Ascot Resources Limited (TSX.V: AOT): Large Scale High-Grade Gold Targets of 20M Oz in the Golden Triangle of British Columbia, Interview with Bob Evans, CFO and Director

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/20/2017

Ascot Resources Limited (TSX.V: AOT) is a focused gold and silver explorer with a portfolio of advanced and

grassroots projects in the Golden Triangle region of British Columbia. The company’s flagship Premier Project

is a near-term high-grade advanced exploration project, with large upside potential. We learned from Bob

Evans, CFO and Director of Ascot Resources, that the most significant development is that Ascot has exercised

its option to acquire the Premier and Dilworth properties. According to Mr. Evans, there is excellent

infrastructure around the project so the cost of putting in an operation will be substantially lower than a

lot of comparable mines. We also learned from Mr. Evans, that there is some spectacular high grade found just

north of the Premier mine area, and Ascot is planning to come up with an NI 43-101 resource at the end of this

year's drilling campaign.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Bob Evans, who's

CFO and Director of Ascot Resources, Limited. Could you give our readers /investors an overview of your

company and what's happening? I know you're getting some very good drilling results, and you're also making

acquisitions. Could you update our readers/investors?

Mr. Bob Evans: Sure. The most significant event, to date this year, is we have exercised our option

to acquire our flagship Premier and Dilworth properties, located in Northwestern BC.

The money from the exercise is in escrow pending settlement of a number of items that still need to be

dealt with. The major outstanding item is the bonding on the property.

Before Ascot can finalize the Premier acquisition, it has to negotiate a new bonding amount for the

existing tailings facilities on the property with the government of British Columbia. We expect that process

may take up to six months.

In terms of the current drilling, we have an ambitious surface drill program going this year. We've

drilled 177 holes to date. I think we've announced results on all but 36 of those holes. We've completed 55

thousand meters of drilling. We're scheduled to do about 140 thousand meters of drilling before the season is

over. The season usually ends late October.

We are getting engineering advice on what to do underground, to establish an underground drill program

and also looking at the possibilities of early production.

Dr. Allen Alper: Sounds exciting. Could you give us a broad brush of what some of your drilling results

indicate?

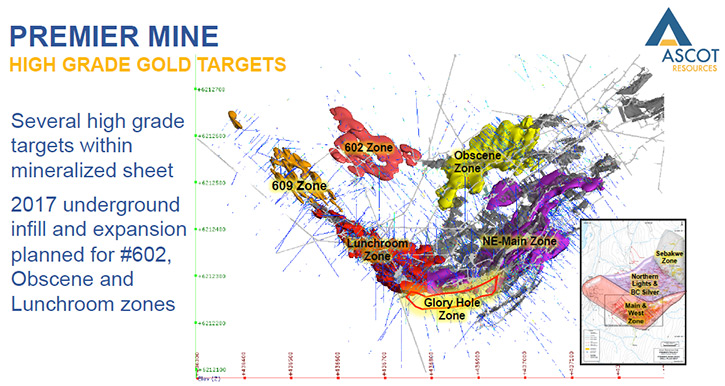

Mr. Bob Evans: The purpose of this year’s drilling is to come up with a resource on the Premier mine

area and the Northern Lights area, just to the north of it. We're drilling on roughly 30 meter centers to come

up with an inferred resource, although some of the areas have been drilled more densely and will provide an

indicated resource. We expect the resource to be in the two to three million ounce range. We've discovered new

zones, new sub-zones, in the Northern Lights that are very encouraging. Many of this year’s results have been

on par with what we've been reporting over the past couple of years. There is some spectacular high grade

within the mineralized zones.

The data from this and previous year’s drilling will be compiled along with some of the historical

data to come up with the resource. Next year we would expect to be working on a PEA and a pre-feasibility

study.

Dr. Allen Alper: That sounds excellent. Could you elaborate a bit on what differentiates your resource

from others? What makes it special?

Mr. Bob Evans: Well, there are several things about our resource. One is the area we're in. The

Premier was a producing mine. There is excellent existing infrastructure. You can drive to the site from the

town of Stewart in Northern BC. The cost of putting in an operating mine could probably be done for around

$200 million, which is substantially lower than a lot of comparable mines.

The actual nature of the resource can lend itself to either open pit or high grade underground or a

combination of both. That will be an engineering decision as to the best way forward it.

Our property is large and even though we have done a lot of drilling there is still substantial blue

sky potential in areas yet untested.

From a geological point of view, we are finding the structural zone virtually wherever we anticipate it. The

only thing that varies within the zone are the grades. We are not looking for narrow high grade zones, we have

high grade within lower grade zones. It should make for low cost mining.

Dr. Allen Alper: That's excellent. I guess it's a very large deposit that has very high grade and a

potential for low cost mining. Is that correct?

Mr. Bob Evans: That is correct. There are two parts to the property. The southern part is where we're

concentrating our current efforts, and that's where the old mine was that produced two million ounces back in

the 1930s and '20s that had a head grade of a third of an ounce.

There are also resources on the northern end of our project, which will be developed later on and

would lend themselves more to the open pit type scenario, bulk tonnage, lower grade.

Dr. Allen Alper: Well, that sounds excellent. Could you tell our readers/investors a bit about

yourself, your team and your board?

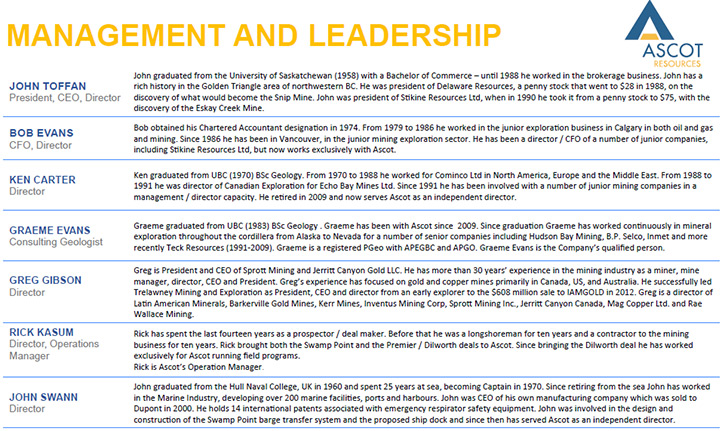

Mr. Bob Evans: Sure. The team is led by John Toffan, who is no stranger to this part of the world. He

was President of Delaware Resources which found what was to become the Snip mine. He was later President of

Stikine Resources, which discovered the Eskay Creek mine. Eskay Creek was extremely high grade and the Stikine

stock went from 30 cents to $75.

Also on the board, we have Greg Gibson who is the representative of Eric Sprott. Eric Sprott made a

$20 million investment in our company last year, and holds 12% of the stock. As part of that investment, he

got the right to nominate one director.

We have Ken Carter, a retired geologist, John Swan, who is a retired marine captain, who are

independent directors. We also have Rick Kasum, who is our Operations Manager up at Stewart.

Dr. Allen Alper: Well, that's an impressive board, well chosen! Could you say a bit more about your

background, Bob?

Mr. Bob Evans: I was with John at Stikine Resources. I've been in the junior mining business since

1981. I am an accountant, but I am fascinated by mining exploration, it's a wonderful way to make a living.

Dr. Allen Alper: Yeah, it's an exciting way. It is fun, and you can make money. Great!

Mr. Bob Evans: It's not like a lot of conventional accounting jobs, it’s exciting.

Dr. Allen Alper: Excellent! Could you tell us a little bit about your capital structure?

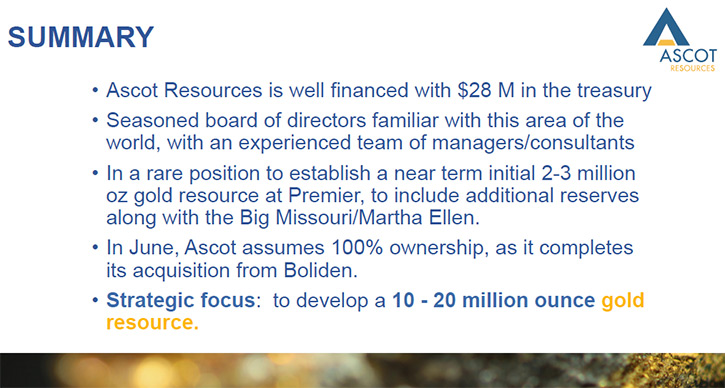

Mr. Bob Evans: We have just shy of 150 million shares outstanding. We're trading at $1.80 Canadian,

at the moment, which gives us a capitalization of about $258 million Canadian. We only have the one class

share. We have about 11 million warrants and 10 million options outstanding. On a fully diluted basis, we'd be

at about 170 million shares outstanding. We have about 20 million in cash, in the treasury.

Dr. Allen Alper: That's excellent. That's a great position to be in. What are your thoughts on what's

going to happen in the gold market?

Mr. Bob Evans: I can’t see gold going anywhere but up in both the short and longer term.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider

investing in Ascot Resources, Limited?

Mr. Bob Evans: We are defining a large resource in a mine-friendly area. The outlook for gold is

good. We have no debt. The major mining companies are returning to acquisition mode and Premier is likely to

be a near term producer. I think it's very exciting times.

Dr. Allen Alper: Well, that sounds great. Is there anything else you'd like to add, Bob?

Mr. Bob Evans: No, I think we've about summed it up. This is one of the more advanced and exciting

gold plays in Canada, and Canada is a very stable jurisdiction. If you're a believer in gold, you should take

a look at Ascot Resources.

Dr. Allen Alper: Sounds great. Excellent reasons to consider your company.

http://www.ascotgold.com/

Ascot Resources

Suite #1550

505 Burrard Street

Vancouver, B.C.

V7X 1M5

778-725-1060

778-725-1070

1-855-593-2951

info@ascotgold.com

|

|