Levon Resources Ltd. (TSX: LVN): Exploring One of the World's Largest Silver Resources, Interview with Ron Tremblay, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/28/2018

Levon Resources Ltd. (TSX: LVN) is exploring one of the world's largest silver resources at the company's 100%-owned Cordero Project in northwest Mexico. We learned from Ron Tremblay, President and Chief Executive Officer of Levon Resources, that they recently announced a 30% increase in the resource, which is now one and three-quarter billion silver ounce equivalent and a PEA, which is giving them a net present value just under $400 million. According to Mr. Tremblay, silver prices should go up, following gold’s upward movement. Levon plans to grow the resource even bigger and to improve the grade as well. Mr. Tremblay believes that the company has lots of upside potential and is way undervalued compared to some of their peers.

Levon Resources Ltd.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ron Tremblay, President/CEO of Levon Resources, Ltd. Could you give our readers/investors an overview of your company, your focus and current activities?

Ron Tremblay: We have a very large resource in Mexico, in southern Chihuahua State by Hidalgo del Parral. The project is 35 kilometers northeast of Hidalgo del Parral, which is just north of the Durango border in Mexico.

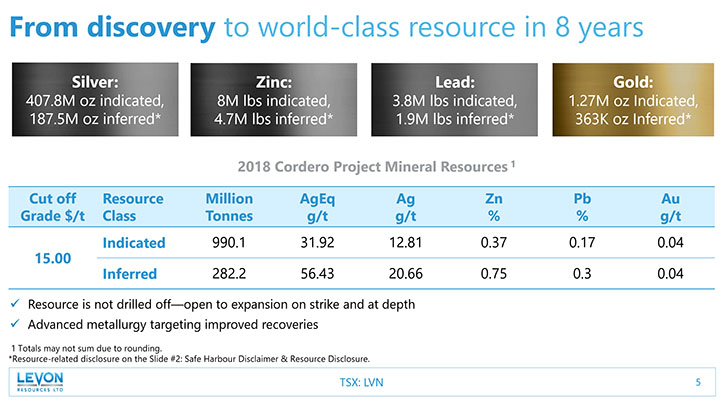

We have a very large resource, and we just announced an updated resource from 1.2 billion silver ounce equivalent up to one and three-quarter billion silver ounce equivalent, so an increase of about 30%. It's silver, gold, lead, zinc, only metallic systems. The majority of the resource is in indicated. In order to get it into measured, we just need to go into a pre-feasibility.

Right now, we just did a new, updated resource, and a PEA (preliminary economic assessment), which is giving us a net present value just under $400 million at below current metal prices. At $25 silver, which is a $5 increase, it bumps the net present value of the resource up to almost $800 million.

You can see, with the slight move in silver, the net present value of the project becomes very, very, very, very big, and growing. If silver performs the way it did about eight years ago, when it went to $49, which, we believe it will, and probably go higher, the numbers just go off the charts.

Very excited about where we are! We're happy to have it. If you compare us with our peers, we're right in the same ballpark as far as the internal rate of return, net present value, and CapEx. We're talking a CapEx in the $500 million range. It all makes sense, economic sense. The resource is big, and a little bump in the price of silver, and this thing becomes a barn burner. We're very excited about it.

Dr. Allen Alper: It sounds like you have great results, and you're sitting on and developing a great property. Looks like at some point the market will favor you.

Ron Tremblay: Yeah, we hope so. When silver started to move up, the last move, it went up to about $21. The stock price doubled and tripled. Obviously, when the metal price starts to move, we're tied to the metal price. We're an excellent call on the price of silver.

Dr. Allen Alper: Sounds excellent! Could you refresh the memory of our readers/investors on your background, your team and your board?

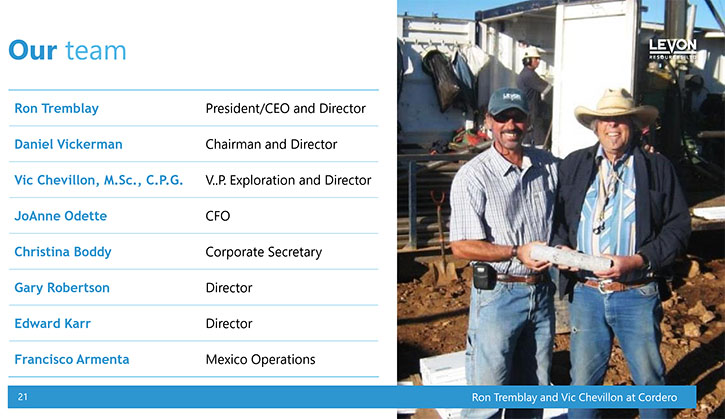

Ron Tremblay: Sure. I was with Yorkton Securities for many years in mining finance. My guys have all been working in the resource IR sector for about 30 years each. We have a lot of experience. Our geologist has about 40 years’ experience with majors. We have a very good team, and we're very excited about the prospects moving forward. The only metal that hasn't moved is silver. It has to move pretty soon.

Dr. Allen Alper: Yeah, usually gold and silver move together. Gold has made its move.

Ron Tremblay: Right. It's the biggest spread between gold and silver, I think it's like 85 to one or something. It should be like 20 to one. If it goes to 20 to one, we're talking like 60, 70, to $80. A big, big, huge difference in the price. At some point, it's going to change.

Dr. Allen Alper: Looks like that's coming.

Ron Tremblay: Yeah.

Dr. Allen Alper: It may be 2018.

Ron Tremblay: Can't happen soon enough. Can't happen soon enough.

Dr. Allen Alper: Well, you've been patient long enough.

Ron Tremblay: Yeah, we've been patient for a long time. Now, we're ready to move.

Dr. Allen Alper: Sounds excellent. Could you tell our readers/investors a bit about your share and capital structure?

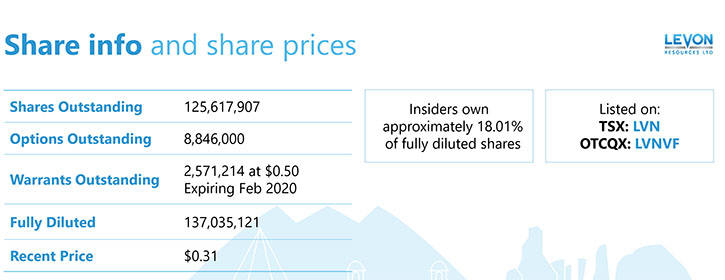

Ron Tremblay: There are about 122 million shares issued and outstanding. I'm the largest shareholder. I control about 17 and a half million shares. We have a lot of good shareholders, a lot of good long-term shareholders that like the project, and believe in silver moving forward. I expect that, a little move in the price of silver, and we're going to see a lot of interest.

We're working hard to create more investor interest, but it is hard with the metal price where it is right now. But, it should be right around the corner.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Levon Resources?

Ron Tremblay: It's a call on the price of silver. One of the biggest out there, if not the biggest. We'll be doing more drilling, and it'll get bigger. We're not done. It's still open. It's going to grow a lot more from here.

We only did under 6,000 meters of drilling, and we bumped the resource up 30%. When we drill closer space, the grade improves, as well. It's all looking very positive.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, Ron?

Ron Tremblay: No, I don't think so. I think we're, we're located very well. If you compare us to some of our peers, you'll see that we're way undervalued. I mean, one of our peers with very similar economics and CapEx in Peru, and they're way up at 20,000 feet. We're at like 3,000 feet in Mexico, next to a major highway, with good infrastructure, roads, and a good workforce close by, and they're trading with about a $200 million market cap. We're trading at a $40 million market cap. That ought to give you an idea of where we should be trading.

Dr. Allen Alper: Well, that shows there's a great opportunity.

Ron Tremblay: Great, exactly. Lots of upside potential.

Dr. Allen Alper: Absolutely!

http://www.levon.com/

Ron Tremblay

President and Chief Executive Officer

778-379-0040

|

|