Sandstorm Gold Ltd. (NYSE MKT: SAND, TSX: SSL): Very Successful High Growth Rate Gold Royalty Company, Interview with Nolan Watson, President, CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 12/3/2017

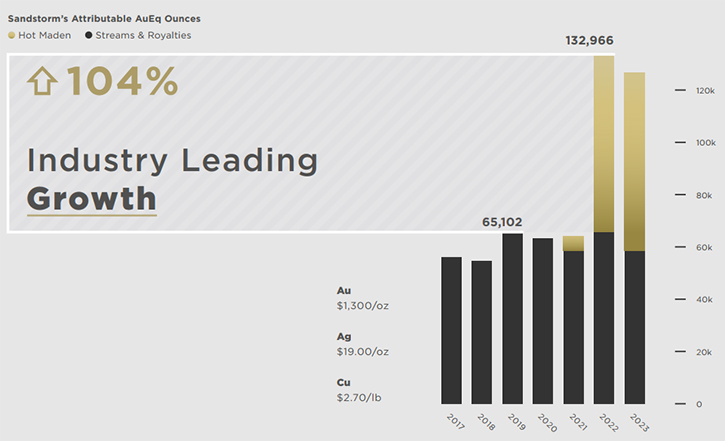

Sandstorm Gold Ltd. (NYSE MKT: SAND, TSX: SSL) is a gold royalty company that provides upfront financing

to gold mining companies and in return, receives the right to a percentage of the gold produced from a

mine, for the life of the mine. Sandstorm has acquired a portfolio of 171 royalties, of which 21 mines

are producing. We learned from Mr. Nolan Watson, President, CEO, and Director of Sandstorm Gold, that

they have royalties all around the world. Their partners span everything from massive, major companies to

mid-tier companies, and even junior exploration companies. Their producing royalties generate about $50

million U.S. per year of free cash flow. This will go up to $100 million by 2022. According to Mr.

Watson, the company's main objective is to keep growing their portfolio, increasing the cash flow per

share, and increasing the value for shareholders.

Arizona Gold Project, Brazil, expected to generate US

$4.5 million annual royalty revenue to Sandstorm Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Nolan

Watson, President, CEO, and Director of Sandstorm Gold Ltd. Nolan, could you give our readers/investors

an overview of your company, your focus, and your goals?

Mr. Nolan Watson: Absolutely. Sandstorm Gold is a precious metals royalty company focused

on the mining industry. We have currently 171 royalties around the world, from a variety of projects,

with a variety of partners, in many different countries. Our partners span everything from massive, major

companies to mid-tier companies. We even have some royalties with junior exploration companies, so we

cover the entire gamut of the industry. Right now, in our portfolio, we have 21 royalties that are

producing. They're generating about US$50 million per year of free cash flow for us. We see that going

up, based solely on the things that we've bought already, to about US$100 million in free cash flow by

2022. We're trying to continue to grow that portfolio, increase the cash flow per share, and increase the

value for shareholders. We're also bullish on the price of gold. Hopefully, the gold price goes up and

increases those cash flow numbers even further.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit more about some of the

relationships you have with high level companies?

Mr. Nolan Watson: We have royalties and streams on projects such as the Cerro Moro mine

that Yamana is currently building and the Chapada mine in Brazil that Yamana operates. We have a gold

stream on a project First Majestic owns and operates, called the Santa Elena mine in Mexico. We have a

royalty on one of Rio Tinto's diamond projects, the Diavik diamond mine, one of the largest diamond mines

in the world. We have a royalty on Bracemac-McLeod, a polymetallic mine that Glencore operates in Quebec,

and a whole host of other assets. We have a stream and royalty on one of Endeavour's mines in Burkina

Faso called Karma, and we're working to continue to build out our portfolio of streams and royalties.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit more about how

the business deals work with some of your companies, what you do and what they do?

Mr. Nolan Watson: In royalty finance, we give the mining company a check upfront on day

one. In exchange, we get a percentage of the revenue going forward. It's a very, very simple business

model. Sometimes we call our contracts streams. The difference between a royalty and a stream is, in a

royalty you just get a percentage of the gold or a percentage of the revenue. In a stream, you get the

right to purchase a percentage of their production at a fixed, artificially low price. A gold stream

might say, "We get to buy 10% of your production at $300 an ounce." If gold's at $1,300 an ounce, our

margin per ounce is $1,000 per ounce. We get this stream of cash flow as we buy gold and sell gold under

that contract.

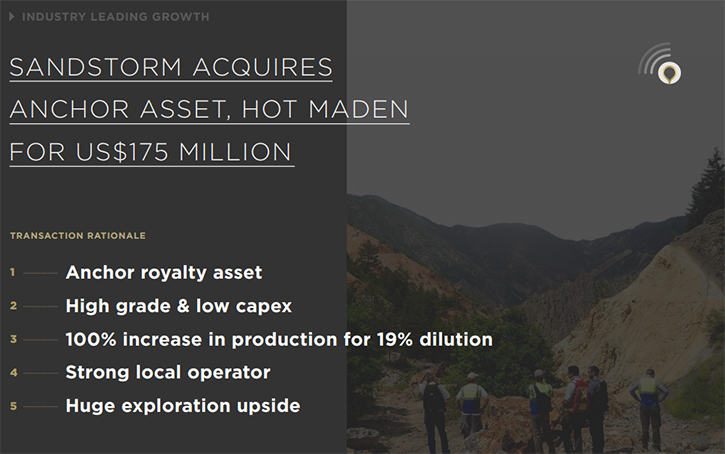

One of our largest investments is a form of net profits investment, where we get 30% of the

profits of a mine in Turkey, an asset called Hot Maden. It's our more recent acquisition. We're very,

very excited about it.

It's an ore body over 40 meters in width, about 30 grams gold in the high-grade main zone, where most of

the gold occurs. Anytime you can find something that's 30 grams gold over 40 meters of width, it's going

to be one of the most exciting, lowest-cost producers in the world, so we're very excited about that

recent addition to our portfolio.

Dr. Allen Alper: That sounds excellent. Could you explain to our readers/investors the advantages

of being a royalty gold stream company versus a mining company or just owning physical gold?

Mr. Nolan Watson: Absolutely. One of the advantages to our business model is that we don't

have to actually operate any of our assets. Whereas management teams of mining companies spend huge

amounts of time and effort managing the actual assets themselves, such that they find it hard to actually

focus on growing their company and adding value to shareholders on a per share basis through

acquisitions, we don't have that issue. As soon as we've made an acquisition, our focus immediately turns

and our attention turns to what royalties and streams we're going to buy next to add to our portfolio.

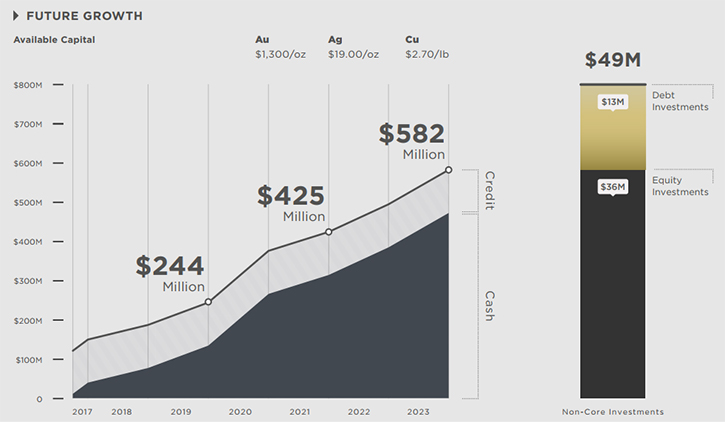

Companies like Sandstorm usually grow much faster than typical mining companies and

have less risk associated with capital expenditure overruns, etc. In the vast majority of our portfolio,

we have absolutely no additional contributions we have to make to the capital expenditures of the mine.

Companies like ours tend to have no debt. Sandstorm is totally debt-free and totally unhedged, so we give

our investors full exposure to the upside potential in the price of gold without the downside risk of

having a struggling balance sheet, which most companies have because they've had to take on debt to build

mines.

There are a host of other benefits, as well. We have much less exposure to increases in operating

costs at the mines than the underlying mining companies would. It's a business model that has more growth

built into it, more excitement, and less risk. Whenever you can get more growth and more upside at less

risk, that's typically a better investment.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a little bit about

your background?

Mr. Nolan Watson: I've been in the mining industry my whole career. I used to work for a

company called Wheaton River Minerals, and then Goldcorp, and then was the first employee at a company

called Silver Wheaton, which is now Wheaton Precious Metals. They are one of the largest

streaming/royalty companies in the world. I was their Chief Financial Officer for a number of years,

until David Awram and I started up Sandstorm in 2009. We have been growing it for a number of years, and

are very proud of what we've built.

Dr. Allen Alper: That's great. Could you tell us a bit more about some of the other members of

your team and board?

Mr. Nolan Watson: We have a very experienced technical team. We hired them from the

International Finance Corporation. They headed up the metals and mining petroleum department at the IFC,

which managed billions of dollars in mining investments. Tom Bruington was the head of that technical

team. He has a master's in mining engineering and a master's in geology. He's seen hundreds and hundreds

and hundreds of projects over the years.

Keith Laskowski, is one of our senior geologists. Very experienced! We also hired him out of the

IFC. He's seen hundreds of projects as well. Tom and Keith are two of the key people on our due diligence

team. We also have other technical members on that team.

Our Chief Financial Officer at Sandstorm is Erfan Kazemi. He's a total all-star and has won

things like CFO of the Year awards. He used to be President of the Alma Mater Society at the University

of British Columbia when he went to school there, and he's a very experienced CPA and a Chartered

Financial Analyst.

We have a number of highly skilled people on our team, experienced in mining. The company is made

up of two types of people, either technical people who are geologists and engineers or corporate

development and banking type people who are CPAs or CFAs, or in many cases both.

Dr. Allen Alper: Sounds great. Sounds like you have an excellent background and a great team.

Could you tell our readers/investors a bit about your capital structure, your share structure and some of

your key investors?

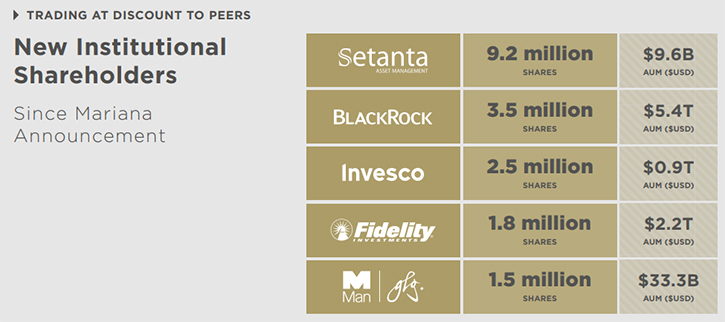

Mr. Nolan Watson: In terms of capital structure, we have no debt at the moment. We're

completely debt-free. We've been financed, primarily, with cash flow from operations and equity.

Currently outstanding are 181 million shares, and we're continuing to reduce that number, because we're

operating under an active share buyback program. We have a normal course issuer bid that we use quite

frequently, so the number of shares continues to shrink. That's basically the share structure. There are

a few warrants outstanding, but most of them are not in the money. Some of them are warrants that other

companies issued and we bought those companies. A few of them are in the money, but we continue to buy

back shares and shrink that share number. As it stands today, market cap is about $800 million U.S., and

we're about $1 billion Canadian.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth

readers/investors should consider investing in your company?

Mr. Nolan Watson: Anyone who believes precious metals are going to do well should look at

Sandstorm Gold. However, we're an attractive investment even if precious metals don't go up. We have a

tremendous amount of cash flow when precious metals are high, and when precious metals are low. We

currently have no debt and substantial amounts of cash flow from operations. When share prices are low,

we are able to buy back our own shares and use those opportunities to make really exciting transactions.

If you look at Sandstorm's history, a lot of the best assets we've ever purchased have been in the

deepest, darkest days of the bear market cycles. We're either doing exciting deals when commodity prices

are low or we're making lots of cash flow when commodity prices are high. The business model works at

both ends of the cycle. We have a lot less risk than a typical mining company, and more upside, so we're

very excited about the business model. We're very happy with what we built.

Dr. Allen Alper: That sounds excellent. Do you have anything to add, Nolan?

Mr. Nolan Watson: I think Sandstorm is just starting to hit its maturity phase. Our

portfolio has reached what I would consider a critical mass. We have more growth already bought and paid

for inside Sandstorm than any other royalty company in the world in the metals and mining space, and

we're just getting started. I'm excited to see what we're going to be able to do in the next 5 to 10

years.

Dr. Allen Alper: That sounds excellent!

http://www.sandstormgold.com/

Nolan Watson

President & CEO

604 689 0234

info@sandstormLTD.com

dharris@sandstormLTD.com

|

|