Interview with Rudi Fronk, Chairman of Seabridge Gold (TSX: SEA; NYSE:SA): Building the Best Leveraged Play to a Rising Gold Price

|

By Dr. Allen Alper, PhD Economic Geology and Petrology, Columbia University, NYC, USA

on 7/4/2017

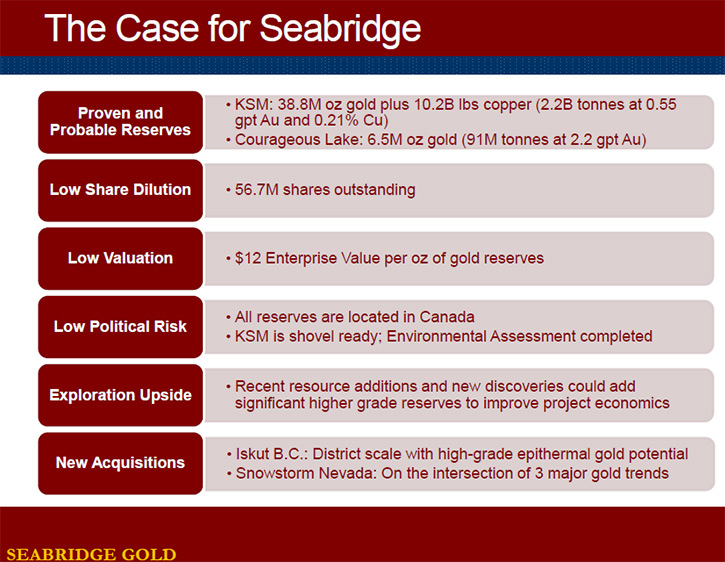

Seabridge Gold (TSX: SEA; NYSE:SA) holds one of the world's largest resource bases of gold, copper and silver in keeping with

its prime objective of growing resource and reserve ownership per share. We learned from Chairman Rudi Fronk that from day one the

company's intention was to build the best leveraged play to a rising gold price, so their share price would outperform not only

gold but also other gold equities. The company holds an industry-leading 1.8 ounces of gold resources per common share. The company

follows a risk-reducing project generator strategy that includes acquiring North American deposits and advancing them through

exploration and engineering to the point where they can be sold or joint ventured to established producers for mine construction

and operation.

Seabridge Gold

Dr. Allen Alper: This is Dr. Allen Alper, Editor-in-Chief of Metals News, interviewing Rudi Fronk, Chairman of Seabridge

Gold. Could you give our readers/investors an overview of Seabridge Gold and also let them know what differentiates Seabridge Gold

from your peers?

Mr. Rudi Fronk: Okay, happy to do that. Seabridge Gold was conceived in 1999, when gold was trading well below $300 an

ounce. Our intention from day one was to build, what we believed would be the best leveraged play in a rising gold price

environment. Our view was that the price of gold would go up substantially over time, which obviously it has, and that our share

price would outperform not only gold but also other gold equities.

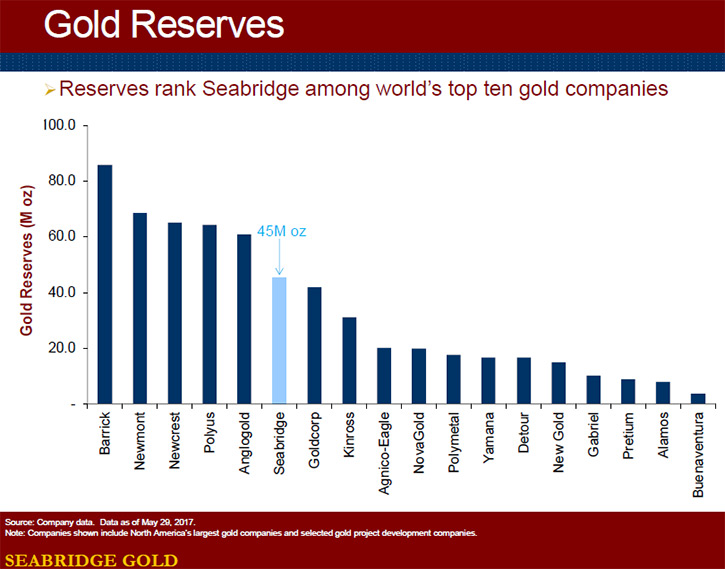

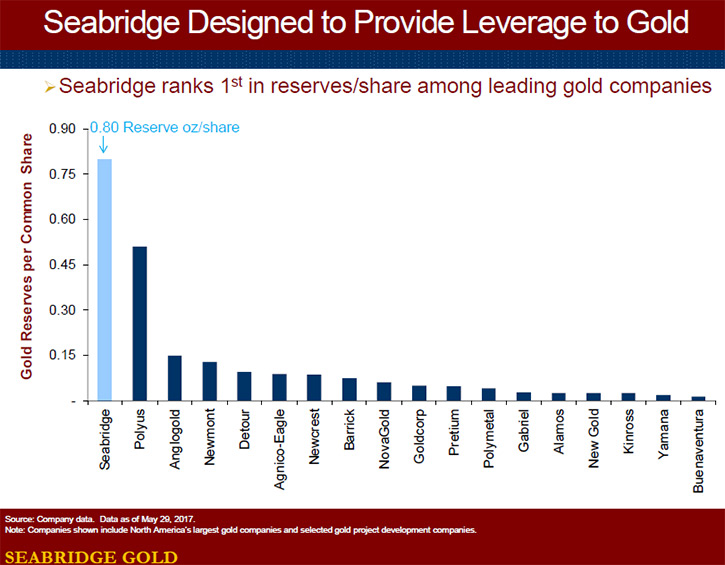

We differentiate ourselves from our peers on the basis of ounces of gold in the ground per common share. Today, if you look at

Seabridge, we have about 57 million shares outstanding and 101 ounces of gold in the ground in all categories of resources, of

which about 45 million ounces are proven and probable gold reserves. On a per share basis, we provide about 8/10ths of an ounce of

gold reserves per common share. On an all-in basis, it’s about 1.8 ounces of gold per common share. Nobody in the industry comes

close to us on that basis.

Dr. Allen Alper: That's fantastic. That's really great work. It's amazing that you've been able to do all of that without

significantly diluting your shares.

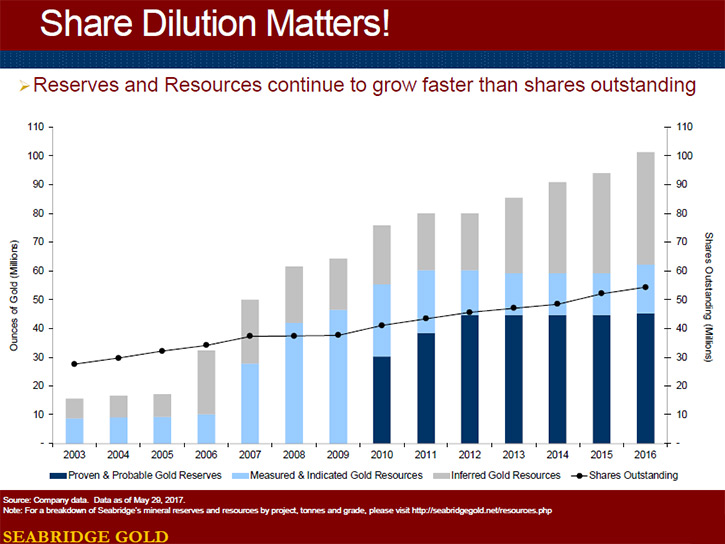

Mr. Rudi Fronk: Yeah, and that's by design. We're willing to suffer equity dilution provided we offset that dilution with

accretion to ounces. I think one of the best slides we have in our corporate presentation shows a graph of the increase in shares

outstanding over the past 18 years compared to the increase in ounces in the ground over that same time period. Most gold companies

won't show you that graph, because most gold companies actually dilute their shareholders' leverage to the gold price by issuing

shares and that are not offset that by additional resources. I think we've been very diligent doing that.

Dr. Allen Alper: That's excellent. Could you tell our readers and high-net-worth investors what your drilling plans and

exploration plans are for this year?

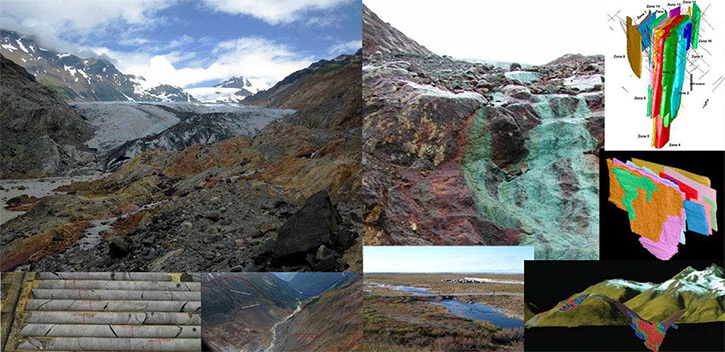

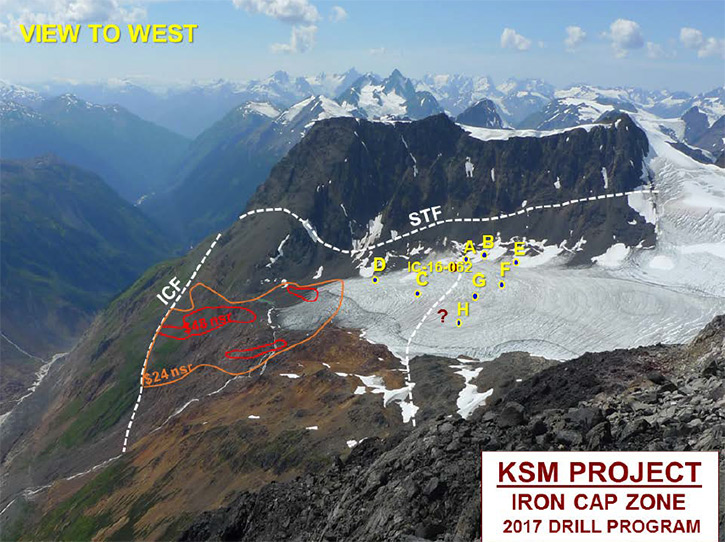

Mr. Rudi Fronk: We have three core projects now. The first and by far the largest is KSM, located in northwest British

Columbia, Canada. KSM today is the largest undeveloped gold and copper project in the world as measured by reserves. At KSM, we

have nearly 40 million ounces of gold and 10 billion pounds of copper in proven and probable reserves. Over the past several years,

we've continued to add resources at grades that are substantially higher than what we report as reserves. We intend to continue

that this season at KSM.

Last year, at the end of the program, we targeted the down-dip extension of the Iron Cap deposit, the smallest of our four

deposits at KSM. The result was an extraordinary hole…550 meters of continuous mineralization grading over 0.8 grams per tonne gold

and about 0.24% copper. We're going to follow up that drill hole this year. We think we can add another five to eight million

ounces of gold resources at grades that are much higher than our reserves.

At the top of that same Iron Cap hole, we unexpectedly hit what we think may be our fifth deposit at KSM. All the drilling to date

at KSM had focused on mineralization that cropped out at surface. This time we may have found our first blind deposit with over 60

meters of almost 1% copper and over a gram per tonne gold. This year's drilling will also get more pierce points on this upper

zone, which could be substantial in its own right.

Our second drill program this season is at our newly acquired Iskut asset. We acquired this project through the acquisition

of a company called SnipGold about a year ago. This is another large porphyry system which not only has the potential that KSM has

in terms of bulk minable, porphyry-style gold and copper mineralization but also has high grade epithermal potential as well.

At Iskut, there are two former producing mines, the Snip mine and the Johnny Mountain

mine, which collectively produced over a million ounces of gold at head grades of about 25 grams of gold per tonne. We believe we

have the opportunity to find higher grade gold in epithermal zones near the top of the system, and we'll start drill testing that

sometime in July.

Our most recent acquisition is a large land package in northern Nevada called the Snowstorm Project that we acquired from

John Paulson, the hedge fund guy in New York. We acquired a large land package, over 25,000 acres, on the northern intersection of

three prolific Nevada gold belts, the Carlin Trend, the Getchell Trend, and the Nevada Rift Trend. We won't be drilling there this

year, but we'll be putting together all the data that's been assembled by the private company that controlled this asset over the

past 20-some odd years, as well as doing some geophysics to try and look under the cover there.

This is elephant country. If you look at some of the projects just to the south of our land holdings, you have the Getchell Mine,

which is part of the Turquoise Ridge JV, operated by Barrick, and also Twin Creeks, which is a large Newmont mine. That's the third

project in our portfolio that we think provides us unmatched exploration potential.

Dr. Allen Alper: Excellent! Sounds like an excellent property to own and explore in a great location, very good. Could you

update our readers/investors on your background, your team, your board?

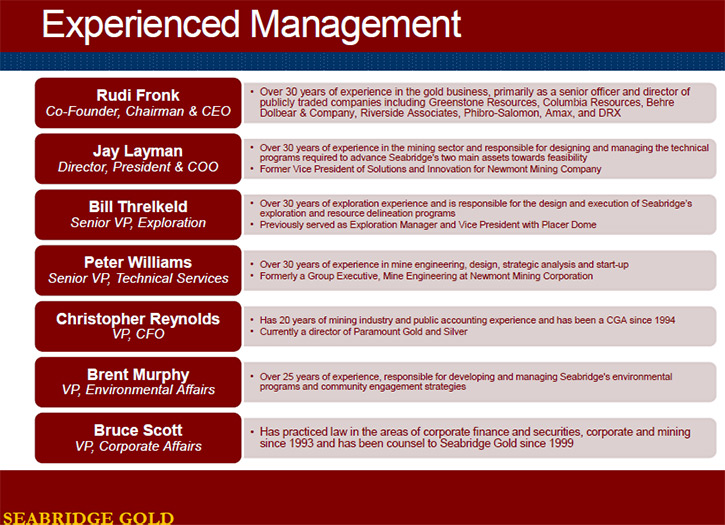

Mr. Rudi Fronk: I've been in the mining space for over 35 years now. I'm a mining engineer by training. I also have

graduate degrees in economics and finance. I've been in the gold space, running publicly traded companies, for over 25 years. I've

built mines in Third World countries like Nicaragua, Honduras, and Panama. I've had mines expropriated in my career in places like

Nicaragua and Honduras. I understand that political risk is real. As you can see from our asset base, Seabridge tries to minimize

political risk by focusing its opportunities in North America.

The rest of my team is comprised of seasoned veterans, individuals who have worked at some of the largest mining companies

in the world like Noranda, Falconbridge, Placer Dome, Newmont, BHP, people who have been involved with big projects that have

become successful mines.

Dr. Allen Alper: What are the primary reasons our high-net-worth readers/investors should consider investing in Seabridge

Gold?

Mr. Rudi Fronk: I think all investors should have some exposure to gold, even if it's just as portfolio insurance. I'm a

gold bug, I'll admit it. I think gold's going to go a lot higher than current levels, but I think as part of a balanced portfolio,

everybody should have somewhere between 5% to 10% of their holdings in a combination of physical gold and gold equities because

these are the assets that perform best when financial assets are under pressure. If you're looking at gold as a hedge, you should

look at stocks that actually have provided outsized returns in the past in rising gold markets, stocks that outperform the price of

gold and other gold equities.

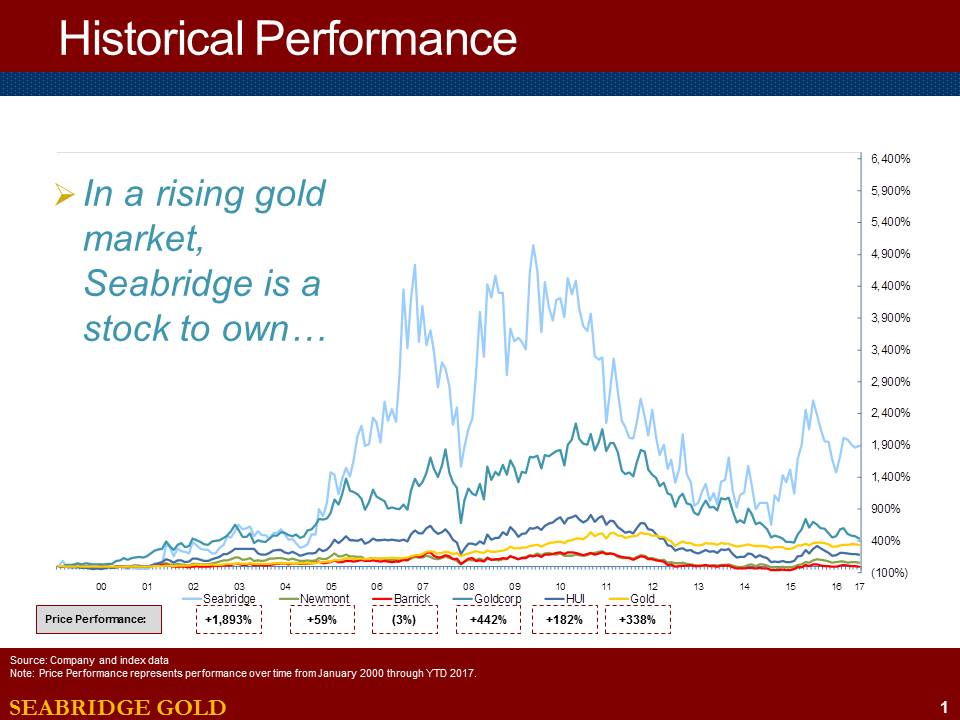

Mr. Rudi Fronk: If you look at Seabridge's track record over the past 18 years since we started the company in October of

1999, the price of gold is up by about 350% from below 300 to about 1200 today, but the price of Seabridge common shares is up

almost 2000%, meaning that we've outperformed the gold price by a factor of five or six to one. If you want to have gold exposure

as part of a portfolio, you want to invest in something that gives you the best bang for your buck, that's going to have the

highest payout when you need it. Our track record shows that we've delivered that.

If you look more specifically at periods of time where the gold market is really strong, like 2004 to 2007, our share price

went from single digits to the high 30s, and then again, coming out of the financial crisis in 2008 to the peak in gold in 2011,

our share price again went from single digits to the high 30s. More recently, we've seen some significant outperformance in our

common shares relative to peer group companies.

Since we saw the bottom in gold in mid-2015, when gold dropped to a low of $1050 per ounce, our share price has gone again from

single digits to above $10 a share, so we've actually gone up 300% relative to a 20% increase in the gold price. If you believe

we're in a bull market for gold going forward, I would argue that Seabridge is the stock to own.

Dr. Allen Alper: That sounds excellent. That shows people who are interested in gold and believe in gold should really

consider investing in Seabridge.

Mr. Rudi Fronk: Most people tend to go right to the senior gold companies, the Newmonts, the Barricks, and the Goldcorps.

If you look at their track record, though, over the past 18 years, both Newmont and Barrick have substantially underperformed the

price of gold, where Goldcorp has just kept pace with the price of gold. You buy a gold stock with the belief that it's going to

outperform the gold price, and for the most part very few companies do. We now have an 18-year track record showing that we do

outperform the gold in any meaningful up move in the gold price.

Dr. Allen Alper: That sounds fantastic. That's really great. Could you tell our readers/investors a bit about why you're so

bullish in gold? What makes you feel that way?

Mr. Rudi Fronk: First of all, we start from the position that gold is not a commodity. Unlike financial assets which are

paper promises to pay that merely represent value, gold is a real or hard asset, real money that doesn't have any counterparty

risk. It’s accepted as final settlement anywhere in the world and has been for over 6,000 years.

Gold tends to do well when financial assets are hitting headwinds, and it underperforms

when confidence in financial assets is high. The past five or six years have been a tough time to be in the gold space as stocks

and bonds have had a big move higher. But if you look at it rationally, you don’t think home insurance is a poor idea if your house

doesn’t burn down.

We believe financial assets like stocks and bonds are now overpriced due to central bank purchases and balance sheet

expansion. We believe that we may now be at a turning point, where financial assets are overvalued relative to the gold price, and

we could see gold outperformance like we had from 2004 to 2007 and then again from 2008 to 2011.

Dr. Allen Alper: Sounds like excellent insight, and I appreciate your sharing that. I’m very impressed with you and your

company.

http://seabridgegold.net/

Rudi P. Fronk, Chairman and CEO

Tel: (416) 367-9292 · Fax: (416) 367-2711

Email: info@seabridgegold.net

|

|