White Rock Minerals (ASX: WRM): In possession of a globally significant zinc and silver VMS Project in Alaska, and a Gold-Silver Project in Northern NSW Australia, Interview with Matthew Gill, Managing Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/15/2017

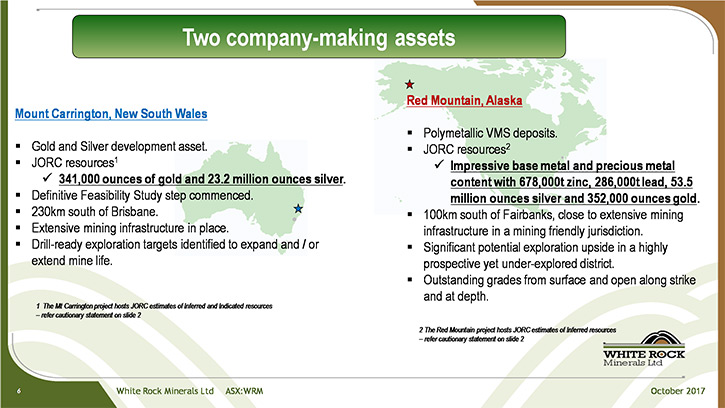

White Rock Minerals (ASX: WRM) is an Australian minerals exploration and development company with projects

located in northern NSW and central Alaska. White Rock’s cornerstone asset is the Mt Carrington epithermal gold-

silver project in northern NSW. Their other asset is the advanced VMS Red Mountain project in Alaska with high

grade zinc and silver in two deposits. We learned from Matthew Gill, who is Managing Director and CEO of White

Rock Minerals that Mt Carrington is an advanced stage project with about 50% gold 50% silver, with a definitive

feasibility study, currently in progress and an approved mining lease. According to Mr. Gill, the project already

has a finance proposal from a private equity group in New York called Cartesian, one of White Rock's largest

shareholders, who would like to fund the construction of the mine. As far as the Red Mountain project, it is a

globally significant zinc and silver project, recently acquired by White Rock that is already able to stand

shoulder-to- shoulder with other ASX-listed peers in the zinc space.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Matthew Gill,

Managing Director and CEO of White Rock Minerals. Could you give our readers/investors an overview of your

company?

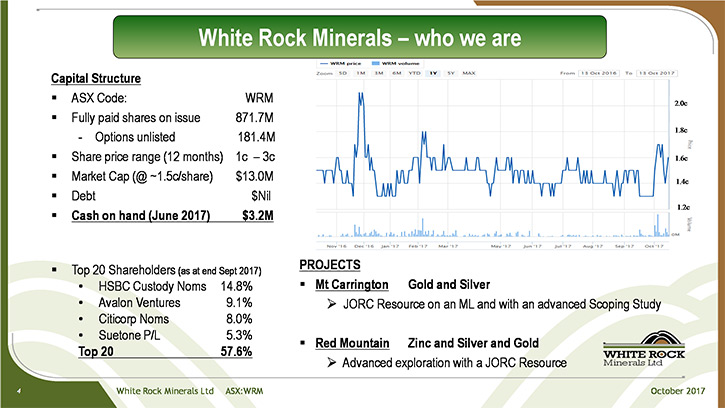

Mr. Matthew Gill: Certainly, Al, we're an ASX listed Australian based company, with a market cap

around 11- 13 million dollars Australian. We have two projects; a precious metals gold and silver project in

northern New South Wales here in Australia, and one that is giving us a lot of excitement and interest, a zinc

and silver VMS project in Alaska, which we only acquired last year. It's turning out to be certainly bigger than

our initial thoughts.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors a bit more about those

projects?

Mr. Matthew Gill: Certainly, Al. The New South Wales project in Australia is at an advanced stage

with a definitive feasibility study currently in progress. It's on an approved mining lease. There was previous

mining there. It has a JORC resource of about 341,000 ounces of gold and about 23,200,000 ounces of silver. So

it's a nice precious metals project. There aren't many like that in Australia. You're often either gold dominant

or silver dominant, or with silver as a by-product. The project is called Mt. Carrington and in terms of the

split, it's about 50% gold, 50% silver. We hope to take that through pre-feasibility by the end of this calendar

year. So there will be some news flow from that and then take that into definitive feasibility next year.

One thing your readers/investors might be interested to know is that we are quite unique in that, subject

to the outcomes of that feasibility study, and obtaining the necessary environmental approvals, we already have a

finance proposal in front of us from a private equity group in New York called Cartesian. Subject to certain

conditions, they will fund the construction of the mine. It's a 19 million U.S. facility. In return, we pay the

loan back out of pretax revenue. That's quite unusual. I don't know any Australian mining company on the ASX that

has that facility. Cartesian is backing four other companies. That's a link with North America that many

Australian companies wouldn't have.

Dr. Allen Alper: That's an excellent achievement. That's great! It shows people have great faith in you

and your project. That's excellent!

Mr. Matthew Gill: Yes, and it goes a bit deeper, Al, the Cartesian group is our second largest

shareholder as we speak. They put equity money in up front. So they have skin in the game. They have about 8% of

White Rock, so that's a great cornerstone, as you say, a vote of confidence. Jeremy Gray, with extensive finance

experience and connections, including Morgan Stanley, Credit Suisse and others, is on our board as Cartesian's

representative. They're certainly backing the project, that's exactly the right view to take.

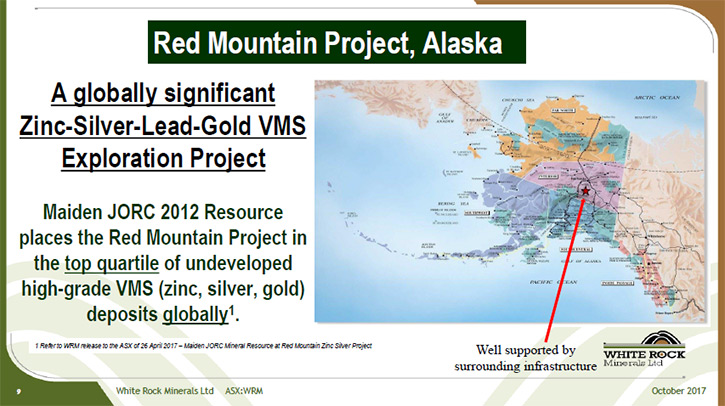

We acquired the Alaskan project, only around April last year. As you know, zinc has certainly finally

come of age as a high-performing commodity. We're fortunate to have been able to pick up a significant zinc and

silver project. It's already globally significant as we generated a JORC resource on it earlier this year. There

are comparison studies on this project comparing it to our peers. It's already able, certainly on the ASX, to

stand shoulder-to- shoulder with our peers in the zinc space and in North America with some VMS projects in the

Yukon. So we think we're in good company, from a peer point of view, a geology point of view, a geography point

of view, and a commodity point of view with this project.

Dr. Allen Alper: Excellent! Could you tell our readers/investors a bit about your background and your

team?

Mr. Matthew Gill: I'm a mining engineer by background. As a mining engineer, I look at the geology,

the mining and the metallurgy, the technical aspects. In my role as Managing Director and CEO of White Rock

Minerals, I also on being corporate aware and aware of what is in the best interests of our shareholders. I have

also come to appreciate the contributions of our board and the importance of the board from the investors’ point

of view. We have an exceptionally experienced board. I do challenge people when I present, certainly on the ASX,

to find a board of our experience and caliber for a company of our size.

We're a board of five. Our Chairman, Brian Phillips is a mining engineer. In fact, four of the five of us are

mining engineers, which is a bit unusual, but it says a lot about our desire to do things, create value, and grow

a business. We're not a life-style law or accounting firm group of people. Brian has 45 years of operational and

corporate experience in the industry. He's also currently chairman of ASX- listed Panoramic Resources, a nickel

company.

We have Peter Lester, again a mining engineer, with forty years’ experience. He's also currently chairman

of an ASX- listed company, Kidman Resources, which is going extremely well with a lithium project. He's also

non-executive director of another Australian company. He's on the board of Nordgold, which is Russia's third-

largest gold company.

Ian Smith is known to most people in Australia. Ian, for five years, was the managing director of Newcrest, which

was the world's third- largest gold mining company. After that he was MD of Orica, which most people would know

for chemicals or explosives. Many people say, "Why would someone of Ian's caliber join a small company?" It's

because of the board, its projects and the ability for us to grow a business.

Jeremy Gray is a commercial finance and mining investment person. He was head of Metals and Mining

Research for Morgan Stanley, Global Head of Basic Materials at Standard Chartered Bank Plc and Head of Mining

Research at Credit Suisse, based in London. He's actually Australian, but lives in London.

Then there's myself, a mining engineer. I worked in underground operational roles, up through to

executive roles. This is my third managing director role. I'm also a non-executive on another company. I am based

just outside Melbourne. I'm the boy on the board with 35 years’ experience.

Dr. Allen Alper: Well you and your board have extremely strong experience. You've put together a fantastic

group.

Mr. Matthew Gill: Yes, it's unusual. It's quite unusual to have on a board, people that are

chairmen on other boards. That brings us a huge wealth of knowledge and experience. We learn significantly from

that. With that sort of horsepower sitting around a table, we have the ability to see, with some clarity and have

good dynamic discussions and really resolve and move things forward. We are able to share experiences and discern

appropriate ways forward as a team. It’s a huge asset to have.

Dr. Allen Alper: Sounds excellent! Could you elaborate a bit more on your capital structure?

Mr. Matthew Gill: Certainly. The company listed in 2010 on the ASX. It has about 871 million shares

out. Depending on share price, which has settled, this calendar year, between 1.3 and 1.5 cents, giving us a

market cap of between 11 and 13 million dollars Australian. There are about 180 million unlisted options.

They're out of the money currently. We have no debt. As of June 30, we had a bit over 3 million dollars in the

bank. We're nicely funded, clearly. With two good projects to advance, we're now testing what options we have

going forward, talking to other companies, especially on the TSX, fund managers, PE groups and investor groups,

to determine how best to unlock the value from our two projects. We have two good projects, but like most

juniors, could always do with a bit more in terms of being able to do what we would like. That's part of the

reason we went to “Mines and Money” in Toronto, to meet investors. It would be ideal if we attracted a

cornerstone investor. I would like to think we have two pretty good projects, either or both of which should

garner some interest.

Dr. Allen Alper: Excellent! Could you tell us a bit more about your plans for the rest of 2017 going into

2018?

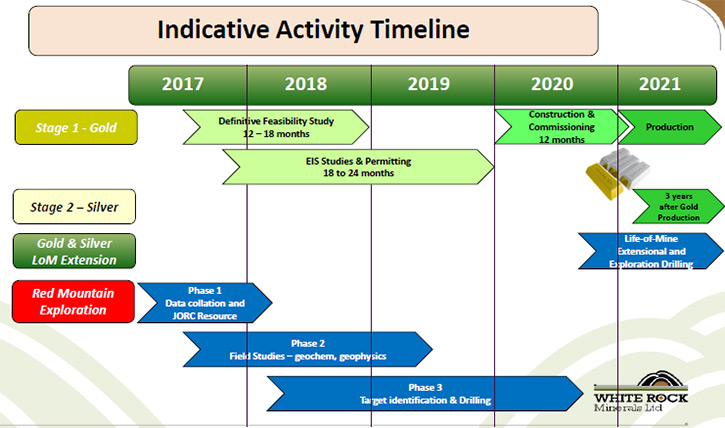

Mr. Matthew Gill: Absolutely, news flow is very important, shareholders need to know what is going

on. Mt. Carrington is a gold and silver project in New South Wales. We are deep into pre-feasibility. It already

has a scoping study wrapped around it, and a mine plan, and economic financial metrics. So we hope to complete

that pre-feasibility before the end of this calendar year. That would generate a JORC- compliant reserve and firm

up financial metrics around production rates, cash costs, internal rate of return, etc. I guess the pre-

feasibility is something like a NI 43-101 for your readers in Canada and North America. It will have a JORC-

compliant 2012 reserve behind it. The news flow that comes with that is the technical work we're doing;

metallurgical recoveries, mining production rates, and mine designs and with estimates on operating and capital

costs. So that's the plan.

Then into 2018, the plan is to complete that to definitive feasibility study level, also called final

investment decision, that being where you've defined the project and commence the environmental approvals

process. The Mt Carrington project is on mining lease and we have had very good relations with the government and

the communities. But there is a formal approval process that you need to go through, which we plan to start next

year.

The long range view, then, all going well and completing the approvals, construction is about a year and we hope

to be producing gold within three years from now. Some mines have taken ten to fifteen years to get into

production. So we feel good where we sit now, we think, we should be producing a gold bar inside three years. So

that's Mt. Carrington.

The Alaskan asset is a really exciting opportunity. When we acquired it last year, it was 15 square

kilometers of claims with two known deposits, an historical estimate that was done in the 1990's. We've expanded

that 15 square kilometers out to 143 square kilometers (35,000 acres). We've identified 30 look- alike

exploration targets to the two known deposits we acquired.

Those targets present a great opportunity. We would hope to get on the ground come next season. In

Alaska, now would be a problematic time to start doing anything. But certainly come the start of the season next

year, we want to be doing some targeted exploration to test these high- priority targets, airborne geophysics,

and on-ground geo-chem. At the same time, we would hope to do some drilling on the two known deposits, which have

given us this globally significant JORC resource of 16 million tonnes of 9% equivalent zinc. These two deposits

are open at surface, open along strike, and open down dip.

So the news flow from Alaska on this project, come next season, could be significant on those two fronts.

The drilling in and around the two known deposits, which have some spectacular intersections already and already

have a robust JORC resource. But as you know, VMS's, volcanogenic massive sulfides, do generally come in

clusters, in camps, in groups of deposits. So we think we have a real prospect, since we already have two and we

have 30 look- alike targets. All of those may not come in, but there is a strong possibility of at least a few to

add to our significant starting base. It is a true poly metallic deposit. It's strong in zinc and silver, but

also lead and gold and copper. So we think we have something exciting. We intend to work very hard next year to

define the exact nature and scope of what we have.

Dr. Allen Alper: That sounds excellent. What are the primary reasons our high-net-worth readers/investors

should consider investing in your company?

Mr. Matthew Gill: We like the quality of our two projects and they're at different stages of

development. I think precious metals is a good commodity to have in any person’s portfolio. Our New South Wales

project with gold and silver is also in a good jurisdiction in Australia. In our Alaskan project, we have an

already globally significant project. Significant upside: it hasn't had exploration since the 1990's and there's

some independent research on our website that I would encourage you to read, which values that project alone at 6

cents a share and White Rock shares are currently 1.5. That research report also values our Mt. Carrington

project in New South Wales at 2 cents a share. So combined, an 8 cent per share valuation and we're currently 1.5

cents. So even if the valuation is half right, there is significant upside potential as we advance both projects.

Dr. Allen Alper: Sounds like a great opportunity.

Mr. Matthew Gill: Well I'm biased, but I think so.

Dr. Allen Alper: Anything else you'd like to add?

Mr. Matthew Gill: I want to thank you for the opportunity to speak with you and also mention that

you don't see a board of the caliber of our board that just wants to develop a 30,000 or 40,000 ounce per annum

gold mine. It's a board that wants to build an entire business and add value. "From small things, big things

grow."

Dr. Allen Alper: That sounds very promising and thank you. I’ve enjoyed talking with you.

http://www.whiterockminerals.com.au/

Matt Gill (MD&CEO)

or

Shane Turner (Company Secretary)

Phone: +61 (0)3 5331 4644

Email: info@whiterockminerals.com.au

|

|