Interview with Ross McElroy President, COO and Chief Geologist, Fission Uranium Corp (TSX: FCU, OTCQX: FCUUF): Major Exploration Success by Award Winning Team and Strong Prospects

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/28/2018

Fission Uranium Corp (TSX: FCU, OTCQX: FCUUF) owns the award-winning Patterson Lake South uranium property, host to the near-surface, high-grade Triple R deposit, part of the largest mineralized trend in the Athabasca Basin region. We learned from Ross McElroy, who is President, Chief Operating Officer and Chief Geologist of Fission Uranium, that what makes the Triple R deposit unique, within the Athabasca Basin, is that it is very shallow with high-grade mineralization starting at 50 meters, and with the whole bulk of the resource (around 140 million pounds total) located between 50-meter depth to about 350. Large size, shallow depth and high-grade make this prospect an open-pittable deposit. We learned from Mr. McElroy, that the high-grade domain in the deposit averages around 18 to 23% U3O8, with the entire deposit being at average grade of 1.8 to 1.82% U3O8, which is in the order of magnitude of 10 to 20 times the average grade of most uranium deposits around the world. Plans for 2018 include completing pre-feasibility study, followed by full bankable feasibility by 2019, 2020. Beyond those milestones, the company can start looking towards production. The long-term plan is to be in production by 2025.

Fission Uranium Corp

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ross McElroy, President, COO and Chief Geologist of Uranium Corp. Ross, could you give our readers/investors an overview of your company?

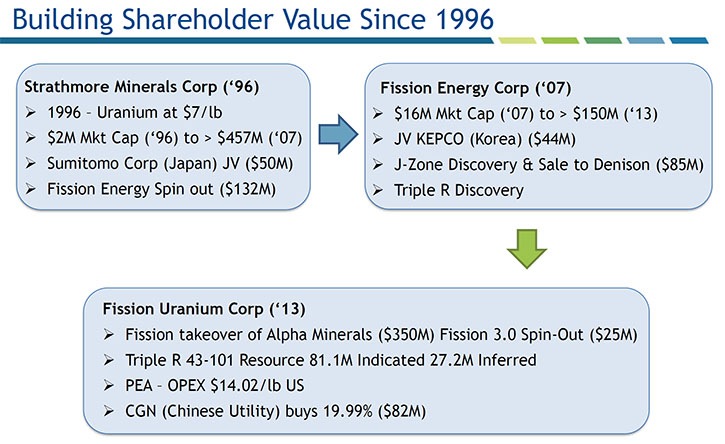

Ross McElroy: I sure can. Yes, Fission Uranium has been around, I suppose in various iterations, since the mid-1990s. We started off life as Fission Energy, which was a spin-out from Strathmore Minerals. Then back in 2013, bought Fission Energy. Denison acquired the majority of our land holdings, which at the time were located primarily in the eastern-Athabasca. We created Fission Uranium Corp and kept the western-Athabasca properties, including PLS, as well as our Peruvian property in it. In the late fall of 2012 we made the first discovery of high-grade mineralization on PLS. The PLS discovery was the first large discovery of a very high grade uranium deposit in the southwestern side of the Athabasca Basin. For the last five or six years, we've been focused on developing that asset into an absolute world class deposit, which we hope to see in production.

Dr. Allen Alper: That sounds excellent. You and Dev have built one of the most amazing uranium companies in the world. Is that correct?

Ross McElroy: I think we've won just about every major and recognized award in the industry. Not just in uranium, in the overall mining sector. This is a testament of our on-going discovery success and to the amazing project that we discovered back in 2012 on PLS. Dev and I have a long term partnership. We've been able to build significant shareholder value for our shareholders and develop a world class asset, the result of having a great relationship and project like PLS.

Dr. Allen Alper: Excellent! Could you elaborate on your PLS project and what you've found to date?

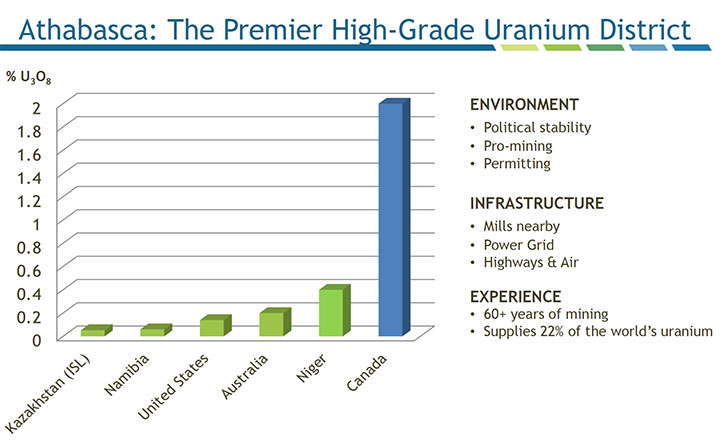

Ross McElroy: Sure. Just to put it in context, the Athabasca Base in the Northern Saskatchewan is recognized as being the premier district for hosting high grade uranium deposits. It's had a good 60-plus year history of development in mining high grade deposits. In the last forty years, those deposits have become extremely high grade. Some of the more familiar world-class projects mined are Key Lake, McArthur River, and Cigar. Those have primarily been located on the eastern side of the Athabasca Basin.

We focused on the western side of the Athabasca Basin, where very little exploration activity and mining had been done prior to our 2013 discovery year. Our target was just outside the margin of the basin. So we were looking for basement-hosted high grade uranium. We were very successful with that. It all started off with an airborne radiometric survey with follow-up prospecting. Our survey identified a large radiometric anomaly and ground truthing discovered the source was glacially transported high-grade uranium boulders. With drilling, we were able to trace the source area where the boulders came from. That was the discovery hole in 2012.

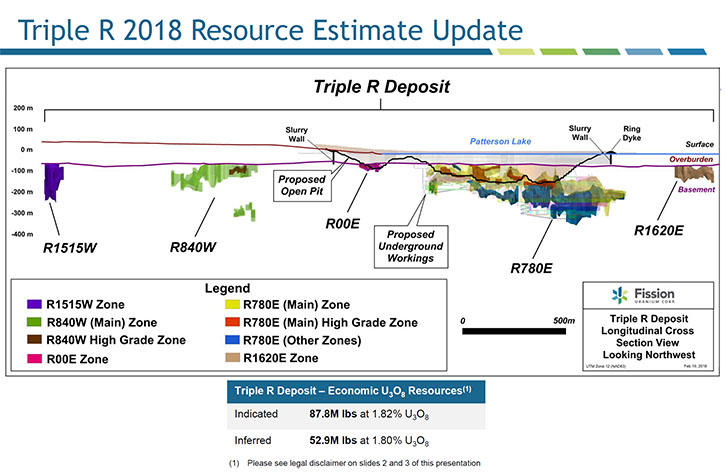

We made the discovery of the Triple R deposit in basement rock very close to surface. We've been working on developing Triple R over the last several years. It's grown to be one of the largest deposits in the Athabasca Basin. As is typical with Athabasca district deposits, it's very high grade. Triple R is unique, compared to any other project, in that it's so shallow. It's very close to surface. Our high grade mineralization starts at 50 meters. And the whole bulk of the resource is between that 50 meter depth to about 350.

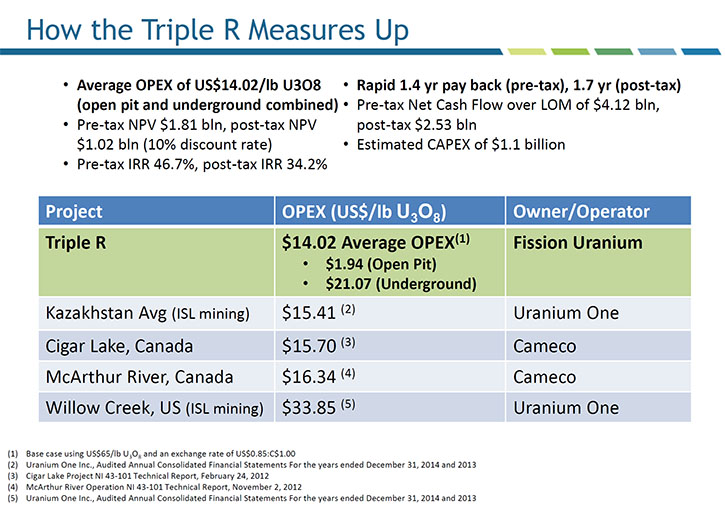

The size and grade and proximity to surface makes it an open pittable deposit, and we haven't seen open pit in the Athabasca Basin for a couple of decades now. Generally speaking, the open pit deposits are less expensive and less problematic to develop compared to underground uranium deposits. Most mining companies would prefer to develop open pit deposits. It's just simpler and the economics are generally much more favorable.

Dr. Allen Alper: Ah, that sounds excellent. Could you tell our readers/investors, a little bit about the size of the resource?

Ross McElroy: Sure. Speaking globally, we're looking at more than 140 million pounds total in all categories. But, when we report resources, we break that out between indicated and inferred categories. Our indicated resource is currently about 87.8 million pounds at a grade of 1.82% U3O8 in 2.2 million tonnes. And that's hosted primarily in the main R780 zone. 43-101 requirements state that only Indicated and higher categories are can be used at the pre-feasibility and feasibility stage.

There are almost 15 million pounds of the high-grade R780E domain that is classified as inferred and part of what we're doing is converting some of the inferred material in the main zone into indicated by doing some in-fill drilling. Ultimately, our goal is to be able to develop our pre-feasibility study on close to 100 million pounds. That's our target for the prefeasibility study. The other material, making up the additional, say 40 million pounds or so, is inferred category. That comes primarily out of new satellite zones that we've found along strike, which occur at similar depth, and also are high grade mineralization as well. These along-strike zones have been discovered both to the east and to the west of the main zone. Thus the project continues to show great strength in the ability to find more and more high-grade uranium near surface. That's the earmark of PLS. All five zones that are in the resource estimate are all shallow depth. The mineralized footprint of Triple R measures about 3.2 kilometers in strike length. This footprint is the most laterally extensive strike length of any deposit and continues to grow.

Dr. Allen Alper: Ah, that sounds excellent. Can you say a little bit more about your grades?

Ross McElroy: Sure. The overall resource averages between 1.80 and 1.82% U3O8. There are certainly some very high-grade components to the deposit. In fact, what we call our high grade zone, in the main 780 zone, averages around 18 to 23% U3O8. This very high grade core is a spine that runs down the entire strike length of the deposit. Basically, down the middle. The lower grade envelope is around that high grade core. There're two main grade zone horizons to it, the high grade down the middle, the lower grade around the side.

We're in the order of magnitude of 10 to 20 times the average grade of most uranium deposits around the world. That's what make the Athabasca unique. That's what we have. It's a large deposit, it's unique in that it is near surface.

Dr. Allen Alper: Oh, that's excellent. Could you tell our readers/investors, a bit about what's happening in the uranium market worldwide and demand?

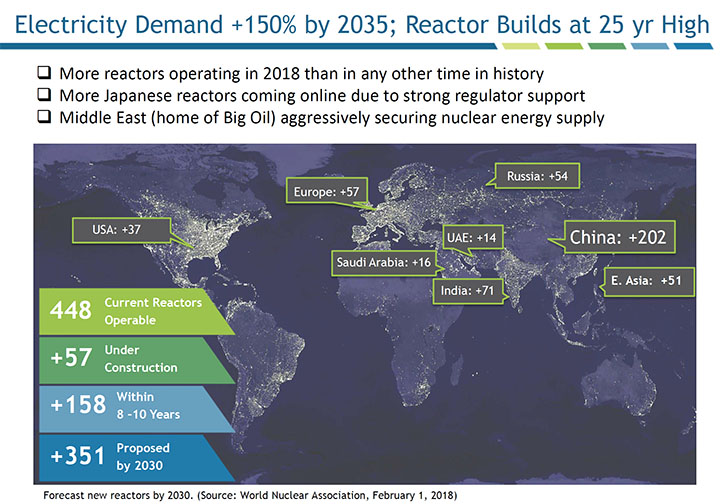

Ross McElroy: The uranium market has been in a multi-year prolonged downturn. Basically since financial crisis of 2008 and then more significantly after the Fukushima earthquake event back in 2011. Fukushima disrupted the cycle and mechanics of how the utilities purchase uranium. They used to buy uranium on contracts that were medium to long term in order to provide fuel for their generators, planning outwards of 5 to 10, to even 15 years. After Fukushima, this process has been broken, with the net result being a low drifting price of uranium. Yet, on the other hand, demand continues to grow. We have significant growth in the number of reactors world-wide and most significantly in China. India's starting to build more and more reactors, as are a number of other countries.

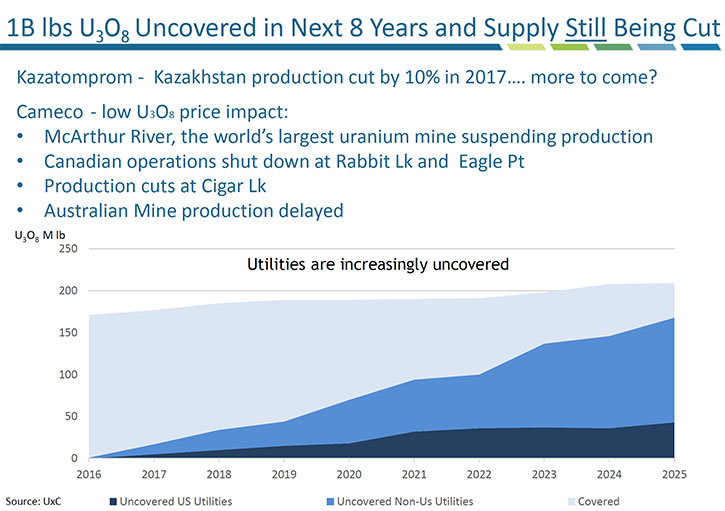

Even the Middle East is becoming quite aggressive in building out nuclear power. It's seen as an alternative to fossil fuels. You can get scalable base-load electrical power generators from nuclear reactors. Many of the developing countries are working strongly towards building more and more nuclear power plants to provide increasing electrical demand. Because of the prolonged downturn in the price of uranium, all of the lowest cost producers, the Kazakhs, and the Athabasca high grade deposits that Cameco operates have been curtailing production.

So in the case of Kazakhstan, they've announced production cuts of up to 20% annually and it may even increase this amount of production curtailing. I've seen some reports that indicate that they're production cuts may be even higher. Close to 25%. In the Athabasca Basin, Cameco shut down its flagship, McArthur River Project. These are all the lowest cost uranium producers. With the price of uranium where it is right now, even the lowest cost producers are not able to provide fuel. Yet, demand is growing with the number of reactors online. I think, not too far in the future, the price will have to rise. The utilities that need the fuel are going to be paying more to get it.

It’s just the nature of our business, but our share price is very much tied with the price of uranium. We're looking for better share performance in the foreseeable future, once the price of uranium goes up. In fact, even this year, we've seen the price of uranium move up from the bottom, from the low $20 dollars, to currently trading around $23 a pound on the spot market. Likewise, our share price has shown appreciation. We think this trend will continue. It is pretty clear to me that there's no new production coming online with uranium prices where they are. I don't even think you'll see any new production on a global basis coming on until uranium is far north of 40 dollars. In fact, most analysts don’t expect meaning new production until Uranium reach the $60 to $70 a pound range.

When that happens, I think we'll be sitting in a very good place with our project of PLS. Our plan is to have our pre-feasibility study done in 2018. I think we can follow on the heels of that, with a full bankable feasibility, within about a year and a half after that. It’s possible, PLS could be a producing asset by 2025. That's the goal. That's when we think the price of uranium will certainly have corrected itself. In fact, we're already starting to see an improvement in the overall sector. Investors should start to take notice. The uranium sector is starting to move upwards. And share prices are starting to go up. It's time to start picking who you think will be winners in the sector.

Dr. Allen Alper: Ah, that sounds good. Could you tell our readers/investors a bit about your strategic Chinese part in CGN?

Ross McElroy: Yes, back two years ago, in 2016, CGN, which is one of the two state owned Chinese nuclear utilities, bought a 19.9% equity in Fission Uranium Corp. CGN is now our single largest shareholder. They have two board members on the Fission Board of Directors. We also have an off-take agreement with CGN for 20% of the annual production with an option for an additional 15% of annual production. So having the world's strongest and largest utility backing, our project is great validation of the project itself. It shows China's long term need and vision for nuclear fuel. When they went shopping for deposits, in which they could gain a significant interest, and ones they believed would eventually reach production, this was the project that was number one on their list.

They looked at everything. They liked what they saw with PLS and the Fission team. It's been a very good, strong relationship. Their investment brought about 85 million dollars into our treasury. That's what we've been using diligently towards continuing to build the resource, over the last couple of years, and completing our PEA back in 2015 and the PFS in 2018. Backed by such a strong group, with a great forward vision of the uranium market, I think is excellent for Fission and for Fission shareholders.

Dr. Allen Alper: Ah, that sounds excellent, to be backed by such a strong buyer of uranium materials, of nuclear reactors.

Ross McElroy: Well, it really is. China is the big growth story out there. As I mentioned earlier, there are a lot of countries that are building reactors. There're more operating reactors now than any time in history. But China is the largest, most aggressive builder of the reactors anywhere. It bodes well for us to have their support. It will be only a few short years from now when China is the dominant country in the world, with the highest number of reactors. Right now, they have about 38. But you start looking outwards of 10 years from now, China may have more than double the amount of nuclear reactors operating in the United States, currently, the largest country by fleet of reactors. So it's truly a remarkable growth story and an excellent partner to have backing us.

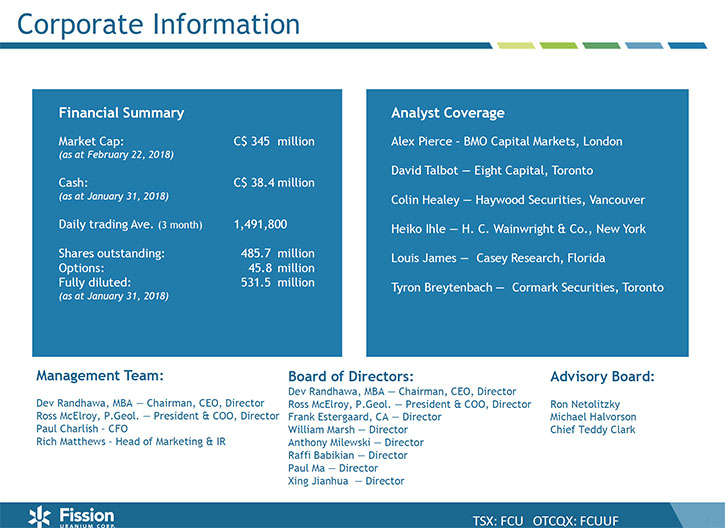

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your share and capital structure?

Ross McElroy: We have about 485 million shares outstanding on Fission Uranium Corp. CGN, our single largest shareholder, has 19.99% equity in the Company. We have a fairly diverse group of large shareholders in Canada, Europe and Asia, including, JP Morgan out of London. As insiders, Dev Randhawa, our CEO and Chairman and myself, have a significant number of shares. We believe strongly in our story. We believe strongly in the company and the product and our ability to be able to move the company forward.

Dr. Allen Alper: That sounds excellent!

Ross McElroy: We currently have about 30 to 35 million dollars in the bank. That should be more than enough to take us through the next two years of development and exploration. We'll certainly be able to complete our pre-feasibility and even part of the way through our feasibility studies, with the treasury that we do have in the bank.

Dr. Allen Alper: Excellent! That's an excellent and rare position to be in. Very good! What are the primary reasons our high-net-worth readers/investors should consider investing in your company?

Ross McElroy: Well, I think your readers would want to be comfortable with investing in uranium to begin with. Most analysts out there think uranium is the next commodity to move. A number of other commodities have moved, including a lot of the base metals. Even precious metals have certainly shown vast improvements over the last couple of years. Uranium has not yet had its move. But now that we're starting to see the utilities come back into the game, the prices being forced higher by the low cost producers shutting down production, I think uranium has a strong upside.

When you start looking at quality uranium companies out there, there's really only a handful of companies that you can choose. You want to pick a company with strong management, with the proven ability to be able to not only raise capital, but be able to put that capital to work effectively. And eventually monetize your asset as well. We have been able to monetize value by selling assets, such as our 2013 sell of Fission Energy to Denison Mines. Now with PLS, we have an even more substantial asset in Fission Uranium Corp. We've done it before.

So we have a long history. Dev's been remarkable at being able to raise capital over the last 20 years. Coupled with our technical expertise, and in being able to figure out how to put that money to work effectively, is what has made us successful. We've done, I think, a great job at building shareholders wealth. That sets us apart from all of our peers and competitors. So look for uranium to have its better days in the very near future. And look for companies with a great balance sheet, great world class assets, and strong management, with a proven track record and Fission should be right up there on your radar.

Dr. Allen Alper: Sounds like excellent reasons for our high-net-worth readers/investors to consider investing in Fission Uranium. Is there anything else you'd like to add, Ross?

Ross McElroy: Well, our near term news flow will be a summer program. We've not yet announced the details of it, but we are working towards having our summer program. I think that we'll likely see drills turning by early July, maybe mid-July. Part of our focus, the work we have ahead of us, is completing the pre-feasibility work. We should be able to wrap that up by the end of 2018. So that's where a great deal of our focus will be. And if the uranium market continues to improve, look to us to be an aggressive player at some point.

We've been very diligent about how we're spending money and mindful of the fact that the sector has been in a prolonged downturn. We really cut back spending on what we do in the project, and G&A running the company. If the market improves and we're starting to be rewarded for our drill announcements, our new high-grade discoveries and advances in the project, look to us to start being a bit more aggressive on the ground and taking advantage of that situation. We should have good news flow from now throughout the rest of the year and going forward.

Dr. Allen Alper: That sounds excellent.

https://www.fissionuranium.com/

Ross McElroy, President and CO

TF: 877-868-8140

ir@fissionuranium.com

|

|