Interview with Peter Clausi, President, CEO and Director of CBLT Inc., Discussion of Cobalt Market and their Cobalt Assets in Ontario and Quebec

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/6/2017

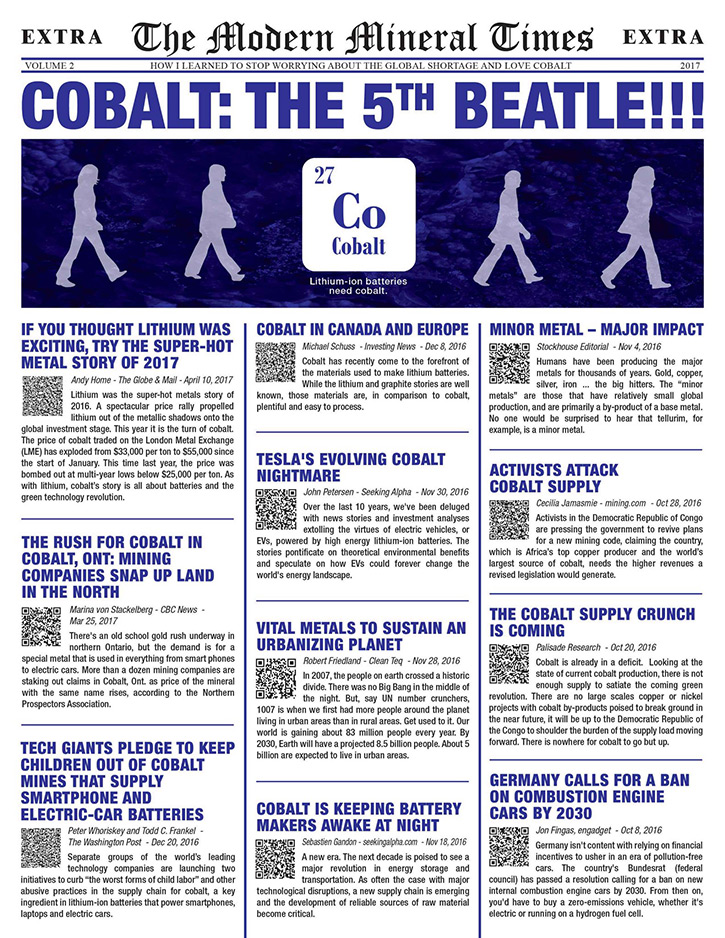

According to Peter Clausi, CEO of CBLT Inc., cobalt - which is one of the main ingredients in

lithium-ion batteries - is in a global deficit position. As 60% of the world's cobalt comes from the

Congo in Africa, there's been a disruption of the supply chain, due to the horrible period of war,

pestilence, political corruption, and famine in the country since the late 1990s. In other parts of the

world, cobalt comes as a byproduct of copper/nickel operations that underwent a tough market recently. As

a result, we are losing global cobalt supply. This will soon choke the fast growing lithium-ion market as

cobalt prices will skyrocket. The company's main asset is located in the world famous Sudbury Basin in

Ontario and holds gold and cobalt mineralization in a quartz vein. Other projects are located in Quebec

and in the world famous Cobalt Embayment.

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Peter

Clausi, CEO of CBLT Inc., listed on TSX Ventures Exchange, with the symbol CBLT as well. Peter, could you

give our readers an overview of what's happening in cobalt and why this is such an important time for

cobalt and the industry?

Mr. Peter Clausi: Sure, Al. And thank you, it's always good to chat with you. Right now,

cobalt is in a global deficit position. It affects all of us, because cobalt is one of the main

ingredients in lithium-ion batteries. For everything from your toothbrush to your electric car, we need

cobalt and there's simply not enough of it in the world.

Dr. Allen Alper: Could you go into more detail on the global situation regarding the supply-demand

dynamics of cobalt?

Mr. Peter Clausi: Sure. 60% of the world's cobalt comes from the Congo in Africa. As most

of your readers know, the Congo has suffered through a horrible period of war, pestilence, political

corruption, famine. It's estimated that over six million people have died since the late 1990's in the

Congo. As a result of the human suffering, there's been a disruption of the supply chain. The production

of cobalt from that part of the world has been impaired.

In other parts of the world, the amount of cobalt mined with copper and nickel has decreased due

to closures of copper and nickel mines because their prices have gone down. You can't simply mine the

cobalt. It's too much of a trace metal within the larger ore body. You have to mine the copper, you have

to mine the nickel, to get to the cobalt. As a result of these factors, we are losing global supply.

To make matters worse, Amnesty International and the Enough Project, commenting on human rights

abuses, are advocating for the imposition of an ethical supply chain on the cobalt and other metals out

of the Congo. If that happens, then an already fragile supply will be disrupted and prices will

skyrocket. On the consumption side, the global usage of cobalt is roughly 100,000 tons a year. That may

sound like a lot, but that's just a blip in the global markets. Of that, roughly 50,000 tons is used for

your standard industrial uses, such as magnets, paint pigments, super alloys, and radiation therapy. The

other 50,000 tons is used in the lithium-ion market, and that market is skyrocketing.

Most people feel there will be a demand for more electric cars next year and the next and the

next. For every one of those cars, we need cobalt for the battery. There just simply is not enough to go

around, and that is causing a choke point, not only for Tesla and Chevy but for every electric battery

manufacturer around the world.

Dr. Allen Alper: What is the forecast for the use of cobalt in batteries going forward?

Mr. Peter Clausi: Cobalt, as a minor metal, does trade on the London Metal Exchange. There

are analysts who follow it fairly rigorously. The predictions right now are fairly standard that we will

be in a deficit position until at least the year 2020. That's because of the supply response. We simply

cannot bring enough mines on stream, quickly enough to supply that cobalt. The quantity varies, depending

upon which assumptions you believe, in the electric battery market. There are some people calling for

three and four million cars to be made by the year 2020. I can't see that happening, simply because the

production facilities don't exist, the logistics of delivering that much lithium and that much cobalt are

tremendous, and then you'd have to have the actual dealer distribution network to sell those cars. Those

things just aren’t happening yet.

Let's look at the Model 3 Tesla's supposed to be putting out next year. Tesla has pre-sold roughly half a

million of those. The average Model 3 needs fifteen kilograms of cobalt per battery array. Half a million

cars times fifteen kilograms is 7.5 million kilograms, or about 8,400 tons, or roughly 8% of the global

supply for one model from one company. This is just further proof there simply is not enough cobalt.

Dr. Allen Alper: That's amazing. Looking forward into the future, what are your thoughts on what's

going to develop?

Mr. Peter Clausi: From a production standpoint, copper and nickel mines will continue to

turn out cobalt as a byproduct in small amounts. There are a couple of projects that are soon to come

online, including the Thangaringa Project down in Australia. Even at full bore, it will produce less than

1% of the world's annual needs for cobalt. There's a beautiful project in Idaho that's due to come on

stream within the next two years (ed. Note: eCobalt Solutions Inc.). They first have to raise 150

million dollars of capex to get the plant built. That, should then, be a 12 to 15 year life of mine, but

it won't be producing for several years, and as you know Al, it takes a couple years to ramp up to a

reliable, consistent production footing. We're at least 3 to 4 years away from seeing any real production

from that. Globally, we're not going to see new production for some time. With the recent outbreak of

Ebola in the Congo, it's safe to say that production and distribution from there will decrease rather

than increase.

As for pricing, we don't see any modifications to our supply model. We do see the demand model

increasing. We called cobalt to hit around 25 dollars per pound by the end of 2016, and it cleared that

hurdle. We're now looking at 35 dollars per pound by the end of 2017. If Amnesty International's

successful in having the ethical supply chain imposed, then we're calling for at least a hundred dollar

cobalt. I know that sounds extraordinary, but we are looking at a limited, fragmented market with no

supply response. If we are taking out roughly 14% of the global supply due to the ethical supply chain,

then hundred dollar cobalt is a reality.

Dr. Allen Alper: That's really amazing, but it sounds like everything is in place for that to

happen.

Mr. Peter Clausi: It certainly looks like it. We're always surprised by the number of

people, in the industry, who fail to realize that cobalt is in such a precarious position. Tesla has said

that it has sourced all of its critical elements, including cobalt, domestically. That's simply not

possible. There just isn't enough cobalt within the United States to fill even a third of Tesla's needs.

We're eagerly awaiting to see how Tesla's going to comply with its public disclosures.

Dr. Allen Alper: That's really something. Could you also tell our readers/investors about your own

company, what you're doing, and what your plans are?

Mr. Peter Clausi: Our Company is called CBLT Inc. It's for "cobalt". It's also the trading

symbol. We sat as a group about two years ago, and decided that cobalt would be in a delicate state. At

the time, cobalt was trading at roughly 9 dollars and 85 cents US per pound. It's now at 25. We made this

prediction. Rather than just make a prediction, we did something about it. We went out into the mining

market, and we contacted people we know in the industry, and found cobalt rich assets to explore and

develop. We purchased them, we've been exploring them. There's news out in the public domain, and we are

back in the field as we speak, exploring those same assets. We like to find small, interesting cobalt

rich assets that can be exploited quickly and put into production. We do not want to find large laterite

fields of copper and nickel, with the cobalt as a byproduct. We like smaller properties, with high-grade

cobalt.

Dr. Allen Alper: That's excellent. Could you tell us a bit more about those properties?

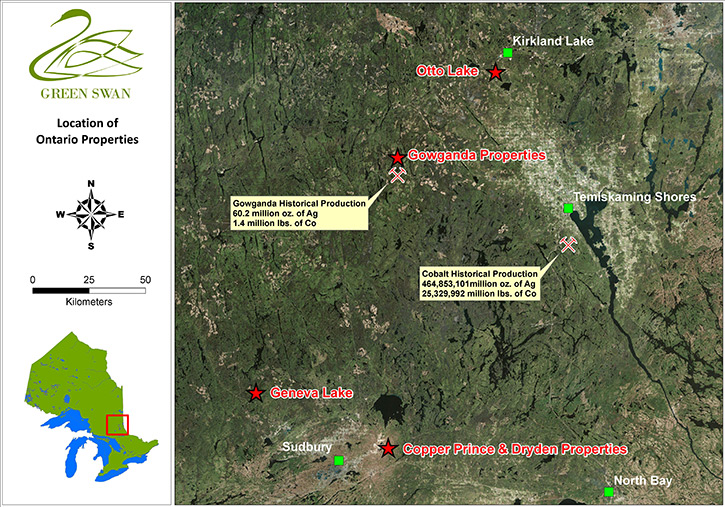

Gowganda location map

GSW Ontario Properties

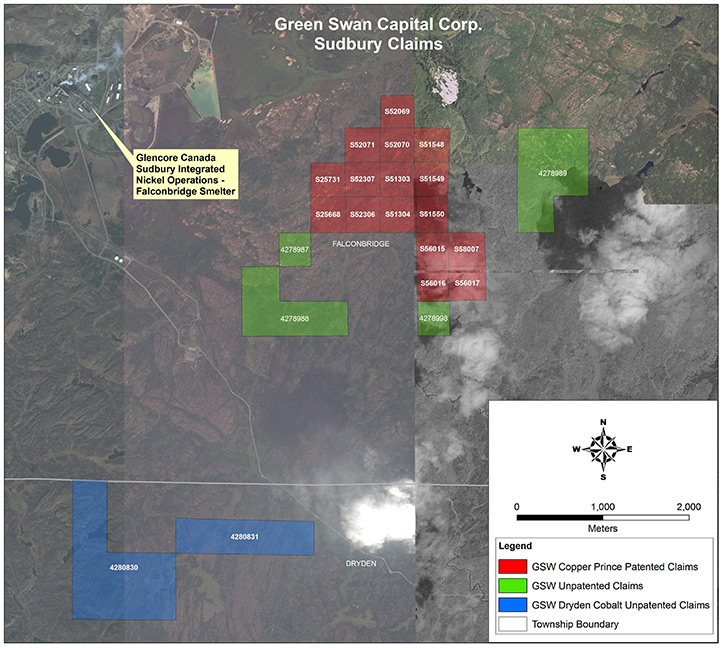

Mr. Peter Clausi: Our main asset is in Sudbury, Ontario, the world famous Sudbury Basin.

Anyone involved in mining knows of Sudbury, and the asteroid that hit that area 1.85 billion years ago.

The asteroid did not bring with it new mineralization, but what it did do was mobilize the mineralization

that was already in the area. Many, many great mines have been set up in Sudbury, and we are relatively

sure that if we were going to find a cobalt-interesting property, it would be in the Sudbury region. We

did, in fact, find one. At our main Sudbury asset, we have found gold and cobalt in a quartz vein. We are

told by the geologist that such a property has never been found anywhere else in the world. We will be

back there this summer, doing more boots and hammer field work, tracking the contact zones, doing some

excavation, and of course taking surface samples to get a good read for how that quartz vein runs.

Relative of assets, in Quebec, our field team started a project there on May the 22nd. That property will

be explored on surface. I don't think we'll be drilling there this summer, as we won't have enough

information to make an informed decision on where to drill.

Half of sample 642, from north part of Chilton

Cobalt

This year, we also announced the acquisition of 28 square kilometers in the world famous Cobalt

Embayment. We're in the Gowganda section of cobalt, with strong historic showings, strong historic

numbers for copper, nickel, silver, and cobalt. We have 3 different teams working up there in the summer

of 2017, again, doing surface exploration work, taking samples, tracking veins, tracking contact zones,

and forming our understanding of the properties so that when we do drill, we're able to drill efficiently

and not wasting a single dollar of the shareholder's capital.

Dr. Allen Alper: That's excellent. Could you tell me a little bit more about yourself and your

team?

Mr. Peter Clausi: We're lucky to have a very strong team that works well together, with a

variety of skillsets. Our Chief Financial Officer has been the CFO for a variety of mining companies over

the years, and he's tremendous at his job. Our technical people on the board are Dr. Tom McCandless, Ed

Stringer, and Judy Baker. Dr. McCandless lives in Vancouver. He's a professor in the United States, and

he's ultimately the Qualified Person responsible for our technical information. Judy Baker is a

geologist. Judy, in addition to her many other skills, is a director on Nemaska Lithium, which is one of

the most advanced Canadian lithium projects that I know of today. It's located in the province of Quebec.

Ed Stringer lives in Sudbury as a prospector and an explorer. Mr. Stringer is one of those local-

knowledge people, who is invaluable to a project. Without Ed's local knowledge, we would be further

behind. Myself, I'm the lawyer and investment banker in a public company, with extended history in the

markets.

Dr. Allen Alper: That sounds like a very strong, well-balanced team you have. That's excellent.

Mr. Peter Clausi: We hire consulting geologists locally as we need them. In this part of

the world where we are, it's hard to have geologists understand Quebec, Sudbury, and Gowganda. We hire

local geologists to assist us, with our thinking in each region.

Dr. Allen Alper: That's a very excellent approach. Could you tell me a bit about your capital

structure?

Mr. Peter Clausi: We've just completed a financing. Our treasury is well stocked. We have

roughly 52 million shares outstanding, together with warrants at 10 cents and 12 cents.

Dr. Allen Alper: That's very good. What are the primary reasons our high-net-worth

readers/investors should consider investing in your company?

Mr. Peter Clausi: The first reason would be every investor needs diversification. Anyone

who invests needs exposure to cobalt, as it is, so far, the best performing metal of the past year and a

half and in our opinion, will continue to be the best performing metal due to the supply imbalances we

discussed earlier. We believe our company is very well run. We respect the shareholder's capital. We have

an excellent suite of projects, and we have a management team that is invested heavily in the company

itself. We're not just management, we are shareholders.

Dr. Allen Alper: That's great. That's good to see a company where the management team has faith in

their company and is well-invested in their company. Is there anything else you'd like to add, Peter?

Mr. Peter Clausi: Cobalt is going to be a fascinating story for at least the next 3 years.

The supply demand imbalance will continue. It may well continue until 2025 or 2030. I find it impossible

to look that far out. I do take note of the fact, though, that Germany has said it was going to outlaw

the sale of combustion engines by the year 2030. It will then start pulling combustion engines off the

road. We need cobalt for all of the electric batteries that will replace those combustion engines. There

is no substitute for cobalt. There's no synthetic substitute and there is no substitute on the periodic

table. If our world is going to continue to develop, we need technology metals and right now, the most

critical one of them is cobalt.

Dr. Allen Alper: That's an excellent insight into what's happening in the cobalt market. It shows

our readers/investors that you and your team have a great amount of foresight to develop and invest in

cobalt properties. That's excellent.

Mr. Peter Clausi: Thank you.

Peter M. Clausi

President, CEO and Director

1 416.890.1232

pclausi@cbltinc.com

|

|