Carpentaria Exploration Ltd.’s (ASX: CAP) Quentin Hill, Managing Director of this Emerging Producer of Premium Quality Iron Ore in Eastern Australia

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 8/20/2017

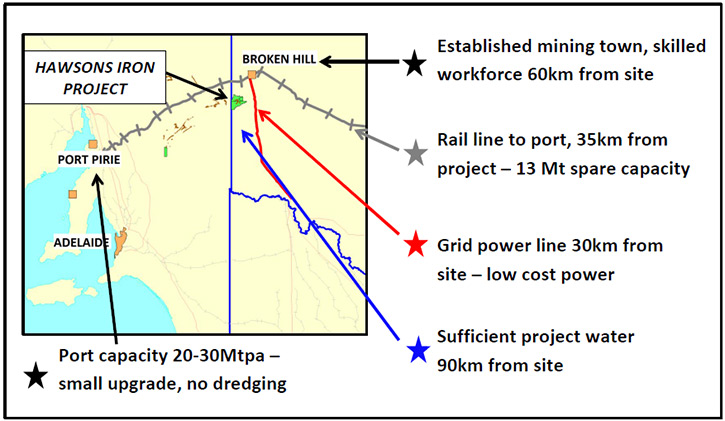

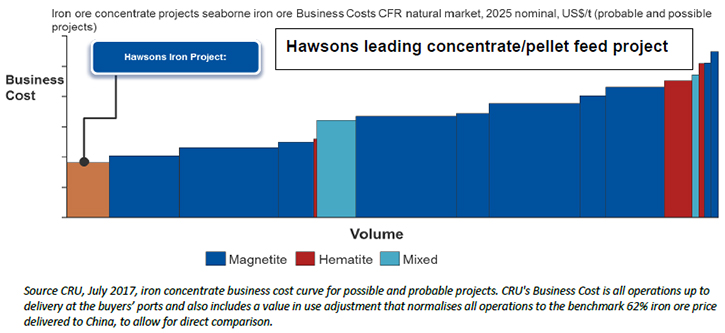

Carpentaria Exploration, Limited (ASX: CAP) is an emerging producer of iron ore in eastern Australia. The

company aims to build a long term, low cost premium quality iron ore business from the development of its

flagship asset, the Hawsons Iron Project, utilizing existing infrastructure. Hawsons Iron Project is the

largest magnetite discovery in eastern Australia. Located only 60 kilometres from Broken Hill, a mining city

in the far west of outback New South Wales, Australia. It is near the border with South Australia on the

crossing of the Barrier Highway (A32) and the Silver City Highway (B79), in the Barrier Range. Hawsons has

access to established rail, road, port and power infrastructure in a region with a long, proud mining history

and a town with generations of skilled mining workers. We learned from Quentin Hill, Managing Director of

Carpentaria Exploration, the Hawsons Iron Project is extremely high grade and will supply the world's best

pellet feed at competitive production costs. According to Mr. Hill, there are very few projects that can

supply high-grade material and pellet feed, and be incentivized into production at the long-term iron ore

prices. This makes Hawsons Iron Project strategically very important and Mr. Hill believes this will help them

get the funding required.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Quentin Hill,

Managing Director of Carpentaria Exploration, Limited. Quentin, could you give our readers/investors, an

overview of your company?

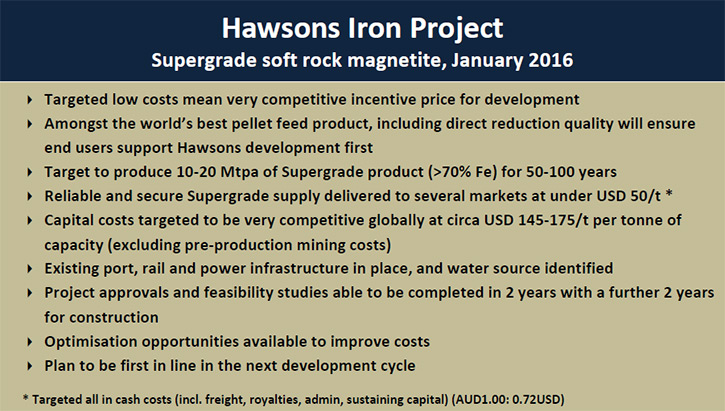

Mr. Quentin Hill: Certainly, Allen. Our company is focused 100% on development of the Hawsons

Iron Project. We're doing this in a difficult environment, because we understand we have a project that meets

a specific niche in the supply of global metallics, because of its extremely high grade, and the ability to

produce at competitive costs. What we're trying to do at Carpentaria, is develop the Hawsons Iron Project,

which will supply the world's best pellet feed. We see that the iron ore market has a problem. There is a

long-term iron ore price forecast around $55 to $65 a ton, but steel mills are increasingly wanting high-

grade, and they're increasingly wanting pellet feed. This includes the direct reduction market.

There are very few projects that can supply high-grade material, and/or pellet feed, and be

incentivized into production at the long-term iron ore prices. We think our project can, and there are reasons

why, which we can go into later. But because we can, we are very strategically important, and we think we will

get the funding required.

Dr. Allen Alper: That sounds great. Have you gotten approval on your product from the steel companies?

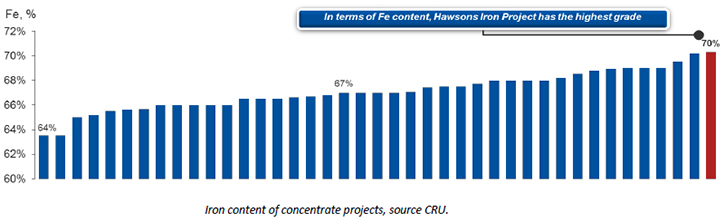

Mr. Quentin Hill: Absolutely, Allen. Just this week, yesterday we announced we plan to produce

10 million tons per annum of a 70% FE product, that is suitable for the direct reduction market, as well as

because of its unique fineness, it is also excellent pellet feed for the growing demand in China for increased

pelletizing burden, pellet burdens in their mills.

To answer your question, yesterday we announced that we now have 11.4 million tons per annum signed up under

non-binding letters of intent. However, we only plan to produce 10 million tons. We are over-subscribed. Our

off-take partners are blue-chip companies, who have invested in magnetite before, so we have Formosa Plastics,

who are steel makers in Vietnam. We have Mitsubishi RTM, we have Shagang Limited out of China, they're China's

largest private steel company. They signed on yesterday. In the Middle East, the direct reduction market, the

high-value, we have Barine Steel, Emirate Steel, and Kuwait Steel.

Dr. Allen Alper: Well, that's fantastic. That's outstanding.

Mr. Quentin Hill: We think that is rare for a project at this development stage.

Dr. Allen Alper: That is very good. What are your plans getting ready to deliver, and what is your

schedule for meeting these non-binding agreements?

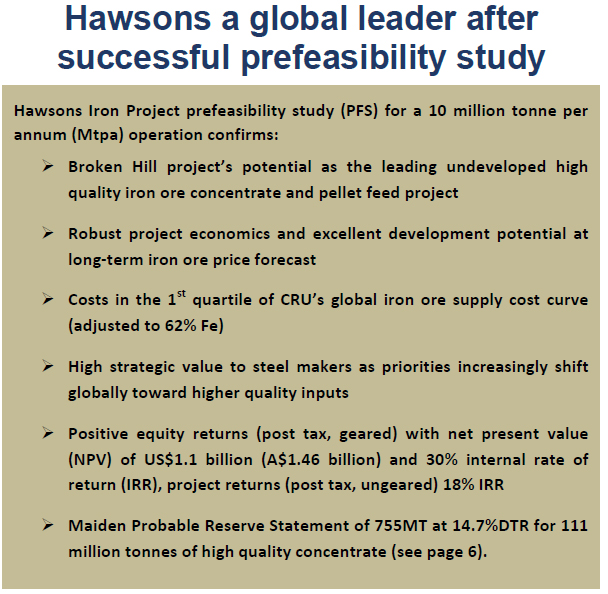

Mr. Quentin Hill: The next step for us is to deliver our pre-feasibility study and meet our cost

targets, and make sure that our cost targets mean that we are incentivized into production. That means paying

back debt and paying a return to equity at the long-term iron ore price. If we meet those targets, we will be

a very attractive proposition for additional investment. We plan to deliver our pre-feasibility study at the

end of June this year. That will increase the investment grade of the company and the project, and increase

the pool of investors able to invest, fund managers and strategics. Now that we have introduced that level of

competition for the off-take, we believe there will be increased confidence from the fund managers that there

will be buyers and support for this project when required. In terms of the off-takers, we would like to think

that if they were to secure their product, investment in the next stage would certainly help.

Post-June 30, post-delivery of the pre-feasibility study, we'll be seeking capital for the bankable

feasibility study from both financial investors and strategic investors. We think there are probably 18

months’ worth of approvals and study to be done, then, 18 months of construction. That means we are targeting

production in 2020. We've told Japan we can do it before the Olympics in Tokyo, and in the Middle-East, we're

looking to do it before the World Expo in 2020 in Dubai.

Dr. Allen Alper: Sounds great!

Mr. Quentin Hill: All of that will be subject to receiving funding directly after the pre-

feasibility delivery.

Dr. Allen Alper: Great!

Mr. Quentin Hill: In terms of project construction, our capital cost is $1.4 billion US to build

the project for 10 million tons per annum. That's certainly what the second stage of the project looks like at

the moment, but in terms of where that places us, we have a significant amount of existing infrastructure. We

have a power line that passes very close on a reliable grid. We've identified the water. It can be provided

under existing regulations. We have a work force in Broken Hill, and we have a rail-line with 13 million tons

of spare capacity, that goes directly to either Port Pirie or Port Whyalla. We have a large amount of existing

infrastructure, which is why we believe the global steel companies have been attracted to us and our product.

The other thing is, the development risk is low compared to other projects. We don't need to build a vast

amount of infrastructure to get our product out. Conceivably, if we go through Whyalla, all we need is the pit

and the plant.

Dr. Allen Alper: Sounds very good!

Mr. Quentin Hill: It is, it is very good.

Dr. Allen Alper: Sounds like you're getting everything set. You have a good plan. You have your off-

takes coming in place. You are working on your pre-feasibility study. You're pulling everything together.

Mr. Quentin Hill: Yes, we think the message on the delivery of the pre-feasibility study will

bring it together quite smartly. The message to financial investors, reading your magazine, is, "Carpentaria

has been largely ignored by the capital markets in Australia. They've tuned out of iron ore for the last two

or three years. We know we've got something valuable here, and we've gone to those that will recognize it. The

industry participants do recognize it." The companies, I've mentioned to you, understand where the iron ore

market is heading. They understand the unique position, in which our cost structure has put the project. They

want to be a part of it, at least getting some of the product. They've endorsed what we're doing, and we think

it's only a matter of time before the capital markets see that.

Dr. Allen Alper: Sounds very good! You feel confident with the costs you have, that you'll be able to

make a good profit on the off-takes you'll be signing.

Mr. Quentin Hill: Without doubt. We're targeting a CFR China cost for a 70% Fe product of less

than $50 a ton. The product will achieve significant price premiums for two reasons, because it's the world's

best pellet feed in terms of chemistry and physical properties, which will give us two premium

characteristics. The other thing is that it's a direct reduction product, so we can land it in the Middle East

at the same cost, and the direct reduction premium in the Middle East is quite generous. We are confident,

absolutely.

Dr. Allen Alper: Excellent. Could you tell me a bit about your background and your management team and

board?

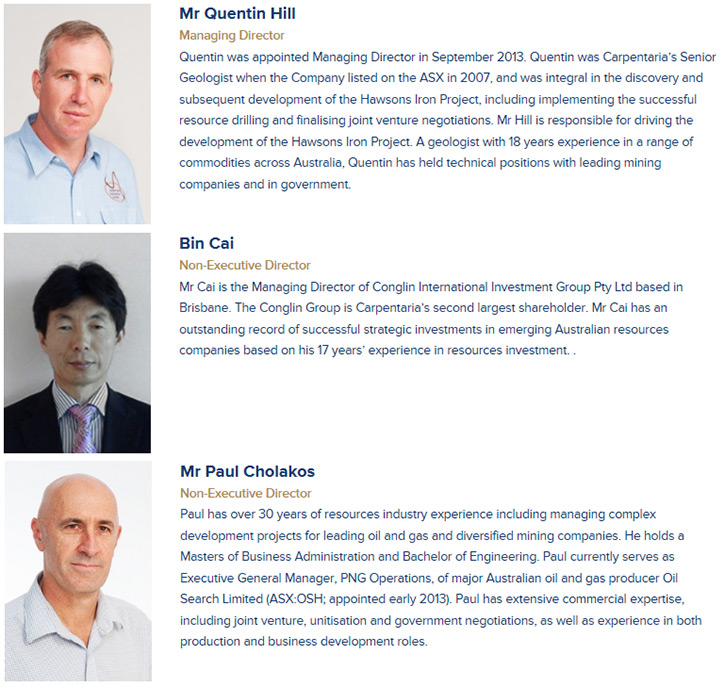

Mr. Quentin Hill: Sure. Our company started as an exploration company in 2007. We discovered the

Hawsons Iron Project in 2009. I was senior geologist with the company at the time, and part of the discovery

team. Since that time, we've been developing the project, along with other exploration assets. I'm a

geologist, and I worked largely in gold and nickel and other commodities within Australia, including coal with

Vale, as a consultant more than anything, and I've worked in government as well. However, I was promoted to

managing director of Carpentaria in 2014. At that stage, capital markets were very tight, and the board chose

to focus on what we'd already found in this very valuable asset, Hawsons, and dispense with the rest of the

exploration assets, because the capital markets were just too tight to pursue both.

We still found those markets to be very tough, which is why we're concentrating on those that know the

industry. However, we think now that the iron ore price and the iron ore market dynamics are becoming clearer,

since China has restructured and is partway along restructuring the industry path, people are confident now,

forecasting what's going on in China. Our decision to focus on the project will be shown to be the right one.

On our board, we have Neil Williams. After a long career with Mount Isa Mines, as head of exploration,

he then ran to South Australia, the leading government geo-science body in Australia for 15 years. Paul

Cholakos is Executive General Manager of technical services for Oil Search. He played a very key role in

making sure the $20 billion PNG-LNG project, I'm not sure whether it's Chevron or Exxon built, got the 20% of

feed required from Oil Search. Paul’s experience on mega projects is very valuable. Bin Cai is our other board

member, representative of one of our major shareholders.

Our project team is very lean and second to none. We have Australia's go-to magnetite engineer, in Ray Koenig

who started his career in the 70s at Savage River magnetite mine, where they have pelletizing, pipelines and

processing facilities. Ray also was one of the key members that designed the Olympic Dam Plant in South

Australia. He's widely known and widely respected, and he's the go-to guy for Magnetite in Australia. He's

been with us for six years. He's behind the flow-sheet that gives us, what we're calling, Hawsons Supergrade

Product.

We recognize we're going to have to fund this project. We've had Adam Wheatley, who's been with us for

around four years now, in a consultant capacity to make sure everything we do increases the bankability of the

project. Together, he is part of the strategy team to get this project into development. He had a key role for

Hancock Prospecting’s side of the Hope Downs financing. The team he built, went on to finance Roy-Hill, one of

the largest project financing exercises in history. Adam certainly knows his way around the iron ore financing

space.

Lastly, Lou Jelenich. He worked with BHP for 40 years, first in the blast furnace at Newcastle, and

later as head of technical marketing for BHP, which means he goes to the steel mills and he talks to them

about their furnaces. He knows, because he's run a furnace before, he knows the language. His job is to make

sure that the ore fits with the customer, and the customer can also fit with the ore. His contacts have been

marvelous in helping us secure an over-subscribed off-take. He's at the top of his field, as are Adam and Ray.

Dr. Allen Alper: Excellent! Sounds like you have a very strong team, well-prepared to do the job. Well

done.

Mr. Quentin Hill: Yeah. I think that's a fair comment.

Dr. Allen Alper: Could you tell me a little bit about your finances and your share in capital

structure?

Mr. Quentin Hill: Sure, we have 169 million shares on issue. We are heading towards $1 million

in the bank by the end of the financial year. We will be seeking capital once the pre-feasibility study is

delivered. We have three major shareholders, Silvergate Capital, Australia Conglin Group, and our first

institution, SG Hiscock out of Melbourne.

Dr. Allen Alper: That sounds great. What are the primary reasons our high-net-worth readers/investors

should consider investing in Carpentaria Exploration?

Mr. Quentin Hill: At the moment, we believe the market has largely ignored us, however the

strength of the project has been recognized by those that know, the iron ore and the steel industry. That is

clearly demonstrated by the quality of off-take partners we have. They have a history of investment in the

Australian industry, and once we secure investment from strategics and fund managers, this will demonstrate to

the Australian retail industry just what they've been missing, and will provide a significant rerating for the

company. We have a product that has a specific and important niche in the supply of global metallics that is

recognized across three different markets, Middle East, Southeast Asia, and China. We have off-takers capable

of assisting the project into development. We have off-takers that are over-subscribed, and we think it will

be the competition that drives the development and the investment in the project. Once we secure that, there

will be a significant rerating in the price, and significant potential uplift for investors.

Dr. Allen Alper: Well that sounds excellent. Very good!

Mr. Quentin Hill: Well, yes. It does sound excellent. We have big challenges ahead of us, of

course. There is a very high capital component to build this project. However, the rewards, in terms of

revenues per annum and other considerations, mean it will be a compelling investment. We look forward to

pushing it as hard as we can over the next two years.

Dr. Allen Alper: Excellent! Very good!

http://www.carpentariaex.com.au/

Quentin Hill

Managing Director

Email quentin.hill@capex.net.au

Phone +61 7 3220 2022

Mobile +61 4 2396 8786

|

|