Paramount Gold Nevada Corp.’s (NYSE MKT: PZG) Glen Van Treek, President, CEO and Director, Talks about Grassy Mountain High Grade Gold Project Advancing to Production

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/25/2017

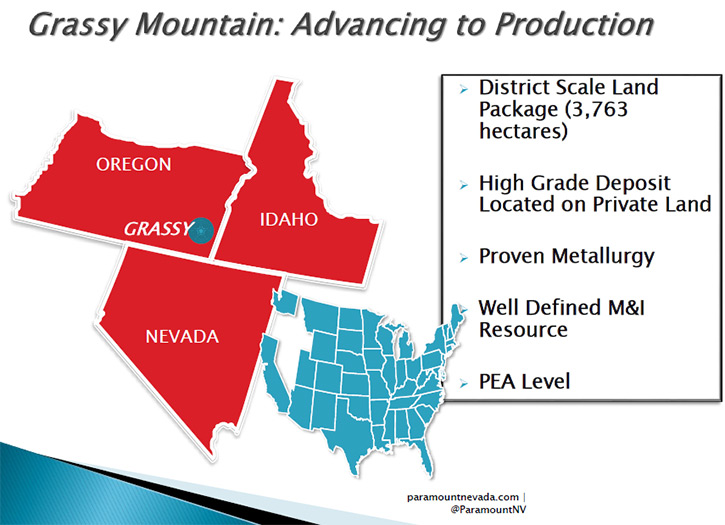

Paramount Gold Nevada Corp. (NYSE MKT: PZG) holds a 100% interest in the Grassy

Mountain Gold Project in Malheur County, Oregon, as well as a 100% interest in the Sleeper

Gold Project located in Northern Nevada. The Grassy Mountain project contains a gold-

silver deposit (100% located on private land) for which a PEA has been prepared and key

permitting milestones accomplished. Paramount’s strategy is to create shareholder value

through exploring and developing its mineral properties and to realize this value for its

shareholders in three ways: by selling its assets to established producers; entering into

joint ventures with producers for construction and operation; or constructing and

operating mines for its own account. We learned from Glen Van Treek, President, CEO and

director of Paramount Gold Nevada, that currently they are conducting a pre-feasibility

study on the Grassy Mountain project. The goal is to have the mine permitted sometime in

2018 or early '19, and to start building the mine. Once they begin receiving the cash flow

from the Grassy Mountain mine, they plan to advance the Sleeper project which is the

bigger asset in term of total ounces.

Grassy Mountain project Nov 2016

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing Glen Van Treek, President, CEO and Director of Paramount Gold Nevada, Corp.

Could you tell our readers/investor a bit about your strategy, Paramount Gold Nevada

Corp.’s strategy?

Glen Van Treek: Certainly. Thanks, Allen, for having me here. Paramount is a US

based exploration company and trades on the newly named New York Stock Exchange American

under the symbol PZG. We have two projects: Grassy Mountain in Oregon, and Sleeper in

Nevada. We're currently executing on our strategy in advancing the Grassy Mountain project

towards production. At present, we are conducting a pre-feasibility study on the project.

Our goal is to submit all of the permitting documents this year to the federal government,

and next year to the state, and have the mine permitted sometime in 2018 or early 2019, at

which point we plan to start building the mine. We believe building Grassy will create the

most value for our shareholders. The cash flow from Grassy Mountain will give us a great

platform to advance the Sleeper Gold project, located in Nevada, which is our larger asset

in terms of total ounces.

Dr. Allen Alper: Could you tell us a bit more about your resources, and the Grassy

Mountain project?

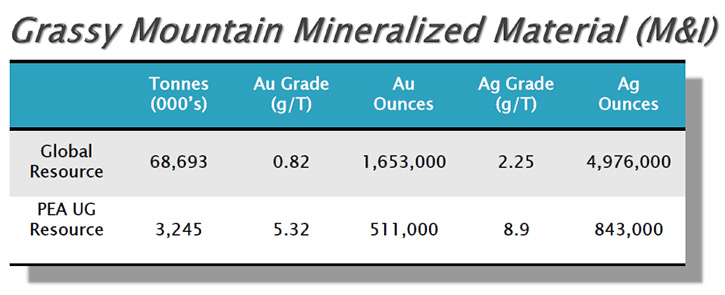

Glen Van Treek: Yes! In terms of measured plus indicated resources at Grassy

Mountain, we have 1.65 million ounces of gold, which includes a high grade core of

approximately 500,000 ounces at 5.32 grams per ton gold. That's a very nice grade.

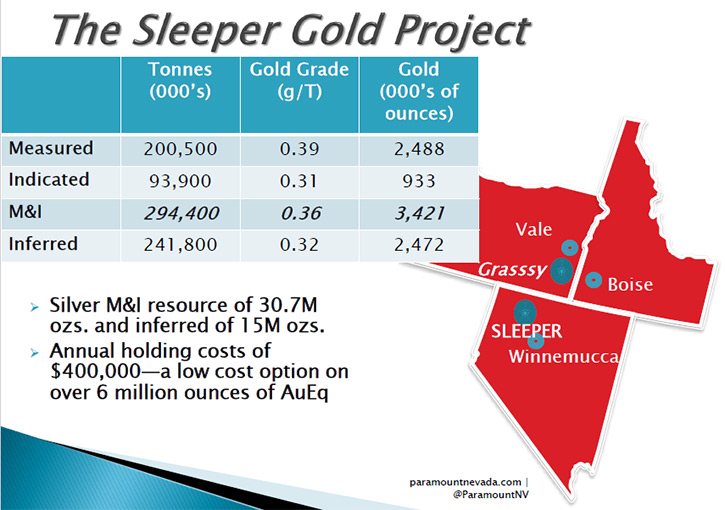

Sleeper is a larger deposit with favorable economics. We're evaluating an open pit

scenario. We have about 3.4 million ounces of measured and indicated ounces of gold plus

about 2.5 million ounces of gold in the inferred category. The total for the company,

including inferred material, is about 7.5 million ounces of gold plus about 45 million

ounces of silver. That's our resource today.

Dr. Allen Alper: That's excellent. Very large resources, and you have one that's

very high grade, and another one that's very large, and you're investigating open pit.

That sounds very good. Could you tell me a little bit more about what your plans are for

2017?

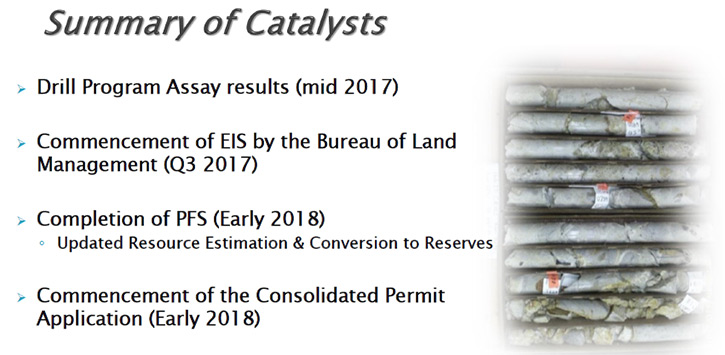

Glen Van Treek: Yes, we are and have been focused on the Grassy Mountain project.

It's a very interesting project, very high grade. We're in the pre-feasibility stage to

develop the underground portion and started that pre-feasibility last year. We've

completed the PFS drill program, which was designed to acquire material for additional

metallurgical testing, geotechnical, and resource infill. We've been releasing results as

we receive them from the lab and expect to receive the remaining assays in the very near

future.

In the remaining part of the year, we will commence a metallurgical analysis. We

plan to file the plan of operation with the federal government by mid-August. That

submission will trigger the commencement of the environmental impact statement by the

Bureau of Land Management. With that and after we complete the PFS in early 2018, we plan

to file the application permit with the state department, the Oregon Department of Geology

and Mineral Industries.

Dr. Allen Alper: That sounds excellent. Could you tell us a bit about your

background, your team and your Board?

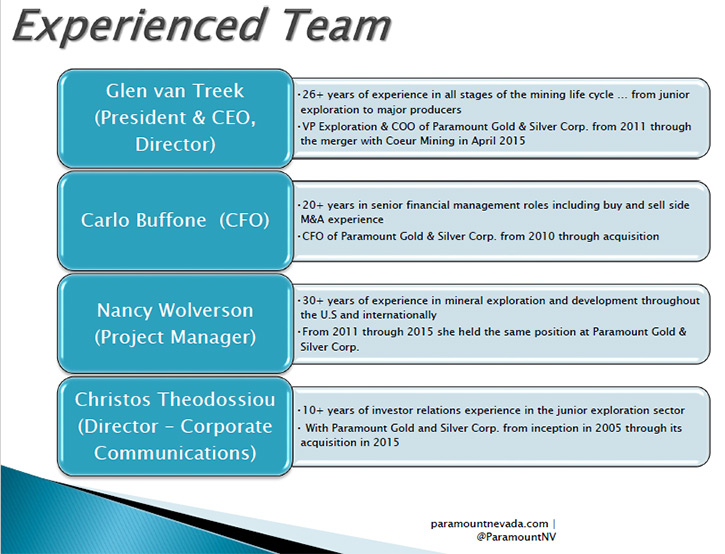

Glen Van Treek: I'm a geologist by education. I have about 30 years’ experience in

mining exploration and operations. I've worked in many countries for both majors and

juniors. Prior to joining Paramount six years ago, I handled research and production at a

producing copper mine. When I joined Paramount we were focused on a project in Mexico that

we sold to Coeur Mining for about $200 million.

Our CFO, Carlo Buffone has been with the company for about seven years. He's been

instrumental in the mergers and acquisitions that we've completed over that timeframe. In

2010 we acquired X-Cal Resources and its Sleeper Gold Project. In 2015, we sold, through a

merger with Coeur Mining, the San Miguel project in Mexico. Then last year, we acquired a

company by the name of Calico Resources and its Grassy Mountain project. Carlo has been

instrumental and was the lead on these acquisitions.

We have a great group of experienced geologists in Nevada and in Oregon that have

been with us for a number of years.

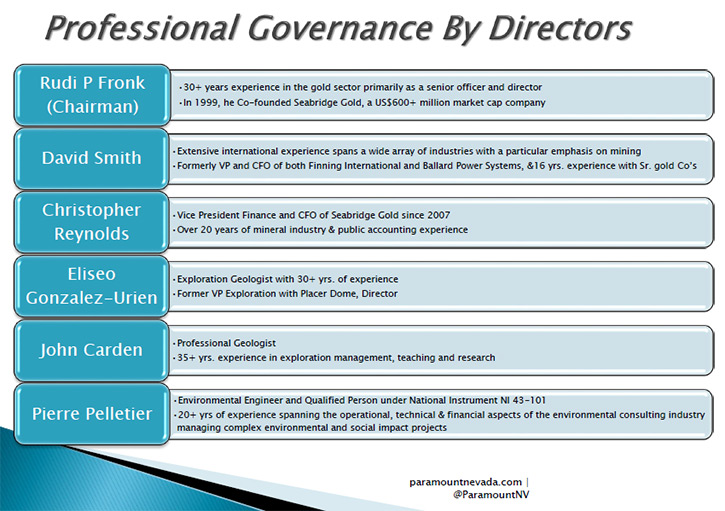

To give you a broad picture of our Board of Directors, they have a very diverse set of

skills amongst them which supports our strategy of building Grassy into a mine. The Board

is comprised of several experienced geologists and financial professionals including the

CFO of Seabridge Gold. In late 2016, we added Pierre Pelletier, an experienced

environmental engineer. His experience will benefit the team with the permitting process

that’s ongoing with our Grassy Mountain project in Oregon. In addition, in early 2017 we

added the CEO of Seabridge Gold, Rudi Fronk, a mining engineer with over 30 years of

industry experience to serve as our chairman.

Dr. Allen Alper: That's a very strong Board, a very experienced Board, and a very

accomplished Board. That sounds great. Could you tell me a bit about your capital

structure?

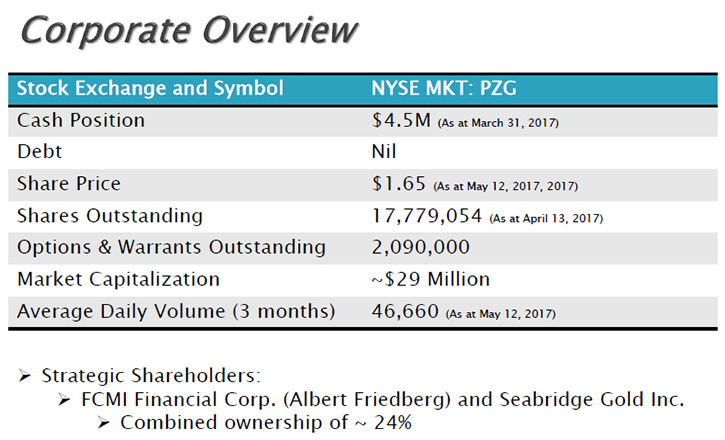

Glen Van Treek: We trade on the New York Stock Exchange American under the symbol

PZG. We have approximately 17.8 million shares outstanding and 19.8 million on a fully

diluted basis. We have no debt.

Our largest shareholders with combined holdings of approximately 25% are FCMI

Financial, a well-known industry investor and Seabridge Gold, a successful explorer with

the largest, undeveloped gold and copper resource in the world.

In February 2017, we completed a $3.6 million non-brokered private placement, with

no fees or commissions paid, with primarily existing shareholders. Both FCMI and Seabridge

participated.

Dr. Allen Alper: Well, it sounds like you have a very strong group of investors.

That sounds great, sounds like you have a lot of financial support. Could you tell me,

Glen, what are the primary reasons our readers and high-net-worth investors should

consider investing in your company?

Glen Van Treek: We have two advanced-stage projects in what we consider the safest

mining jurisdiction in the world. Both projects have been significantly de-risked with

the completion of multiple geologic and financial assessments that show both projects are

economic at present gold and silver prices.

We expect to have a permit for our high grade Grassy Mountain project in hand in late 2018

or early 2019. In the first three years of production it will cash flow approximately $50

million per year. This cash flow will allow us to proceed with a PFS at our 6 million

ounce Sleeper gold project, while drilling numerous exploration targets that we have

defined at both projects, without further dilution.

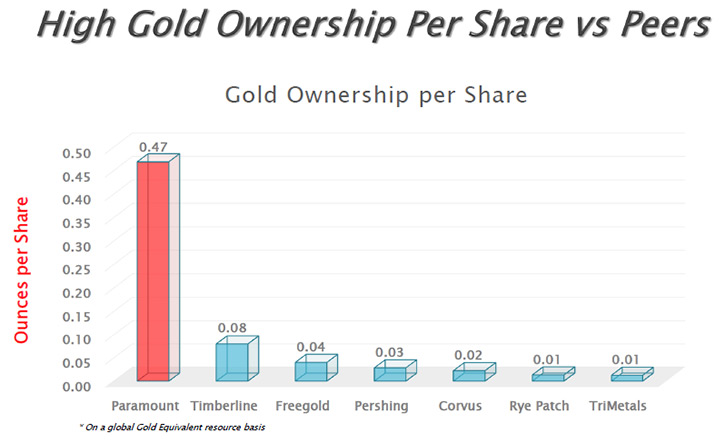

We believe we are undervalued relative to our peer group. We have over 8 million ounces

of gold between both projects, which provides great leverage to the price of gold and with

our current plan we see strong potential for our shareholders to have positive returns.

Dr. Allen Alper: That sounds excellent. Very strong reasons for our readers and

high-net-worth investors to consider investing in Paramount Gold Nevada. Is there anything

else you'd like to add, Glen?

Glen Van Treek: In addition to advancing our current projects, we are very excited

about our exploration potential at both Grassy Mountain and Sleeper. At Grassy, we have

several targets that have strong potential to find additional resources, which would add

years to the mine life. At Sleeper, given our large land package, we have identified some

high priority drill targets south of the historical mine pit that we believe can host gold

deposits that made the original Sleeper mine famous for its mining grade and

profitability.

Dr. Allen Alper: That sounds great. What would be the timing going forward to go

from pre-feasibility to feasibility, and then your plans for production? Then do you have

a feel for that or you wait, or you're still developing that?

Glen Van Treek: Firstly, we would move directly from Pre- Feasibility to

Production as many aspects of the PFS are being conducted to feasibility levels. There's

several steps that we need to accomplish along the way. One of the first steps is to file

the plan of operation with the BLM, which we expect to complete in late July or early

August. With that filing, the BLM will start the environmental impact statement, which

will take a year to 18 months. We expect to have the federal permit in place in 2019. Once

the PFS is complete in early 2018, we plan to file the permit application with the State

of Oregon and expect to have that in late 2018 or early 2019.

We expect to commence construction in 2019 with first pour expected in late 2020.

Dr. Allen Alper: That's a very short time. That's great! You have a great strategy,

a great property and great plans. You now have a favorable administration to help, so you

should be able to get all your permits and be able to move forward.

Glen Van Treek: Yes, yes. Moreover both Nevada and Oregon have well defined

permitting processes with defined timelines.

We believe it is important to note that the high grade deposit at Grassy provides us with

protection against one factor outside of our control, the gold price.

By following our strategy, I think we're going to achieve our goal.

Dr. Allen Alper: That sounds good. Do you have a feel for what your costs might be

in mining, how competitive you'll be as a producer?

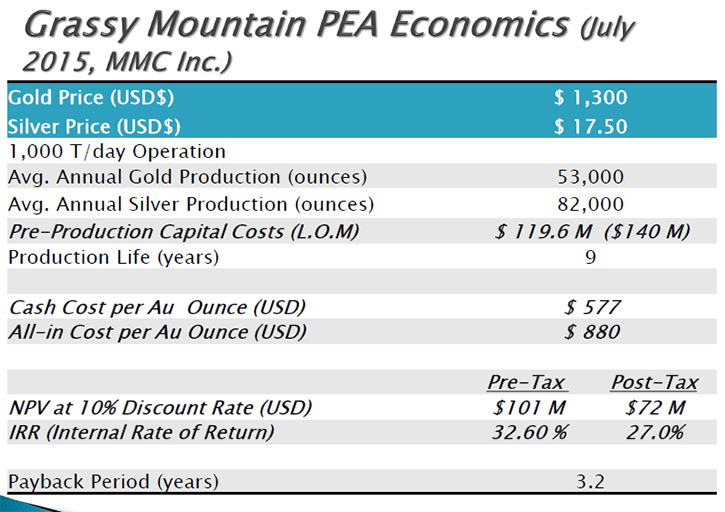

Glen Van Treek: At Grassy, we have a preliminary economic assessment completed,

that envisioned a CapEx of $120 million which we believe we could reduce by 20-30% and a

cash cost per ounce of gold produced of $577. The all-in cost is $880.

When you evaluate producing companies there costs are in the range of $900 to $1,000. That

figure is cash cost plus sustaining capital and does not include the initial capital. In

our case, our cash cost plus sustaining capital would be in the range of $600 to $700.

That's well below the average in the market right now of $900 to $1,000.

Dr. Allen Alper: That sounds excellent, that's very good. Is there anything else,

Glen?

Glen Van Treek: I just want to conclude by saying that we have a committed team

that is very focused on achieving our goal of advancing Grassy to production in the near

term. When we think about Sleeper we don’t believe there is a better advanced stage

multi-million ounce gold project that exists in Nevada.

Dr. Allen Alper: Okay, great!

http://www.paramountnevada.com/

Glen Van Treek, President, CEO and Director

Carlo Buffone, CFO

Christos Theodossiou, Director of Corporate Communications

866-481-2233

|

|