Pan American Silver Corp. (NASDAQ: PAAS; TSX: PAAS): One of the Largest Primary Silver Producers, Reducing Costs and Delivering Strong Operating Results, Siren Fisekci VP Investor Relations

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 11/1/2017

Pan American Silver Corp. (NASDAQ: PAAS; TSX: PAAS) is one of the largest primary silver producers in the

world that owns and operates six mines across Mexico, Peru, Argentina and Bolivia. Pan American also owns

several development projects in the USA, Mexico, Peru and Argentina. According to Siren Fisekci, who is VP of

Investor Relations and Corporate Communications of Pan American Silver, for the first half of 2017, they

generated net earnings of $36 million and are among the lowest cost in their peer group of silver producers. The

company pays dividends and is looking forward to growing free cash flow over the next several years, thanks to

two major expansions at their mines in Mexico. Pan American's vision is to be the world's pre-eminent silver

producer, with a reputation for excellence in discovery, engineering, innovation and sustainable development.

Pan American Silver Corp.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing

Siren Fisekci, Vice President of Investor Relations & Corporate Communications for Pan American Silver Corp.

Could you give our readers/investors an overview of your company?

Siren Fisekci: Pan American is the world’s second largest primary silver producer, creating value

through excellence in discovery, engineering, innovation and sustainable development. Pan American’s success

story started 23 years ago and we have steadily grown to six silver mines located in Mexico, Peru, Bolivia and

Argentina. Our six development projects are located in the United States, Mexico, Peru and Argentina.

We have been highly successful in growing our silver assets through acquisitions, expansions of existing

projects and through mine-site exploration efforts. From less than a million ounces 23 years ago, we are

expecting to produce between 24.5 and 26.0 million ounces of silver in 2017. Over the last 13 years, we have more

than replaced mined silver reserves. Our mineral reserves are estimated to contain about 286 million ounces of

silver and 2 million ounces of gold at the end of 2016.

One of the areas where we’ve had the most success in growing reserves is at our La Colorada mine. Since 2010,

reserves at La Colorada have increased 200%. In 2016, we added 13.3 million ounces of new reserves, bringing

total silver reserves at that mine to over 98 million ounces while maintaining silver grades of around 400 grams

per tonne. Our success in growing reserves at La Colorada has been the foundation for expanding the mine to

increase the production of silver, zinc and lead. That expansion was completed ahead of schedule and slightly

under budget, with mining and processing rates reaching the designed 1,800 tonnes per day in Q2 2017. We expect

average annual silver production to grow to 7.7 million ounces in 2018 while efficiencies reduce costs.

Dr. Allen Alper: That sounds very good. Could you tell us a bit more about the operations of the mines and

more on exploration?

Siren Fisekci: Certainly. We’ve also got an expansion underway at our Dolores mine in Mexico. We’re

expecting silver and gold production to increase in 2018 with a new underground mine and a pulp agglomeration

plant. We began commissioning the new 5,600 tonnes per day pulp agglomeration plant in Q2 2017, which will

accelerate and improve the recovery of silver and gold from the higher-grade ore. In terms of exploration, we

have a budget of US $21 million in 2017, up about 45% from 2016. Much of that spending is directed at mine and

near-site exploration programs to continue our strong track record of replacing mined reserves. We tend to leave

greenfield exploration to the companies where that is their focus. We do seek to acquire projects, as they move

up from the initial exploration phase to a stage where we can add our value as a proven mine builder and

operator.

Dr. Allen Alper: That sounds very good. Could you tell us how your cost compares to the others?

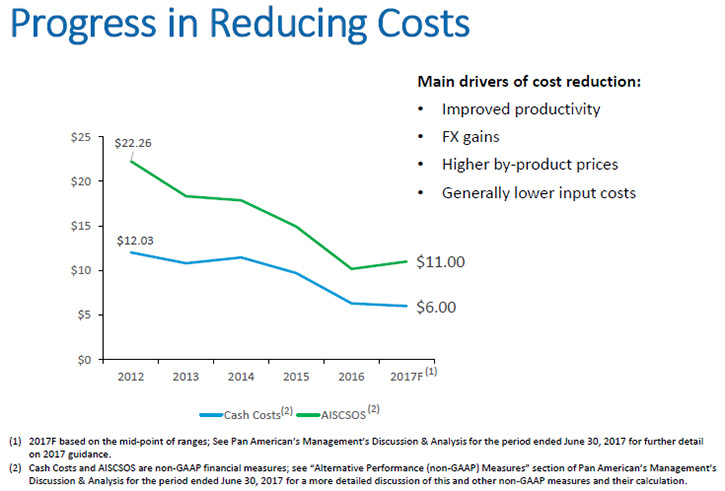

Siren Fisekci: Our analysis indicates that our costs are very competitive with our silver peer group.

For example, for the first half of 2017 our all-in sustaining cost per silver ounce sold averaged $10.73. It's

often difficult to get an apples-to-apples comparison of costs among different companies because of what may be

included or excluded. In Pan American's case, our all-in sustaining cost number includes everything but any

capital to expand or grow our operations, and taxes. It includes all of our sustaining capital to maintain

current operations, G&A, royalties and production costs. We’ve worked hard to reduce the cost structure at our

mines by investing in productivity and efficiency improvements. In our three-year outlook to the market issued in

January 2017, we expect costs to remain low, and in a range similar to what we've achieved for the first half of

2017.

When you're looking at costs, probably the best way to determine whether or not they are competitive is

to look at the operating margins the company is generating. In Pan American’s case, we’re generating very

attractive mine operating margins. Even at today’s silver prices of around $17 per ounce, we're a very profitable

company.

Dr. Allen Alper: Sounds great. Could you tell us a bit about yourself, the team and the board?

Siren Fisekci: Certainly. I joined Pan American in 2016 as the VP of Investor Relations and Corporate

Communications. I have 20+ years in the resource and commodity based sector. I joined a well-established team at

Pan American. Our senior management has been together for over 10 years. This is the same team that has delivered

the growth you see. The Chair of our board, Ross Beaty, was the founder of Pan American. He has more than 40

years of experience in the international minerals industry and I expect many of your readers will recognize the

name given that he's founded several resource companies over that period of time. Our board is also supported by

a diverse level of expertise from finance to mining professionals.

Dr. Allen Alper: Wow. That sounds very good. I've interviewed Ross, oh, about six years ago. I'm very

impressed with him and what he's accomplished. Could you tell me a little bit about your balance sheet?

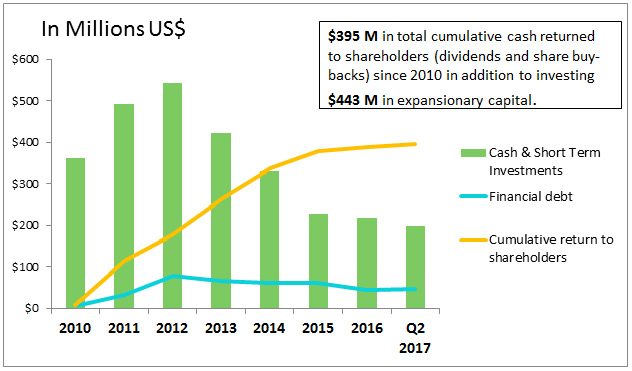

Siren Fisekci: Certainly. Pan American aims to maintain low levels of debt on our balance sheet so that

we can manage through the silver commodity price cycle. We don't have control over silver prices. What we can

control is our costs and our balance sheet. Maintaining low levels of debt provides a cushion of financial

capacity to manage through periods of softer metals prices and it enables us to take advantage of opportunities

in the market during those periods. For example, we invested in our business during the last bear market cycle to

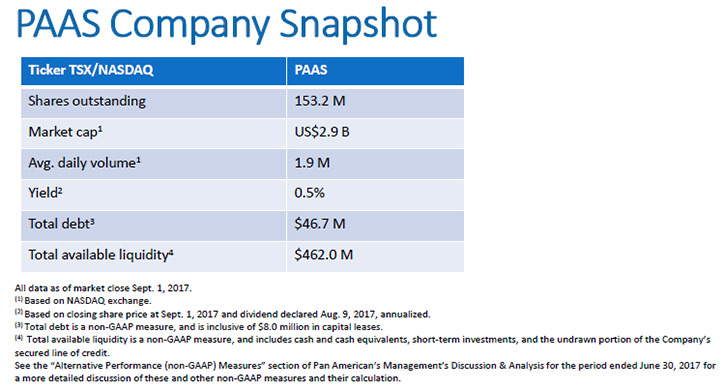

expand our operations at the La Colorada and Dolores mines. At June 30, 2017, we had debt of only $46.7 million

and cash and short-term investments of about $198 million.

Dr. Allen Alper: Wow. That's outstanding.

Siren Fisekci: Yes. It would certainly be one of the strongest balance sheets in our sector. At June 30,

2017, we had total available liquidity of about $462 million, including the line of credit, so we have the

ability to take advantage of opportunities that might come our way.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit about your capital

structure?

Siren Fisekci: At the end of Q2 2017, our total debt was $46.7 million and total shareholders’ equity

was roughly $1.5 billion for total debt to equity of about 3%

Dr. Allen Alper: I see your stock is listed in various places. Could you fill us in on that and the

symbol?

Siren Fisekci: Our trading symbol is PAAS. We're listed on the Toronto stock exchange and the NASDAQ

exchange, so in the U.S. and Canada.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider

investing in Pan American Silver?

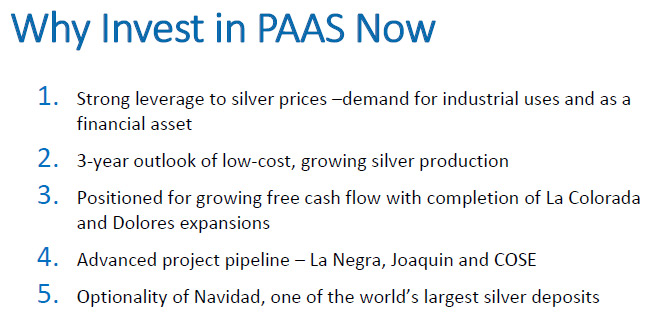

Siren Fisekci: Probably the most notable near-term reason is the growth in free cash flow that should

occur from the two major mine expansions in Mexico that we are just completing. Silver production is expected to

rise, approaching 30 million ounces annually in 2019, while costs remain at the low levels we’ve indicated in our

guidance, positioning us for very healthy margins on our operating base. Depending on silver prices, we're

looking at robust free-cash flow generation over the next couple of years. And that excludes any contribution

from our newly acquired Joaquin and COSE projects in Argentina. The free cash flow generated in the business will

be available to redeploy into new growth projects, ones that would deliver a high rate of return to our

shareholders, whether they be within our existing portfolio of assets or through acquisitions in the market.

Secondary, we do pay a dividend. At the beginning of this year, we doubled the dividend to 10 cents annually.

Further increasing the dividend is another option for our Board to return value to our shareholders. Since 2010,

we have returned $395 million in total cumulative cash to shareholders through dividends and share buybacks.

Dividend levels will necessarily fluctuate, reflecting the cash generated in our business and metals prices, but

our view is that we can pay a healthy dividend and still continue to invest in our business and growth. That is

our objective.

We have two other projects that are not currently considered within our growth profile – Joaquin and COSE -- two

new acquisitions that we made earlier this year in Argentina. Both are located near our existing Manantial Espejo

mine, enabling us to use the processing facilities at this mine and benefit from that invested capital.

We disclosed some information on the COSE project in our second quarter 2017 report. We expect to begin

producing from COSE at the end of 2018. It's a very high grade, small deposit that would produce for around 18

months at roughly 112,000 ounces of silver per month and 2,300 ounces of gold per month. The Joaquin project

will generate substantially higher production than COSE, and we expect to provide further detail on that later

this year once we have completed the preliminary economic assessment.

Finally, Pan American is the 100% owner of the Navidad Project, which is one of the world's largest

undeveloped silver deposits. A ban on open-pit mining in the province of Chubut, Argentina, currently prevents us

from developing the resource, but it does represent a free option for our shareholders to a world-class silver

project.

Dr. Allen Alper: Sounds excellent. You have an extremely impressive company and those are very compelling

reasons to consider investing in Pan American Silver.

Siren Fisekci: Well, thank you. We're very proud of the company and the level of expertise that exists

in Pan American Silver to continue to grow and provide strong returns to shareholders.

Dr. Allen Alper: Very impressive.

https://www.panamericansilver.com/

Pan American Silver,

Siren Fisekci,

VP, Investor Relations & Corp. Communications,

Tel: +1 604 806 3191,

Email: ir@panamericansilver.com

|

|