger margins than currently exist, and also more efficient operations. We're pressing ahead with the development and also in the early phase of the partner selection process, because we need, I think, a big partner with an interest in the titanium and vanadium industries to take this forward with us. It's a very large project and I think we would benefit from having a partner, with technical as well as financial muscle, to add to the project. We’re looking at advances in costs that bring down the cost of titanium dioxide into the couple of hundred dollars range, so big prize at the end. It justifies us going for it.

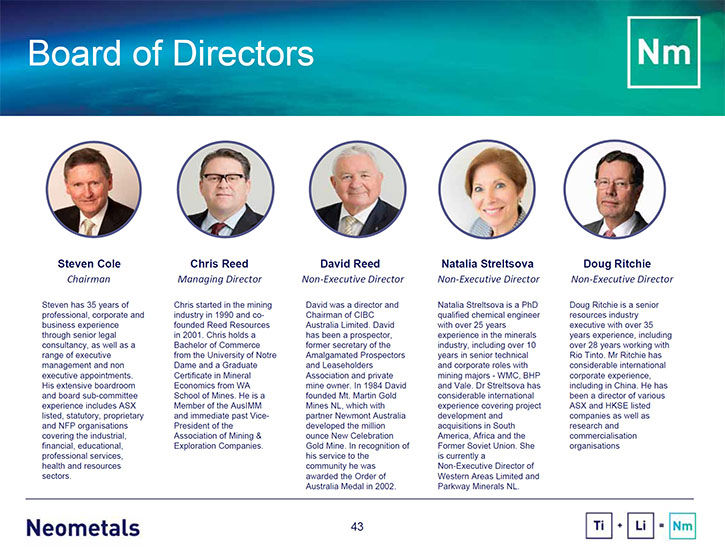

Dr. Allen Alper: That sounds excellent, that's a great opportunity for Neometals. Excellent diversification! Could you highlight your background, the team’s and the Board’s for our readers/investors.

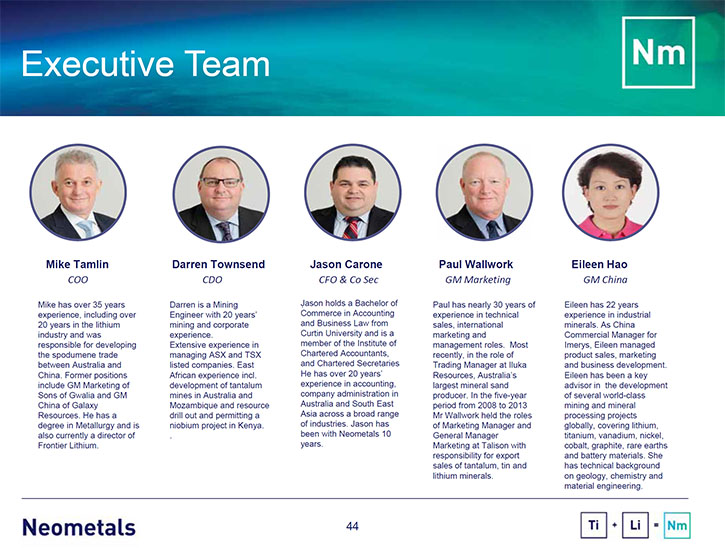

Michael Tamlin: In fact Al, we've enlarged the team. One of the key issues for a company of our size is that we need to both executive and technical capabilities as we advance these projects. The company is led by Chris Reed. Chris founded the company, with his father, more than 15 years ago. I think it's a testament to his success, that the company's been in a very difficult industry for such a long time and has strengthened itself during that time. We paid a dividend just in the last couple of days to our shareholders. I think that's the third dividend we've paid in the last few years. From that point of view, as a business operator, who understands how to balance the needs of development as well as the shareholders, I think Chris has a very strong track record. I am Chief Operating Officer, I've been involved in the lithium industry since 1995. I'm a metallurgist by profession, but a non-practicing one for several years. I've been involved more in the commercial development of companies and management of companies for a long time, but project development and market development has been part of my background.

I'm very happy to say that part of the team that has developed Mt Marion is now developing the Kalgoorlie Lithium Refinery, and adding battery recycling to that will be a very satisfying achievement for me. Darren Townsend is our Chief Development Officer and he's involved as the leader of the Barrambie Titanium Vanadium Project. He's a mining engineer, a former colleague of mine from Sons of Gwalia in, where he made his name operating and developing the Wodgina mine back 15 years ago, very good operator and a very steady pair of hands to take that project forward. We have a very sound CFO and company secretary, Jason Carone. Jeremy McManus has joined us just in the last couple of months, he's General Manager, Commercial and Investor Relations and he's adding a lot of drive to the way we interact with our stakeholders and also has a very strong commercial background. As we move forward in partner negotiations and in the contracting area for these projects, Jeremy will be invaluable.

Paul Wallwork is another solid colleague of mine, Paul is General Manager, Product Development and Marketing. Paul has spent a long time in the marketing of both lithium and titanium minerals, and products. He's a welcome addition to the team in the last six months or so and will be working across both lithium and titanium. Eventually we’ll have to add somebody to assist him. Dr. Sharma is our Technical Project Manager for the lithium project, he's an electro-chemist and he has a long history in lithium, and lithium process development, and his input into the process development, where lithium refinery has been very strong. I should mention our Board, of course it goes without saying that a strong board and a very interactive board is essential for a company like ours. We have a range of board members across corporate governance, commercial and financial, strong technical input as well. The Board is very much engaged with the company and has, I think, a very good balance of leaving the executives to discharge their duties, but still keeping a close eye on how the company is run.

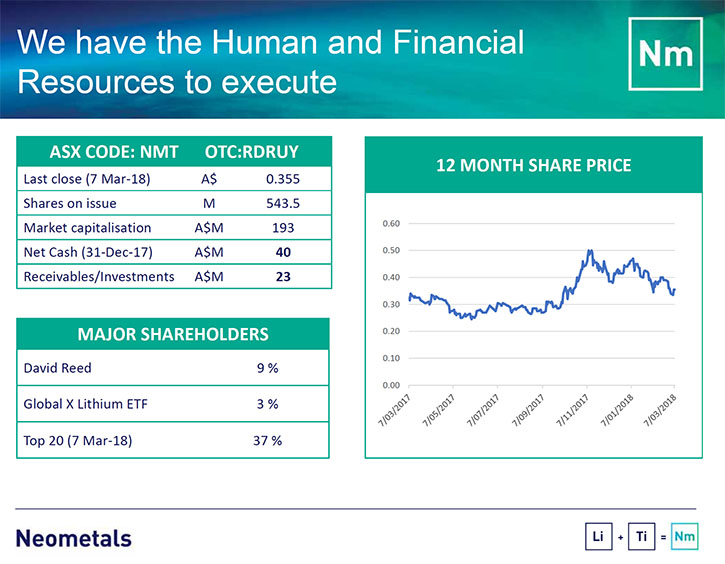

Dr. Allen Alper: That's great, you have an excellent background and an outstanding board. You have the team to do it and you're showing that you can do it, that's wonderful. Could you say a few words about your share structure?

Michael Tamlin: Yes. The company is traded on the Australian Stock Exchange, under the ticker ASX:NMT. At the end of April, our shares were trading at about 33 cents Australian, with roughly 540 million shares. The market cap at that stage was 179 million dollars, it's slightly up now. Our aim is to increase the market capitalization substantially, in a sustainable way and look after the shareholders, through both capital growth as well as having paid dividends where possible. We have no debt in the company and a significant amount of cash, which is marked for the development of the company. For the time being, we are moving along on our development path, using the cash. Once we have the investment decision and the need to fund projects, we will then be engaging in the fundraising process. For example, with the Lithium Refinery Project, in progress now, we are planning development for the funding strategy and the state of discussions on that, with a view to implementing it at the appropriate time.

We also have the facility through NASDAQ (OTC:RDRUY) now and those details are available on our website. The company is free of debt, has a strong position and we're in the middle of our budgeting process now, to ensure our cash is deployed wisely over the next year.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Neometals?

Michael Tamlin: Yes, we have development horizons that should provide us with enhanced financial position, through development of expansion at Mt Marion, coming in the last part of this year, which will remove pricing discounts for lower grade concentrates as well as increasing the total output. From the end of this year, we expect that the return for Mt Marion operations will increase as a result. We will then be involved in the Kalgoorlie Lithium Refinery Project that will upgrade the value of the lithium units that we produce and result, in the next few years, in us having another stream of income at a higher margin than is available from the mine. Battery recycling, developing a very low cost position in the cost curve and what we have forecasted as very profitable business in the future. That development will also be commercialized in two to three years, probably at the two year end of that timeframe if not before, if we can manage it. In the longer term, we have the prospect of increasing our revenue through development of Mt Edwards and potentially enlarging the lithium refinery to increase the revenue in profit from there. Also, in the five year timeframe, we'll be hoping to engage with a partner on the Barrambie property and full steam ahead in development of that project. In the meantime, over the next two years, we would anticipate some revenue coming from the DSO operations.

Key take-aways for investors should be that Neometals is heavily exposed to the world’s most sought industrial minerals and advanced materials. We are looking downstream to maximize margins. We have a strong track record and have built projects, attracted large partners and are on the cusp of regular revenue that lets us pay dividends. Our lithium and the chemicals made from that lithium have been validated and we have security over long life supply. With that as a backdrop, we have a clear strategy to grow and a strong balance sheet to chase that growth.

There are several milestones that we can look to, to enhance the company's size and strength, and return to shareholders.

Dr. Allen Alper: That's excellent. Those are very compelling reasons for our high-net-worth readers/investors to consider investing in Neometals.

http://www.neometals.com.au/

Chris Reed

Managing Director

+61 8 9322 1182

info@neometals.com.au

|

|