Premier Gold Mines Limited (TSX-PG): Proven Management Team, Low-Cost Production, Rapid Growth and Sustained exploration, Interview with Ewan Downie, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/14/2017

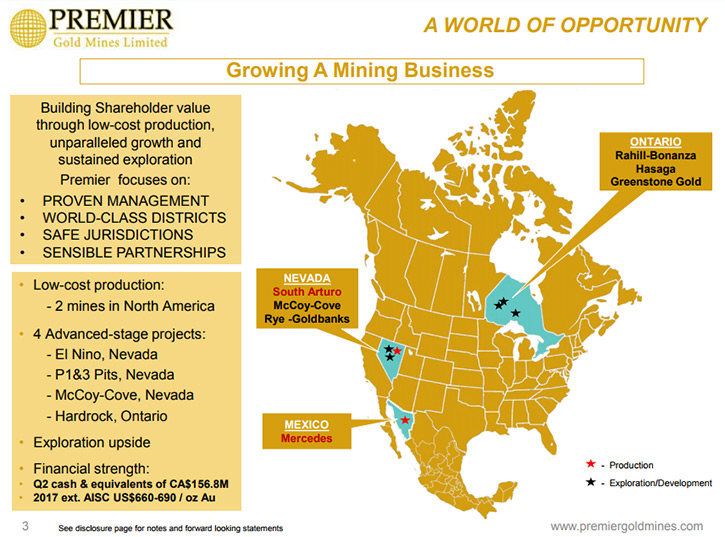

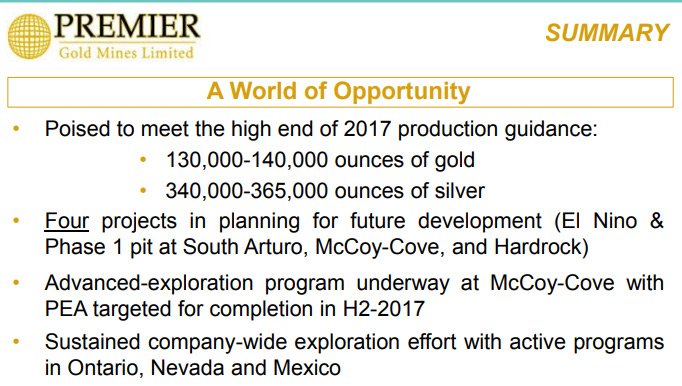

Premier Gold Mines Limited (TSX-PG) is a gold producer and respected exploration and development company, with a high-quality pipeline of precious metal projects in proven, accessible and safe mining jurisdictions in Canada, the United States, and Mexico. We learned from Ewan Downie, President and CEO of Premier Gold Mines, that they achieved production just over a year ago and currently operate two mines; one in Nevada, one in Mexico. In addition to that, Premier has three advanced stage development projects. According to Mr. Downie, in 2018 they will be starting developing their El Nino underground and the Phase One open pit project. The company is generating positive cash flow and has a very substantial exploration budget.

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mr. Ewan Downie, President and CEO of Premier Gold Mines Limited. I wonder if you could give our readers/investors an overview of your company, and what differentiates your company from others.

Mr. Ewan Downie: Premier is a relatively new producer in the gold space. We achieved production just over a year ago. We went from being a full exploration company, to a multi-mine, because we have currently two operations: one in Nevada, one in Mexico.

In addition to that, Premier has five other projects that we're advancing, including three projects, within our portfolio, which are in the advanced stages of development. Unlike a lot of our peers, who have single asset companies, I believe Premier offers a lot of growth, given our multi-project portfolio approach.

Dr Allen Alper: Well that sounds excellent. Could you tell us a bit more about your production?

Mr. Ewan Downie: This year, 2017 is our first full year of production. Our guidance for the year is that we will produce between 130 and 140,000 ounces of gold. We have already increased our guidance once this year. Based on results to date and our upcoming third quarter release, we are tracking to meet our upper end of guidance.

Dr Allen Alper: That sounds excellent. Could you also tell us a bit about your development projects?

Mr. Ewan Downie: Yes, one of our mining operations, South Arturo, is a joint venture with Barrick. We just completed the Phase Two Mine, as it's called. It's an open pit operation. With Barrack, we are doing substantial work towards developing an underground extension to that open pit, in the El Nino deposit and also the Phase One open pit operation.

We built phase two first, but we are working on the Phase One option. It's quite conceivable that both the El Nino underground and the Phase One open pit will both go into development in 2018.

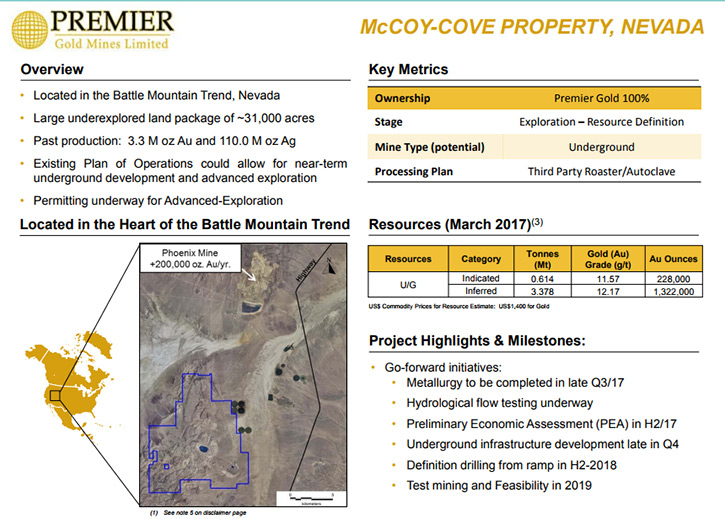

We also have our McCoy-Cove project in Nevada. It's 100% owned property. We are moving towards preliminary economic assessment that will be announced in the fourth quarter, prior to initiating underground development for the purposes of advanced exploration, drilling and bulk sampling.

We expect that development project will also start in 2018. Also, this year, 2017, we submitted our EA and EIS documents to the provincial and federal governments of Ontario and Canada, looking to get permits to build our Hardrock mine at the Greenstone Gold Mines project. That's a joint venture we have with Ontario Gold.

We currently have four projects right now, which are looking to be advanced to full mine development in the next several years. I think that's something rare to find in one of the small producer groups. So we're expecting substantial growth in Premier in the future.

Dr Allen Alper: Well, that sounds really exciting. It's really great news. Could you tell our readers/investors a bit more about your exploration activities?

Mr. Ewan Downie: We at Premier, come from an exploration background. We started as an explorer, and went into development and production. But that has never taken away from our exploration focus. In 2017, alone, we expect to spend approximately 40 million Canadian dollars in exploration.

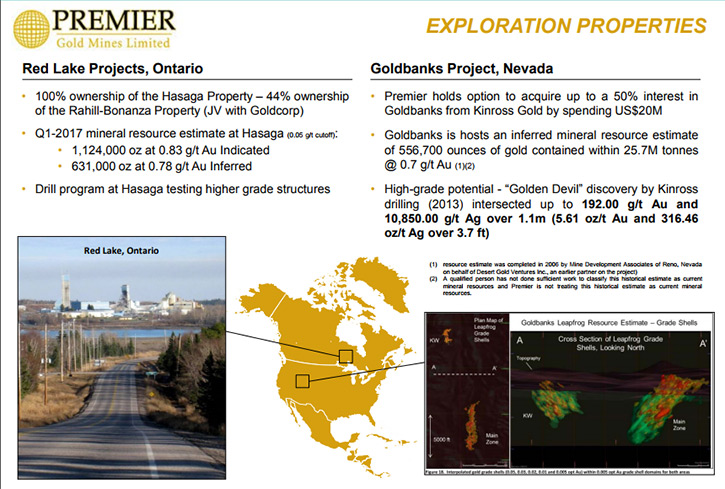

From our generation of positive cash flow, we have a very substantial exploration budget. We've announced two new resources in 2017, and expect additional resources from our exploration portfolio going into the future. We are moving towards advanced stage exploration in the Red Light Camp of Ontario. One of our two projects there is 100% owned. The other is a joint venture with Goldcorp. We also have a joint venture with Kinross in Nevada, where we are exploring the Gold Banks Project. We believe the Gold Banks area is a very exciting, potentially high grade district in Nevada. We plan to prove its potential through drilling this year and next year.

We expect, in 2018, to have a similar sized exploration budget. We are intent on remaining very firmly focused on our exploration portfolio, as we continue to develop resources that will become our mines of the future.

Dr Allen Alper: That's fantastic, a really great opportunity for investors. Your group is doing a fantastic job. Could you tell our readers/investors a bit more about your reserves and resources?

Mr. Ewan Downie: We have a pretty substantial reserve and resource base. In reserves, it's primarily at our Mercedes mine in Mexico. We have about a four year reserve life. We are looking to replace reserves year on year, as we advance that project. On our joint venture with Centerra, we have just over four and a half million ounces of reserves at the Hard Rock project. We are working at South Arturo with Barrick to advance resources to reserves in the Phase One, and El Nino underground Projects.

We also have considerable resources at Hardrock, about 4.5 million ounces of resource in addition to our 4.5 million ounce reserve. It's essentially a nine million ounce gold deposit, here in Canada. We have one and a half million ounces of open pit resource to find at our Hasaga Project in Red Lake. We also have more than one and a half million ounces, at about 12 grams per ton, drilled off at our McCoy Cove project. So, we do have considerable resources and reserves within Premier's portfolio.

Dr Allen Alper: Very, very impressive reserves and resources Premier has! Could you tell us a bit about your background, refresh our readers/investors’ memories?

Mr. Ewan Downie: I come from an exploration family. I grew up in the mining industry, born in Timmins, Ontario, a very famous mining camp in Canada. I started my career in exploration directly out of University. I founded a company called Wolfden Resources, in the late 1990s, which I took public, my first public company. We grew that company from when it started trading in 1998 to where it was taken over by Zinifex out of Australia in 2007. Premier Gold Mines was a spin out from the original Wolfden Resources. Our shareholders at the time received Premier as a free share.

Since 2006, when Premier was created as a spin out, we have been successful raising cash, finding deposits, and moving the company into producer status. I believe we generate top of pier group cash flow. I think that's a result of having built a prudent operation and prudently buying low-cost, producing assets. Our goal is to continue to grow our company into the future.

My foray into the public sector was starting my own junior company. It became a successful explorer that was subsequently acquired by a larger company.

Dr Allen Alper: That sounds excellent. Could you tell us a bit more about your team?

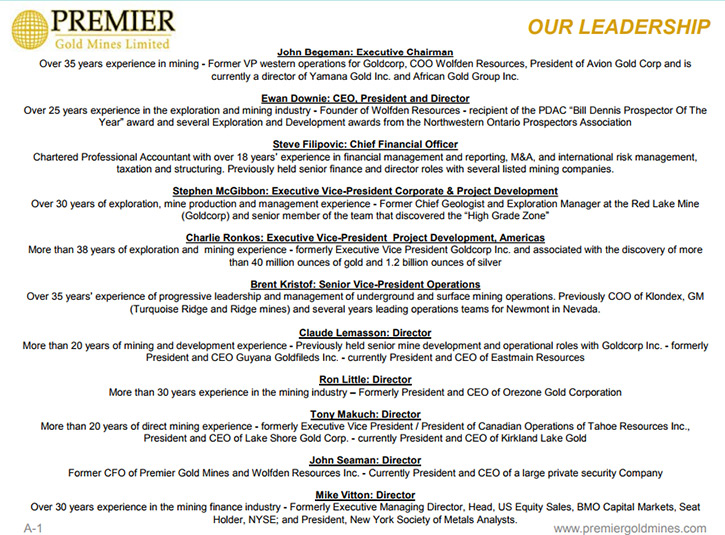

Mr. Ewan Downie: We have a very strong team. Our Board of Directors has continued to evolve since 2006. In 2006, we were primarily a group of explorers on the Board. We have since transitioned to be mostly mining engineers, to facilitate our move from explorer to producer.

Six of our Company Directors either have been or are currently CEOs of other mining companies, very, very strong Board. Our Chairman, John Begeman is a mining engineer. He heads up our operations and development group, has a very strong history in mining development and mining company development. He was last with Avion, acquired by Endeavor. Our mining operations in Africa have Charlie Ronkos, who was formerly Executive EP of exploration at Goldcorp. Brent Kristof, formerly the Chief Operating Officer at Klondex, and a solid mine operator with Barrick and Newmont prior to that, is the head guy in our development and operations group. Steve McGibbon, who oversees most of our exploration, was the key guy in discovering, delineating and bringing the high grade zone into production for Goldcorp, which essentially made their company.

Both on the Board and in management, I believe, we've assembled a top-rated team, to which I attribute our success.

Dr Allen Alper: You have a very outstanding team. That's excellent! Could you tell our readers and high-net-worth investors a bit about your tier structure and some of your key investors?

Mr. Ewan Downie: Premier currently has just over 200 million shares outstanding. We have a very solid investor group. We have numerous large institutions that own about 10% of our company. Some of these institutions have been with us almost since the inception of our company, since 2006. Management is a fairly large shareholder. I personally, am rated as one of the top seven shareholders, according to Bloomberg.

Dr Allen Alper: Excellent! Could you tell us a bit more about some of the institutions invested in Premier?

Mr. Ewan Downie: Our large investors include Fidelity, one of the largest gold funds, actually in the world. They're listed as our largest shareholder on Bloomberg. Orion Mine Finance, instrumental in helping us with our transition from explorer to producer, is a very large shareholder. Tocqueville, out of New York, John Hathaway and his group, one of the more respected gold funds I think you'll find in North America, is one of our largest shareholders. So we do have some of the more respected gold funds as some of our largest shareholders.

Dr Allen Alper: That's excellent! What are the primary reasons our high-net-worth readers/investors should consider investing in Premier Gold?

Mr. Ewan Downie: Premier is a company with a solid track record from discovery to production. We have transitioned into a producer with almost no issues, unlike a lot of what we see happening in new producers, who often have years of issues as they implement their production portfolio, growing pains so to speak. We haven't had that. We have a pier best balance sheet. Our cash at the end of Q two was over 155 million Canadian. We offer a portfolio of highly prospective and operating projects in some of the top gold districts anywhere in the world, including the Red Lake camp, the Carlin trend of Nevada, and the Battle Mountain trend of Nevada.

Dr Allen Alper: Excellent! These are very, very excellent reasons our high-net-worth investors should consider investing in Premier.

https://www.premiergoldmines.com/

Ewan Downie, President & CEO

Phone: 807-346-1390

Fax: 807-346-1381

e-mail:Info@premiergoldmines.com

|

|