Interview with Patrick Donnelly, President of First Mining Finance Corp (TSX: FF, OTCQX: FFMGF, FRANKFURT: FMG): Executing a Mineral Bank Strategy Acquiring Valuable Properties at Low-Cost

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/11/2017

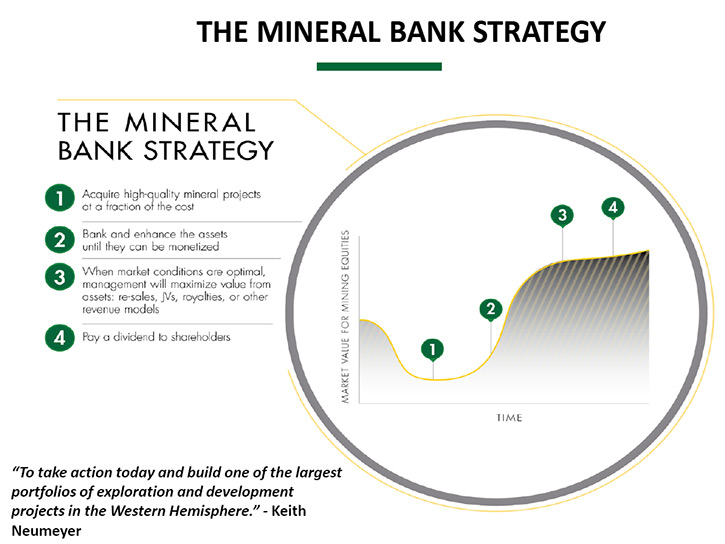

First Mining Finance Corp. (TSX: FF, OTCQX: FFMGF, FRANKFURT: FMG) is a mineral property "bank"

focused on acquiring, enhancing and monetizing high-quality mineral assets in the Americas. The

Company currently holds a portfolio of 25 mineral assets in Canada, Mexico and the United States

with a focus on gold, as well as silver, copper, lead, zinc and nickel. We learned from Patrick

Donnelly, President of First Mining Finance Corp., that the company was founded in early 2015 by

Keith Neumeyer with a vision to take advantage of the severe bear metals market and acquire high

quality assets that were held by financially distressed junior mining companies. In the long term,

the business model is to advance their assets to the point where they can be taken by larger mining

companies, who would move the assets into production, while First Mining Finance retains some

interest in a form of royalties, streams, joint ventures, spinouts, or a combination of the

above.

First Mining Finance Corp. – Springpole Gold

Project

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing

Patrick Donnelly, President of First Mining Finance Corp. Could you give our readers/investors an

overview of your company, your strategy, and what you've been doing?

Mr. Patrick Donnelly: Absolutely. Thanks for interviewing me. First Mining Finance is a

relatively new story. We've been around for just over two years and we were founded in early 2015.

Our founder and Chairman is a gentleman named Keith Neumeyer. Keith is fairly well known in the

global mining sector because he founded First Quantum Minerals, which is now one of the largest

copper producers in the world. He also founded First Majestic Silver, which is the second largest

silver producer in Mexico. He founded it in early 2015 because, at that time, the mining sector was

in terrible shape. Gold prices were weak, and there were no investment dollars coming in. It was a

one-in-twenty-year opportunity to go out and acquire high quality assets, being held by highly

distressed junior mining companies. The business model for First Mining Finance was to go out and

take advantage of this severe bear market and start accumulating highly undervalued but high-

quality assets.

We were listed on the TSX-V in April of 2015. In a period of just over a year, we did eight

transactions and added 12 assets to our portfolio. We currently have 25 assets, focusing primarily

on gold in Canada, the United States, and Mexico. We have seven million ounces of measured and

indicated and five million ounces of inferred gold.

Our overall business model is to continue acquiring assets. We are advancing some of these

assets to de-risk them and add internal value. Long term, the business model is not for us to put

these assets in production. We will advance them, do economic studies on them, drill them, and de-

risk them. But we would also partner up with other companies, larger mining companies that have

technical experience. They would move the assets into production, and we would hold onto some sort

of residual interest in the form of royalties, streams, joint ventures, spinouts, or a combination

of the above, and therefore a long-term, unlocked value.

Dr. Allen Alper: That sounds great. Could you tell us a little bit more about some of the

assets you have in the Americas?

Mr. Patrick Donnelly: Absolutely. Our flagship assets are located in eastern Canada. Our

number one asset is our Springpole gold project. It has five and a half million ounces of gold

equivalent. We acquired that through the acquisition of a company called Gold Canyon, and we paid

about fifty-eight million dollars. What we like about Springpole is that it's big; it's one of the

biggest gold deposits in North America. It's economic; there was an economic study done in 2013.

We're currently updating that economic study. We think there's a lot of room for improvement. It's

going to be an open-pit gold operation. The current PEA contemplates a two hundred thousand-ounce-

per-year producer. So we're looking at a number of scenarios to see whether we can make that

larger.

The other asset, we’re putting a lot of time and effort into right now, is our Goldlund gold

project, in northern Ontario. We acquired that through the acquisition of Tamaka Gold. Goldlund has

half a million measured and indicated ounces as well as 1.75 million ounces of inferred gold

ounces, and we're currently drilling there. We just finished our first phase of drilling. We

drilled over a hundred holes in about twenty-four thousand meters. So far we've released the

results of thirty-nine holes. Out of those thirty-nine holes, thirty-six have intersected gold.

We're fairly optimistic that Goldlund could become a very viable project. We expect to continue to

have press releases on Goldlund in the next weeks and months on drilling. Hopefully, sometime in

the next few months or by the end of the year, we can have a new mineral resource on Goldlund.

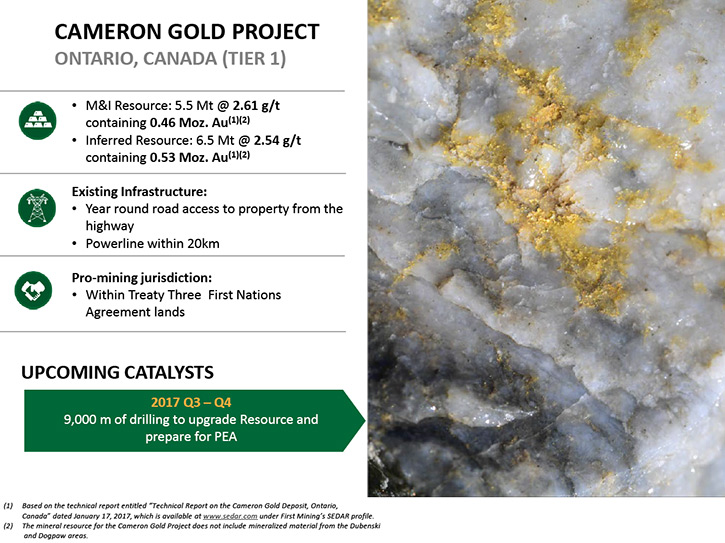

The third asset I want to point out is our Cameron project, which is also located in Ontario. It

has about a half a million ounces of measured and indicated gold and another half million ounces of

inferred gold, which all run over two grams per tonne. It has very good infrastructure and is

pretty close to the Rainy River project, which is currently being developed by New Gold. We expect

to start drilling at Cameron soon and we're planning to drill nine thousand meters. We'll have news

from there as well. We’ll also do some more work on a few other assets. We're fairly busy on all

these assets we've acquired, which we believe will have great potential. Therefore we're putting

money into the ground to unlock value.

Dr. Allen Alper: Sounds excellent! Could you tell us a bit about yourself, your team and

your board?

Mr. Patrick Donnelly: I'm a geologist. I'm also a former mining analyst. I was a sell-

side analyst in Toronto. I also have an MBA and I've been in this business for over twenty years.

My father was a miner, so it's in my blood. When I was a mining analyst, evaluating mining

equities, I learned mining's very risky. Because of that, you need good managers.

Obviously, any sector and any company needs good management, but I think even more so for mining

because of the risky nature of it. And I think our chairman is definitely one of the best in the

business, Keith Neumeyer, because he's founded two billion-dollar companies. Not many people have a

track record like Keith Neumeyer. Our CEO is a gentleman named Dr. Chris Osterman. Chris is

American; he lives in Tucson, Arizona. Chris is a mining engineer, but he also has a PhD in

geology, so Chris has experience all the way from exploration through the operation side of mining.

Chris runs the technical aspects of the company, whereas I run the day-to-day parts of the company.

I run the corporate side, marketing, raising capital, doing M and As, whereas Chris runs the

technical part, the exploration programs and the economic studies, that sort of thing.

So the three of us work pretty closely together; Keith oversees everything as Chairman, and

Chris and I run the day-to-day. We've assembled a very strong technical team, led by our VP of

Technical Services, Bill Tanaka, who is based in Denver, Colorado. Bill is just a phenomenal person

to have on board. We have a very, very strong team; we have decades of experience in this sector.

We work very, very well together. The beauty of being a really close, tight team is, if we see any

opportunities to do an acquisition, we move very, very quickly. I think that's a testament to how

closely this team works together and supports each other.

Dr. Allen Alper: Well that's excellent; sounds like your team has a great background and an

excellent record of success. That's very good. Could you tell me about your capital structure?

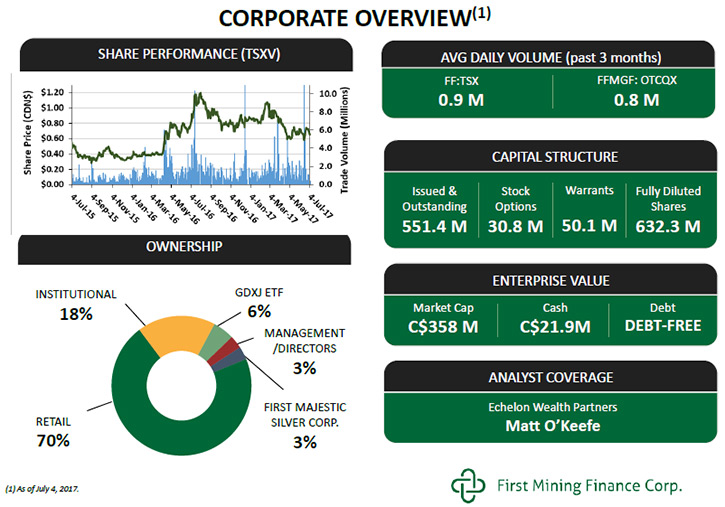

Mr. Patrick Donnelly: We have around five hundred forty million shares outstanding. We

have very little debt; it's about a couple million Canadian dollars of debt. Cash-wise, we have

twenty-three million Canadian in cash. This year, we were very liquid. We trade, on average, about

three million shares a day, some days up to ten million shares a day, so we're very, very liquid.

We just recently graduated to trading on the TSX from the TSX-V and we also trade on the OTCQX.

We're doing a lot of work right now with some of our assets, so by the end of the year,

we'll probably be down to ten million in cash because we've been very busy adding value internally.

We can survive on that for a while. If we're not doing any work on our assets our burn rate comes

down considerably, to about five million a year. We also have the ability to raise additional

capital, but our focus right now is on advancing some of these assets. Our focus is to continue to

add value by putting money into the ground, and generating organic value for our shareholders.

Dr. Allen Alper: That sounds excellent, an excellent approach. What are the primary reasons

our high-net-worth readers/investors should consider investing in First Mining Finance Corp?

Mr. Patrick Donnelly: Management is critical in this sector, and Keith Neumeyer is one of

the best in the business.

We have a different business model. We have twenty-five assets in various jurisdictions at

various stages, all focusing on gold. I call it private equity for the little guy, almost like an

ETF, except we're deriving internal value. Normally when you want exposure to the junior gold

market, you have to buy a basket of junior gold equities. In our case, you don't need to do that

because we have chosen a basket of really high-quality gold assets. Exposure to First Mining will

give you some pretty good exposure to all these assets.

We're very liquid. We trade over three million shares a day in Canada and the United States.

Some of your readers/investors might have heard about the VanEck GDXJ ETF, which recently

went through a massive rebalancing, and we're in that ETF. So our shares have been subjected to

some pressure because of that, and right now we are trading at around sixty-seven cents. So I think

we're considerably undervalued; just a couple months ago we were a dollar Canadian. It's a great

opportunity for anybody to get some undervalued shares in a company with a collection of high-

quality assets, led by Keith Neumeyer, who has created two billion-dollar companies.

Dr. Allen Alper: Sounds excellent, like an excellent reason for high-net-worth investors to

consider First Mining Finance Corp. Pat, is there anything else you would like to add?

Mr. Patrick Donnelly: Look for lots of news flow coming out, more drilling, an economic

study, so every couple of weeks we're going to have news. Despite the GDXJ, it's business as usual

for us, and we're going to continue to generate internal value. If there are any interesting deals

to be made, acquisitions, and they meet our criteria, we'll do that as well. The goal is to

continue to add value for our shareholders. I think we offer a compelling value right now.

Dr. Allen Alper: That sounds excellent.

First Mining Finance Corp. - Cameron Project

https://www.firstminingfinance.com/

First Mining Finance Corp.

Patrick Donnelly

President

604-639-8854

Derek Iwanaka

VP, Investor Relations

604-639-8824

info@firstminingfinance.com

|

|