Ultra Lithium Inc. (TSX.V: ULI): Lithium Exploration Company with Diversified Projects in Argentina, Canada and USA

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/24/2017

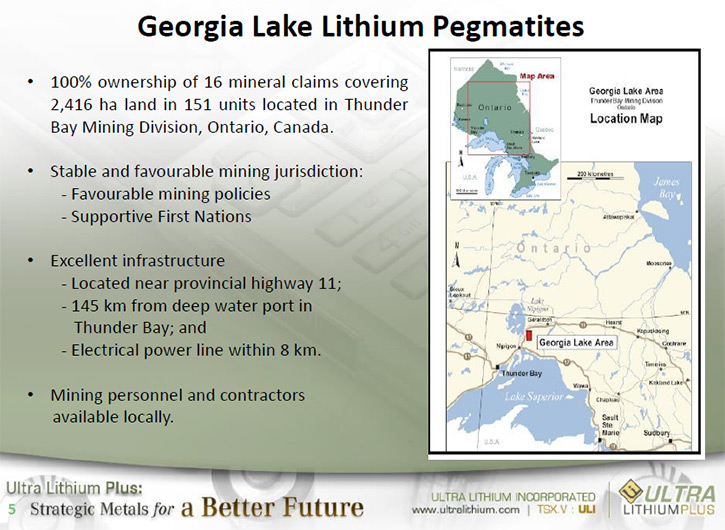

Ultra Lithium Inc. (TSX.V: ULI) is a Canadian exploration and development company that

holds an option to acquire a 100% interest in the La Borita Brine project in Argentina, and

wholly owns the Georgia Lake Lithium Pegmatites project in Ontario, Canada and the Big

Smoky Valley Project, located in Nevada, USA. We learned from Afzaal Pirzada, Vice

President of Exploration of Ultra Lithium that they are currently compiling the results of

the exploration work at Georgia Lake and later plan on drilling based on these results.

Other plans for 2017 include sampling work on the Argentina property, as well as continued

exploration at the Big Smoky Valley Project. According to Mr. Pirzada there are three main

reasons to take a closer look at Ultra Lithium Inc. Their stock is stable and tightly held,

they have a balanced portfolio of projects that includes hard rock and brine deposits, and

they have a strong and experienced management team committed to maximizing shareholder

value.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News,

interviewing Afzaal Pirzada, Vice President of Exploration, Ultra Lithium Inc. Could you

give our readers/investors an overview of your company?

Afzaal Pirzada: Thank you, Doctor Allen, for giving me time to share my experiences

and work with your readers. Ultra Lithium, is a lithium focused exploration and development

company based out of Vancouver. We have a brine lithium project in Argentina, next door to

Salar de Antofalla brine lithium deposit, which was owned and explored by Rio Tinto and is

currently owned by Albemarle, one hard rock lithium project in Canada and one brine lithium

project in Nevada, near the Silver Peak Mine, also owned by Albemarle, which is the only

lithium-producing mine in the USA.

Dr. Allen Alper: Could you tell our readers/investors more details about the

deposits?

Afzaal Pirzada: There are two main types of lithium deposits, pegmatites and

brines. Pegmatites, which contain mainly spodumene, are good for producing battery grade

lithium carbonate. Other pegmatites, such as petalite, lepidolite, and amblygonite are

suitable for ceramics and other industrial uses. These pegmatites are found in Australia,

Canada, the USA, and some other countries. There are two types of brines. One type is

sedimentary brines, as are found in Nevada, and other neighboring states in the USA. The

first sedimentary lithium brine discovery was made at the Silver Peak Mine in Clayton

Valley, Nevada which is currently owned and operated by Albemarle. The second type of

lithium brines are salt brines found in the salars located in the Lithium Triangle of

Argentina, Bolivia, and Chile. These salars are high altitude salt flats, where lithium has

been concentrated in lake beds in the form of salt brines. Over 50 percent of the world's

resource of lithium is within this triangle. We have been working really hard to obtain

projects with all types of lithium deposits.

Dr. Allen Alper: That sounds very good. Could you tell us a little bit more about

what your plans are for 2017, going forward?

Afzaal Pirzada: For 2017, we have done decently. We completed 2017 spring/summer

exploration program at our Georgia Lake project, which included drilling short holes,

trenches and channel sampling. The results of short drill holes recently announced indicate

1.42% lithium oxide over 5 meters. The results look very promising to me. We will be

carrying out further drilling in the winter of 2017 to check continuity of pegmatites from

surface.

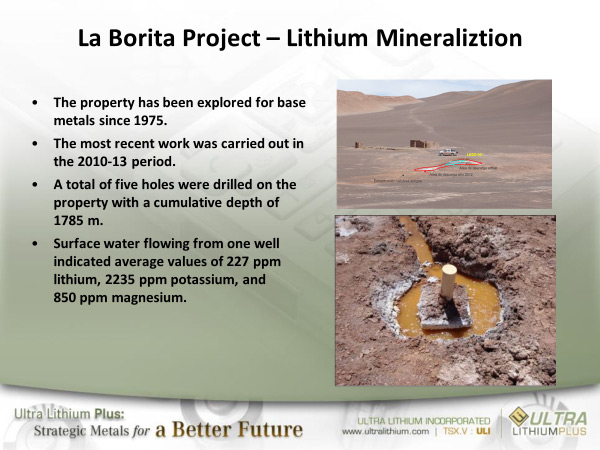

On our La Borita lithium brine project in Argentina, some exploration was done by a

Canadian mining company from 2010 to 2013 when they drilled five holes on the property in

search of base metals like copper, lead, zinc, silver, and gold. Water started coming to

the surface of one of the holes. They tested it and reported values of over 220 parts per

million, lithium, which sounds very interesting to us. We would like to investigate that

more, for the next three or four months, as the weather clears over there to first confirm

the historical data and carry out further exploration.

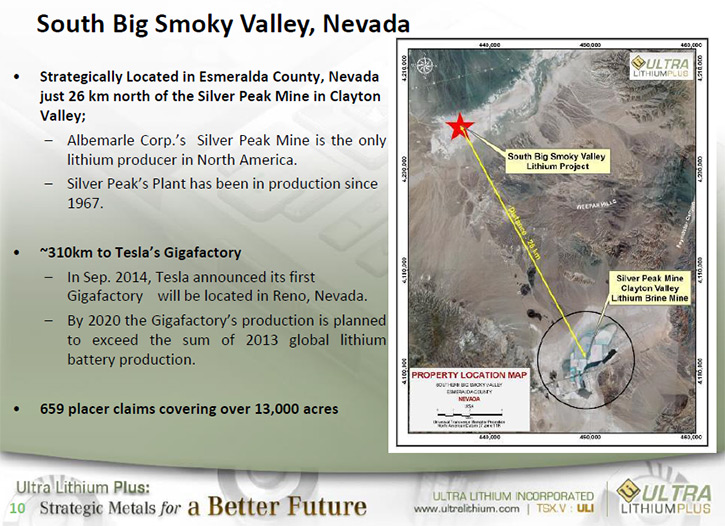

On our third project, the Big Smoky in Nevada, we did some exploration during the 2014-16

period, consisting of two drill holes, geophysical surveys, and surface sampling. Now we

have optioned 200 claims of the property to two other junior lithium companies in exchange

for cash payments and shares. They have plans to do some more surface sediment sampling and

more water sampling. They want to continue the work, where we left off on those projects.

Dr. Allen Alper: Sounds good. Could you tell our readers/investors the advantages

and disadvantages of getting lithium from the various type of deposits?

Afzaal Pirzada: Yes. I will start with hard rock lithium deposits, which are

typical pegmatites and require conventional mining. They have some advantages and some

disadvantages. Their main advantage is that you can produce as much as the size of the

deposit allows. You can ramp up your production. You can cut down your production. It is

relatively easier to control your timeframe for the project and forecast your production.

However, processing of these deposits is relatively expensive compared to brine lithium

deposits, because once you get pegmatite concentrate of 6% lithium oxide, then you have to

heat it to over 1000 degree Celsius, and it is an energy intensive process to convert alpha

spodumene to beta spodumene. That is where the expensive metallurgy takes over. If the

lithium prices stay around the level where they are now, then these deposits are economical

as is shown by Australia, the number one producers in the world for lithium. All their

deposits are hard rock lithium, conventional mining, and they are shipping most of their

lithium oxide concentrate to China.

On the other hand, the brine type lithium deposits, are cheaper, but they are dependent on

nature. Once you pump out brine, then you have to do solar and wind evaporation. Fill those

brine solutions in a series of large ponds, where you get rid of different impurities to

get the final product of lithium salt. The more impurities, the more time it takes and more

processing cost is involved. The main impurities, in brine types, are magnesium, calcium,

sulfate and iron. Potassium can be a byproduct to be used as fertilizer, but if you are not

interested in that, then potassium can also be an impurity. The second thing is your grade,

if it is not high enough and your lithium is attached with magnesium or sulfate, then the

process can be expensive, and time consuming. The third thing is the ratio of magnesium to

lithium. The lower the ratio the lower the cost to separate the magnesium from the lithium.

The fourth thing is, how much brine you can pump, because every brine bearing zone has a

limited capacity.

These are the major factors: once you pump out a brine, it will take over a year to

get final product due to solar or wind evaporation, so you are dependent on nature. It is

cheaper to operate, but you cannot ramp up production very fast. I was in a lithium

conference in 2010. At that time, the lithium industry was still in the development stage.

And it is still in the development stage in 2017. True there is no shortage of lithium

resource in the world, but can we keep up our production with the increasing demand? That

is a challenge because of our dependence on nature and the remoteness of brine type

deposits, and the limitations these brine deposits have. Without disturbing their very

unique ecological system, keeping pace with the increasing demand is a challenge.

Dr. Allen Alper: I appreciate your discussion and analysis of the lithium industry.

I know our readers/investors will appreciate your insight as well. Could you tell us a

little bit about your background?

Afzaal Pirzada: I've been an exploration geologist working in mining industry for

the last 30 plus years. I started with uranium exploration and then did some work in base

metals and PGE deposits. Since the late 2008 and early 2009, most of my time has been spent

working on industrial minerals space i.e., lithium, graphite, titanium and iron. I have

been working on lithium since 2009. First, I started with the hard rock lithium and then

moved to sedimentary brines in Nevada and then to salt brine in Argentina.

Dr. Allen Alper: It sounds very good. Could you tell us a bit about Ultra Lithium's

team and board?

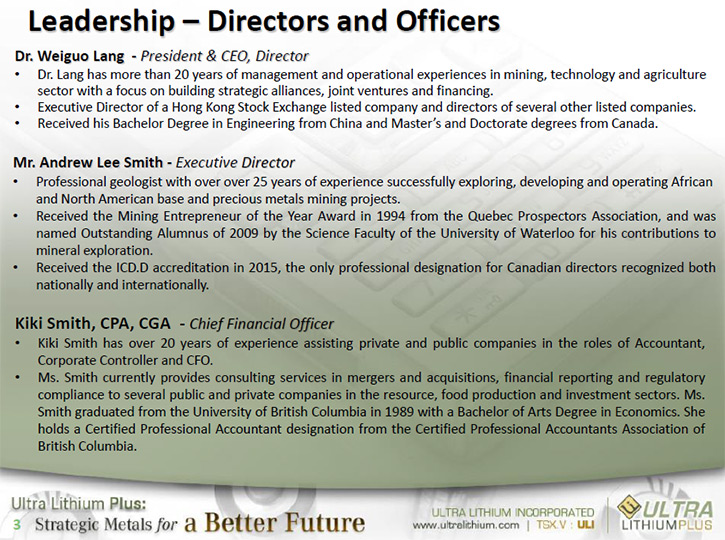

Afzaal Pirzada: Dr. Weiguo Lang has Ph.D. in engineering, now he is more into the

mining finance side and project acquisition and development. He is based out of Beijing in

China. Currently Ultra Lithium's major investment base is in Asia. Kiki Smith is our CFO.

She is experienced and knowledgeable in the resource industry, especially related to

compliance with junior mining companies in Canada. Mr. Andrew Lee Smith is a director of

the Company with over 25 years’ experience in the mining industry.

Dr. Allen Alper: That sounds very good. Could you tell us a bit about your capital

and share structure? Where you are listed?

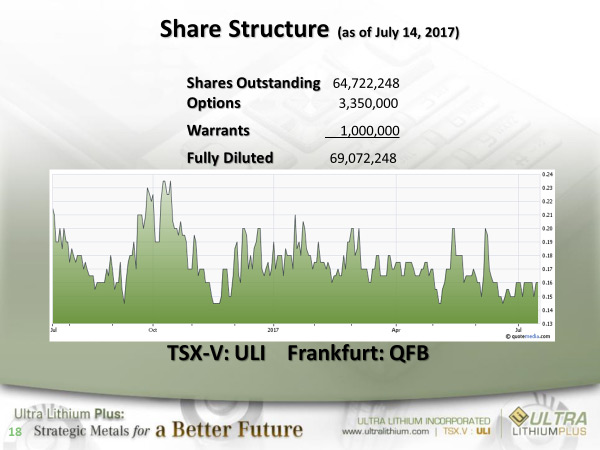

Afzaal Pirzada: We are listed on the TSX Venture Exchange. We are planning a

listing in the USA with the OTC Market Group. We have 64.7 million shares outstanding. We

are trading today around 15 cents. We think this is a good opportunity for new investors to

come in.

Dr. Allen Alper: It sounds very good. What are the primary reasons our high-net-

worth readers/investors should consider investing in Ultra Lithium?

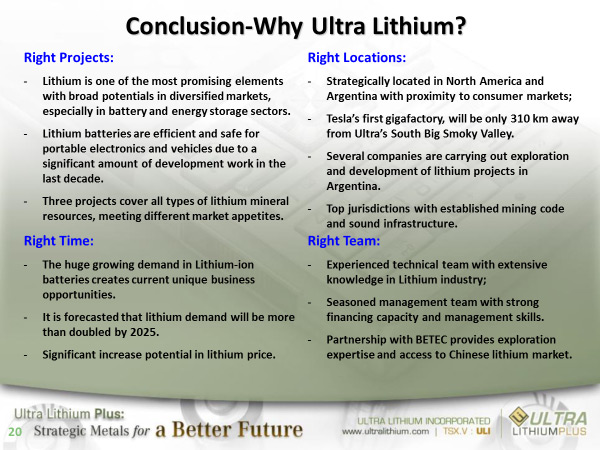

Afzaal Pirzada: In my opinion, there are three main reasons that Ultra Lithium is a

good company for investors. Number one, our stock is held very tightly by high- net-worth

shareholders. It has been very stable. I think it is a good entry point for new investors.

Secondly, we have a balanced portfolio. We have hard rock lithium deposits where we can

cater to the glass and ceramic industry, and we have the potential to cater the lithium ion

battery industry through our brine as well as hard rock lithium deposits. We are a very

well-balanced company in terms of assets. We are also pleased to have received expressions

of interest from potential Asian lithium buyers.

Thirdly, we have quite experienced management. We are a bit on conservative side. Because

of my and Dr. Weiguo Lang's science background, we take projects very seriously. We develop

our projects in a way that our shareholders benefit.

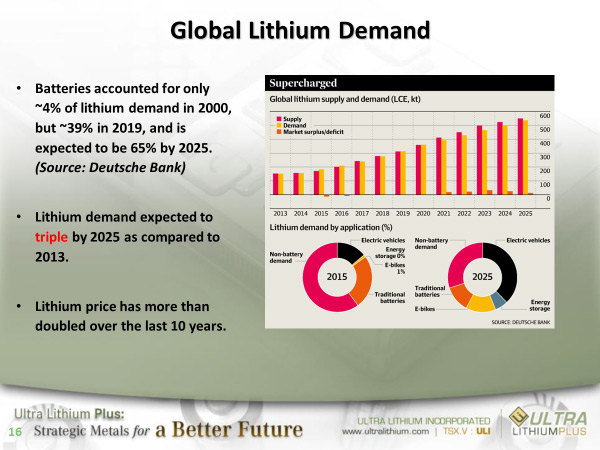

Dr. Allen Alper: It sounds very good. Could you tell us a bit about the global

lithium demand?

Afzaal Pirzada: The global lithium demand, currently in 2017, was about 200,000

tons of lithium carbonate equivalent (LCE). Demand is going up at a rapid pace of over 10%

every year. It is forecasted that in 2025 lithium carbonate demand will be about over

700,000 tons of LCE. Lithium ion batteries will take the major share of the demand in 2025.

The lithium mining industry has not matured, and there are many challenges increasing the

supply of lithium.

I think until 2025, demand will keep on increasing, and there will be periods of

mild to medium shortages of lithium.

Dr. Allen Alper: I appreciate that information and I know our readers/investors

will. Is there anything you would like to add?

Afzaal Pirzada: The investment community should look at companies that have end-

buyer connections, and they should have access to financing. They should be experienced in

project acquisition and development. All three are important.

Dr. Allen Alper: Sounds very good. I’m very impressed with your scientific approach

and your company. Thank you for sharing your insight with us.

http://www.ultralithium.com/

Kiki Smith

Telephone: 778 968-1176

Facsimile: 604 909-4682

Email:kiki@ultralithium.com

|

|