GTA Resources and Mining Inc. (TSXV: GTA): Focused on Exploring for Gold and Zinc in Canada, Interview with Peter M. Clausi, CEO and Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/14/2017

GTA Resources and Mining Inc. (TSXV: GTA) is focused on exploring for gold and zinc in Canada, and recently celebrated

its 10th year of being listed on TSX Venture Exchange. GTA currently has three projects located in northern Ontario: the 54%

owned Northshore Gold Project in the world-famous Hemlo Gold Camp; an option to acquire a 100% interest in the Big Duck Lake

Gold Project; and, the 100% owned Auden Project near Hearst. GTA also owns a 100% interest in the Burnt Pond Zinc-Silver

Project in central Newfoundland. We learned from Peter M. Clausi, CEO and a Director of GTA Resources, that Northshore has a

NI 43-101 resource estimate of over one million ounces of gold, while Big Duck Lake Gold has a historic resource of 53,000

tons of gold, averaging 10.5 grams of per ton. Near term plans include drilling at Big Duck Lake to prove the historic data

with the aim of releasing the results in December.

The map below shows Northshore, Burnt Pond and Auden. Big Duck Gold is 25 km north of Northshore. GTA recently sold the

Ivanhoe Property to a midsize mining explorer at a profit with an NSR.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Peter Clausi, CEO of GTA

Resources and Mining Inc. Peter, could you give our readers/investors an overview of your company? Also, the environmental

issues that might be involved in getting permitting.

Mr. Peter Clausi: GTA is a Canadian company, which trades on the TSX Ventures Exchange. We've been in business

quite a while, we're a ten year company and in fact we've just been invited by the stock exchange to ring the bell to

celebrate our tenth year of being listed. We've been fairly successful, we've discovered a fair amount of gold, haven't

spent too much money to do so, so we've been efficient stewards of the shareholders' money. As of next Monday the drill is

turning on another one of our properties and we're very excited about what we're going to find there.

Dr. Allen Alper: Great. Could you tell our readers/investors a bit more about the properties you have and what makes

them important?

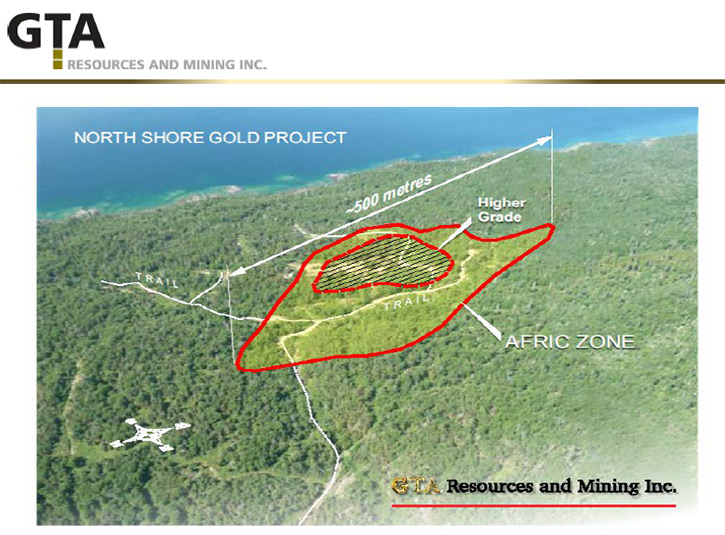

Mr. Peter Clausi: The main property is called Northshore. It's in the Hemlo Gold Camp in Ontario. Hemlo Gold

is a world-famous area that has produced a variety of poly-metallic mines and a lot of gold has come out of that area. Hemlo

Gold itself has produced about 22 million ounces of gold since the 1980's. Our Northshore property has a resource estimate

on it, under NI 43-101 rules, of over one million ounces of gold. Right now we're trying to determine the next step for that

property and have engaged environmental engineers to give us an overview of what environmental issues might be involved in

getting permitting.

We have a property that's 25 kilometers north of that, called Big Duck Lake. It seems a lot of properties out that way are

named after animals. At Big Duck Lake there's been historic work done. There's an historic resource of 53,000 tons,

containing gold averaging 10.5 grams of gold per ton. There are also some copper showings and other metallic showings. Next

week we will have a drill turning at Big Duck Lake to prove up some of that historic data. We're very excited about that.

Dr. Allen Alper: That's great.

Mr. Peter Clausi: Well it is an easy value for the shareholders. We know the mineralization is there, but the

historic estimate was done prior to the 43-101 rules. If we're going to do a resource estimate on that property at Big Duck

Lake, we have to update the information. We're drilling into the mineralized area to prove up the historic information. We

hope to have that information in the public domain first or second week of December if the labs cooperate. They should be

decently mineralized.

Dr. Allen Alper: That's excellent. Could you tell me about your zinc property in Newfoundland?

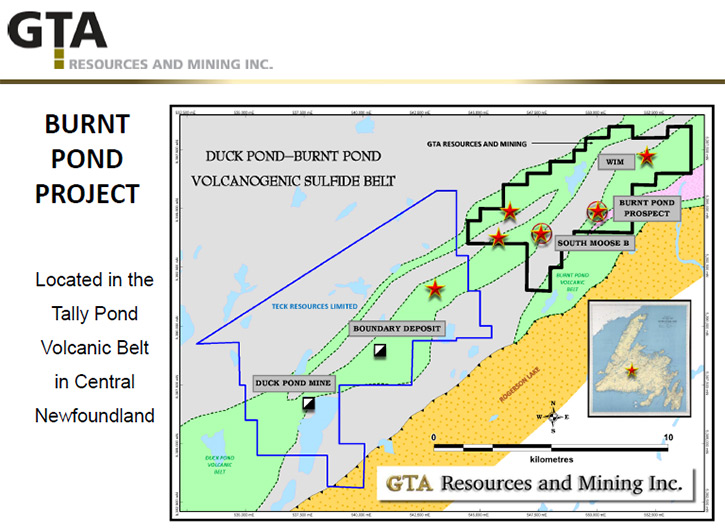

Mr. Peter Clausi: Out in Newfoundland we have a property called Big Duck, I told you a lot of things have been

named after animals. For a while we were looking at a property that had another animal name, and it turned the meeting kind

of hilarious because we were confusing the names even though we knew what the properties were. Anyway, we have Big Duck and

Burnt Pond. Burnt Pond is in Newfoundland next door to the former producing Big Duck Lake, owned by Tech Resources. Burnt

Pond appears to be the same geology as Big Duck. If they pulled a metallic asset on a VMS setting, we have drilled to what

we think is the zinc horizon and it does appear to by poly-metallic. That's another property that we will return to and

advance.

We've been well-received in the province of Newfoundland; the government has been highly supportive of our efforts

and we have qualified for their JEAP program which refunds us some of the money we've spent in the ground. We've also

received financing from the government of Ontario, for which we are extremely grateful, under the JEAP program here.

Dr. Allen Alper: That sounds excellent.

Mr. Peter Clausi: They're highly supportive mining jurisdictions, which is part of the reason we're there. We

know the government will give us support; financial, geologic and intellectual. I've never met a bad district geologist,

working for the government. They're incredibly supportive with their time and their ideas, and Ontario and Newfoundland are

some of the best mining jurisdictions in the world.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors your plans for the remainder of this year and

going into 2018?

Mr. Peter Clausi: At Big Duck Lake, in Hemlo, we are going to carry out this drill program of about 500

meters, get the results out as soon as possible, and we'll be carrying out a financing at that time on the back of those

results. We are studying the data from Burnt Pond in Newfoundland to determine our next steps in the spring. We're waiting

for the engineering report at Northshore before we make any financial commitments there. I hate spending money unless we

absolutely have to, so we're waiting on the engineering report from the environmental engineers before we take another step

at Northshore.

Dr. Allen Alper: Could you refresh our readers/investors’ memories on your background, your team’s and your board’s?

Mr. Peter Clausi: I'm originally from Northern Ontario. In fact, I put myself through law school working in

one of the zinc mills. So zinc is literally in my blood. Literally. My undergrad degree is in computer science. I am a

lawyer, investment banker, I've been head of compliance and CEO for several publicly listed companies. Our Chief Financial

Officer has been in the business well, I don't even know how many years, and is an extremely well regarded member of the

board of directors and does a tremendous job of keeping us in governance, in compliance, and ensuring that all of our

disclosure is done on a timely and accurate basis.

Also on the board are Jamie Macintosh, a well-known Toronto businessman, Julio DiGirolamo, who is a CFO for public

companies, and was involved in some large M&A transactions whereby one mining company has purchased another. Birks Bovaird,

who is the Chair of Energy Fuels, the largest uranium producer in the United States, and lastly Wayne Reid, a very well-

known geologist out of Newfoundland, who has been a P.Geo for I think 25 years. Overall we have a very well-rounded board,

who is happy to sit down and have detailed conversations and engage in the controversial topics that have to be discussed

like diversity, corporate social responsibility, and local First Nations' engagement.

Dr. Allen Alper: That sounds great, it sounds like you have a very strong background and you have a strong team and

board, that's excellent.

Mr. Peter Clausi: We all like each other, which makes it easy to have difficult conversations. Our board

meetings are always a lot of fun because there are always a lot of ideas being thrown around. And since everyone likes and

respects each other it makes for a good meeting.

Dr. Allen Alper: That makes all the difference to have mutual respect for each other, so that's fantastic. Could you

tell our readers/investors a little bit more about your capital structure, where your shares are listed and how many shares,

etc.?

Mr. Peter Clausi: We've always been very cheap with the shareholders' money. If you don't spend a lot of the

money, you don't need to raise more money and issue more shares. The company has been listed for ten years, and we only have

roughly 45 million shares issued and outstanding. We have never consolidated the stock. That's the original share structure

from a decade ago.

When we grant options, they’re at a premium to the market, there are no discounts. So we have a fairly tight share

structure, a fairly loyal shareholder base, and it's indicative of the level of respect that we show for the shareholders

that we're in this position.

Dr. Allen Alper: That's excellent. What are the primary reasons our high-net-worth readers/investors should consider

investing in GTA Resources and Mining?

Mr. Peter Clausi: That's an interesting question. I was out last week with a broker who was asking the same

thing, and so we drew up a chart of publicly listed gold companies, their market cap as a ratio of their resource estimates.

And GTA shows up on the extreme left side of that, showing that it's a low valuation related to the gold in the ground. We

think we're undervalued relative to the market averages and the results that we put out in December from Big Duck should go

a long way to addressing that. Showing that the value is actually there.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, Peter?

Mr. Peter Clausi: We're a happy company. We work hard for the shareholders. We try not to spend money where it

doesn't have to be spent. We're not trying to play specialty metals. Gold is gold, is gold, is gold. There is always a need

for gold. It's something we understand, we understand the structures in the areas we're in. It lowers the risk of investment

to know that you have a management team, who knows the area and we know at Big Duck, there's gold in the ground.

Dr. Allen Alper: That's excellent. What are your thoughts on what's happening in the gold market and what might

happen in the future?

Mr. Peter Clausi: I really don't know. Every time I make a call on gold it goes the other way so maybe I

should start betting against myself. You're probably in a far better position to make that call than I am, sir.

Dr. Allen Alper: I think there are a lot of people, who are optimistic that things are going to turn up with gold, so

I'm hoping they're right.

Mr. Peter Clausi: I would agree with you. There are a lot of indicators that it should be higher, and that it

should turn, especially with the political instabilities not just in the United States but globally, one would think that

gold would move more.

Dr. Allen Alper: Right.

http://www.gtaresources.com/

Peter M. Clausi

President and CEO

416-890-1232

pclausi@gtaresources.com

|

|