Interview with Daniel Major, CEO of GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF): One of the Largest Development-Ready Uranium Resources

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/7/2017

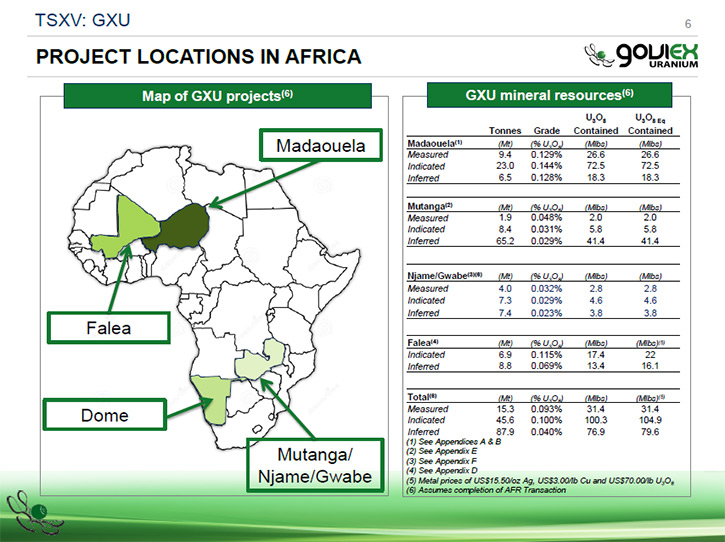

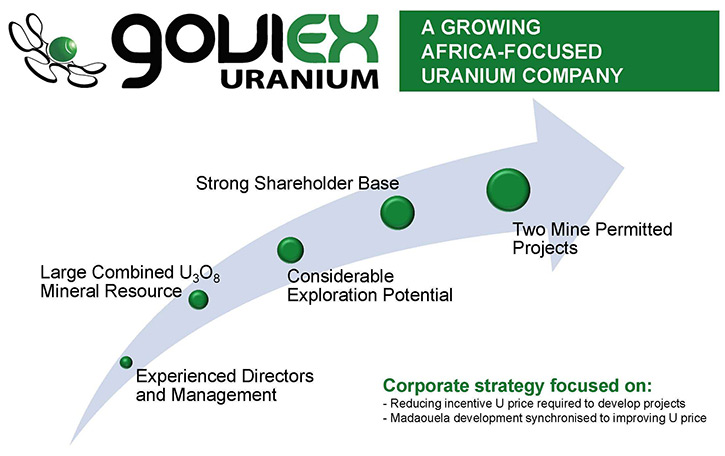

GoviEx Uranium Inc. (TSX-V: GXU; OTCQB: GVXXF) is a mineral resource company focused on the

exploration and development of its African uranium properties. GoviEx’s principal objective is to become

a significant uranium producer through the continued exploration and development of its mine permitted

Madaouela Project in Niger, its mine-permitted Mutanga Project in Zambia, and its Falea Project in Mali.

GoviEx controls one of the largest uranium resource bases among publicly-listed companies, with combined

National Instrument 43-101 (“NI 43-101”) measured and indicated resources of 124.29 Mlbs U3O8, plus

inferred resources of 73.11 Mlbs U3O8. According to Daniel Major, the CEO of GoviEx Uranium, GoviEx

recently announced an acquisition of assets adjacent to their Mutanga Project, which will add another 11

million pounds of uranium, and provide them with an expanded, fully permitted project in Zambia, ready to

go. According to Mr. Major, GoviEx is a company with over 200 million pounds of uranium in resource, with

three projects (two of them fully permitted), and interesting shareholders including Cameco, Denison,

Toshiba, and Ivanhoe.

GoviEx Uranium Inc.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing

Daniel Major, CEO of GoviEx Uranium. Daniel, could you give our readers and investors and overview of

your uranium company?

Mr. Daniel Major: Absolutely. GoviEx is a uranium development company focused on developing

its three projects.

The most advanced is the Madaouela Project in Niger, which is a fully permitted project. Madaouela has

almost a hundred million pounds of uranium in measured and indicated (M&I) resources, and 18 million

pounds in inferred resources. Based on the 2015 Preliminary Feasibility Study, the project has a forecast

cash cost of $25 a pound, and a total capital expenditure of $360 million.

Following Madaouela, in terms of development timeline, our next project is Mutanga, in Zambia, which

currently has 8 million pounds of M&I resources and 41 million pounds of inferred resources. We have

recently announced a transaction to acquire the properties adjacent to Mutanga from Africa Energy, which

will add another 10 million pounds of uranium resource and expand our fully permitted project in Zambia.

Our target, on completion of the Africa Energy transaction, is to provide a Preliminary Economic

Assessment in order set out the economic potential of the project.

Thirdly, we have the Falea Project in Mali, with 17 million pounds in indicated and 13 million pounds in

inferred resources. Given the amount of technical work completed, Falea is an advanced exploration

project.

All of our projects have considerable exploration upside, given that a lot of their surface area has yet

to be reviewed.

Source: GoviEx Uranium Corporate Presentation – full

presentation available at www.goviex.com

Dr. Allen Alper: That sounds great. Could you tell our readers/investors what the market for

uranium is and the outlook for uranium supply and demand?

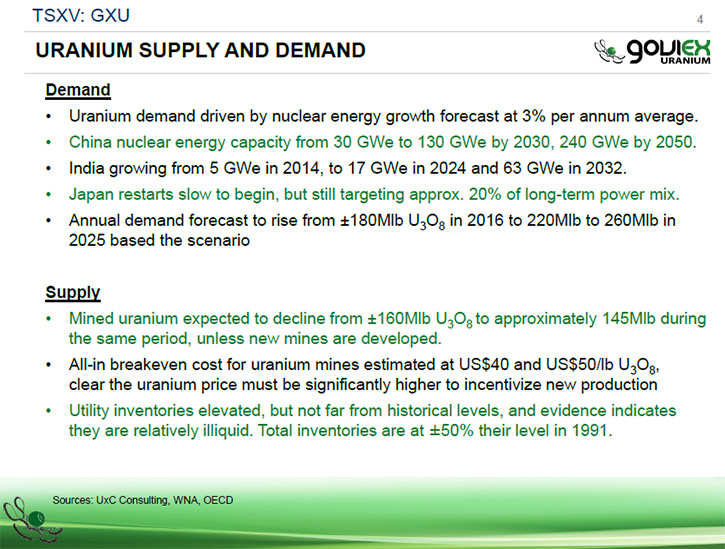

Mr. Daniel Major: The long-term impact is driven by two real factors.

On the demand side, most of the industry forecasts indicate an average 3% per annum growth on uranium

demand long-term. This demand is driven by large scale reactor construction in China and in India. Both

China and India are targeting 20% nuclear energy generation, starting from their current status of less

than 2%. In addition, Japan is steadily restarting its reactors, with five reactors going and a target of

roughly 30 reactors, or 20% nuclear generation, by 2030. Europe and the U.S. continue to be fairly stable

on reactor generation, with the U.S. becoming increasingly supportive.

Source: GoviEx Uranium Corporate Presentation – full

presentation available at www.goviex.com

On the supply side, on an all-in cost basis, the industry is uneconomic – below $40 a pound; therefore,

the current uranium producers cannot afford to replace their uranium pounds at the current spot or term

prices. As we move forward, and if we do not an improvement in uranium price, the industry is expected to

go into a supply deficit, on the basis that new production cannot be incentivized, and a number of large

scale projects are coming to the end of their life. The industry needs a higher price to build new

operations. On top of that, there is the issue of timelines for permitting projects. This issue is

particularly significant in North America, where it can take five to ten years to permit a project,

thereby delaying the start-up of the big projects.

So, we're expecting to see the supply-demand gap open up, and that's why GoviEx is preparing its projects

– particularly Madaouela. We believe we have to be in a position to benefit from that supply gap.

Dr. Allen Alper: That sounds great. Could you tell me a little bit more about your proposed

development strategy?

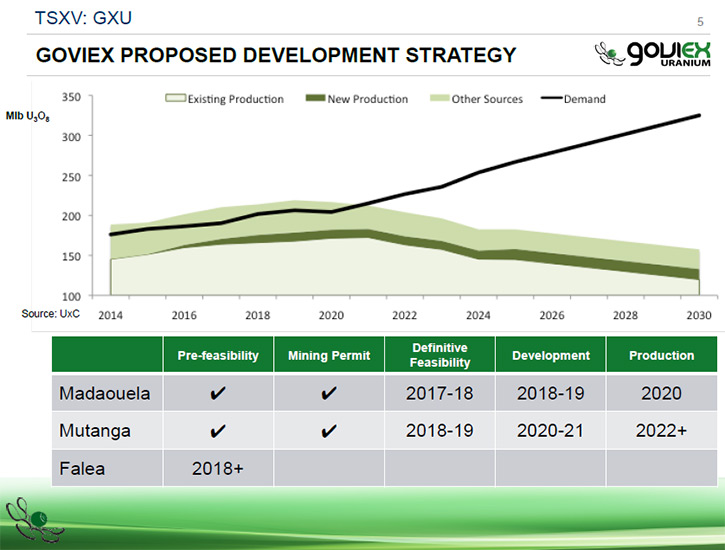

Mr. Daniel Major: Yes, certainly. In the case of Madaouela, we've taken a four-prong

approach, breaking each of the component parts up, and undertaking them in tandem.

For Niger, we feel it is best to build a properly-structured model for financing the project, so we've

already initiated the debt site. We're well advanced on our debt discussions with a number of banks.

Source: GoviEx Uranium Corporate Presentation – full

presentation available at www.goviex.com

Our focus is base debt financing around export credit-backed facilities. We appreciate our geography and

we appreciate that the project finance market is extremely difficult at the moment. We have found that

having sovereign insurance protection for the underlying lenders makes the lenders much more interested.

We have started conversations on the long-term project off-take, but obviously, as the uranium price

continues to flounder at under $20, we're not pushing those very aggressively, because we're looking for

uranium price contracts in the mid-50s. Certainly, there's a lot of interest in our project from the

off-takers, and as we see the uranium price move, we expect to advance those discussions.

As we're going to produce more than two-and-a-half million pounds per annum, we are a large project.

We're continuing to work at optimizing the project. There are a number of areas of the project where I

believe we can reduce costs considerably, and improve the economics.

Further down the track, we will consider the equity side of the project capital as we advance

further on the debt and off-take discussions; it will become a lot easier and more interesting for equity

investors when those two key components are well advanced.

Dr. Allen Alper: That sounds very good. Could you tell me a bit about your resource in comparison

with some of the other uranium companies?

Source: GoviEx Uranium Corporate Presentation – full

presentation available at www.goviex.com

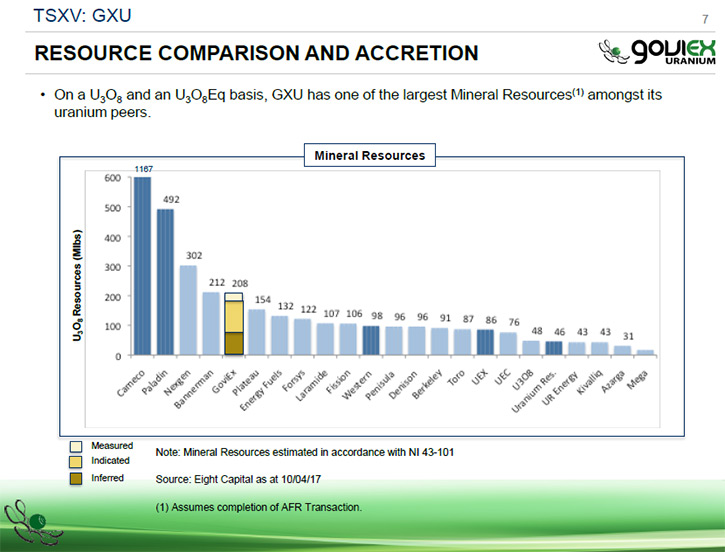

Mr. Daniel Major: Yes – with a total resource of over 200 million pounds, that puts us in

the top five public uranium companies.

The grades are running about 0.14%. They're lower than Canada grades. What you find in our industry is

that the grade doesn't always directly relate to cost, and you have projects in Africa mining at 0.05% at

$25 a pound, which is in line with the in situ leach (ISL) projects in North America. It's that ease of

permitting to get into operation that is very key to projects like our own.

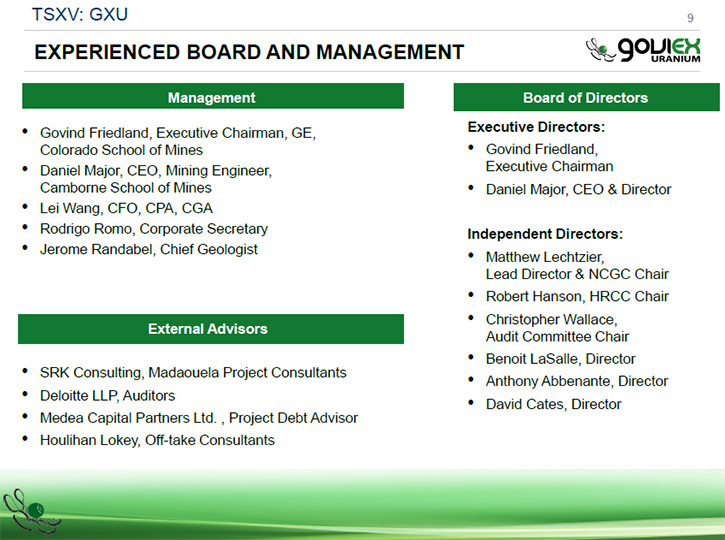

Dr. Allen Alper: That sounds good. Could you tell me a bit about your experience, board and

management?

Mr. Daniel Major: I certainly can. On the board we have Govind Friedland, who founded the

company back in 2007, and who advanced the project through one of the largest global exploration

programs. We have Benoit La Salle, the Founder and former President and CEO of SEMAFO, an experienced

west African gold operator; David Cates, who is the CEO of Denison Mines and UPC; and GoviEx’s chief

geologist, Jerome Randabel, who has considerable experience in uranium across Australia and Africa. We

have guys who have been there and done this before, and have a lot of industry experience.

Source: GoviEx Uranium Corporate Presentation – full

presentation available at www.goviex.com

Dr. Allen Alper: That sounds like a very strong board and management team. Could you tell

readers/investors a little more about your strategic shareholders?

Mr. Daniel Major: Absolutely. We’ll start with the largest; Denison Mines. They are well-

known to most North American investors. They own the Wheeler River project. We acquired three of our

projects in Africa from them in 2016. They were looking to focus on their Canadian projects, but they

wanted to maintain leverage on their African projects. As a result, we did a transaction with them where

they became a 25% shareholder and we took on the projects. They're very much focused on a desire to have

all the projects developed. They're in this for the long haul and are great partners to have.

Source: GoviEx Uranium Corporate Presentation – full

presentation available at www.goviex.com

We have Toshiba Corporation, who owns Westinghouse. While Westinghouse has been going through its

problems, we certainly see that situation improving as things go along. They are major reactor vendors.

We have Cameco, one of the largest uranium producers in the world. They've been with the company

since 2008.

In 2015, Ivanhoe Industries, part of the Ivanhoe Group, the Friedland Group, joined the company as well,

as an investor.

Dr. Allen Alper: That sounds like excellent strategic shareholders, a very strong group for

support. How do you feel you compare to your peer group?

Mr. Daniel Major: Our cash is $25 a pound. That puts us in the mid-tier. Our capital is

$360 million, towards the lower end, resulting an all-in cost of $37 a pound.

In Mutanga, you're going to see higher operational expenditures (OPEX), but much lower capital

expenditures (CAPEX), so our all-in costs are going to be around $40. That is comparable with an ISL

project, and it is actually lower than some ISL projects if you look at an all-in cost, so we stack up

very well in the industry.

One of the key factors is we are already permitted. As we see prices rise, we can actually develop our

projects into rising prices. We don’t need to be spending our time continuing to develop or explore or

permit a project. As mentioned earlier, permitting can take a considerably long time in some regions.

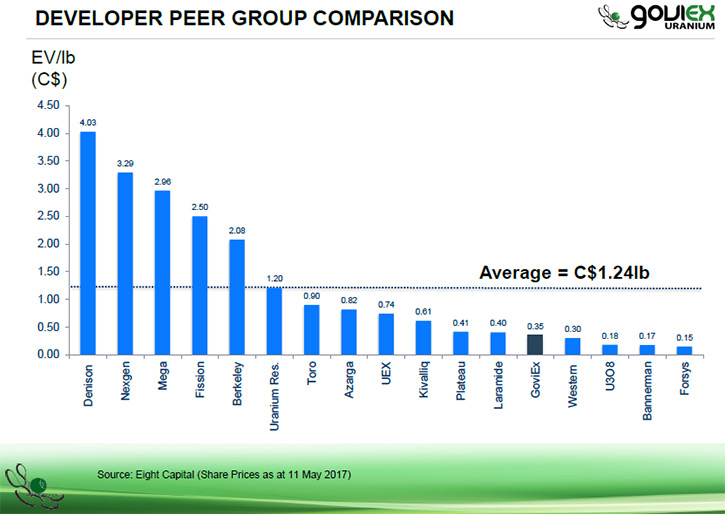

Dr. Allen Alper: Could you tell us how your share prices compare with your peer group?

Mr. Daniel Major: Relative to an average on an EV/lb – that's the simplest one that most

analysts use – on an EV/lb, we're about a quarter of the peer group average. We're sitting at about 35

cents a pound in the ground, compared to a peer group, which is averaging $1.24 per pound.

Source: GoviEx Uranium Corporate Presentation – full

presentation available at www.goviex.com

Dr. Allen Alper: That's excellent. Could you tell me a bit about your capital structure?

Mr. Daniel Major: We have 321 million shares on issue. We have about three million dollars

of cash in the account. We have 131 million in the money warrants, of which approximately 80 million can

be accelerated. At the end of Q1, we had $3.9 million in cash, enough to keep us going well into next

year.

Dr. Allen Alper: That sounds good. What are the primary reasons our high-net-worth

readers/investors should consider investing in GoviEx?

Source: GoviEx Uranium Corporate Presentation – full

presentation available at www.goviex.com

Mr. Daniel Major: I think the first trigger you have to look at, of course, is the uranium

market itself. If you believe that the uranium market is going to be very positive and constructive from

a price point of view, then obviously you want to invest in the uranium sector. In the uranium sector

itself, I think we are one of the few companies that is in a position to actually develop our projects

and go into construction, and that's important, because if you looked at the last bull cycle from 2006

through to the end of 2007, the two outperforming companies in that cycle were Paladin Energy and Energy

Fuels. Those companies outperformed the whole sector, and the difference between them and everybody else

was that they actually built mines, and nobody else did.

Dr. Allen Alper: Well, that's very good. Is there anything else you'd like to add?

Mr. Daniel Major: Thank you, Dr. Alper, for the opportunity to share information about

GoviEx Uranium’s prospects with you and your readers/investors. We feel we are well positioned for the

future.

Dr. Allen Alper: Well, I thank you. You've given our readers/investors an excellent idea of what

your company's all about, what the uranium market is doing, and good reasons why they should consider

investing in your company.

All slides are excerpts from GoviEx Uranium’s corporate presentation. The full presentation, including

all appendices and disclaimers, is available at www.goviex.com.

www.goviex.com

Govind Friedland, Executive Chairman

Daniel Major, Chief Executive Officer

+1 604-681-5529

info@goviex.com

|

|