Pine Point Mining Limited (TSXV: ZINC): Past Producing Zinc Mine, PEA Shows Robust Economics, Low CAPEX, and IRR of 34.5%, Interview with Jamie Levy, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 10/11/2017

Pine Point Mining Limited (TSXV: ZINC) acquired a 100% interest in the past producing Pine Point lead-zinc

project in December, 2016. Since that time, a positive Preliminary Economic Assessment (PEA) on the project,

showing a robust mining operation, which over a 13-year mine life, would have an after-tax net present value of

$C210.5 million and internal rate of return of 34.5%, with a payback of 1.8 years. We learned from Jamie Levy,

President and CEO of Pine Point Mining, that the deposits occur over a 70-kilometer strike length with great

infrastructure and a huge exploration upside. Plans for fall and winter 2017/2018 include some gravity geophysics

work around the old Pine Point town site followed by drilling, with the aim of starting the feasibility study as

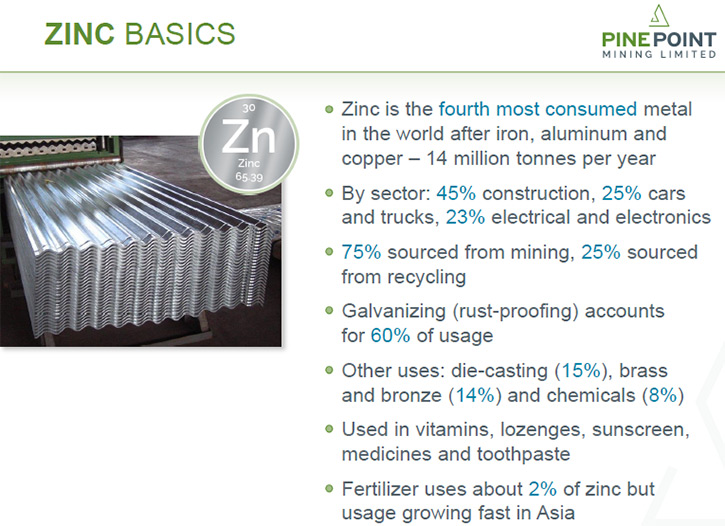

soon as possible and fast tracking the permitting process. Mr. Levy believes zinc is one of the better commodities

out there, it's the fourth most consumed metal in the world, after copper, aluminum, and iron.

A former open pit mine at the Pine Point Lead-Zinc Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Jamie Levy,

President and CEO of Pine Point Mining Limited. I wonder if you could give our readers/investors an overview of

your lead-zinc company, and why it's so interesting.

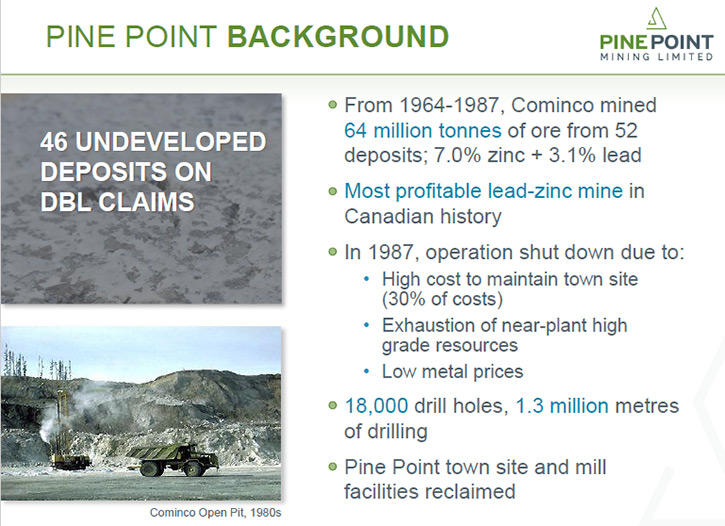

Mr. Jamie Levy: Thank you for this opportunity, Dr. Alper. We at Pine Point Mining, purchased the Pine

Point Mine and changed our name to Pine Point Mining to reflect this important asset, it’s now our primary asset.

Pine Point was an actual town in the Northwest Territories, and the former owner built a mine around it. It was

discovered in the early 1900s, and it finally came into production in 1964 by Cominco. They closed it down in

1987. It was in production for almost 25 years. It produced over 64 million tons of ore. The combined grade of

that was over 10% lead and zinc. They mined out52 different deposits, pod-like structures, typical of the geology

of Mississippi Valley Type mineralization.

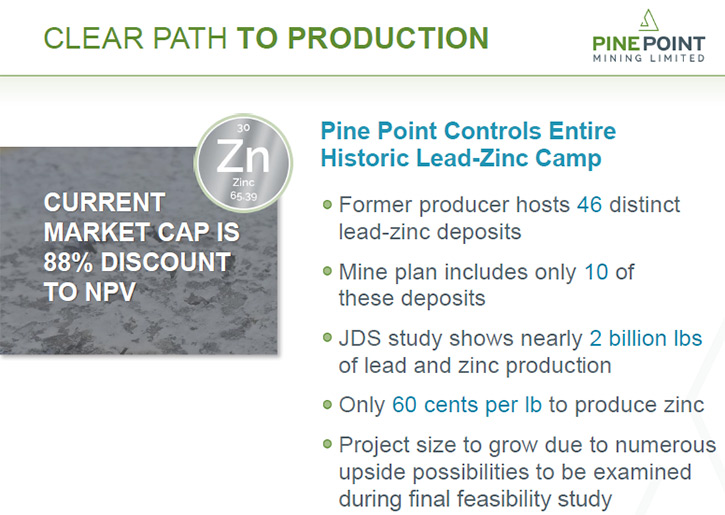

Cominco, after the '80s, left behind over 46 deposits on our property, we estimated close to 70 million

tons of historic resources. They also left the cleaned up site of a town of over 2,000 people. They removed all

the buildings. What is left of the old town site is curbs and roads and sidewalks. Over that time, Cominco and

others had drilled over 1.3 million meters of drilling 18,000 drill holes. They left the lower grade stuff they

didn't mine, and they left a huge exploration upside, many areas over the 70-kilometers strike length have had

little exploration.

Dr. Allen Alper: Sounds great. I understand that was one of the most successful lead-zinc mines. Is that

correct?

Mr. Jamie Levy: We’ve hear that it was one of the most profitable lead-zinc mines in Canadian history.

Cominco had direct shipped over a million tons of 45% combined lead and zinc, so rich they just sent it right down

to their smelter in BC, the Trail Smelter, without having to mill it. Then they mined over 10% combined lead and

zinc by open pit. I don't know what that would equate to today for grade, but that's pretty phenomenal to have 10%

open pit lead and zinc.

Dr. Allen Alper: Could you tell our readers/investors a bit about what your Preliminary Economic Assessment

shows?

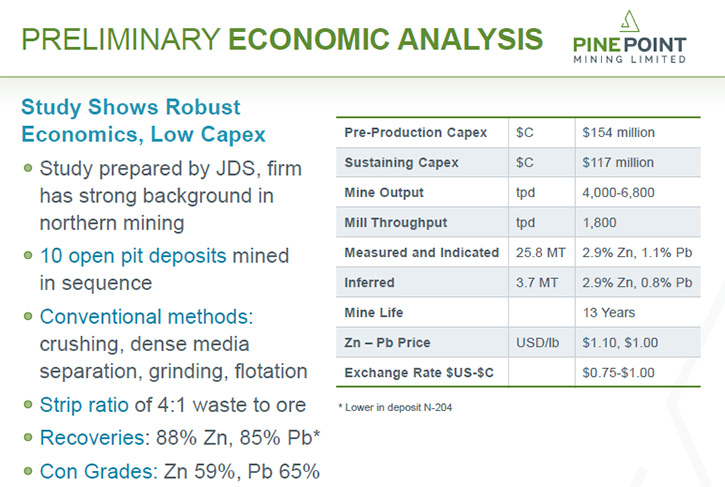

Mr. Jamie Levy: When we took over the property in December of 2016, the previous operator had a technical

report, but we were unable to use that. We engaged JDS Mining and Energy to use a lot of that previous data and

update it to reflect today's costs. There was one underground deposit in the old PEA, and nine open pits. We

decided to remove the underground because there was some question about dewatering. We substituted an open pit for

the underground, so we included 10 open pits. JDS adjusted some of the costs to make the report.

The report indicated a pre-production capex of $154 million Canadian, and sustaining capex of $117

million. In there was a resource of just under 26 million tons of lead and zinc, and then another inferred

resource of 3.7 million tons. One of the most exciting things about this project, is that the capex is relatively

low compared to other projects out there. The reason why it is so low is the infrastructure, what we have at the

project. We are excited by this. Because it was a brownfield deposit, there were over 100 kilometers of haul roads

within the project that obviously Cominco had left behind, and they are still mostly in great shape.

There's a highway from Hay River that goes all along the project. There's a substation on our project that

goes to power the people in Hay River, a town of 4,500 people, which is about 50 kilometers away from the middle

of our property. We have a workforce there. There are daily flights into that airport, and there's also a rail

head. When you're producing concentrator-based metal, you either need water or rail transportation. Otherwise the

trucking cost will eat away your profits.

We have a rail head that comes right to Hay River where the trains bring in fuel for the Northwest Territories. We

could always use the trains to haul concentrate back south, because I'm sure they'd be more than happy not to have

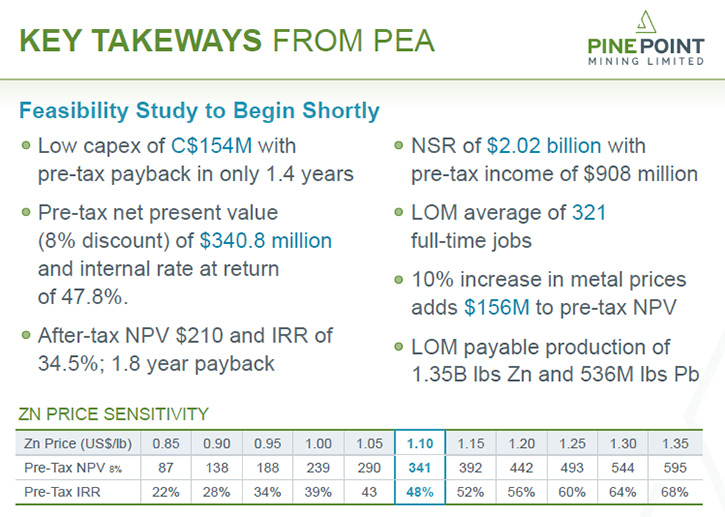

a deadhead going back. The PEA numbers came out from only 10 of the deposits. There are a total of 46 deposits

that Cominco left behind. But we only had 10 in the PEA. Within those 10 deposits, we had an NPV of $340 million

Canadian pretax, post-tax was $210 million. Payback is only 1.4 years pretax, after tax it is 1.8 years. The

payback is very quick. The IRR is about 48% pretax and post-tax is 34.5%. There's a big difference in the taxes,

pre and post-tax. There's a high tax amount in the Northwest Territories. We are looking at ways to reduce that.

Basically the NSR of the project is over $2 billion. It's going to produce 100 million pounds of zinc and

40 million pounds of lead per year. The numbers are pretty good. It would be well over $200 million Canadian in

revenue in most years. The cost is 60 cents U.S. a pound to produce, zinc equivalent. With a US$1.10 pricing,

which is what we used in the PEA, there's a very good profit margin in today's price. But, the Pine Point project

economics would make a substantial higher move at today’s zinc price of $1.40because for every 10% move in zinc,

our NPV goes up by C$150 million.

Dr. Allen Alper: That sound excellent. Sounds like you're in an excellent position and the return is great

to get your money back, 1.8 years. That's terrific. Could you tell our readers/investors what your plans are for

the rest of 2017 going into 2018?

Mr. Jamie Levy: In 2017, we had a spring summer program of drilling. We've only announced around 30 holes.

We still have another 80 or 70 holes to come out. We have a plan to do a gravity geophysical survey around the old

Pine Point town site. Our plan is to do another Fall drill program with some of the other targets will didn’t

drill in the spring summer program and hopefully so new gravity targets.

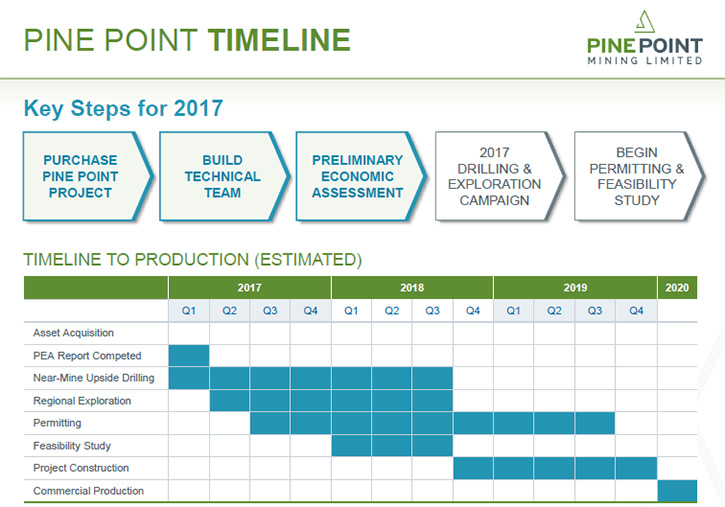

Dr. Allen Alper: Sounds very good. Can you tell us a bit about your estimated timeline to production?

The estimated timeline depends on when we begin the permitting process. We're looking to start the

feasibility study very soon, but we're still drilling. We only have 10 of the deposits in our original PEA. Going

into the feasibility study, we want to add maybe another 10 to 15 deposits, which need confirmation drilling. We

already have done that on several of them, but there are a few more that we need to drill off in the winter. Then

we’ll know which are the best deposits and the sequence we will be mining them, whether we will be increasing the

mine life, if we have to increase the mill capacity, that sort of thing. We're hoping to have a better idea by the

end of the winter drill program, the beginning of quarter two. We can't start the permitting process until we know

which deposits we are going to mine.

From the time we finish all the drilling, the Northwest Territories says it will be two years, maximum, to permit,

if we have everything in order. Because this is a brownfield deposit, the previous operator Tamerlane had a mining

permit, and this other company called Avalon had a feasibility study and they were about to be granted a milling

permit. In our area, around the town site, around Pine Point, we're hopeful that we can fast track the permitting

process of two years to maybe a year or a year and a half.

After the permitting, it will be nine months to a year to construct the mine. Production in 2020 would be

aggressive, maybe 2021. But, if we could fast track maybe we could get it started in 2019.

Dr. Allen Alper: Sounds like fun, Jamie. Could you tell us a little bit about your background and your

management?

Mr. Jamie Levy: My chairman, Kerry Knoll, is pretty well known in the industry. He's had many winners.

That's how I was introduced to him. He had this little company called Wheaton River. They had the only heap leach

gold mine in Canada. Wheaton River ended up merging into Goldcorp. He had another one called Blue Pearl, which

turned into Thompson Creek, one of the biggest winners as a molybdenum deposit in 2005/2006. He also started

Glencairn Gold, which had a couple of operating mines in Central America. It was taken over by B2 Gold. He's had a

lot of mining experience, a lot of experience in the capital markets.

Our CFO is Halina McGregor. She's worked with Rob McEwen, over at Goldcorp. She worked over at Sherritt

International. On the operations side, the first thing Kerry and I did, when we took over this project was to find

the guys that actually had the zinc experience in the north. Even though we're not that far north, we call it the

subarctic, just because infrastructure is good and the weather isn't nearly as bad as it is in the far north. We

hired John Key, a mining engineer, who worked at Cominco for over 28 years. He worked as a GM over at Polaris, a

zinc mine in the Arctic islands, one of the most profitable zinc mines around. Then he managed Red Dog in Alaska,

and expanded it to become the largest zinc mine in the world.

Tim Smith is our Vice-President of Operations, a metallurgical engineer. He's a met specialist. He worked

at Sullivan, at Red Dog, and over at Polaris. He's had a lot of zinc experience. Those two guys have probably

mined more zinc than most other people around nowadays. Our chief geologist is Stan Clemmer. He's had a lot of

experience with Cominco, Falconbridge, and a few other places. On our board, we have Parviz Farsangi, the ex-COO

of Canadian Royalties, also ex-COO of Vale and Falconbridge.

Denise Lockett does our community relations. She’s worked a lot with the First Nations, and in permitting.

She's well known up in the Northwest Territories. She can definitely help us get our permits quicker and maintain

good relations with the Aboriginals. We have a very interesting guy named Jim Vice. Jim Vice was at Teck Cominco

for 36 years. He did the concentrate marketing for Teck, all the buying and selling for one of the largest zinc

producers in the world. He pretty much knows everybody in concentrate, who's trying to buy and sell. He's very

positive in zinc as most other people are. But what he really likes about this Pine Point deposit, is that it's

had the history, the 25 years of mining.

Historically, Cominco had a 61% concentrate, which was one of the highest concentrate grades around and no

deleterious materials, like some of the other deposits have. It's clean, no penalties, there's no mercury, no

manganese. It's what a lot of the smelters want, because it can blend in with some of their nasty stuff. We're

very excited to have Jim out there because he's going to help us market our concentrate.

Dr. Allen Alper: It's a fantastic team that Pine Point Mining Limited has. Could you tell us a bit more

about yourself?

Mr. Jamie Levy: My background is in finance. I was a trader or broker for 15 years. Then I went to work in

a little mining investment company called Pinetree. Through the years I saw hundreds if not thousands of mining

companies or other companies come through the door. I have a checklist of things that I liked and didn't like

about companies. I had a good idea of what was a good management team and what was a good deposit and what was

bad. Kerry and I were kicking the tires looking for deposits with certain characteristics, which could be built

into a mine.

I think the checklist that we had was pretty good. Then we found Pine Point. We worked on getting Pine

Point for over two years. We finally were able to get it for what we think was a good price. We like zinc, and we

like the asset. We think we have one of the better zinc projects out there. I was at Pinetree for over five years.

Then I came over to work with Kerry. I'm very happy about it.

Dr. Allen Alper: That sounds excellent. Could you tell our readers/investors why zinc is important, what it

is used for and what's happening in the zinc market?

Mr. Jamie Levy: Zinc is the fourth most consumed metal in the world, after copper, aluminum, and iron.

It's mostly used in construction and automobiles. It's an anticorrosive. You would put about 40 pounds of zinc in

a car. You put the steel down and put the zinc on top of it, then the paint. The demand is coming from lots of

places in China. I think only 10% of the cars in China now use zinc, so there are a lot of rust buckets over in

china, same in India. The government's mandating putting some zinc into some of the cars. Obviously zinc is used

in most buildings so the steel doesn't rust. We can't control the demand, nobody can control it. It just depends

on how quickly the US is growing, China is growing, India is growing.

There are estimates. It's 5%, 6%, 7% per year. I can't predict the demand side, but what we do know is the supply

side. Zinc is in a deficit, and it's going to continue to be in a deficit. There are not enough new mines out

there that could match the demand. And it will take several years for most new ones to begin. That's why the price

of zinc is rising, because, as of right now, there's just not enough supply to meet the demand. Analysts are

anticipating a deficit in two, three years until some of these mines, like ours, can come back into production. I

guess the readers/investors have to look for what they think are the next deposits that are possible to come back

in line. Some deposits out there might be able to come back in line with that timeline, but I don't think there

are too many. I think we're one of the ones that can come back, while zinc is still in a deficit. Analysts have

predicted zinc is staying around $1.50 a pound for the next couple of years until the supply can catch up to

demand.

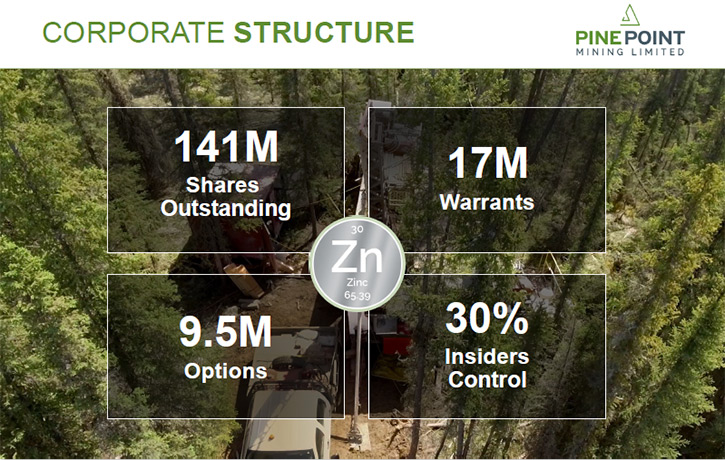

Dr. Allen Alper: That sounds excellent. Could you tell us a little about your corporate structure?

Mr. Jamie Levy: We have 150 million shares outstanding. The biggest shareholder is the private equity fund

from whom we bought the asset. They own about 27 million shares. The Lundin Family Trust owns about 20 million

shares. Pat DiCapo owns about 10 million shares. Management and directors own probably close to 20 million shares.

We have some friends and family. Rob McEwen owns about five million shares.

Dr. Allen Alper: Sounds great.

Mr. Jamie Levy: We have about $3 million in cash.

Dr. Allen Alper: Excellent! What are the primary reasons our high-net-worth readers/investors should

consider investing in Pine Point Mining Limited?

Mr. Jamie Levy: The main reason is our people. The management team is very, very strong. They believe this

is a mine and it will be a mine. We believe zinc is one of the better commodities out there, so we don't need to

worry about the price falling off a cliff like a lot of other commodities. We're very bullish on zinc, and we're

very bullish on our asset. Our project is one of the few brownfield deposits that we can get into production more

quickly than others and we have an exploration upside. We have 70 kilometers strike length and several large areas

have had almost no exploration.

We want to go back out there and try to find more of these bigger deposits, higher grade deposits like the ones

Cominco mined. We think we have a mine now, and we think we have great economics and I think we have some

exploration upside, which we can make this mine even more robust. This is not just a small little project, it is

an area, it is a district. We're glad to be the only one in this district, there's no one around us. We think that

we can build a mine here.

Dr. Allen Alper: Sounds great. You have great, knowledgeable, important investors that have faith in what

you're doing. That's excellent.

Mr. Jamie Levy: I appreciate your time and interest. Thank you.

https://pinepointmining.com/

365 Bay Street, Suite 400

Toronto, Ontario

Canada M5H 2V1

Tel. 416-862-7885

Fax. 416-361-2519

Jamie Levy

President & CEO

jlevy@darnleybay.com

416-567-2440

|

|