Pasinex Resources Limited (CSE: PSE; FSE: PNX): Doubled Zinc Production and Well Positioned for Growth, Interview with Steve Williams, President and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/27/2017

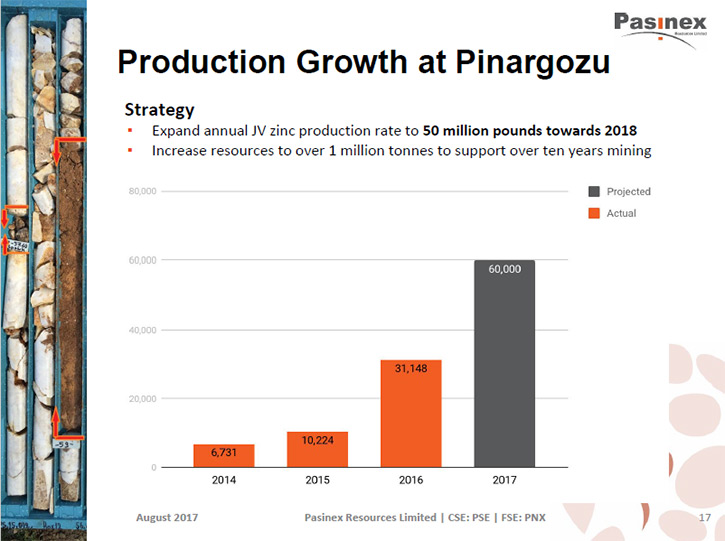

Pasinex Resources Limited (CSE: PSE; FSE: PNX) and Joint Venture partner Akmetal, are currently producing

high-grade zinc from their mine called Pinargozu, in the province of Adana, south-central Turkey. We learned from

Steve Williams, President and CEO of Pasinex Resources, that since they expanded the mine last year, they have

been able to double their production, which brought them to 160 metric tons per day. As a result, their revenues

and profitability significantly increased. Plans for 2017/2018 include ongoing underground mine-development and

exploration at the mine site. According to Mr. Williams, Pasinex is a growth story and Zinc is going to be well

positioned near term.

Pasinex Resources Limited in Turkey, 2017

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Steve Williams,

President and CEO of Pasinex Resources LTD. Could you tell our readers/investors about Pasinex, give them an

overview? I know you've had a great year.

Mr. Steve Williams: We're focused on our zinc productions, well production and exploration, but

particularly our zinc production from our mine called Pinargozu, which is in the south of Turkey, in the province

of Adana. We did a new adit into the side of the mountain last year, August/September. That opened-up a whole new

part of the deposit and enabled us to build more mining areas, more mining stopes; so this year we're starting to

realize the benefits of the development work we did last year. So our production has increased. We're now doing

something on the order of 160 metric tons per day of production from the mine. That's as a result of the new adit,

we added last year. We have nearly doubled our production from last year to this year. Our revenues are up

significantly and we have increased profitability, which is very nice.

Dr. Allen Alper: Excellent. Could you tell our readers/investors what's happening in the zinc market?

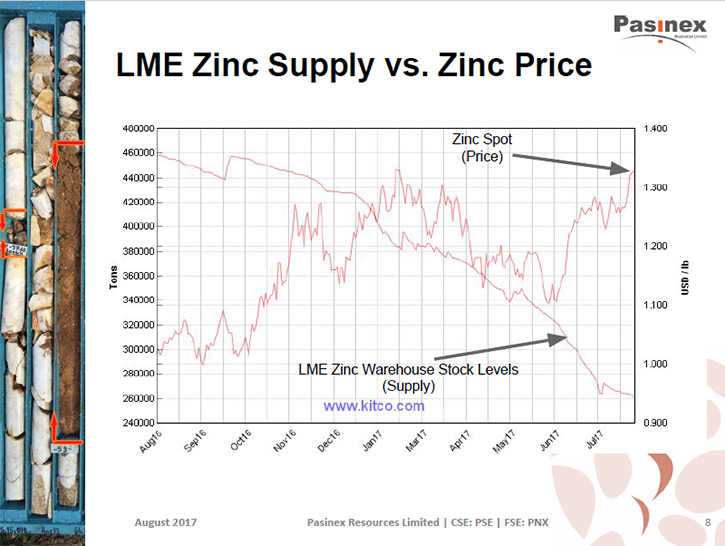

Mr. Steve Williams: Zinc is hot. We knew that was coming. It's been coming for a long time, but

particularly in the last three or so weeks? The zinc price has really taken off. There was a big run up in the

zinc price in 2016, but then it hit a ceiling very much at around nearly $1.30 US per pound. But in the last three

weeks, it's broken through that ceiling and we've gone as high as $1.45 US per pound. We're off a little bit

today, we're at $1.40 US per pound, but it's broken through the $1.30 US per pound ceiling. As I look at the rest

of the year, I see it as all very positive for the zinc price. I think we have more upsides yet on the zinc price.

It's all about supply and demand. The supply of zinc metal stocks continues to go down and down and down.

That's publicly available information. You can find it on the web. The reason it took a bit of time to break

through the $1.30 US per pound ceiling is that there was some concern that maybe China was stockpiling zinc metal

stocks and though the supply of zinc metal stocks continued to deplete, we didn't have visibility on the Chinese

stocks. So that was some sort of psychological barrier keeping the zinc metal stocks price down. But it's become

very clear recently that China is also desperate for zinc metal stocks. Once the market assimilated that

information, the zinc metal stocks price just took off.

And as I look at it now, the fundamentals are the driver here. There is very little zinc metal stock and that's

going to continue to be the situation certainly for the rest of this year and into next year.

Dr. Allen Alper: That sounds excellent for the miners of zinc. Could you update our readers/investors on

how zinc is used? I know you're a metallurgist by background, qualified to talk about how zinc is used to protect

iron and other metals.

Mr. Steve Williams: The single biggest use of zinc is in galvanizing to protect steel from rusting.

That consumes about 55% of the world's zinc. Zinc in that case is tied to steel and very much about construction,

buildings, housing, roads, ports, where you can actually see zinc in galvanizing. The steel railings they put

along the sides of freeways and roads that have a dull, splotchy look, that’s the color of zinc. The zinc, on

those steel railings, protects them from rusting. So it's pervasive.

It's pervasive in society, it's very much tied to growth. Ongoing global growth and global economic well-

being drives zinc consumption. Zinc is the fourth most consumed metal in the world. Number one is steel/iron,

number two is aluminum, number three is copper, and number four is zinc. It's more important than metals like

nickel, titanium or other metals. Zinc is more important, given that it's about construction and things like that.

China has emerged as the world's biggest consumer. They consume about half the world's zinc.

The other big use for zinc is in dye casting. Little electrical pieces and things like that are made of zinc metal

for dye casting. A growing area is health and nutrients. We need zinc in our bodies. Zinc is consumed in things

like vitamins. In health, the biggest use of zinc is to protect us from sunburn. The active ingredient in a lot of

sun screens is zinc.

Dr. Allen Alper: Thank you. I know our readers/investors will appreciate being updated on zinc consumption

and also on the market. Could you tell us a bit more about your plans for the rest of 2017 going into 2018?

Mr. Steve Williams: Certainly. It comes down to two big things. The first thing is to continue to

build the mine and grow the mine. We're doing a lot of mine development for the Pinargozu zinc mine. We're doing a

lot of underground development this year. It's ongoing as we're speaking. That is to open up more mining areas. We

did a new development last year, which enabled us to increase the production for this year, and we have ongoing

development this year, which hopefully should enable us to increase our production even more going into next year.

I'm optimistic that our second half of this year could be even better than the first half of this year. That's

priority number one.

Priority number two is exploration. This is what's called a carbonate replacement type zinc deposit. It

consists of chimneys and mantos, long arms of zinc mineralization. And we're actually mining the end of one of

those arms, of what we hope is a long arm of zinc mineralization. We're towards the end of that arm. So we're

continuing to follow that arm, those chimneys and mantos with our exploration, as well as doing development to

open up more production in the mine. We're also doing development, so we can open up more underground drill pads,

so we can continue to drill deeper and deeper. Our second priority is to continue to grow the resource as we go

deeper. That will be all sulfides, too. We are focused on deep drilling for deeper sulfides.

Dr. Allen Alper: That sounds great. Excellent! Could you refresh our memories on your background, your

management team, and your board?

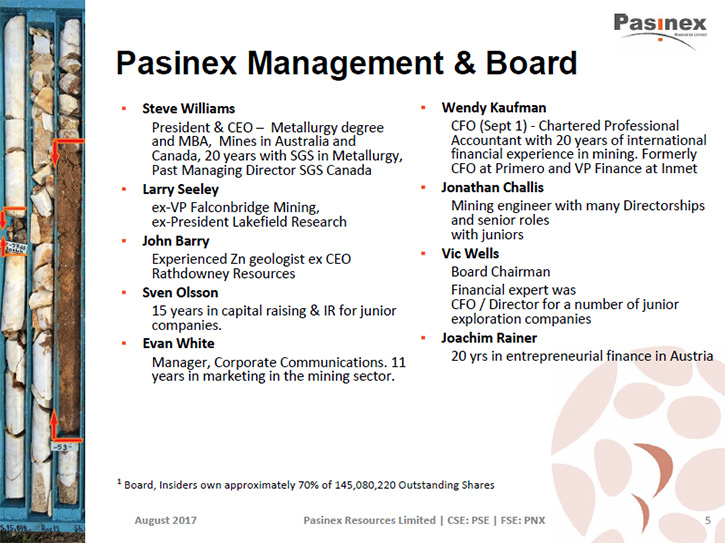

Mr. Steve Williams: Certainly. We're very technical. I'm a mining professional, as are a number of the

people on our board. I have a degree in metallurgy from the West Australian School of mines in Kalgoorlie West

Australia, and an MBA from Tulane University in New Orleans. And yeah, I've spent all my life in mining. I've been

in mining in Australia and Canada, Chile. I've been involved in consulting in the Philippines, Mongolia, Dominican

Republic, and pretty much most of my experience has been base metals: copper and zinc.

Our board, consists of a mixture between definitely mining professionals. We have a geologist on the

board, we have a mining engineer on the board, and we have another metallurgist on the board. A metallurgist,

chemical engineer, our major shareholder, Dr. Larry Seeley, MASc, PhD, P.Eng., an internationally recognized

leader in developing successful mining and metallurgical processes. So we have more mining professionals and we're

very much rooted in mining. But we also have investment and marketing people on our board. We have an accounting

type person, we have a marketing type person, and we have an investment type person. So that makes up our board,

which I think is a good mix. But our roots are in the mining profession.

Just recently we made a strategic hire, Ms. Wendy Kaufman as our new CFO. She officially took over as CFO

of Pasinex as of the first of September of this year. She also comes from the mining industry. She was Vice

President of Finance for the old Inmet Mining for 19 years. They had a mine in Turkey that gave her exposure to

business in Turkey. And she's been involved with other mining companies as CFO. So she's a well experienced CFO

from mining. She's just started with us and I must say, she's already doing a great job.

So that's the team. We're rooted in mining, that's what we love. That's why we're doing it. And this is

about bringing all our knowledge and experience into developing a successful mining company.

Dr. Allen Alper: Excellent. Could you tell us a bit about your capital structure, where your shares are

listed, etc.?

Mr. Steve Williams: Absolutely. We're listed on the CSE, the Canadian Stock Exchange, and we're also

cross listed into Frankfurt on a number of the Frankfurt Exchanges or the German Exchanges. We have 139 million

shares out, of which some is tightly held. The directors hold, directly or indirectly, with associated parties,

about 70% of the stocks, so tightly held. That's good. That's how we get strength for the company because it is

tightly held. About 25% to 30% of that 139 million is a true flow.

This year has been great for us in terms of market. We went from under ten cents, eight/nine cents

beginning of this year, and with the run up in the zinc price, and with our story evolving, our share price hit

32/33 cents the other day. We're about 31 cents as we're talking right at the moment. I'm talking Canadian cents

here. Now our market capitalization is around 45 million Canadian. It's been a good year for us, related largely

to the positive strength of the company.

Dr. Allen Alper: Excellent! Could you tell our readers/investors how it is operating in Turkey?

Mr. Steve Williams: Yeah. You know, whenever you step out of your comfort zone, it always has its

challenges. It's a different culture, a different language. And you know, you've got to learn. What's been great

about this experience, you know, we have a joint venture partner here at the Turkish mining company. In building

the company in Turkey we’ve been trying to bring the best of both worlds together. Some of the Turkish practices,

some of the Turkish strengths are very much about getting in and being very focused on mining. We bring,

particularly, our technical roots and also some of our business strategy.

So it's been a challenge in terms of working through how we work together and trying to be knowledgeable and

respectful of each other’s strengths. We’re bringing the strengths of Turkey together with some of our strengths.

You do think about things differently and you have to work your way through that. But I think that's reality

whenever you step out of your comfort zone. But a lot of fun, Al.

Dr. Allen Alper: That sounds great. That's excellent you have a strong Turkish partner helping you mine and

operate in Turkey, so that's excellent. What are the primary reasons our high-net-worth readers/investors should

consider investing in Pasinex?

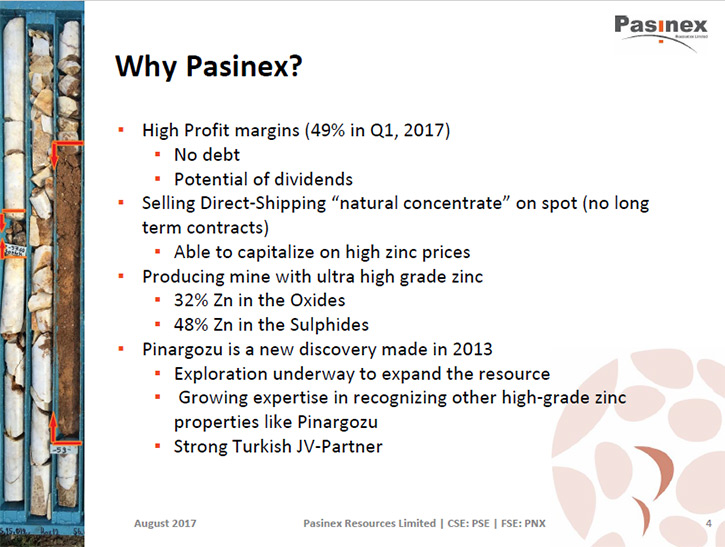

Mr. Steve Williams: I think we're a growth story. We're underpinned in zinc. I think zinc still has

some upside. As I look at the next couple of years in zinc, I think it's going to be a very strong position. Zinc

is going to be well-positioned in the next couple of years. So we're producing. I believe we have further upside

on production and we can demonstrate that as we go through the rest of this year. We're producing, we're selling

zinc as the zinc price continues to rise. We're already very profitable. I think our profitability can continue to

improve. Yeah, if you want to be in a strong zinc story at the right time, you should really look at Pasinex

because I think we're going to get stronger.

We still have exploration upside. We're continuing to build our resource and I think we will continue to do that.

It's a strong zinc play, if you're looking for a strong zinc play, you've got to look at Pasinex.

Dr. Allen Alper: It sounds like an excellent opportunity. Is there anything else you'd like to add Steve?

Mr. Steve Williams: Thank you for this opportunity to share our progress with you and your

readers/investors. As I look at the next two, even three years, I think this is going to be a great time for zinc.

I'm really looking forward to delivering over those next couple of years for our shareholders. It’s a great

feeling to be able to reward support and loyalty.

Dr. Allen Alper: That's excellent!

http://pasinex.com/

Steve Williams

President/CEO

Phone: 416.861.9659

Email: info@pasinex.com

|

|