Hecla Mining Company (NYSE: HL): A Leading Low-Cost U.S. silver Producer and a Growing Gold Producer, Interview with Mike Westerlund, VP- Investor Relations

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/1/2017

Hecla Mining Company (NYSE: HL) is a leading low-cost U.S. silver producer with operating mines in Alaska,

Idaho and Mexico and is a growing gold producer, with an operating mine in Quebec, Canada. We learned from Mike

Westerlund, VP of Hecla Mining, that the big difference in Hecla and a lot of other companies is its strategy of

acquiring long-lived, low-cost mines, in which it can invest to improve productivity and safety. Also of note,

are the high grades of their silver mines, which allows them to generate positive cash flow in most market

environments. From a gold perspective, they have doubled the through-put of their gold mine in Quebec, since they

acquired it in 2013. They expect the second half of this year to improve operations considerably with higher

grade. Another aspect that differentiates Hecla from a lot of companies is their focus on innovation, which is

part of its strategy of investing in innovative mining techniques in their operations now.

Hecla Mining Company

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Mike Westerlund who

was VP of Hecla Mining. Could you give our readers/investors an overview of Hecla Mining?

Mr. Mike Westerlund: Certainly. Hecla Mining Company is a 126 year old miner. We have four operating

mines and are the largest producer of silver in the US and the third largest producer of lead and zinc. Two of

our mines are considered in the world's top ten valued mines per ton by Mining.com; San Sebastian in Mexico and

Greens Creek mine in Alaska. We also have a silver mine that's been running for 75 years in Idaho called Lucky

Friday. And then we own a gold mine in Quebec called Casa Berardi.

Dr. Allen Alper: That's excellent. Could you tell us a bit more about your properties and what

differentiates Hecla from other mining companies?

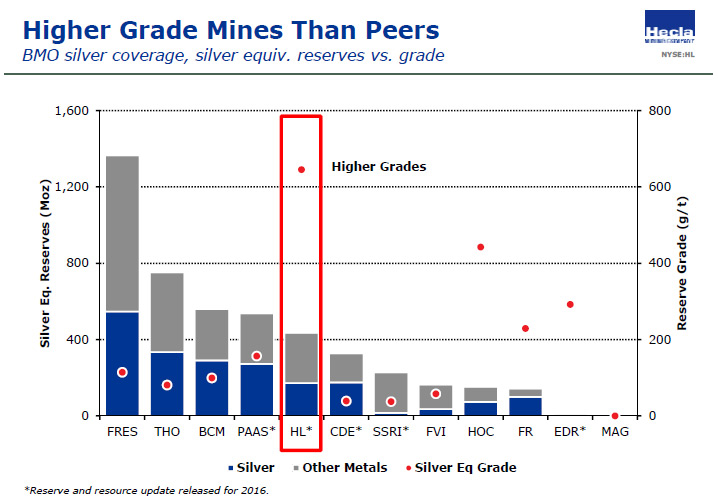

Mr. Mike Westerlund: Sure I can. A key differentiator for Hecla is that our mines, certainly our

silver mines, are high grade. Our high grade gives us flexibility when prices change because we have a very good

cash margin, meaning that we don't have to change our operations just because of a reduction in price, allowing

us to generate positive cash flow in most environments, which is very positive as well.

From a gold perspective, we like our gold mine in Quebec. We've spent a lot of time and energy improving

it. We've doubled the through-put since we acquired it in 2013 to more fully utilize the over-sized mill. The

mine originally ran underground only and now we have the flexibility of mining ore from the first of several open

pits on the surface as well as from underground. We expect that mine, during the second half of this year, to

improve operations considerably with higher grade and continued strong throughput.

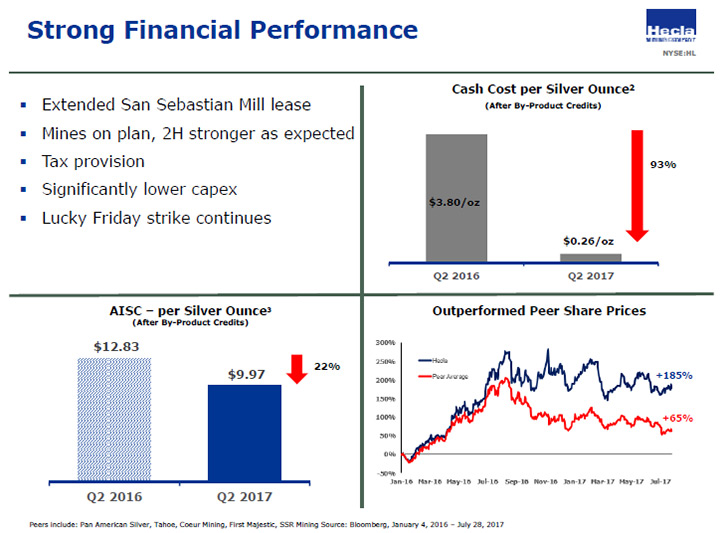

The other big news for us is in Mexico, at San Sebastian mine, where we have extended the mill rental

agreement for two more years. This is a very profitable mine that was recently started up with very little

capital investment, as we rent a third party mill and have hired mining contractors. In fact, it only took about

$4 million to start the mine up in late 2015 and it generated about 92 million of free cash in 2016. It generated

about another 20 million in free cash the first half of 2017. The sustaining capital for this mine is a couple

million dollars a year, so it is a strong cash flow generator for us. We've discovered more high-grade material

at depth and we're going underground at the end of this year. We expect the mine to produce positive cash flow in

its first year of mining underground, a feat that is rare in the mining industry.

Dr. Allen Alper: Excellent! Could you tell us a bit more about Hecla's plans for the remainder of this

year going into 2018?

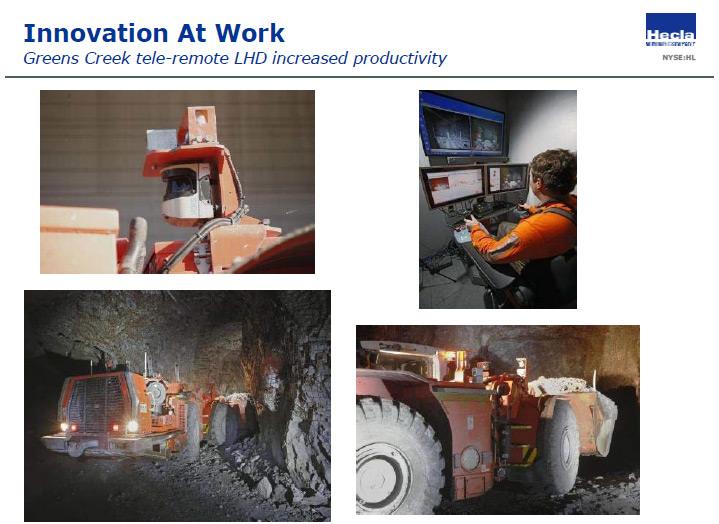

Mr. Mike Westerlund: Certainly. Hecla’s focus on innovation differentiates us from a lot of companies.

We're bringing in innovative mining techniques in our operations now, starting with wireless communications in

the mines. In Alaska we have tele-remote, load haul dump machines, which means we can run them from the surface

during the shift change so the mine can keep operating even when the men are out of the mine. We have ventilation

on demand coming into Alaska by the end of the year. It will allow the fans to operate automatically, when they

sense someone or a piece of equipment is in the stope. An analogy would be your house, where, instead of air

conditioning your whole house all the time, you just air condition the rooms that you're in. It's a lot more

efficient, so we expect it to help us save energy costs in Alaska.

From a production point of view, our mines are performing very well. We do have a strike on right now at Lucky

Fridays, which may take time to resolve, but it is our highest cost and lowest margin mine, so it isn’t having a

very great impact on our strong financial position. We're in a strong position operationally and we expect to

continue to invest in innovations that will continue to improve our mine's operations in the future. For example,

we're looking at a remote vein mining machine along with Atlas Copco, which will cut the rock instead of drilling

and blasting it. It's considerably safer, considerably more efficient. It should take a few years until the

technology is introduced into Lucky Friday, which is one of the deepest mines in North America, but we expect the

impact on the mine to be dramatic, basically turning it into a rock factory.

We believe you're going to see the Quebec mine do better in the second half this year because of higher

grade and the improved throughput. You're going to see the Mexican mine move to underground operations by the end

of the year. Greens Creek in Alaska continues to have stand-out performance. There's a lot going on with Hecla

right now, when we resolve this strike, all of our operations will be firing on all cylinders. We look forward to

that.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors, a bit about your background,

the management team and the board?

Mr. Mike Westerlund: I can. I've been with Hecla for five years. I joined just before we acquired the

Casa Berardi gold mine. I've been in the business, on the mining side, for over 15 years. We have a seasoned

management team. Phil Baker has been our CEO for about 14 years, one of the longest tenured CEOs in the business.

If you look at the performance of the stock over that time you'll see that we've outperformed almost everybody. I

think that has to do with the strategy of investing in assets, investing in the business, buying long term mines,

making them better, and making more money doing it. Dean McDonald's the head of exploration and a seasoned

veteran. He’s done a really good job extending, increasing our reserve for 10 years in a row. Larry Radford's the

head of operations, and he has over 30 years of both open pit and underground mining. Our CFO is Lindsey Hall,

who joined us from Gold Corp just over a year ago and directs the company from a financial point of view. The

board has undergone some refreshing. We have added new directors with expertise in taxation, operations and legal

matters, which should benefit the Company as we have transitioned into 4 mines in 3 countries. With those

changes, I think the company's in very good shape going forward.

Dr. Allen Alper: That sounds great. Could you tell me a bit about your balance sheet?

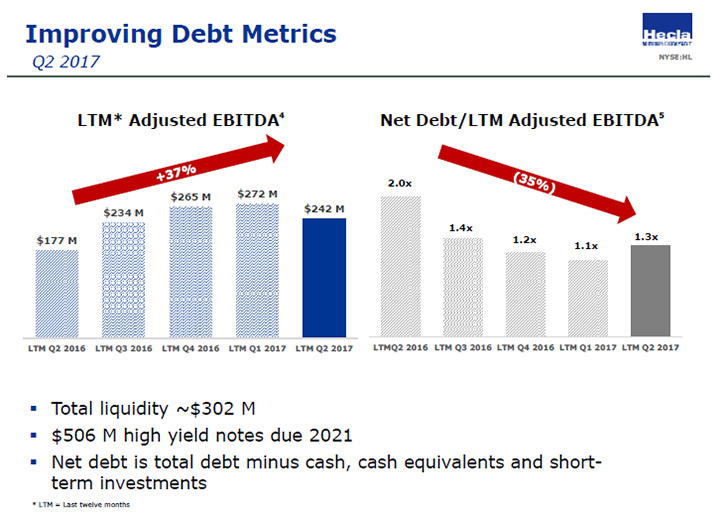

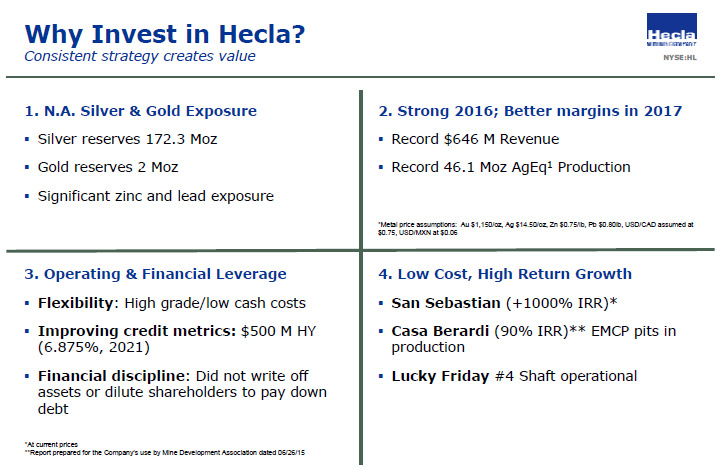

Mr. Mike Westerlund: Sure. We have approximately $200 million in cash. We're carrying approximately

500 million in long term high yield notes, which mature in 2021, the interest rate is 6 and 7/8th percent. Our

net debt is about $300 million and we are happy with our leverage ratios. We like having some debt on our balance

sheet because it keeps the debt market open to us, allowing us to minimize the dilution of our shareholders. Part

of our strategy is to minimize the shareholder dilution.

That's worked very well over the last five years, where we have had very few issuances of stock unless we were

acquiring actual assets that would benefit the shareholders in the future. When our debt comes due in 2021, we

expect to have at least 3 and potentially 4 mines operating, and we believe the market will be receptive to

rolling it. In the meantime, we’re looking for ways to lower our cost of borrowing. One of the ways would be to

extend the debt out to a lower interest rate, which we are looking for. At some point, we expect we'll extend the

debt or part of the debt out, if we can lower the cost of borrowing for the company because that's a key priority

of ours.

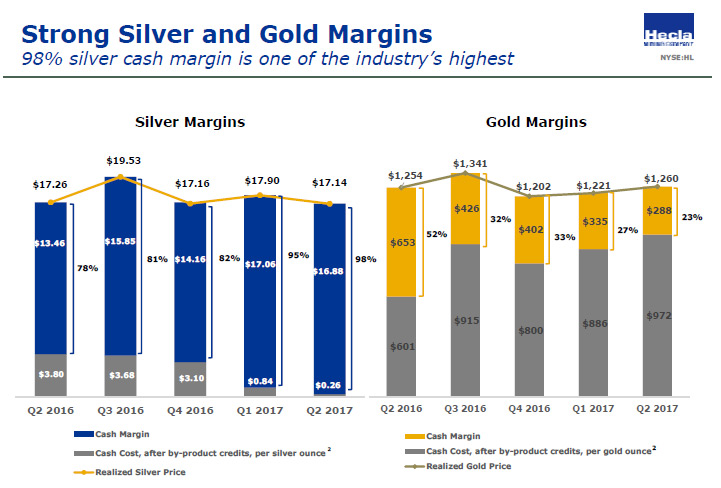

We are seeing the benefit of being a large producer of lead and zinc, as the prices of those metals has performed

well over the past year, and this has an impact on our revenues and on our cash costs, after by-product credits,

which are among the lowest in the industry.

Dr. Allen Alper: That's very good. Could you tell us a bit about your capital structure?

Mr. Mike Westerlund: We have about 400 million shares outstanding. We have a number of institutional

investors, and a large retail following here in the US, due in part to our strong performance and long tenure on

the NYSE.

Dr. Allen Alper: That's excellent. That's really fantastic. What are the primary reasons our high-net-

worth readers/investors should consider investing in Hecla Mining?

Mr. Mike Westerlund: Hecla Mining gives investors exposure to silver and gold, very large, very high

quality reserves in good mining jurisdictions across the world, like Quebec and Alaska and Idaho. We've

calculated our silver reserves at $14.50 an ounce, which is the lowest in the industry and gives us a built in

margin in every ounce that most companies don't have. Hecla is a large conservative company. We've been around

for 126 years and our strongest production year was 2016. We also have bought two very large development projects

in Montana in the past couple of years. When they're in operation in the future, it should double the size of the

company from a metal production perspective. So, we do a have a long term growth plan, and in the meantime have

excellent operations now. We're benefiting from the higher prices. Everything's going really well for us right

now.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add?

Mr. Mike Westerlund: Thank you for the opportunity of speaking with you, Dr. Alper

Dr. Allen Alper: Thank you. It’s been a pleasure.

http://www.hecla-mining.com/

Hecla Mining Company

Jeanne DuPont

Corporate Communications Coordinator

Investor and Public Relations

1-800-HECLA91 (1-800-432-5291)

hmc-info@hecla-mining.com

|

|