Balmoral Resources Ltd. (TSX: BAR): Successful Well-Funded Canadian Exploration and Development Company, Expanding High-Grade Gold and Ni-Cu-Co-PGE Deposits in the Abitibi, Darin Wagner, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/18/2017

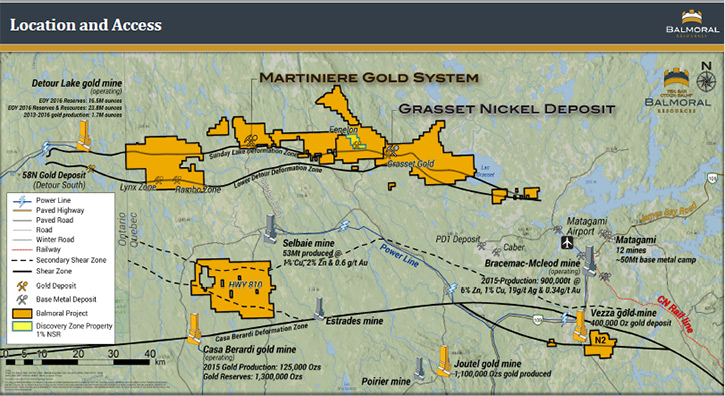

Balmoral Resources Ltd. (TSX:BAR) is a well-funded Canadian exploration and development company focused on delineating

and expanding numerous gold deposits and discoveries within the Martiniere gold system, on its 1,000 square kilometer Detour

Gold Trend Project in Quebec, Canada. The Detour Gold Trend Project also hosts Balmoral’s Grasset Ni-Cu-Co-PGE deposit, as

well as numerous other gold and base metal occurrences.

We learned from Darin Wagner, President and CEO of Balmoral Resources, that the Martiniere gold system is large, located in

a great jurisdiction and continues to grow, all of these factors leading to increasing interest in the asset. With planned

exploration work for 2018 already funded the Company is anticipated a steady stream of positive results from its recently

completed summer/fall 2017 program. , Employing an award winning exploration team, Balmoral has a philosophy of creating

value through the drill bit.

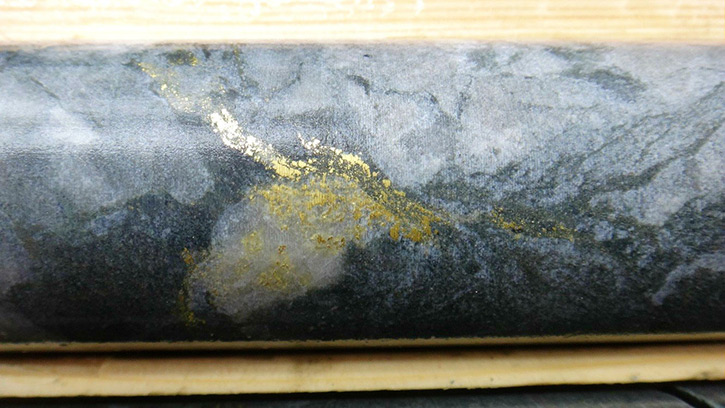

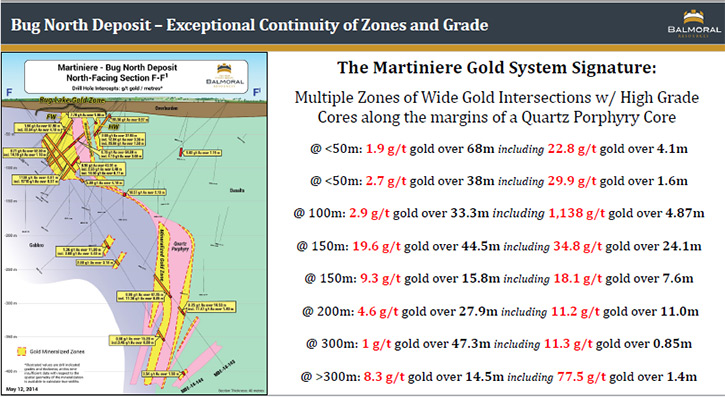

Bug Lake Footwall Zone - Gold Smeared on Outside of Core grading 1,138 g/t

gold over 4.87 metres

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Darin Wagner, President

and CEO of Balmoral Resources. Could you give our readers/investors an overview of your company, your focus and current

activities?

Mr. Darin Wagner: Absolutely. Balmoral is a Canadian-based and Canadian-focused exploration and development

company with two significant assets, a nickel asset and a gold asset, located in west-central Quebec, along the same

regional trend that hosts the mammoth Detour Lake gold mine right across the border in Ontario.

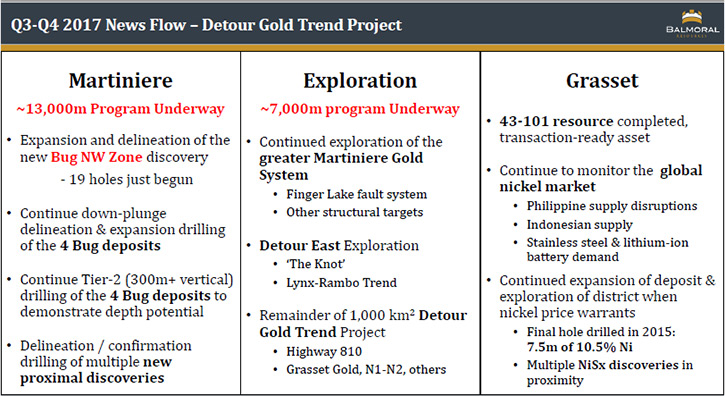

Our current focus is on the gold asset. That's the Martiniere gold system, which is currently in delineation. The

Martiniere system hosts four gold deposits which we are currently delineating in preparation for an initial resource

estimate.

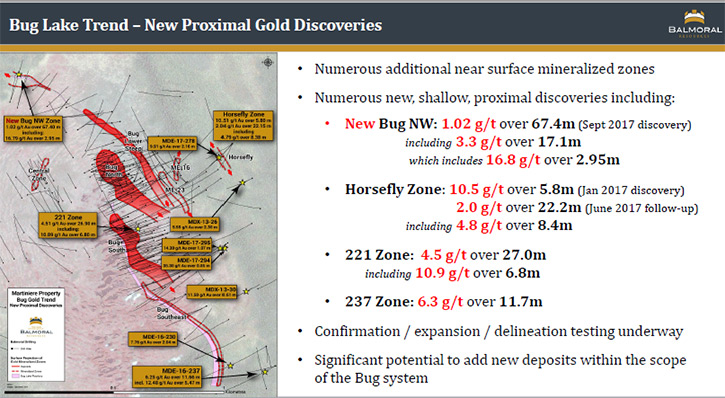

At the same time, we are working on continuing to expand and grow the system, both the four principal deposits, and

also a number of recent discoveries that are very close by to those four deposits. It's becoming quite a large gold system

and it continues to expand on multiple fronts. Unlike so many assets in this region that were first drilled in the 1950’s to

the 1970’s the Bug Gold Trend on the Martiniere Property is a new discovery made in 2012 and our understanding of it

continues to evolve with new discoveries made during every program since.

Dr. Allen Alper: Well, that sounds excellent. Could you tell us a bit more about it?

Mr. Darin Wagner: The Martiniere system hosts a series of gold deposits. There are currently four principal

deposits, three along what we call the Bug Gold trend and one along the Martiniere trend. All four deposits come to the

bedrock surface, and then they reach down as deep as 750 meters below surface. They're all open below that, so everything's

open to depth here. That's pretty typical of the Abitibi.

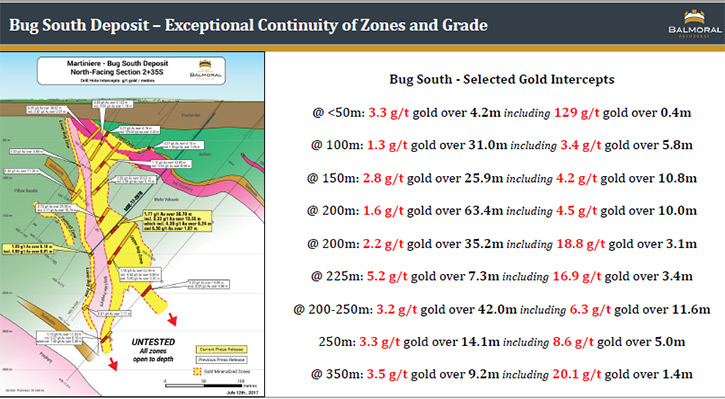

Each of the deposits is characterized by a high grade core zone. By high grade, we're looking at gold mineralization

which typically exhibits 5 to 20 g/t grades but will locally get into the 100 to 1,000 gram per tonne range. Then, they have

much broad lower grade halos of gold mineralization around them in the one to two gram range. That gives us potential to

start each deposit as a small open pit, and then progress underground targeting that higher grade mineralization. That's a

pretty typical mining scenario for the Abitibi region.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a bit about your neighbors and why this

region is so important?

Mr. Darin Wagner: This is one of the very best jurisdictions on the planet for gold mining. It has been for

decades, literally. Both Ontario and Quebec always finish near the top of any kind of ranking.

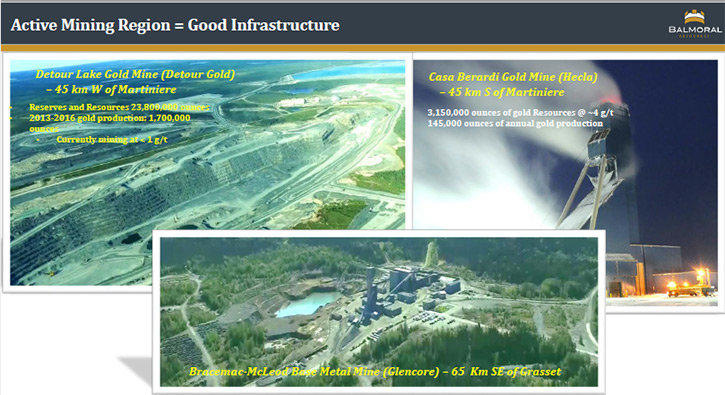

In terms of neighbors, it's an active mining region, which means our path forward is a fairly easy and a well

understood one. We have the big open pit low grade Detour Lake gold mine sitting just about 40 kilometers to the west of us.

About a similar distance down to the south of us is the higher grade underground Casa Berardi gold mine run by

Hecla. That's a gold mine that's was initially put in production almost 30 years ago.

Then, off the eastern end of the project package, we actually have base metal operations in the Matagami region.

Those are operated by one of the largest mining companies in the world, Glencore.

So it's a very active region. It's an area where mining is accepted and understood and supported. It's also, from an

explorer's point of view, where there is likely to be a fair level of interest in the assets as they evolve going forward.

Dr. Allen Alper: Sounds great. Could you tell us a bit about your Grasset nickel deposit, too?

Mr. Darin Wagner: Absolutely. That's the sleeper here, in terms of the company. We discovered the Grasset

nickel deposit in 2014. It's an open-ended 15+ million tonne nickel sulphide deposit which makes it the largest nickel

sulphide deposit in the region. It has a high grade core of about three-and-a-half million tonnes around which we based the

initial resource estimate the details of which are readily available on our website. It has payable metals in nickel,

cobalt, copper, platinum, and palladium. Metallurgically, it's a very simple nickel deposit and it sits right under the

existing logging road network.

It's been quiet for us the last couple of years because the nickel market has been extraordinarily weak. But, in the

last six or eight months, there’s seen a very strong increase in the nickel price on the back of the larger base metal run.

There’s a lot of chatter now around the need for nickel assets like Grasset to supply the burgeoning electric vehicle

battery world, where the vast majority of the cathode of the leading types of those batteries, no matter what else they're

comprised of, is actually nickel. Good quality nickel sulphide sources, which is exactly the kind of material Grasset would

produce, are the key to the EV revolution.

We're starting to see a return of the nickel market and a return of interest in nickel assets like Grasset. In addition to

the deposit itself, we have a number of other nickel discoveries nearby. Nickel is coming back into focus. For individuals

looking at the Company it's really being carried, with not a whole lot of attributed value in the market, but we think that

is going to change fairly quickly here as the nickel price meets and potential exceeds the base case in our resource

estimate which quickly brings a larger tonnage of material into focus.

In 2014, the last time the nickel price was stronger, it was probably carrying $100 million-plus of market cap for

us. So, that can be almost a free recovery for us in terms of share price appreciation, if the nickel price continues to

move forward.

Dr. Allen Alper: Sounds excellent! Could you tell our readers/investors a bit more about your exploration plans going

into 2018?

Mr. Darin Wagner: We just wrapped up the 2017 program on the project. We have results from over 40 holes still

pending, so you should see some fairly steady news flow from us over the next few weeks. We'll walk into 2018 with about a

$6 to $6.5 million exploration budget. A fair bit of that still focused on the gold side of the equation, namely the

Martiniere and Detour East properties.

We are very encouraged by what we see at Martiniere and now starting to see evidence of very strong shear corridors at

Detour East. The 2018 program will likely consist of two phases. A winter program that will start sometime in January or

February and then, a summer program that usually kicks off sometime in late May or early June and will run through October.

It should be another busy year for us. We're looking forward to a steady stream of positive results, as the deposits

continue to grow, and as we open up a bit more on the exploration front with new discoveries, which are always very exciting

for the

Dr. Allen Alper: Excellent! Could you tell our readers/investors about your background, your team and board? I know

you have an excellent background, and your team is very strong.

Mr. Darin Wagner: The team itself is built to be an exploration team. Personally I have an extensive, global

background on the exploration side working on a suite of precious and base metal projects over the last 27 years. I’ve been

around a number of significant discoveries and really enjoy the discovery process.

Our two most senior explorers have worked for the likes of Cominco and Barrick, so they're very strong, gold

focused, explorationists. We have a series of young geologists behind them that are now proving their mettle and helping to

direct these discoveries. And even our corporate development manager is a successful explorer. So we have great bench

strength.

We have a board with the likes of Dan MacInnis, who ran MAG Silver, one of the industry’s most successful

exploration companies in recent years.

Graeme Currie, who was a long time mining analyst and investment banker at Canaccord brings a tremendous depth of

knowledge on the industry and markets to the board.

Larry Talbot, who's a corporate securities lawyer and has been for over 30 years now, in Vancouver.

And our newest addition is Mr. Bryan Disher, whose background as a former partner at PWC, brings the Board a very

valuable outside business perspective.

It's a well-rounded board. A bit of everything there, but all very experienced and all very serious individuals, helping the

company have success.

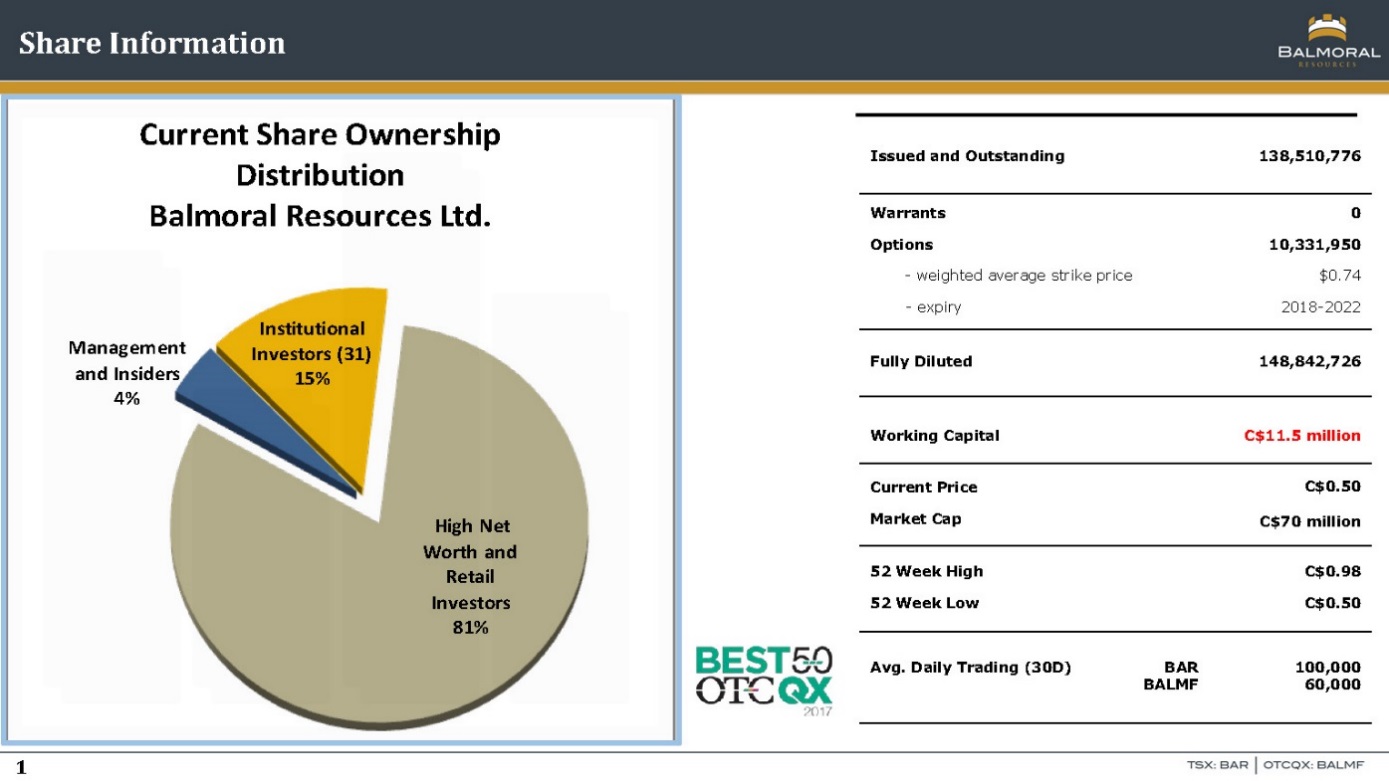

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about the share structure and the

key investors?

Mr. Darin Wagner: Right now, we're sitting with $11.5 million in working capital. The Company has received

tremendous, long term backing from a core of retail shareholders and institutional groups like M& G Investment Management,

SIDEX, AGF and others. We recently welcomed the Sprott Group and the Caisse de Depot in Quebec as significant investors. The

Caisse is the largest of the Quebec mining funds and was the largest backer of our most recent offering.

We have a very strong retail shareholder base, including a number of very large shareholders, who've been

tremendously loyal and tremendously supportive of us over the years. They really helped to drive our business forward.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors should

consider investing in Balmoral Resources?

Mr. Darin Wagner: I think the primary reason to have a really good look at Balmoral is because, in our

business, it always starts with the people, and we do think our people are first rate. They're very serious about the work

they do, and they work very, very hard for our shareholders.

The next are assets and jurisdiction. There aren't very many better places to be than the province of Quebec. In

terms of assets, we have both a sizable gold system continuing to emerge out here at Martiniere with that all-important high

grade core. Lurking in the background is the promise of value from the nickel asset at Grasset returning into the market

cap, really without a whole lot of work. It's open, and it can grow and beautifully set up to meet the needs of the emerging

electric vehicle revolution.

Then, we have what is probably one of the most enviable exploration land packages in the entire Abitibi region,

which is the number two global gold producer. We have a team of explorers who've proven that they can go in there and find

things.

And whether I like it or not the price is right. Right now you are looking at being able to invest, alongside some

of the savviest investors in the gold space, who've just recently put money into the company. You're not looking at any

significant overhang from warrants. There are none. I think you can follow their lead with some confidence.

Dr. Allen Alper: That sounds fantastic and extremely powerful reasons for our high-net-worth readers/investors to

consider investing in Balmoral. Is there anything else you'd like to add, Darin?

Mr. Darin Wagner: No, I think that covers the key points, Al. Really, I think with the share price currently

where it is, it's a pretty compelling opportunity for people. It's not like it's not backed by solid assets and good people.

The money's been raised, so you probably don't see another fundraise from us for quite some time now, so it's really market

driven from this point on. I think, as the results from the summer have started to flow now, with more to come and much to

look forward to in 2018 it’s a great time to look at Balmoral.

Dr. Allen Alper: That sounds terrific.

http://www.balmoralresources.com/

Darin Wagner

President and CEO

John Foulkes

Vice-President, Corporate Development

Tel: (604) 638-5815 / Toll Free: (877) 838-3664

E-mail: jfoulkes@balmoralresources.com

|

|