Interview with David Grondin, President and CEO TomaGold Corporation (TSXV: LOT): A Rapidly Growing, Well Diversified Canadian Project Generator, has Three Joint Ventures with IAMGOLD, Goldcorp and New Gold

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/27/2017

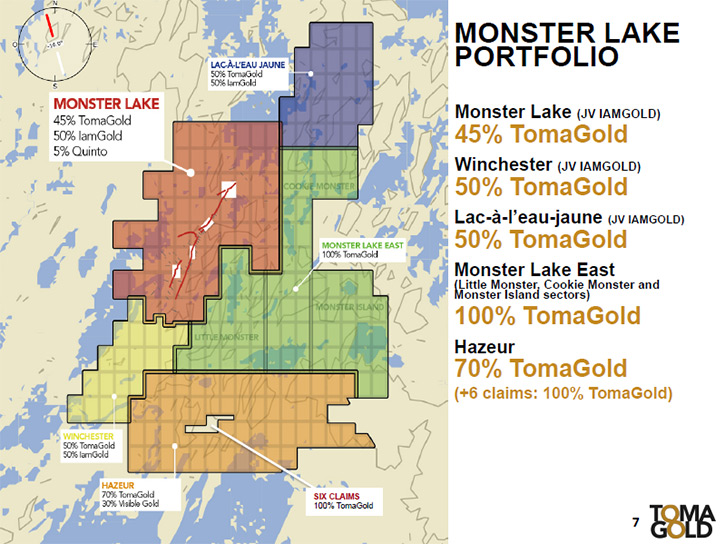

TomaGold Corporation (TSXV: LOT) is a rapidly growing, well-diversified Canadian

project generator, engaged in the acquisition, assessment, exploration and development of

gold mineral properties, together with major mining companies. We learned from David

Grondin, President and CEO of TomaGold that they have 3 joint venture agreements with:

IAMGOLD Corporation, for the Monster Lake project that recently published high grade

drilling results, Goldcorp Inc., for the Sidace Lake property, and Goldcorp and New Gold

Inc., for the Baird property. Additionally, TomaGold has interests in six gold properties

in northern Quebec: Monster Lake, Winchester, Lac-à-L'eau-Jaune, Monster Lake East,

Obalski and Lac Cavan near the Chibougamau mining camp. It also has an interest in the

Sidace Lake property, near the Red Lake mining camp in Ontario. Finally, it has an option

to acquire a 70% interest in the Hazeur property, at the southern edge of the Monster Lake

group of properties. According to Mr. Grondin, TomaGold has good exposure with

institutions, a good portfolio, is well diversified, well financed, and participates in

joint ventures, with established companies - all significant plus factors to invest in the

company.

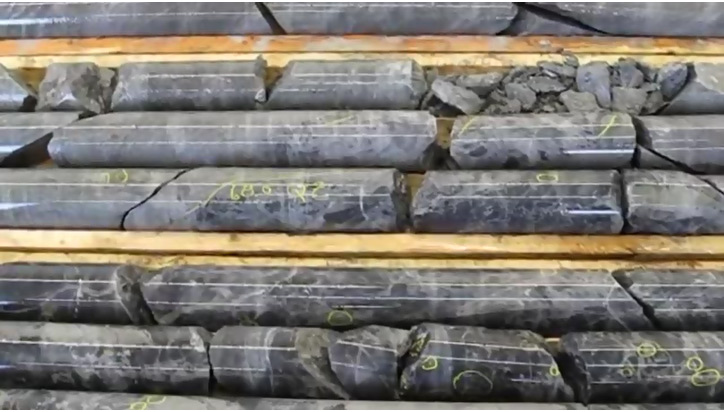

Bonanza Grade of 237.6 g/t Au at Monster Lake

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing David Grondin, President and CEO of TomaGold. Could you give our

readers/investors an overview of your company?

Mr. David Grondin: Yes. TomaGold is a Montreal-based company. We are a

project generator. We bought our first project in 2012 and now have three active joint

ventures with majors. We have one in particular, with IAMGOLD, called "Monster Lake." It's

in the Chibougamau mining camp in Quebec. The project historically started as a huge

learning program. We ended up doing a joint venture with IAMGOLD at the end of 2013.

The Monster Lake joint venture project (IAMGOLD: 50%; TomaGold: 45%) is located 50

kilometres southwest of Chibougamau, Quebec, Canada. We recently announced that IAMGOLD

intersected some very strong grades on the property, including 121.67 g/t Au over 3.1

metres.

Only half of the grades that are available were

published. Of the 10,800 meters that we've contracted, we have released the results for

about 5,100 meters. We have more grades to come, and pretty soon I guess.

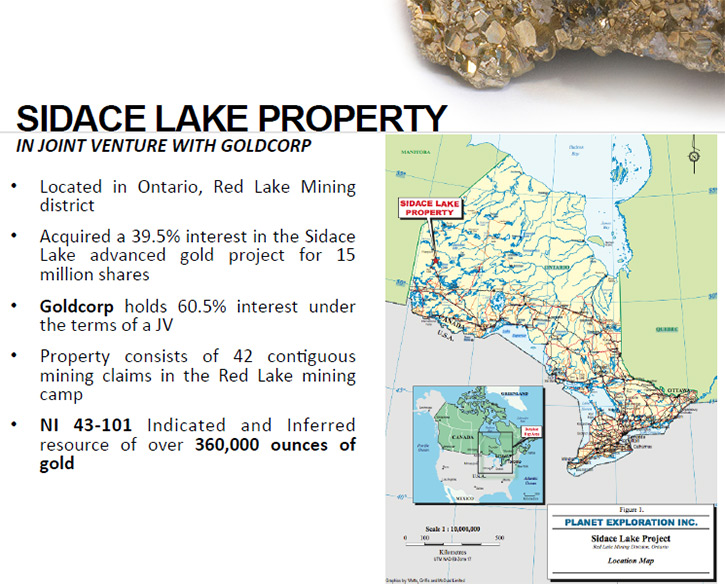

We also have a joint venture with Goldcorp in the Red Lake mining camp. The project is

called Sidace Lake. It is well located and easily accessible. We have a 39.5% interest in

the project, whereas Goldcorp has the remaining 60.5%. The property hosts a deposit, which

has an indicated and inferred NI 43-101 resource of over 360,000 ounces of gold and is

open at depth. We are looking to fund an exploration program during the current year.

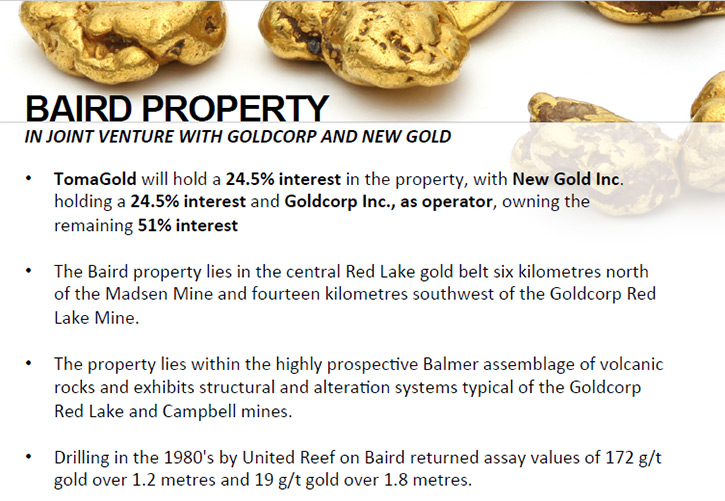

The last JV we have is with Goldcorp and New Gold. It's called Baird. It's a grass root

project in Red Lake. Right now we are assessing what kind of work can be done on the

project. It's still a project with two majors, so it could be really interesting.

We also have the Obalski gold-silver-copper project, of which we own 100%. This advanced

past-producing project is located south of Monster Lake and includes one mining concession

and hosts seven separate mineralized zones, one 85-metre shaft and two ramps. 230 holes

were drilled on the property for a total of over 60,000 meters, most of which was surface

drilling. In 1964, United Obalski Mining Co. Ltd. mined 90,093 tons grading 3.0 g/t Au,

6.2 g/t Ag and 1.53% Cu. Our latest 1,700-meter drilling program has enabled us to

intersect semi-massive sulphides grading 15.0 g/t Au, 46.8 g/t Ag and 10.4% Cu over 2.0

meters at a vertical depth of 95 meters. More work is planned during the current year.

The Hazeur project, which is on the southern border of the Monster Lake group of

properties, is more of a grass root project, located on a different gold structure. It has

yielded some strong geophysical and early stage drilling targets. More work will be done

there during the current year.

Our final project, of which we own 100%, is Monster Lake East, also a grass root

play. The project is located on the southern edge of Monster Lake. We did some geophysics

as well as some structural drilling to identify and test what we saw in the geophysical

report. More work needs to be done there, which we are planning to do during the current

year or next year.

Overall, that's what we do. We are currently open to acquiring other high quality

projects, entering other joint ventures or reselling these projects. We're a project

generator. We think it's the best way to minimize the risk for the company. By working

with majors, you share common interests and you work with qualified technical teams. You

don't usually count on external contractors, everything is done by internal staff, which

is a more efficient way to work.

We're open to acquiring projects in Canada. We've looked at projects abroad. If

the quantity, the price, and the contract terms are right, we might venture out of the

country. But, for now, we are focusing on what we have.

That's TomaGold.

Dr. Allen Alper: An excellent approach! You have terrific partners. You're getting

very good results! Excellent!

Mr. David Grondin: Yes.

Dr. Allen Alper: Could you tell me a bit about yourself and your team?

Mr. David Grondin: I'm a former analyst and investment banker. I've been with

TomaGold since the inception of the company in 2012. I was also involved in another

company, in Quebec, where we made a discovery. I've been in the mining industry for over

ten years. That's my background, finance and now mining.

Our CFO is Martin Nicoletti, with more than twenty-two years of experience. He has

been involved with public junior mining companies since 2004. He also acts as CFO for a

number of public companies.

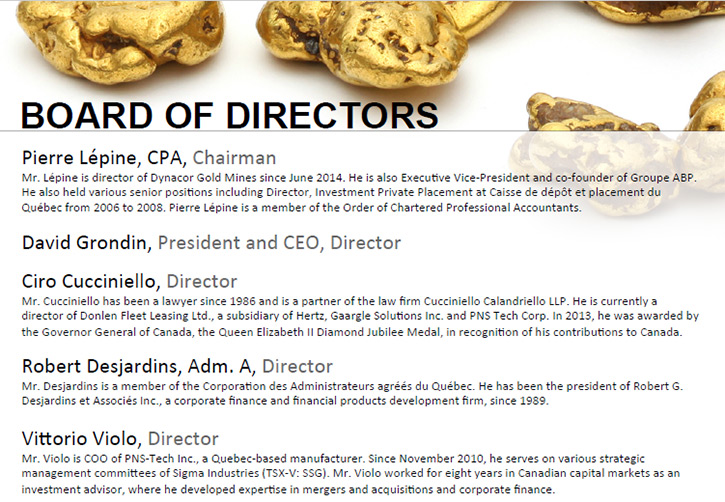

The board members are either lawyers or businessmen. Ciro Cucciniello, is a

lawyer. Pierre Lépine is a business entrepreneur, co-founded Groupe ABP and held various

senior positions at the Caisse de dépôt et placement du Québec (CDPQ) government pension

fund. Vittorio Violo is a businessman, former broker, banker, and investment banker. And

Robert Desjardins is a former director by trade, so he sits on numerous boards of public

companies. That's our board and management.

Dr. Allen Alper: That sounds like a very good team.

Mr. David Grondin: Yes, it is.

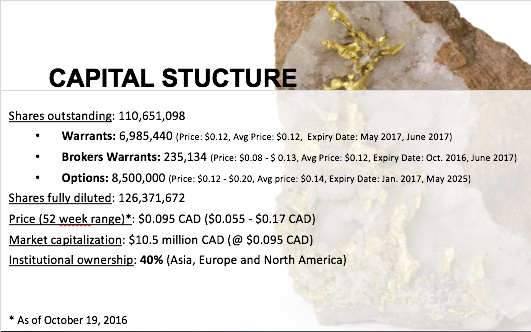

Dr. Allen Alper: Excellent! Could you tell us a bit about your capital structure?

Mr. David Grondin: Right now we have about 110 million shares outstanding,

126 fully diluted, including warrants and options. Most of the warrants will expire in May

and June of this year. Forty percent of the shareholders are institutions spread

throughout Canada, U.S., Europe, and Asia. We have a strong investment base in Asia and in

Europe. We've committed to some marketing time in Asia and Europe in the last few years,

so we have long-term investors and large shareholders over there.

Dr. Allen Alper: That sounds very good. I notice you have some recommendations from

newsletters.

Mr. David Grondin: Last year Gecko Research covered us and wrote a good

recommendation. RB Milestone in New York gave us some good coverage, and also from time to

time, AlphaStock based in Vancouver.

Dr. Allen Alper: Sounds good! What are the primary reasons our high-net-worth

readers/investors should consider investing in your company?

Mr. David Grondin: In light of our recent results, I would say that

TomaGold’s future is pretty bright. We are highly optimistic on Monster Lake. IAMGOLD has

released half of the drilling results for the current program; the other half should

follow soon and they’re very committed to the project. We're also looking to do work on

Sidace Lake and on our own projects. We have a consistent news flow on our projects with

good, above average grades, mostly from Monster Lake.

We are well diversified. It's not just the one play, one company project. The risk

is spread over multiple projects, multiple joint ventures, and partners. Nothing relies

only on one head. The risk and benefits have been spread to different areas: IAMGOLD in

Quebec, Goldcorp in Ontario with the JVs we have. We don't have to spend millions to

sustain our position in the JVs. The costs of the claims are already covered. We have a

strong international position. Long-term players are involved in the capital, in the

stock, and in the equity of the company.

All significant plus factors to invest in the company: good exposure with institutions, a

good portfolio, well diversified, and joint ventures with majors.

Dr. Allen Alper: Sounds like excellent reasons! You're getting such great results.

You have great plans. Sounds like excellent reasons for our high net-worth

readers/investors to consider investing in TomaGold.

Mr. David Grondin: Well, thank you. I think we have something really good

going on here. The future looks really bright. We're looking forward to seeing the next

update with IAMGOLD because, well the first one was really good and spectacular. They did

an amazing job confirming what we found, identifying new zones, and possibly expanding

Monster Lake’s gold potential.

Dr. Allen Alper: Sounds excellent. Is there anything else you would like to add,

David?

Mr. David Grondin: Thank you very much for the opportunity to speak with you,

Allen.

Dr. Allen Alper: I enjoyed talking with you.

http://www.tomagoldcorp.com/en/

David Grondin

President and Chief Executive Officer

514 583-3490

|

|