Metro Mining Ltd (ASX: MMI): An Australian Bauxite Exploration and Mining Company, Offtake Secured and Attractive, Interview with Simon Finnis, Managing Director and CEO

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/11/2017

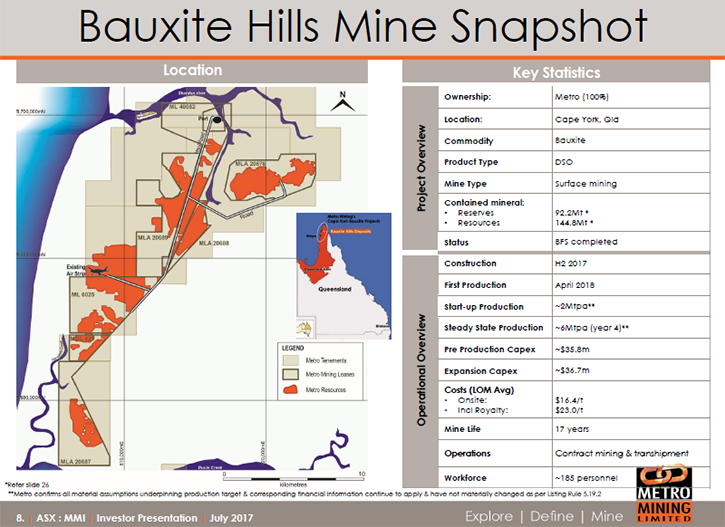

Metro Mining Ltd (ASX: MMI) is a Brisbane based, Australian exploration and development company, whose flagship

project, the Bauxite Hills Mine, located 95 kilometres north of Weipa, is the largest independent bauxite project

within the internationally acclaimed Weipa Bauxite Region. We learned from Simon Finnis, Managing Director and CEO

of Metro Mining, that they have a 144 million tonne resource, containing 92 million tonnes of direct shipping

bauxite ore. The ore is sent straight to the refineries in China, where it is used in making alumina which is used

to make aluminium. According to Mr. Finnis the construction of the project is scheduled to be completed at the end

of the year, and they expect their first shipment in April 2018.

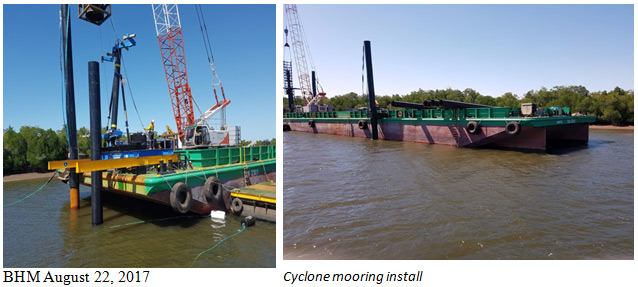

Example of a typical floating crane that would be used to transfer bauxite to the OGV

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Simon Finnis,

Managing Director and CEO of Metro Mining Ltd. Could you give our readers/investors an overview of your company?

Simon Finnis: Metro Mining Ltd. is developing a bauxite mine on Cape York. We've recently entered the

construction phase. The resource base is 144 million tonnes, 92 million tonnes of what we call DSO bauxite, so

direct shipping ore. We don't process the ore, we just mine it and send it straight to the refineries in China,

who consume it to manufacture alumina, which then goes into making aluminum. The project is on track for

construction to be completed this calendar year, and will be in production as soon as the wet season finishes next

year, so we're anticipating our first shipment in April 2018.

Dr. Allen Alper: Excellent! Do you have offtake agreements in place?

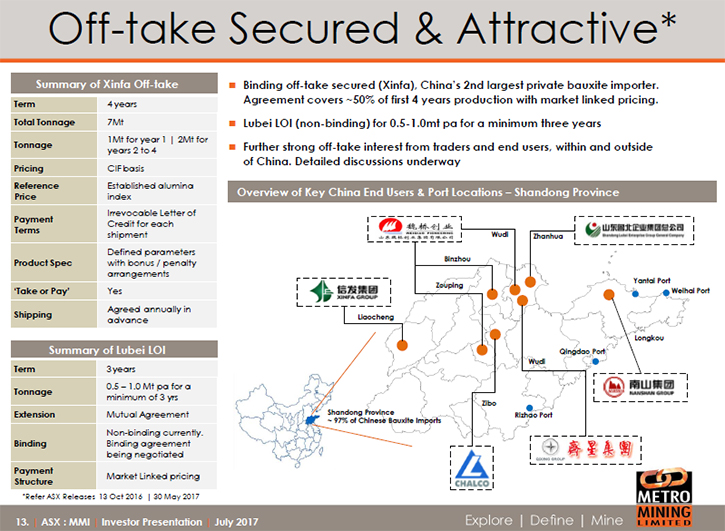

Simon Finnis: We have a binding offtake agreement with the Xinfa Group, one of China’s largest aluminum

companies. That agreement in summary is seven million tonnes over four years. So, year one is one million tonnes,

and then two million tonnes for three years thereafter. It is an agreement that is linked to the Chinese alumina

price, and there's a ratio, obviously confidential, but it provides a robust bauxite price for us.

We're also negotiating a three-year agreement with a company called Lubei Chemicals, another Chinese

company in Shandong province. That's still at a nonbinding letter of intent stage but we're negotiating a binding

contract, and we hope to complete that in the next couple of months.

Dr. Allen Alper: That sounds excellent. Could you tell us a little more about your deposit and your

resource and what differentiates Metro Mining from other companies?

Simon Finnis: Sure. The bauxite itself is located on the surface, so it's very cheap to mine and then

ship. The deposit itself sits about a hundred kilometers north of the world class Weipa bauxite region in Northern

Australia, so very close to the customer base in China, and we have a river that runs right along-side the

project. From a logistics point of view, we truck it to the river, we load it onto barges, and then we transship

it to ocean going vessels.

For a relatively low value commodity such as bauxite, it has everything going for it - a low logistics

cost, cheap operating costs, given that it's on the surface and free-dig, and also low capital costs because all

we really need to do is facilitate loading of the vessels, have somewhere for people to live, and then it's

machinery and roads etc. So capital is low, operating costs are cheap, and the product is close to market and

well-understood by consumers, so it has all those boxes ticked.

Dr. Allen Alper: That sounds excellent. Could you tell us a little bit about yourself and your team?

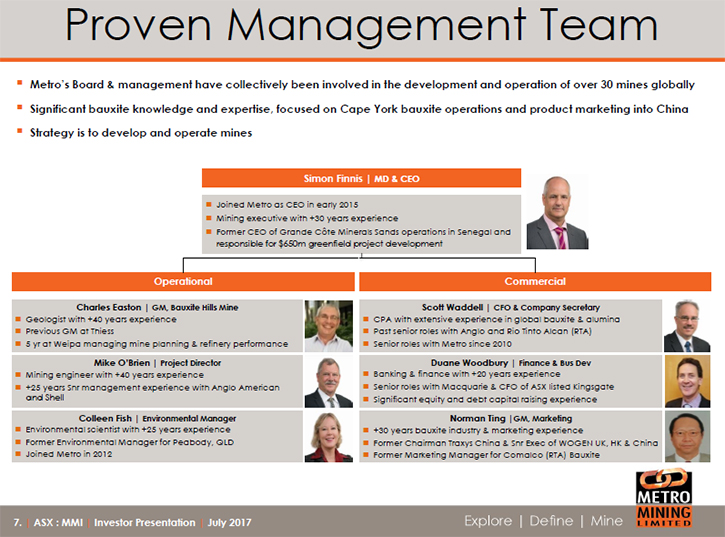

Simon Finnis: Metro gained control of this project in early 2015. We put together a management team to

get ourselves through the environmental approvals phase and get the mine into production. We are very focused on

developing this asset and obviously creating value for our shareholders. My specific background has been

developing projects for the last 10 or 15 years now.

Most recently I was in Africa and we developed a mineral sands mine called Grande Côte for a group called

TiZir. We are hoping to emulate that project construction here, although this project is much simpler and much

easier than that one was.

We've managed to recruit very well. Our site based general manager of operations spent six or seven years

in an operating role at Weipa. He has lots of experience in bauxite mining, logistics, et cetera. We have started

to put together a very strong site-based operations team to get the project into production. So it's extremely,

satisfying.

Dr. Allen Alper: Well, that sounds excellent. Could you tell us a bit about the size of the resource and

the life of mine you're expecting?

Simon Finnis: Sure. Resource immediately around Bauxite Hills is 144 million tonnes, and the reserve is

92 million tonnes. We plan to mine at a steady state of six million tonnes per annum, so currently the BFS

suggests a 17-year mine life. We would anticipate, however, transferring some of those resources into reserves as

time goes on, and perhaps discovering other resources in the vicinity. So we would anticipate a long-term mine at

that six million ton a year headline mining rate.

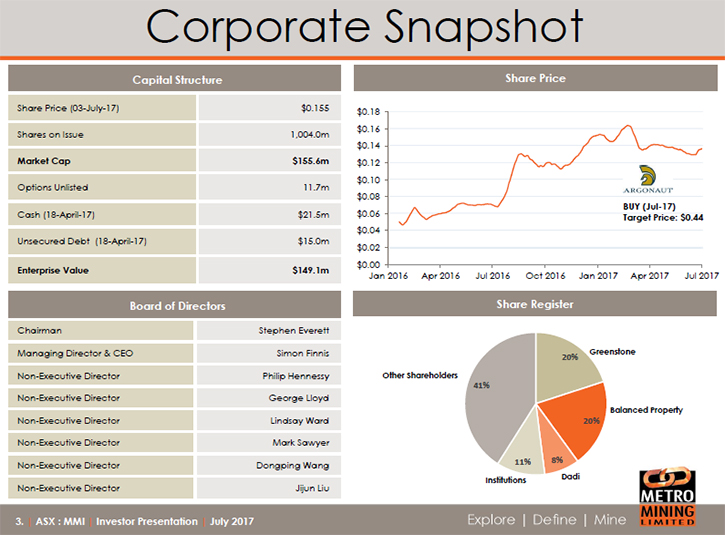

Dr. Allen Alper: Well, that sounds excellent! Could you tell us a little bit about your capital structure?

Simon Finnis: The project itself has an initial capital requirement of A$36 million, and then as we

expand after year two from three million tons per annum to six million tons per annum, we anticipate spending a

further A$36 million, so total capital costs barring sustaining capital, is a very low, $72 million to get a six

million tonnes per annum of production.

Dr. Allen Alper: That sounds very good. Could you tell us a little bit about where your shares are listed,

and the structure of your shares, how many shares are outstanding and your market cap, et cetera?

Simon Finnis: We're listed on the Australian stock exchange. Our ticker code is MMI, and we have nearly

1.3 billion shares on issue, at the share price of about 17 cents, so a market cap just about A$230 million

Aussie, quite a significant company, which is actively traded on the ASX every day.

Dr. Allen Alper: Well, that sounds great. Could you tell us a bit about what type of investors you have?

Simon Finnis: Certainly. We have managed, over the last 12 months, to attract a number of global

resource specialist institutions to the register. Obviously, as we get closer to production, the risk goes down

and as people start to better understand the bauxite market this trend is expected to continue. So currently

Australian and international institutions sit about 26-27% of the register, over about seven or eight different

investors.

As our major shareholder, we have a UK private equity fund called Greenstone, and then we have a high-

net-worth investors as our number two, sitting about 16%, and then the rest of the register really is retail

investors out of Australia and I guess elsewhere.

Dr. Allen Alper: Ah, that sounds excellent. What are the primary reasons our high-net-worth

readers/investors should consider investing in Metro Mining?

Simon Finnis: We always point to our BFS, our bankable feasibility study we released in February; low

capital cost, near-term production, generating margins over the life of mine, around about A$25 per ton, so that

generates an NPV of just over A$600 million, internal rate of return of about 81%, and average life of mine EBITDA

of A$145 million.

So even at a market cap of A$230 million, we can certainly see plenty of upside based on those earnings.

Once we're in production April next year and the revenue starts to roll in, I think people will start to take

notice, so certainly there is some appeal for those people happy to look at pre-production assets to invest now

and look at the upside next year.

Dr. Allen Alper: Ah, that sounds excellent, sounds like your company is in a great position, has offtakes

and has a low cost mining operation with plenty of reserves, and you're getting all set to go. Well done.

Excellent!

Simon Finnis: That's exactly right. We're fully funded now, as well, so our debt and equity has been

raised so we don't need any more funds to get us into production. We're ready set to go.

Dr. Allen Alper: Well, that's an excellent position to be in. Is there anything else you'd like to add,

Simon?

Simon Finnis: I think I covered it. Thank you very much for the opportunity.

http://www.metromining.com.au/

P +61 7 3009 8000

F +61 7 3221 4811

E info@metromining.com.au

|

|