Fission Uranium Corp (TSX: FCU) (OTCQX: FCUUF) (FRANKFURT: 2FU), Ross McElroy, President, COO, and Chief Geologist Interview: High-Grade Low-Cost 108 Million Pounds

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 9/1/2017

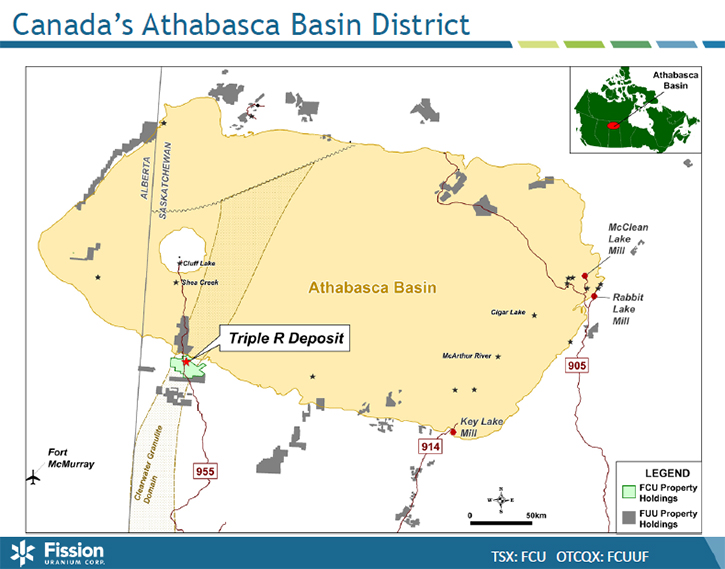

Fission Uranium Corp (TSX: FCU) (OTCQX: FCUUF)(FRANKFURT: 2FU) is a Canadian

based resource company engaged in the strategic exploration and development of the

award-winning Patterson Lake South uranium project, host to the near-surface, high-

grade Triple R deposit - part of the largest mineralized trend in the Athabasca

Basin region. As we know from our previous interviews with Ross McElroy, President,

COO, and Chief Geologist of Fission Uranium, in addition to being high grade the

Triple R deposit is open pittable, which is its main advantage and one of the

reasons it has won many awards. The deposit itself is about 108 million pounds with

grades ranging from a little under 2% to 20%, and three quarters of the resource is

indicated. There are also three additional, high-grade zones that have not yet been

added to the resource estimate. As well as continued exploration, the company is

progressing pre-feasibility work, which will be followed by feasibility study and

production.

Fission Uranium Corp

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing Ross McElroy, President, COO, and Chief Geologist of Fission Uranium

Corp. Could you tell our readers/investors about the awards and the recognition

Fission Uranium Corp. has received for the exploration work you have done? Just

outstanding!

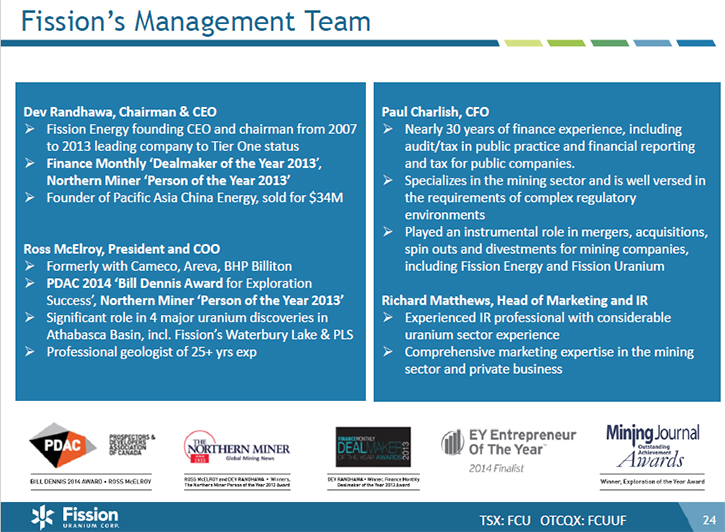

Ross McElroy: I sure can. We've been very fortunate to be the recipient of

a number of very prestigious awards in the exploration and mining sector. We were

awarded the Mining Journal Outstanding Achievement Award in 2016. The CEO and I were

EY Entrepreneur of the Year finalists. I myself have won the PDAC Bill Dennis Award

back in 2014. We've been the recipients of the Northern Miner “Mining Persons of the

Year”. That's Dev Randhawa, our CEO, and then myself. Also, Dev has won Finance

Monthly’s CEO of the Year and Deal Maker of the Year. It really has been quite a

list of prestigious awards.

That's a reflection of the underlying recognition of the PLS assets, the uranium

deposits in the Athabasca region and the southwest side of the province. Of course

the Athabasca Basin is well-known for hosting world-class deposits, but this one is

unique in that it's not only large and high-grade, but it's very shallow. It starts

at 50 meters depth, which makes it open pittable. That's really why it's won all the

awards it has, because it's a very special deposit and the peers and colleagues that

we work with recognize it as such.

Dr. Allen Alper: That's excellent to receive that kind of recognition. Could

you elaborate a little bit more on your resource and what differentiates it from

others?

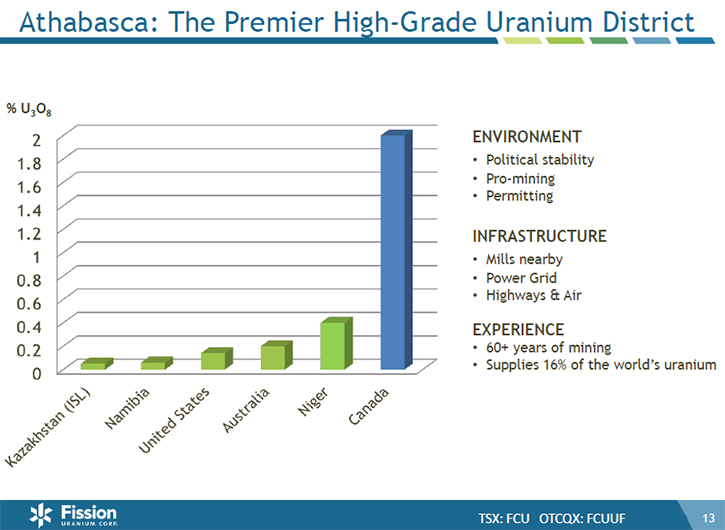

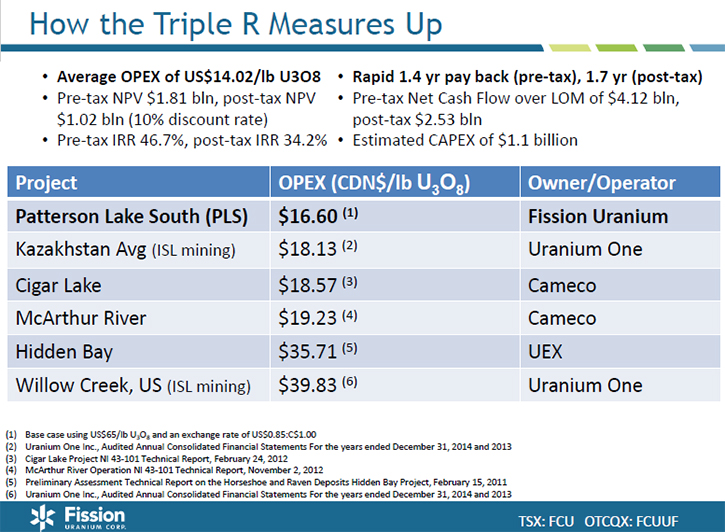

Ross McElroy: The Athabasca Basin is quite famous for hosting high-grade

deposits. A number of them are quite large. They do have the highest-grade deposits

known anywhere in the world, and that sets that whole district apart from everywhere

else, because as we know in the business, grade is king when it comes to an economic

deposit. That's what the Athabasca Basin has above everybody else.

The fact that our deposit is really quite shallow is special in the Athabasca Basin.

It starts at just 50 meters below the surface. That's where the high-grade material

is. If you want to compare with other deposits in the basin, there are currently

production coming from two underground mines. One of them is about 600 meters below

the surface, and that's the MacArthur River deposit. The other one in production is

the Cigar Lake deposit. That's 400 meters below the surface, and actually relatively

difficult rock to be mining in, although the grade is so spectacular that it makes

up for it. When you have a deposit that's as close to the surface as ours, that's

basically an open-pittable deposit, which has a lot fewer engineering hurdles to

overcome to try to mine out, it is very fortunate. All things being equal, the

closer a deposit is to the surface, the more economically viable it is.

That's really what differentiates us from the others. We're in basement rock, not

sandstone and not unconformity, and it's so near surface we can consider mining it

out open-pittable.

Dr. Allen Alper: That's great. Could you tell our readers/investors a bit

more about the size and other information on the resource?

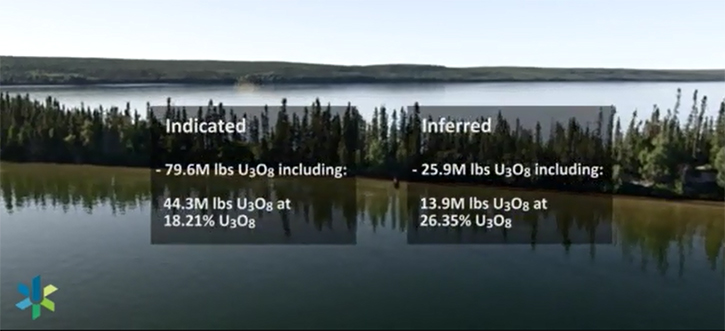

Ross McElroy: Sure. The deposit itself is about 108 million pounds, made

up of both indicated and inferred. The majority of the deposit is in the indicated

category. 75% of the resource is indicated. That's what allows us to be able to move

its status up very quickly towards pre-feasibility and ultimately feasibility and

production. You have to have indicated resource, which means that you've drilled it

quite closely spaced, enough that you understand all the nuances of the deposit.

That's something we started on back in 2013, with the discovery and the big growth

year in 2014. We've been able to grow this deposit to such a level that we feel

confident and other third-party consultants feel comfortable with the geological

deposit geometry of it. Thus we can build an economic case study around that quite

easily.

We’re embarking on this pre-feasibility work right now. 108 million pounds,

we're grading just a little less than 2% overall, but there's a portion of the

deposit that is over 20% U308, which is phenomenal by any standards. Those are some

of the highest grades of resource in the world. That high-grade component makes up

just under half of the deposit, so a very well-endowed, high-grade, near-surface

deposit.

Dr. Allen Alper: Excellent! That's a really amazing deposit. Could you give

our readers the highlights of how the deposit was formed in nature?

Ross McElroy: Yes. It's a structurally hosted deposit. That's something it

has in common with the other deposits in the Athabasca Basin region. They all come

up in deep-seated fault zones. They're generally reactivated fault zones, but they

have to be in the right kind of host rock. You get a big, several kilometers long

and deep fault zone that intercepts the right kind of rocks. They also come up a

graphitic lithology, which we can actually see as a geophysical conductor, an EM

conductor. That's the setting they come in. Because they're structurally controlled

deposits, they tend to be high grade but focused around those fault zones.

That means, when you compare these types of deposits to other kinds of

uranium deposits globally, we get much higher grade, for one thing, but also a

smaller footprint. Because of their small footprint, they're notoriously difficult

to discover, whereas big, widespread, low-grade deposits in other parts of the world

might be easier to find. These are more difficult, and rely a lot more on other

sciences like geophysics and geochemistry to hone into the areas that are

prospective, and then it takes a commitment to drilling.

That's roughly the general nature of the deposit, but in order to make these

discoveries, you have to build up a team of expert geoscientists, all very skilled

in these various aspects, geophysics, geochemistry, structural geology. We put it

together, and it's been able to deploy quite effectively. That's why we've made two

discoveries, as a group, in the last six or seven years. We started off with the

Waterbury deposit on the eastern side of the basin back in 2010, and then the

discovery of PLS in 2012. It really sets our group apart from everybody else, our

expertise and commitment to making discoveries.

Dr. Allen Alper: That's excellent. Could you tell our readers/investors a bit

about your background and Dev's background?

Ross McElroy: As for myself, I started in the uranium business in the

mid-1980s. I'm a geologist. Right out of school after graduating, I was hired by

what is now Cameco. I started in the uranium sector very early on, and I was

privileged enough to be able to be on some significant discoveries, including the

MacArthur River discovery back in 1987 and '88. MacArthur is now probably one of the

most significant mining operations in the uranium sector. It's a very large, high-

grade deposit. That's where I cut my teeth.

I also spent a couple of years working with Areva, a French conglomerate, on other

projects, including another discovery in the Athabasca Basin. Then, went to work for

BHP in the exploration and actually in the mining groups as well, and came back to

uranium in the early 2000s, and joined forces with Dev Randhawa, Fission's CEO, back

in 2007. Together, we've been very successful.

I can give a little bit of background on Dev. He has also been in the

uranium business quite a number of years. He put together the original company,

Strathmore Minerals back in the mid-1990s, and was able to split off different

companies, successfully along the way, sell assets, split up the company and

continue on. It went from Strathmore to Fission Energy to Fission Uranium. We also

have another offshoot called Fission 3.0, which is an exploration company. Dev's

been in this business, in the uranium sector as a CEO for over 20 years, which

probably makes him the longest-standing CEO in the uranium sector against anybody.

He has a great history of being able to raise money in capital markets and

properly promote these companies. Together with my technical background and his

ability to raise money, those are really the two most important aspects for any

junior company to be able to get money in the door and to make discoveries and keep

repeating that cycle. We've had a very synergistic relationship that's been

successful for the company and for shareholders.

Dr. Allen Alper: Excellent! Could you tell us a bit more about your funding,

your capital structure, and some of your key investors?

Ross McElroy: The key investor that we have at the moment would be the

CGN, which is a Chinese state-owned utility. It made a 19.9% investment in Fission

Uranium Corp. back in 2016. With that, they paid $85 million at a premium to the

stock price. That's built up our treasury quite significantly indeed. Basically we'd

put them as the single largest shareholder of Fission with just under 20% of the

shares available. They've been an important group.

The Chinese, state-owned, utilities are growing and will be the dominant

utility companies in the world. They're very important in the world of nuclear power

because China's the real growth story of nuclear power. They're the ones that are

building most of the new nuclear power stations, so it's great to have them as a

partner. As a country, they are desperate for clean, reliable energy and that’s

what nuclear is. They've been very easy to work with and very supportive of the

project. Ultimately I think they'll be able to help us out as we progress the

project closer to a production scenario, because CGN has a background in mining as

well. They bring expertise as well as money.

There are other very important shareholders, more on the investment side. That would

be groups such as JP Morgan that own a significant block of shares, JP Morgan out of

London. Probably 25% of our shares are held by groups in Europe, primarily in

London, such as JP Morgan, CQS, and a number of groups there that are long and

faithful shareholders. We have many shareholders in North America, and we have the

support of shareholders in Asia, as well. CGN is the number one shareholder, and

probably JP Morgan number two.

Dr. Allen Alper: Could you tell us a bit more about where your shares are

listed and trading?

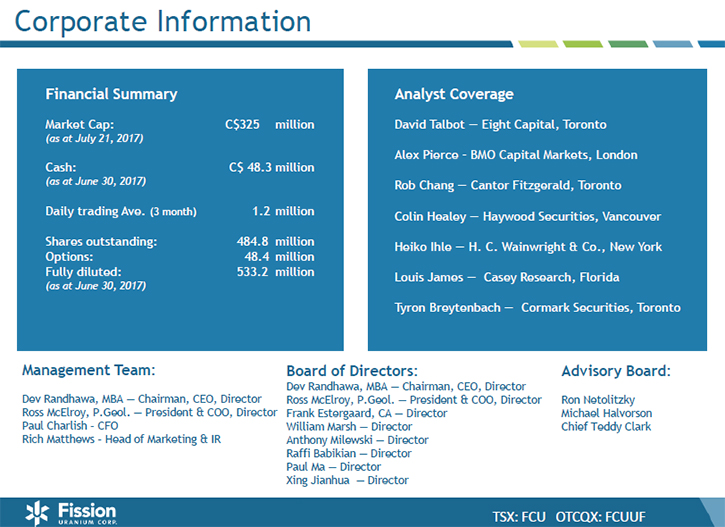

Ross McElroy: We trade on the TSX senior board. The symbol is FCU. We

have just under 485 million shares outstanding. We have just under $50 million in

the treasury, and daily trading averages over a million shares, so we're a very

well-covered company. We have approximately eight or nine analysts that cover us

from North America and London, which is quite a number of analysts. Insiders, Dev

and I are the largest shareholders inside the company, and of course a board of

directors, with a great wealth of influence.

Dr. Allen Alper: Sounds excellent. Could you tell us a bit more about your

plans for the remainder of this year going into 2018?

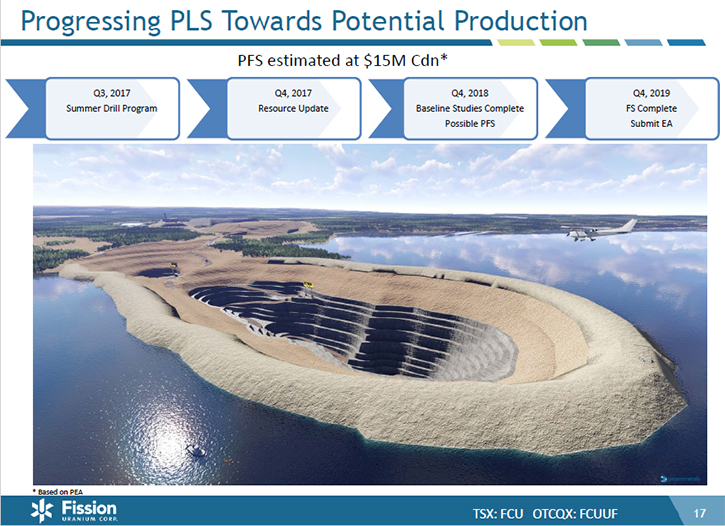

Ross McElroy: We recently embarked on our summer program, which has two

focuses. The primary focus would be work that's geared towards the pre-feasibility

study. That's an advanced engineering study that we hope to have ready by late 2018.

The work that's involved to get us to that pre-feasibility study would be

geotechnical drilling to understand the open pit perimeter wall, the characteristics

that it will have. We're also doing some advanced metallurgical work along the same

lines. That's work that's going into the pre-feasibility study.

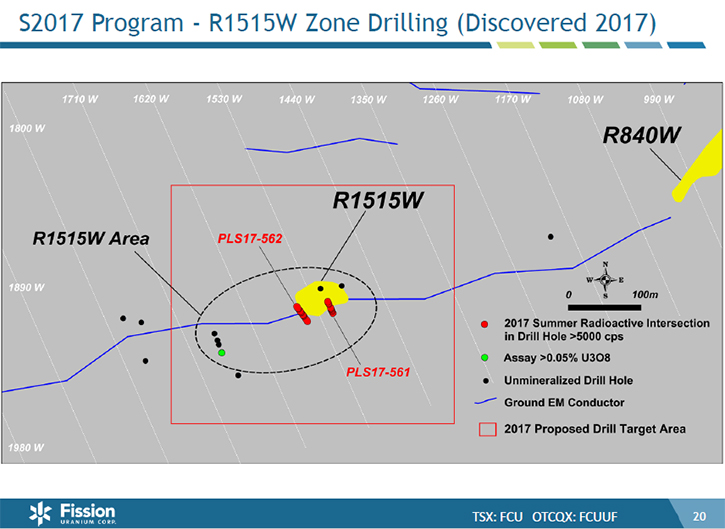

At the same time, we've made a new discovery of a zone a little farther on-

trend just this past winter. That's what we refer to as the R1515W zone. It starts

at around 1.5 kilometers west of the resource zone that we know as the Triple R

deposit. This past winter, we were able to put eight holes into this new zone, of

which six were mineralized, four of them very strongly mineralized. It's a new

target. It's something we hope we can continue to drill and build up in size and

grade.

We recently released results from the first four summer holes at R1515W and

we are excited about the results. The holes have intercepted wide mineralization

with high-grade intervals. Most importantly, we are seeing multiple stacked lenses

in these holes. That’s a feature we came across in the Triple R’s R780E zone, which

contains the majority of the Triple R deposit’s uranium. When you get multiple

stacked lenses, you generally find that the lbs build up very quickly. That’s what

happened with the R780E zone and we are very encouraged by the fact that the R1515W

has this same feature. This is the first zone we’ve found outside of the Triple R to

have multiple stacked lenses.

That's part of the focus of the summer work, too. We have seven additional

holes planned for this new zone over the summer. If we continue to be successful on

it, we'll be able to identify a significant resource on the 1515W zone and bring

that into the overall resource estimate and ultimately to the mine plan. That's our

long-term vision. Currently, we're exploring, but we're also moving the main part of

the asset to an eventual production decision.

Dr. Allen Alper: Sounds excellent. What are the primary reasons our high-

net-worth readers/investors should consider investing in Fission Uranium Corp?

Ross McElroy: I think your high-net-worth readers/investors have to be

comfortable with the uranium sector. There are lots of advantages to being in the

uranium sector. First of all, uranium is in one of these historic low periods right

now. The price is less than what it needs to bring on new production, so we are in a

low part of the cycle. But I think, as most people that invest in the resource

sector realize, most of these commodities are quite cyclical and uranium is one of

them. We happen to be at the low trough, but we believe things will change. The

whole sector should turn around due to the number of reactors being built and the

production that has come offline over the past twelve months. The commodity prices

will strengthen. When that happens, it is important to be involved in the strongest

companies out there.

Fission Uranium is one of the strongest of the uranium companies. I think we

have the best uranium asset out of the group. It's my belief this project will get

to eventual production. If you like a good turnaround story, pick a uranium company

and then go for the best, the one with the strongest management and the best asset

in the ground. That's really Fission Uranium. I think we'll be able to take

advantage, significantly, of an increase in the overall price of the commodity.

We're very leveraged to the price of the commodity.

As all pure uranium companies are, people tend to value them based on what the price

of the commodity is doing, not necessarily the underlying asset itself as far as how

viable it is, what is it, it is a low-cost producer. All those things matter once

the price starts to tick upwards, and then the strongest companies will see the

greatest improvement in share prices. That's where we think Fission Uranium steps

in. It's one of the strongest companies out of the group. We have the best asset,

probably the best chance of having production over any of the other newer projects

in the Athabasca Basin region, and we're just waiting for the eventual turn in the

price of the commodity.

Dr. Allen Alper: Sounds like compelling reasons for our high-net-worth

readers/investors to consider investing in Fission Uranium Corp.

Ross McElroy: Thank you.

http://www.fissionuranium.com/

Investor Relations

Rich Matthews

TF: 877-868-8140

rich@fissionuranium.com

www.fissionuranium.com

|

|