Leading Edge Materials Corp. (TSXV: LEM, OTCQB: LEMIF): Mining and Producing Materials for the Lithium-Ion Battery Sector, Interview with Blair Way, CEO and President

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/14/2017

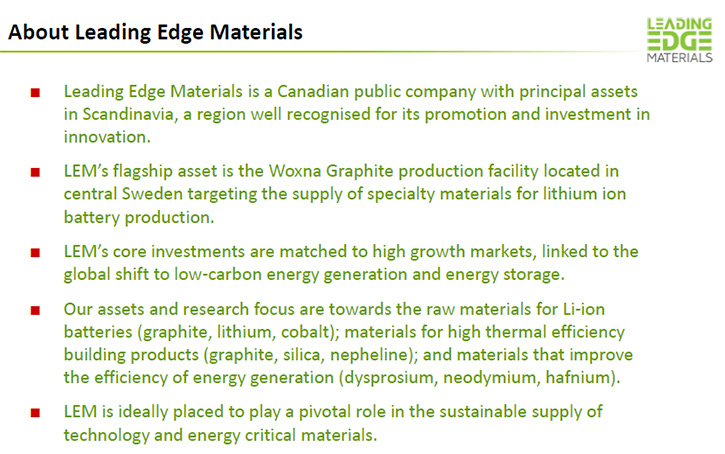

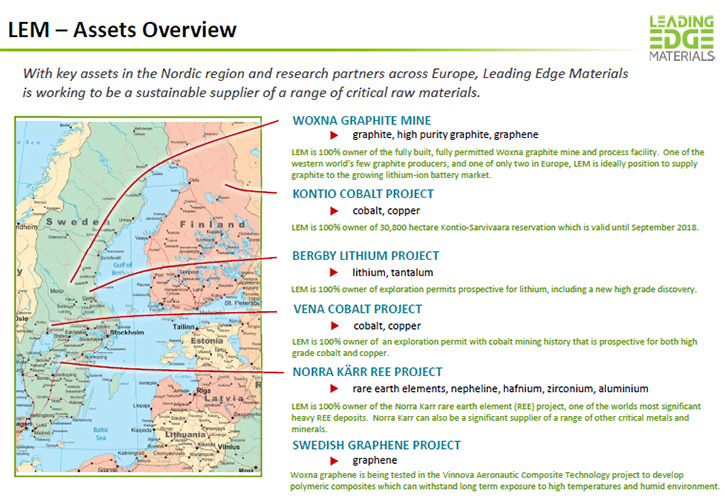

Leading Edge Materials Corp. (TSXV:LEM, OTCQB: LEMIF) was formed in August 2016 via the merger of Tasman Metals Ltd. with

Flinders Resources Ltd. We learned from Blair Way, who is CEO and President of Leading Edge Materials, that they have been

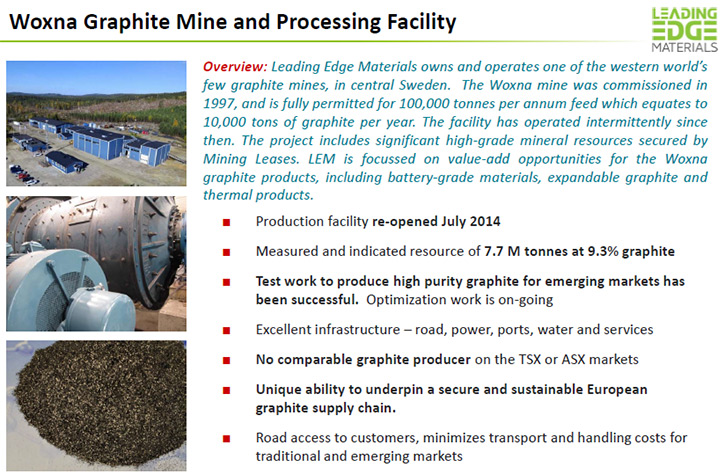

progressing their flagship property called the Woxna Graphite facility, which is a fully-permitted and constructed graphite

production facility. LEM uses the graphite product and tailors it to meet the needs of the lithium ion battery sector. In

addition to that, LEM has lithium and rare earth assets in Sweden. With the focus on the green energy markets of Europe,

and, with assets in innovation-rich Scandinavia, the company is ideally placed to play a pivotal role in the sustainable

supply of critical technology materials.

Woxna Graphite Mine

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Blair Way, CEO and President

of Leading Edge Materials.

Could you give our readers/investors an overview of your company, Blair?

Mr. Blair Way: Certainly. Leading Edge Materials is a specialty materials company targeting providing those

materials for the lithium ion battery market. Our core of assets are all Scandinavian-based, but we are a TSX-listed

company, trading under the ticker symbol LEM. Certainly we've been progressing our flagship property, which is the Woxna

Graphite facility, a fully-permitted, built and constructed production facility for flotation graphite. We're taking that

graphite product and tailoring it to meet the needs of the lithium ion battery sector. In addition to that, we have both

lithium and Rare Earth Element assets in Sweden.

Dr. Allen Alper: Sounds great. Could you tell our readers/investors a bit more about your plans for the remainder of

this year going into 2018?

Mr. Blair Way: Sure. We have a number of initiatives underway. We're undertaking a dual listing currently, listing

our company on the NASDAQ Stockholm First North market. That will give us more exposure to Scandinavian investors, which are

very interested in the lithium ion battery and green energy storage market. Currently, First North doesn't really have a lot

of opportunity for investors to gain access to this sort of market. That's one of the initiatives we are targeting that for

the end of this year, before Christmas.

We also have a number of projects underway. We're working on refinements with our graphite and also further markets

for our product. We are working with lithium ion cell manufacturers to ensure our high purity graphite is tailored to those

customers or future customers in Europe. We're also looking at managing some of the by-products of our production to be

value-added products, used in some composites. We have a project currently, with Innova in Sweden, where we're taking our

graphene, from our Woxna Graphite, and incorporating it into special composite materials in anticipation of assisting in

light-weighting for the aeronautical industry.

We were also taking our graphite from our Woxna facility and putting it through various thermal purification techniques to

identify the most environmentally-friendly way to produce high purity graphite that displaces a synthetic graphite that's

traditionally used in lithium-ion batteries. Synthetic graphite has quite an unfriendly environmental footprint, and we're

optimistic that these projects will identify how our material is a suitable substitute.

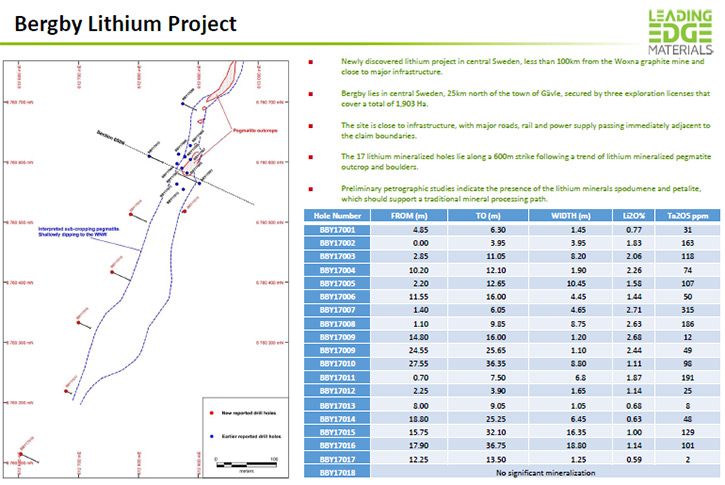

We're also working with a lithium project called Bergby and we've just completed a second small drill program on

that property. We're expecting the assay results to be out in the coming weeks. There will be some progress on that. We're

also working with our Norra Kärr Rare Earth project. One of the recent initiatives that we have underway is to refine the

processing technology that we've identified for that project. We've recently press-released some news on that and we expect

other news in the coming months.

Photo of 18650 cells made with 100% Woxna graphite anode materials

Dr. Allen Alper: Well that sounds very good. Could you tell our readers/investors a bit more about the kind of

lithium deposit you have and why you are enthusiastic about it?

Mr. Blair Way: Certainly. Our Bergby Lithium Project is an early stage discovery, about 2.5 hour drive north of

Stockholm. It is reasonably close to our Woxna center graphite facility, which helps us logistically. Great infrastructure-

roads, rails, and power are very nearby. In an initial 18 hole drill program, we identified lithium mineralized pegmatite in

17 of the 18 Holes, with spodumene in the pegmatite as the key lithium minerals.

We've had some quite decent percentages come out of those drill holes, justification for this second drill program, the

assay results from which will start coming through in the coming weeks. We expect them very soon and the normal flow as the

data flows from the assay lab. We're very pleased with the results to date. As we gather more drill data, we can talk

further about scale and size.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your plans for the Rare

Earth Project?

Mr. Blair Way: Our Rare Earth Project is one, with which many people are familiar. Our Norra Kärr REE Project had a

PFS completed January 2015. We have been doing hydrometallurgical work in order to refine some of the processing that was in

that PFS in 2015. We are working through a number of options in regards to the Rare Earth. We are looking to find the right

type of partners to enable us to move this project forward.

We believe it to be quite a significant project. There is growing interest back in the Rare Earth space, and we hope

to have more to tell you about Norra Kärr, towards the end of this year, into the New Year.

Dr. Allen Alper: Sounds excellent. I understand you also have plans to work with cobalt, is that correct?

Mr. Blair Way: That's correct. We have a couple of cobalt projects that we have been working on. There are a number

of opportunities we are exploring that we aren't able to speak about at this stage. We are seeking out cobalt in Europe and

we believe we have some opportunities there in the future. We can talk about them in more detail later.

We expect to have some news on the Kontio-Cobalt project in Finland in the coming weeks, but it's a very early stage

property. Cobalt is of great interest to many of our graphite customers. For us to be able to provide solutions to lithium

ion battery cell manufacturers for their graphite needs and also lithium and cobalt gives us the opportunity to strive

towards that 'one-stop-shop' for many of the specialty materials for this space.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit more about your vision for your

company being the leading edge supplier of strategic materials?

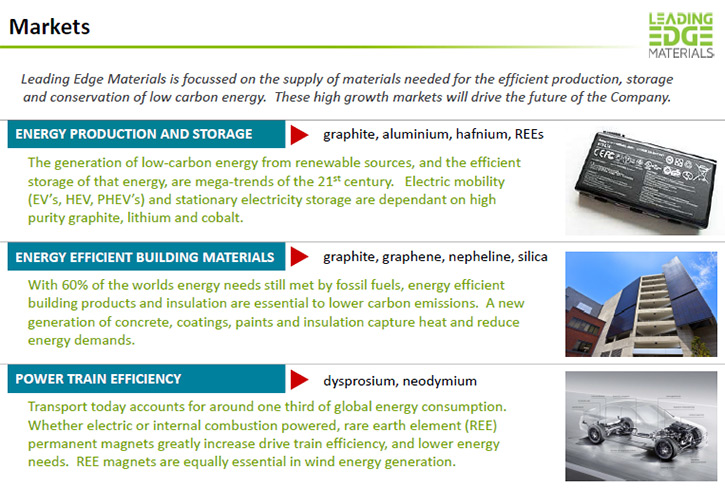

Mr. Blair Way: Certainly. We believe we're positioned to supply these critical raw materials to a high-growth, low

carbon energy sector. The electrification of vehicles, the uptake of stationary storage and the ability to capture solar

energy to be utilized in the evening after the sun has set, all provide an opportunity to take renewable energy to the next

level.

We have a suite of assets for that. They're all Scandinavian assets at this time, but we're focused on meeting these

raw material needs for Europe. There's a forecast for uptake with numbers in the order of 120 GW hours by 2025, or even

earlier for some forecasts. Those are big numbers for production of lithium ion battery cells in Europe. They are going to

need graphite, lithium, cobalt and even nickel, copper and other 'traditional' commodities.

Our focus, at Leading Edge, is on these special materials such as graphite, lithium and cobalt, where we can differentiate

ourselves from some of the other players. We have quite a suite of those, especially when you factor in the Rare Earth

Project and the Nora Kärr Project and how that ties into, not only the electrification of vehicles for energy storage, but

also the electrical motors and the like where we'll be seeing increased demand.

We think our portfolio of projects, and the opportunity to value add, is a big plus for our company and how we're

targeting this specialty market.

Dr. Allen Alper: Sounds good. You mentioned why you are so excited about the specialty market and its growth

potential and the applications.

Mr. Blair Way: A year ago, the talk about electrification of vehicles was mostly tied to the likes of Tesla. But in

the last 6-12 months, we've hearing about how all the major producers are identifying the need to electrify a large part of

their fleet. In broad brush numbers, we have over a billion cars on the road right now. The forecast is by 2030 there'll 2

billion cars. They are forecasting half a billion electric vehicles on the market.

Currently there's less than 1% of the existing 1 billion. There's this big movement towards the electrification of vehicles

and the trickle effect from that is all the stationary stores and the need for electrification of buses and trucks. The

uptake of energy storage and the raw materials that are needed for energy storage is huge.

WE hear forecasts for electrification of vehicles is in the order of 30-40% by 2030 or 2040, so the numbers are

enormous. We believe our company is well positioned to provide some of those key materials that are required to accommodate

this growth in electrification.

Dr. Allen Alper: That sounds excellent. Could you refresh the memories of our readers/investors about your

background, your team and your boss?

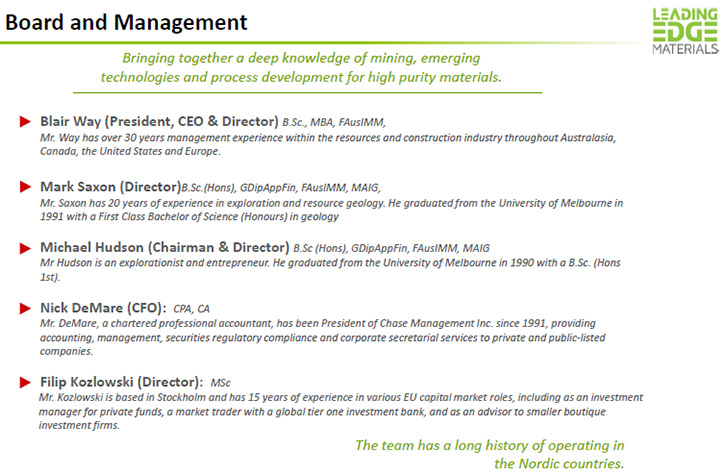

Mr. Blair Way: Sure. We have a long history of working in the Scandinavian region. Or board is made up of both

explorers and financial people, and myself with a development and production background.

My experience for the last 35, 40 years has been taking a resource, turning it into a business, getting it into

production and demonstrating that cash-flow model from that resource base. Our team has a very wide base of capabilities,

both from an exploration point of view all the way through to financial markets. That enables us, working in Europe enables

us to tie our assets and our business model together utilizing the resources in Europe.

Dr. Allen Alper: That sounds great. Could you tell our readers/investors a bit more specifically about some of your

people and their backgrounds?

Mr. Blair Way: I'm President, CEO and Director. I come from a science and implementation prospective, taking

resource projects through feasibility, study, construction and production.

Mark Saxon is a director. He comes from an exploration background and has been working in the field for the better

part of 20-odd years.

Mike Hudson is also a Director and Chairman. He comes from an exploration background, has been working in base

metals as well as precious metals for many years. Both Mark and Mike are founders of the company.

Nick DeMare has been working as a professional accountant for decades and has been providing the services of CFO for

many public companies for many years.

Filip Kozlowski is a recent addition. He brings financial market knowledge from the Stockholm and Sweden region.

He's been working in Europe for many years from a financial perspective. That's important to us in order to reach out and

find the right connections within the European Union in order to help us facilitate the growth of our company-both through

financing future endeavors, but also meeting and finding the right customer base and working with those partners in Europe

and Sweden to ensure that we build a solid business.

Our board has a very broad experience-base. We have a number of personnel that support us on the ground in Sweden as

well.

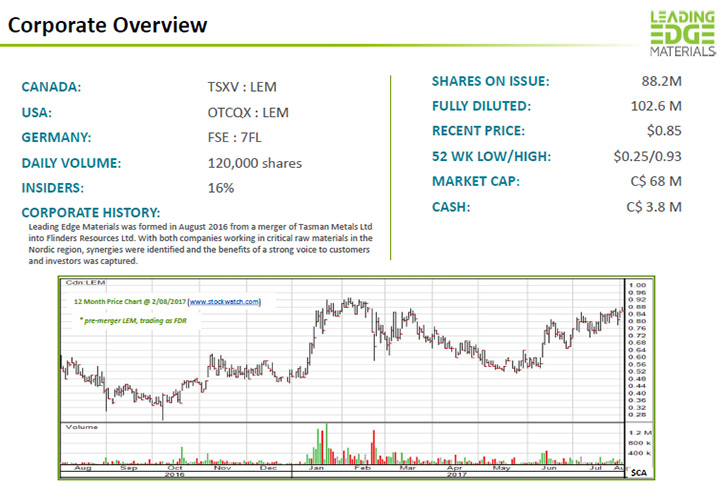

Dr. Allen Alper: That sounds excellent. Could you tell us a bit about your share structure?

Mr. Blair Way: Sure. We've been listed as a TSXV company under the ticker LEM for almost seven years now. We have

88.3 million shares on issue, our market cap is in the order of about 55, 60 million dollars and just under 4 million cash.

About 15, 16 percent insider ownership and our volume, not huge volumes but daily volumes, in the order of about 100,000

shares a day.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should

consider investing in Leading Edge Materials?

Mr. Blair Way: One of the key reasons is the forecast for massive growth and the demand for the specialty materials

products. Our Woxna facility is a graphite facility with near-term cash flow opportunity.

Upgrading that facility to meet the future demands for battery graphite is less expensive because it's an expansion

rather than a green-field construction. We're working in Sweden, which is a very mining friendly location and it also gives

us access to EU markets as well as EU-possible funding opportunities there.

We have quite a bit of exploration upside by having lithium, cobalt, and our Rare Earth projects to enhance our

graphite business.

We have a sizeable opportunity and the ability to upgrade our existing graphite deposits to meet these future

demands.

Finally we have a very experienced management team with specific Scandinavian and also European experience.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add, Blair?

Mr. Blair Way: Leading Edge has been around for some time, and a lot of investors are familiar with the story, with

the market. There are a number of peer companies that are targeting the same market for the growth and lithium ion space but

they are explorers who hope to build a mine and processing facility. I guess it's important for investors to be able to

understand the difference between a company like Leading Edge Materials and some of the other companies on the ASX and TSX.

We have a fully permitted and operational graphite facility. We still are in the process of developing the markets for our

materials because lithium ion batteries currently aren't really manufactured anywhere but Asia.

We are working with future lithium ion battery manufacturers in Europe and North America. There are electric

vehicles being constructed now, but the majority of those cells are manufactured either in Asia or with Asian materials. As

the lithium ion cell manufacturing grows in Europe and North America, we have an opportunity to be the first to sell into

that market.

There is a timing issue there. With our fully permitted facility in Sweden, we're well ahead of the 'pack' in order

to be able to meet the demands of these future cell manufacturers.

Dr. Allen Alper: That's excellent.

http://leadingedgematerials.com/

Blair Way, President & CEO

1.604.685.9316

info@leadingedgematerials.com

|

|