Interview with Dr. John Parker, Managing Director of Lincoln Minerals Ltd. (ASX: LML): Australian Graphite Developer and Emerging Iron Ore Producer

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/10/2017

Australian graphite developer Lincoln Minerals Limited (ASX:LML) is focused on Eyre Peninsula in South Australia, where their flagship Kookaburra Gully Graphite Project is located just 35 kilometres north of the region's main hub, Port Lincoln. We learned from Dr. John Parker, Managing Director of Lincoln Minerals, that it is a small, but very high grade project which means lower operating costs per tonne of graphite concentrate, and on top of that high concentrate purity and 90% recovery according to their process flow sheet. According to Dr. Parker, some of the advantages of operating in Australia are the secure, mining friendly jurisdiction, as well as very strict environmental controls that will make their project one of the cleanest, greenest graphite projects in the world. We learned from Dr. Parker that a shipment of about 37 tonnes of samples is on its way to China for pilot plant test work that will result in a few tonnes of product concentrates for product development work with the aim of identifying potential customers most likely in lithium ion batteries industry.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Dr. John Parker, Managing Director of Lincoln Minerals LTD. John, could you give our readers/investors an overview of your company?

Dr. John Parker: We are a mineral exploration and mine development company, based in Australia, with our head office in Melbourne, but with all our projects on Eyre Peninsula in South Australia. We're an ASX listed company and have been on the boards for just over 10 years now. In that time, we've spent quite a bit of effort looking for iron ore initially, but more recently we have focused on graphite. We have a number of graphite prospects, in particular one very high grade deposit, Kookaburra Gully, which we are in the process of developing. So, for the Kookaburra Gully Graphite Project, we have a mining lease that was granted to us middle of last year, June 2016, and the main final stage of government approvals is to complete and get approved a PEPR, which is a Program for Environment Protection and Rehabilitation. That PEPR is a detailed set of management plans for environmental management, mine management and rehabilitation as we go forward. That has required us to do a considerable amount of extra work.

On top of the mining lease application, which involved detailed environmental studies such as flora, groundwater and additional drilling in the area for resource definition, preparation of the PEPR has involved detailed metallurgical work to finalize our metallurgical process and process flow sheet. We have come up with a detailed design for a process plant now and have determined what the capital and operating costs might be for that.

We have also had to prepare a more detailed mine design, which includes everything from access ramps and bench plans for the various stages of the mine schedule and defining the amount of ore and waste that we're going to mine month by month. We've also had to do a detailed design of our tailings storage facility for the tailings or the waste products from our process plant. They go out as a mixture of water and 55% solids. So a number of reports have been produced, and we're just finalizing the compilation of all of those into the PEPR, with the aim of lodging the PEPR in a month or so.

Dr. Allen Alper: Well that sounds very good. Could you tell us what differentiates your graphite deposit from others and what you're doing versus other graphite companies?

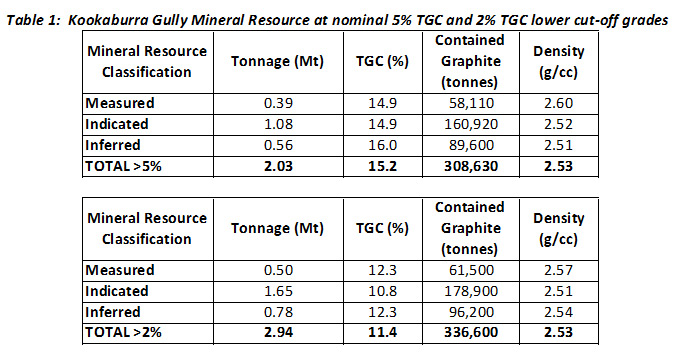

Dr. John Parker: A couple of things, first of all we have a very high grade deposit. The average grade is 15.2% graphitic carbon. It is a small deposit, certainly much smaller than big graphite deposits in Mozambique or China, but it's a high grade deposit up in the top 10 in the world from the point of view of grade and, as you know, high grade means lower operating costs from the point of view of processing to get a high grade product. We only have to process something of the order of 250,000 tons of ore per year to produce around 35,000 tons of graphite concentrate. So that's one of the advantages of the project.

The predominant composition of our concentrates is relatively fine by some of the other project standards. We only have about 10% of our product that is coarse flake graphite, so most of ours is in the finer category. We don’t see that as an issue from the point of view of producing micronized graphite or from the point of view of going down the path of producing spherical graphite in the long term, or other micronized graphite products of high purity.

We have shown that we can get better than 95 percent graphitic carbon purity ¬¬in concentrates, and the other thing is that with the new process flow sheet we're getting at least 90% recovery of our graphite. So we're getting good recovery of our graphite.

The advantage we have over the East African projects, for example, is sovereign risk and security, one of the big advantages of being in Australia. It's a disadvantage in some respects, but it's an advantage in others. There are very strict environmental controls in Australia, so at the end of the day we will be probably one of the cleanest, greenest graphite projects in the world, because of all the strict environmental controls placed on us by the governments, particularly the South Australian state government, and the environmental protection authorities. So yes, in summary, we have a very low sovereign risk here from the global point of view and we will be producing a very clean and green product, and that's going to be a significant selling point for us.

Dr. Allen Alper: Sounds excellent. Could you tell us a little bit about the geology of the area?

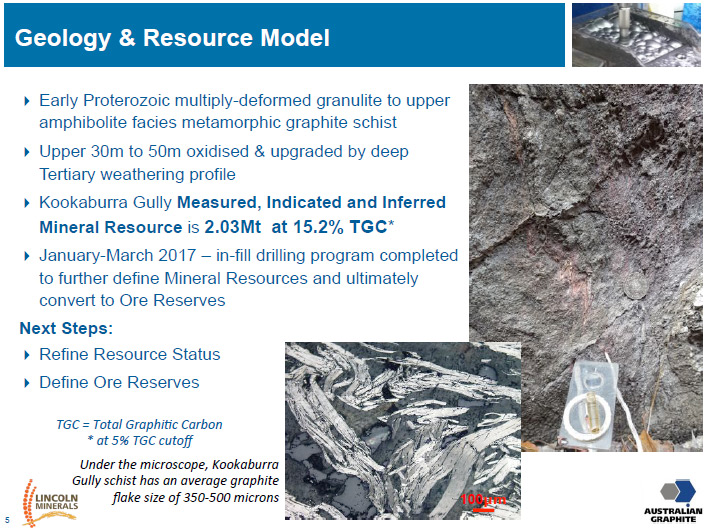

Dr. John Parker: The graphite occurs as flake graphite in high metamorphic grade rocks. They're coarse grain metamorphic schists and gneisses with associated other units such as marble and quartzite. They are Paleoproterozoic rocks, one thousand seven hundred and fifty million years in age, and peak metamorphism occurred around about that time or shortly thereafter. They have been intruded by a series of granites and in some cases these granites and pegmatites have created coarser flake graphite. That has helped in a couple of occasions.

The rocks have been multiply deformed, and the process of multiple deformation or folding of the rocks has led to thickening and thinning of the lenses in different situations. During the Tertiary, the southern area of Eyre Peninsula was subjected to a deep weathering profile, so that the upper 20 to 40 meters of the deposit has been oxidized to clay plus graphite, quartz and other minerals, and in that process it upgraded the resource that we find right at the surface. We are looking at grades that are close to 20% graphitic carbon near surface, and the deposit is about 15 to 20 meters thick and fairly steeply dipping from subvertical through to about 50 degrees in dip. There's a little bit of sulfur in the lower part of the ore body, but the upper part, where it's oxidized, is sulfur free, so that certainly helps us from the point of view of environmental issues.

Dr. Allen Alper: That's a nice overview of the geology. Could you tell us a bit about your background, your team, and your board?

Dr. John Parker: Yes, I'm a structural geologist and geophysicist. I did my PhD over on the Peninsula, in the general region where we're working 40 odd years ago. I've been in the mineral industry for 45 years or more now. I did get a Fulbright post-doctoral research grant in the early 80s, which led me to go to Minnesota, where I spent a year working on banded iron formations in the Mesabi Range in Minnesota. I was with the South Australian state government in the South Australian Geological Survey for 15 years or so and ended up being Chief Geologist of the Mapping Branch. Whilst there, I established their geographic information system, or GIS. I set that up in the late 1980s, so we were the first in Australia to establish geographic information systems as a mapping tool.

In the early nineties I left the government and since 1993 I've been working in industry. Initially I ran my own consultancy Geosurveys Australia, which still exists, but for the last 10 years I've been Managing Director of Lincoln Minerals and helped with listing the company on the Australian Stock Exchange 10 years ago. I've worked overseas in places like the USA, Sri Lanka, Mauritius, Algeria, etc. So that's my background.

From a Board point of view, Chairman Jin Yubo is Chinese, but lives in Australia and China. He has a legal background and has been Chairman of the company now for about five years. Vice Chairman, James Zhang is in the real estate and property development business. Both he and Mr. Jin have a very strong financial background. The third non-executive director on the board is Eddie Pang. Eddie is a chemist with about 40 years’ experience as well, but he's also Executive Chairman of Genesis Resources, a mineral exploration company, based in Australia, but developing a big copper/gold project in Macedonia. Eddie has a really strong chemical, mining and mineral exploration background. So we have on the board very strong financial and development support and then also mining industry support.

The Company Secretary, Jarek Kopias, has been involved in the mining industry and the oil and gas industry for about 20 years now and has been involved in various mineral projects including another graphite company.

Dr. Allen Alper: Could you tell us a bit about your share and capital structure?

Dr. John Parker: We declared, at the end of March, that we have about three million Australian dollars in the bank, but it would be a little bit less than that by now. We are in the process of doing a placement, with companies associated with two of our directors to raise $9.6 million. That was announced recently. We have to go through a shareholders meeting to have that approved, so are in the process of doing that at the moment. When that's completed, we'll have of the order of $11 million or so in the bank, which puts us in a really good position going forward from the point of view of developing the Kookaburra Gully project and also raising the additional funds that we'll need for the capital expenditure.

Currently we have about 460 million shares on register and the major shareholders are predominantly of Chinese backing. So if you look at our register, the top 20 are predominantly Chinese names, a lot of them based in Australia, but a lot of the money has come out of Hong Kong and China. After the placement, the two directors or their associate companies, putting this money in, get 150 million shares each, so that'll increase the number of shares we have in the company.

Dr. Allen Alper: Do you have any off take agreements right now.

Dr. John Parker: The short answer to that is no, no specific off take agreements. We have an agreement with a Shanghai based financial management company to assist us with that process and also with raising funds for the capital cost. We have a 37 tonne ore sample currently on the water on the way to China for pilot plant test work. Out of that test work, we'll end up with a few tonnes of product concentrates, on which we are planning to do product development work, with the aim of identifying specific customers. We have a marketing team working on it, but we don't have any specific off take agreements or MOUs yet.

Dr. Allen Alper: Could you tell us a bit about the graphite market, the uses of graphite and the outlook?

Dr. John Parker: From the point of view of the market, I think we all know one of the big, huge growth areas is in lithium ion batteries, of which graphite is a major constituent; there's 10 times more graphite than lithium in the lithium ion battery. It's not a huge market, but it is a growing market. We've seeing significant growth in the lithium ion battery market over the last year. It's certainly predicted to grow quite significantly over the next 10 years. It's not just from electric vehicles, one of the applications in which lithium ion batteries are used, but also for the large scale or even grid scale battery storage systems, the Tesla grid scale battery systems. There's a large growth there! So that's one of the areas we're targeting from a micronized graphite point of view. The spherical graphite used in lithium ion batteries is less than 20 microns in size, so we don't need coarse flake. But we do need to produce pure flake, so that's a focus.

There are a number of other micronized graphite uses we're looking at getting involved in. Coarse flake graphite will, potentially, go into the graphite foil or expandable graphite market.

Dr. Allen Alper: That sounds very good. What are the primary reasons our high-net-worth readers/investors should consider investing in Lincoln Minerals?

Dr. John Parker: Our project is one of the best graphite deposits in the world. We have a mining lease for that project, putting us well on our way to develop our graphite mine. We're in a country with very low sovereign risk for developing projects, but strong environmental controls. We'll be able to produce a clean and green product, very important for the lithium battery market and selling into the clean and green electric vehicle market. We're looking at capital costs probably less than 50 million Australian dollars.

Dr. Allen Alper: That sounds very good, John. Is there anything else you'd like to add?

Dr. John Parker: While our focus is on developing the graphite, we still have an iron ore resource with 100 million tons of iron ore, mostly magnetite but with some higher grade hematite. We also have a couple of very good copper-rich base metal exploration projects that we'll be moving ahead on later.

Dr. Allen Alper: That sounds really good.

http://www.lincolnminerals.com.au/

Registered Office

Suite 4, Level 7, 350 Collins Street,

Melbourne Victoria 3000

t: (613) 9600 0782

f: (613) 9600 0783

Adelaide Office

28 Greenhill Road, Wayville, South Australia 5034

t: (618) 8274 0243

e: info@lincolnminerals.com.au

|

|