Mustang Resources Limited (ASX: MUS), Interview with Christiaan Jordaan, Managing Director: Only Pure-Play Ruby Mining Company, First Sale Planned in October for 200,000 Karats of Medium to High-Quality Rubies.

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/29/2017

Mustang Resources Limited (ASX: MUS) is an emerging gemstone developer and producer

focused on the near-term development of the highly prospective Montepuez Ruby Project in

northern Mozambique. We learned from Christiaan Jordaan, who is the managing director of

Mustang Resources that they are one of the two companies listed that are mining rubies and

shortly will be the only pure-play ruby mining company. Mustang flagship property is a

very exciting recent discovery in the Montepuez gem field in Northern Mozambique. They

have rapidly grown their ruby inventory to 132 000 carats of rubies on hand and they have

their first sale planned in October this year for 200 000 carats of medium to high-quality

rubies. Arena Investors LP, a major US institutional investor, has just invested in

Mustang, committing $8.5 million of new capital. They are also making progress on their

flake graphite project, which is shaping up to be one of the highest grade flake graphite

projects in the world.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing Christiaan Jordaan, Managing Director of Mustang Resources Ltd. A lot of

great things are happening with your company, could you give our readers/investors an

overview of the company?

Mr. Christiaan Jordaan: Mustang Resources is currently one of only two companies

listed that are mining rubies. We're mostly mining in Northern Mozambique, in a very

exciting recent discovery in the Montepuez gem field. A recent development in the industry

has seen us being the only company that will be a pure-play, listed ruby mining company by

the end of July. Our neighbor Gemfields is being de-listed following a takeover battle

between Pallinghurst Resources, a JSE-listed private equity firm and their largest

shareholder, and the Chinese conglomerate Fosun International, Fosun Gold, was not

successful in their cash bid to acquire Gemfields.

That has all led to increased awareness of what we are doing in Mozambique,

especially as our company Mustang is now in production. We have rapidly grown our ruby

inventory. We have 132 000 carats of rubies on hand. We are continuing to focus on

secondary deposits, which yield high-quality rubies that come out of Mozambique, and we

have our first sale planned in October this year for 200 000 carats of medium to high-

quality rubies.

Yesterday we announced a milestone transaction with a major US institutional

investor called Arena Investors LP, a company based in New York, managing more than $600

million US. They've invested in Mustang in the mezzanine financing round, committing $8.5

million of new capital that leaves us fully financed to our first revenue in October

through the Convertible Note Deed that we executed with them. That was a major step for us

in the right direction.

We are making rapid advancements in our non-core asset, our Caula Graphite Project, where

work done on that project has already shown it to be one of the highest-grade graphite

projects in the world, and we still intend to unlock value from that project for our

shareholders in the next 6 to 12 months. But focus is fully and squarely on the ruby

project and cashflow from that in October this year.

Dr. Allen Alper: Sounds excellent! Could you tell us a bit more about your

plans going forward with the ruby project? Also a bit more about your plans to move

forward with your graphite project.

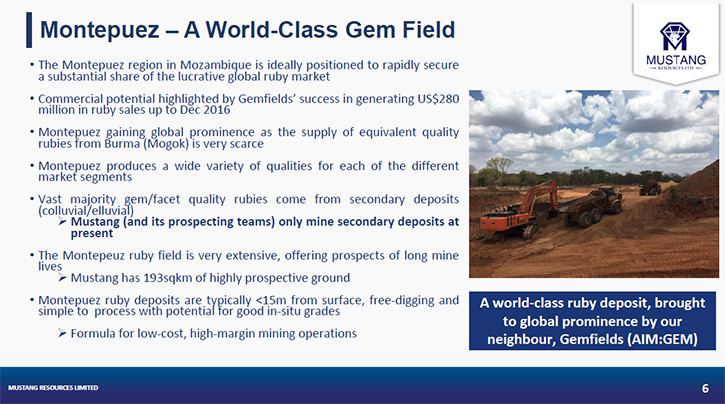

Mr. Christiaan Jordaan: Moving forward with our ruby project, since we last

spoke we've had significant developments acquiring a new piece of ground, about 35 square

kilometers, adjacent to our existing three licenses. We've increased our land package,

we've gone on, after an acquisition, to make a major new discovery on that new concession.

We've discovered a major secondary deposit of gem-quality rubies within about three

kilometers south-east of our upgraded processing plant. And that's great because the

quality, the size of the stones coming out of there is phenomenal, the grade of the stones

has picked up substantially as well, indicating around 50 carats per 100 ton ROM. The

mining cost there is extremely cheap as the deposit there is less than two meters from

surface so it's very cheap to extract, and it's already showing itself to be quite

extensive already, more than 2.2 kilometers in strike length that we've identified with

manual test pitting on that area.

To date, we’ve discovered numerous ruby deposits on our concession areas. In June

and leading into July, we have upgraded and commissioned our new processing plant, which

gives us 250 ton per hour feed capacity. On an annualized basis, one operational shift

equates to approximately 400 000 tons per annum, but obviously there's a lot of growth

potential by just implementing a second and third shift in the future. Now that we have

the capital, that becomes a possibility for us to do. On the ruby project, at the moment,

we're also making great inroads into establishing our company amongst the cutters and

polishers, amongst the manufacturers in predominantly Thailand and India and Hong Kong in

the lead-up to our first tender in October.

Mr. Christiaan Jordaan: We've identified all the major rough ruby buyers. We

already have about 92 on our list. Currently, we're focusing on the top 21 buyers,

engaging with them, getting them excited about our project, explaining our rough grading

system. Since we last spoke, we've developed a rough grading system, which is very

important, as we've seen in the diamond industry. Also with Gemfields our neighbor, a big

part of the success of a rough gemstone sale is how you grade and sort the stones before

you take it into a tender where the rough buyers will bid in a competitive process. So

we've implemented that as well, and we're very excited about what lies ahead for the Ruby

Project.

There are a few analysts, who have done reports. Most recently, Hartleys Limited

in Perth, a major broker group over there, released a research publication showing an 8.5

cent price target and expectations of at least $10 million of sales in October, which I

think is quite conservative. Another group, Independent Investment Research, developed a

more comprehensive financial model to get to I think about a 17 cent per share price

target. Their analyst Mark Gordon was on-site a couple of weeks ago, so we expect him to

release updated research over the coming weeks. So yeah, there's a lot happening on that

front.

Dr. Allen Alper: Well, that's just excellent news. It sounds fantastic.

You've made tremendous progress since the last time we talked and the last time we

published a featured article on your company. I'm very impressed with what you and your

team are doing. Could you tell us a bit more? Give our readers, our high-net-worth

investors, more information about yourself and your team?

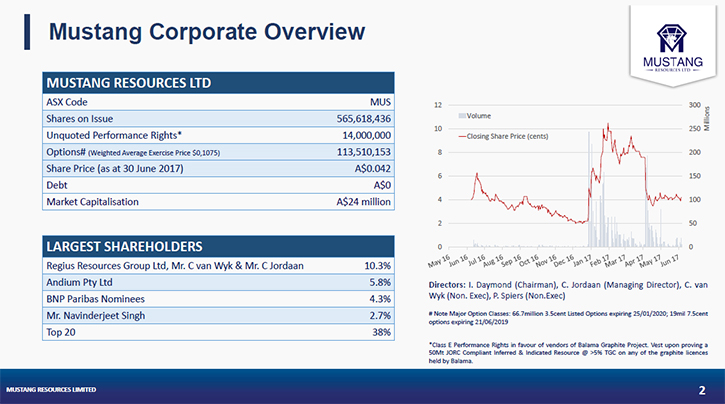

Mr. Christiaan Jordaan: I'm one of the founders of the projects held by Mustang

Resources Limited. I have privately invested in them together with my business partner,

fellow South African Cobus van Wyk, who's also a director on the board of Mustang.

We've been in Mozambique investing our own capital in developing projects there

for the last 12 years now. We then vended these projects we started into a listed cash

shell in Australia, which is now known as Mustang Resources, paying additional capital to

develop the projects to where they are today. And we are still significant shareholders,

actually the largest shareholders in the company, over 10.3% shareholding. And we are

actively involved, me in the corporate side and my business partner Cobus based in

Mozambique driving the operational front of the business.

So yeah, we have a really entrepreneurial team of guys we've brought in to support

myself and Cobus. We've brought in really great expertise from the board level down to the

ground level. At the board level, we recently appointed Peter Spiers, based in Brisbane,

Australia. He's a former Western Mining Corporation Head of Business Development, a

geologist, he also started a gold company and found a gold deposit in West Africa, which

was then acquired by SEMAFO from Canada for about $170 million in a hostile bid.

Subsequent to that, he took a year or so off and then joined our board. We have Ian

Daymond, our Chairman, very well-experienced executive in African resources, formerly with

Delta Gold in Zimbabwe and Southern Africa.

On the ground level we've put together a top-notch team with experience in

gemstones, a group of South African miners, gemstone miners, who've done this type of

project throughout all of Africa. The geology side of things is led by Paul Allan: 25

years of experience in gemstones, started with De Beers back in the day and he was most

recently responsible for discovering the rubies and the ruby deposit for our neighbors

Gemfields in 2012/2013, before he joined our team in 2015-16.

Dr. Allen Alper: You have put together a great company! I’m impressed.

Could you tell our readers/investors a bit about your capital structure and where your

stock is listed?

Mr. Christiaan Jordaan: Mustang is listed on the Australian Stock Exchange under

the ticker MUS. We have 565 million shares on issue at the moment, trading at about 5.5/6

cents, capitalizing the company around $30 million Australian. We have 130 million options

on issue of various strike prices. There are some 67 million listed options trading on the

Australian Stock Exchange under the ticker MUSOA that has a strike price of 3.5 cents and

still have about two-and-a-half years left on them so they are in the money and long

duration left on them. And then the rest of the options striking between 6 cents and 15

cents, even with some striking at 20 cents.

In terms of capital, we've raised equity capital in March, a replacement for $5.8

million which was used to finance the last remaining upgrades on our processing plant and

to finance working capital on the mining side. Recently we announced the transaction for

Convertible Notes with Arena Investors of 18-month duration. More information on that can

be found on our website and also on the ASX platform.

Dr. Allen Alper: That sounds great, sounds like you're in an excellent

position to move forward with your company. That's very good news for our

readers/investors. What are the primary reasons our high-net-worth readers/investors

should consider investing in Mustang Resources Ltd.?

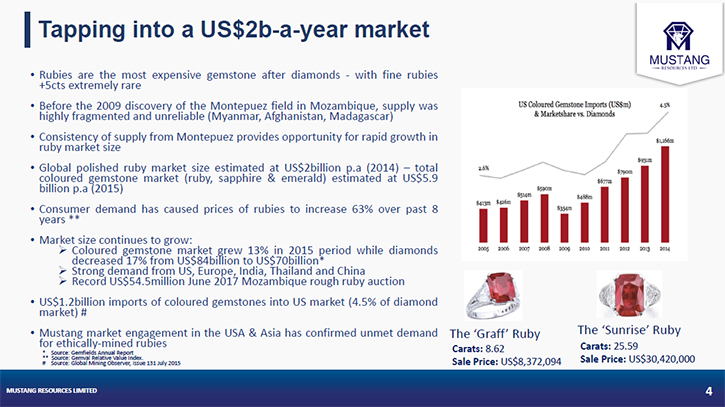

Mr. Christiaan Jordaan: Take a step back from our operational success, our team

and being near cashflow; all those great things. Look at the market opportunity for

colored gemstones firstly, and then secondly for rubies. It is just phenomenal. We're at a

point in history where, for the first time ever, we have ruby deposits in Mozambique, a

gem field in northern Mozambique, which can deliver rubies, consistently to the market. If

you go back in history rubies are arguably the most sought-after gemstone, from Eastern

royalty through to all the major Eastern cultures, they've been revered for thousands of

years. It's always just been a problem of consistent supply and very unreliable supply up

to date until the discovery in Mozambique was made in 2009.

We also see a phenomenal opportunity for the growth of this market, from the

younger generations leading the change in the trading of how gemstones are bought in

Western markets like the United States, where you now see a divergence away from just

buying diamonds. Younger buyers are looking to get their hands on colored gemstones.

Rubies are right on the top of the list as the most sought-after gemstone.

It's a very rare commodity: if you look at other deposits there's really nothing

else outside of Mozambique. Burma has been mined for 2000 years. It’s basically at the end

of its tenure and won't be able to supply the volumes, required for market growth.

Afghanistan will never be a major supplier. Thailand, Cambodia are basically depleted.

Discoveries in Tanzania in East Africa are of commercial rubies that don't deliver the

quality stones we mine. Madagascar is heavily constrained due to environmental and social

issues that they face mining there. That leaves Mustang in Mozambique, already established

as the dominant supply source of the global ruby market.

And that leaves us in an absolutely fantastic position, and more so if you look at the

investment universe. By the end of this month Mustang will be the only pure-play ruby-

mining company in the world. For investors, who see the potential for rubies to grow and

for colored gemstone markets to grow, they can basically only access that through

investing in Mustang Resources.

We've ticked the right boxes on business details, in terms of the committed

management team that has skin in the game, our near-term cashflow, very conservative

balance sheet, well-financed, a lot of upside growth and more discoveries to be made in

the coming years.

Dr. Allen Alper: Those are excellent reasons for our high-net-worth

readers/investors to consider investing in your company, really excellent.

http://www.mustangresources.com.au

Managing Director:

Christiaan Jordaan

info@mustangresources.com.au

+61 (0) 2 9239 3119

|

|