Interview with Don Baxter, President and CEO of Alabama Graphite Corporation: The Most advanced Battery Grade Graphite Project in USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/30/2017

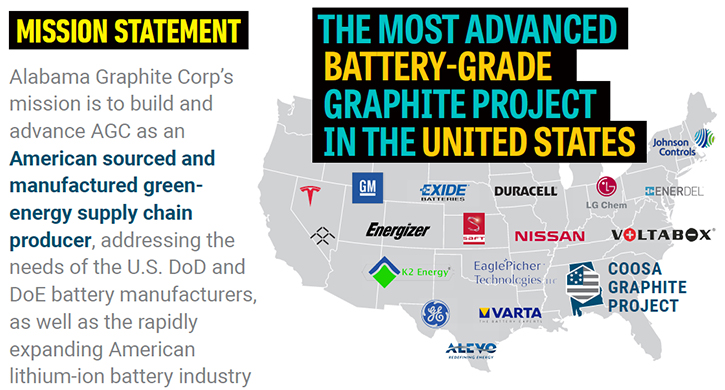

Alabama Graphite Corp. (TSX-V: CSPG; OTCQB: CSPGF; FRANKFURT: 1AG)

is a Canadian-based flake graphite development company, as well as an

aspiring battery materials production and technology company. The

Company operates through its wholly owned subsidiary, Alabama Graphite

Company Inc. (a company registered in the state of Alabama). With the

only completely battery-focused flake graphite project in the

contiguous USA, Alabama Graphite intends to become the first producing

American graphite mine this century — and to become a reliable, long-

term leading US supplier of specialty high-purity graphite for the

growing green-energy Lithium-ion battery markets. We learned from Don

Baxter, President and CEO of Alabama Graphite Corporation, that the

only significant future demand for flake graphite is for battery-ready

graphite materials, and that's what the company is focused on.

According to Mr. Baxter, graphite demand is only projected to increase

for battery graphite, and you need to have the requisite expertise to

process the material. Companies interested in the batteries made by

Alabama Graphite include some Department of Defense contractors, who

are mandated to use products made and sourced in the contiguous USA

whenever possible. No other company out there can offer that, which

puts Alabama Graphite in a uniquely strong position.

Alabama Graphite

Corporation

Dr Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of

Metals News, interviewing Don Baxter, President and CEO of Alabama

Graphite Corporation. Don, could you give our readers/investors an

overview of your company and what differentiates it from other

companies?

Don Baxter: Alabama Graphite (AGC) is not a typical mining

story, it's more of a clean tech business. It is about mining, but

more importantly, it involves a secondary process for transforming

graphite concentrate into battery-ready materials.

Other graphite development company business models are based on

producing and selling large, medium and fine flake graphite

concentrate. Although everyone talks about batteries, the vast

majority of existing PEAs or feasibility studies are based on

producing this basic graphite concentrate for traditional industrial

applications. I have not seen any other graphite development company

release the same quality or depth of technical data about battery

development work and most companies that talk about batteries have

shown no data at all. These companies’ technical reports cannot speak

to the cost or CAPEX/OPEX involved in producing battery-ready

graphite. I've been in the space long enough to know that a

traditional graphite play is not the right approach anymore. It may

have been reasonable to produce primary processed concentrate in 2012

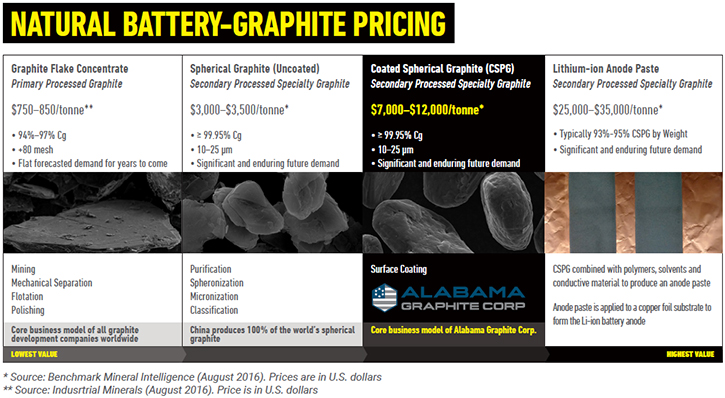

when the price for large flake graphite was $2,000 a ton. However,

today it is less than $1,000 a ton – which means it is no longer

economic to produce copious amounts of this material with such

depressed prices and an oversupplied market.

When I joined AGC, end of June 2015, just over two years ago, I knew

that the only meaningful future demand for graphite was going to come

from the increasing importance and use of lithium-ion batteries. Since

AGC was at an early stage, I could do things right from the very

beginning. Accordingly, I developed a business model based on

producing and selling products that everybody wants. I initiated AGC’s

preliminary economic assessment (PEA) and based it entirely on

producing battery-ready graphite materials. I wanted to differentiate

AGC and take full advantage of the fact that this is the only graphite

deposit under development in the contiguous United States. I had the

knowledge base to put together the flow sheets for the secondary

processing, to make the graphite battery-ready. The highest margins,

in the space, are for coated spherical purified graphite or CSPG.

Lithium-ion battery manufacturers need CSPG to manufacture anodes for

electric vehicles, stationary storage and portable electronics.

Don Baxter: After we produced our PEA, we initiated

testing on the batteries we had made, using our graphite, processed by

us, in our lab in the United States. The results were quite favorably

received. Shortly thereafter, I received the first of several calls

from Department of Defense contractors. Currently we have 14 DoD

related NDA’s and a total of 29 NDA’s which includes both non-DoD and

DoD-related NDA’s. Much of the DoD-related interest in our material

stems from the DoD mandate that its contracted battery manufacturers

source American material, whenever possible. No other graphite company

out there can say that their material is sourced in America – not even

the project up in Alaska. This is because, (according to the

military), only the contiguous United States are included in their

sourced in America protocols.

Our location places us in a truly unique position and others are have

recognized the value of our business model. There have been attempts

to imitate our business plan, which demonstrates that others realize

that we are on the right track. Though some may try to imitate our

strategy, nobody can copy our location. I believe from that standpoint

Alabama has a definite advantage that the markets haven't quite

realized yet. Actually, I believe our share price is not at all

reflective of our true value, based on what we've accomplished as a

company. I attribute this partially to the fact that people are still

confused and unable to differentiate between when other companies are

talking about primary processed graphite or battery-ready graphite.

People often assume that battery-ready graphite is automatically

included in the numbers that other companies put out and in their

business plan because those companies mention that they “intend” to

produce it. That's a key factor, from an investment standpoint. People

also assume there's an abundance of graphite in the world, and that

the prices are depressed, so they think there's no sense of urgency

about graphite. But this is only true for traditional graphite

concentrate – the same cannot be said for battery graphite.

Syrah Resources will be coming online shortly, developing a deposit in

Mozambique. It's a monstrous project that's going to produce more

traditional graphite flake than the entire world consumed last year.

The economics of that make you scratch your head a little bit and

wonder how they will be able to sell all their material and stay in

business. They're going to produce primary graphite, which you can't

use in a battery, and as I mentioned, is in oversupply with depressed

pricing.

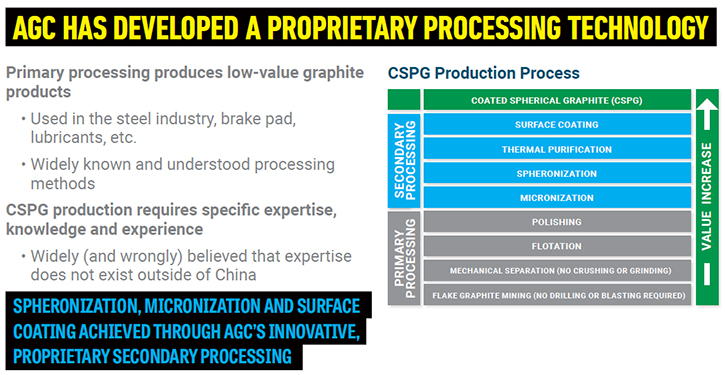

It requires a significant amount of skill to secondary process

graphite into battery material. It's not rocket science, but it takes

time, effort, understanding, and a certain expertise to be able to

make flake graphite into coated spherical purified graphite ready for

a battery. We are fortunate enough to have the requisite experience to

do so – that’s what distinguishes Alabama Graphite from every other

graphite story out there. We are all about the secondary market since

it is the high-margin, high-demand material. The demand for graphite

for lithium ion batteries is projected to grow beyond 400,000 tons by

2020. The market is currently 110,000 tons with about 65,000 tons of

that being natural. You can use natural or synthetic graphite for

batteries. Panasonic presently uses synthetic graphite for the anodes

of Tesla’s cells. However, at $20,000 per ton, synthetic is

significantly more expensive. Natural graphite for batteries costs

between $8,000 and $12,000 a ton.

Equally (and perhaps even more importantly), natural graphite will

perform better in a battery than synthetic graphite, due to its

physical characteristics. The amount of graphite used in batteries is

growing and natural flake graphite is beginning to overtake synthetic

graphite as the preferred material. Two years ago, the market share of

natural graphite was about 50%. Today it's about 65%, and it's

growing. By 2020, with more and more companies using larger

quantities, that number is going to get significantly higher. Also,

synthetic graphite has a huge environmental footprint because it is

basically a petroleum residue that is cooked in massive ovens at

incredibly high temperatures for weeks and weeks. Companies are more

concerned about corporate social responsibility these days, so

environmental concerns are also a factor in the transition to natural

flake graphite.

Currently China produces 100% of the world’s battery-ready

graphite, and much of the coating of the spherical graphite is done in

Asia. 100% of spherical graphite comes from China, and the methods

they use, which include purifying with hydrofluoric acid, are not

environmentally sustainable nor acceptable by Western standards.

That’s a problem and companies like Tesla, Apple, Volkswagen or

Mercedes are being held more and more accountable for where they

source their input materials.

Dr Allen Alper: Very good. Can you tell our readers/investors

a bit more about China and its impact on the market?

Don Baxter: I just returned from China and other parts of

Asia after spending a week in Shandong Province and up into

Heilongjiang Province looking at some graphite processing and graphite

mining and processing plants. The purpose was to gather market

intelligence and get some further information about how they mine and

process their graphite.

Don Baxter: What I learned was, the Chinese appear to be

ramping up their own graphite development, however, they are expected

to consume all of their own spherical graphite. For every battery

plant built in the West, there are probably 10 built in China for

Chinese consumption.

Mercedes has recently announced that they are building a plant in

Germany. Whether they know it or not, many companies (for example,

Apple) are going to be directly or indirectly exposed to Chinese

graphite, which is produced via questionable methods, environmentally

speaking. Of the several mining companies I visited in China, most are

either already secondary processors of graphite or they're looking at

becoming secondary processors of graphite. They don't want to sell run

of mine graphite anymore because they can't make any money doing that.

They want to make spherical graphite, and they want to make expanded

graphite, so more and more feedstock is going to be put into their own

spherical graphite consumption. China's mandated a million or two

million electric cars on the road in the very near term, within two

years. They must switch from gas and diesel to electric because of

their pollution problems.

The West does not yet realize the significance of China

controlling one of the key ingredients for producing batteries. From

an investment standpoint, most westerners have been chasing lithium.

There's a huge bubble with lithium and now they're chasing after

cobalt, stepping over graphite, thinking there's lots of graphite in

the world, so we don't have to worry about that. I can assure you,

however, the Chinese are not overlooking graphite. They are gearing up

in a massive way to support themselves in the electrification of their

economy. We at Alabama Graphite are basing our model on coated

spherical purified graphite from the only mine in the contiguous

United States.

In China, one of the world's largest graphite mines is gearing up in a

massive way to increase production to shift and produce 100,000 tons a

year of spherical graphite for domestic consumption. This company has

joint ventured with Beijing-based electric car companies and battery

companies in order to supply them with the graphite they need for the

batteries. The biggest takeaway I had from my visit to China is that

Alabama Graphite is definitely on the right track, with the right

business model, and we're just waiting for the markets to catch up and

realize just what we're doing here and the importance of it.

Dr Allen Alper: Yes, and your company, Alabama Graphite has

developed a proprietary processing technology, is that correct?

Don Baxter: Yes it is. I wouldn't call it patentable, but

it is definitely proprietary. It's not a complicated metallurgical

process like producing lithium hydroxide or rare earth, but it's

unique and it's different for every property. You have a purification

process that works for one deposit, and it's different for each one.

Alabama Graphite is the only company that has true graphite processing

experience within it. Myself, I'm a mining engineer and I was chief

engineer at one of two graphite mines that got up and running in

Canada in the early 1990s. On my board are two others, Jean Depatie

and Daniel Goffaux, who were at the other. Daniel Goffaux, being a

metallurgist, basically figured out and got the Lac des Iles mine and

processing plant (which is now Imery's) up and running and producing

decent graphite. We're in a pretty unique position with our experience

in the field.

Dr Allen Alper: That sounds great. Could you tell me a bit

about your capital structure?

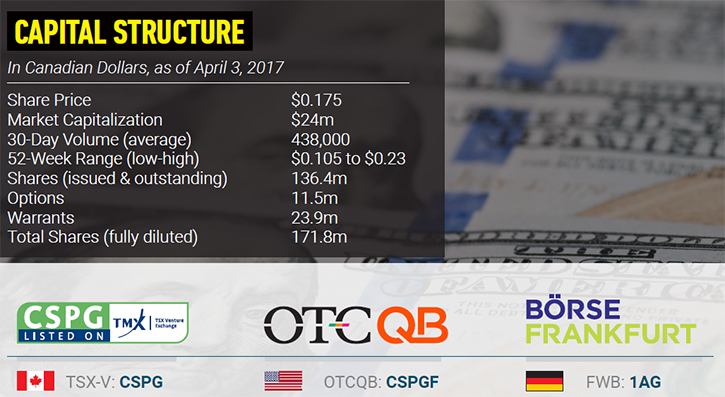

Don Baxter: We're mainly in retail. We did a small $1.3

million raise in May, so let's say roughly 136 million shares

outstanding. Insiders are a little over 4%. I myself own more than 2%.

I'm probably one of the larger shareholders. I own 3 million shares.

Dr Allen Alper: Tell me a little bit about your plans for the

remainder of 2017 and 2018.

Don Baxter: We are currently advancing on our secondary

process as well as in the process of completing a 150-kg sample of our

battery-ready graphite materials. It is critical for us to

substantially increase the amount of material we have on hand, to

respond quickly to our potential customers. They typically come back

after testing gram-sized samples, wanting somewhere in the

neighborhood of 200 to 400 grams, and then subsequently kilogram

quantities that they wish to further evaluate. The material is

produced in a batch process (as opposed to a continuous process). As

such, we are producing and characterizing the material as we make it.

To date, we have produced almost 100 kgs (of the 150-plus-kilogram

inventory) and we are finishing the characterization and

electrochemical test work of the first 50 kg. It will be another few

months before we finish the rest of production and test work of the

remaining material. It takes approximately one month to produce the

material and up to 3 months to characterize/test each amount of

material produced, as we must build CR2016 cells for electrochemical

testing. Soaking the anode for a CR2016 cell takes more than one month

to complete; initial electrochemical testing requires approximately

two months to complete.

We know of no other graphite development company that has produced

such a substantial amount of material. Having the material on hand is

going to help move us closer to that offtake stage more quickly. We're

going through the proper stages of providing samples and looking for a

return of existing samples. We are building, first, on our base of

Department of Defense contractors, and then non-Department of Defense

contractors. We're continuing our development and moving into pilot

plants and then ultimately full feasibility study for the project.

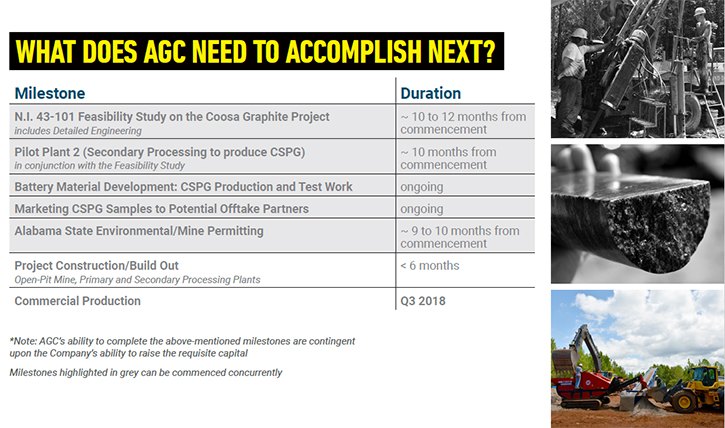

The Feasibility Study is critical aspect of what we’re doing, but by

no means a critically time-sensitive one. Completing the Feasibility

Study will be a straightforward 10-month (max) endeavor, and our

permitting process can be commenced concurrently with the Feasibility

Study and is an incredibly fast 6-month process in Alabama. With most

of our peers the process takes years and is very complicated.

Our battery accomplishments are what potential end-users are

interested in (and unfortunately, they are very technical and

sometimes difficult for investors to comprehend and appreciate).

Although end users do want a timeline for when we might be in

production, most of these entities don’t even know what a feasibility

study is and are not waiting for it. That being said, pending

financing, we intend to initiate our feasibility study by the end of

the year.

We continue to advance our silicon-enhanced coated spherical purified

graphite and as a result of very strong potential end-user interest,

we are also working on our delaminated expanded graphite and

conductivity enhancement material for both alkaline and lithium

battery cathodes.

We will also continue to advance our numerous discussions with

potential end-users both in the DoD and non-DoD. Our progress thus far

has been incredibly encouraging.

Dr Allen Alper: That sounds excellent. What are the primary

reasons our high-net-worth readers/investors should consider investing

in Alabama Graphite Corp?

Don Baxter: I think the best reason is that presently

we've gone unnoticed by the markets. We're sitting at 12 cents right

now. We are, I think, tremendously undervalued. If you look at our

peer group, some of them are incredibly overvalued and I think the

actual valuation of them and us should be somewhere in the middle of

where it is right now. We're sitting at approximately $17 million for

our market cap. I think we're extremely undervalued, we haven't been

discovered yet in the markets. We're doing our best to increase our

profile but, what we've accomplished on the technical level, either

isn't understood or isn't recognized by the market just yet. On a

positive note, end users have taken notice of and understood our

technical advancements. We believe that it is only a matter of time

before the market does too, and I think we have a lot of room to move

on our valuation.

Dr Allen Alper: Sounds very good. Is there anything else you'd

like to add, Don?

Don Baxter: This is the only pure play graphite battery

materials company out there. We're the only graphite company in the

contiguous United States. That the United States is solely dependent

on imports of materials for this critical component of the new green

energy economy is disturbing. We are in a new era of electrification

of vehicles and other power sources and renewable energies. I think

we're in a strong position to be a key player in this economy going

forward. I think people are going to recognize that Alabama Graphite

Corp. is undervalued right now and may consider getting in on this.

You could take a look too, Allen. Also, in New York, Debra Fiakas is

writing about us. She is another reference source (via Crystal Equity

Research), as far as independent evaluation goes. We have Edison

Research covering us and Stormcrow Capital has written about us as

well. We're beginning to get the word out, and it’s beginning to

spread. I think once people have a chance to take a look at this

company, they're going to realize that wow, this is something pretty

exciting. I know that I'm pretty excited about it.

Dr Allen Alper: Thank you so much for taking the time to share

all of this with our readers/investors. You have definitely presented

some excellent reasons for our high-net-worth readers/investors to

take a good look at your company.

http://alabamagraphite.com/

Alabama Graphite Corp.

Ann-Marie M. Pamplin

Vice President, Investor Relations

+1 416 309 8641

apamplin@alabamagraphite.com

|

|