Interview with Claude Lemasson, President, CEO Eastmain Resources (TSX:ER, OTCQX: EANRF): Eau Claire High-Grade Low-Cost Gold Project, a Positive and Robust PEA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 6/27/2018

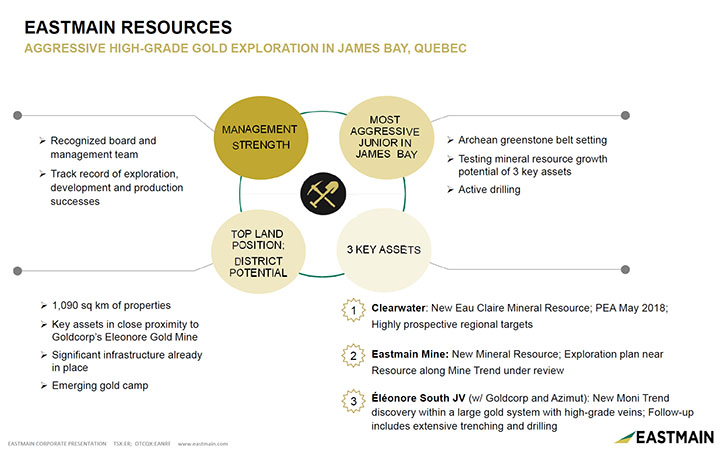

Eastmain Resources (TSX:ER, OTCQX:EANRF) is a junior gold exploration company, with three main projects in the region of James Bay, northern Quebec: the Eau Claire Project, located approximately 800 kilometres north of Montréal, the high-grade Eastmain Mine Project, located within the Upper Eastmain River Greenstone Belt of northern Québec, and the Eleonore South Joint Venture with Goldcorp and Azimut, located in the Opinaca geologic sub-province of James Bay, Québec, where they announced a major discovery in October 2017. We learned from Claude Lemasson, President and CEO of Eastmain Resources, that the company recently published a PEA and updated mineral resource estimate for their Eau Claire Project. The results of the PEA are very robust, showing a high-grade low-cost gold mine, combination open pit and underground operation, that will produce just over 950,000 ounces of gold over the 12-year life of the mine with payback of just over 3 years. Going forward, as it approaches a development decision, Eastmain would want to look at opportunities such as potential strategic investments or partnerships with others to advance the project. Also, raising money in the market is an opportunity as well as looking at other different forms of financing.

Eastmain Resources

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Claude Lemasson, President and CEO of Eastmain Resources. Could you give our readers/investors an overview of Eastmain?

Claude Lemasson: Yes, absolutely, and thank you for having us. Eastmain Resources is a small Junior Exploration Company that is specializing in Gold and mainly has projects in the region of James Bay, Northern Quebec. We have three projects that we are advancing. The first main project is called Eau Claire, for which we have just issued a PEA, a Preliminary Economic Assessment. We have the Eastmain Mine Project, where we have a new high-grade gold resource estimate as of last January. We also have the Eleonore South Joint Venture, which is a Joint Venture with Goldcorp and Azimut, which is near Goldcorp’s Eleonore Mine in Northern Quebec. We announced a major discovery in October 2017 on that property.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit about the highlights of the Preliminary Economic Assessment?

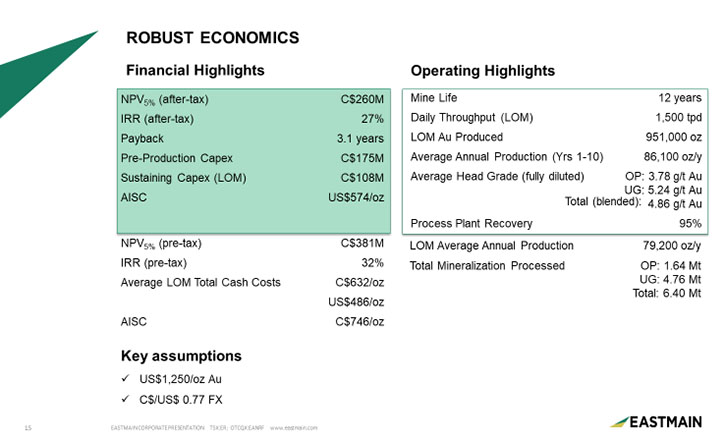

Claude Lemasson: Absolutely. After a solid two years of working fairly extensively on the Eau Claire Project, we extended the drilling, mainly infill drilling, that was done. We had, two years ago, about 200 thousand meters of drilling and we have since added another 91,000 meters. So we were at 291,000 meters of drilling on the deposit. It's a high grade gold deposit and it's in James Bay, Quebec. So, with all of that drilling, we issued a resource last September, 2017, and that resource was very solid, very robust. Based on that, we decided to proceed and drill a few more holes. We added a little bit to the resource; we ended up with a revised resource that was combined with the PEA. So the PEA work was done mostly in the last four or five months and we just issued the results on May 23rd. The results of the PEA have been very, very strong, very robust results. We have a high-grade gold mine, combined open pit, and underground operation for a life of mine of 12 years. The open pit is the start of the mine with a 3-year life for the open pit. It's very high grade at 3.78 grams per tonne, and that's a diluted grade, so very high grade. While the open pit is being mined, we proceed underground and we have about 10 years of mining underground.

As far as the key economic factors to consider out of the PEA, we have an after tax net present value at 5% of over $260 million. We also have an Internal Rate of Return, so an IRR, after tax of 27% and a payback of just over 3 years. Very significant numbers, very robust. The pre-production Cap-Ex (capital expenditure) required to build the mine is $175 million, and then the money spent during the mine life, as far as sustaining capital, is another $108 Million, during the 12 years. Our all-in sustaining cost, which is a measure to compare the cost per ounce required to extract gold out of the ground and produce it. Our all-in sustaining cost is extremely low at $574 US per ounce. Our production rate would be 1,500 tonnes per day and we would produce just over 950,000 ounces of gold over the life of the mine.

Dr. Allen Alper: That's fantastic! So, what are your plans going forward?

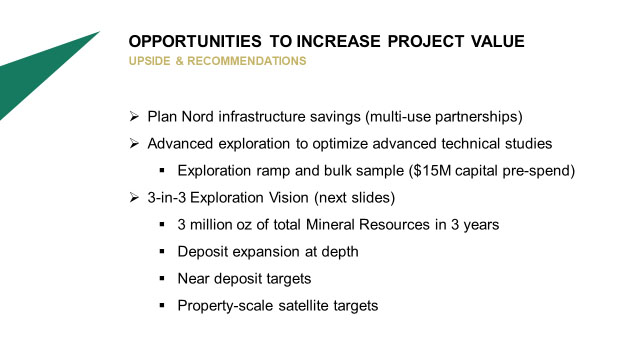

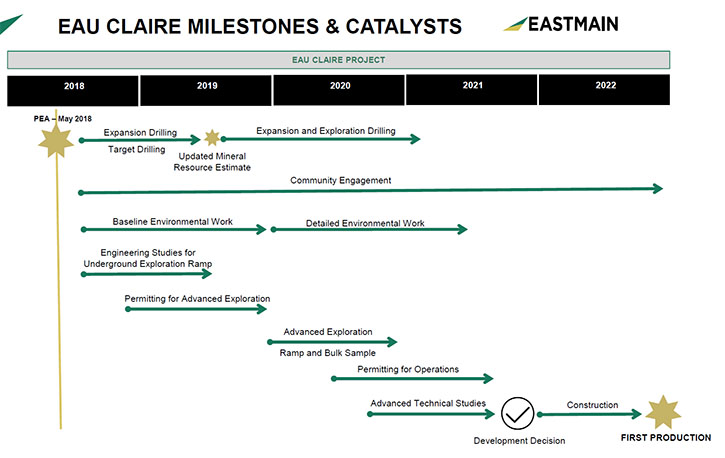

Claude Lemasson: Now that we've reached this major milestone, which is the biggest achievement the company has seen in its life, we are moving forward with a multi-faceted series of opportunities to move the project forward. First of all, we want to advance the various technical studies. When I refer to technical studies, I'm talking about work that has to be done to head towards feasibility studies, some geo-technical work as well as some metallurgical work, to advance the project.

Parallel with that, we're going to start baseline environmental work. This is what's required to trigger the permitting of the project. We'll start all of that work within the next few months. We'll also start community engagement. Now that we have a PEA to talk about, we're able to show a 3D model and 3D video to the Cree communities of James Bay, which are very supportive, proactive, and very pro-development. We will be showing them what we plan to do on this site. We are excited about our exploration vision. We believe we can grow the resources.

We have a 3-in-3 vision, getting to 3 million ounces of gold in a 3-year period. To build upon the PEA itself and the Eau Claire deposit, we have different areas of expansion that we're looking at for exploration. We continue to be open at depth, so we will continue to drill the deposit deeper to expand the deposit. At surface, near the Eau Claire deposit, within about a 3-mile radius, we have six different key targets that we've identified, where we want to do more exploration, including drilling, to be able to identify more mineralization and ultimately increase the potential feed of ore to the mill. These are all part of our plans moving forward. We have a clear plan to get to a development decision within 2 to 3 years and then build the mine and start producing.

Dr. Allen Alper: Do you plan, at that point, to build it yourself?

Claude Lemasson: Well, we're a fairly small junior company and in most situations like this, you have to look at all of the opportunities as you're advancing the project. If you have a strong, robust project like we do, you have to look at your opportunities and your abilities to finance a project of this size. Although it's a fairly straightforward, very solid, smaller, highly profitable gold mine, we would want to look at opportunities such as potential strategic investments or partnerships with others to advance the project. Also, raising money in the market is an opportunity as well as looking at other different forms of financing. All of these things would be under review in the next couple of years as we approach a development decision.

Dr. Allen Alper: That sounds very good. Would you like to say anything about your other projects?

Claude Lemasson: We issued a new resource at the Eastmain Mine Project, with a lot of potential for exploration near the existing resource. We're planning on doing some more exploration later this year to the northwest of the resource. That's a high-grade gold resource, over 8 grams per tonne. Our plan is to explore further to identify more mineralization.

On our third project, the Eleonore South Joint Venture, with our two partners, we are furthering the exploration efforts aggressively, doubling the amount of work being done as we move forward. We are taking the opportunity to build on the discovery that we announced last fall. We have plans to do a lot more trenching and stripping as well as drilling, to basically identify more mineralization that will ultimately lead us to establishing a maiden resource on that project, located only about 10 miles away from the producing Eleonore Mine, which is a gold mine that has a mill, with capacity, a perfect arrangement.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your background, your team, and your Board?

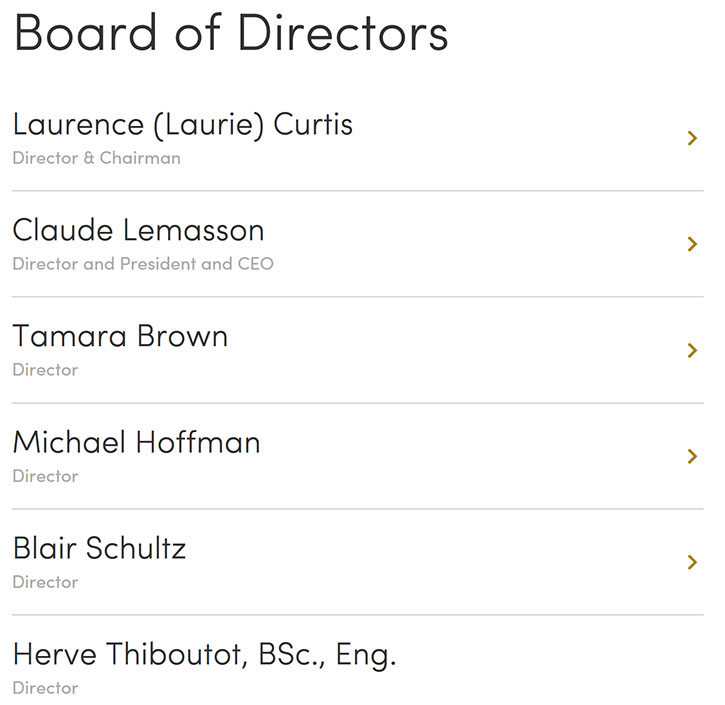

Claude Lemasson: Yes. We put a team together a couple of years ago. The company has been around for many, many years, but we made some changes so we could advance these key projects. We have a new six person Board. I'm a director. All six members of the board of directors are experienced people in different facets of the mining business, whether it's geology or mining or finance, a very strong, supportive board. When I took over two years ago, I rebuilt the management team from scratch and established a very strong, very lean and nimble team. All of them are very qualified within their field of expertise. Whether it's finance, or geology, or exploration, or even on the technical side on projects and project development. I've been in mining for over 30 years. I've been working, moving up from originally being a construction engineer, building mines, into operations, over my career to become an executive in various companies. And now I’m the President and CEO of Eastmain. My expertise is to take projects from the advanced exploration stage, move them through all the work and the studies to reach a development decision, and then build mines, and then bring them into operation. The Eastmain projects are in my wheelhouse and we are taking the Eau Claire Project, and moving it forward.

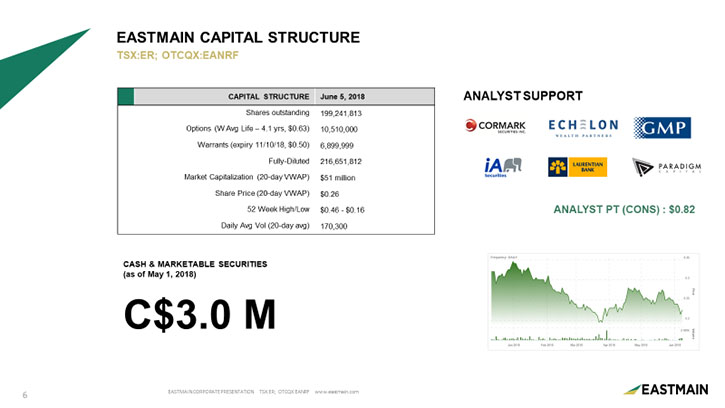

Dr. Allen Alper: It sounds like you have an excellent background and a very strong, experienced team. That sounds very good. Could you tell our readers/investors a bit about your capital structure?

Claude Lemasson: Certainly. First of all, we are listed on the TSX, on the main board in Toronto under ER for Eastmain Resources. We're also listed in the U.S. on the OTCQX under EANRF. Our U.S. investors can trade our stock in the U.S. We have just under 200 million shares outstanding. Our current share price is around 25-26 cents Canadian, equivalent to roughly 20, 21 cents U.S. We have a market cap around $50 million Canadian right now, obviously much lower than it should be. We believe this is a great opportunity for investors now that we've established a much greater value in our key projects moving forward. That's our structure, we are fairly liquid, we trade anywhere between 200 and 500 thousand shares per day, making our shares quite available to the investor.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should consider investing in Eastmain Resources?

Claude Lemasson: One of the main reasons is that we've methodically and systematically delivered on key milestones over the last two years, culminating in this preliminary economic assessment for our main asset, the Eau Claire Project, which is well established and has a fairly strong evaluation. We believe there's an opportunity right now for the investor to look at that opportunity, which is based on high grade gold in the ground, and be able to compare to potential peers and also to other investments. When we look at how undervalued we are in general, Eastmain’s market cap is approximately 20% of the valuation established by the Eau Claire PEA and this also ignores any value for our Eastmain Mine Project and Eleonore South Joint venture. This means that it's a great opportunity for investors to get in at the bottom and then basically carry on with us as our valuation grows when the market recognizes the great news that we've recently issued, plus some of the catalysts coming up in the company. It's a very unique opportunity.

At this point in the market, many investors have not been investing in gold and gold equities, yet the gold price has been relatively stable and strong. However, the gold equities themselves have disconnected significantly from the gold price. That is meant to change moving forward. We think the gold price itself will continue trending up as it has been. As it does, I think the valuations of a lot of gold equities, including ours particularly, should increase significantly in the short term, and in the medium term, as well.

Dr. Allen Alper: That sounds excellent, sounds like compelling reasons for high-net-worth readers/investors to consider investing in Eastmain Resources. I and my family are stockholders of Eastmain Resources.

Claude Lemasson: Very good. Thank you for supporting us.

Dr. Allen Alper: We appreciate the work you're doing and you finished the PEA, so that sounds great. Was there anything else you'd like to add?

Claude Lemasson: I think it is time for investors to look seriously at gold assets because they are currently undervalued in general. This is a unique opportunity for investors to look at us as one of those opportunities to come back into the gold market and benefit from our progress.

Dr. Allen Alper: That sounds very good.

Disclosure: Alper family owns Eastmain stock.

www.eastmain.com

Claude Lemasson, President and CEO

+1 647-347-3765

lemasson@eastmain.com

|

|