U.S. Gold Corp. (NASDAQ: USAU): Advancing High Potential Gold Projects in Nevada and Wyoming in a Major Gold System, Interview with Edward Karr, President, CEO and Chairman

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/11/2017

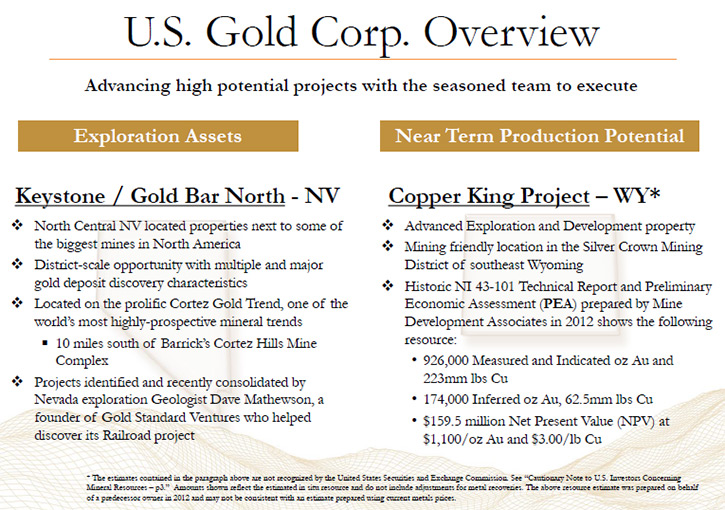

U.S. Gold Corp. (NASDAQ: USAU) is a U.S.-focused gold exploration and development company, advancing high

potential projects in Nevada and Wyoming. We learned from Edward Karr, President, CEO and Chairman of U.S. Gold

Corp., that their development asset is called Copper King, and located just outside of Cheyenne, Wyoming. Copper

King has an historic, preliminary-economic-assessment that shows a real robust resource of about 1.1 million

measured, indicated, inferred ounces of gold, and 300 million pounds measured, indicated, inferred pounds of

copper. In Nevada, U.S. Gold Corp. has another flagship asset, called Keystone. Keystone has been identified and

consolidated by legendary Nevada geologist Dave Mathewson, who also has put together a scout drilling program,

which showed that there is a major gold system on the property and in the district.

Copper King Property

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Edward Karr,

President, CEO and Chairman of U.S. Gold Corp. It sounds like you have been accomplishing a great deal since we

last spoke. You have your company up and running and are publicly traded on the NASDAQ with the symbol USAU. This

sounds great.

Edward Karr: Thanks, Al. We have been really excited recently. We are constantly progressing, adding

to the company and our properties. If we're not out in the field, in our headquarters in Elko, Nevada or on site

in Cheyenne, Wyoming, I'm on the road meeting with investors and doing a lot of the fundamental day-to-day

business that needs to be done. It's been a really exciting time!

Dr. Allen Alper: Really exciting! Could you give our readers/investors an overview of your company?

Edward Karr: Absolutely. I am happy to. U.S. Gold Corp. is a publicly traded gold exploration and

development company, traded on the NASDAQ. As you mentioned, our symbol is USAU. We have been a publicly traded

company since the 23rd of May 2017, just over three months now. Our business model is to prove up gold

discoveries and advance our development properties in Wyoming and Nevada.

In Wyoming, our development asset is called Copper King, located about twenty miles to the west of

Cheyenne. Copper King has had a lot of historical exploration done on the project in the past. Copper King has

an historic preliminary economic assessment that was done by MDA (Mine Development Associates) in 2012. That

preliminary economic assessment shows a robust resource at Copper King. There are about 1.1 million measured and

indicated and inferred ounces of gold, and 300 million pounds measured and indicated and inferred pounds of

copper. When MDA did their study in 2012, they used 1,100 dollar gold and three dollar copper. With those

numbers, the project showed a net present value of 159 million dollars at a 5% discount rate. The existing

resource is robust and viable. As we know, the price of gold is higher today, and the price of copper is in the

same range. We are confident the historic economic numbers are going to be even more attractive at current metals

prices.

We plan on adding value to U.S. Gold Corp. in two specific ways on Copper King in Wyoming. Number one, we are

moving forward with the permitting process, with a goal of bringing the existing resource to production. We are

working closely with the state regulatory authorities in Cheyenne. Copper King is located on all state of Wyoming

claims, so we only have to deal with the state regulators. The state of Wyoming's a very favorable jurisdiction

for mining. The State of Wyoming has a 5% NSR on the project and these revenues will go primarily towards the

school systems. If we are successful in getting Copper King into production, the economic value of the project to

the state of Wyoming and especially its K-12 education system could not come at a better time.

The second way we think we can add value is through exploration upside. We did an aero-magnetic

geophysical survey on the property this summer. We put out a press release on this survey. We are in the process

of organizing another geophysical survey, an IP survey right now. We will be defining drill targets this Autumn.

All our exploration geologists believe there is additional upside, and there could be a second potential deposit

on the property, which has never been drilled. Overall, we are excited about that. I think your readers/investors

should continue to monitor our Copper King developments closely this Fall.

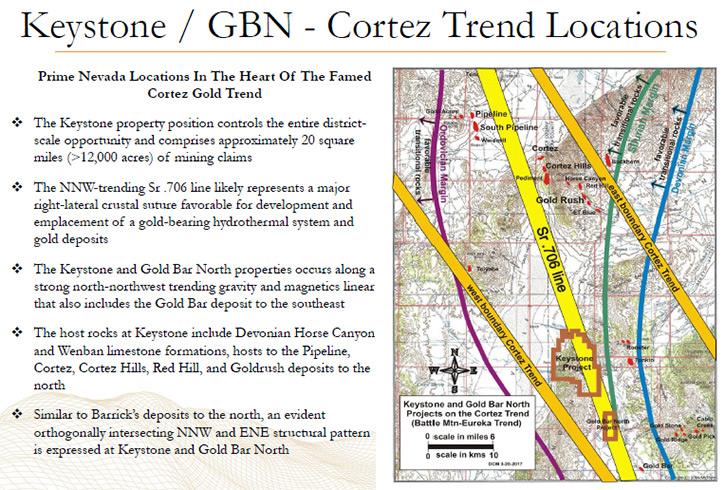

Switching to Nevada, we have two exploration properties. Our flagship asset in Nevada is called Keystone.

Keystone is a large, district scale exploration property, located on the Battle Mountain-Eureka gold trend,

otherwise known as the Cortez gold trend. Keystone is approximately 10 miles south of Barrick Gold’s Cortez Hills

mine. Keystone is now twenty square miles, over six miles long by three plus miles wide. Our land package is up

to 12,000 acres or 650 total mining claims, including the new claims just recently staked. Keystone has been

identified, consolidated and increased by legendary Nevada geologist, Dave Mathewson. His most recent company was

Gold Standard Ventures, where he led major discoveries on the railroad property on the South Carlin Trend.

Keystone is located on the Cortez trend, ten miles south of Barrick's Cortez Hills mine. Dave Mathewson believes

the geology, the stratigraphy, and host rocks, which include Devonian Horse Canyon and Wenban limestone

formations, really look very similar if not identical to the Cortez Hills and Pipeline mines to our North. Our

initial exploration efforts in 2016 and early 2017 have shown us that a large gold system potentially exists in

the district.

Dave Mathewson designed and organized a district-wide scout drilling program in 2016 and 2017. We published a

press release on these results in early August 2017, talking about some of our completed scout drill holes and

intercepts. Dave drilled those holes down to a depth of 1,500 feet. We hit the right host rocks. We have

incredible signs that there's a major gold system on the property and in the district. We're seeing huge

intercepts of highly brecciated, highly altered rock in permissive rock formations. We're seeing anomalous gold

throughout the drill holes. So now Mathewson will start the process of vectoring towards economic mineralization.

He needs to try and vector to drill into a high-grade feeder zone. Our challenge is in proving up a discovery.

However, based upon the early information Dave Mathewson is seeing, he is extremely encouraged because we do

believe there are multiple potential deposits on the property. So that's the overview, Al.

Dr. Allen Alper: Could you tell our readers/investors about your background, your team, and your board?

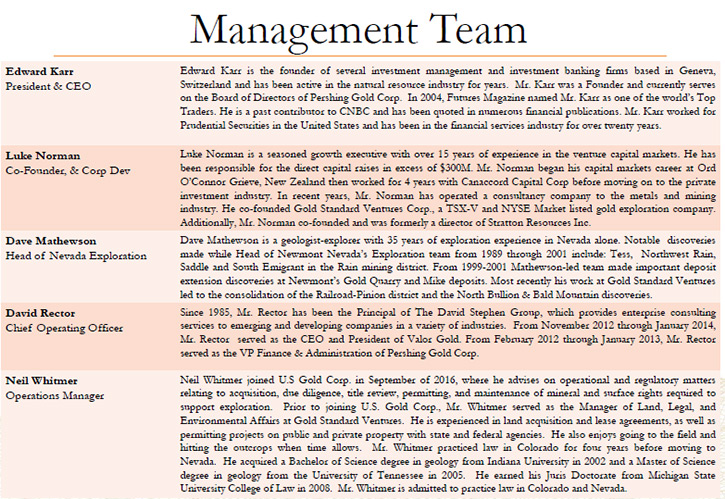

Edward Karr: I am based in Geneva, Switzerland and have a long history in the financial services and

natural resource industries. I am a capital markets specialist. I have founded a few Swiss independent asset

management and investment banking companies. Over my career, I have raised a substantial amount of money for the

natural resource sector. I know the sector well. I am on the board of a couple different mining and natural

resource companies including Pershing Gold Corp. and Levon Resources.

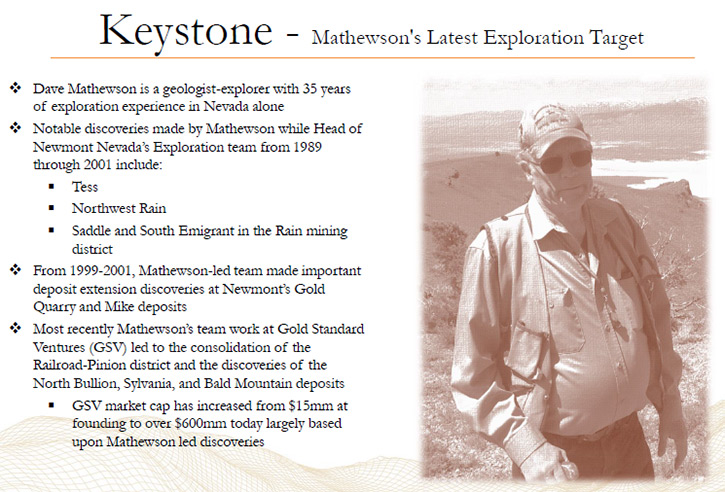

Our Chief Geologist, Dave Mathewson, is a very successful exploration geologist. In my opinion, Dave is

probably one of the top generative exploration geologists in the world. He previously worked for Newmont Mining in

Nevada as head of exploration. After that, he formed a company called Tone Resources, which he successfully sold

to Rob McEwen, part of his roll up of the Carlin Trend. Then Dave went on to co-found a company called Gold

Standard Ventures. He made a big discovery at railroad on the south Carlin Trend. Dave Mathewson has a 50-year

career as an exploration geologist, 35 years alone in Nevada, and is responsible for discovering with his teams,

tens of millions of ounces of gold.

Other members of our team include Luke Norman. Luke is one of the co-founders of Gold Standard Ventures, with a

very strong background in business development and corporate development. Neil Whitmer is our Operations Manager.

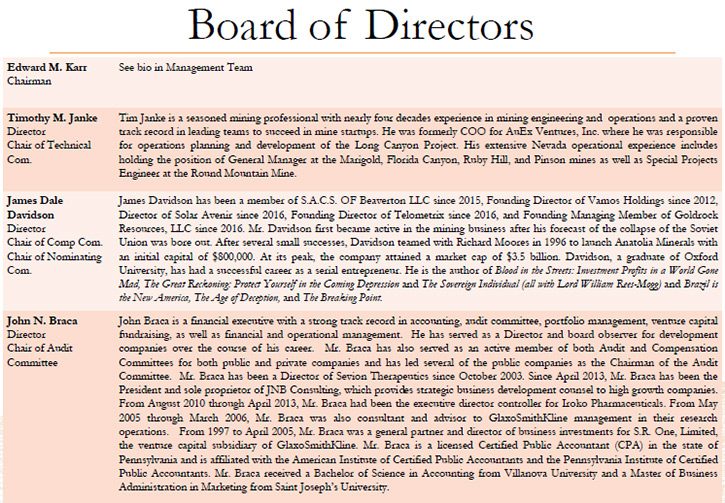

Neil is a lawyer and a geologist, so he handles a lot of our permitting. On our board, we have a couple key

individuals. Tim Janke is a mine engineer and knows the sector really well.

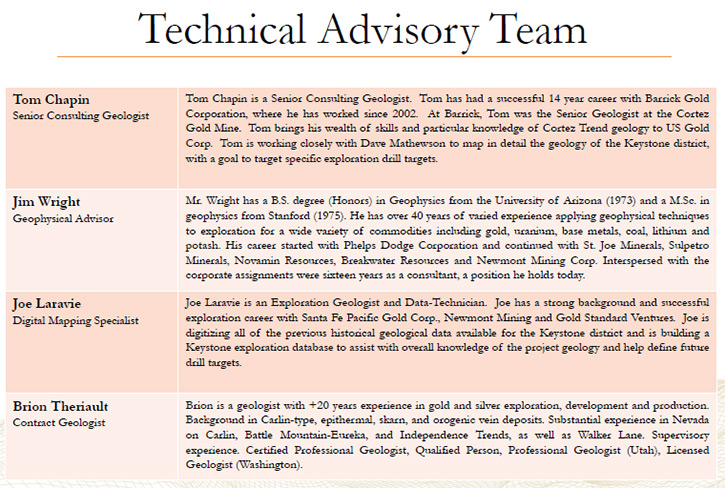

We also use many outside consultants that have worked with Dave Mathewson for years. We have a gentleman

working with us, his name is Tom Chapin. Tom worked previously for Barrick Gold. His job was to map Cortez Hills,

Gold Rush and ET Blue deposits. Tom is now working with us, mapping the entire Keystone district. This has never

been done before. Jim Wright and Joe Laravie are other consultants that Dave Mathewson has worked with for many

years. Brion Theriault is an experienced exploration geologist, working with us at Keystone.

We are extremely confident in our team. We have a lot of proven capabilities. We believe we have a very

entrepreneurial team in place to prove up the potential discoveries we believe exist on the Keystone and Gold Bar

North properties.

Dr. Allen Alper: Could you tell me about your share structure?

Edward Karr: Happy to. As of today, - the 28th of September 2017, we have approximately 13 million 25

thousand shares issued and outstanding assuming our small amount of remaining preferred shares fully convert into

common. We have no debt. USAU has a very clean capitalization table. We do have some broker warrants that were

associated with a raise that we did back in 2016. I believe it is 452 thousand warrants with a $2.64 strike

price.

We originally financed U.S. Gold Corp. as a private company through a retail offering. We have a lot of

retail investors. We raised approximately 12 million dollars privately at the end of 2016. That raise was done at

$2.64 a share. We don't, at this point, have many institutions in the stock or a lot of large, concentrated

shareholders. Management are some of the largest shareholders. I believe Dave Mathewson is one of the largest

shareholders in the company. Dave Mathewson believes in the company and the potential of Keystone so much, that

he takes 75% of his monthly compensation in restricted stock at the market. This is a real statement from a major

insider. We have many legacy shareholders from the Dataram merger. We literally have thousands and thousands of

shareholders because Dataram has been publicly traded since 1971.

Dr. Allen Alper: Very good. What are the primary reasons our high-net-worth readers/investors should

consider investing in your company?

Edward Karr: I believe we are the most exciting exploration story currently in the market. We have an

incredible combination of a later stage development asset in Copper King, with the historic PEA and the robust Net

Present Value, your readers can really hang their hat on our valuation, just on the Copper King project alone.

U.S. Gold Corp. has a solid cash position, your readers can look at our 10-Q we recently filed. In addition to

Copper King, with USAU, investors get this incredible embedded blue sky exploration option in the company with

Keystone and Gold Bar North. Dave Mathewson believes Keystone is the best exploration project he has seen in his

career.

If Dave Mathewson and our exploration team can prove up a deposit at Keystone, it's going to get very

exciting quickly. Dave keeps telling me that Keystone is the biggest system he has ever seen in Nevada. It is

showing him the biggest intercepts of the best host rocks, incredible signs of heat alteration, and all the right

trace elements are there. We have arsenic off the chart. It looks extremely prospective.

I think your high-net-worth readers/investors should watch USAU closely. Dave Mathewson is designing a

new follow up drill program this Fall. Junior exploration stocks tend to really move on the announcements of

discovery holes, as you well know Al; so, I think it's a really good time for your high-net-worth

readers/investors to put U.S. Gold Corp on their watch lists.

Dr. Allen Alper: That sounds excellent. Is there anything else you'd like to add Ed?

Edward Karr: No, that's it. We are positive. We think from a global macro standpoint, the fundamentals

for investing in gold equities are very timely. When you look at nuclear weapons in North Korea, terrorism

incidents, unfortunately, every other month in Europe, and political chaos and gridlock in the United States of

America, we believe it's a great time to own gold. Plus, the Federal Reserve is now talking about unwinding their

massive balance sheet. We believe all this global uncertainty will set up a new bull market for the sector. We

are probably in the first inning of a nine-inning ball game, and your high-net-worth readers/investors should

start getting positioned in this sector for some good upside over the next several years.

http://www.usgoldcorp.gold/

U.S. Gold Corp. Investor Relations:

+1 800 557 4550

ir@usgoldcorp.gold

|

|