TriMetals Mining Inc. (TSX: TMI, US OTCQX: TMIAF): Exploration and Development of the Large-Scale Near Surface, Gold Springs Gold-Silver Project in Mining Friendly Nevada and Utah, Interview with, Ralph Fitch, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/28/2017

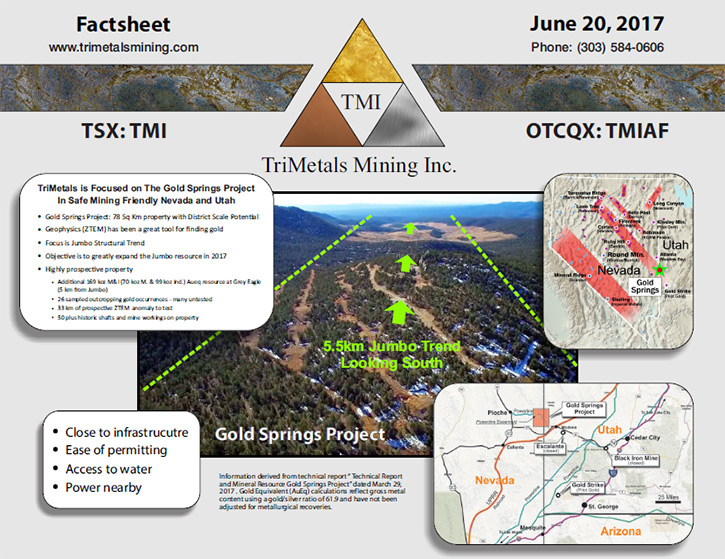

TriMetals Mining Inc. (TSX: TMI, US OTCQX: TMIAF) is a growth focused, mineral exploration company, creating

value through the exploration and development of the near surface, Gold Springs gold-silver project in mining

friendly Nevada and Utah in the U.S.A. Ralph Fitch, President and CEO of TriMetals Mining is an exploration

geologist, with over 50 years of international exploration management and field experience. He is excited about

the last season's drill results, especially at the Jumbo Trend that has significant growth potential. The new

drilling campaign is currently under way with the results expected at the end of the month. Another project,

coming into focus for TriMetals Mining, thanks to the firming copper prices, is the Escalones copper-gold porphyry

project in Chile that holds six and a half billion pounds of copper equivalent 43-101 based resource, and has lots

of potential to expand.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Ralph Fitch

President and CEO of TriMetals Mining Inc.

Ralph, could you update our readers/investors, give them an overview of TriMetals Mining Inc. and let them

know what's happening?

Mr. Ralph Fitch: It would be a pleasure, Al. Assuming everybody knows a little bit about the company, just

a little reminder that TriMetals Mining symbol in Canada is TMI and in the US, it's TMIAF. Our focus is the

exploration and resource expansion at the Gold Springs gold-silver project in what we call, 'mining friendly',

'permitting friendly' Nevada and Utah. That's the main focus of the company. We're there drilling right now, so

that's the new news. We're in the middle of a drill program, first results should come out towards the end of this

month.

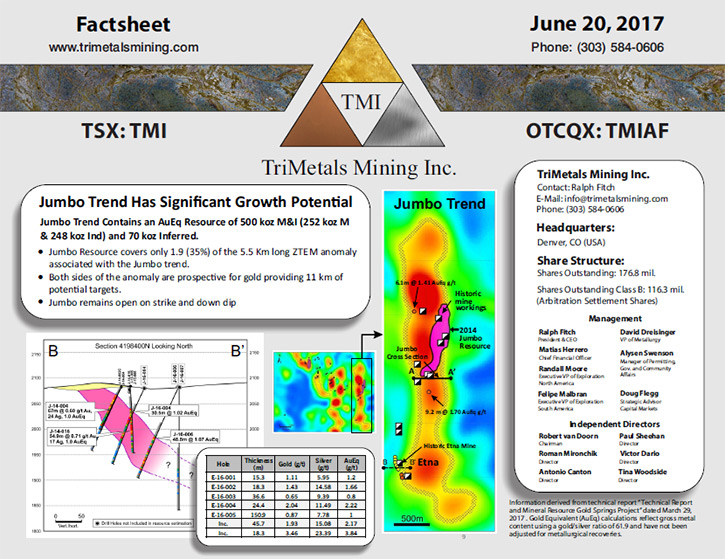

We're really excited to get this program going because, your readers may recall at the end of last year,

we drilled some really good holes at the south end of the zone we call the Jumbo Trend. This is a north-south zone

on the Utah side of the property. The property straddles the Nevada-Utah line. But the Jumbo Trend is over five

and a half kilometers long. We have two resource blocks on it. At the end of last year, we had one hole, in the

area in the south, of 150 meters of one gram gold equivalent. That was .87 grams gold plus the remainder in

silver. Within that was 18 meters of 3.4 grams. So a very exciting hole with similarly good holes around it. The

first holes we're drilling this year, we're on hole 10 now, will be in that zone.

The Jumbo Trend holds the majority of the resource we presently have on the Gold Spring property, about half a

million ounces in the measured and indicated categories. Obviously, our plan is to continue to expand the

resource. If you can imagine a block of ground, about a kilometer wide and five and a half kilometers long, with a

resource at the north end and a smaller resource at the south end, which is where we got those really good

grades last year. We're drilling around that area in the south and now we're moving the rig towards the middle.

There's an undrilled gap between the two resource blocks of about two and a half kilometers and we want to fill

that in.

We think the whole trend, based on geophysics, is prospective. So we think we have a very good chance of a

multi-million ounce type resource, within that Jumbo block alone. For those who are familiar with the property,

you will remember the Jumbo Trend is just part of this 78 square kilometer property. The other major targets are

typically on the Nevada side. We have 33 kilometers of these geophysical targets that we need to drill. We've

drilled about three of them and our present resource is about three quarters of a million ounces. That is why we

see this tremendous upside in terms of potential to discover more gold mineralization. That's probably a pretty

good update on the Gold Springs target.

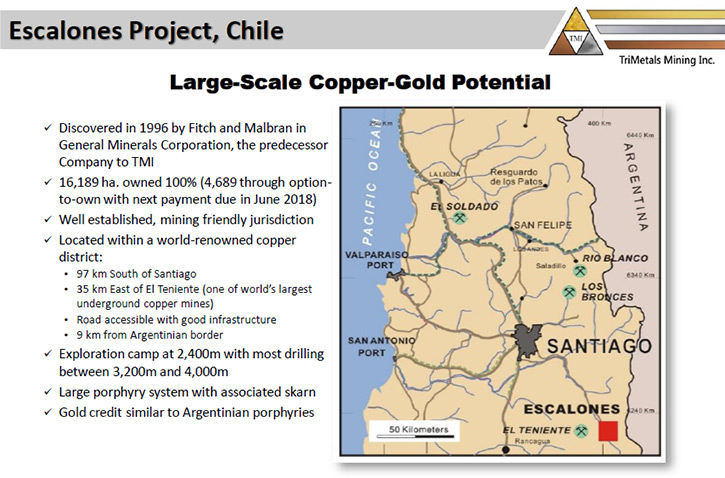

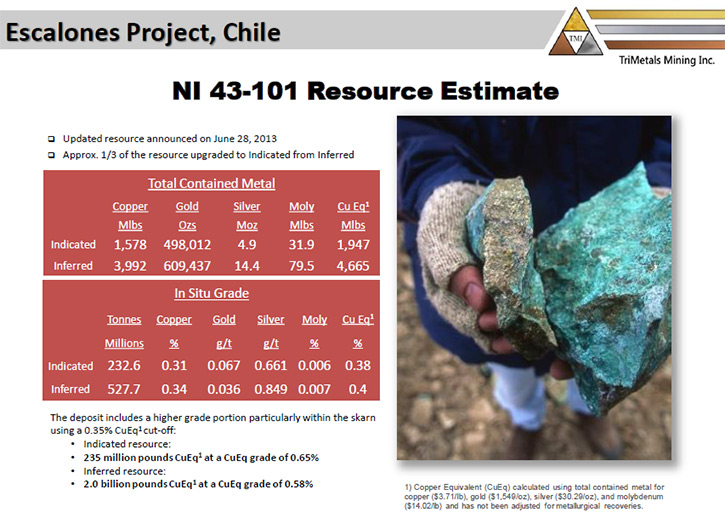

Now, Gold Springs is our focus, that's where we think we're going to add value with news releases coming out.

Probably the first one at the end of the month and then probably on a monthly basis beyond that. Because the

copper price is firming, we're thinking about reviving a project we've held onto for many years called Escalones

copper-gold porphyry in Chile. We have six and a half billion pounds of copper equivalent resource there, 43-101

based resource, a very big porphyry copper-gold project, lots of potential to expand. We just recently doubled our

land position there, we've permitted it for 20,000 meters of drilling and have a lot of upside to continue to

develop that project.

We've had this in our financials for a couple years, but now we're looking for ways to add value with this

project. We think now is the time, with the firming copper price. Studies suggest projects like this in stand-

alone companies might have valuations in the future of two to four cents a pound. So we're looking at the usual

partnering, joint venturing. Another option that appeals to me, is to spin it out to existing shareholders and

then take it public as a separate company. Existing shareholders would potentially get a big boost in value by

earning the shares of both companies.

TriMetals, once this plan starts to gel, may see a significant increase in value also due to the

revaluation of these big porphyry copper projects.

Dr. Allen Alper: Sounds really great, like you have two very excellent projects, and it sounds like it's a

great time for both projects.

Mr. Ralph Fitch: I believe it is.

Dr. Allen Alper: Could you tell our readers/investors a bit more about how your gold and gold-silver was

formed in Nevada and Utah?

Mr. Ralph Fitch: Certainly. The ore type is “gold that is related to a hot spring deposit”, so we call it a

hot-spring type gold deposit. If you have a major structural corridor, like our Jumbo Trend, where we're doing all

the drilling, at Gold Springs now, you effectively have a crack or fault that goes down quite a few kilometers

into the earth's crust. The hot gold bearing fluids, which are super pressurized at depth, come up these faults.

When they reach approximately a kilometer below the surface, or something of that order, the super pressurized

fluid explodes into steam.

We call that the boiling zone. It creates a lot of brecciation and deposition of silica quartz and the

gold. That's what we look for in this geological model, to find the boiling zone. At Gold Springs, pretty much

over the entire area where we have outcrop, and we have 26 areas of outcrop of plus one gram gold, we see the rock

characteristics of this boiling zone or the gold deposition zone in this geological model. We think we're in a

really good spot at Gold Springs to continue to expand the resource. These big structures are showing up in the

geophysics and we have about 33 kilometers of these structures to drill. We've drilled about three of them and

we're at about three quarters of a million ounces. So we think we have great potential to continue to build the

resource.

Dr. Allen Alper: Sounds fantastic! Could you update our readers/investors on your background?

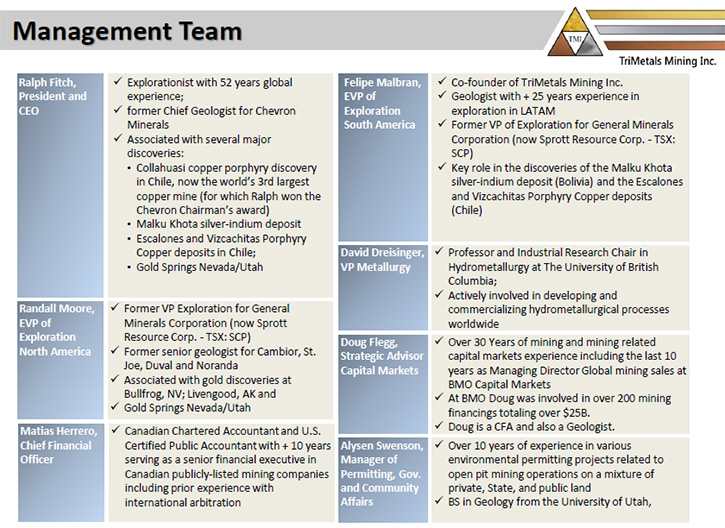

Mr. Ralph Fitch: Yeah, I've been a geologist a long time, Al. I think it's my 53rd year as a paid

geologist. I obviously enjoy doing it and discovering ore bodies. I started in West Africa for diamonds with De

Beers. I went to Australia with De Beers. Actually I was the first De Beers geologist in Australia. Then I

switched to base metals, with Anglo, spent some time underground in the South African gold mines and a little

exploration down in that part of the world. Then I came to the US, joined Chevron and worked my way up to Chief

Geologist. I was part of the Collahuasi discovery in northern Chile, the big porphyry copper, I think it's maybe

number three in the world in terms of production.

When Chevron decided to get out of the minerals business, I started a series of these TSX listed

companies. The first one was called General Minerals. We were the best performing stock on the TSX for a month or

so when we first discovered the Vizcachitas porphyry down in Chile. Then we suffered through the Bre-X fiasco that

really slaughtered our stock. Eventually came back a bit Eric Sprott and Rick Rule took over the company in, I

think that was 2007. And I IPO'd out two companies from that, South American Silver in South America and High

Desert Gold in the US. South American Silver found the Malku Khota silver Indian project in Bolivia, we got up to

400 million ounces, but unfortunately, it was expropriated.

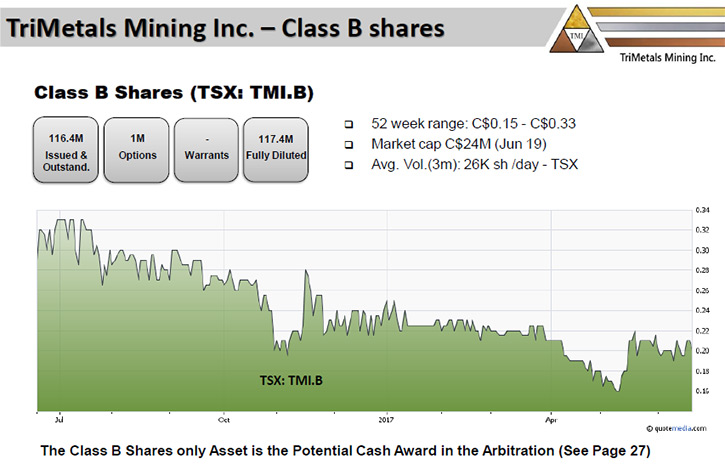

Actually, an aside there, we have B shares TMIBF in USA and TMI.B on the TSX. They get 85% after costs of

any cash award from the arbitration settlement. We have been in international arbitration against Bolivia which

we've now completed, we're just waiting for the arbitrators to make a decision. High Desert Gold found the Gold

Springs project and when South American Silver lost the Malku Khota project, which was a major discovery I\South

American Silver no longer had a precious metal property so we merged the two back together again and changed the

name to TriMetals.

Dr. Allen Alper: It sounds like you have a fantastic background, great experience and great discoveries.

That's something to be very proud of.

Mr. Ralph Fitch: Well, thank you very much. I certainly enjoy it.

Dr. Allen Alper: It's fun. It's nice to be able to discover metals and materials, a very enjoyable

experience! It’s great to enjoy what you're doing.

Mr. Ralph Fitch: Yep, and hopefully, we make some money for shareholders. We have in the past in the

different cycles and we think we're in a really good position this time around with a firming gold price and

firming copper price. I think we have a very good chance of our shares being revalued upwards.

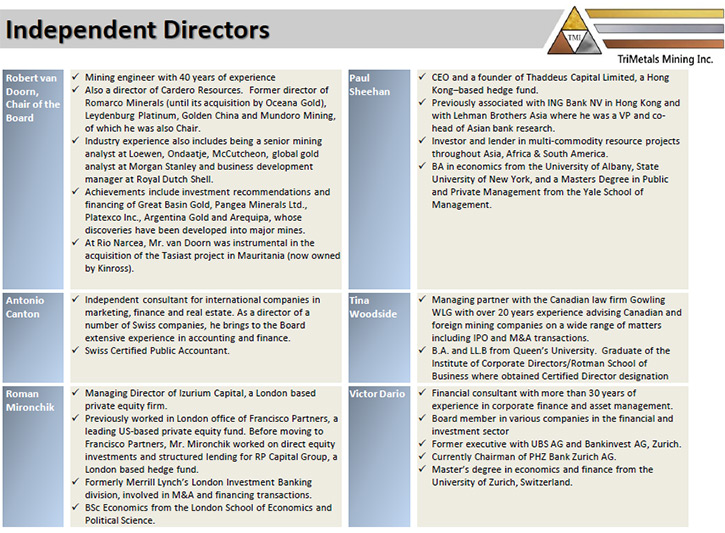

Dr. Allen Alper: That sounds great. Could you tell us a bit more about your board and some of your

investors?

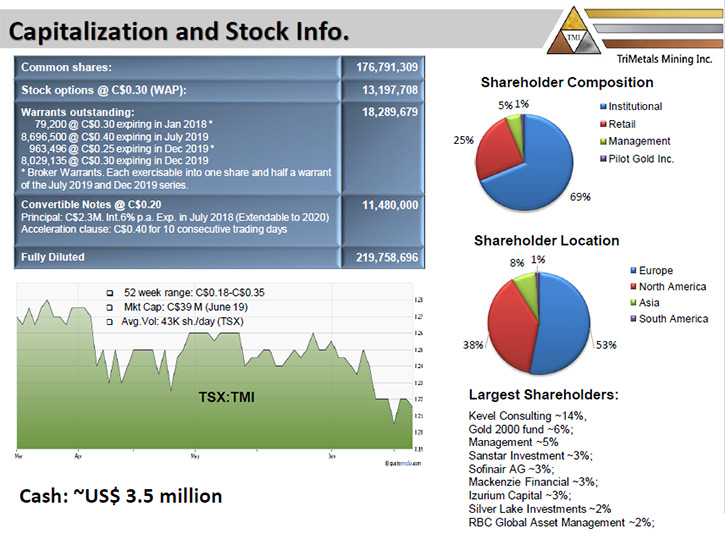

Mr. Ralph Fitch: We have a very global group of investors, from China, Europe, the US, and Canada. Most of

them are not well known names. But Gold 2000, a very well-known gold fund, came in to the last two financings. We

also have McKenzie out of Toronto. Those are probably the best known major funds that we have in the company.

In terms of our board, last year I asked Robert Van Dorn, who is a very experienced engineer and was

previously a board member, to become chairman so he's taken on that role, taking little off my shoulders.

Mr. Ralph Fitch: We have Tina Woodside, who was female Lawyer of the Year this year up in Canada, so a very

high profile lady, brilliant lawyer. I've actually worked with her since 1994. I believe we were her first client

when we started the first company, General Minerals Corporation. So we have Van Dorn, we have Tina Woodside. We

have one Russian gentleman who represents some of the funds from that part of the world. We have Paul Sheehan, who

is a Harvard guy, who represents our Chinese investors. Antonio Canton, who was proposed by our Swiss

shareholders. We have a big group of Swiss, very loyal shareholders, who have been with the company since the

beginning, through good times and bad.

Dr. Allen Alper: That sounds like a very diverse, very experienced board. Excellent!

Mr. Ralph Fitch: And very independent. They don't let me do everything I want to do, Al. They keep me in

check.

Dr. Allen Alper: Could you tell us a bit about your market structure?

Mr. Ralph Fitch: 176 million shares outstanding, that goes up over the 200 million fully diluted. That

additional script, is warrants. We have some options, but it's considerably less than the 10% that we're allowed

to issue. Management owns about 5%. I buy more shares every year including this year. I have about 4.6 million

shares now, I believe, in TMI. I'm clearly a believer.

Dr. Allen Alper: Very important that investors know you believe in the company and you're continually

investing in it. Well done.

What are the primary reasons our high-net-worth readers/investors should consider investing in your

company?

Mr. Ralph Fitch: The first thing is, if you want exposure to gold, buying into the explorers, the

discoverers, gives you much greater leverage to increases in the price of gold than buying gold bars or buying

producers where the outcomes are much better known. The big upside is if they discover more gold, you're creating

wealth where there was none before so you create value whether the gold price is high or low, but you typically

get a big spike in share prices if we get a decent bump in the gold price, which seems fairly likely in the next

year or so.

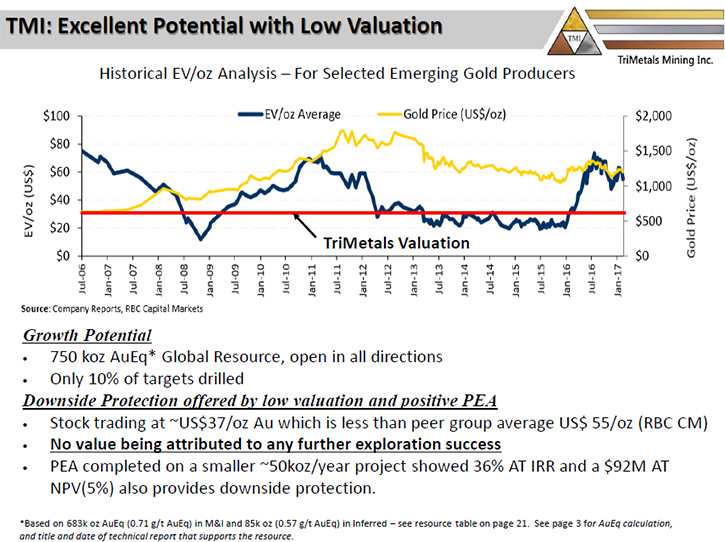

I think if you want exposure to gold, a company like ours is a good bet. We have a PEA, Preliminary

Economic Assessment already on the Gold Springs project. It's really a demonstration PEA, it's not the project we

want to build. It's about a 50,000 ounce a year project we have the PEA on, it's a backstop. So if we never

discovered anything more, which is very unlikely, you already have a block of ore that is likely to make good

money and be able to go into production. So you have a good backstop. With the Escalones porphyry copper, the fact

we have 6.5 billion pounds of copper equivalent with the copper price rising is again another nice backstop. If we

did nothing more, we've two really good assets, which should give increasing value to our shares even without

further discovery, which is very unlikely since we are presently drilling in the area where we got excellent gold

intercepts last year.

At Gold Springs, if you look on our website and look at the actual presentation, geologically there's clearly a

very good opportunity that we're going to continue to discover more gold ounces. I think if folks are interested

in the gold sector, a company like TriMetals Mining Inc. is a really good idea to consider for investments.

Dr. Allen Alper: Sounds great! Sounds like excellent reasons for our high-net-worth readers/investors to

consider investing in TriMetals Mining Inc.

Mr. Ralph Fitch: Yeah, I think it's actually a really good time to look at precious metals and also the

base metals. They're starting to stir again. It looks like there will be a copper deficit down the road so likely

prices will go higher.

Dr. Allen Alper: Sounds excellent!

http://www.trimetalsmining.com/

Ralph Fitch

President & CEO

303.584.0606

ralphfitch@trimetalsmining.com

|

|