Alt Resources Limited (ASX: ARS}, Interview with James Anderson, CEO: Australian Gold and Based Mineral Exploration Company

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/27/2017

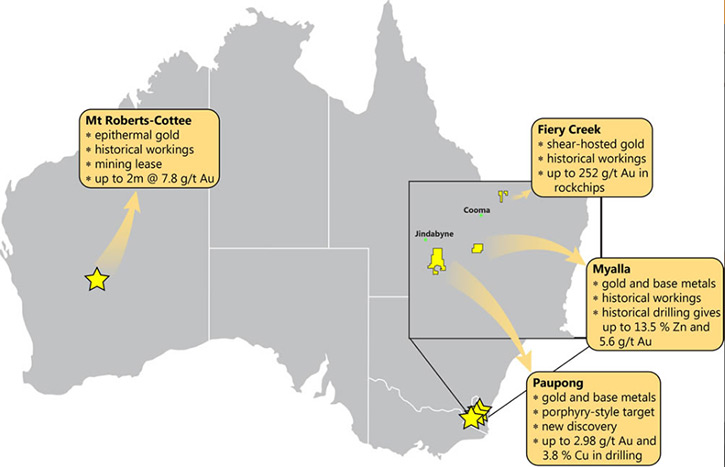

Alt Resources Limited (ASX: ARS) is an Australian based mineral exploration company.

The company’s portfolio of assets includes the Paupong IRG Au-Cu-Ag mineral system, Myalla

polymetallic Au-Cu-Zn project and the Mt Roberts Cottee Au project west of Leinster in WA

and the Fiery Creek Au-Cu project in the Lachlan Orogen NSW. We learned from James

Anderson, who is CEO of Alt Resources, that they are a small exploration entity with their

own drilling rig equipment, their own IP survey equipment, and a group of dedicate

geoscientists who work for the company, they are reasonably vertical with their

exploration operations and progressing their projects nicely.

Alt Resources Limited

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing James Anderson, who is CEO of Alt Resources Limited. Could you give our

readers/investors an overview of Alt Resources?

James Anderson: Allen, Alt is a small productive exploration company based in New

South Wales with gold and copper projects in the Lachlan Orogen which the US and Canadians

would know as the Lachlan Fold Belt and the Agnew-Wiluna greenstone belt in the eastern

goldfields of Western Australia, and recently we picked up a project area in the

Norseman-Wiluna greenstone belt of Western Australia also in the eastern goldfields. We

own our own drilling rig equipment, and our IP survey equipment so we are reasonably

vertical in our operations for a small company, we have a dedicated group of geoscientists

who work for the company and we're progressing our projects improving our investors

portfolio of assets.

Dr. Allen Alper: That's great. I think you have three interesting projects, what

are your plans for them, and what makes them of interest?

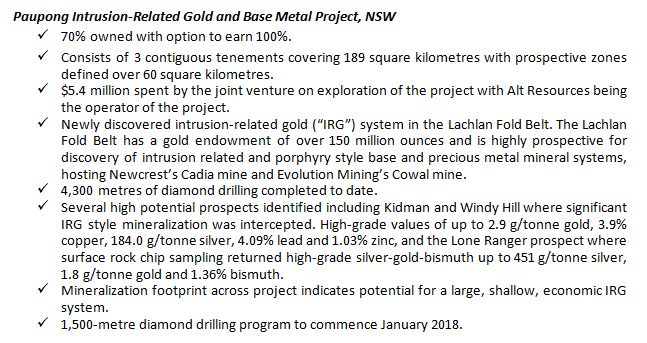

James Anderson: Our flagship project is the Paupong Intrusion Related Gold system,

which is a newly discovered mineral system in the Lachlan Fold Belt, new mineral system

discoveries are rare globally and probably something that hasn't been done for a number of

years in New South Wales exploration. The state is considered as a mature exploration

province in terms of new mineral systems so Paupong is an anomaly. We discovered Paupong

about five or six years ago, and we've been slowly progressing the science at the project.

It's a complex poly-metallic mineral system and at this stage we have not identified the

dominant mineral in this IRG system.

James Anderson: The Paupong IRG system is a district scale project we've been

advancing for the last six years and It's a very large system currently extending over an

area of 60 square kilometers. This year we have extended our deep diamond drilling around

4500 meters to date. The highest grades we have so far are coming from copper, gold,

silver, and lead and zinc. It’s a poly-metallic system, with up to 3.9 percent copper,

2.9g/t gold, over 180g/t silver 4 percent lead and 1 percent zinc from drill core assayed.

Deeper drilling has intercepted IRG style alteration zones. This year we've been drilling

IP and mag anomalies that were generated over the last two years with field survey work.

Paupong has all the elements that bigger mining companies are looking for. It has

a large scale footprint, it has big crustal scale structural corridors, it’s has had lots

of heat and fluid introduced over millions of years, and the mineralogy is from an igneous

source and the right kind of rocks in the Lachlan Orogen. But Allen like all projects of

this scale it requires quite a bit of money being spent on it now to find the economic

mineralized zones. We have done the hard yards and proven the system model and now we are

vectoring into to the source of the mineralization. I don’t think it will be long before

we have an economic discovery hole.

Dr. Allen Alper: What are your plans for this year, and next year I think you have

more drilling plans?

James Anderson: Well at Paupong, We have six or seven prospects that we're

developing. This year we focused drilling on an area called Windy Hill, and put some very

deep holes in there. We encountered significant alteration zones, very pervasive

arsenopyrite content in very altered turbidites across extensive meters. We also hit some

significant shear zones that contained high-grade mineralization. The mineralization

wasn't economic quantity but certainly indicating the nature of the system. We found some

very high-grade bismuth, one percent zinc, four percent lead, three perfect copper, three

grams gold, so we're quite intent on drilling further, deeper holes here. We have three

targets, we're going to drill, generated by the MAG survey, and various IP and soil

surveys that we've completed this year. It's winter here now and we have drill programs

running at our other projects in WA. We have rainfall in the Paupong area over winter and

it's a little hard to move the drill rigs around the site. So we won't start drilling

again until probably December or January. Then we are going to put more holes into the

various targets we've generated and see if we can intercept the zones where mineralization

is more intense. We're constantly working on the site, in winter; we do soil grids, IP

survey work and field mapping. It is a very big area, and we do have seven prospects that

we're working on constantly.

Dr. Allen Alper: That sounds great. How about the other project?

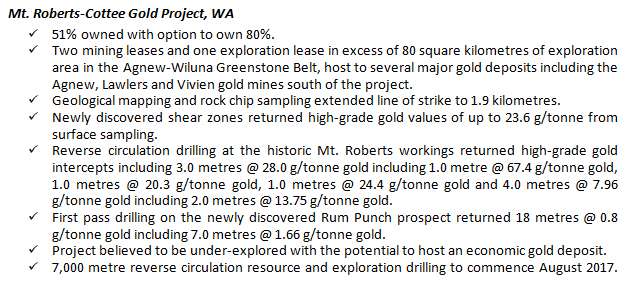

James Anderson: Allen our other flagship projects is the Mount Roberts project in

West Australia. It's a straight up gold project in the Agnew-Wiluna greenstone belt. It

sits about five kilometers from Leinster, very close to GoldFields, Agnew-Lawlers gold

mine, and about five kilometers from the Ramelius Resource's Vivien's gold mine. Mount

Roberts is a project that we picked up from some prospectors who had mined some ore grade

quartz vein material but done very little exploration work there. We have been very active

at Mt Roberts and we think it also represents a district scale project now.

Initially we see Mt Roberts as being a small an open pit toll-treating project. It's going

to have a good stripping ratio. At mining stage we would be into the ore body virtually

from the start of stripping. At the moment it’s a small project, but we have a strike zone

currently, about 300 meters. We've intercepted up to 67 grams of gold per ton in this

particular project with some intercepts of four, five meters at eight or nine grams. It's

had quite a lot of structural faulting through it. This particular shear zone's been

offset by some faults that are running through the middle of the tenements. We have just

recently done some high-res MAG survey work on it, and we have some excellent clear images

of the structural controls there.

We field mapped the tenements in March and in doing that mapping we extended the

strike length to probably about one point nine kilometers. And whilst we were doing the

work, we picked up a lot of surface rock sampling. Discovering four new shear zones that

had reasonably high-grade gold results from the grab samples. Some rock samples grading at

19, 23 grams a ton in quartz veins hosted in the shear zones. In October 2016 we drilled a

gold soil anomaly that was rating at 180 parts per billion in its highest rating, which

was significant in terms of soil chemistry. Drilling the soil anomaly we intercepted a

shear zone with quartz veining at 40 meters down hole and intercepted 7.5 meters at 1.7

gram a ton and the interesting thing that we found in that particular hole was that the

mineralization had penetrated into the wall rock, into the footwall, predominately. Its

very early stage at Mt Roberts and we're going back there in late August running a 7,000

meter drill program consisting of 7,000 meters of resource of RC drilling. So we hope to

have a JORC compliant resource at the end of that drilling program.

As part of that project we've picked up surrounding ground, a tenement from

Montezuma Mining extending the project area to cover 80 square kilometers. The Mount

Roberts project consists of two mining leases, so it will be quite quick to develop that

project in terms of its mining. We haven't done any significant work on the adjacent

ground yet. We have just undertaken geophysics over the area with a high resolution AIRMAG

survey and we're interpreting this working out the structural controls on the ground

associated around our two mining leases. We'll extend this project out as we progress over

the next 6 months.

There's been a lot of work done there in the past by Xstrata and Jubilee Mines,

who were looking for nickel, so typically a lot of these companies, when they're exploring

for one mineral, ignore others, and that was a classic example of that. This area was

historically a nickel area. BHP, Nickel West runs a large nickel operation out of

Leinster. They ignored the gold prospectivity. The area is unexplored for gold. We think

Mt Roberts has potential as a district scale gold project in the longer term.

Dr. Allen Alper: That sounds great.

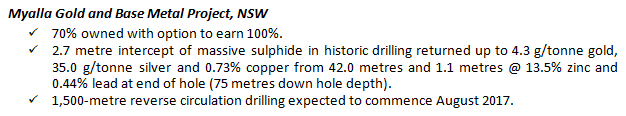

James Anderson: Now, we have another small project, which we're actually going to

start drilling in the end of July. It's the Myalla prospect. It's only a small project

area, about 20 square kilometers, but we came across this sort of accidentally. We had a

diamond driller, who was working for us at the Paupong project, and he was actually a

geotech driller more so than a mineral driller, and he was the first drill contractor we

used on the Paupong project. He told us about a project he worked on in the eighties when

he was a junior driller, and he was only reiterating the story because he never got paid.

He did a drill program for a prospector and subsequently he kept some of the core from the

job, because the guy didn't fix him up. He brought the core to show us one day and because

he's not a mineral driller did not recognize what he was holding. It was a meter length of

solid, massive sulfide.

James Anderson: We sent the core to ALS and had it essayed. It came back with; I

think it was nearly five grams gold, an ounce of silver, and nearly one percent copper. So

we said, "Okay, let's go and find out where this is." So we grabbed the driller, because

he couldn't actually remember where he drilled this in the eighties.

It wasn't far from our project area, so we drive around on the back roads and eventually

found the property and the farmer who owned the property. That's how we came across this

particular project. In our research, we uncovered the historical work that had been done

by the prospector in the government and the regulator archives. They were looking for gold

and had junior geologists that were fairly inexperienced on the drilling rig. They were

drilling vertical holes, which was probably not the smartest thing to do at the time. We

came across the logs and did a research project on it and subsequently a lot of field work

doing EM and IP surveys. We discovered that they had intercepted nearly three meters of

massive sulfide grading at the grade that we tested.

We picked up a tenement, and in the global research of the project we discovered

another hole they drilled 75 meters down hole they had intercepted another massive

sulfide. But it was zinc. And it was 13.5 percent zinc with low-grade gold and silver. We

picked up this project on the basis of these two intercepts of sulfides, and particularly

the zinc massive sulfide, which was at the end of hole, was nearly one and a half meters

of 13.5 percent zinc.

We thought it was unusual to have two massive sulfides with very different

mineralogy that were so close together. The intercepts were 300 meters apart; the prospect

is sitting in an exposed area of sediments, within a tertiary basalt cover. Zinc, silver

is quite common in the Ordovician rocks in Lachlan Fold Belt. But to have zinc, silver,

and gold in a massive sulfide and then gold, copper, and silver, within 300 meters is

quite unusual. We are looking forward to drilling this project.

Dr. Allen Alper: Very good! Could you tell us a little bit about your background,

the team, and the board?

James Anderson Allen this is the list of key people who are working for the Company as

employees and also as consultants.

Mr. James Anderson, Founder and Chief Executive Officer, was responsible for

taking the Company to listing on the ASX in 2015. He is the discoverer of the Paupong IRG

mineral system. Mr. Anderson is a business entrepreneur owning and running complex global

manufacturing and supply chain business systems in the apparel and accessory business.

Formerly, he was the Chief Executive Officer of SMP Limited USA, Chief Executive Officer

and Managing Director Aloha Surf and Chief Executive Officer of Sunseeker International.

He has been responsible for all Corporate and operational programs of the Company. Mr.

Anderson earned a Bachelor of Arts majoring in Political Science from the University of

Sydney.

Mr. William Ellis, Chairman, is the Co-Founder of Alt Resources. He has

practiced as a public accountant for more than 40 years having been a member of both the

Institute of Chartered Accountants and the Institute of Public Accountants. Mr. Ellis

holds a Bachelor of Commerce from the University of Melbourne.

Ms. Neva Collings, Non-Executive Director, is a sole practitioner solicitor

with a Masters in Environmental Law. Ms. Collings is a Co-Founder of Alt Resources and

currently acts as a Consultant in the management of environmental and regulatory approval

applications. She has worked for the United Nations Office of the High Commissioner for

Human Rights in Geneva and participated in meetings of the United Nations Convention on

Biological Diversity. Ms. Collings is the principal solicitor for Orange Door Legal and a

former solicitor of the NSW Environmental Defenders Office. Ms. Collings is a member of

the Australian Institute of Company Directors Committee, a former Board member of the

Australian Institute of Aboriginal and Torres Strait Islander Studies and a former

Director of the Forest Stewardship Council Australia. Presently she sits on the Board of

the NSW Aboriginal Housing Office and is a sitting member of the NSW Housing Appeals

Committee.

Mr. Clive Buckland, Executive Director and Company Secretary, previously

worked at IBM Australia for over 32 years, where he held roles in management and senior

professional positions including Finance and Administration, Consulting and Professional

Services. Mr. Buckland is a certificated member of the Governance Institute of Australia.

He is also a certified project management professional and has a diverse range of

commercial experience across the information technology, banking and telecommunications

sectors, with international exposure. Mr Buckland graduated from the University of Sydney

in 1979 with a Bachelor of Economics.

Mr. Tim Symons, FIPA, Chief Financial Officer, has worked in a variety of

financial and accounting roles from 1979 to 2001 for various firms including Myer

Department Stores, BHP Stainless and BHP Limited at Port Kembla. He has also worked at

other organizations including the Universities of New South Wales and Wollongong, managing

the accounting department of Wollongong University’s research company, Unisearch Limited.

At BHP Stainless, Mr. Symons was the Management and Financial accountant for a division of

400 employees and turnover of $125 million. He has been a member of the Institute of

Public Accountants since 2009. He is currently a Fellow of the Institute of Public

Accountants, and is also a Registered Tax Agent. Mr. Symons graduated from the University

of New England, Armidale NSW in 1980 with a Bachelor of Financial Administration.

Dr. Helen Degeling, Exploration Manager, is an experienced Geologist with

over 10 years of gold and base metals exploration experience in the Pilbara, Yilgarn and

Gawler cratons and the Mt. Isa Inlier and the Lachlan Fold Belt. Dr. Degeling has worked

in management and senior roles at CST’s Lady Annie project, MM Mining in Mt. Isa, SRK as a

Consultant Geologist and at the Indee Gold project in the Pilbara as Mine Geologist for

Range River Gold. Dr. Degeling earned a Bachelor of Science (Geology), First Class

Honours, from the University of Sydney and a Ph.D. in geochemistry from the Australian

National University. She is a Member of the Australian Institute of Mining and Metallurgy

(AusIMM).

Mr. David McInnes, Consultant Geophysicist, is an exploration geophysicist

with over 30 years experience working with CRA/Rio Tinto, WMC and Pasminco. He specializes

in target generation, geological/geophysical modeling and data interpretation both at

regional and prospect scale. Mr. McInnes earned a Bachelor of Science (Geology and

Geophysics) from the University of Sydney.

Mr. Thomas Klein, Consultant Geophysicist, previously worked as a

geophysicist and crew leader at Fender Geophysics running IP, EM and ground magnetics

crews, including large offset 3D surveys throughout NSW and QLD. He is a current Member of

the Australian Institute of Geoscientists. Mr. Klein completed a Bachelor of Science

majoring in Geology and Geophysics from Macquarie University.

Dr. Russell Fountain, Senior Exploration Consultant, is a Sydney-based

geologist with over 40 years of international experience in all aspects of mineral

exploration, project feasibility studies and mine development. He has held a number of

Directorships in ASX-listed exploration companies, including Geopacific Resources Ltd.

Previous senior management positions include President, Phelps Dodge Exploration

Corporation (US based); Vice President Australasia, Phelps Dodge Exploration Corporation;

Exploration Manager, Nord Pacific Ltd.; and, Chief Geologist, CSR Minerals. Dr. Fountain

has had global responsibility for corporate exploration programs with portfolios targeting

copper, gold, molybdenum, nickel and mineral sands.

James Anderson: In terms of our board. Our Chairman has a bachelor of commerce and

economics, and is from a taxation and money background. Our Executive Director is also our

company secretary, who comes from IBM. He's quite conservative which is a good thing. He

is a project manager, bachelor of commerce as well, but fundamentally, a systems-type

management person.

Neva Collings, who's a master of laws, environmental law. And she's a key person

in all our operational and permitting process along with environmental and heritage

protocols.

Dr. Helen Degeling is a senior geologist. She's a doctor of geology and

geochemistry, so she's our key industry person in terms of exploration and operations.

I'm the CEO of the company. My background is logistics and operations management,

so I really run all of the company programs and the projects concurrently in terms of the

logistics and mitigation and implementation of the programs, our senior geo designs the

programs.

We have in house geologists, in-house geophysicists, because we do run geophysics

programs and do all our own interpretations in house. We do bring in some consultants.

David McGinnis is a consultant geophysicist. He's a senior geophysicist for Geoscience

Australia. He comes in and has oversight over really all our geophysics programs that

we're going to implement, what the interpretations are leading us towards. He's involved

with Helen in designing our drill programs and our exploration programs.

We have Dr. Russell Fountain, a senior geologist, CSR, large company geologist,

who comes in as a consultant. He works on the Paupong and the Myalla projects in target

generation and interpretation.

And then we have a general company structure staffing, field hands, you know, we

have a fairly tight, small operation. We don't waste any money in our corporate staff.

Most of our money is invested in the ground. We probably invest 70 percent of our funds

available in exploration and drilling. Our corporate overheads, we keep very low.

Corporate structure cost-wise runs about 350,000 per annum, including the director’s fees.

We are pretty tight that way. I don't like wasting money.

Allen Alper: Very good!

James Anderson: We are quite vertical. We don't use contractors for our IP data

collection. Air mag and heli mag we use contractors, but on ground, magnetics, IP, dipole,

gradient arrays, we do all that ourselves. We have a small RC rig that we put in play

about two years ago, which does a lot of our initial first pass drilling, so we manage our

drill programs fairly cost effectively.

For diamond drilling we use DDH1 Drilling contractors who are the best in

Australia and they are key stakeholders in the Company, Diamond drilling is fairly

specialized thing and it's the most expensive drilling operation. DDH! Have a reasonably

large position in our company in terms of shareholding. We have some good industry backing

in terms of people on our share register. We're a tight little company.

We're very undervalued at the moment, but I think there are a lot of junior

exploration companies undervalued at the moment in Australia. The exploration space is

quite difficult, it's can be difficult raising funds. So this year we're raising funds

through a Canadian-based investment bank called IBK Capital. Actually, they're in the

midst of it now. So they're out presenting a company into the North American market. I

think the North American market is a bit more switched on to the potential in junior

explorations space in Australia. Australia has no sovereign risk as an investment

destination and a tier one country to operate in.

Dr. Allen Alper: Sounds like a good approach. What are the primary reasons our

high-net-worth readers/investors should consider investing in Alt Resources Limited?

James Anderson: Well currently we're sitting on a market cap of around five and

half million. We have a very tight share register. We don't have a lot of shares on issue.

We have some very good projects that are going to be drilled for the next 12 months,

fairly constantly. We're going to have a lot of good news flow. I think our assets are

worth significantly more then what our market capitalization is. We have two district

scale projects the Paupong project and Mt Roberts. Paupong is a large, new mineral system.

The project is being watched closely by a number of larger companies. There are not many

new system discoveries made globally and these big companies have not been exploring that

much, so the pipeline of projects developing is pretty slim for them. Many big companies

are getting hammered in countries where government stability and legislation can change on

a whim. Billions in investment is at risk in these high sovereign risk environments and

they are looking for other options.

All our operations are in very safe jurisdictions in terms of destination for

capital investment, we have regulator approval for all our drill programs. So you know, I

think it's a very sound little investment at the moment. It's very undervalued. At Paupong

alone we have invested in excess of 5 million in exploration.

Dr. Allen Alper: Sounds like very strong reasons why our readers/investors should

consider investing in Alt Resources Limited.

James Anderson: Well we're going to have a lot of news flow. We have a drill

program commencing on a massive sulfide deposit in August, which will have immediate news

flow. The 7000-meter RC program commencing in late August at Mt Roberts. We're drilling

known targets, we're not speculating. We're going to develop our resource at Mt Roberts

and have some significant new discovery there.

Paupong, we don't know what the outcome's going to be with the new deep drilling

but we will be drilling 500 meter plus holes looking for the source rock. If we drill into

a mineralized zone at Paupong, it'll be hundreds of meters, Allen. It won't be like two or

three or four meters. It will be an event, possibly a Cadia-like discovery; it will be a

large Intrusion Related Gold system discovery.

Drilling a discovery hole at Paupong will be a Company making event. That is the

nature of these IRG systems and why this project is being watched so closely by the bigger

companies and by the geological survey. It is a fairly significant project.

http://www.altresources.com.au/

Business address:

11-13 Baggs Street JINDABYNE NSW 2627

Postal address:

PO Box 1054 JINDABYNE NSW 2627

1300 66 0001

info@altresources.com.au

|

|