Northern Graphite Corporation (TSX-V: NGC; OTCQX: NGPHF) interview with Greg Bowes, CEO: Best Flake Size Distribution of any New Graphite Project

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/17/2017

Northern Graphite Corporation (TSX-V: NGC; OTCQX: NGPHF) owns a 100% interest in the Bissett Creek

deposit, located in eastern Ontario. Bissett Creek is an advanced stage project with a bankable Final

Feasibility Study and its major environmental permit. We learned from Greg Bowes, who's CEO of Northern

Graphite, that the next stage is raising $100 million Canadian to build a mine. According to Mr. Bowes,

their project has the highest percentage of large flakes, which are the most valuable product in the

graphite business because they have much more desirable physical qualities that manufacturers need. The

Company believes Bissett Creek has the highest margin, best flake size distribution and lowest marketing

risk of any new graphite project, and has the added advantages of low capital costs, proximity to

infrastructure, and realistic production levels relative to the size of the market.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Greg Bowes,

CEO and Director of Northern Graphite. Could you give us, our readers and investors, an overview of your

company?

Mr. Greg Bowes: Northern Graphite was the original New Graphite Company six or seven years ago. We

started the whole thing based on the potential of lithium-ion batteries and electric vehicles and all of

that good stuff. Because we've been at it for a while, this is a very advanced stage project. We have a

full feasibility study and our major environmental permit. The next stage is raising $100 million

Canadian to build a mine. That is a little bit of a challenge in the current market, because the graphite

price is still low due to declines and the slowdown in the steel industry, and it has not yet responded

to the growth in lithium-ion batteries as have lithium and cobalt, but it is getting close.

What differentiates our project from others is that it is located in the southern part of Canada,

close to infrastructure, so a very good location. Most of our peers are in the north of Canada or they

are in Africa. Our project has the best flake size distribution in the industry, meaning the highest

percentage of large flakes, which are the most valuable product in the graphite business, very low unit

operating costs, which leads to the highest margin of any new project. We also have the lowest capital

costs of any new project. We think we're very well positioned for when the graphite price starts to rise.

We only have roughly 60 million shares outstanding, so a very good capital structure.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Greg Bowes,

CEO and Director of Northern Graphite. Could you give us, our readers and investors, an overview of your

company?

Mr. Greg Bowes: Northern Graphite was the original New Graphite Company six or seven years ago. We

started the whole thing based on the potential of lithium-ion batteries and electric vehicles and all of

that good stuff. Because we've been at it for a while, this is a very advanced stage project. We have a

full feasibility study and our major environmental permit. The next stage is raising $100 million

Canadian to build a mine. That is a little bit of a challenge in the current market, because the graphite

price is still low due to declines and the slowdown in the steel industry, and it has not yet responded

to the growth in lithium-ion batteries as have lithium and cobalt, but it is getting close.

What differentiates our project from others is that it is located in the southern part of Canada,

close to infrastructure, so a very good location. Most of our peers are in the north of Canada or they

are in Africa. Our project has the best flake size distribution in the industry, meaning the highest

percentage of large flakes, which are the most valuable product in the graphite business, very low unit

operating costs, which leads to the highest margin of any new project. We also have the lowest capital

costs of any new project. We think we're very well positioned for when the graphite price starts to rise.

We only have roughly 60 million shares outstanding, so a very good capital structure.

Dr. Allen Alper: Could you tell our readers why large graphite flakes are important?

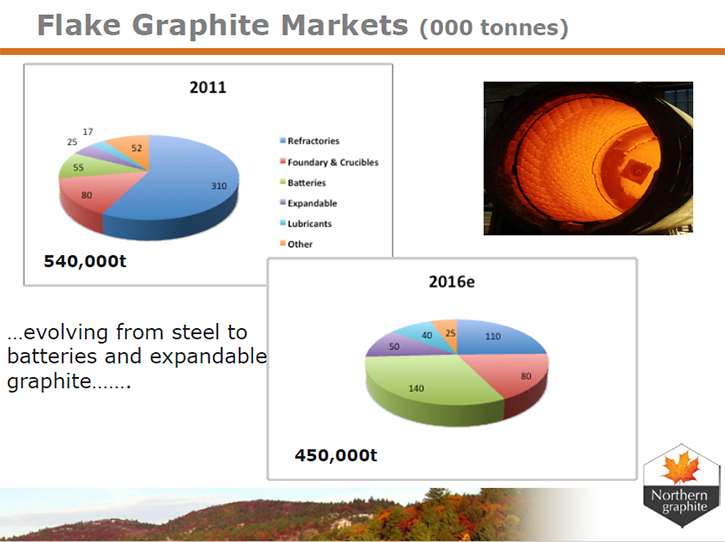

Mr. Greg Bowes: They're more valuable because of the properties they have. For example, for making

refractories, you could put very small flakes in there, but you would need a lot more of them. Expandable

graphite requires extra-large flakes which have a much higher expansion ratio than a small flake.

Generally, they have much more desirable physical qualities that manufacturers are looking for. Also,

they are rarer so the supply is less than the market demand.

Dr. Allen Alper: That's a good analysis. Could you tell us a little bit about graphene and why

it's important?

Mr. Greg Bowes: Graphene will be the new wonder material. I'm sure most of your readers are

familiar with graphene being a single layer of carbon atoms. It is much stronger than steel, much more

conductive than copper. It's semitransparent, and it's flexible. You can go on YouTube and type in

graphene, and look at all the wonderful products that could in theory be made with it. A graphite flake

is essentially like a deck of cards. It's thousands and thousands of layers of graphene. If you

delaminate a flake down to its lowest common denominator, you're left with a one-atom-thick layer called

graphene.

There are other ways of making graphene, for example chemical vapor deposition, which does not

require natural graphite, but the biggest challenge of the graphene industry is that there is no way to

make it economically in scale yet. Even if you do, from natural graphite, you're left with a whole bunch

of little bits of graphene. How do you stitch them together into one big coherent sheet, for example, to

make a very thin, light TV screen, just as an example? There really aren't any graphene commercial

products yet that take advantage of its amazing features, so it's still very much a research and

development story.

Dr. Allen Alper: Thank you. Could you also tell us how your graphite deposit in Canada, was

formed?

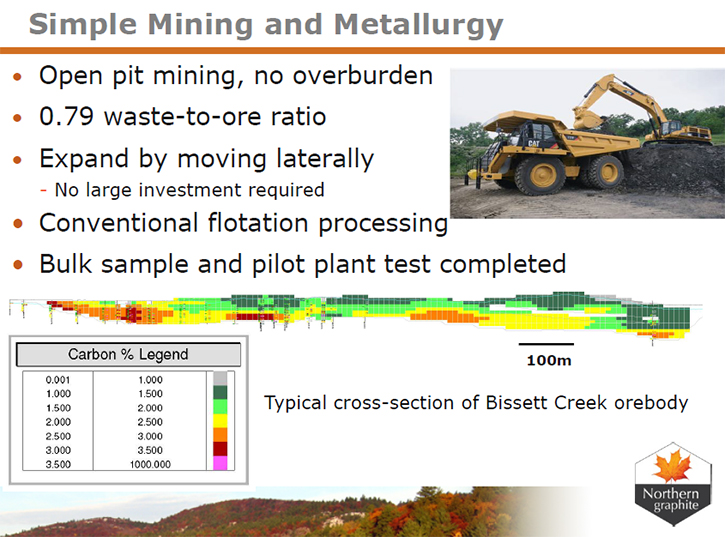

Mr. Greg Bowes: Yes. Essentially, graphite is a metamorphic product, so you had carbon in the host

rock, either organic or inorganic carbon, and over billions of years of heat and pressure, that carbon

has been converted to the graphite molecular structure. You could almost think of it as a low-grade

diamond kind of thing. Ours is a little bit unique in that most graphite deposits are high grade, highly

variable, smaller, concentrated bodies with a lot of small flakes. Ours was more a regional metamorphic

event, so we have a lower grade deposit but it's almost entirely large flake. It's very uniform, very

consistent over a wide area, which makes for very low costs.

Dr. Allen Alper: What is the host rock for your graphite flakes?

Mr. Greg Bowes: It is a quartz-biotite-graphite gneiss, gneiss being a metamorphic rock.

Dr. Allen Alper: Could you tell our readers a bit about your background?

Mr. Greg Bowes: Yes. I am a geologist, MBA by education. I've spent about 30 years in the

industry, more on the corporate development side than the actual field geology side. Most recently, I was

the senior vice president of Orezone Gold, which had a five million ounce gold deposit in Burkina Faso,

West Africa, which we took right through the feasibility study and permitting. It was bought from us by

Iamgold, who went on to finish construction. That's the largest project ever in Burkina Faso history and

the number one contributor to their GDP.

Back in 2008, when we were taken over, I was asked to get involved in Northern Graphite. I knew

nothing about graphite at the time. Everything I've done so far or learned so far has been since that

time.

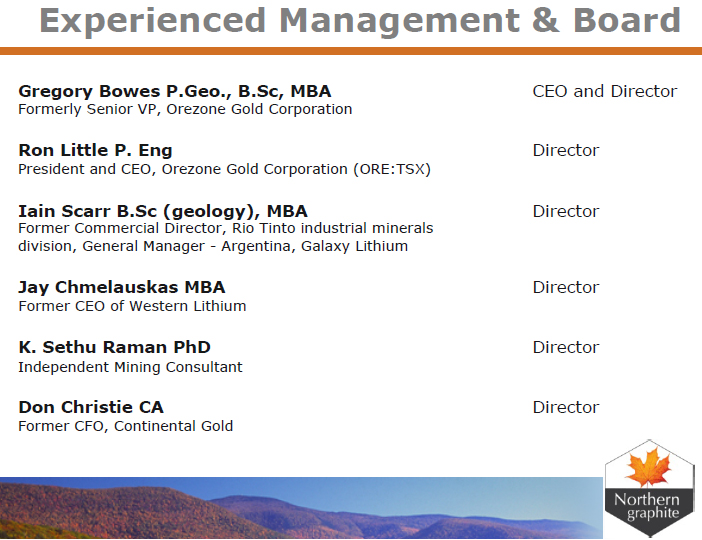

Dr. Allen Alper: Thank you for that. Could you tell us a little bit more about your team and your

board?

Mr. Greg Bowes: Yeah. We have a very small team right now, for the simple reason that all of the

heavy lifting is done. All of the drilling is done, the engineering studies are done, and the majority of

the permitting is done, so we are mainly keeping admin costs low. We have about three million in cash and

a very low burn rate, because the next major step is a strategic partner, an offtake agreement,

financing. Once we have that in place, we will start building an operational team to convert from an

exploration development company into an operating company. That is something that many junior explorers

get wrong, because they think they have the skills to do both. We recognize that it's a different set of

skills. A new team has to come in and actually build and operate the mine.

As far as our board goes; Ron Little, CEO and founder of Orezone Gold, is on the board. Jay Chmelauskas,

who was the CEO of Western Lithium, which merged with Lithium Americas. Iain Scarr, who was the

commercial director of Rio Tinto's industrial minerals division for many years, and is now a consultant,

mainly in the lithium space. Dr. Sethu Raman, who has been involved in the discovery and development of

multiple mines around the world. Don Christie, who's a CA and was involved with Continental Gold in

Colombia. Very knowledgeable, very experienced, very senior board!

Dr. Allen Alper: That seems like a springboard, and you have a nice, very good background, too.

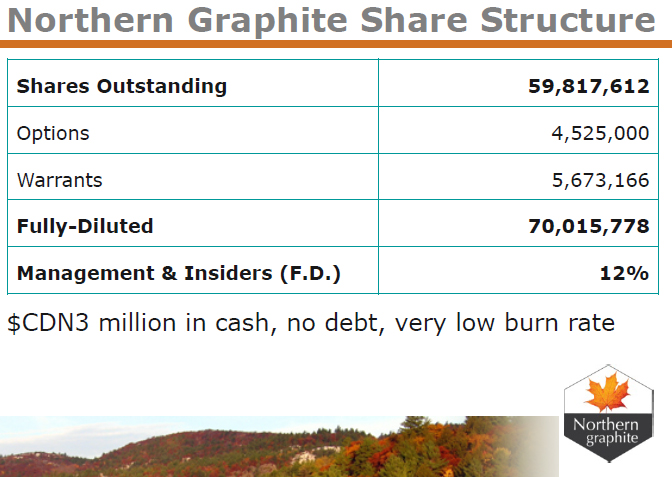

Could you tell us a bit about your capital structure, where your stock is located, how many shares, and

that sort of thing?

Mr. Greg Bowes: Yes. We've done a very good job, I think, of managing the capital structure,

because we have a feasibility study and our major environmental permit all completed and we only have 60

million shares outstanding. There's never been a rollback. We've been quite careful with the capital

structure over the years, and that's where we are today. We have about 10,000 shareholders, mainly small

retail people holding 10 or 20,000 shares. About 60% in Canada and 40% in the US. Very small

institutional ownership.

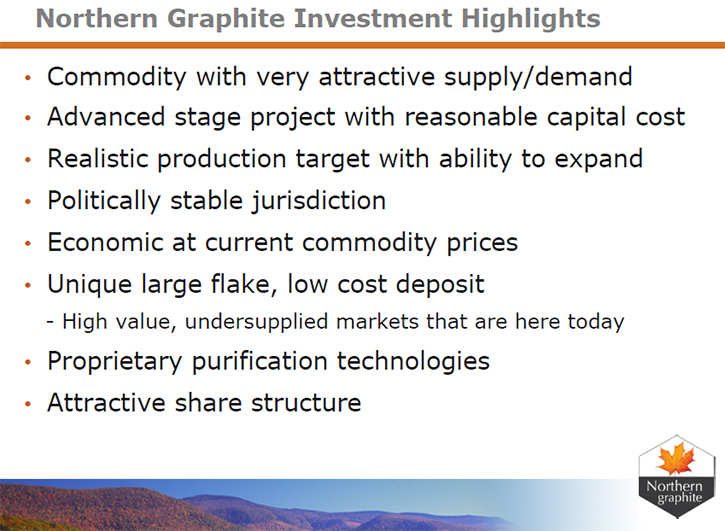

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider

investing in Northern Graphite Corporation (TSX-V: NGC; OTCQX: NGPHF)?

Mr. Greg Bowes: I think firstly, they have to be comfortable with the lithium-ion battery growth

story. Lithium-ion batteries are a $20 billion market, growing at over 20% a year. What else can say that

in these current economic times? That's mainly been from cell phones, cameras, laptops, all of the small

stuff. The big stuff like electric vehicles and grid storage is still coming. There's still a lot of

runway left for lithium-ion batteries, and the replacement technology is not even out of the lab yet. So

there are lots of years left for good growth in lithium-ion battery demand. It's already caused lithium

prices to take off. It's caused cobalt prices to take off. Graphite is next. All of these markets are

quite small, relative to the automobile market which is very large.

I think a very key point is, we're not talking about electric vehicles taking over the world. A very

small percentage of new vehicle sales, let's say 2% or 3%, maybe 5%, if they were electric, we would

require multiple new lithium, cobalt, and graphite mines, so there's really a lot of leverage to graphite

in that whole story.

I think if you look at graphite projects out there, we have the best flake size distribution. We

have the highest margin. We have the lowest capital cost, and it's a very advanced stage project in a

very good location, in a very friendly mining jurisdiction.

Dr. Allen Alper: Sounds like very good reasons to consider investing in northern graphite! Is

there anything else you'd like to add?

Mr. Greg Bowes: Thank you for the opportunity to speak with you, Dr. Alper.

Dr. Allen Alper: Thank you. It was very interesting.

http://northerngraphite.com/

Gregory Bowes,

CEO

(613) 241‐9959

|

|